This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

ETF vs Stock – What’s Better For Beginners?

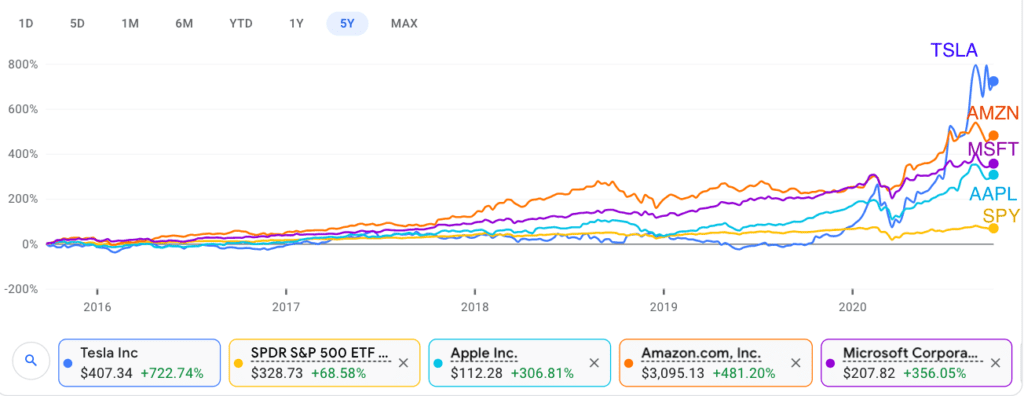

If you want to start investing in individual stocks, keep in mind that it is not a walk in the park. There are over 2800 stocks trading on the New York Stock Exchange (NYSE). Picking a handful few to invest in is not an easy task. When you mention someone about stock picking i.e. buying select stocks in the market, it’s a difficult job of evaluating a company’s fundamentals and competitive advantages to identify potential winners. It is true, when you look back and wonder how much you could have made if you invested in Tesla (TSLA) stock at $100 apiece (before stock split!), it looks like pretty easy money. Looking forward and picking a stock to hold for the next 10 years – not so easy! The stock picking vs ETF debate is healthy, especially for new investors.

Stocks and ETFs are some of the investment types that can make money for you somewhat passively. But, investing, and especially stock picking requires the right knowledge and research. Stock picking involves more risk than investing in ETFs, the upside and downside can vary hugely between the two strategies.

Individual stocks may collapse in a downturn (and many have in the past), stock markets have always recovered, historically. This is what makes investing in ETFs relatively safer. But there are trade-offs on the upside potential as well.

FinPins

If you are a freshman in the world of investing, then you may have to decide between stocks and ETFs. Well, we have good news for you – we’re about to discuss just that! Let’s see the pros and cons of picking one style over the other. For some, a hybrid approach works best.

ETF vs Stock: A Closer Look

What Are Stocks?

Stocks are also known as equities and they are basically the shares of certain publicly traded companies. Essentially, a share of stock can be seen as owning a rather small part of a company.

Certain businesses will sell stocks in order to raise funds for a variety of reasons, for example. Moreover, stocks may allow those who own them to vote during the important meetings of a company – such as shareholder meetings.

Stocks also imply that you may get paid a part of the company’s profits as an investor – rewards that are called dividends.

What Are ETFs?

ETF stands for exchange-traded fund. ETFs represent a type of professionally pooled and managed investment. The exchange-traded fund will start by buying commodities, stocks, bonds, as well as other securities and put them in a so-called basket.

The fund will then start selling shares of the aforementioned basket to investors. The managers of the fund may sell or buy shares of the basket’s holdings in order to keep the fund aligned so that it stays true to certain investment goals.

Please keep in mind that I’ve picked this period that includes the painful period of the 2008-2009 recession. I’ve done so on purpose to show that if the investment horizon is long enough, the returns are decent despite the occasional downturn in the market.

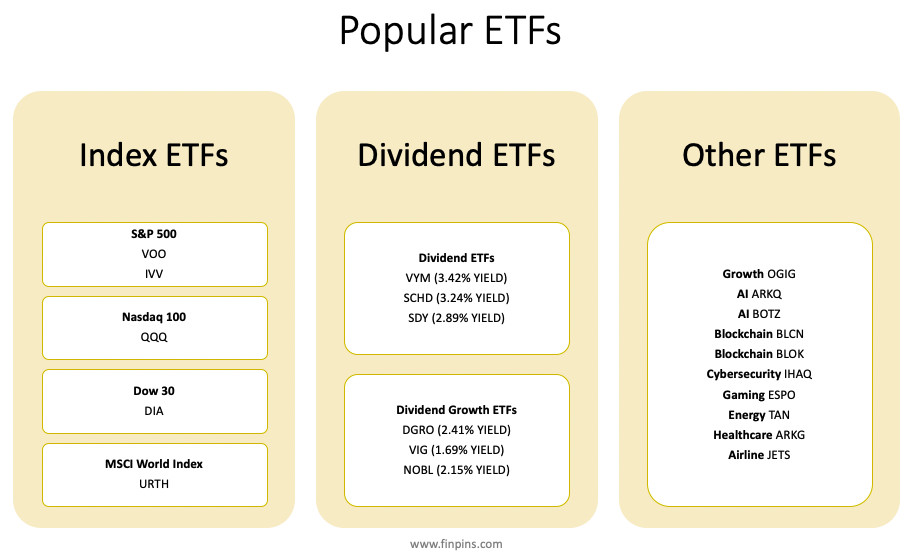

Some Popular ETFs

ETF vs Stock: When Should You Choose Stocks?

You should consider buying stocks when you are faced with situations or industries where you can notice a wide dispersion of returns.

You can also look for instances where the ratios and the other forms of fundamental analysis can be used to discover underpricing. As you may know, if a stock-picker is able to spot an underpriced stock, they can make purchases that will exceed any expected returns.

Another popular method is spotting a megatrend, such as Applied Artificial Intelligence, and picking stocks accordingly. This can be much more profitable than buying ETFs.

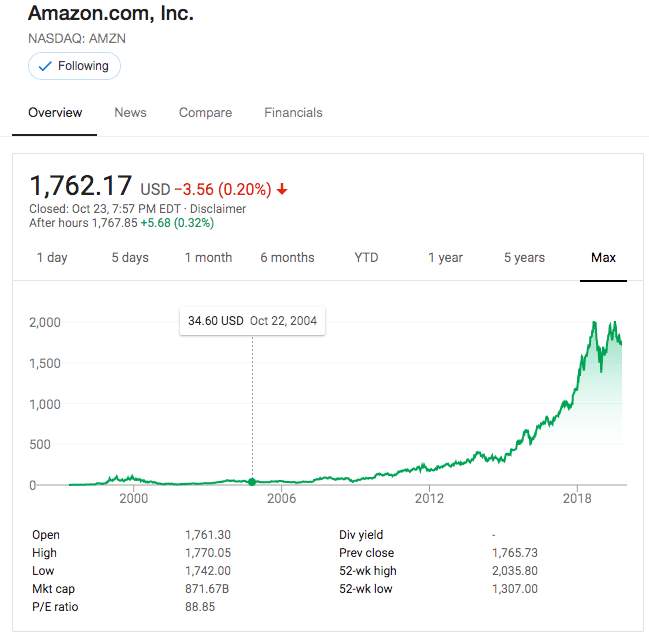

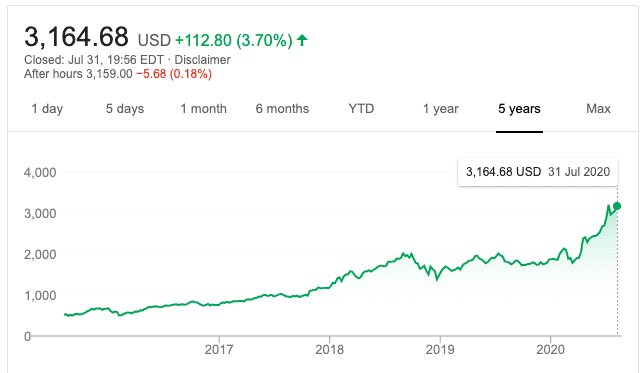

Stock Picking Case Study: Amazon Stock

Oct 2019 Value = 1762.17

(Screenshot: google finance)

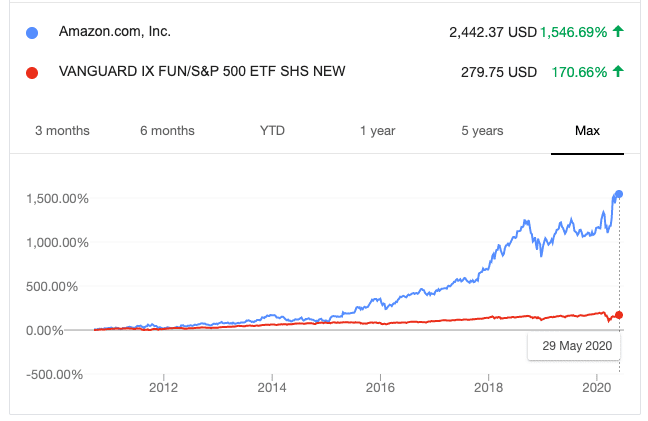

Imagine what returns you’d have got if you spotted the rise of the e-commerce giant in 2004? An Amazon stock in Oct 2004 was worth $34.60, whereas in Oct 2019 it stands at $1762.17. Your money invested in Amazon back then would have been worth 50 TIMES!!! For comparison with the 7% S&P 500 growth rate (see below), AMZN grew at 30% per year in the last 15 years.

Careful Stock Picking can give exceedingly rewarding returns.

A $1,000 investment in Amazon in Oct 2004 would be worth $51,000 in Oct 2019.

Bestseller Personal Finance Books

Update: A $1,000 investment in Amazon in Oct 2004 would be worth $91,500 in August 2020.

ETF vs Stock: When Should You Choose ETFs?

Naturally, industries that feature a narrow dispersion of returns are not fit for stocks.

This is why, if the performance of a company – as well as what drives it – is more difficult to understand, then you might want to trust ETFs. On the other hand, the sectors of specialty technology or certain commodities are usually preferred when it comes to buying ETFs.

For example, if you research the market and think that now is the perfect time to invest in the mining or semiconductors sector, you will definitely want to gain industry exposure as well.

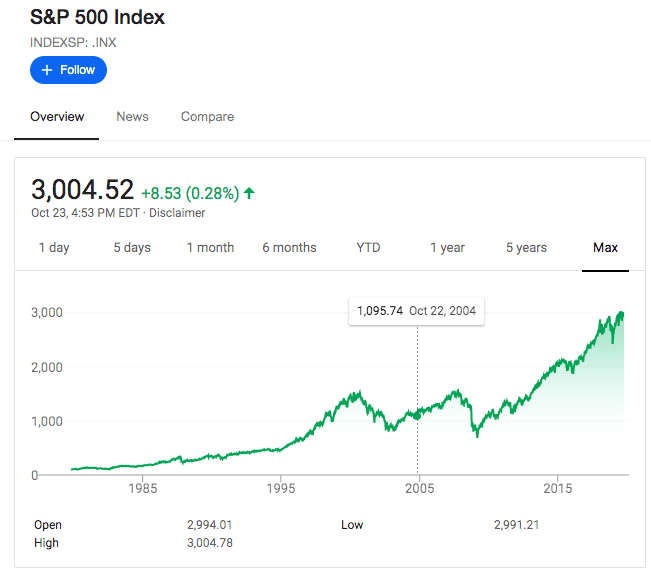

ETF Case Study: S&P 500 Index

Oct 2019 Value = 3004.52

(Screenshot: google finance)

An ETF that tracks the broad market index such as S&P 500, would have returned somewhat like this: Over the last 15 years i.e. from Oct 2004 to Oct 2019 the index has grown from 1,095 to 3,004, which is 2.74 times or a 174% overall growth. On an annualized basis the growth of the S&P 500 index is about 7%.

A $1,000 investment in an S&P 500 tracking ETF would be worth $2,742 in Oct 2019

Popular ETFs from Vanguard

Vanguard S&P 500 (VOO)

- Invests in stocks in the S&P 500 Index, representing 500 of the largest U.S. companies.

- Goal is to closely track the index’s return, which is considered a gauge of overall U.S. stock returns.

Vanguard Mid-Cap (VO)

- Seeks to track the performance of the CRSP US Mid Cap Index, which measures the investment return of mid-capitalization stocks.

Vanguard Small-Cap (VB)

- Seeks to track the performance of the CRSP US Small Cap Index, which measures the investment return of small-capitalization stocks.

Vanguard Total Stock Market (VTI)

- Seeks to track the performance of the CRSP US Total Market Index.

- Large-, mid-, and small-cap equity diversified across growth and value styles.

Is Stock Picking a Good Strategy?

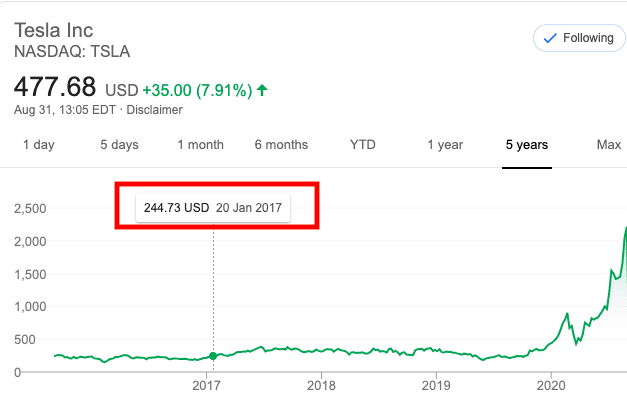

Personal story: during my MBA, I took a course ‘Applied Investment Management’ in which I got to invest $35,000 in the market. The goal was to beat the market keeping in mind 3-5 year investing horizon. Based on my knowledge, research and optimism, I put about $20,000 of my university’s money in Tesla (TSLA) stocks.

The price in Jan 2017 was around $245, so I could buy 81 shares of Tesla stock.

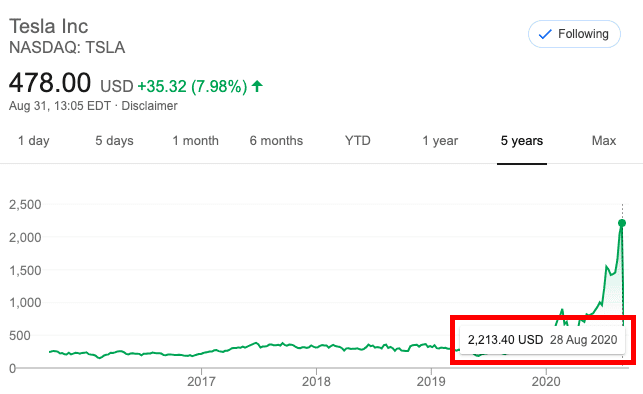

Fast forward to August 2020, TSLA stock reached $2,213 just before the 5:1 stock split.

At this price, the $20,000 investment is worth approximately $180,000 (almost 9X !!!). Could I predict these returns at the time of buying? Hell no. But I took a chance and placed a bet (stock picking is like placing bets) based on several factors.

It boils down to how much risk an investor is willing to take. The returns on investment in the stock market are never guaranteed and past performance is not a predictor of future results.

The Bottom Line: ETF vs Stock Picking – What’s Better?

ETF vs Stock Picking has always been a debate in the investor community. As a general rule in investing, you have to look at both the risk and the potential returns when trying to decide whether to go for stock picking or ETFs. Your aim is to get maximum returns with minimum possible risk.

On one hand, stock picking can come with an advantage due to the wide dispersion of returns from the mean. Moreover, you can gain a certain advantage as you use your personal knowledge of the stock or industry. So, if you’re willing to invest time in stock research or get help from trusted resources, stock picks can reward you many times over.

On the other hand, ETFs come with advantages in the sectors that have a narrow dispersion around the mean or when you cannot gain an advantage via knowledge and research. For investors who are more passive and less inclined on stock research, ETFs are a perfect choice.

Stocks and ETFs not your thing? Check out other investment options and alternative investing

Want to level up your investing? Check out Stock Options

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents