This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

DiversyFund vs Fundrise

Before we get to the comparison of the two private real estate income trust (REIT) funds to invest in real estate – Diversyfund vs Fundrise, let’s fully understand a few things:

- Why should you invest in real estate at all?

- How to invest in real estate? (different methods)

- How to invest in real estate with little money, as low as $500 only?

Invest Like A Millionaire

Real Estate Investment with just $500. DiversyFund Growth REIT.

You don’t have to be rich to invest in apartment complexes. DiversyFund makes it simple and affordable.

Advertisement

- DiversyFund vs Fundrise

- Invest Like A Millionaire

- Why Invest in Real Estate?

- Returns on Stocks vs Real Estate Investment Trust (REIT) Funds

- How to Invest in Real Estate?

- How to Invest in Real Estate with Little Money?

- Crowdfunding Real Estate Investment: DiversyFund vs Fundrise

- DiversyFund Growth REIT Overview

- Fundrise Overview

- DiversyFund vs Fundrise: Comparison

- DiversyFund vs Fundrise Fee Comparison

- DiversyFund vs Fundrise Investment Strategy

- DiversyFund vs Fundrise Minimum Investment Required

- DiversyFund vs Fundrise Investment Horizon

- DiversyFund vs Fundrise Liquidity and Redemption

- DiversyFund vs Fundrise Key Statistics

- DiversyFund vs Fundrise Target Returns

- DiversyFund vs Fundrise Comparison Table

- DiversyFund vs Fundrise – which is better?

- Invest Like A Millionaire

Why Invest in Real Estate?

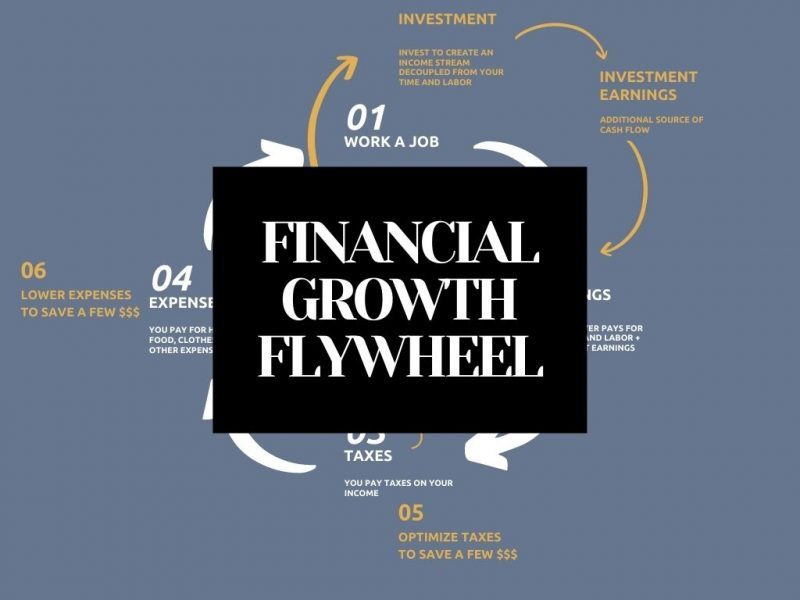

Alternative Investing is important to diversify the portfolio outside of the stock and bond market. Real Estate investments are lucrative because they offer the following advantages to investors.

- Rental income from residential and commercial properties provides regular cash flow on a monthly basis.

- Property price appreciation i.e. increase in market value of the property helps the investor sell the property at a higher price in the future.

- Real Estate has potential to renovate and upgrade the properties to increase the rental income as well as the market price of the property- hence benefitting from increase regular cash flow and more profits on selling it in future.

- Real Estate provides investors diversification outside of the stock market, with relatively less short term volatility.

- Tangible assets, such as property, that have intrinsic value that will not go down to zero (unlike stocks that can go to $0 if the company goes bankrupt).

- Investors gain leverage on real estate investing. For example, if you buy a house, you can pay a small down payment (3-20%) and borrow the remaining amount at cheap interest rates (2.8% interest for a 30-year mortgage as of writing this article).

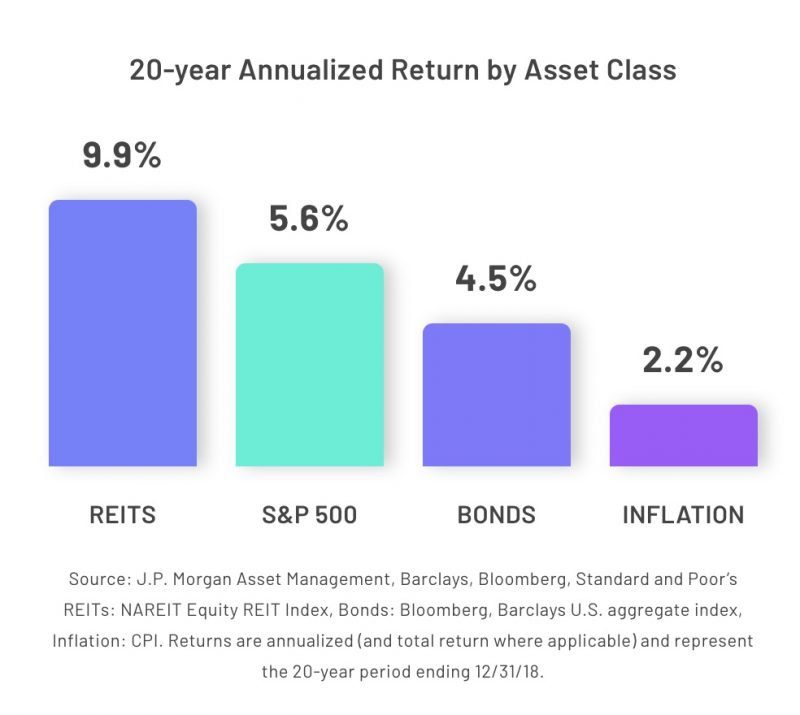

Returns on Stocks vs Real Estate Investment Trust (REIT) Funds

Over the 20 year period 1998 – 2018, REITs have outperformed the other asset classes such as S&P 500 Index and Bonds.

Buy Land, They’re not Making it Anymore – Mark Twain

How to Invest in Real Estate?

There are multiple ways in which you can start investing in real estate. Here are the three most popular options:

Physical Real Estate

Actual physical purchase of house, apartments, piece of land. This requires capital upfront for a downpayment, maintenance, etc.

Stocks

Real Estate Investment Trust Stocks – some REITs are publicly traded on the stock market, therefore easy to buy and sell.

Private Funds

Private Real Estate Investment Trust Funds– some REITs are private such as DiversyFund and Fundrise. They are crowdfunded real estate investments and have a reasonable threshold for investor entry. DiversyFund and Fundrise aim to provide good returns through active management (renovation, marketing, etc.) of properties to increase rental income (for cash flow) and increase property value through market price appreciation.

How to Invest in Real Estate with Little Money?

Stock Market

A REIT traded publicly on the stock market can cost as low as $1 when purchasing fractional share on Robinhood. One such example is Vanguard US REIT Fund (VNQ).

DiversyFund or Fundrise

$500 is all that is required to get started with investments in real estate investment trust (REIT) options such as Fundrise and DiversyFund. Below, we will take a look at how the two popular Crowdfunded Real Estate Investment platforms compare against each other.

Crowdfunding Real Estate Investment: DiversyFund vs Fundrise

Fundrise and DiversyFund have minimum investment requirements starting at $500, hence being accessible to more investors. Here we compare these two real estate investment platforms.

DiversyFund vs Fundrise Snapshot

DiversyFund Growth REIT Overview

DiversyFund Growth REIT is a Real Estate Investment Trust (REIT). It aims to create wealth for investors by investing in multi-family residential apartment buildings (with 100 or more units). The Growth REIT has a mid to long-term investment horizon (5+ years). DiversyFund screens and selectively invests in buildings across the United States that have positive cash flows. DiversyFund then renovates them to further increase the market value of the properties.

Where does DiversyFund invest?

We could find three projects featured on the DiversyFund website, as of writing this article. The target return on the three projects ranges from 15.5% to 21% per year.

- Summerlyn (Killeen, TX): 200 unit apartment complex with potential return of 18% per year.

- Park Blvd (San Diego, CA): 59 unit mixed use development (residential + commercial) with potential return of 21% per year.

- McArthur Landing (Fayetteville, NC): 211 unit apartment complex with potential return of 15.5% per year.

Is DiversyFund Growth REIT Regulated?

I quote the following from the DiversyFund website itself.

The U.S. Securities and Exchange Commission (SEC) qualified the DiversyFund Growth REIT under Regulation A in November 2018. What this means is that we go through rigorous vetting, which includes strict reporting requirements and annual audits similar to the standards for public companies listed on the stock market.

DiversyFund

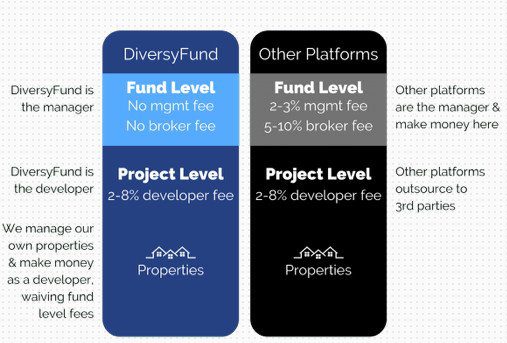

Does DiversyFund charge management fees?

DiversyFund does not charge any platform fees or broker fees, hence passing on that extra benefit to the investor. Here’s a screenshot below from the DiversyFund website explaining the no management or broker fee charged at the fund level by DiversyFund.

Bestseller Personal Finance Books

Fundrise Overview

Fundrise offers a variety of investment options such as Starter Portfolio (minimum $500), Core Investment Plans (minimum $1,000), Advanced (minimum $10,000), and Premium (minimum $100,000). For a like-to-like comparison with Diversyfund, here we will focus on Starter Portfolio and Core Investment Plans.

Fundrise: Starter Portfolio

As the name suggests, the Fundrise Starter portfolio is a great option for new investors starting out investing in private REITs, with a minimum investment of $500 only. Fundrise is currently offering investors a free upgrade to the Core Investment Plans that offer a choice of investment that suits the investors’ style of investing. It is to be noted that for this upgrade the investor must have $1,000 invested in a starter portfolio (because the minimum investment required for Core is $1,000).

Fundrise: Core Investment Plans

Core offers investors three different Investment plans – Supplemental Income, Balanced Investing, and Long Term Growth – based on the investor goals of regular income or long-term growth or a little bit of both.

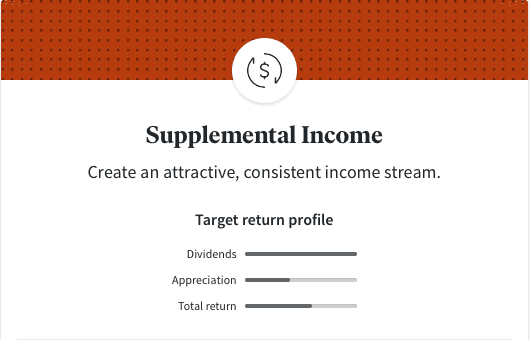

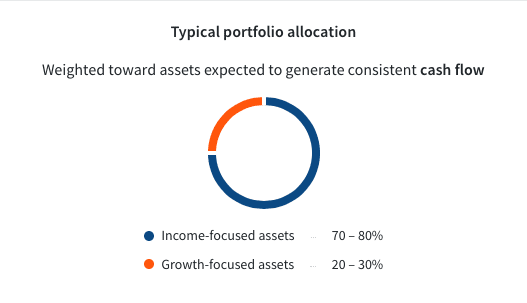

Supplemental Income Plan

Supplemental Income aims to create a consistent income stream by focusing more on dividends. Understandably, due to the regular dividend payouts, the potential return over the life of the investment is lower (as compared to the other two Core Investment plans). Supplemental Income plan invests 70-80% in income-focused assets and 20-30% in growth-focused assets.

Fundrise Core Investment Plan: Supplemental Income (source: fundrise.com)

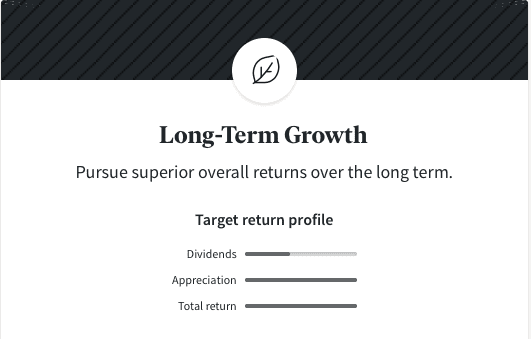

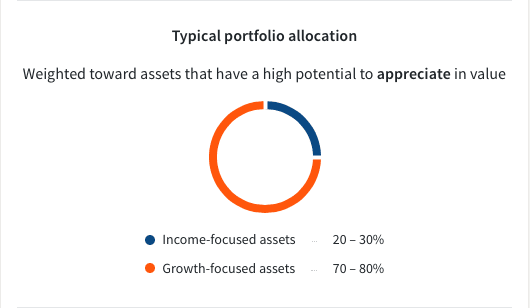

Long Term Growth Plan

Long Term Growth investment plan is for investors who are more focussed on the overall growth of the portfolio rather than a consistent income stream early on (as expected in the Supplemental Income plan). The LTG plan is biased toward price appreciation rather than dividends and invests 70-80% in growth-focused assets and 20-30% in income-focused assets.

Fundrise Core Investment Plan: Long Term Growth (source: fundrise.com)

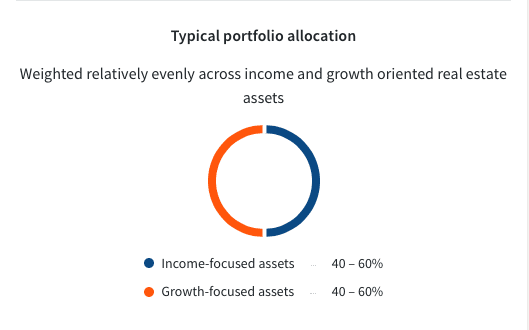

Balanced Investing Plan

Balanced Investing fund tries to meet the two other plans (Supplemental Income and Long Term Growth) in the middle. It offers some returns early on while preserving the potential for higher returns later in the investment’s life. Balanced Investing plan invests 40-60% in income-focused assets and 40-60% in growth-focused assets.

Fundrise Core Investment Plan: Balanced Investing (source: fundrise.com)

Where does Fundrise invest?

As of writing this article, there are 217 active projects and 77 completed projects listed on the Fundrise website.

Does Fundrise charge management fees?

Yes, Fundrise charges a low 0.15% annual advisory fees + 0.85% fund management fees + discretionary 0 – 2% fees for activities such as acquisition, liquidation etc.

DiversyFund vs Fundrise: Comparison

DiversyFund vs Fundrise Fee Comparison

Fundrise Fee

The fee at Fundrise is structured in the following manner:

- 0.15% annual advisory fee

- 0.85% annual management fee

- Additionally, Fundrise can charge 0-2% as initiation fee, acquisition fee, liquidation fee etc.

DiversyFund Fee

DiversyFund does not charge investors fund management fee or broker fee or any other platform fees. In comparison to Fundrise, the investor benefits more from having no fees.

DiversyFund vs Fundrise Investment Strategy

Fundrise Investment Strategy

Fundrise invests in a broad spectrum of real estate assets – residential as well as commercial. It uses both debt and equity investments in its portfolio.

Diversyfund Investment Strategy

Different from Fundrise, Diversyfund invests primarily in multifamily residential apartment buildings.

DiversyFund vs Fundrise Minimum Investment Required

Fundrise Minimum Investment Required

Fundrise has multiple investment options, the starter portfolio has a minimum requirement of $500, and the Core investment plans have a minimum investment requirement of $1000.

DiversyFund Minimum Investment Required

DiveryFund’s Growth REIT has a minimum investment requirement of $500.

DiversyFund vs Fundrise Investment Horizon

Fundrise Investment Horizon

Fundrise aims to keep the investors’ investment for the mid-to-long term with an investment horizon of 5+ years.

DiversyFund Investment Horizon

DiverysFund also aims to keep an investment horizon of 5+ years.

DiversyFund vs Fundrise Liquidity and Redemption

Fundrise Liquidity and Redemption Options

Fundrise recommends that investors stay for the long term, but it offers investors the option to redeem quarterly and even monthly subject to certain conditions.

DiversyFund Liquidity and Redemption Options

Like Fundrise, DiversyFund also recommends that investors stay for the long term to benefit fully, but it offers redemption options quarterly.

DiversyFund vs Fundrise Key Statistics

Fundrise Key Statistics

- Date started: 2012, HQ in Washington DC

- Investors: 130,000+ active investors

- Assets transaction value: $4.9B

Diversyfund Key Statistics

- Date started: SEC qualified in 2018

- Investors: 15,000+ active investors

- Total Investment: $30M

DiversyFund vs Fundrise Target Returns

Fundrise Target Returns

Fundrise mentions the target returns are in the range of 7 – 10% per year on its Core Long Term Growth plan.

DiversyFund Target Returns

DiversyFund provides a broader range of target returns, 10 – 20% per year.

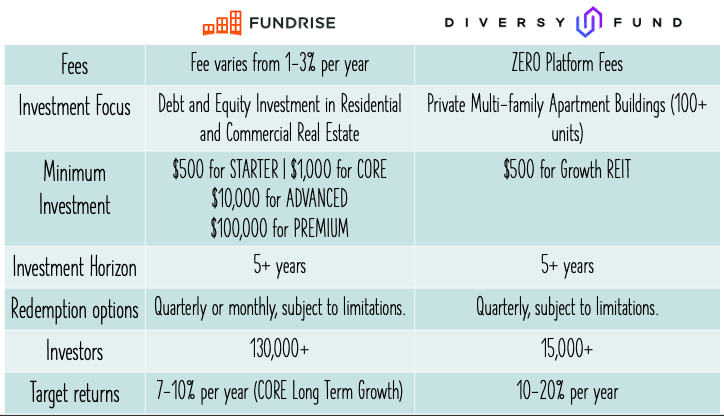

DiversyFund vs Fundrise Comparison Table

| Fundrise | DiversyFund | |

| Fees | Fee varies from 1-3% per year | ZERO Platform Fees |

| Investment Focus | Debt and Equity Investment in Residential and Commercial Real Estate | Private Multi-family Apartment Buildings (100+ units) |

| Minimum Investment | $500 for STARTER $1,000 for CORE $10,000 for ADVANCED $100,000 for PREMIUM | $500 for Growth REIT |

| Investment Horizon | 5+ years | 5+ years |

| Redemption Options | Monthly or Quarterly, subject to limitations. | Quarterly, subject to limitations. |

| Investors | 130,000+ | 15,000+ |

| Target Returns | 7-10% per year (CORE Long Term Growth) | 10-20% per year |

DiversyFund vs Fundrise – which is better?

We like both Fundrise and DiversyFund as investment platforms. Fundrise offers more investment options to suit the investor requirements whereas DiversyFund’s lower (0) fees can bring better returns for investors in the longer term. Why not give both a try?

Invest Like A Millionaire

Real Estate Investment with just $500. DiversyFund Growth REIT.

You don’t have to be rich to invest in apartment complexes. DiversyFund makes it simple and affordable.

Advertisement

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents