This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Dividend Definition: What Is Dividend?

A dividend is best defined as a reward to shareholders in the form of cash or stock. See Types of Dividends later in the article.

Suppose you start a lemonade stand, your friends and family help you monetarily and become investors (shareholders) in your lemonade stand business. After a year in business, the lemonade stand has a net income of $20,000, after all, expenses and deductions. You (and the board of directors) have to make a decision – what to do with the $20,000 now? You can either put it back into the business for growing it or you can distribute the profit, as ‘dividends‘, among your shareholders, or a bit of both!

How much ‘dividend yield’ would your investors get compared to their investment? On what date would you check your books to identify which investors qualify for the dividend payout? These are important considerations for dividends. We will discuss everything about dividends in the article – the rationale behind dividends, dividend rate vs dividend yield, date of record, ex-dividend date, etc., and take a look at some dividend-paying stocks and ETFs.

If the board of directors decides that it’s best to give away some part of the profits as dividends, then the company gives out dividends to reward the investors, else reinvests the profits in future growth opportunities.

In general, most mature companies such as AT&T, Apple, Verizon, etc. pay out dividends to the shareholders, while high growth companies choose to reinvest their profits in expansion projects instead of paying out dividends.

- Dividend Definition: What Is Dividend?

- Types of Dividends

- Important Dates for Dividends

- Dividend Investors

- Dividend Paying Stocks

- Do FAANG companies pay dividends?

- Dividend ETFs

- M1 Finance Pie with Dividend ETFs

- Dividend Taxes

Dividend Payout Ratio

Out of the $20,000 net income, if you (and the board of directors) decide to pay out $8,000 as dividends to investors, and retain the remaining $12,000 for investing in a future expansion or some other business-related projects, your business would have a dividend payout ratio of 0.4 or 40%

Dividend Payout Ratio: Dividend paid out / Net Income = $8,000 / $20,000 = 40% or 0.4

Retained Earnings: 1 – Dividend Payout Ratio = 1 – 0.4 = 60% or 0.6

Alternatively, Retained Earnings: $12,000 / $20,000 = 60% or 0.6

What Is Dividend Yield?

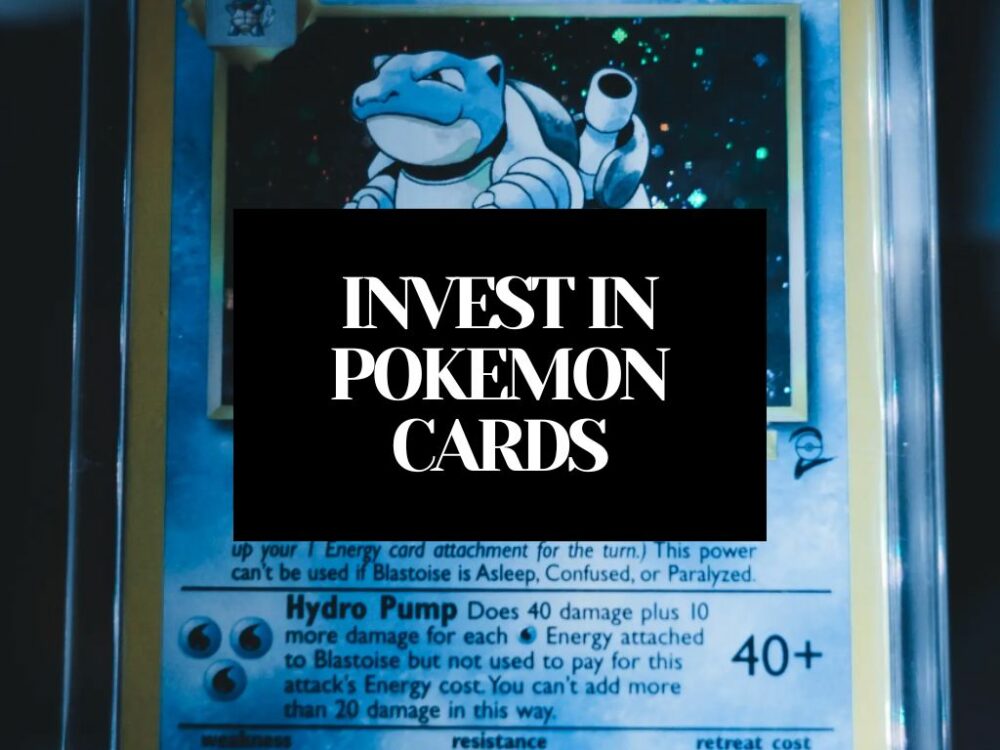

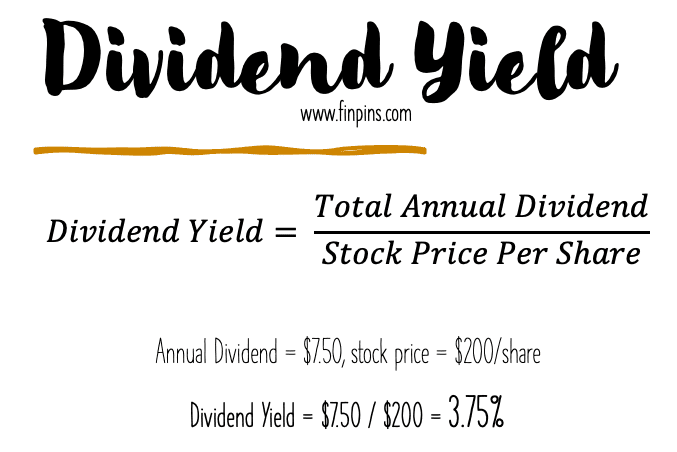

Dividend yield is the ratio of annualized dividend and the price per share of the stock.

Dividend Yield Formula

Suppose a stock paid out dividends of $1.50 per share in Q1, $1.75 per share in Q2, $2.00 per share is Q3, $2.25 per share in Q4, the total annual dividend paid is $1.50 + $1.75 + $2.00 + $2.25 = $7.50

If the stock is now trading at $200 per share, the trailing 12-month dividend yield = $7.5 / $200 = 3.75%

Pro Tip: Before investing in stocks with high dividend yield, investors should investigate whether the stock is increasing the dividend or whether the price of the stock has declined, causing the dividend yield ratio to go up.

Dividend Rate

The total annualized dollar amount, $7.50 in our example, is called the dividend rate. It’s different from the dividend yield which is expressed as a percentage.

The dividend rate, on its own, doesn’t reflect the return on investment for the shareholders, as a high dividend rate on a stock with a high share price might not be suitable for dividend investors who are seeking high dividend income through their investment.

Types of Dividends

Cash Dividend

A cash dividend is a payout in the form of cash. For example, you own 100 shares of a company, the company pays out a quarterly cash dividend of $1.50 per share; you’d receive $1.50 * 100 = $150 as a cash dividend.

Bestseller Personal Finance Books

You may choose to enroll in DRIP (Dividend reinvestment plan) so that the $150 gets used to purchase shares at the market price (say $200/share). $150 / $200 = 0.75 shares will automatically get added to your account.

Stock Dividend

A stock dividend is a payout in the form of a company’s shares instead of cash. For example, you own 100 shares of a company, the company pays out a quarterly dividend of 0.05 share/share held. 100 * 0.05 = 5 shares gets added to your account.

Important Dates for Dividends

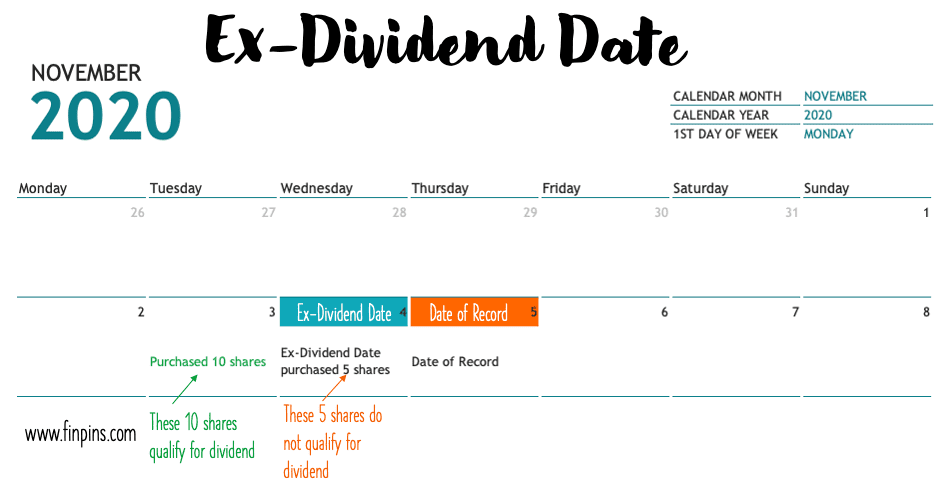

Ex Dividend Date

The ex-dividend date is the date on or after which a stock dividend is not paid to a new buyer.

For example, a company declares a dividend of $1.25 per share with an ex-dividend date of 18 November 2020. If an investor buys 10 shares before the ex-dividend date (say 17 November 2020), and 5 shares on 18 November 2020 (ex-dividend date), she is eligible to receive her dividend for that quarter on only the 10 shares (i.e. $1.25 *10 = $12.5 ) purchased before the ex-dividend date. She will not receive the dividend on the 5 shares purchased on the ex-dividend date.

Date of Record

The date of record is the day the company will check its record books for who owns how many shares. Using the records on that day, the company will pay out dividends to the investors.

Generally, the date of record is one business day after the ex-dividend date. It takes 2 business days to update the record books, hence in the example only the shareholders who are on books before the ex-dividend day qualify to receive the dividends.

For simpler understanding, investors can just focus on the ex-dividend date – i.e. buy before the ex-dividend date, and hold it for at least the ex-dividend date to qualify for the quarterly dividend.

Dividend Investors

Dividend Investors invest in dividend stocks and dividend ETFs for many reasons.

- Generally established companies pay dividends, and investing in established companies are reassuring for investors.

- Cash flow – some investors need regular cash flows, and dividends help them achieve that objective.

- Dividend stocks tend to be less volatile than other stocks, hence investors feel more protected against a downturn or a stock market crash.

- While some investors look for high yield, some others look for dividend growth that would ensure better cashflows in the future.

advertisement

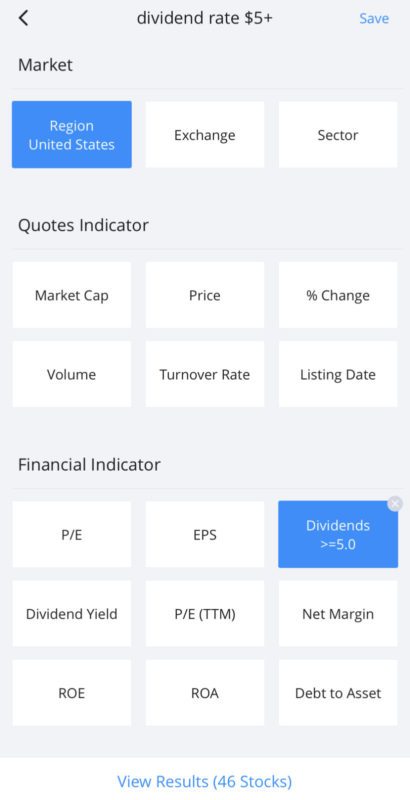

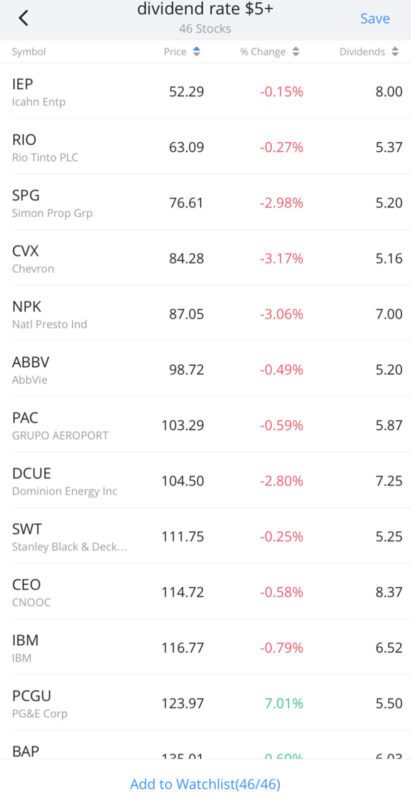

Dividend Paying Stocks

Using the screeners, such as one on WeBull, it is easy to identify the stocks that pay dividends.

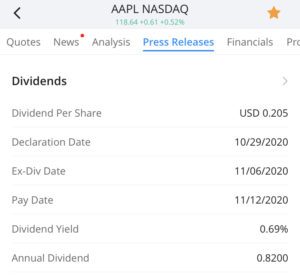

Dividend for Apple

Apple’s trailing twelve months dividend yield is 0.69% as of Nov 2020.

Dividend for AT&T

AT&T’s trailing twelve months dividend yield is 7.36% as of Nov 2020.

Dividend for IBM

IBM’s trailing twelve months dividend yield is 5.56% as of Nov 2020.

Dividend for 3M

3M’s trailing twelve months dividend yield is 3.43% as of Nov 2020.

Dividend for Amazon

Amazon doesn’t pay dividends to stock investors, as of Nov 2020.

Do FAANG companies pay dividends?

Among the FAANG companies, only Apple (AAPL) pays dividends, the remaining four – Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google (Alphabet – GOOG) do not pay dividends as of October 2021. If we consider MFAANG, then Microsoft (MSFT) also pays dividends in the elite group along with Apple (AAPL).

Dividend ETFs

If you don’t want to screen and pick individual stocks that pay dividends, you can choose an ETF instead. Dividend ETFs are a great way to invest and diversify at the same time in dividend-paying stocks in a very easy manner.

The dividend ETF will invest in dividend-paying stocks and will pay the investors some dividends on a regular basis. The fund manager of the ETF does the job of investing in well-researched dividend stocks so that the investors in the ETF (people like you and me who just buy the ETF instead) don’t have to do the heavy lifting.

The investors have a choice to either cash out the dividends or reinvest them for more growth in the future – based on their individual goals. A reinvestment will enable the investor to buy more shares of the ETF and build more wealth in the long term.

Are There Vanguard Dividend ETFs

Yes, Vanguard offers dividend ETFs to investors. Two popular ones are the following:

- ETF for High Yield from Vanguard: VYM (see details here)

- Dividend Growth ETF from Vanguard: VIG (see details here)

M1 Finance Pie with Dividend ETFs

Here’s my dividend pie on M1, with a target dividend yield of approximately 4%, and an expense ratio of 0.29%

Components

- VYM

- SCHD

- SDY

- BDJ

- DVY

Dividend Taxes

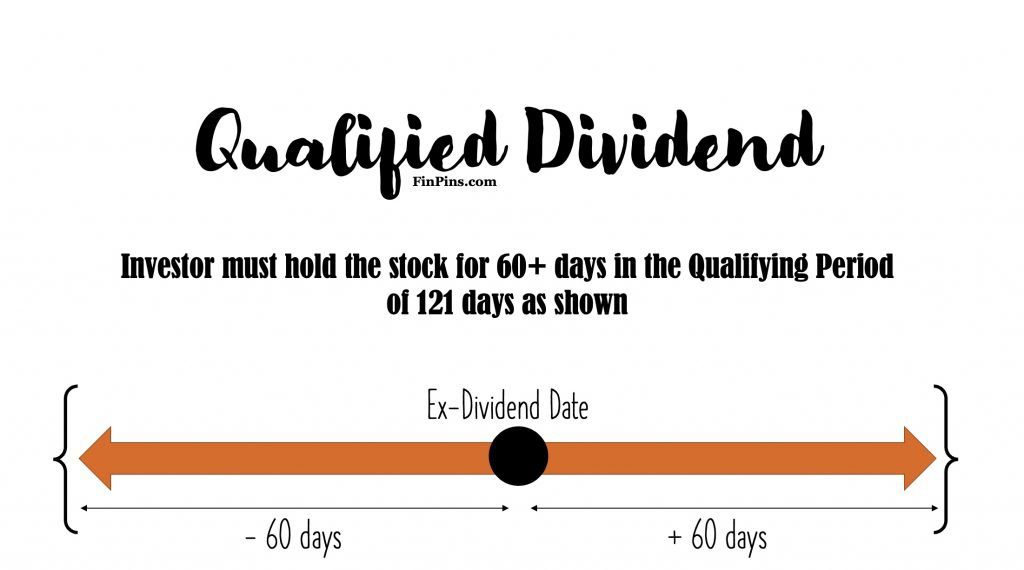

A dividend is a form of income that investors receive. Depending on your tax-filing status, there may be tax consequences on your dividend income. The taxes on dividend income also vary depending on whether your dividends are classified as ‘qualified dividends’ or ‘ordinary dividends’. Ordinary Dividends are also called ‘non-qualified dividends’.

What Dividends are Qualified?

The IRS treats qualified dividends favorably and taxes them at a lower rate. A dividend is considered ‘qualified’ where certain conditions are met.

- Generally, to be considered a ‘qualified dividend’, the dividend must be paid by a US company. In some cases, certain foreign companies’ dividends may also be considered.

- The dividend must be paid out by a for-profit organization. Dividends from a tax-exempt organization are not considered for being treated as ‘qualified dividends’.

- The investor must hold the underlying stock (or any security that pays dividends) for more than 60 days in the qualifying period. The qualifying period is determined by the ex-dividend date. If the ex-dividend date is D, the qualifying period is (D – 60) days to (D + 60) days.

This is information of general nature, for details and exceptions, please refer IRS Publication 550.

Qualified Dividend vs Ordinary Dividend

Any dividend that does not satisfy all the criteria for being considered a ‘qualified dividend’ may be treated as an ‘ordinary dividend’. While qualified dividends are given preferential treatment and investors (almost always) pay lower taxes on them, ordinary dividends are usually taxed at the same tax rate as the investor’s personal income tax rate.

Thankfully, the brokerage account should clearly specify whether the dividends you receive are ‘qualified’ or ‘ordinary’ in the tax forms, taking the burden away from you of classifying the dividends.

Qualified Dividend Taxes

Qualified Dividends are taxed at three different rates. Depending on taxable income and tax filing status, the tax rate for qualified dividends can be 0%, 15%, or 20%. It’s important to note that while the personal income tax rates in the US can be as high as 37%, the maximum tax rate on qualified dividends is 20%.

Here’s how the tax rates are determined for qualified dividends.

- 0% on any amount that otherwise would be taxed at a 10% or 15% rate (personal income tax rate),

- 15% on any amount that otherwise would be taxed at rates between 15% and 37% (personal income tax rate), and

- 20% on any amount that otherwise would be taxed at a 37% rate (personal income tax rate)

Understandably, people in higher tax brackets, i.e. higher annual income pay a higher dividend tax rate on qualified dividends as well.

This is information of general nature, for details and exceptions, please refer IRS Publication 550.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents