This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Financial Literacy Quiz

Take the FREE financial literacy quiz here and see how many of the 7 basic questions you get right. The main motive of this website is to make financial literacy easily accessible to everyone. Evaluating the current state of knowledge with the financial literacy quiz is a good starting point.

The average American can score 3.2 on this quiz of 7 questions (that’s less than 50%!!!).

Can you beat that score? Don’t worry if you get a few questions wrong, we have also compiled complete and detailed solutions to the financial literacy quiz below.

In case something is unclear, we are here to help without any judgments. Simply drop an email to contact@finlightened.com with the subject “Help on Financial Literacy Quiz”, and we’ll get back to you soon!

Financial Literacy Quiz (Slider Version)

Imagine that the interest rate on your savings account is 1 percent a year and inflation is 2 percent a year. After one year, would the money in the account buy more than it does today, exactly the same or less than today?

True or false: Buying a single company's stock usually provides a safer return than a stock mutual fund.

Suppose you owe $1,000 on a loan and the interest rate you are charged is 20% per year compounded annually. If you didn't pay anything off, at this interest rate, how many years would it take for the amount you owe to double?

Which of the following indicates the highest probability of getting a particular disease?

If interest rates rise, what will typically happen to bond prices? Rise, fall, stay the same, or is there no relationship?

Suppose you have $100 in a savings account earning 2 percent interest a year. After five years, how much would you have?

True or false: A 15-year mortgage typically requires higher monthly payments than a 30-year mortgage but the total interest over the life of the loan will be less.

Share your Results:

Download FREE Financial Literacy Quiz PDF

Are you smarter than the average American? Can you prove that by scoring 4 or more on the financial literacy quiz?

You will get an email with a link to download the Financial Literacy Quiz PDF instantly. Don’t forget to check your spam.

Add contact@finlightened.com to your contact WHITELIST to prevent misdirecting emails to spam.

Take the quiz and for complete solutions to the financial literacy quiz, see below.

Page Contents

- Financial Literacy Quiz (Slider Version)

- Financial Literacy Quiz (Simple Version)

- Solutions to Financial Literacy Quiz

- Suppose you have $100 in a savings account earning 2 percent interest a year. After five years, how much money would you have?

- Imagine that the interest rate on your savings account is 1% per year and inflation is 2% per year. After one year, would the money in account buy more than it does today, exactly the same or less than today?

- If interest rates rise, what will typically happen to bond prices?

- A 15-year mortgage typically requires higher monthly payment than a 30-year mortgage but total interest over the life of loan will be less. True or False?

- True or False: Buying a single company’s stock usually provides a safer return than a stock mutual fund.

- Suppose you owe $1,000 on a loan and the interest rate you are charged is 20% per year compounded annually. If you didn’t pay anything off, at this interest rate, how many years would it take for the amount you owe to double?

- Which of the following indicates the highest probability of getting a particular disease?

Financial Literacy Quiz (Simple Version)

Results

Page Contents

That’s less than a 50% score.

There’s room for improvement, you can kickstart your journey toward financial enlightenment right from here!

Page Contents

#1. Suppose you have $100 in a savings account earning 2 percent interest a year. After five years, how much would you have?

#2. Imagine that the interest rate on your savings account is 1 percent a year and inflation is 2 percent a year. After one year, would the money in the account buy more than it does today, exactly the same or less than today?

#3. If interest rates rise, what will typically happen to bond prices? Rise, fall, stay the same, or is there no relationship?

#4. True or false: A 15-year mortgage typically requires higher monthly payments than a 30-year mortgage but the total interest over the life of the loan will be less.

#5. True or false: Buying a single company’s stock usually provides a safer return than a stock mutual fund.

#6. Suppose you owe $1,000 on a loan and the interest rate you are charged is 20% per year compounded annually. If you didn’t pay anything off, at this interest rate, how many years would it take for the amount you owe to double?

#7. Which of the following indicates the highest probability of getting a particular disease?

Solutions to Financial Literacy Quiz

Suppose you have $100 in a savings account earning 2 percent interest a year. After five years, how much money would you have?

Assuming simple interest is being discussed here

- In the first year the $100 will earn an interest of 2/100 * $100 = $2

- In the second year, the $100 will earn another $2.

- Likewise, in years 3, 4, and 5 also the $100 will earn $2 each year.

- After five years, the total amount in the savings account will be $100 + 5 * $2 =$110

Assuming compound interest is being discussed here (when interest earned in a previous period also earns interest in subsequent periods)

- In the first year, the $100 will earn $2 interest.

- At the beginning of year 2, $102 is available in the savings account. This entire $102 will earn 2% interest. 2/100 * $102 = $2.04

- At the beginning of year 3, $104.04 is available in savings account. This can be calculated as (1 + 0.02) ^ 2 * $100 = $104.04

- Likewise, at the end of year five, (1 + 0.02) ^ 5 * $100 = $110.41 is available in the savings account.

For the purpose of this quiz, it doesn’t matter whether you compute using the simple interest or compound interest formula, the correct answer is More than $102

Imagine that the interest rate on your savings account is 1% per year and inflation is 2% per year. After one year, would the money in account buy more than it does today, exactly the same or less than today?

Inflation is a term that describes a general increase in the price of something. Effectively, it tells us that if there is positive inflation in the economy, the value of money is going down.

Starting with $100 in a savings account today, the amount next year will be $101 (1% interest rate on $100).

A 2% inflation means that something that can be purchased for $100 today, will cost $102 next year.

Since the cost, next year will be $102 for the same quality and quantity of a product and we will have $101 available at that time, we will have to compromise on either quality or quantity.

Hence, for a similar quality product, the money will buy LESS than what it buys today.

If interest rates rise, what will typically happen to bond prices?

There is an inverse relationship between bond price and interest rates (yield). So, as interest rates rise, the bond prices will FALL.

Bestseller Personal Finance Books

Read more here for a comprehensive understanding of the topic.

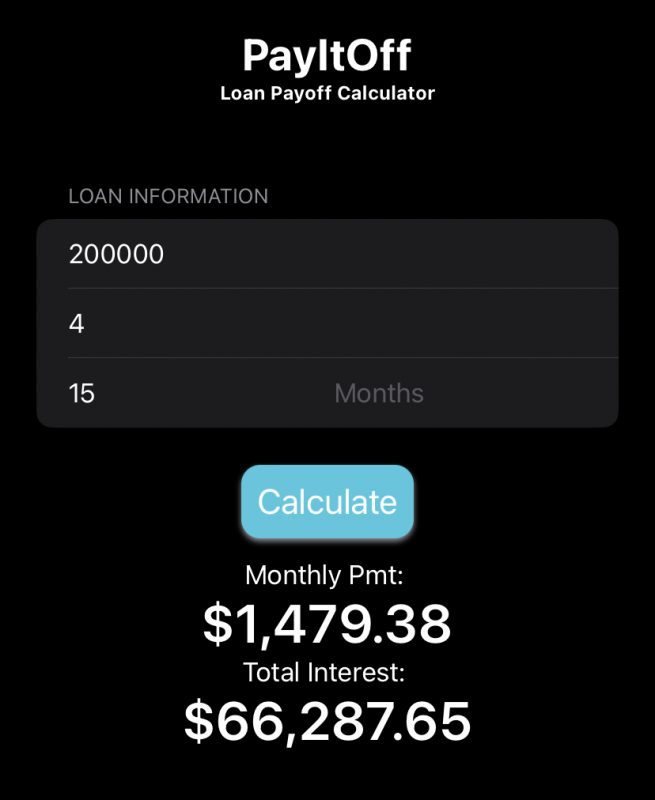

A 15-year mortgage typically requires higher monthly payment than a 30-year mortgage but total interest over the life of loan will be less. True or False?

Conceptually, a 15-year mortgage will try to spread the principal payment over a shorter period of time as compared to a 30-year mortgage, so the monthly payments will be higher.

Since you pay off the mortgage quickly, the interest payments will also be lower over the life of the loan.

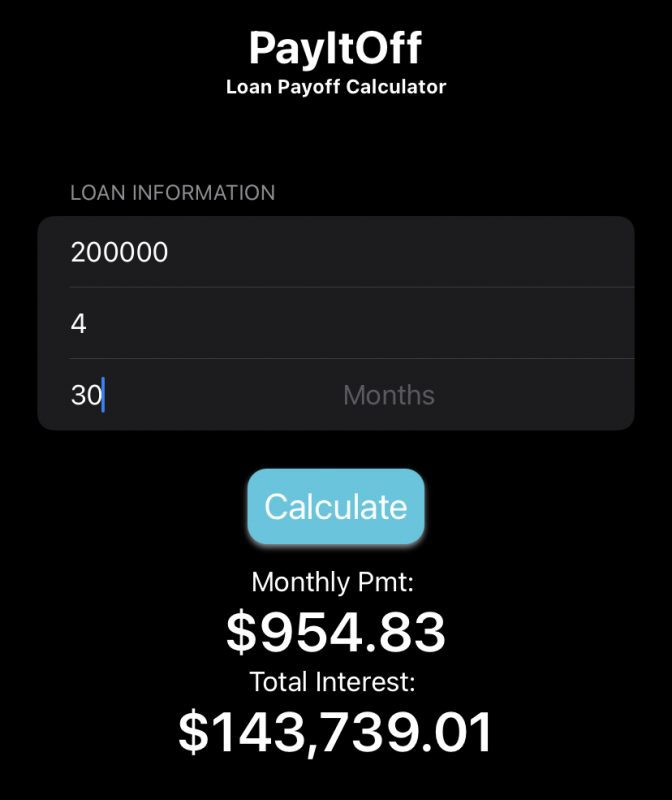

Let’s use the mortgage calculator to confirm our beliefs.

15-year mortgage ($200,000)

- Monthly payment = $1,479

- Total interest over life of loan = $66,288

30-year mortgage ($200,000)

- Monthly payment = $955

- Total interest over life of loan = $143,739

As we can see, the monthly payments are higher ($1,479 > $955), but the interest paid ($66,288 < $ 143,739 ) overall is much lower for the 15-year mortgage. The answer is TRUE.

True or False: Buying a single company’s stock usually provides a safer return than a stock mutual fund.

A single company’s stock tends to be more volatile than a stock mutual fund which is a diversified portfolio. Generally, well-diversified funds are more stable than a single stock.

So, the answer is FALSE.

Suppose you owe $1,000 on a loan and the interest rate you are charged is 20% per year compounded annually. If you didn’t pay anything off, at this interest rate, how many years would it take for the amount you owe to double?

If you know the rule of 72 (more like a rule of thumb, than an actual mathematical rule), the number of years * interest rate = 72 for the money to double. So, for example, if you have an interest rate of 9% per year, it will take 72 / 9 = 8 years for the money to double.

Using the rule of 72, we can quickly calculate 72/20 = 3.6 years

So, among the options, the correct answer is 2 to 4 years.

Which of the following indicates the highest probability of getting a particular disease?

This question can throw you off. But the question has nothing to do with the virality of disease in a medical sense, but more with understanding fractions and percentages.

The probability of something happing can be expressed in percentages. The higher the percentage, the higher the probability.

Let’s evaluate the fractions and percentages mentioned in all the options.

- There is a one-in-twenty chance of getting the disease: one-in-twenty means 1/20, which is 5%

- 2% of the population will get the disease: This is a clear percentage, 2%

- 25 out of every 1,000 people will get the disease: 25 out of 1000 is 25/1000 = 2.5/100 or 2.5%

Among the three options, the highest percentage is 5%, so the correct answer is ‘there is a one-in-twenty chance of getting the disease.’

Page Contents

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator