This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Before we compare the similarities and differences between Straddle vs Strangle Options, let’s first understand options straddle and options strangle in detail. To jump to a particular section, please use the ‘Page Contents’ menu below.

Page Contents

- Straddle Option Definition

- Long Straddle Option: What is a Long Straddle?

- Long Straddle: Profit and Loss Graph

- Short Straddle Option: What is a Short Straddle?

- Short Straddle: Profit and Loss Graph

- Strangle Option Definition

- Long Strangle Option: What is a Long Strangle?

- Long Strangle: Profit and Loss Graph

- Short Strangle Option: What is a Short Strangle?

- Short Strangle: Profit and Loss Graph

- Straddle vs Strangle Options: Similarities and Differences

Straddle Option Definition

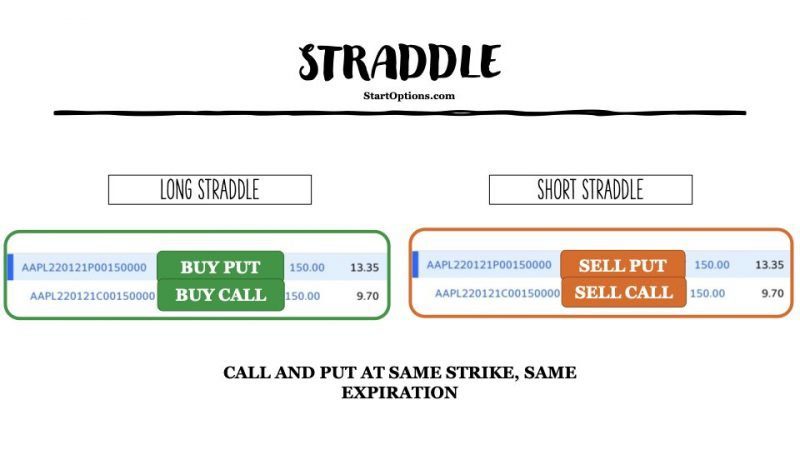

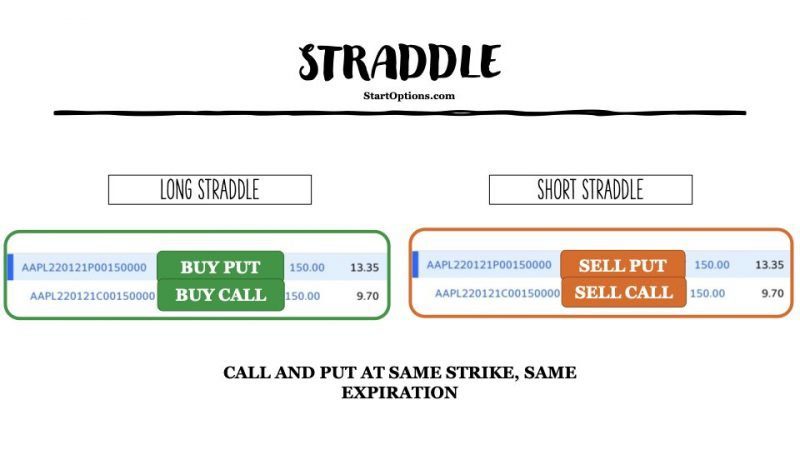

A Straddle Option is a combination of two stock options – one call option and one put option.

A Straddle Option is created when we buy (or sell) one call option + one put option at the same strike price and same expiration date.

Long Straddle: When we buy the call + put option, we create a long straddle,

Short Straddle: When we sell a call + put option, we create a short straddle.

Long Straddle Option: What is a Long Straddle?

A Long Option Straddle is created by buying a call and a put option with the same expiration date and same strike price. In the example above, we are buying an AAPL $150 strike call + an AAPL $150 strike put – both with the same expiration date of 21 Jan 2022.

Is Long Straddle a Net Debit or Net Credit Trade?

Since we need to pay a premium to buy both the call and put options, a long straddle is a net debit trade. In the example, we are paying $13.35 to buy the $150 strike put and $9.70 to buy the $150 call i.e. a total of $23.05/per share or $2,305.00 for the long straddle (100 shares).

What is the Maximum Profit in a Long Straddle?

The maximum profit in a long straddle is unlimited because it contains a long call option. If the stock price skyrockets, the profitability of the call option (hence the long straddle) is practically unlimited.

What is the Maximum Loss in a Long Straddle?

The maximum loss in a long straddle is limited to the net debit paid to create the straddle. In this example, the maximum loss is $23/share or $2,300 for the straddle (100 shares).

What is the Breakeven Point of a Long Straddle?

Long Straddle has two breakeven points, one in either direction of the strike price. The breakeven points are

- lower breakeven point = strike price – |net debit|

- and, higher breakeven point = strike price + |net debit|

The long straddle is profitable above the higher breakeven point AND below the lower breakeven point.

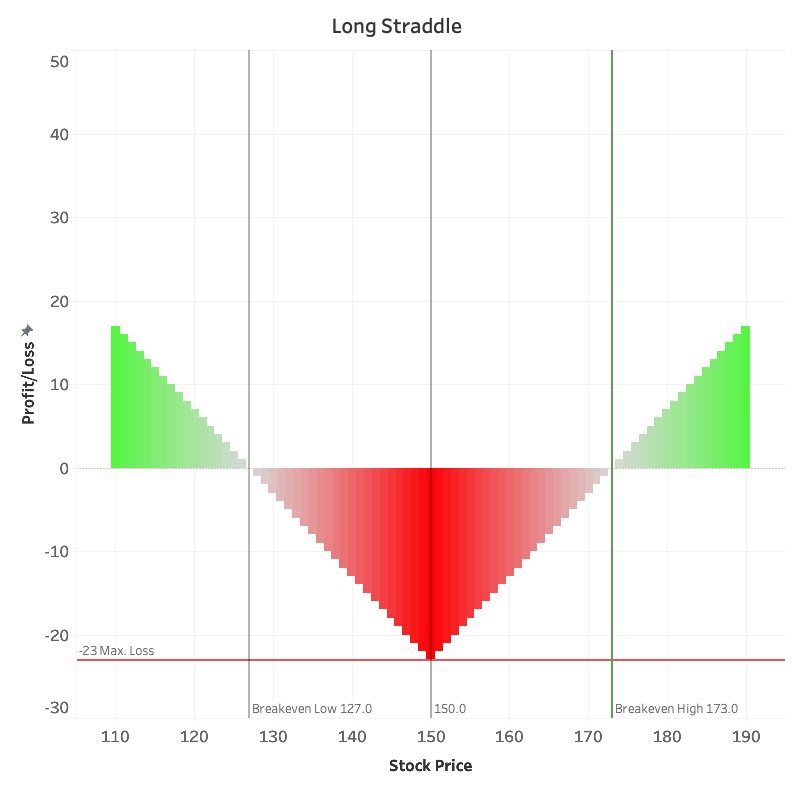

Long Straddle: Profit and Loss Graph

The maximum loss in a long straddle is observed when the stock price = the strike price. The loss reduces as the stock price moves away from the strike price in either direction. The long straddle becomes profitable when the stock price goes below the lower breakeven point or goes above the higher breakeven point.

In this example, the maximum loss is $23/share or $2,300. The maximum profit is unlimited when the stock price goes up and above the higher breakeven point. The profit is limited to $127/share if the stock price goes below the lower breakeven point, down to $0/share.

Short Straddle Option: What is a Short Straddle?

A Short Straddle Option is created by selling a call and a put option with the same expiration date and same strike price. In the example above, we are selling an AAPL $150 strike call + an AAPL $150 strike put – both with the same expiration date of 21 Jan 2022.

Bestseller Personal Finance Books

Is Short Straddle a Net Debit or Net Credit Trade?

Since we collect premium when we sell both the call and put options, a short straddle is a net credit trade. In the example, we are collecting $13.35 while writing the $150 strike put and $9.70 while writing the $150 call i.e. a total of $23.05/per share or $2,305.00 for the short straddle (100 shares).

What is the Maximum Profit in a Short Straddle?

The maximum profit in a short straddle is limited to the net credit, i.e. $23/share in our example.

What is the Maximum Loss in a Short Straddle?

The maximum loss in a short straddle is practically unlimited. Because we are selling a call option, if the stock price skyrockets, the sold call option can bring us huge losses.

What is the Breakeven Point of a Short Straddle?

Short Straddle has two breakeven points, one in either direction of the strike price. The breakeven points are

- lower breakeven point = strike price – |net credit|

- and, higher breakeven point = strike price + |net credit|

The short straddle is profitable in between the higher breakeven point and the lower breakeven point.

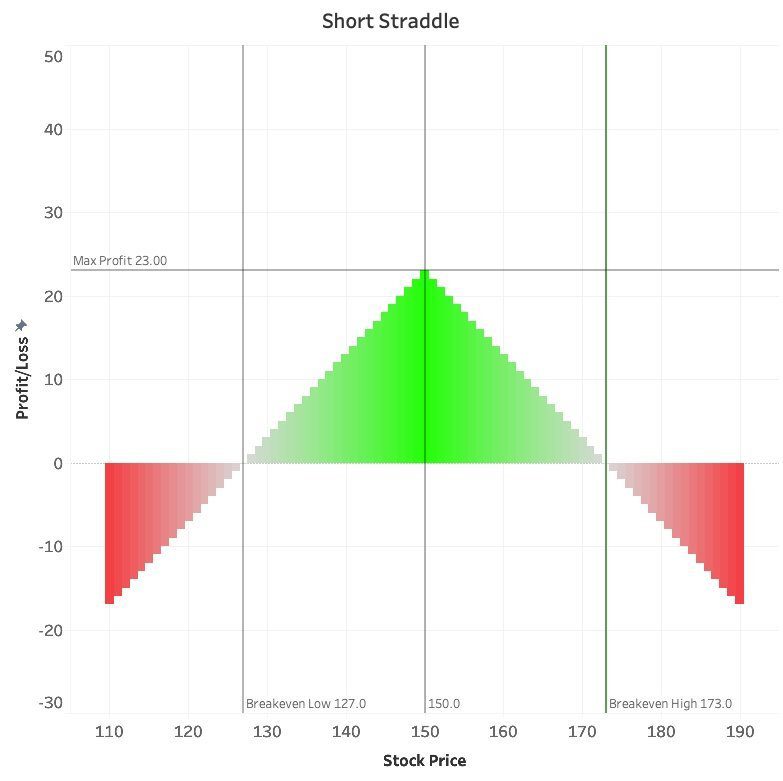

Short Straddle: Profit and Loss Graph

The maximum profit in a short straddle is observed when the stock price = the strike price. The profit reduces as the stock price moves away from the strike price in either direction. The short straddle loses money when the stock price goes below the lower breakeven point or goes above the higher breakeven point.

In this example, the maximum profit is $23/share or $2,300. The maximum loss is unlimited when the stock price goes up and above the higher breakeven point. The loss is limited to $127/share if the stock price goes below the lower breakeven point, down to $0/share.

Strangle Option Definition

A Strangle Option is a combination of two stock options – one call option and one put option.

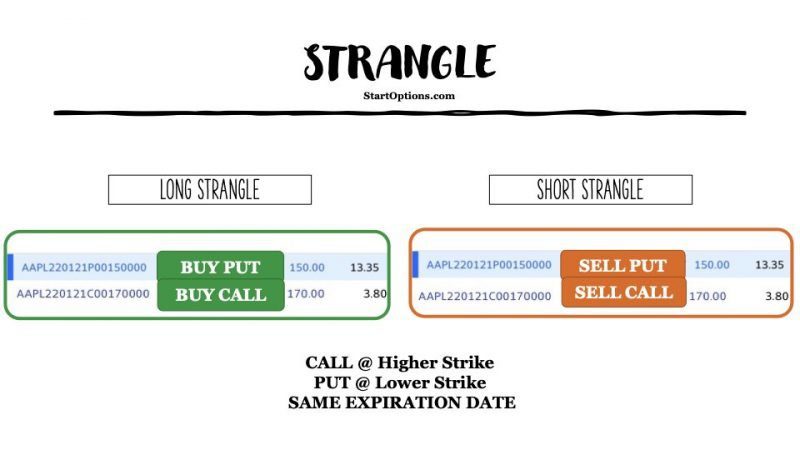

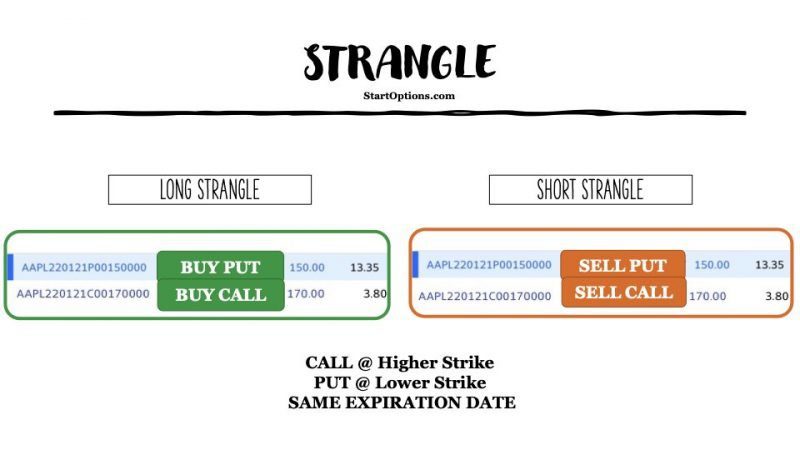

A Strangle Option is created when we buy (or sell) one call option at a higher strike price + one put option at a lower strike price and same expiration date.

Long Strangle Option: When we buy the call + put option, we create a long strangle,

Short Strangle Option: When we sell a call + put option, we create a short strangle.

Long Strangle Option: What is a Long Strangle?

A Long Strangle Option is created by buying a call option at a higher strike price and a put option at a lower strike price with the same expiration date. In the example above, we are buying an AAPL $170 strike call + an AAPL $150 strike put – both with the same expiration date of 21 Jan 2022.

Is Long Strangle a Net Debit or Net Credit Trade?

Since we need to pay a premium to buy both the call and put options, a long strangle is a net debit trade. In the example, we are paying $13.35 to buy the $150 strike put and $3.80 to buy the $170 call i.e. a total of $17.15/per share or $1,715.00 for the long strangle (100 shares).

What is the Maximum Profit in a Long Strangle?

The maximum profit in a long strangle is unlimited because it contains a long call option. If the stock price skyrockets, the profitability of the call option (hence the long strangle) is practically unlimited.

What is the Maximum Loss in a Long Strangle?

The maximum loss in a long strangle is limited to the net debit paid to create the strangle. In this example, the maximum loss is $17.15/share or $1,715 for the strangle (100 shares).

What is the Breakeven Point of a Long Strangle?

Long Strangle has two breakeven points, one lower than the strike of the put options, and one higher than the strike price of the call option.

The breakeven points are the following:

- lower breakeven point = strike price of put (i.e. lower strike price) – |net debit|

- and, higher breakeven point = strike price of call (i.e. higher strike price) + |net debit|

The long strangle is profitable above the higher breakeven point AND below the lower breakeven point.

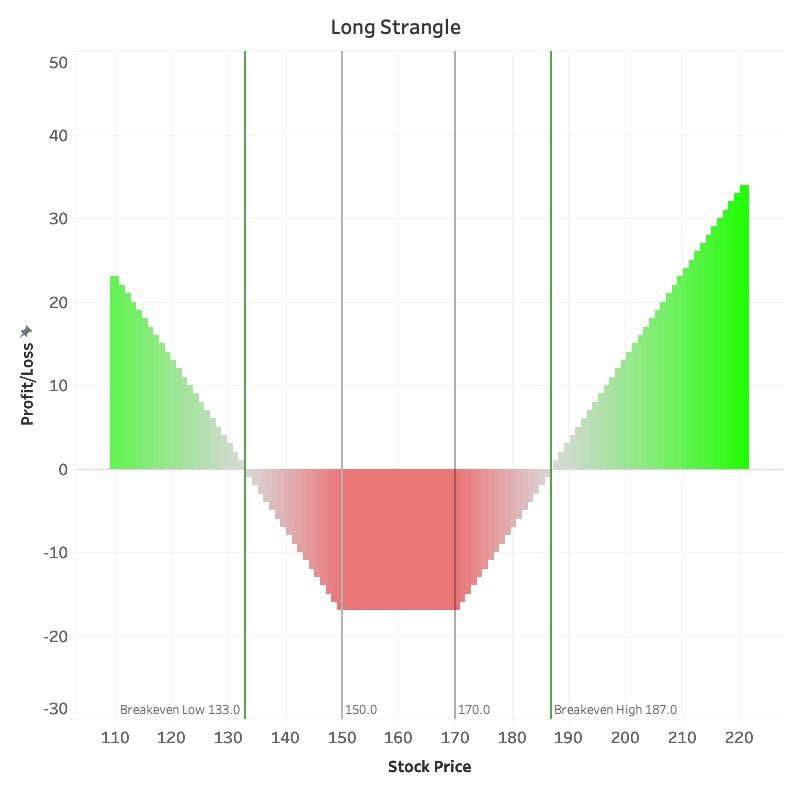

Long Strangle: Profit and Loss Graph

The maximum loss in a long strangle is observed when the stock price is between the two strike prices of the call and put options. The loss reduces as the stock price moves below the lower strike price or above the higher strike price. The long strangle becomes profitable when the stock price goes below the lower breakeven point or goes above the higher breakeven point.

In this example, the maximum loss is $17.15/share or $1,715. The maximum profit is unlimited when the stock price goes up and above the higher breakeven point. The profit is limited to $133/share if the stock price goes below the lower breakeven point, down to $0/share.

Short Strangle Option: What is a Short Strangle?

A Short Strangle Option is created by selling a call at a higher strike price and a put option at a lower strike price with the same expiration date. In the example above, we are selling an AAPL $170 strike call + an AAPL $150 strike put – both with the same expiration date of 21 Jan 2022.

Is Short Strangle a Net Debit or Net Credit Trade?

Since we collect premium when we sell both the call and put options, a short strangle is a net credit trade. In the example, we are collecting $13.35 while writing the $150 strike put and $3.80 while writing the $170 call i.e. a total of $17.15/per share or $1,715.00 for the short strangle (100 shares).

What is the Maximum Profit in a Short Strangle?

The maximum profit in a short strangle is limited to the net credit, i.e. $17.15/share in our example.

What is the Maximum Loss in a Short Strangle?

The maximum loss in a short strangle is practically unlimited. Because we are selling a call option, if the stock price skyrockets, the sold call option can bring us huge losses.

What is the Breakeven Point of a Short Strangle?

Short Strangle has two breakeven points, one lower than the strike price of the put option, and one higher than the strike price of the call option.

The breakeven points are the following:

- lower breakeven point = strike price of the put option (i.e. lower strike price) – |net credit|

- and, higher breakeven point = strike price of the call option (i.e. higher strike price) + |net credit|

The short strangle is profitable in between the higher breakeven point and the lower breakeven point.

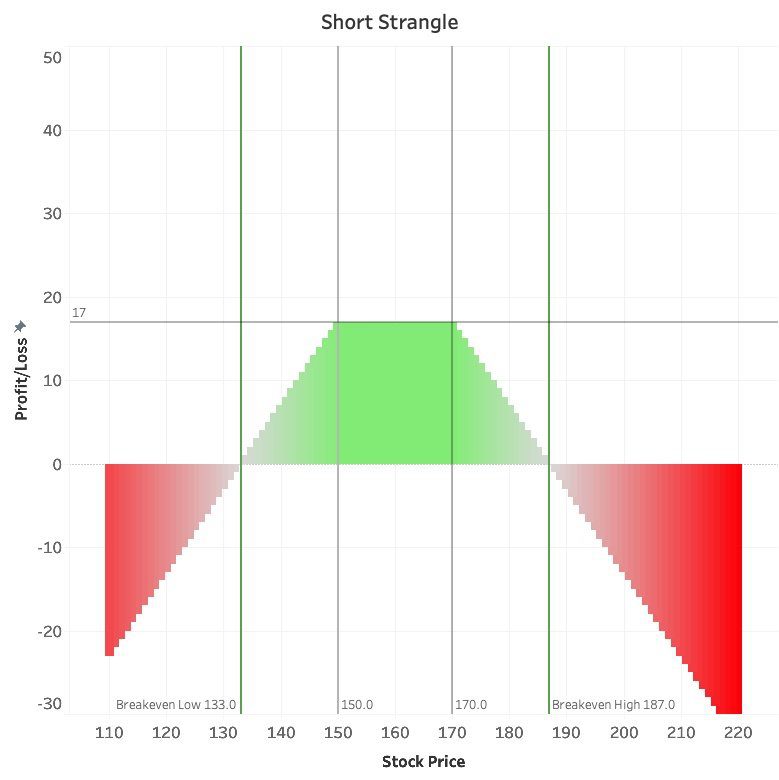

Short Strangle: Profit and Loss Graph

The maximum profit in a short straddle is observed when the stock price is between the strike price of the call and put options. The profit reduces as the stock price moves below the strike price of the put option or above the strike price of the call option. The short straddle loses money when the stock price goes below the lower breakeven point or goes above the higher breakeven point.

In this example, the maximum profit is $17.15/share or $1,715. The maximum loss is unlimited when the stock price goes up and above the higher breakeven point. The loss is limited to $133/share if the stock price goes below the lower breakeven point, down to $0/share.

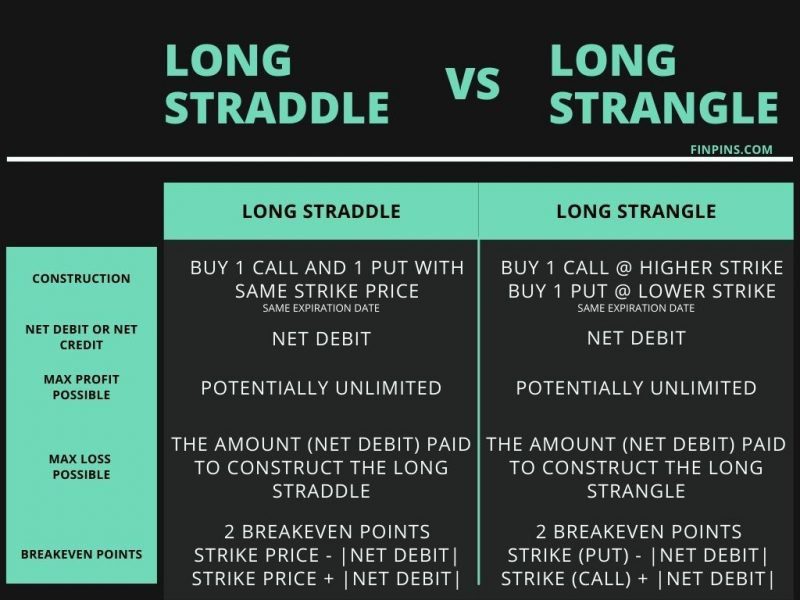

Straddle vs Strangle Options: Similarities and Differences

For keeping things easy to understand, we will first compare long straddle vs long strangle. Then, we will compare short straddle vs short strangle after that. We will see both the similarities and differences during the comparisons.

Long Straddle vs Strangle Options

We will compare the long straddle vs strangle options on the 5 criteria:

- construction, i.e. how to create a long straddle or strangle (or how to open a long straddle position)

- net debit vs net credit, i.e. whether we collect premium or pay a premium to construct the long straddle or strangle

- max profit possible in the trade

- max loss possible in the trade

- breakeven point(s)

Short Straddle vs Strangle Options

We will compare the short straddle vs strangle options on the 5 criteria:

- construction, i.e. how to create a short straddle or strangle (or how to open a short straddle position)

- net debit vs net credit, i.e. whether we collect premium or pay a premium to construct the short straddle or strangle

- max profit possible in the trade

- max loss possible in the trade

- breakeven point(s)

For more on Stock Options, check out StartOptions.com

Read also: Stock Basics

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents