| Year | Cash Flow | |

|---|---|---|

IRR Calculator: What Is It?

IRR Calculator is an online tool to calculate the IRR or the Internal Rate of Return.

It is a helpful tool to determine the return on investment of a project based on the cash flows it generates over multiple years, and the money invested in the project. IRR Calculator simplifies the return on investment by representing it in an ‘annualized’ rate of return.

What is IRR in Finance?

IRR stands for Internal Rate of Return in Finance.

IRR is the return on investment at the project’s breakeven point (i.e., the project is barely justified as valuable).

To understand IRR, you must understand NPV or Net Present Value.

When NPV is positive, the project is expected to be valuable, and the management will give a green light to the project. When NPV is negative, the management will most likely not proceed with the project.

IRR is the rate of return when the NPV of the project is 0 (i.e. when the NPV just breaks even).

How To Calculate IRR Using IRR Calculator

Step 1.

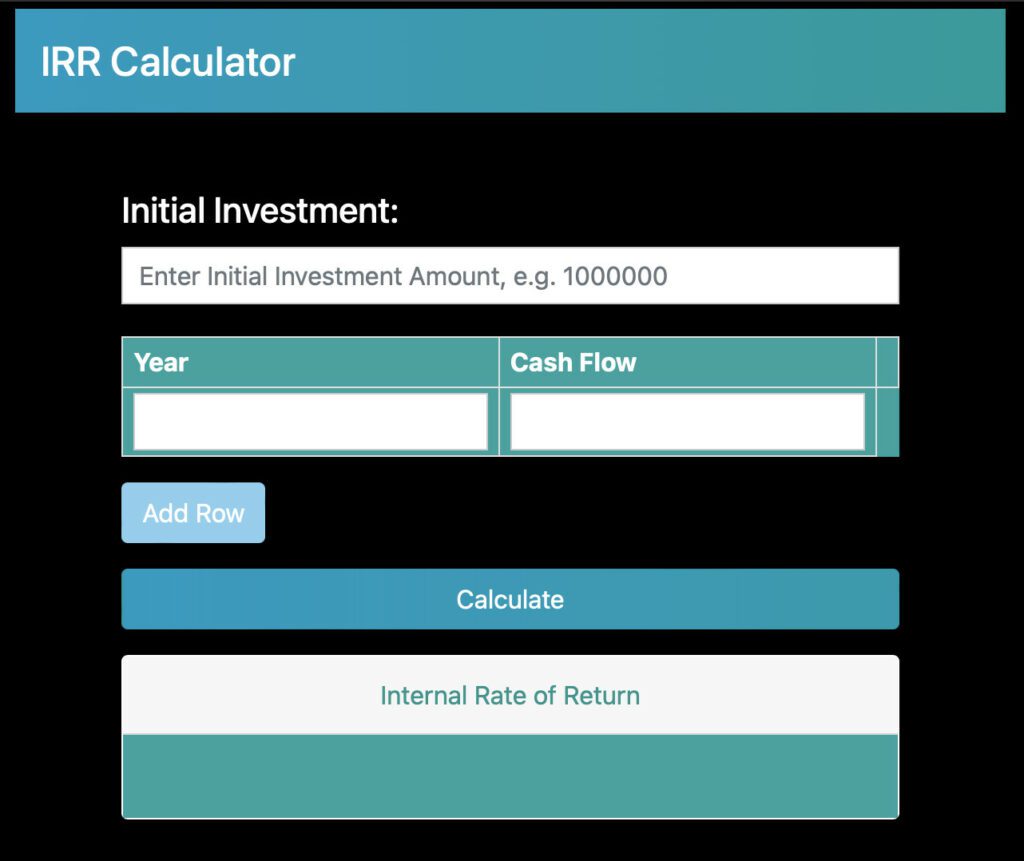

Open the IRR Calculator, you should see a simple form like this – with input fields for the ‘initial investment amount’, and more fields for ‘year’ and ‘cash flow’.

Step 2.

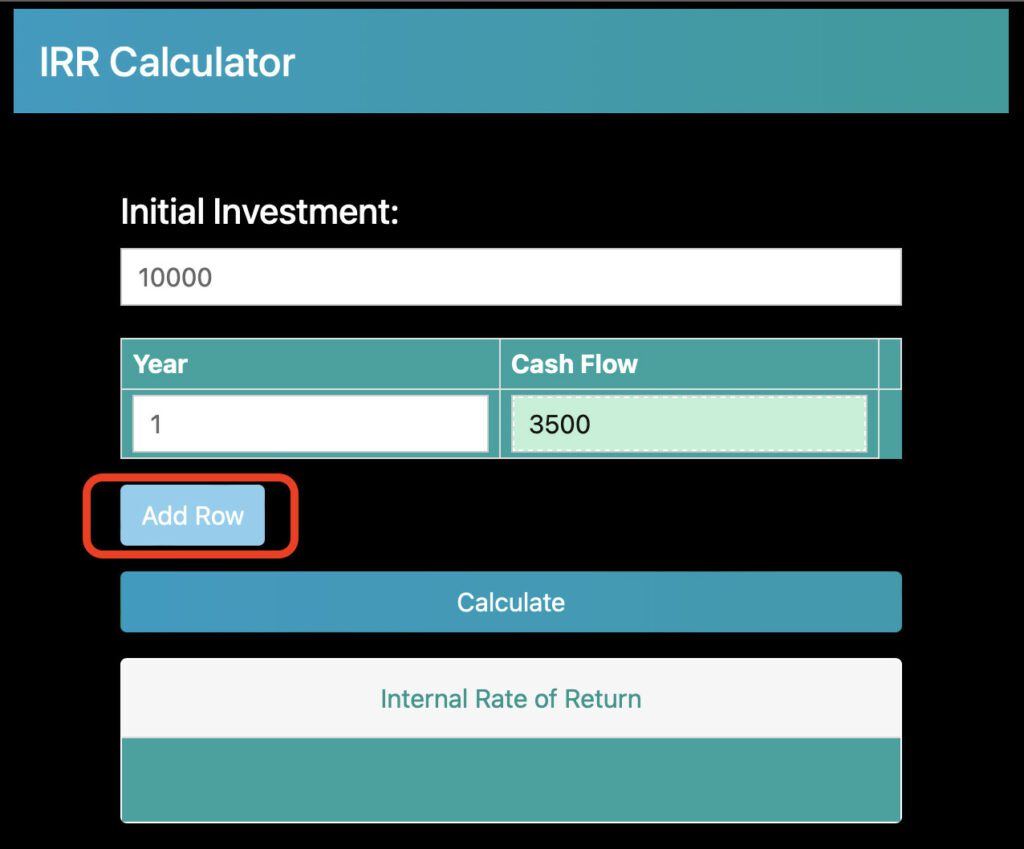

Enter the amount of initial investment, and proceed to fill the fields for years and cash flows.

You can add as many fields for years and cash flows by using the ‘Add Row’ button.

Let’s say my initial investment for the project is $10,000.

Step 3.

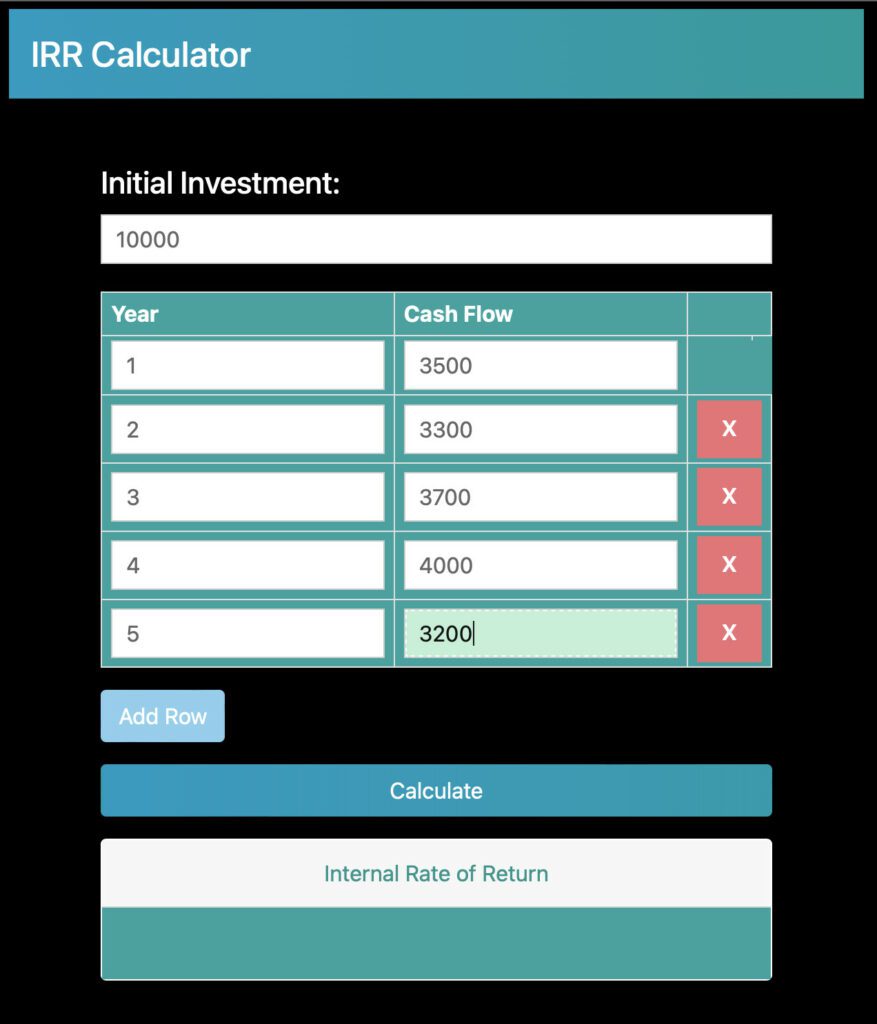

Fill out all the cash flow projections by year.

Let’s say my cash flow projections are the following:

- Year 1: $3,500

- Year 2: $3,300

- Year 3: $3,700

- Year 4: $4,000

- Year 5: $3,200

Assume the project stops generating cash flows after 5 years.

Step 4.

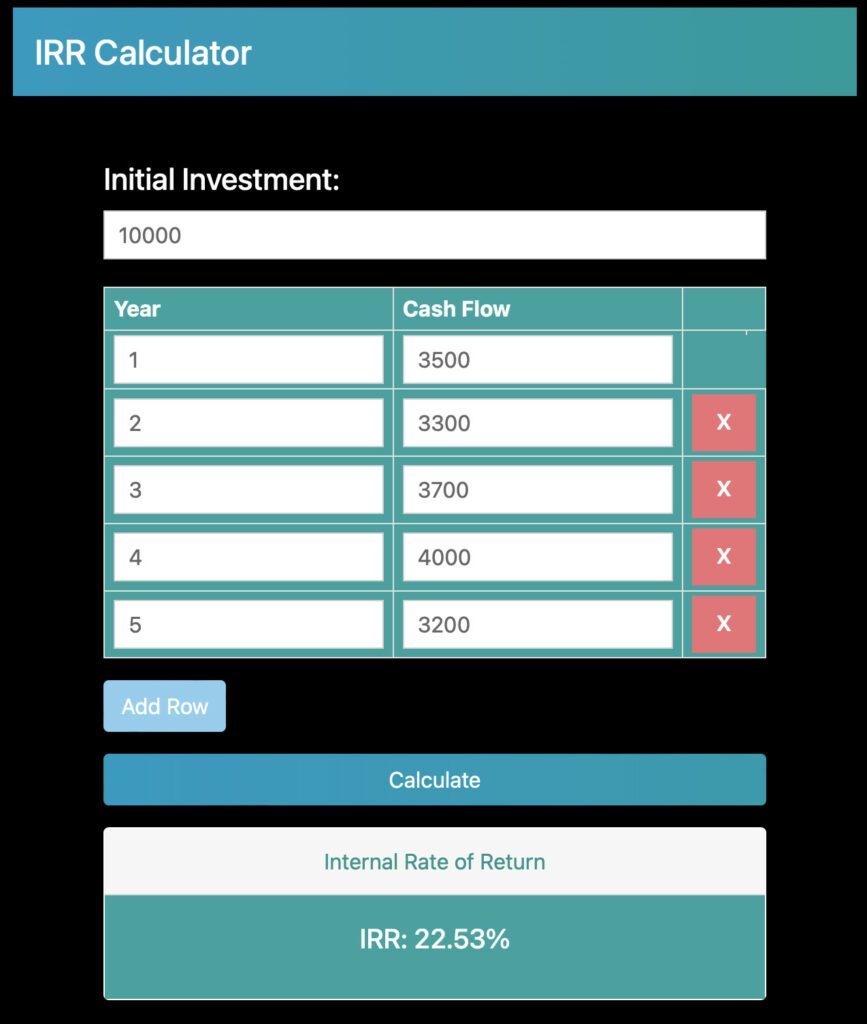

Once the cash flows are filled in, hit the ‘Calculate’ button at the bottom of the form, and wait for a second.

You should see your response from the IRR Calculator below the Calculate Button.

In my example, I got an IRR of 22.53%.

How To Verify IRR Using NPV Calculator

In order to verify if we have a good approximation of the IRR, we can feed the IRR we received from the IRR calculator, and feed it in the NPV Calculator.

Step 1.

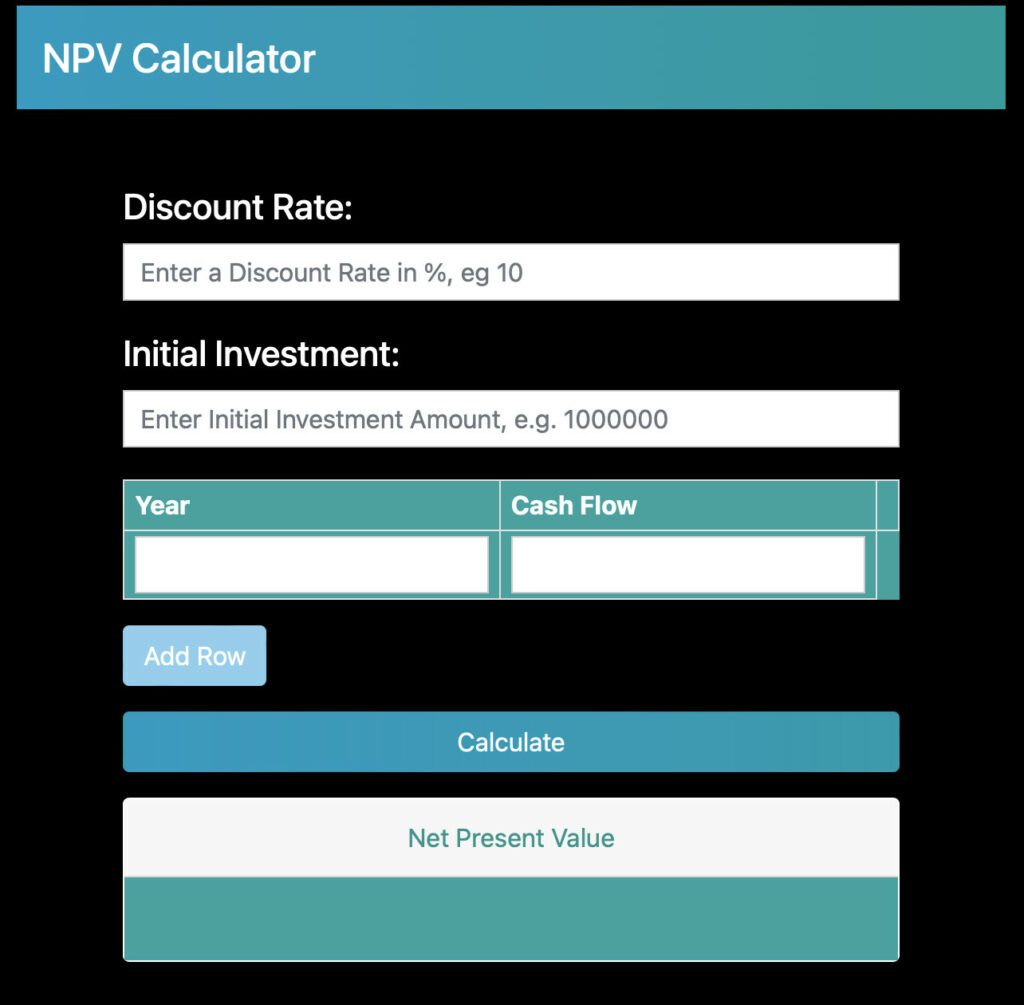

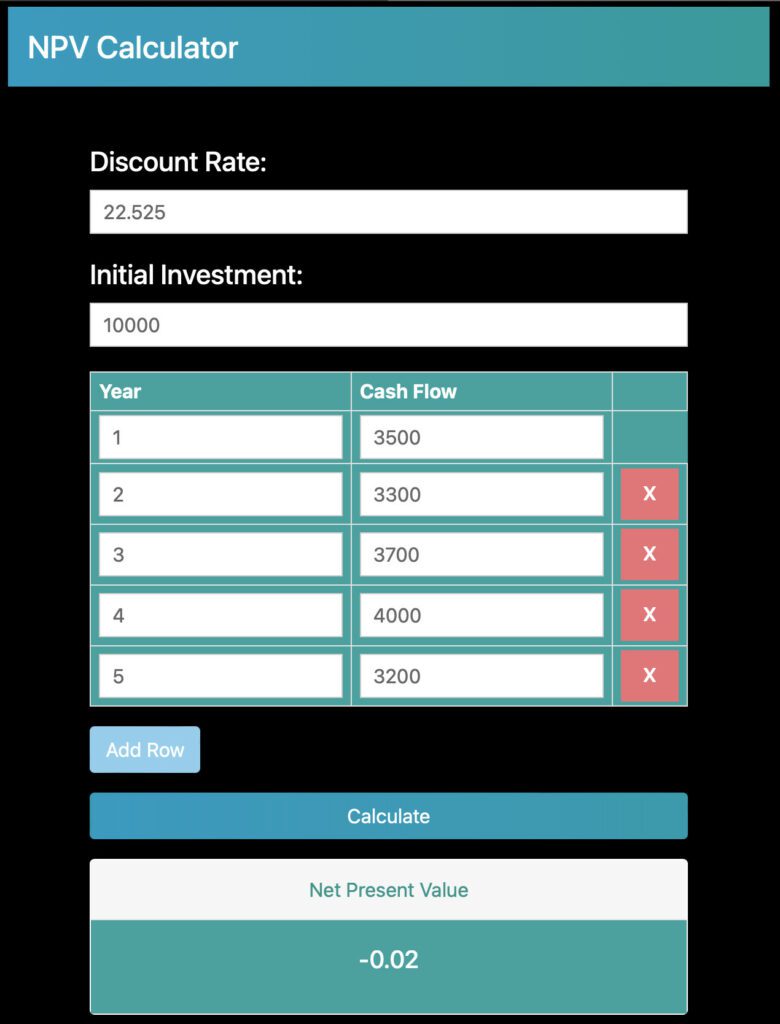

Open the NPV Calculator. You should see a simple form with input fields for ‘Discount Rate’, ‘Initial Investment’, and more fields for years and cash flows.

Step 2.

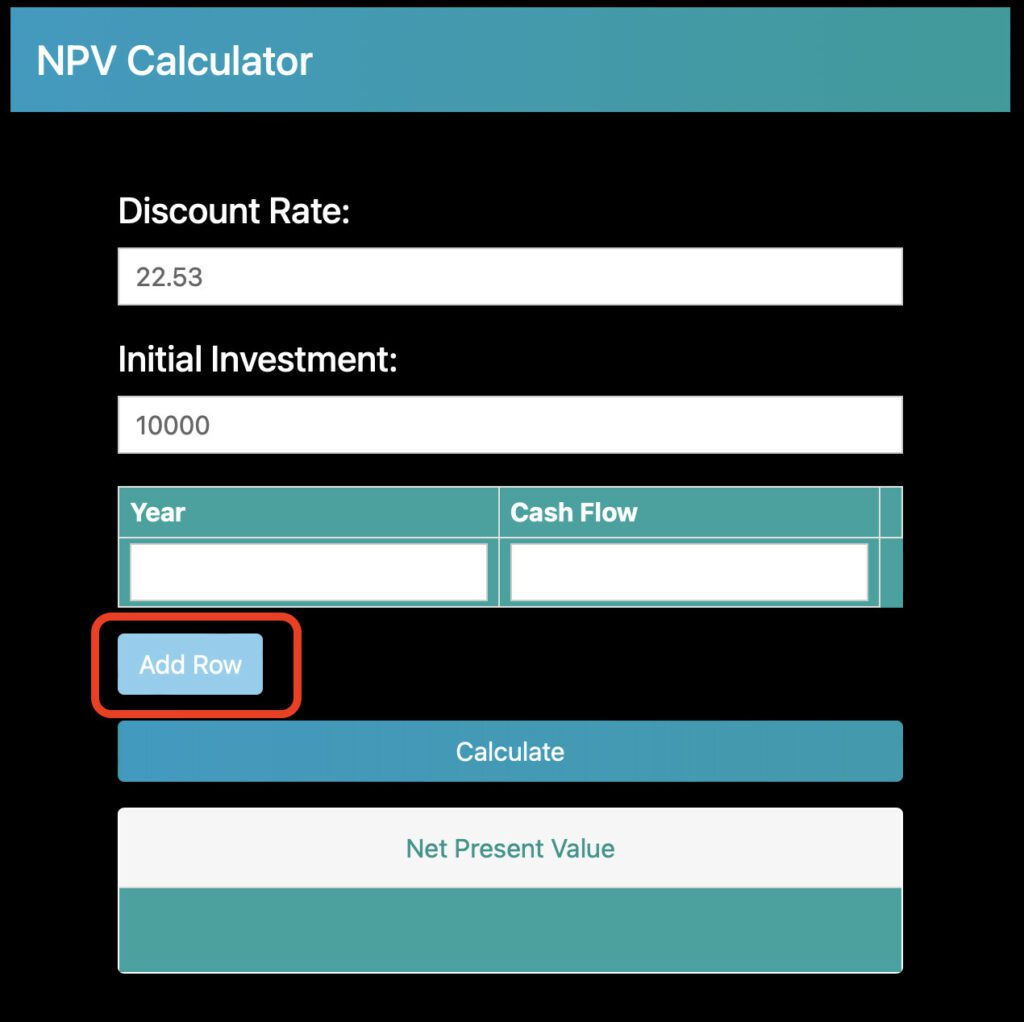

Input the ‘IRR’ value received from the IRR Calculator in the ‘Discount Rate’ field of NPV Calculator.

Input the initial investment (same as in the example for IRR).

Proceed to fill in the year and cash flow values. You can add more cash flows by using the ‘Add Row’ button.

Step 3.

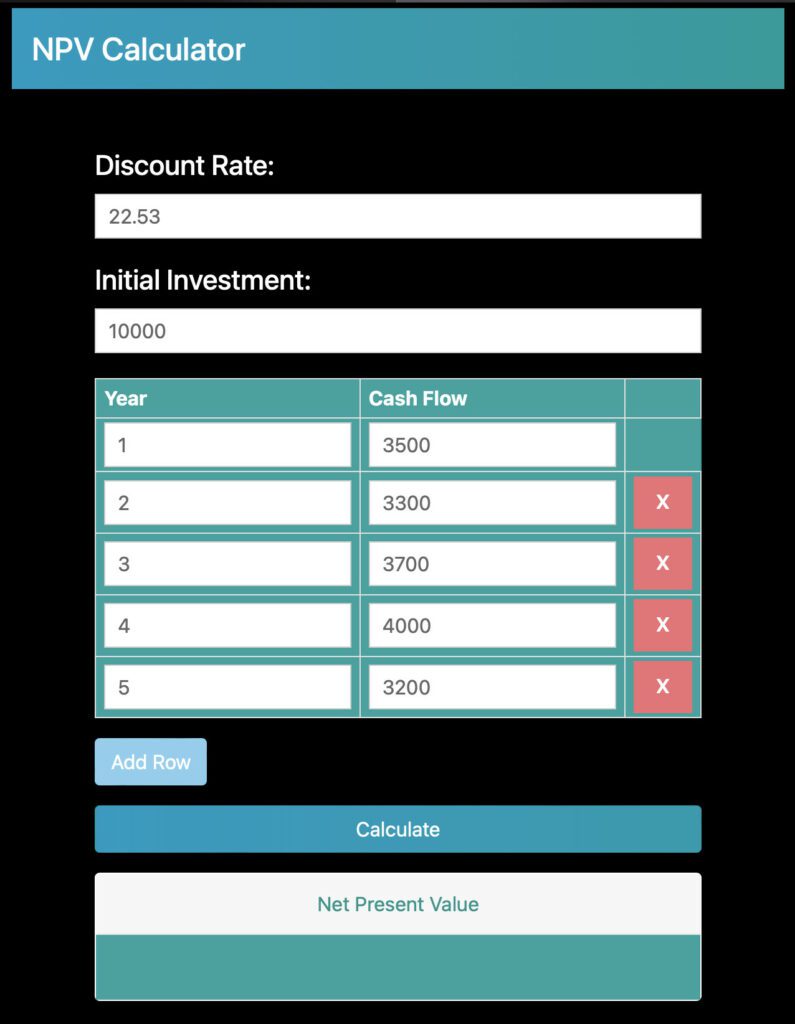

Fill in all the cash flow values as used in the IRR Calculator

For example, I am using these:

- Year 1: $3,500

- Year 2: $3,300

- Year 3: $3,700

- Year 4: $4,000

- Year 5: $3,200

Step 4.

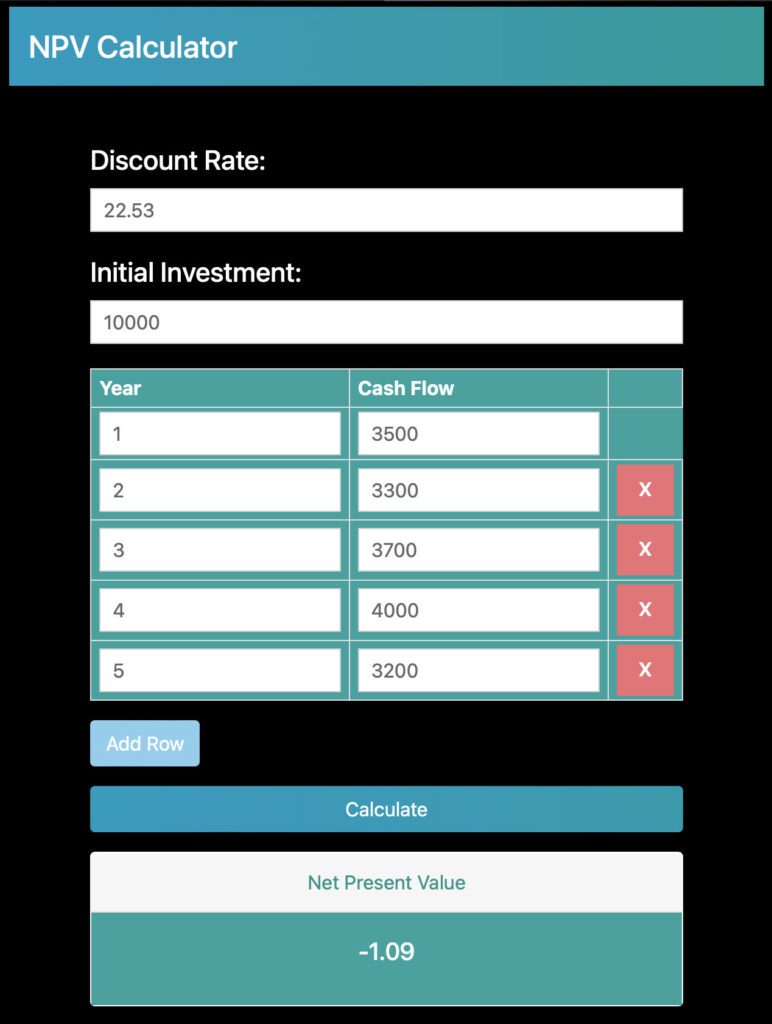

Once all values are filled, hit the ‘Calculate’ button. Below the calculate button, you should see the NPV.

Based on the definition of IRR, when we use IRR as the discount rate, the NPV should be 0.

In my example, I get the answer for NPV as -1.09. It is not exactly 0, but very close to 0. This is because of approximation and rounding off the percentages in the IRR Calculator.

Step 5.

If you want a more accurate IRR, you can play around with the Discount Rate a little to get NPV = 0.

In my example, I tweaked the IRR (Discount Rate in NPV Calculator) a little and at value 22.525%, I get an NPV = -0.02.

For all practical purposes, an NPV that small should be treated as zero!

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents