This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Do you want to help decide on a credit card for the nanny who is taking care of your child? Or, are you a nanny that needs a credit card? Here, in this article, you will not only learn about the benefits of credit cards but also know the best credit cards for nannies. But before jumping to the best credit cards, you might also want to learn about them a little to know why these particular cards are recommended.

Best Credit Cards For Nannies (Jump To Section)

CHASE FREEDOM UNLIMITED OFFER

Nanny – a small word but the responsibility is huge. For all working parents out there, it is important to have someone to take care of the baby in their absence. Especially, if the child is not going to school, the child must be properly taken care of. It is very much important for a parent to know about the nanny they can trust with their children. For parents to maintain a healthy relationship with their child’s nanny, they need to have a good and consistent working relationship with them.

Nannies are professional child care providers who offer full-time care to children. When you are a working parent, it becomes ever so slightly more difficult to give the proper care to your baby. At that time, it is important to have a nanny for your child. Some nannies work till you return home after work whereas other nannies can live with you.

The Importance Of A Nanny

Whether it is wiping runny noses, changing diapers, and staying awake for the baby – nannies come to the rescue of the parents. Sometimes, nannies are the ones who can experience the first step of the baby or something the baby achieves at an early age. No doubt, the importance of nannies in a child’s life as well as for a parent’s working schedule is multifaceted.

Here are a few duties of a nanny:

- A nanny will always make sure that your dear child is safe.

- Sometimes nannies may take a few nursery-like duties such as taking care of your child’s clothes, cleaning the stroller, preparing milk, food for the baby etc.

- Sometimes, you may want an educated nanny who will take care of your child’s early stages of learning as well. Nannies are also responsible for the developmental milestones of your child.

- Nannies may ensure that your child is getting the proper stimulation, be it mental or physical, throughout the day.

- Nannies sometimes work other homely chores such as cooking, housekeeping, etc (though it can be based on contracts beforehand).

- Often, nannies arrange play dates and educational classes for your child.

- You can discuss with your child’s nannies to have common goals for your child as well.

Benefits of Hiring a Nanny for Your Child

- When you will hire a nanny for your child, your baby will be provided with sole-focused care. The nanny will know all the needs of your child so that they can take proper care and fulfill their needs.

- When your child is away from you, a nanny will provide a strong base of attachment. It is generally accepted that parents are the primary source of care for their children but when you are a working parent it is not possible to take care of your child properly. A nanny can take the charge of the security of your baby. The child can also develop an emotional attachment with the nanny because the nanny can be present 24*7.

- Nannies are responsible for making the child’s day as productive as possible. A nanny will take the child on various activities like playtime, outings, educational visits, and activities.

- If your child’s nanny is bilingual, they can also teach your child a new language.

- When your child has a nanny, you can be quite sure that your child’s days are organized, safe, as well as stimulating.

- It may sound weird but having a nanny means you can spend quality time with your child after all hectic work schedules. Why? Well, as the nanny is taking care of almost all the needs, you can just sit by your child and have a conversation with them. You need not worry about your child’s food or other daily activities.

So, you can understand that having a nanny is so important when you are a working professional. When this person is so important for your child as well as you, then taking care of a few particular needs of your nanny and going the extra mile counts a lot in the long run.

How To Manage Spending Money For Your Nanny

The caregiver in your absence, i.e, the nanny is important for your child as well as you, thus, it is necessary to provide proper spending money to the nanny so that there will be no salary issues between you and the nanny. According to a report, in the year 2020, 50% of families spent about $10000 on nannies and childcare.

This percentage has increased to 59% in 2021. Nowadays, 85% of families are spending more than 10% just on childcare services or nannies. You need to know the details on how to give spending money to your nanny. Along with this, you will also learn about the best credit card for nannies.

You need to keep in mind that spending money needs to be reliable, transparent, and flexible too. When you are going to hire a full-time nanny or an after-school babysitter, they are going to spend your money. To make this financial scenario smoother, you need to keep in mind these terms and understand them properly.

Reliable: When you are hiring a nanny for your child, you need to take care of the reliability of the whole system because if the relationship gets disturbed, it can affect your child.

Transparent: Transparency signifies you require to know that your money is being spent on what you plan.

Flexible: You need to be flexible with the nanny in case, you need to hire someone else if required.

We are mentioning a few ways to give your child’s nanny spending money.

Cash

You can leave the whole cash amount for the nanny on the shelf. It will help your nanny to understand exactly how much amount need to be spent. But right now, people are not interested in leaving hard cash because cash is discouraged in a few places. Also, cash is easy to lose. This poses another problem as daily, you need to keep track of the expenses which are done by the nanny. You also need to review all receipts for all expenses done by the nanny. Nanny also needs to be very careful to take care of personal money and the money given by you for spending on daycare.

Money transferring apps

You can also make use of money transferring applications through which you can just send money digitally to your nanny. Though you need to keep a track of all receipts.

Bestseller Personal Finance Books

Reimbursements

It is quite an exceptional one. You have to measure the reimbursement amount properly. You need to pay the exact amount in cash or transfer it to a bank account. It may be embarrassing for the nanny to ask for reimbursement from you. So, this option is not the best.

Prepaid reloadable cards

You can opt for prepaid re-loadable cards for your child’s nanny. This option has a few benefits such as you can reload the cash whenever needed digitally. In case you need to employ a new nanny, you can easily replace the card. Depending on the feature of the card, you can track all kinds of expenses through this card.

Credit card for a nanny

One of the best ways to build a trustworthy relationship with your baby’s nanny is by providing a credit card. There are a lot of options for the best credit card for nannies nowadays. You can choose from those options. You can also lower the credit limits so that there will be no overspending on the credit card. You can also track all kinds of transactions if needed.

It seems true that the expense of a nanny is a never-ending expense. Rather, these days, expense is increasing rapidly. You can ease the burden a little by using the best credit card for nannies as many of the cards come with perks and benefits too. Without any further ado, here are a few best credit cards for nannies that are available in 2022.

Best Credit Cards For Nannies

Here is a list of a few best credit cards for nannies.

- The Blue Business Plus Credit Card from American Express

- Capital One Venture Rewards Credit Card

- Chase Freedom Unlimited

- The Business Platinum Card from American Express

1. The Blue Business Plus Credit Card from American Express

The most interesting feature of the card is the welcome offer when you sign-up for this. As a welcome offer, you will get 15,000 points after spending $3,000 in the first 3 months of account opening. This card offers good reward points for your nanny-based spending as well. With the Blue Business Plus Credit Card, you can avail of 2x per dollar on the first $50,000 in purchases per calendar year. Apart from this, 1 point per dollar afterwards with no annual fee will be maintained.

Another feature is a 0% intro APR on purchases for 12 months from the date of account opening. After this period of twelve months, the rate will vary from 13.24% to 19.24%. Though it will be based on creditworthiness. As per the TGP valuation, your nanny will be available to earn 4 cents per dollar in value back for your nanny-based expenses.

2. Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is another best credit card for nannies because you will not face any issues while signing up for the card. Your nanny can easily earn miles or points without any kind of spending category. 2 miles per dollar is the reward point for the cardholder.

Apart from this, as a welcome bonus offer, 60,000 bonus miles are available if, within the first three months of account opening, you or the nanny can spend an amount of $3,000 on purchases. You should know that the Capital One Venture Rewards Credit Card has an annual fee of $95.

3. Chase Freedom Unlimited

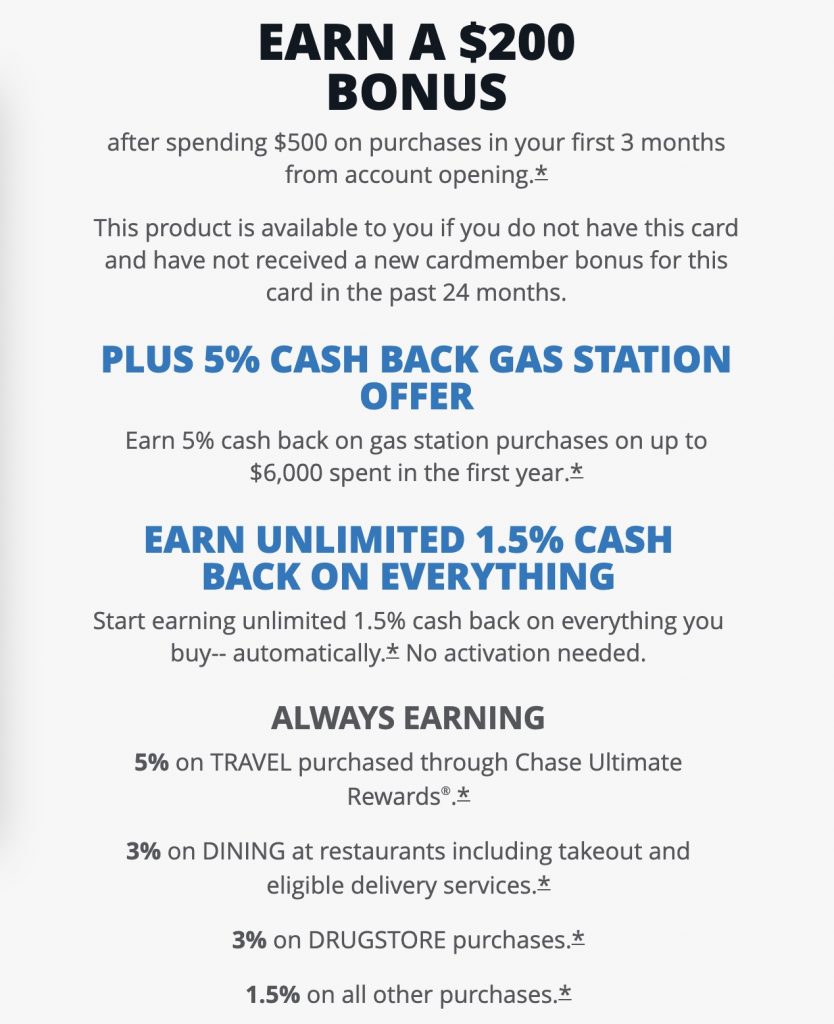

If you want to get a lot of cashback offers on the credit card for the nanny, then you have to go for Chase Freedom Unlimited. With this card, you can get $200 after spending $500 on purchases. Though this task should take place within the first three months of account opening. Apart from this facility, you will get a 0% intro APR on purchases for the first 15 months. After this, the rate will be from 14.99% to 24.74%.

CHASE FREEDOM UNLIMITED OFFER

4. The Business Platinum Card from American Express

This is not just a classy one but it is also quite worthy. The Business Platinum Card from American Express is a demanding card because it provides you with lots of incredible perks and benefits. Though it will take an annual fee of $595, there are authentic reasons to mention that the Business Platinum is one of the best credit cards for nannies.

When you will get this card after signing up, you will receive 120,000 Membership Rewards® points after you spend $15,000 on selected purchases with the card. It can be a heavy task for some people to spend $15,000 in just three months. But this can work well when the money is going to your nanny directly through the card.

So, here are a few extra tips on the best credit card for a nanny. Now you need to know a few more things when you are choosing these options. When you are planning to hire a nanny for your baby, you need to take care of small daily expenses along with upcoming expenditures and the nanny’s monthly purchases. Surely, you can go for these best credit cards for nannies because through a credit card, you will track all kinds of nannies’ work-related expenses.

How does the best credit card for a nanny work?

The best credit card for a nanny can be anyone from the above-mentioned credit cards. Though the nanny is the user of the credit card, remember the bill should come to you so that you can have a look at the expenses. Before a nanny will start using the credit card in your house, you can create a few guidelines about the usage limit as well as when the card should be used. You can also go for setting up an activity budget.

These things will help you to outline specific amounts that can be spent monthly, weekly, or daily. Through this, you can create a specific amount for all kinds of baby-related activities. Also, when the nanny will use the card, he or she is responsible for having all the receipts of expenses so that you can take a look at them later. You can also use a nanny binder where all kinds of paperwork and receipts can be kept.

The Bottom Line

The expense of a baby’s care or a nanny’s expenses can be hard to maintain at first. But with the best practice of a credit card, it can be solved easily. Don’t hesitate to try them out yourself. It will save you time as well as make the work easier for you. I hope, this article solved all the doubts you had in your mind regarding the best credit card for nannies. Stay tuned to us for more similar pieces of informative content in the future.

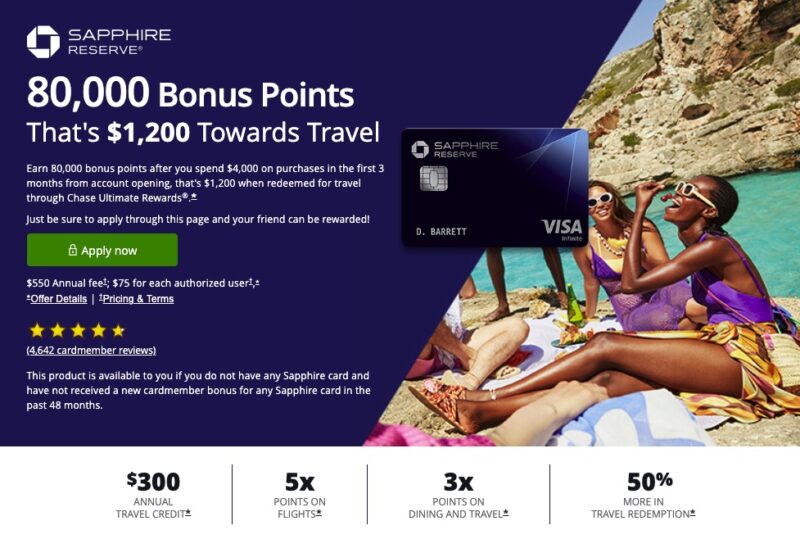

Chase Sapphire Reserve Offer

Frequently Asked Questions (FAQs)

- Can I add my nanny to my credit card?

You can add a nanny as an authorized user of the credit card. You just need to contact your customer service department and they will ask you some questions. You need to answer those genuinely. That’s it.

- Can anyone work as a nanny on a tourist visa?

Unfortunately, this can bring problems for both parents as well as the nanny. In the USA, a tourist visa does NOT allow anyone to work as a nanny. It WILL cause legal problems, so make sure you are on the right side of the law.

- How do you evaluate a nanny while hiring for your child?

When hiring a nanny, you need to be thorough with everything and check everything beforehand. Here’s how you can evaluate a nanny.

- Check whether a nanny’s interest to work with children and as a caregiver is genuine or not.

- You can also check if the nanny has Safety certifications and childcare training.

- whether or not the nanny can take on additional household responsibilities, will be helpful for you.

- What is included in a nanny’s regular work schedule?

A nanny is hired for a baby’s care and to ensure safety. As a nanny, generally, one needs to prepare nutritious food, dress up a baby properly, do laundry for the child, reinforce proper care and discipline if needed, provide mental and physical stimulation to the baby, etc. As the nanny is connected to a baby’s day-to-day activities, a nanny should know all of the above and more so that it can be taken care of on time.

Read more:

- 4 Best Credit Cards For Nannies

- 9 Best Credit Cards for Wedding Expenses

- 10 Best Credit Cards For Consultants

- 8 Best Credit Cards For Golf Lovers

- 6 Best Credit Cards for Traveling Consultants

- How to Use Credit Card Responsibly: 7 Must-Have Credit Habits

- Plastic Money – 3 Huge Payment Networks – Visa, Mastercard, and American Express

- Apple Pay and Google Pay – Which Is Better Among Top 2 Services?

- 8 Cool Benefits of Obtaining A Personal Loan – When to Consider It?

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents