This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Credit cards are useful for not just making expenses, but also keeping track of expenses in an efficient manner. A credit card designed primarily for farmers can provide advantages while supporting good expense tracking.

Getting the best credit card for farmers improves purchasing experience, generates rewards from purchases, and maintains a healthy credit score.

Best Credit Cards For Farmers

Each of the cards we discuss below is good in some other way. A few of the best credit cards for farmers are as follows:

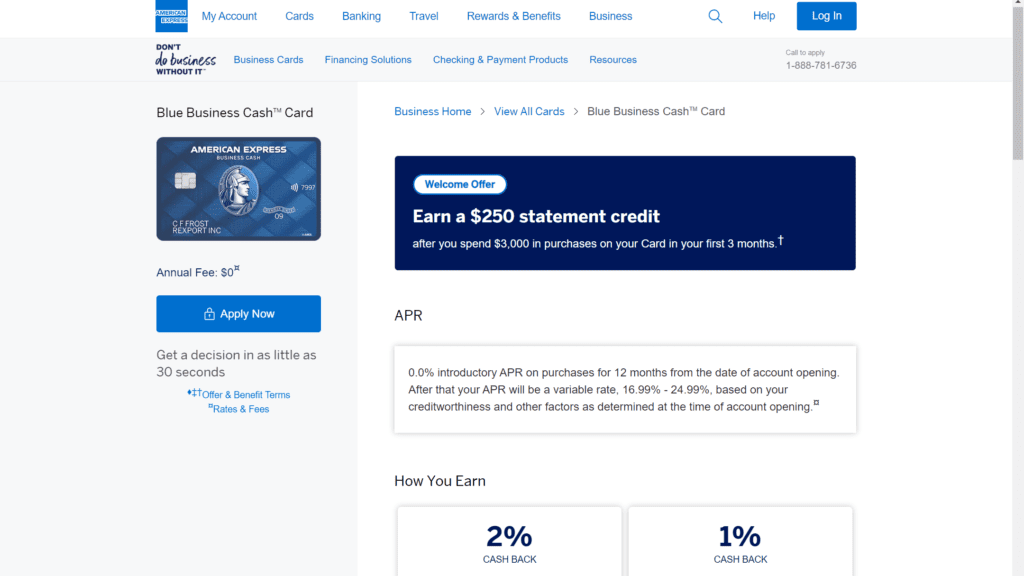

1. The Blue Business Cash Card from American Express | $0 Annual Fee

The American Express Blue Business Cash Card is one of the best credit cards for flat-rate business cash rewards. Cardholders receive 2% cash back on up to $50,000 in eligible purchases per calendar year; after that, 1% cash back is paid automatically to your statement.

Additionally, it has Expanded Buying Power, which enables cardholders to spend more than their credit limit. Keep in mind that there are limitations to how much you can spend on top of your credit limit. How it changes is affected by the use of the card, payment and credit history, financial resources that American Express is aware of, and other reasons.

A $250 statement credit is given to new users who spend $3,000 in the first three months after obtaining their card. There is no annual charge for this card.

Key Features:

- 2% cashback on transactions up to $50,000, then 1% cashback after that

- Expanded Buying Power enables cardholders to spend more than their credit limit.

- A $250 statement credit is available as a signup bonus on spending $3,000 in the first three months after obtaining their card.

- $0 annual fee.

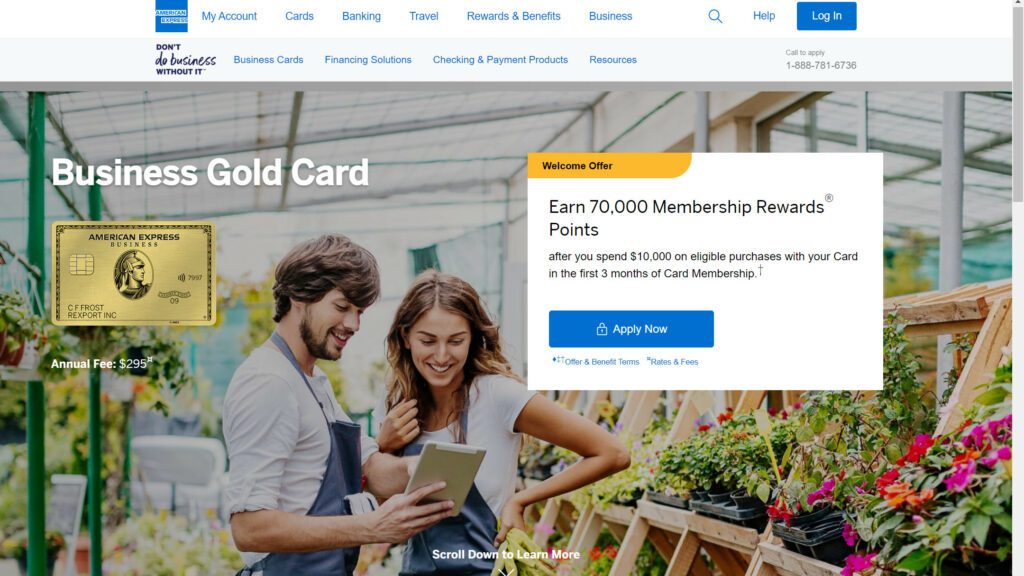

2. American Express Business Gold Card | $295 Annual Fee

American Express Business Gold offers up to 4x point benefits on flight bookings for farmers who use Amex Travel frequently.

This credit card gives you 4x rewards on the two categories of your choice, where your company spends the most money. The 4x, however, is limited to the first $150,000 in total purchases made each year. Any subsequent purchases receive one extra point for every $1 spent.

The following categories are available:

- Ticket purchases are straight from airlines.

- Gasoline pumps (U.S. purchases).

- Delivery purchases (U.S. purchases).

- Restaurants (U.S. purchasing) (U.S. purchases).

- Publicity via TV, radio, and online (U.S. purchases).

- Technology company for computer software, hardware, and cloud services (U.S. purchases).

Any farmer who travels by plane for vacation uses a lot of gas or belongs to any of the other categories mentioned above should make this choice. However, I would only advise it to farmers who travel frequently. The awards appear to be of the highest value when used as flying rewards.

For instance, each point is worth one cent when booking prize travel with Amex Travel. You also get back 25% of your points, up to 25,000 points per year. Finally, you can transfer points in a 1:1 ratio to the frequent flyer of a partner airline.

Key Features:

- Earn 4x rewards on the two categories of your choice, on purchases up to $150,000 per year.

- You can transfer points in a 1:1 ratio to the frequent flyer program of a partner airline.

- Each point is worth one cent when booking award travel with Amex Travel.

- You also get back 25% of your points, up to 25,000 points per year.

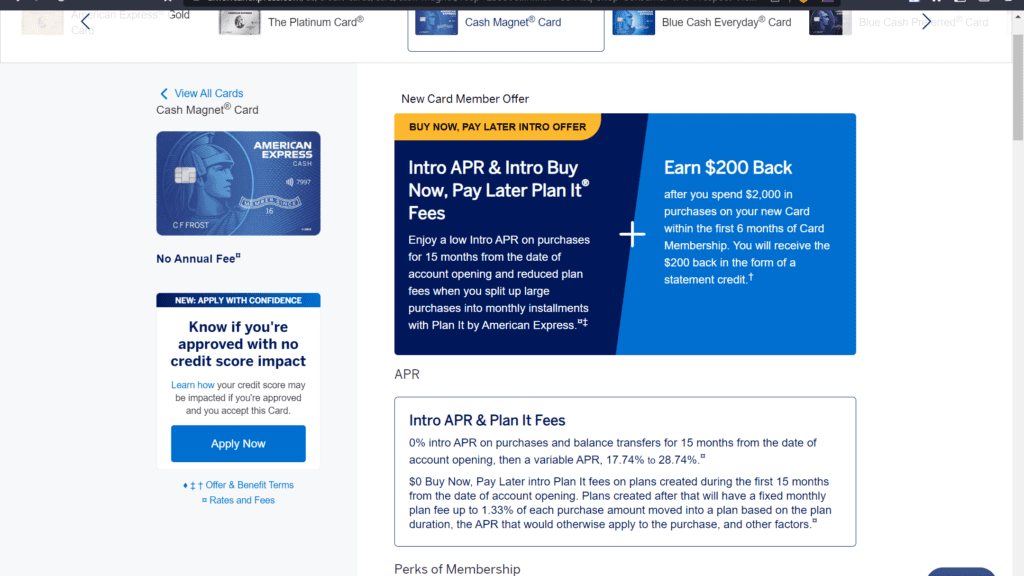

3. Cash Magnet Card by American Express | $0 Annual Fee

The 5% discount on phone and business product purchases and the 3% discount on one of the sections we have mentioned in the reviews section is simply cash plus strong points.

On purchases from telecom organizations and office supply businesses, SimplyCash Plus earns 5%. Airfare, vehicle rentals, dining establishments, shipment, computer parts, transportation, ads, and hotels are more categories where you can earn 3%.

Key Features:

- $200 signup bonus, on spending $2,000 in the first 6 months.

- $0 annual fee

- Special discounts on office supplies and phone service.

- Earn 3% on airfare, vehicle rentals, dining establishments, shipment, computer parts, transportation, ads, and hotels.

- Earn 1% cash back for other transactions.

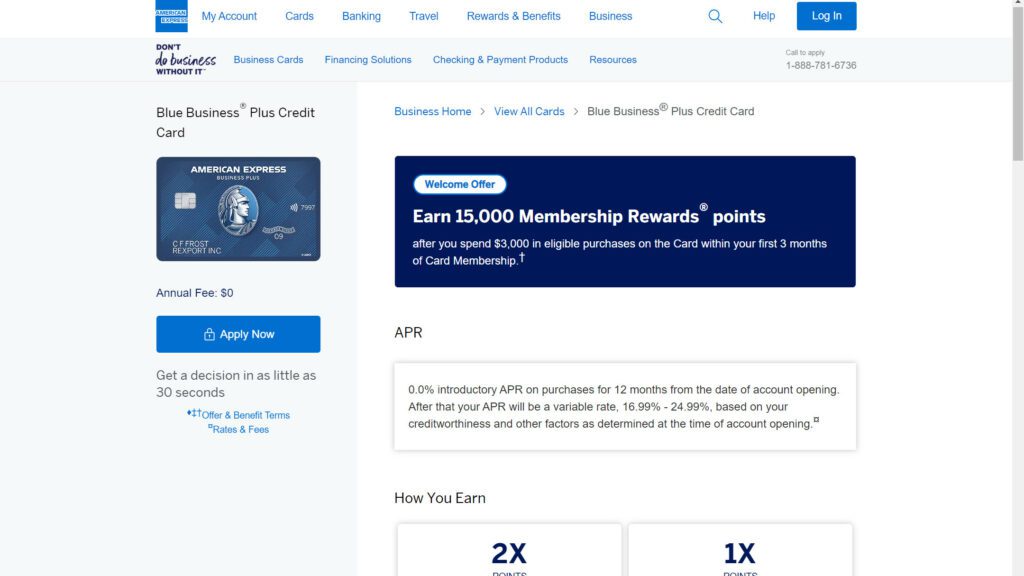

4. American Express Blue Business Plus Credit Card | $0 Annual Fee

This credit card doesn’t require tracking the spending of every category if you can make the most of how you use your membership reward points.

This credit card offers a signup bonus of $150 (15,000 Membership Reward Points), which is still a fantastic initial bonus for a credit card with no annual fees.

Bestseller Personal Finance Books

Additionally, credit card offers simple incentives. On daily business expenditures up to $50,000 annually, you can earn 2X Membership Rewards points. You earn 1X points for every dollar spent after this point level. Earning rewards is simple because you do not have to keep track of any particular earning categories.

You may use your points in many ways, but transferring them to airline and hotel partners will give you the best value.

Key Features:

- $0 annual fee.

- You are allowed to exceed the budget.

- It has a fee for foreign transactions.

- Earn 15,000 Membership Loyalty points, by spending $3,000 on qualifying purchases over the first 3 months.

- Earn 2X Membership Rewards points on up to purchases of $50,000 per year, 1X points after that.

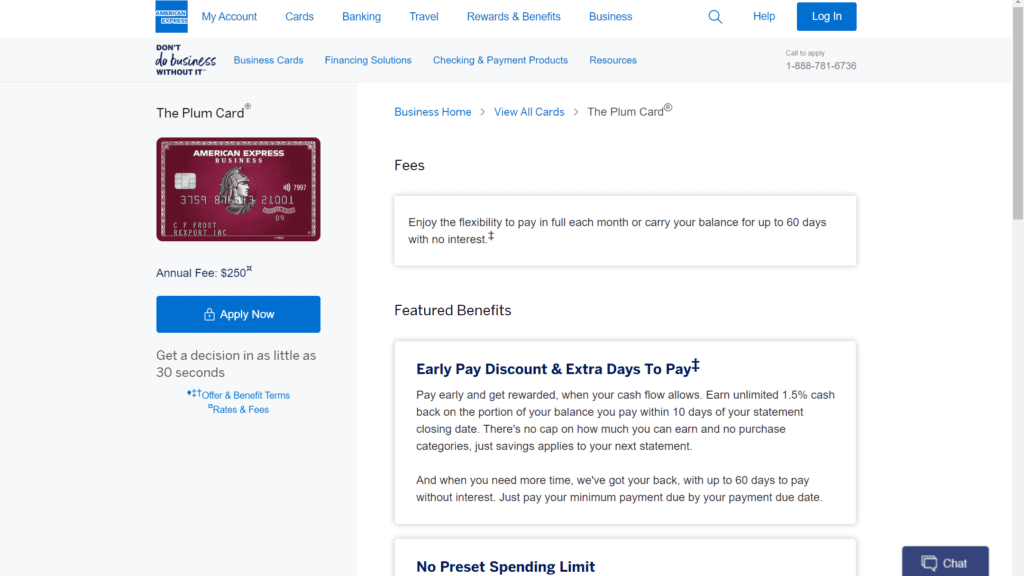

5. The Plum Card from American Express | $250 Annual Fee

For things you can not afford in full advance, you might now use a credit or have a credit card debt. You have to pay it back on your balance. When you pay the amount needed by the Payment Due Date and use the Plum Card, you have up to 60 days to pay without paying interest.

Additionally, paying in advance is advantageous. There is no cap on how much you can recover, and you receive a 1.5% early pay discount on your account for payments made within ten days of the statement closing date.

The yearly cost is $250. The Plum Card is worthwhile if it can help you avoid paying at least $250 in interest fees.

Key Features:

- Up to 60 days to pay without incurring interest.

- 1.5% early pay discount for payments made within ten days of the statement closing date.

- $250 annual fee.

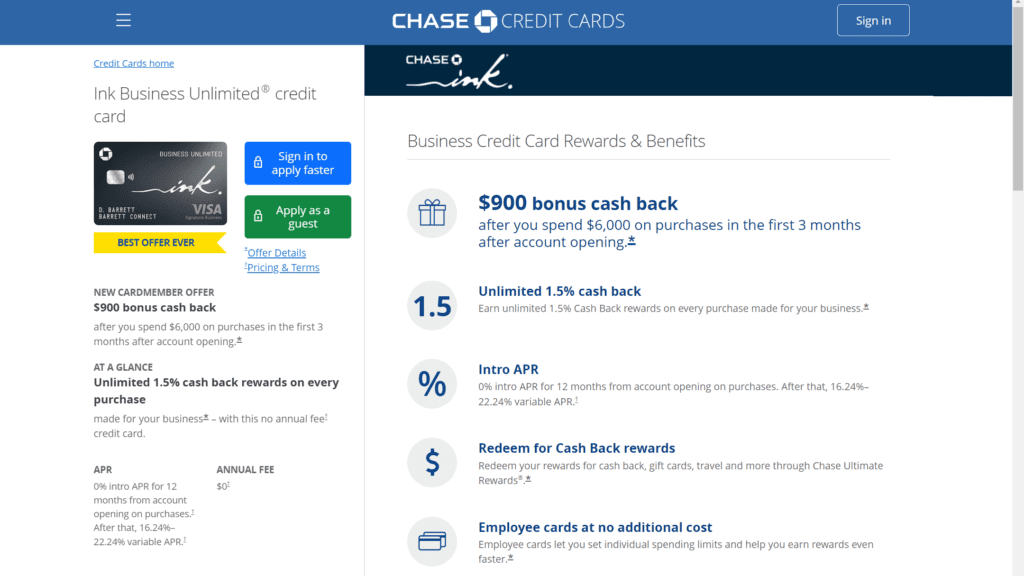

6. Chase Ink Business Unlimited Credit Card | $0 Annual Fee

For farmers that want flat charges and user-friendly services, this is a good solution.

On all transactions, the Chase Ink Business Unlimited Credit Card offers an unlimited 1.5% back. Therefore, this is a great card for farmers who want flat-rate payouts.

With this credit card, you can get a $900 bonus cashback once just $6,000 in payments are made during the first three months after account setup. Employers who want to have more control over their employees’ credit cards and accelerate the earning of rewards can set specific spending limits.

Reward points can be exchanged for vacation, gift cards, cash back, and other items. Either your bank account will be credited with the cashback or a statement credit will be issued.

Key Features:

- Earn unlimited 1.5% cashback.

- Signup bonus of $900 on making qualifying transactions of $6,000 during the first three months.

- 0% APR for the first 12 months.

- $0 annual fee.

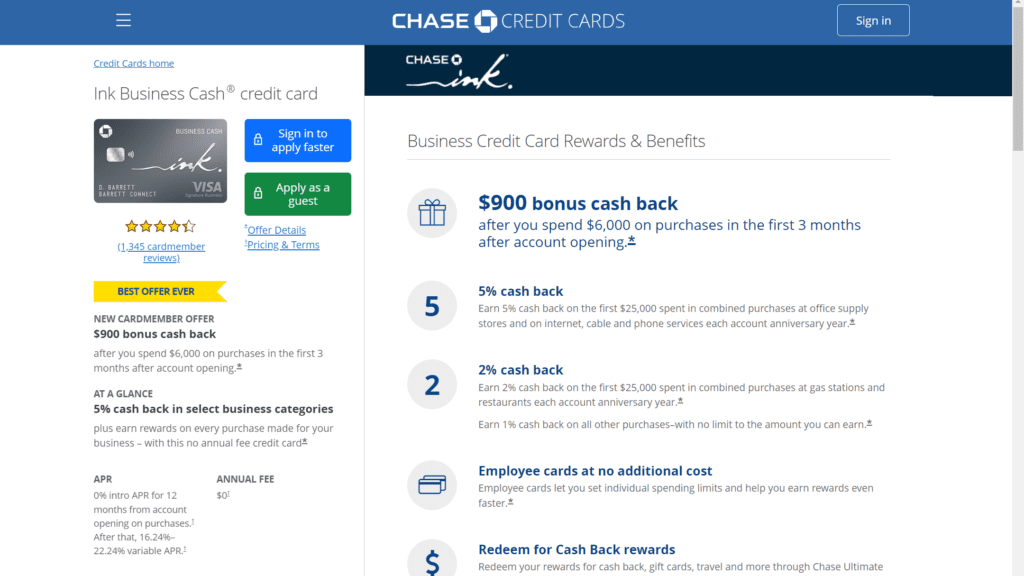

7. Chase Ink Business Cash Credit Card | $0 Annual Fee

This credit card should be your top concern if you frequently spend money on business supplies, telephones, cables, and internet services. But it will also be helpful for people who frequently visit petrol stations and restaurants.

For a farmer who frequently spends money on things like phones, cable, internet, restaurants, and office supply stores. Additionally, you get a chance to earn 2% cashback on your first $25,000 of purchases at restaurants and petrol stations. On the first $25,000 in combined purchases for office supplies, phone, cable, and internet service, you receive 5% cashback.

You receive 1% cash back on all other purchases, with no caps or restrictions. However, you can receive up to $900 in cashback if you can manage to spend $6,000 on all transactions within the first three months. Through the Chase Ultimate Rewards portal, you may exchange your rewards for cash back, gift cards, and more. You have the option of getting the cashback deposited or as a statement credit.

Key Features:

- 5% cash back on office supplies, internet, and phone services, on purchases of up to $25,000 per year.

- 2% cashback on your first $25,000 of purchases at restaurants and gas stations.

- $0 annual fee

- $900 signup bonus on spending $6,000 in the first 3 months.

8. Fleet Rewards Visa Credit Card

With the Fleet Rewards Visa Credit Card, you may earn up to 4x points for every $1 spent at Fleet Farm. Every dollar spent on non-Fleet Farm purchases earns you one point. You can exchange your rewards points for a $25 Fleet Farm store credit once you have 2,500 points in your account. You can also get unique discounts and financing terms if you have a card.

Key Features:

- Earn up to 4X points for every $1 spent at Fleet Farm.

- Earn 1X points on other purchases.

- Get special discounts and financing terms.

9. Casey’s Business Mastercard

You can save as much as $0.08 per gallon with Casey’s Business Mastercard. The cost of fuel is reduced by 1 cent for every gallon purchased between 1 and 499 times per month. You must buy at least 10,000 gallons of unleaded diesel every month to qualify for the full gas rebate. Any other gas station that accepts Mastercard will likewise accept this card.

Key Features:

- Reduced gas prices: 1 cent for every gallon purchased between 1 and 499 times per month.

- Buy 10,000 gallons of unleaded diesel per month to qualify for the maximum gas rebate.

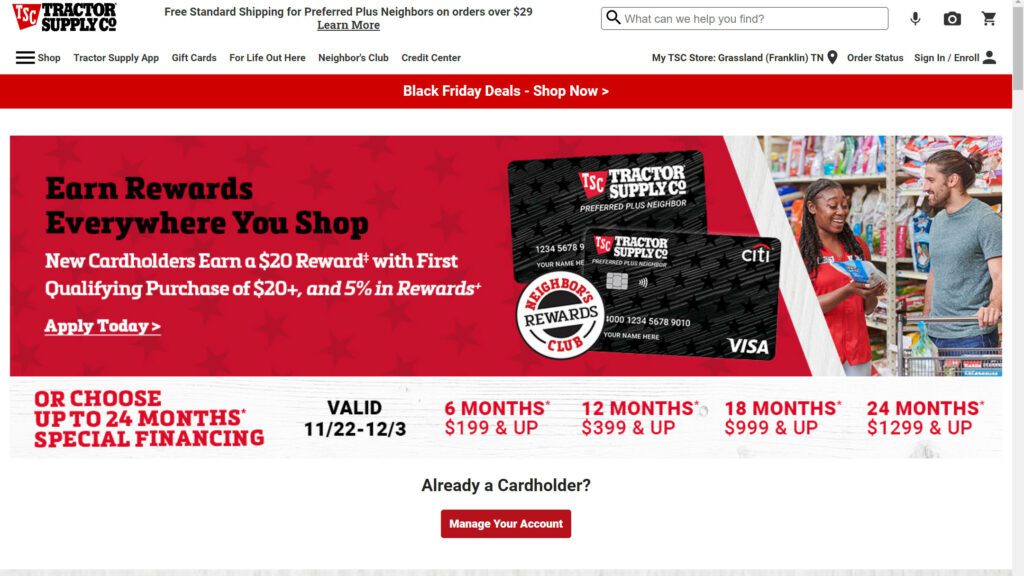

10. Tractor Supply Credit Cards

Consider applying for a personal or corporate credit card from Tractor Supply if you shop there frequently.

You can get 5% back in Neighbor’s Rewards or special financing for 6 and 12-month payback options with the Tractor Supply personal card, the TSC Personal Credit Card Rewards. Additionally, if your application is accepted, you will receive an additional $20 in cash.

An exclusive line of credit is provided through the Tractor Supply company credit card. Special discounts and financing conditions might also be available to you.

Key Features:

- Earn 5% cash back in Neighbor’s Rewards or special financing for 6 to 24-month payback options.

- Signup bonus of $20 on the first qualifying transaction of $20 or more.

11. Capital One Spark Cash for Business | $150 Annual Fee

Would you like to receive 2% cash back continuously? That is exactly what Capital One Spark Cash for Business does. All year long, you receive an unlimited 2% back on all transactions. This Visa Signature Credit Card is almost universally accepted by merchants.

When new cardholders spend $5,000 on transactions within three months of starting their accounts, they will receive a one-time $500 cash incentive. There are also free employee cards available, and all purchases qualify for unlimited 2% cash back.

Key Features:

- Earn unlimited 2% rewards on all transactions.

- $0 annual fee for the first year, and $150 per year after that.

- $500 signup bonus after spending $5,000 in the first 3 months.

- Additional $500 bonus after spending $50,000 in the first 6 months.

12. Capital One Secured Mastercard | $0 Annual Fee

Capital One Secured is an option for farmers who don’t have any credit history or who want to improve their credit score. Capital One Secured asks you to deposit to demonstrate that you are a legitimate borrower, just like any other conventional secured credit card. The deposit is always between $200 and $2,500, depending on the card you choose, and it is refundable.

Although the $200 credit limit on Capital One Secured Credit is fixed, there is a possibility of an increase if you demonstrate that you are an honest borrower who makes on-time payments. Additionally, unlike other cards, Capital One Secured does not prohibit deposits up to your full credit limit. The amount of money you can deposit to meet this quota is somewhat unclear.

The company states on its website that you can qualify for the $200 credit limit with a deposit of either $49, $99, or $200. Zero international transactions and annual fees are further advantages. However, it lacks a rewards program, unlike the other credit cards for farmers that we analyze in this study.

Key Features:

- Requires a minimum refundable deposit between $49 and $200 for an initial credit limit of $200.

- $0 annual fee.

- No foreign transaction fees.

Conclusion

There isn’t a perfect credit card for farmers that matches every situation. What purchases you want to make to receive bonus incentives will depend on where you live. Regardless of the card you select, timely payments increase your company credit score, which increases your purchasing power in a variety of ways.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents