This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Credit cards for millennials on our list offer considerable rewards such as signup bonuses, rewards on dining & traveling, travel insurance, and cash back on purchases.

Best Credit Cards For Millennials (Jump To Section)

These credit cards are a must for the new generation. It depends on the individual’s purchasing power that how much money you can spend, but with the help of credit cards, you can get the most out of your spending.

Mainly, millennials are known for their unique spending habits. They mostly enjoy dining out, traveling, and online shopping. So, having a credit card that rewards them well, is a great starting point.

There is no single credit card that works for everyone.

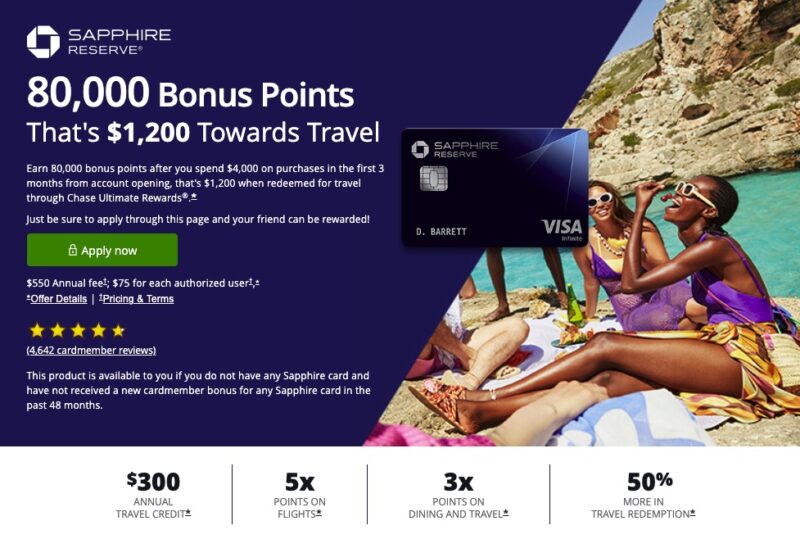

Chase Sapphire Reserve Offer

Best Credit Cards For Millennials

Let’s take a look at our list of the best credit cards for millennials, available in the market today.

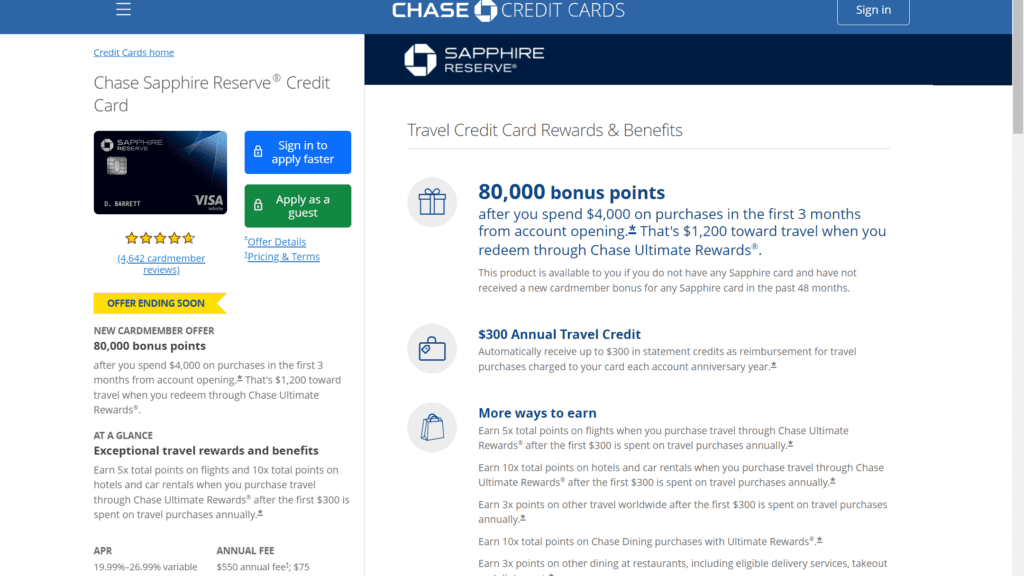

1. Chase Sapphire Reserve Credit Card | Annual fee: $550

The Chase Sapphire Reserve credit card is for travelers (millennials love traveling!). It offers 3x reward points on all travel expenses (other than those incurred with the $300 travel credit and dining expenditures).

Additionally, it includes travel insurance that provides service for medical emergency and dental coverage and also reimbursements for fees incurred due to delayed flights and baggage.

Customers can get up to $300 annual travel credit on dining and traveling with the protections involved. These can all add up to a lot of value if you travel often.

Moreover, cardholders of the Chase Sapphire Reserve credit card can move their miles to partner hotels and airlines or redeem them for 1.5 cents/point on the Chase Ultimate Rewards website.

In the first three months following the activation of your account, you will receive 80,000 more points after spending $4,000 in total. According to the most recent TPG estimates, this bonus is $1,600.

Key Features:

- Through the Chase Ultimate Rewards travel portal, points can be directly redeemed for 1.5 cents each or transferred to 11 airlines and three hotel partners.

- Pre Check application fees are credited by TSA/Global Entry every four years.

- Rental car customers of National Car Rental receive special incentives.

- $550 yearly fee

- Travel credits worth $300 per year.

- Free 12-month Lyft Pink membership with membership to The Luxury Hotel & Resort Collection with zero foreign transaction costs.

- You can get 10 points through Chase travel on each 1$ spent on hotels and car rentals.

- One point is for every $1 spent on all other purchases,

- With advance restaurant booking, Chase offers 10 points for every $1 spent through Ultimate Rewards.

- For every dollar spent on flights through Chase Travel, customers receive 5 points.

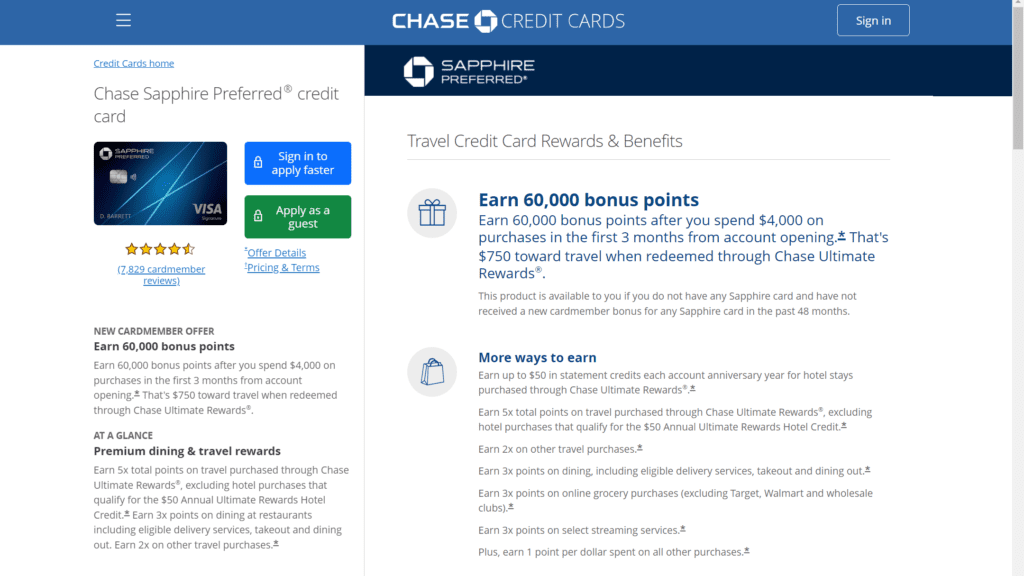

2. Chase Sapphire Preferred Credit Card | Annual fee: $95

The Chase Sapphire Preferred card is the best option for millennials and regular travelers who wish to get the most out of their credit cards. It is currently one of the most popular travel benefits credit cards. By professionals in travel hacking, the Chase Sapphire Preferred is sometimes referred to as the entrance card into the world of rewards, miles, bonuses, and benefits.

This credit card costs less and provides you with more than a regular cash card. It is the best move if you’re starting to use it or you’ve been using your credit card for a while. The Chase Sapphire Preferred Credit Card is cost-free for the first year of use. The annual fee for the next year is $95.

Key Features:

- After spending $4,000 within the first three months, you’ll receive 60,000 bonus points. You’ll also earn additional bonus points for grocery shopping.

- Restaurant meals, travel, and dining all result in 2x point earnings.

- Annual Fees of $95.

- 0 foreign transaction fees.

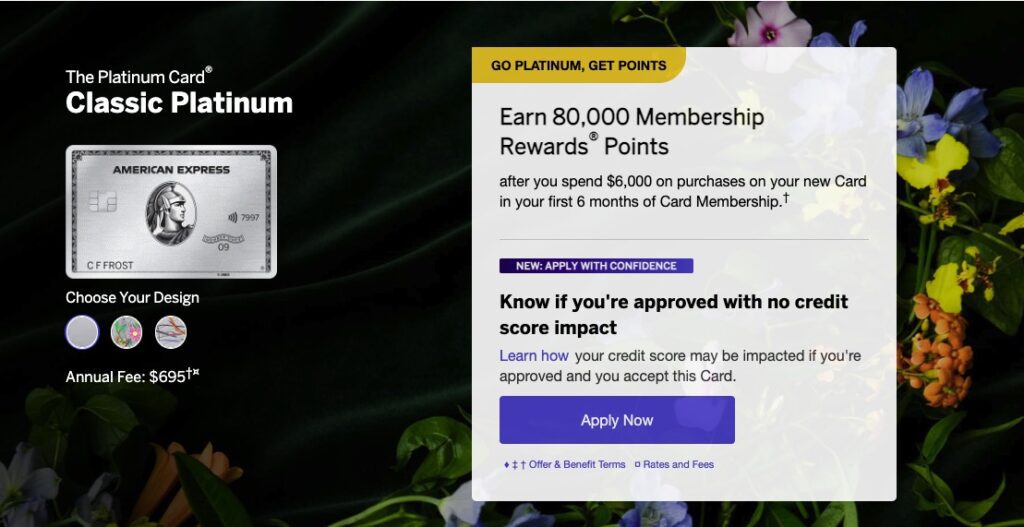

3. American Express Platinum Card | Annual fee: $695

To get the most out of your trip as a Millennial, you must have an American Express Platinum card. The Amex Platinum gives more than $1,400 in annual bill credits. In addition to lounge benefits of any credit card available. Earn 80,000 Enrollment Rewards Points after spending $6,000 in the first six months of card membership. TPG estimates $1,600 based on the most recent valuations.

Prepaid booking hotels made through American Express Travel earn 1 point for every $1 spent.Airline bookings made directly with airlines or through American Express Travel (up to $500,000 per calendar year, then 1 point per $1) earn 5 points for every $1 spent.

Bestseller Personal Finance Books

Key Features:

- Credit credits for the Equinox membership of up to $300 annually.

- Credit credits for the Equinox membership of up to $300 annually.

- Prepaid hotel bills and airline charge statement credits are eligible for a $200 annual credit.

- Uber Cash up to $200 each year.

- Yearly Visible subscription statement credits of up to $189.

- Application expense credits are offered every four years for Global Entry or every 4.5 years for TSA Pre-Check.

- It offers traveling safety measures, such as trip cancellation and delay insurance. No foreign transaction fees at all.

4. American Express Business Gold Card | $295 Annual Fee

If you’re a freelancer or have a small business, you can apply for a business credit card as well.

American Express Business Gold rewards up to 4x points on airfare for individuals who use Amex Travel frequently. Earn 4x rewards points by choosing the options where you want to spend the most cash each month. The 4x is limited to the first $150,000 in total annual purchases. After then, a point adds for every dollar spent on things.

Each point is worth one cent when booking a prize trip with Amex Travel. You also get back 25% of your points, up to a maximum of 25,000 points every year. Finally, you can transfer points 1:1 to the frequent flyer program of a partner airline.

Key Features:

- Get 70,000 bonus points after making a $10,000 purchase within the first three months.

- Earn four times rewards points by choosing the place where you want to spend the most cash each month.

- For all other purchases, earn 1x points.

- 0 foreign transaction fees.

- $295 yearly fee

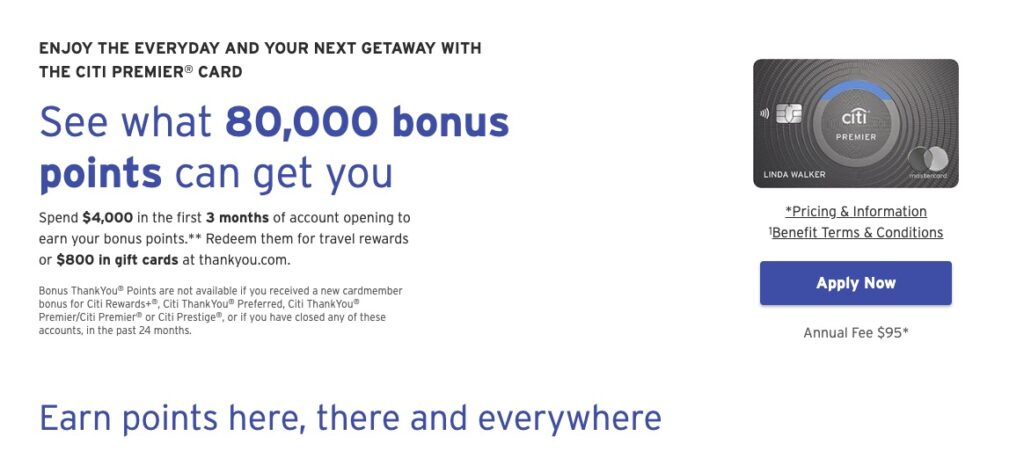

5. Citi Premier Credit Card | $95 Annual fee

The Citi Premier offers a 24-month extended service benefit, which can be helpful knowing how depended today’s lifestyle is on technology products. It also has earning rate for a well-balanced mix of daily life and travel.

After spending $4,000 during the first three months in purchases, earn 80,000 Citi Premier points. According to TPG’s calculations, that bonus is worth $1,440. For every $1 spent at petrol stations, restaurants, hotels, airports, and supermarkets, you’ll get three points, plus one point for every subsequent dollar.

Key Features:

- Invest in an extended warranty with theft and damage insurance.

- Use the Citi ThankYou travel center to move points to more than Fifteen partner airlines or to instantly redeem points for tickets at a rate of 1.25 cents each.

- You will get a 100$ annual statement credit for a hotel booking made through Thankyou.com for $500 or more each calenders year- excluding taxes and fees.

- You can add an authorized user to your account without paying anything.

- International transactions are free of charge.

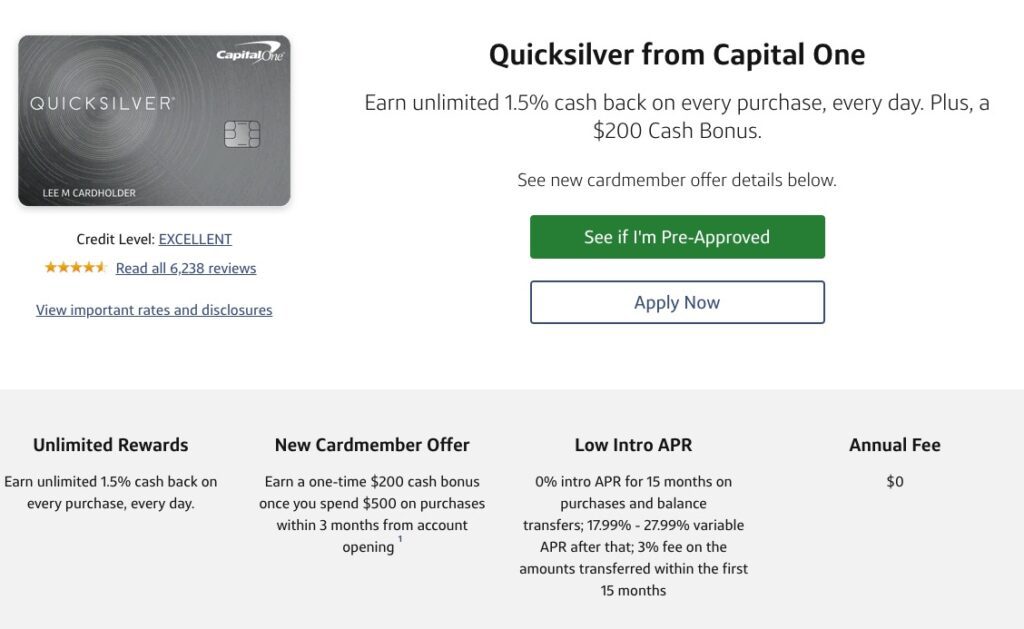

6. Capital One Quicksilver One Rewards Credit Card | 0$ Annual Fee

The Capital Quicksilver Credit Card is a superb option for any traveler though it doesn’t include many travel-related advantages.

Key Features:

- No charge for international transactions.

- No yearly fee

- 1.5% in rewards.

- Get a $200 cash bonus if you spend $500 in the first three months.

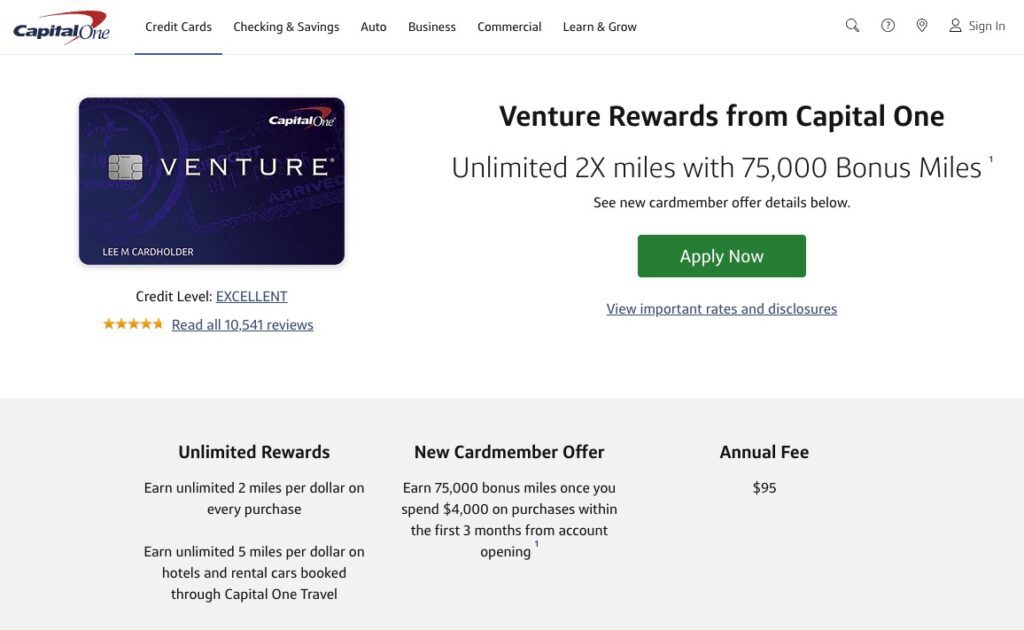

7. Capital One Venture Rewards Credit Card | Annual fee: $95

The Capital One Venture cards have flat-rate, tension-free benefits. It is one of the main attractions. Regular travelers and Millennials can benefit from its various rewards, including the option of transfer points to airline and lodging partners.

You may get 75,000 extra miles with this travel credit card after spending $4,000 in the first three months after opening an account. If you convert your points into travel at a specific rate, the bonus is worth $750. When you apply for the Capital One Venture card, there are no annual fees. Benefits are only available to accounts that qualify for a Visa Signature card.

You can use your points to receive reimbursement for any travel costs by booking a trip with Capital One Travel and can transfer your points to airline or lodging partners due to connections with more than 15 travel loyalty programs.

Additionally, you will receive an unlimited 2X mile bonus for every transaction you make. The miles are valid till your account is open and have no expiration date. You don’t have to choose a card while making a purchase.

Capital One Travel credit card gives 5X miles on hotel and rental car bookings. The credit card offers the lowest prices on thousands of travel options.

Key Features:

- You will receive 75,000 bonus miles if you spend more than $4,000 in the first 90 days.

- 100 in travel credits) 10000 Anniversary Miles.

- Double miles on all subsequent purchases.

- $95 for each year.

- On lodging, rental cars, and flights bought through Capital One Travel, you earn 5x miles. Pre-Check and Global Entry every four years.

- $100 in application credits for TSA

- Access to airport lounges is provided via a free Priority Pass membership with unlimited visits.

- For authorized users, there are no extra fees.

- No charges for international transactions.

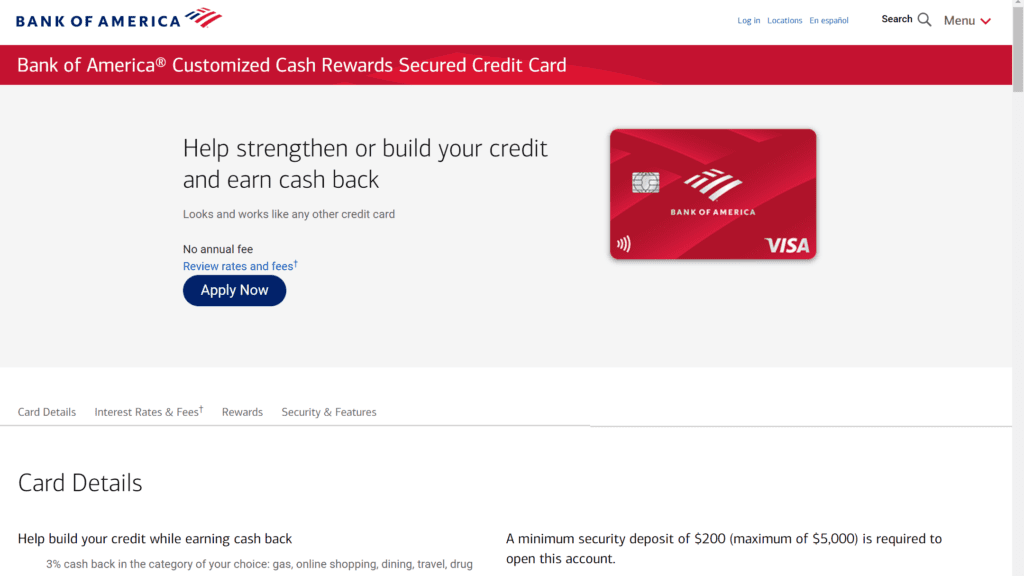

8. Bank of America Customized Cash Rewards Secured Credit Card | 0$ Annual Fee

After spending $1,000 or more within the first ninety days of creating your account, you’ll receive a $200 online cash rewards incentive and the option to pick how often you want to earn rewards.

Get 3% cash back on sales in your preferred sector, 2% at wholesaler club and grocery shops (up to $2,500 in total quarterly revenue in your preferred segment at these establishments), and an unlimited 1% on all other transactions.

While the card benefits for Millennials and moderate spenders alike, it benefits Bank of America Preferred Rewards customers, who see a 25%–75% increase in cashback earnings.

Key Features:

- Customers who use Bank of America Preferred Rewards receive 25% to 75% cashback.

- Potential to gain decent rewards with the option to switch the 3% bonus group each month.

- No yearly cost and incentives never expire.

- A contactless card has a security chip that allows the customers to use the card with a tap.

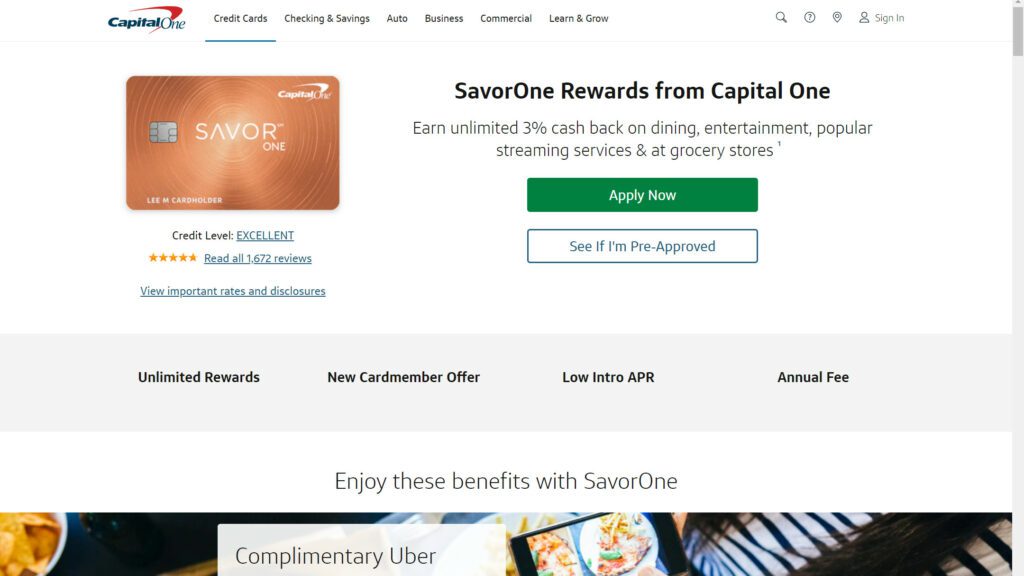

9. Capital One Savor One Cash Rewards Credit Card | 0$ Annual Fee

The capital one SavorOne credit card has a generous reward for the food and entertainment field. It is by keeping the lifestyle of millennials in mind.

They are an essential item for anyone trying to get the most out of their experiences because of their wide range of categories, which range from pubs and restaurants to movie tickets and live events.

Key Features:

- After spending $500 on items during the first three months after opening an account, you will receive a one-time $200 cash reward.

- Earn endlessly 1% cash back on all other expenditures, plus 3% cash back on food, online streaming, and supermarkets (but not superstores like Walmart® and Target®).

- On items purchased using Uber and Uber Eats, you can receive 10% cash back.

- On Capital One Entertainment purchases, get 8% cashback.

- Earn an unlimited 5% cash back on all lodging and auto rentals made through Capital One Travel, where you’ll find the company’s lowest rates on a selection of travel alternatives.

- Earning cash rewards doesn’t require rotating or signing up, and there is no cap on the amount you make or how long it will last.

- There is no annual fee charge.

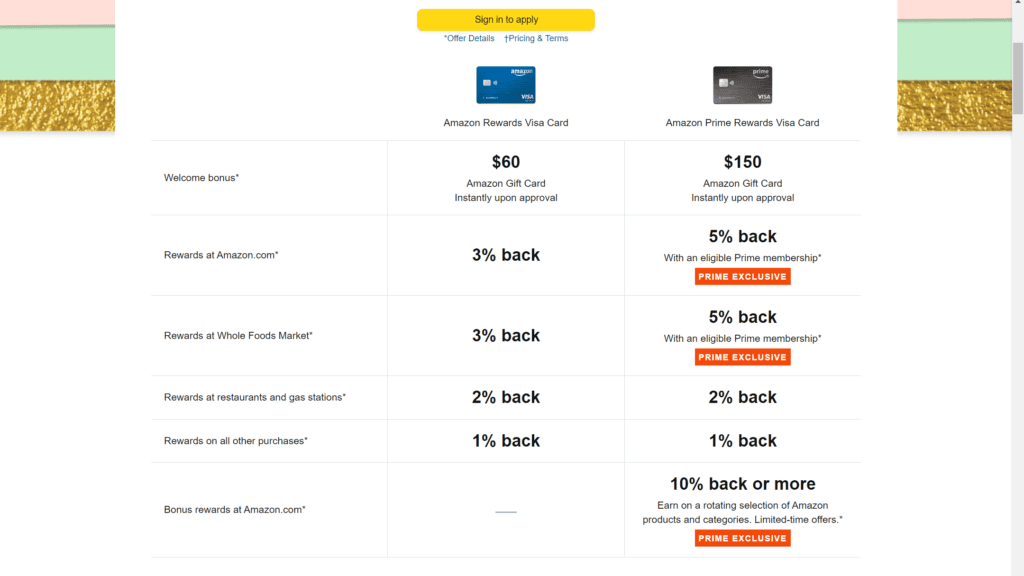

10. Amazon Prime Rewards Visa Signature Card | 0$ Annual Fee For Prime Members

The Amazon Prime Rewards Visa Signature Card is a great credit card for customers who value flexibility. This card comes with travel opportunities, no international transaction fees, and a stunning 5% cash back on Amazon orders. If you frequently buy things from Amazon, this card is an excellent method to use your money as far as possible.

Earn 5% Back at Whole Foods Market and Amazon.com; Receive 2% Cash Back at restaurants and pharmacies; On all other purchases, you can earn 1% back.

The 5% rewards rate is excellent for current Prime members who often buy at Amazon and Whole Foods. The Amazon Prime Rewards Visa provides 2% rewards + Visa Signature advantages to attract customers.

The card only offers 1% cash back on standard transactions, so unless you frequently buy from Amazon, it isn’t worth it.

Key Features:

- Gain an Amazon Gift Card Bonus without having to purchase anything.

- There is no international transaction fee.

- It offers unlimited 5% cashback at Whole Foods and Amazon.

- Upon approval, receive an Amazon gift card right away.

- There is no minimum required to redeem prizes.

- You can pay for all or a portion of your purchase with Amazon Rewards.

- $0 with a Prime subscription, which costs $139 annually.

- Extended warranty protection for a further year on warranties that qualify three years or less.

- You will get up to $3,000 in lost luggage reimbursement.

- Purchase damage or theft insurance for 120 days (up to $500 per claim and $50,000 per account).

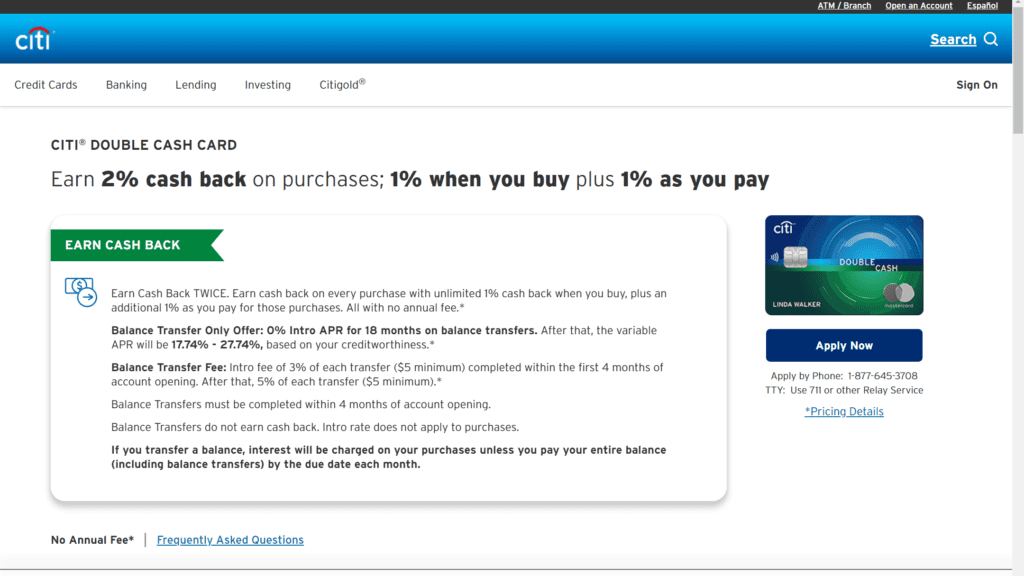

11. Citi Double Cash Card | 0$ Annual Fee

If your spending doesn’t fit neatly into any categories or you don’t want to track where to use which card, this card’s unlimited 2% cash back provides a tension-free way to collect on every card transaction. So whether you want to order in and binge-watch the newest series or spend a night out visiting the hottest spots, this card may help you earn cash back on every purchase.

Key Features:

- Pay the minimum amount required on time to receive cash back.

- Offer limited to balance transfers: 18 months at 0% intro APR on balance transfers. After that, depending on your creditworthiness, the variable APR will range from 17.74% to 27.74%.

- Cashback is not for balance transfers. Purchases are not subject to the intro APR.

- If you transfer a balance point of your purchases, it will incur less if you pay off your debt (including balance transfers) by the due date every month.

- A one-time intro balance transfer fee of 3% of any transfer made within the first four months of account setup (minimum $5) applies. After that, each transfer will cost 5% (minimum $5).

12. Discover it Miles | 0$ Annual Fee

Another best travel rewards card. You can exchange the miles earned on your card for statement credits that can use to pay for eligible travel-related items like lodging, transportation, and airline. This credit card eliminates the hassle of annoying blackout dates.

While younger generations are certainly not only responsible for the growth of internet shopping, they still do so because they value convenience and potential savings.

Additionally, credit card companies have noticed. Amazon.com is one of the most frequent retailers to qualify for credit card bonus rewards. Several issuers are now offering rewards for online shopping purchases.

Key Features:

- With no yearly charge, you can automatically earn 1.5 times as many miles on every dollar spent.

- Your monthly charge, including the bare minimum, can be paid using miles.

- Convert Miles into cash at any moment and for any amount. Or use it as a statement credit to pay for travel-related expenses like lodging, transportation services, restaurants, motels, and more, without any restrictions on when to use it. Miles retain their value regardless of how you redeem them. And miles never expire.

- The Standard Variable Purchase of 15 months have APR that ranges from 14.99% to 25.99%.

- Your personal information can delete by Discover from online websites. You will get a Free activation with a smartphone app.

- Best Credit Cards For Millennials

- 1. Chase Sapphire Reserve Credit Card | Annual fee: $550

- 2. Chase Sapphire Preferred Credit Card | Annual fee: $95

- 3. American Express Platinum Card | Annual fee: $695

- 4. American Express Business Gold Card | $295 Annual Fee

- 5. Citi Premier Credit Card | $95 Annual fee

- 6. Capital One Quicksilver One Rewards Credit Card | 0$ Annual Fee

- 7. Capital One Venture Rewards Credit Card | Annual fee: $95

- 8. Bank of America Customized Cash Rewards Secured Credit Card | 0$ Annual Fee

- 9. Capital One Savor One Cash Rewards Credit Card | 0$ Annual Fee

- 10. Amazon Prime Rewards Visa Signature Card | 0$ Annual Fee For Prime Members

- 11. Citi Double Cash Card | 0$ Annual Fee

- 12. Discover it Miles | 0$ Annual Fee

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents