This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

What Is FICO Credit Score?

In short, a FICO Credit Score is a number that can define your financial fitness. Basically, the higher your FICO score, the better you are perceived by a bank or a lending institution.

What this means is, if you keep your FICO score high, you get loans at lower interest rates, your loan payments are lower, and you qualify for premium credit cards.

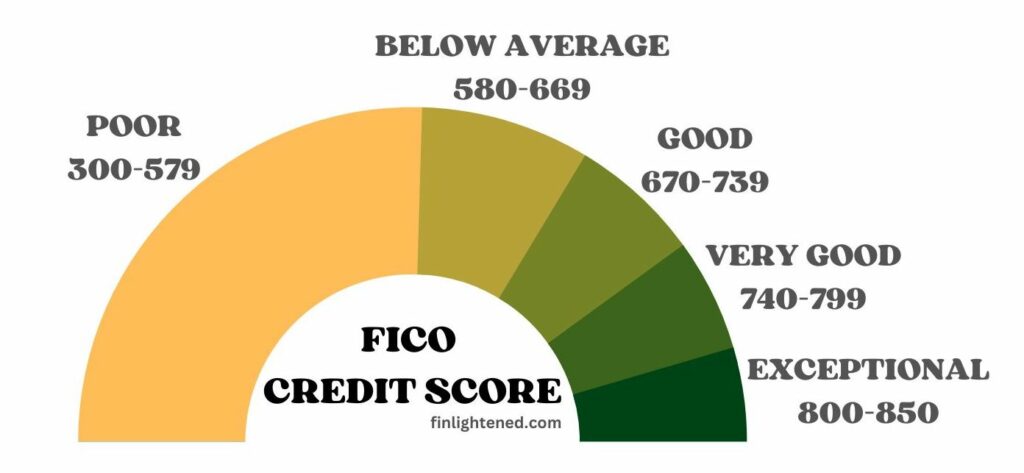

FICO score is a number in the range of 300 to 850.

Let’s Break The Score Range Down Into 5 Categories:

- Your score is considered “EXCEPTIONAL” if it is more than 800.

- Your score is considered “VERY GOOD” if it is between 740 and 799.

- Your score is considered “GOOD” if it is between 670 and 739. Most Americans fall in this Credit Score range.

- If your FICO score is between 580 and 669, you are considered “BELOW AVERAGE”, and you may have difficulties in obtaining a loan, or you will be charged higher interest rates on your loans if approved.

- Things get more difficult for people with FICO scores below 580. Any score below 580 is considered “POOR”. It’s difficult to access loans and credit cards with scores in this category.

The good news is you can increase your credit score with the right strategy. For doing so, let’s understand how a credit score is computed, i.e., what factors impact the FICO credit score.

5 Components of the FICO Credit Score

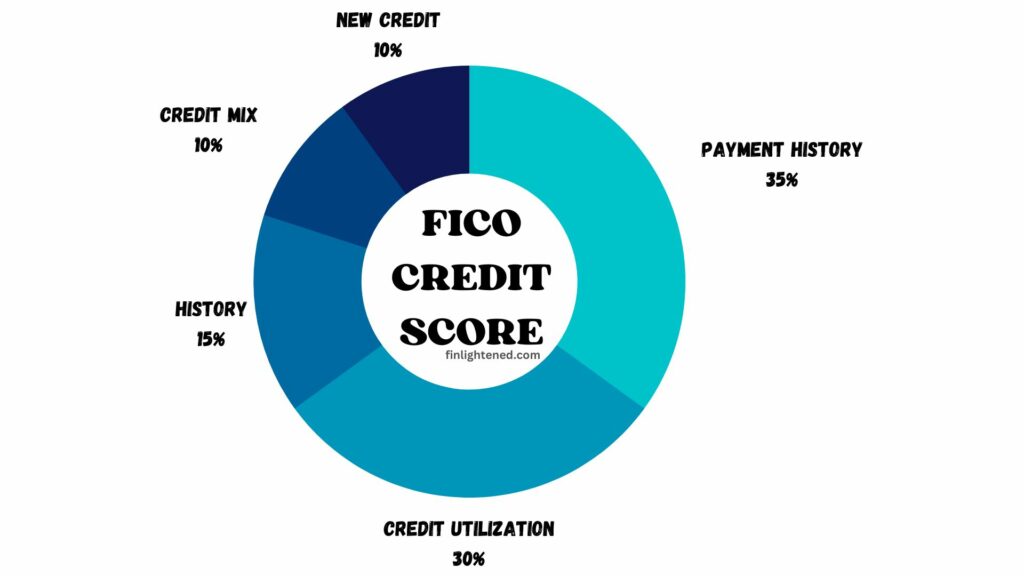

There are 5 components that go into the FICO Score model. They are – payment history, credit utilization, length of credit history, credit mix, and new credit.

1. Payment History | 35%

The most important factor in the FICO Score is payment history. It has 35% weight in the calculation. If you are paying your debts in a timely manner, the FICO scoring model will reward you for doing so.

2. Credit Utilization | 30%

The second most important factor in the FICO score is Credit Utilization. It has a 30% weight in the FICO Score calculation. Credit utilization is the calculation of your debts as a percentage of your total credit limit, i.e. up to what percentage are you using your debt capacity. So, on a credit card with a limit of $10,000, if you are using $2,000, your utilization is 20%.

Keep your utilization under 20% and you will see an increase in your credit score over time!

3. Length of Credit History | 15%

The Length of Credit History has a weight of 15% in the FICO score calculation. So, it takes into account the time for which all your credit accounts have remained open and computes the average age of your credit history. Keeping open older credit accounts, naturally, helps the avg. credit history and boosts the credit score.

4. Credit Mix | 10%

Credit Mix accounts for 10% of the weight in the FICO score calculation. Mortgages, auto loans, credit cards, and personal loans are all different types of credit. A good mix of different types of credit is rewarded by the FICO Score model.

5. New Credit | 10%

New Credit accounts for 10% in the FICO score model: Opening too many Recent Credit Accounts can be a sign of riskiness (it can appear shady if the person is trying to access too much credit in a short span of time), especially for people without a long credit history. So, when you are opening credit accounts, pace it well to avoid damaging your FICO score.

So, now that you know what factors go into the FICO Score model, and which one matters the most, you can focus on improving your credit score.

Here are 4 Tips To Increase Your FICO Credit Score:

- Make your payments on time. Keep track of due dates, and automate the payments. Set a reminder to double-check if the payments are made by the due date (sometimes there might be glitches in technology, so don’t take chances).

- Keep your credit utilization under 20%, I’d say ideally at 10%.

- Keep your old credit cards active. If there’s no annual fee on those credit cards, make small transactions on them every now and then, and keep them active to help boost your credit history.

- Do not open too many credit cards in quick succession. Have a strategy as to when to apply for a credit card. Keep a 6-month gap between two new credit cards.

Conclusion

FICO Credit Score can play an important role in your life. Hope this short article helped decode the FICO Credit Score for you. Follow the tips and cruise through your financial life. Cheers to a higher credit score in the future!

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents