| Year | Cash Flow | |

|---|---|---|

NPV Calculator: What Is It?

NPV Calculator is an online tool to calculate the NPV or Net Present Value. It is a helpful tool to determine whether a project, business, or investment idea is good or bad. If the NPV is positive, then the idea will create value and is considered good. If the value is negative, then the idea will destroy value and is considered bad.

What is NPV in Finance?

NPV stands for Net Present Value in Finance.

Before we understand what NPV is, let’s understand a few basic concepts of finance.

Conceptually, a dollar today (say in 2023) is worth more than a dollar 10 years in the future. Why? Because I can invest this dollar somewhere and in 10 years have much more than a dollar with me. Essentially, there is some ‘time value of money’.

Time Value of Money

The time value of money is a financial concept that refers to the idea that money available today is worth more than the same amount of money in the future. The basic premise is that a dollar received today is worth more than a dollar received in the future because of its potential to earn interest or increase in value over time.

Present Value

Now that we know that a dollar today is worth more than the same dollar 10 years in the future. Directionally we understand that the value of money decreases with the passage of time.

When a business or an investor plans out a business, they also project the cash flows of the business, i.e., how much money they expect to earn in year 1, year 2, year 3, year 4, year 5, etc. However, they have to make an upfront investment today to start the business. Now, we have money in various years – year 0 through year 5. How do we compare them all?

With the knowledge of ‘time value of money’, we can estimate the ‘Present Value’ of money from the future in today’s dollar value.

All future cash flows are adjusted by a factor to estimate their current value or present value. The adjustment factor is called ‘discount rate’.

Discount Rate

A discount rate is not a one-size-fits-all solution. Depending on the context, the discount rate for calculating the present value can vary.

A good way to think about a discount rate is this: “What is the alternative place where I can put this money and what is the return I can expect with a similar amount of risk”

For example, a common investor can use the expected returns of investing in a S&P500 Index ETF. A venture capital fund might have different risk tolerance and their discount rate would be different for their calculation purposes.

The discount rate is used on future cash flows to approximate their value in today’s dollar terms.

NPV

Okay, now we know that there is something called time value of money and discount rate can be used as a tool to determine the time value of money and approximate the future cash flows into Present Value.

So, we make an investment today – we already know the Present Value of that investment.

We use the Discount Rate to calculate the Present Value of all future cash flows.

Now we have all dollar amounts in today’s value. To calculate the Net Present Value, we add all the Present Values (of future cash flows) and subtract the investment made today.

Voila, we have our Net Present Value with us.

The NPV Calculator does all of the calculations for us in a simple manner.

How To Use NPV Calculator

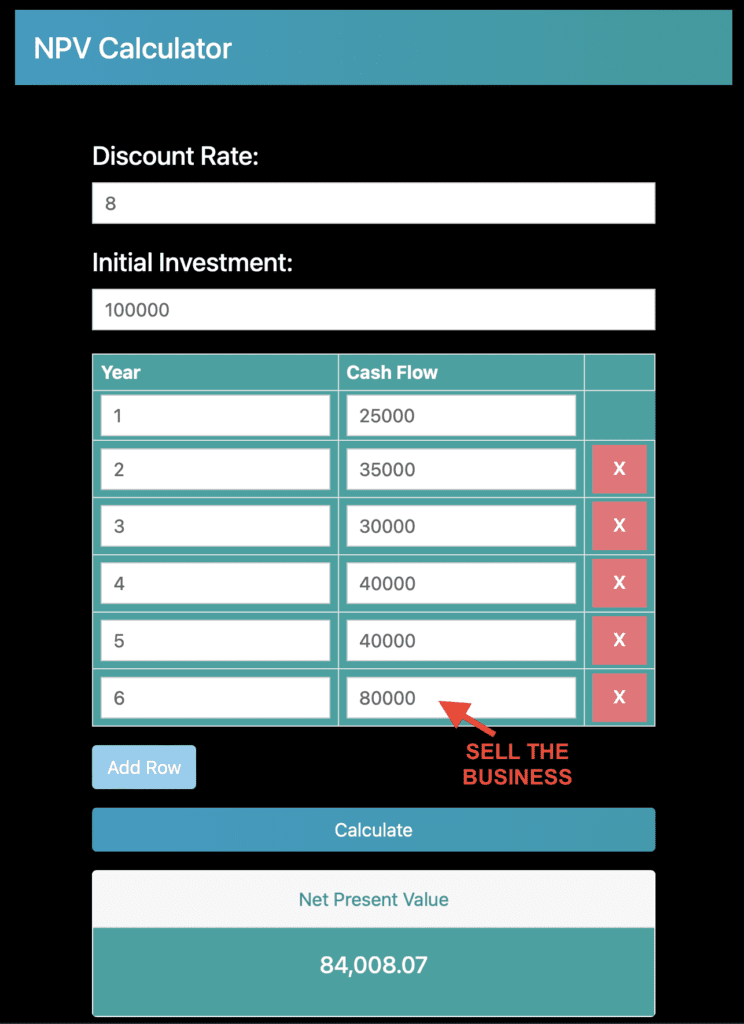

Let’s say I have $100,000 to invest in a new business today, and I want to know whether it is a good idea to proceed with the investment.

Step 1.

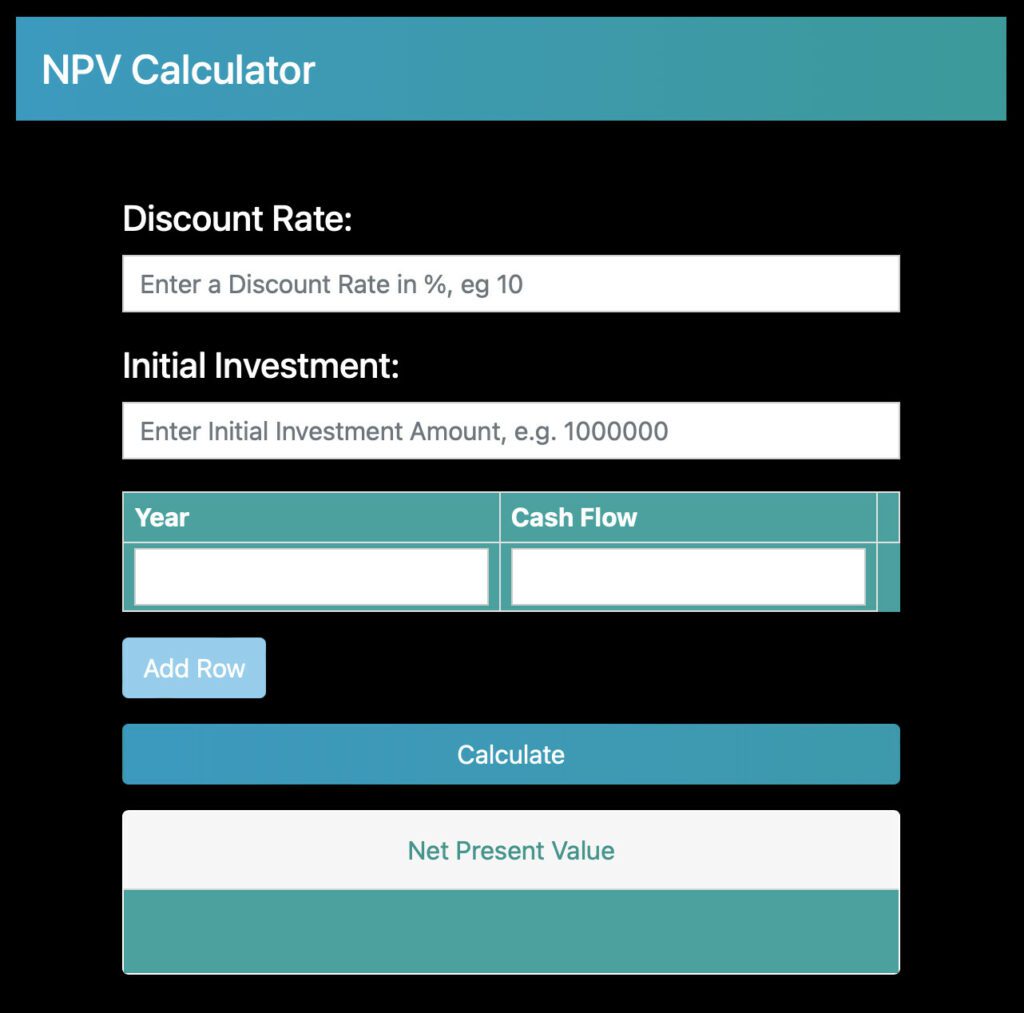

Open the NPV Calculator. This is a simple online tool with the following fields: Discount Rate, Initial Investment, and fields for Year and Cash Flow.

Step 2.

Fill in the Discount Rate and Initial Investment Amount.

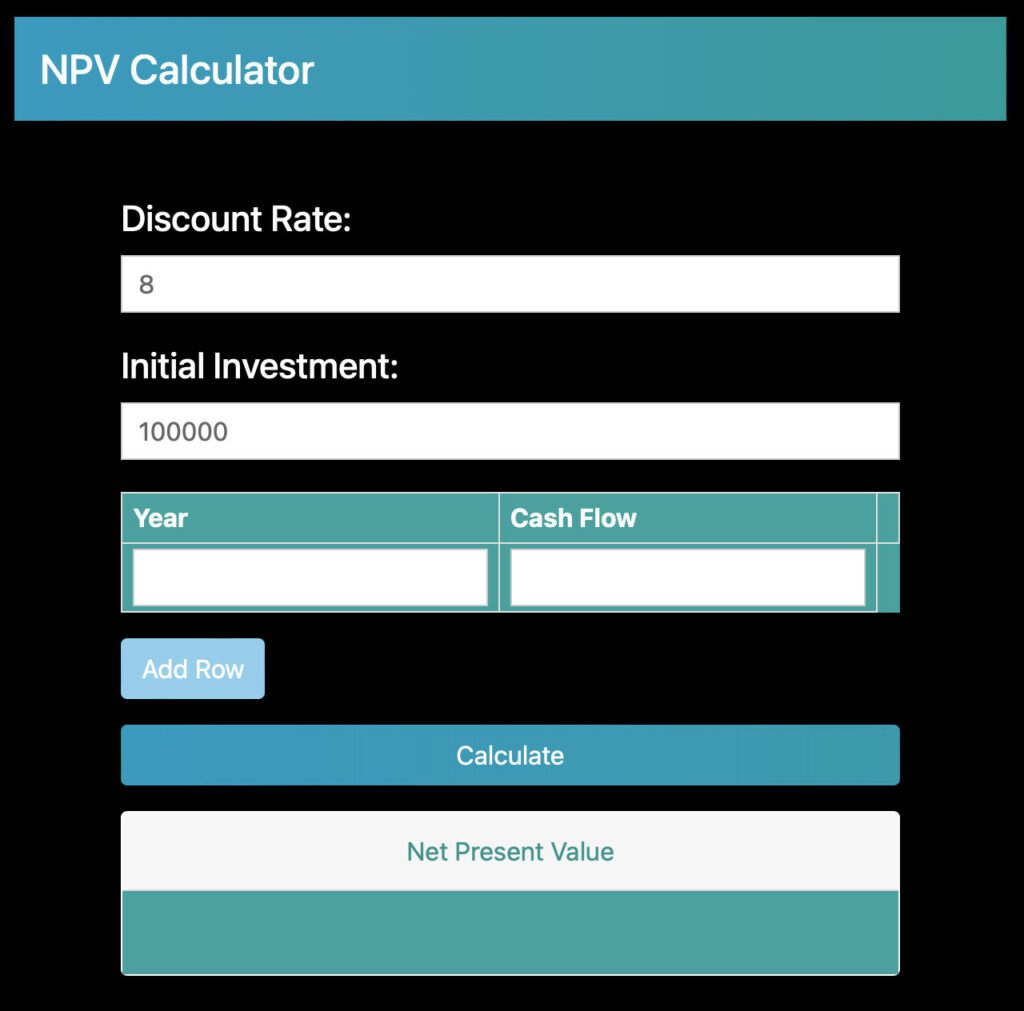

In my case, if I don’t invest my $100,000 in this business, I will simply invest the money a broad market index fund, such as an S&P 500 ETF. I expect the returns from the S&P 500 ETF to be 8% per year for the next several years.

So, in this case, my discount rate = 8% (you don’t need to put the ‘%’ sign in the NPV Calculator)

My initial investment = $100,000 (you don’t need to put the ‘$’ sign and ‘,’ separator in the NPV Calculator)

Step 3.

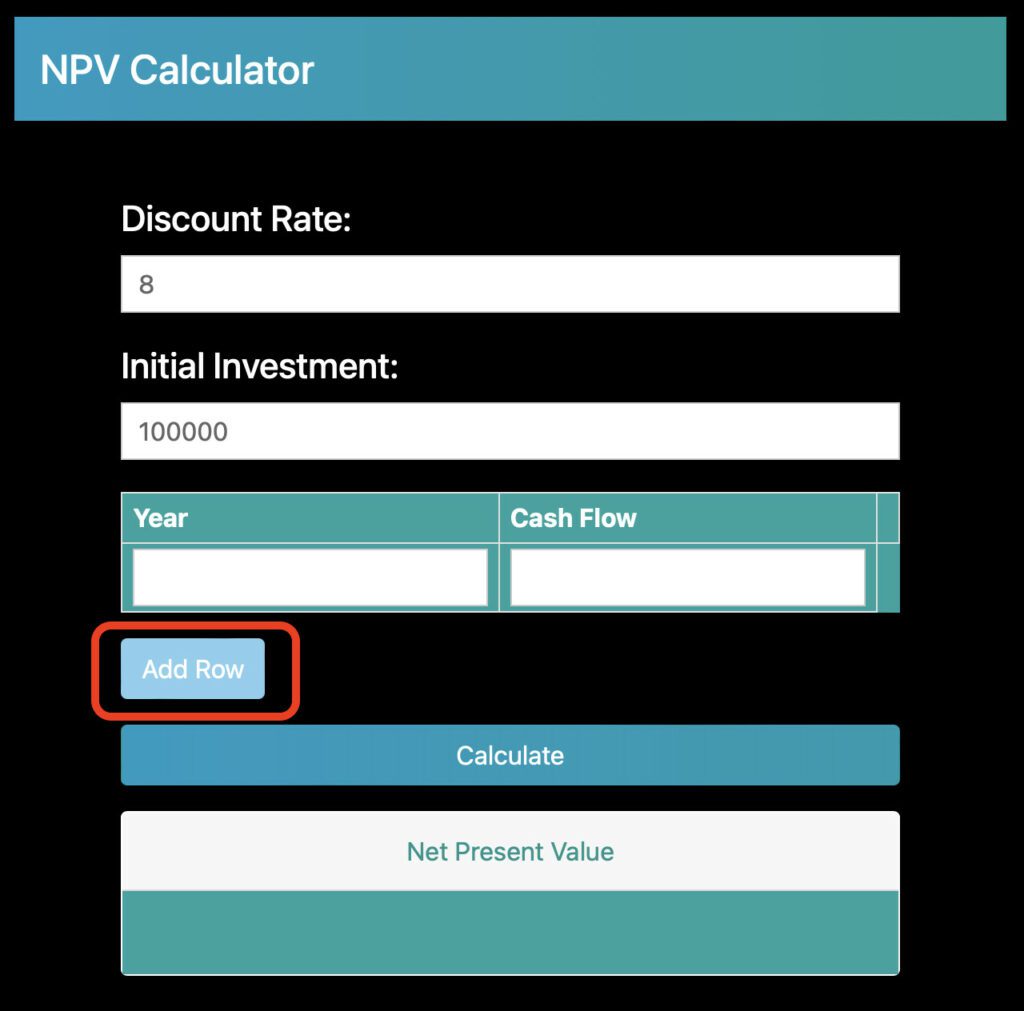

Add the yearly cash flow projections from the business.

Cash flows can be either positive or negative. In case the business is generating profits (hopefully!) the cash flows are positive. In some cases, the business might require further investment in some years, so the cash flow may be negative in that case.

In the NPV Calculator you can keep adding more and more years for cash flows by using the ‘Add Row’ button.

For my potential business investment, I have the following cash flow projections:

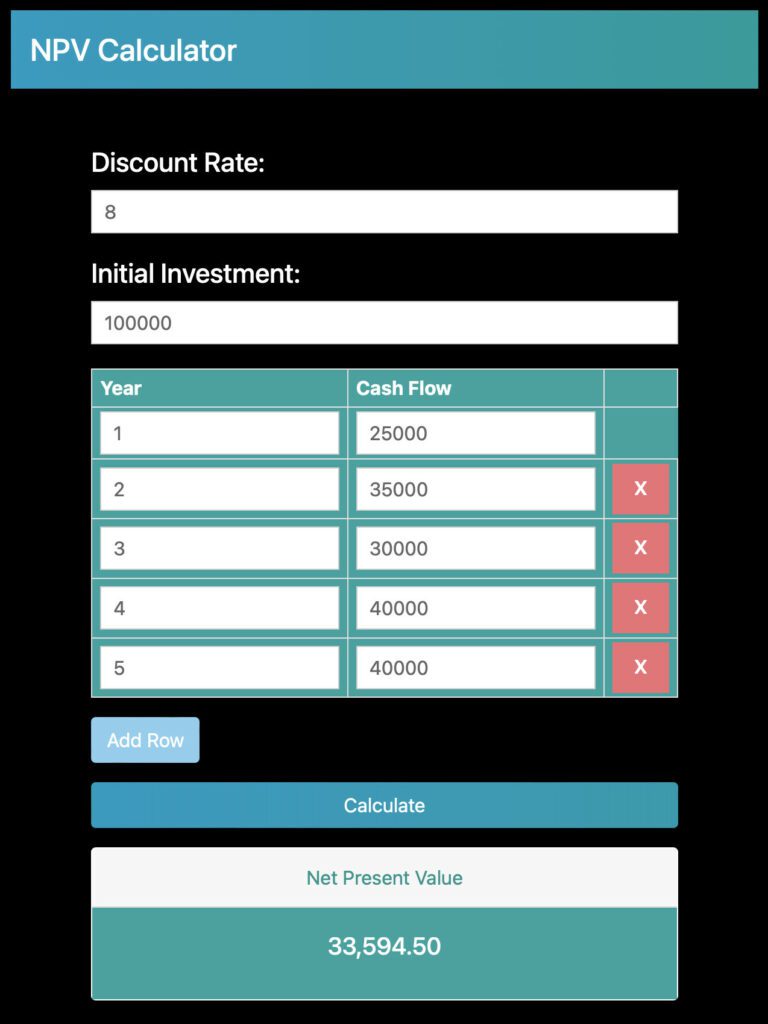

- Year 1: $25,000

- Year 2: $35,000

- Year 3: $30,000

- Year 4: $40,000

- Year 5: $40,000

After inputting the cash flows, hit calculate to see the NPV.

The NPV of this business idea is in excess of $33,500 by taking into account the first 5 years of cash flow projections. This looks good already!

But I still have a business with me after 5 years, it might still have some value.

Step 4.

Determine a terminal value or scrap value or resale value.

What happens to the business after the first 5 years? You can continue running the business forever if you want to, or you can sell it for some money.

Let’s say, after 5 years I decide to sell the business in the 6th year for $80,000.

So, I input the cash flow of $80,000 in year 6, and hit the Calculate button again.

Now, I see the NPV of the business idea, once I sell the business after 6 years of owning it.

The NPV is $84,000 (in today’s dollar value).

What that means is investing in this business is more profitable than investing in the S&P 500 Index by $84,000 today (based on all assumptions I have mentioned).

NPV Formula

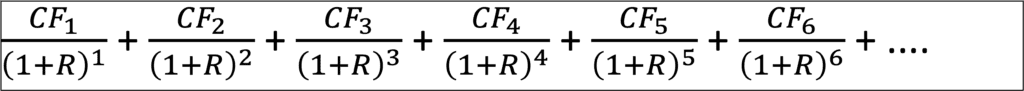

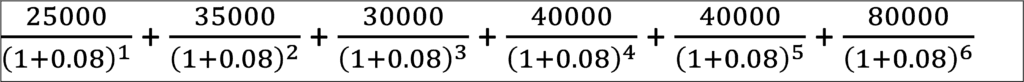

The Present Value of future cash flows is calculated by using the Discount Rate and no. of years the cash flow is in future.

Present Value =

where,

- CF is the cash flow of the period. CF1 = Cash Flow in Year 1, CF2 = Cash Flow in Year 2…

- and R is the Discount Rate

Filling in my cash flow values in the formula, I get the Present Value = $184,008

Now, I have to subtract the initial invest to get the NPV.

Net Present Value = Present Value – Initial Investment

NPV = $184,008 – $100,000 = $84,008

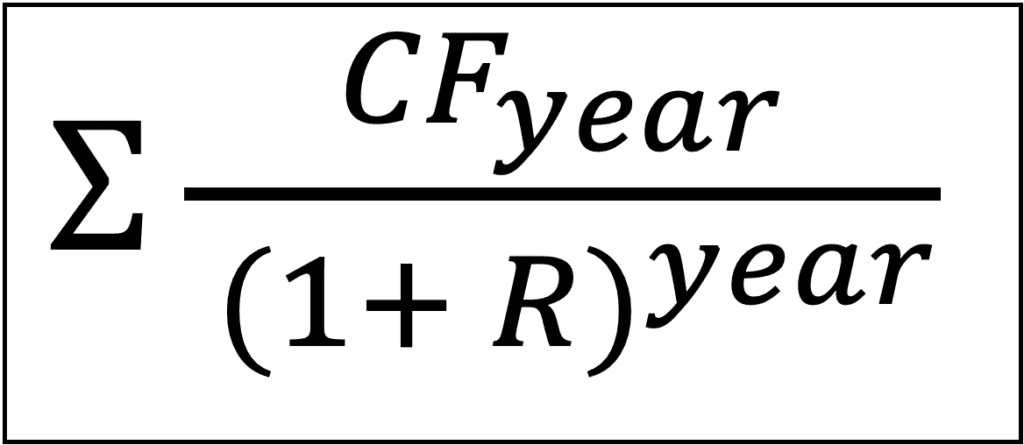

A condensed representation of the NPV formula is this:

where

- CF = Cash Flow for the year

- R = Discount Rate

The summation occurs for all years where there is a cash flow available, including year 0 when the initial investment is made.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents