This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Regardless of being wanderlust or not, everyone wants to do a fair bit of traveling, be it a solo journey, or a family vacation. Traveling is almost everyone’s top wish. And it is understandable because it will help you to explore more new places and learn new cultures, and languages, and meet new people etc. As much as traveling is fun, it is also a rather expensive pursuit. Regardless of your style of traveling, there are a fair bit of unavoidable expenses.

Best Credit Cards For Traveling Consultants (Jump To Section)

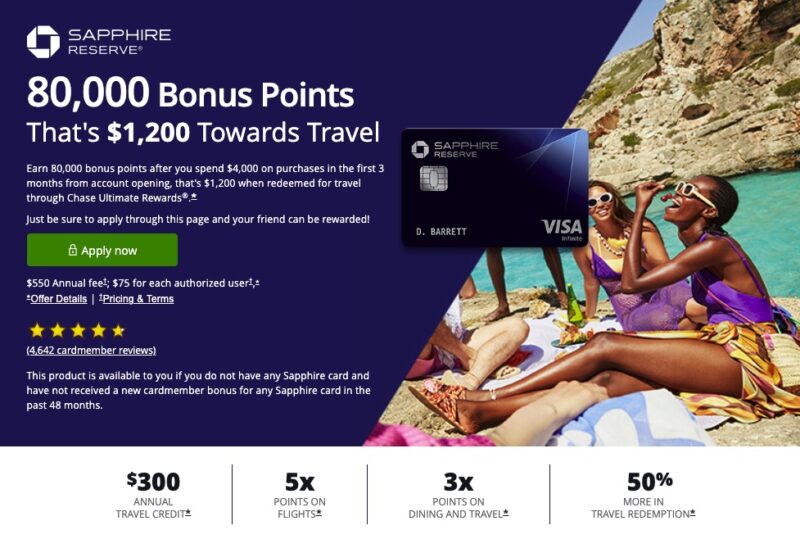

Chase Sapphire Reserve Offer

Everyone knows about credit cards and how they can help you some extra buck here and there. But when it comes to checking fees and other expenses related to travel, it may get you confused. Worry not, this article about the best credit card for traveling consultants is going to help you with all of these. This article is going to cover things in detail and hopefully, by the end, you will have your answers. This will be especially helpful if you are a traveling consultant in the USA.

Before getting directly into the best credit card for traveling consultants, you need to know about certain other things first. This section will help you to understand which factors should be kept in mind while choosing a credit card. Also, you will understand what kind of rewards you can expect from these credit cards for traveling.

A Few Tips For Choosing A Credit Card For Traveling Consultants

Travel the world is a dream for millions of people throughout the globe. The bucket list for traveling is endless- experiencing a new culture, discovering new places, getting closer to people around the planet, diverse cuisines, culture-based activities, and so forth. To make all of these dreams come true, how are you planning? Are you planning to contact a travel consultant?! Or better yet you want to manage your travel expenses by yourself. Whatever the case, we are here to help you regardless.

Do not worry at all because, in this article on the best credit card for traveling consultants, you will find all the necessary information. Once a wise person said that just having money is not the most crucial thing to travel well. Proper planning and smart saving hacks can go a long way too. Yupp, it’s true and for that reason, I am here to suggest you use the best credit cards for travel consultants. But before that, here are a few tips that will help you to get a detailed insight into the best credit cards for travel consultants.

Lots of people are still unaware that choosing a good credit card can fund their travel dreams. Those who possess a proper insight into a credit card can indulge themselves in the wanderlust of travel. Just imagine, how these card-savvy people are making smart moves with the best credit card for traveling and saving tons of money. You can make your smart choice by choosing the best credit card for traveling consultants and jumping on the bandwagon. Here are a bunch of things to consider first.

- Travel includes much more than you can imagine.

- International or domestic travel facilities.

- Make a comparison among air mile rewards.

- Offers with travel aggregators.

- Partnership with various airlines.

- Welcome bonus gifts and other rewards with the credit card.

- Fees on the card for traveling consultants.

- Foreign currency markup fees.

- Know various traveling habits beforehand.

- Maximize the benefit of the credit card for your convenience.

- Check all kidneys of eligibility.

- Build your credit score.

Now it is time to get to know these key factors a little better.

1. Travel includes much more than you can imagine

When you are choosing a credit card for traveling, you need to keep in mind that the main benefit of credit cards is not just getting access to travel miles that will help to get free airline travel. It is a lot more than that. Proper travel includes places for accommodation, meals, and modes of transportation as well. Now, when you are going to choose a credit card for travel, look for these benefits as well:

- Elite hotel or resort membership.

- Access to various airport lounges.

- Travel miles for domestic as well as international travels.

- The opportunity of fuel surcharge if required.

- Access to railway lounges in case a train is needed for the tour.

2. International or domestic travel facilities

Before starting your travel, you need to think about your travel goals, habits, and aspirations. This will be the key to deciding what credit card you should consider for traveling. Be it an international or a domestic trip, you need to check whether the card is offering international and domestic hotel miles, and hotel memberships or not. As per your destination choice, you can handpick a credit card. Also, before going for the credit card, make sure your choice of the airline has a tie-up with that card company.

3. Make a comparison among airline miles rewards

Though accommodation facilities can be hacked by travelers, the air mile reward is always one of the most demanding. When you are going to choose a credit card for traveling, you need to check the rates at which you can earn air miles. Also, make sure to know how you can redeem them as well. Generally, you can redeem the air mile through vouchers or miles based on spending.

4. Offers with travel aggregators

A few credit cards have a tie-up with specific online travel aggregators. So, it is possible to travel with that special travel aggregator so that you can get all kinds of available offers on your card. If your card is not having a partnership with your favorite travel aggregator, then you can choose the credit card accordingly beforehand.

5. Partnership with various airlines

If you have chosen a credit card that has a tie-up with an airline, you will get all kinds of facilities with that particular airline. Even if the airline is providing an access to a flyer’s club, you may be that lucky person to get special access through your credit card. Apart from this, some cards are specifically designed for a travel mile partnership with a top-grade airline company. If you have a lot of travel scheduled or any other business travel, then you may choose that card to get huge perks and benefits.

6. Welcome bonus gifts and other rewards with the credit card

The most lucrative factor to look into is the welcome bonus and other reward programs associated with the credit card. Lots of credit cards provide an opportunity to get instant reward points to gift vouchers for airline and hotel memberships. When you are choosing a credit card for your travel, make sure you have evaluated the overall value of the credit card before signing up. Do not skip this factor because credit cards are accompanied by several fees. If you do not travel frequently, then you may end up paying a few extra bucks for the credit card all the while not getting the most out of it.

7. Fees on the card for traveling consultants

A lot of credit cards come with huge amount of annual fees. Also, these credit cards are easily available for all kinds of eligibility So when you are planning for getting a credit card, you must check the annual fee as well as any other fees if you need to cover it.

Bestseller Personal Finance Books

8. Foreign currency markup fees

You need to check if the card demands a foreign currency markup fee when you are in other countries.

9. Know various travel habits beforehand

This is a very interesting one because when you get to know about other travel habits, you can get the maximum benefit out of a credit card. Make sure you are going to use air miles for the next tour or bonus points for various facilities associated with the card.

10. Maximize the benefit of the credit card for your convenience

We do not recommend any big non-travel spending on the card, it is also advisable that you should put big purchases on the card in order to maximize all benefits of the card.

11. Check all kinds of eligibility

When you are done choosing the most suitable credit card for you, the next step is to check the eligibility criteria of that specific card. Also, don’t delay any payment on the credit card.

12. Build your own credit score

Travel credit cards come with attractive benefits. But you must pay your credit card bills always on time so that you never miss any chance of making a strong credit score. Timely payment will make a good credit history for you which in turn will be useful in the future.

So now when you are done with the basics, you need to go through the options available in the market at this moment for credit cards. Here we have created a strong recommendation list for you. Choose the best one wisely and accordingly to your eligibility and the offers given with the card. Do consider your travel needs and style while making the decision.

Best Credit Cards For Traveling Consultants

Here is the list of the best credit card for traveling consultants. Check out the details.

- Capital One Venture X Rewards Credit Card

- Chase Sapphire Preferred Credit Card

- United Club Infinite Card

- Hilton Honors Aspire Card from American Express

- Chase Sapphire Reserve

- The World Of Hyatt Credit Card

Let’s get started with the description of these credit cards.

1. Capital One Venture X Rewards Credit Card

If you want to avail the most classic and sophisticated credit card for you, then Capital One Venture X Rewards Credit Card is the best. This card is packed with lots of extra benefits that can easily make it stand out among the rest. The only thing is the annual fees, which may be a matter of concern. As a welcome bonus, you will earn 75,000 bonus miles when you will spend $4,000 on purchases within the duration of the first 3 months from account opening. This is quite similar to the value of $ 750.

If you will book through Capital One Travel, you will get up to $300 cashback annually as statement credits. You can also avail of 10,000 bonus miles (equal to $100 towards travel) per year. This will count as the day of your first anniversary with the credit card.

If you will book through Capital One Travel, you will be avail of unlimited 10X miles on hotels and rental cars. Apart from this, you will also get 5X miles on flights booked through Capital One Travel. You will be eligible for Unlimited complimentary access and two guests to 1,400+ lounges in the network of this Capital One Travel. Make sure, you will make use of your Venture X miles to make travel expenses, including flights, hotels, rental cars, etc. The annual fee for this exclusive Capital One Venture X Rewards Credit Card is $395.

2. Chase Sapphire Preferred Credit Card

With a blend of higher rewards rates and redemption flexibility, this credit card is among the best credit card for travel consultants. Those who love to spend on food while traveling can get the best out of this extraordinary credit card. This credit card comes with an annual fee of $95. As a welcome bonus, you will get 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

You can also get benefits like $50 annual Ultimate Rewards on Hotel Credit, 3x on dining & 2x on all other travel purchases, or even sometimes 5x on travel purchased through Chase Ultimate Rewards®. When you redeem your points, you can get up to 25% off on airfare, hotels, car rentals, and cruises. But you need to book through Chase Ultimate Rewards®.

Apart from all of these benefits mentioned above, you can also count on trip Cancellation or interruption insurance, auto rental collision damage waiver, lost luggage insurance, etc. These things are much needed for a traveling consultant.

3. United Club Infinite Card

The most unique credit card for traveling consultants is the United Club Infinite Credit Card. You will be amazed by the amazing value of this credit card. This card demands an annual fee of $525. You will get 100,000 bonus miles after spending $5000 on purchases for the duration of the first three months after opening the credit card account. This card offers 4 miles per $1 spent on United® purchases including tickets, Economy Plus, inflight food, beverages, and Wi-Fi.

This offer is valid if you travel through United Club facilities. If you want to travel with others, you will earn 2 miles per $1 spent. 2 miles per $1 spent on dining including delivery services are also available on this card. 1 mile per $1 spent on all other purchases is another benefit of this credit card. You can get up to $100 Global Entry or TSA PreCheck® fee credit on this card.

When you will be on board United-operated flights, you can get 5% back as a statement credit on purchases of food, beverages, and Wi-Fi but you need to pay with your Club Infinite Card.

4. Hilton Honors Aspire Card from American Express

To match a high-end status, this Hilton Honors Aspire Card from American Express is quite interesting and lucrative for all traveling consultants. Those who are hunting for Hilton properties can go for this card to get suitable perks and benefits as well. With the enrollment, you will get a complimentary Priority Pass. As a welcome bonus, you will earn 50,000 Hilton Honors bonus points when you will spend $4,000 in purchases through the card within the duration of your first 3 months of card opening.

You can also get 3X Hilton Honors bonus points on various eligible purchases. With your Hilton Honors American Express Aspire Card, you are going to enjoy up to $250 in statement credits. With this exclusive Hilton Honors Aspire Card from American Express, you can book flights directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and other benefits in various U.S. restaurants.

Apart from all of these perks and benefits, you can earn up to $250 in statement credits each year of card membership.

5. Chase Sapphire Reserve

One of the most popular cards is the Chase sapphire reserve which comes with an annual fee of $550. This credit card is especially known for its superior points earning rate when you are a frequent traveler or love dining out. You can get 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. Also, you will earn 5x total points on air travel and 10x total points on hotels and car rentals. But this will be credited when you will purchase travel through Chase Ultimate Rewards®.

Chase Sapphire Reserve Offer

You will be eligible for getting 50% more value when you redeem your points for travel through Chase Ultimate Rewards®. You will get access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™. This card also offers you trip cancellation or interruption insurance, auto rental collision damage waiver, lost luggage insurance, etc.

6. The World Of Hyatt Credit Card

Though there is no such extensive network for the Hyatt properties, you will still be offered a great value on the World of Hyatt Credit Card. If you are a frequent card user, you will get a higher point redemption value, sweet perks, and one free night’s stay per year. This card demands an annual fee of $95. As a welcome bonus, you will get 30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening.

Apart from that, you will also get up to 30,000 more bonus points by earning 2 bonus points total per $1 spent in the first 6 months from account opening. As long as your account is open with the Hyatt Credit card, you can enjoy complimentary World of Hyatt Discoverist status as well.

After opening the account on the Hyatt Credit Card, you will also get 1 free night each year. You will be also eligible for 2 Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airlines. This is also available on local transit and commuting and fitness club and gym memberships.

Here is a summary of all of these above-mentioned credit cards.

Summary: Best Credit Cards For Traveling Consultants

| Card Name | Best For | Annual Fees | Welcome Bonus |

| Capital One Venture X Rewards Credit Card | Best for all services | $395 | 75000 miles |

| Chase Sapphire Preferred Credit Card | Best Mid-Tier Travel Rewards Card | $95 | 60,000 bonus points |

| United Club Infinite Card | Best Airline Card | $525 | 100,000 bonus miles |

| Hilton Honors Aspire Card from American Express | Best Hotel Card | $450 | Earn 150,000 points |

| Chase Sapphire Reserve | Best Premium Card for Transfer Partners | $550 | 60,000 bonus points |

| The World Of Hyatt Credit Card | Best for Hyatt Loyalists | $95 | up to 60,000 Bonus Points |

The Bottom Line

Almost all the relevant detail about the best credit cards for traveling consultants is included in this piece of article. I hope this was helpful to you in deciding on the most suitable credit card for all kinds of travel expenses.

Read more:

- 4 Best Credit Cards For Nannies

- 9 Best Credit Cards for Wedding Expenses

- 10 Best Credit Cards For Consultants

- 8 Best Credit Cards For Golf Lovers

- 6 Best Credit Cards for Traveling Consultants

- How to Use Credit Card Responsibly: 7 Must-Have Credit Habits

- Plastic Money – 3 Huge Payment Networks – Visa, Mastercard, and American Express

- Apple Pay and Google Pay – Which Is Better Among Top 2 Services?

- 8 Cool Benefits of Obtaining A Personal Loan – When to Consider It?

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents