This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

With the combination of two call options with the same expiration date, we can create Call Spreads. We can do so in both directions, whether we feel bullish or bearish. Let’s take a look at the details and compare Bear Call Spread vs Bull Call Spread.

Bear Call Spread

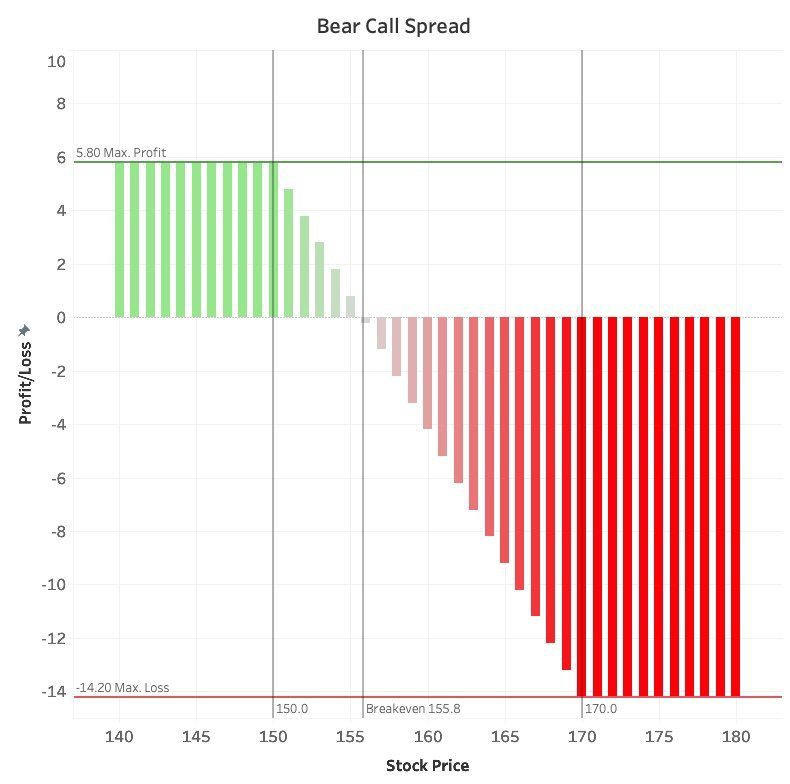

A bear call spread is a vertical spread created by buying a call option (long call) at a higher strike price and selling a call option (short call) at a lower strike price. Both the call options – long and short – must have the same expiration date. In the example below, we are buying a $170 Strike Price call and selling a $150 Strike Price call. Both have the same expiration date of January 21, 2022, and the strike spread is $20 (i.e. $170 – $150).

Is Bear Call Spread a Net Debit or Net Credit spread?

A Bear Call Spread is a Net Credit spread.

Since we sell a lower strike call (which is more expensive) and buy a higher strike call (which is cheaper), on a net basis we collect money to create a bear call spread. In the example shown above, we can buy the $170 strike call for $3.60 per share (or $360 for the contract of 100 shares), and we can collect $9.40 per share (or $940 for the contract of 100 shares) for selling the $150 strike call.

On a net basis, we’ll collect $5.80 to create this bear call spread, hence it is a net credit spread.

Net credit = $5.80 per share or $580 for the spread.

What is the Maximum Profit in a Bear Call Spread?

The maximum profit in a bear call spread = Net Credit

In this case, maximum profit = $5.80 per share, or $580 for the spread.

What is the Maximum Loss in a Bear Call Spread?

The maximum loss in a bear call spread = Strike Spread – Net Credit

In this case, maximum loss = $20 – $5.80 = $14.20 per share, or $1,420 for the spread.

What is the Breakeven Point of a Bear Call Spread?

The breakeven point of a bear call spread = Lower Strike Price (i.e. of Short Call) + Net Credit

In this case, breakeven point = $150 + $5.80 = $155.80.

Bear Call Spread – Profit and Loss Graph

Both the maximum profit and maximum loss are observed between the higher and lower strike prices of the bear call spread. The maximum profit is capped at the point when the stock price reaches the lower strike price. The maximum loss is contained at the point when the stock price rises to the higher strike price. There is one breakeven point and (mostly) it lies in between the two strike prices.

Bull Call Spread

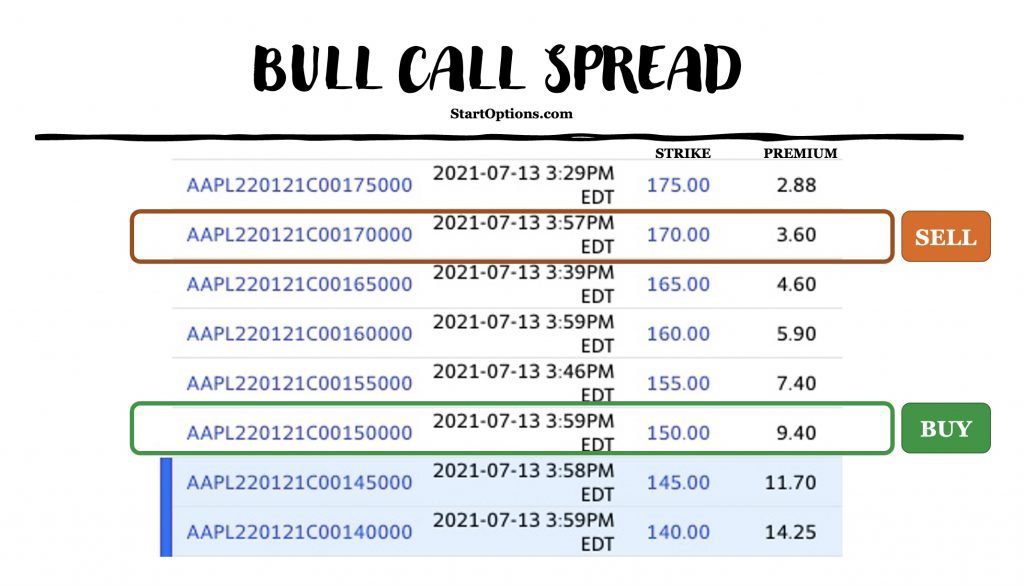

A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price and selling a call option (short call) at a higher strike price. Both the call options – long and short – must have the same expiration date. In the example below, we are buying a $150 Strike Price call and selling a $170 Strike Price call. Both have the same expiration date of January 21, 2022, and the strike spread is $20 (i.e. $170 – $150).

Bestseller Personal Finance Books

Is Bull Call Spread a Net Debit or Net Credit spread?

A Bull Call Spread is a Net Debit spread.

Since we buy a lower strike call (which is more expensive) and sell a higher strike call (which is cheaper), on a net basis we pay money to create a bull call spread. In the example shown above, we can buy the $150 strike call for $9.40 per share (or $940 for the contract of 100 shares), and we can collect $3.60 per share (or $360 for the contract of 100 shares) for selling the $170 strike call.

On a net basis, we’ll have to pay $5.80 to create this bull call spread, hence it is a net debit spread.

Net debit = $5.80 per share, or $580 for the spread.

What is the Maximum Profit in a Bull Call Spread?

The maximum profit in a bull call spread = Strike Spread – |Net Debit|

In this case, maximum profit = $20 – $5.80 = $14.20 per share, or $1,420 for the spread.

What is the Maximum Loss in a Bull Call Spread?

The maximum loss in a bull call spread = Net Debit

In this case, maximum loss = $5.80 per share, or $580 for the spread.

What is the Breakeven Point of a Bull Call Spread?

The breakeven point of a bull call spread = Lower Strike Price (i.e. of Long Call) + |Net Debit|

In this case, breakeven point = $150 + $5.80 = $155.80.

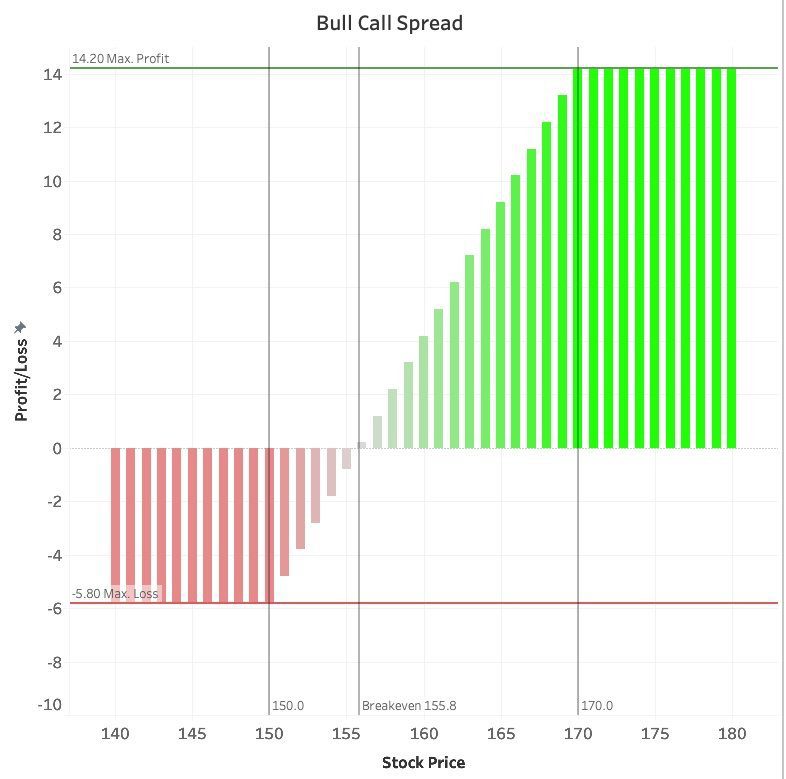

Bull Call Spread – Profit and Loss Graph

Both the maximum profit and maximum loss are observed between the higher and lower strike prices of the bull call spread. The maximum profit is capped at the point when the stock price reaches the higher strike price. The maximum loss is contained at the point when the stock price falls to the lower strike price. There is one breakeven point and (mostly) it lies in between the two strike prices.

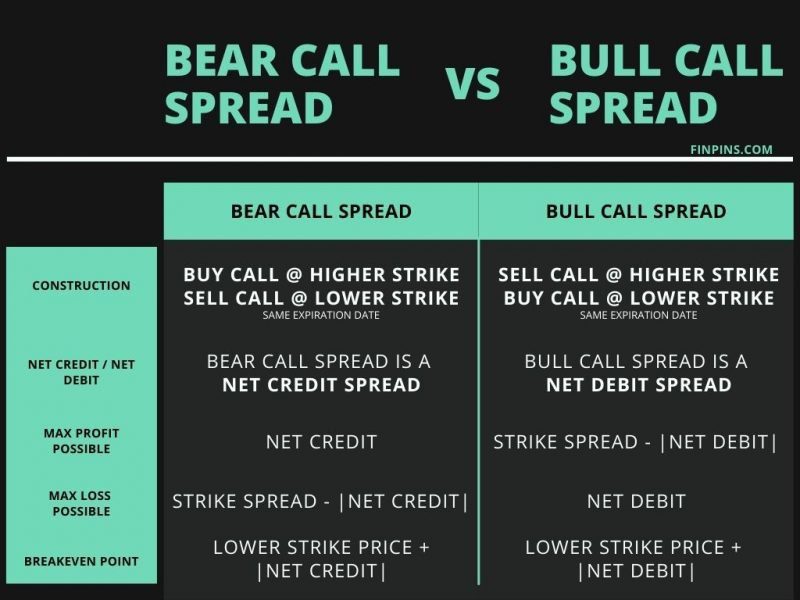

Bear Call Spread vs Bull Call Spread: Comparison

We will compare the bear call spread vs bull call spread on the 5 criteria:

- the construction of the spread, i.e. how you can create the spread

- net debit or net credit, i.e. whether we have to pay to buy the option contract

- max profit possible in the trade

- max loss possible in the trade

- breakeven point

For more on Stock Options, check out StartOptions.com

Read also: Straddle vs Strangle Options, Bear Put Spread vs Bull Put Spread

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents