This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Tips on Maximizing Returns on Your Retirement Fund

Retirement Fund Strategy 1: Get maximum employer match

Most employers provide a match to your 401(k) contributions. For example, if an employer matches dollar-for-dollar for your contribution, up to 6% of your salary, if you make $50,000 a year, you can contribute $3,000 in a year toward your retirement fund, and your employer will also add $3,000 to your 401k account. Please note that some employers have a vesting schedule so the employer contribution does not become ‘yours’ straight away, you might have to work a certain number of years for the employer contribution to vest. However, your contributions are ‘yours’ no matter what the vesting scheme of the employer is.

Retirement Fund Strategy 2: Start Investing Early

I cannot emphasize enough the benefits of starting your investment journey early. Time is your friend, and starting early can create the magic of compounding on your fund.

Retirement Fund Strategy 3: Keep an Eye on the Fund Management Fees (Expense Ratio)

Most funds do not outperform markets. By markets, I mean broad market indexes such as S&P 500 or the Russell 2000. So, if the fund is not generating more returns than the market, you should not be paying a premium for that. Of course, some actively managed funds give positive abnormal returns (more than broad market returns), you shouldn’t mind paying a premium for extra returns. So, for example, if fund ABCXYZ consistently returns 12% annually and charges 1% fund management fees, your effective return is 11%, which is higher than the avg. market return (say 8%).

Having said that, most funds actually do not outperform the market, so make sure you’re not overpaying to get market returns or even worse returns.

CASE STUDY : Jane vs. John

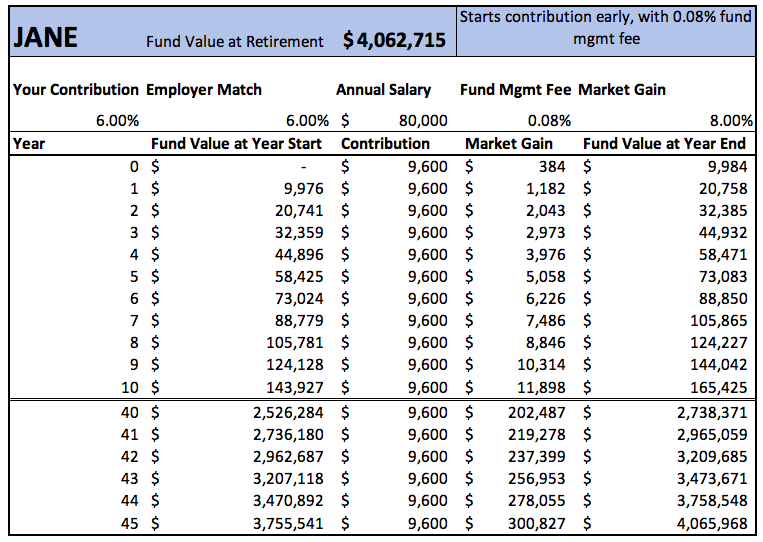

Scenario 1: Jane’s retirement fund strategy

Jane has a salary of $80,000 and she starts investing at age 20, in a low-cost index fund (management fee 0.08%) that tracks the market. Her employer matches her contribution dollar for dollar, up to 6% of her salary. So, effectively, Jane puts $4,800 and the employer puts $4,800 i.e. a total of $9,600 is added to Jane’s retirement account every year.

Assumption: The index fund returns 8% per year, on average.

Please note this is a simplified model that assumes a constant salary of $80,000. In real life you’d expect the salary to increase every year.

By age 65, Jane’s retirement account would have $4 million in it.

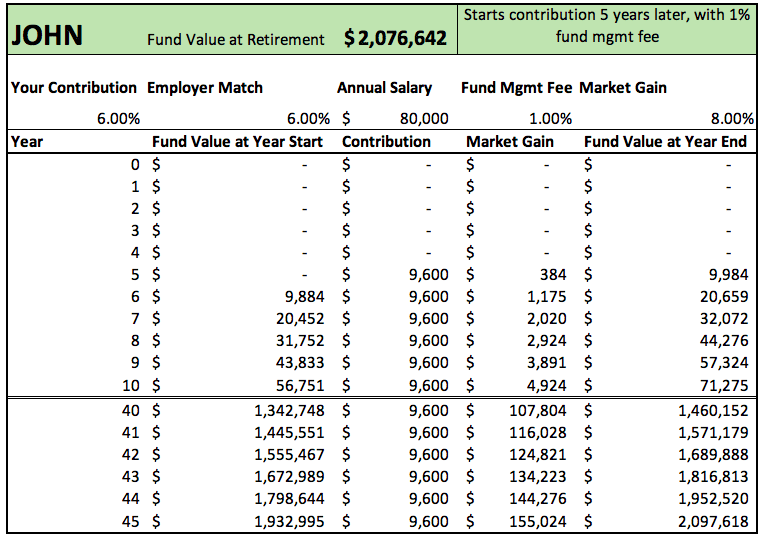

Scenario 2: John’s retirement fund strategy

John has a salary of $80,000 (same as Jane’s) and he starts investing at age 25. John is not careful in picking his investment funds, and puts all his money in a fund that doesn’t beat the market (i.e. returns 8% per year), but charges 1% as a fund management fee.

John’s employer also matches his contribution dollar for dollar, up to 6% of his salary. So, effectively, John puts $4,800 and employer puts $4,800 i.e. a total of $9,600 is added to John’s retirement account every year

By age 65, John’s retirement account would have just $2.1 million in it.

Conclusion

So, where did John miss the trick to end up 50% less than what Jane would have at retirement, despite making the same contributions to his retirement account?

John made two mistakes:

- He started late, not by much, just 5 years late.

- He didn’t pay attention to the fund management fee

Avoid these two mistakes with your retirement fund!

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents