This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

What is a Long Call Option?

Before we go to the ‘How to buy a long call option’ guide, let’s quickly recap what a call option is. As the name suggests, a call ‘option’ is a contract that gives you the option of buying 100 shares of a stock at a pre-determined price. You can choose to exercise the option or choose not to exercise the option to buy those 100 shares.

When you buy a call option, you buy the contract that will allow you to buy 100 shares of a stock at a fixed price (called the strike price). But, this contract is not valid indefinitely, it comes with an expiration date. The expiration date and the strike price play a crucial role in determining the price (premium) of the contract.

For more details check out the following article: Call vs Put Options

- What is a Long Call Option?

- Why Buy a Call Option?

- How to Buy a Long Call Option on Robinhood (Step by Step Guide)

- How to Buy an In The Money Call Option (ITM) on Robinhood

- How to Buy an Out of Money Call Option (OTM) on Robinhood

- How to Buy a Long Call Option on WeBull (Step by Step Guide)

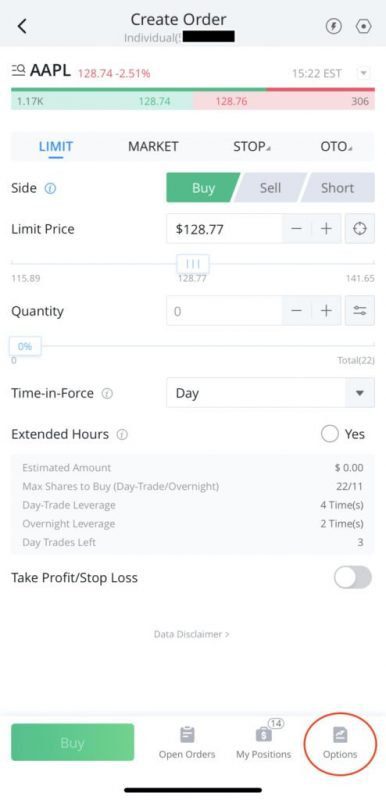

- Step 1. Click on ‘Quick Trade’.

- Step 2. Search For The Stock.

- Step 3: On the Create Order screen, look for the ‘Options’ button on the bottom right and click on it.

- Step 4: The Options Trading screen looks like this. Click on the Expiration Date to open a list of all expiration dates.

- Step 5: Choose the desired expiration date.

- Step 6: The list of all relevant call options with the chosen expiry date will open up.

- How to Buy In The Money Call Option on Webull

- How to Buy Out of The Money Call Option (OTM) on Webull

- Is Buying a Call Option Risky?

- Conclusion

Why Buy a Call Option?

Call options provide investors with financial leverage. For example, if you believe a stock trading at $100 today has huge upside potential, you can do a couple of things

- you can buy some shares of the stock at the price of $100/share and wait for the stock price to rise.

- you can gain financial leverage by buying a call option to tap the upside potential of the stock.

Case 1 is fairly straightforward. If you want to look at how to buy stocks, please read this: how to buy your first stock.

Case 2 is what we will discuss in this article.

If you are convinced that the stock price will rise within the next few days, weeks, or months, you can choose a call option with the most suitable expiration date + strike price and bet on the upside of the stock by paying a premium. The premium for the call option is generally a fraction of the cost of actually buying 100 shares, hence giving you the financial leverage we talked about earlier.

Need a primer on investing in the stock market? See below:

How to Buy a Long Call Option on Robinhood (Step by Step Guide)

Step 1. Look for The Desired Stock or Security.

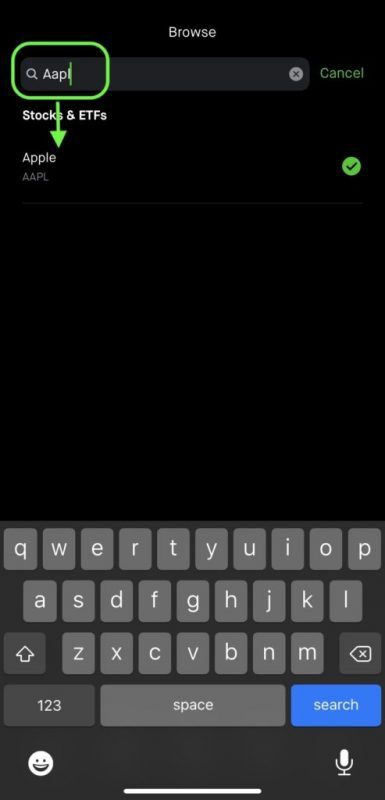

Search for the stock for which you want to buy the call option. For the demo, we are looking at the Apple stock (AAPL). Click on the stock name to proceed with the selection.

Search for the stock for which you want to buy the call option. For the demo, we are looking at the Apple stock (AAPL). Click on the stock name to proceed with the selection.

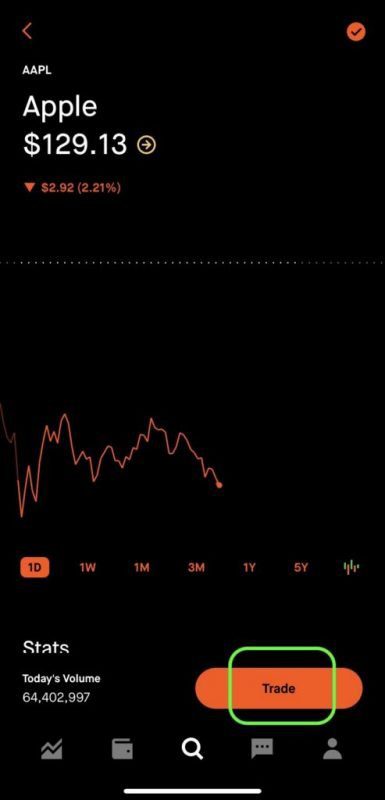

Step 2. Click on the ‘Trade’ button at the bottom right of the screen.

Click on the ‘Trade’ button at the bottom right of the screen.

Step 3. A small menu will up, select ‘Trade Options’ on the menu.

A small menu will up, select ‘Trade Options’ on the menu.

Step 4. Now the main Option Trading screen will appear.

4a. On the top row there is a list of expiration dates, you can slide right and left to pick an expiration date.

4b. On the buttons right below the expiration dates, select ‘Buy’ and ‘Call’

Note that the current stock price is also indicated, ‘Share Price: $129.14’.

The Call Options with ‘Strike Prices’ greater than the current share price ($129.14) are called ‘Out of Money Call Options’. Here, on the screenshot, we can see Out of Money Call Options with Strike Prices of $130, $135, $140. To view more strike prices, you can scroll up and down.

The Call Options with ‘Strike Prices’ less than the current share price ($129.14) are called ‘In The Money Call Options’. Here, on the screenshot, we can see In The Money Call Options with Strike Prices $125, $120, $115. To view more strike prices, you can scroll up and down.

Now the main Option Trading screen will appear.

a. On the top row there is a list of expiration dates, you can slide right and left to pick an expiration date.

b. On the buttons right below the expiration dates, select ‘Buy’ and ‘Call’

How to Buy an In The Money Call Option (ITM) on Robinhood

Continuing from steps 1-4 described above.

Bestseller Personal Finance Books

Step 5. Select an In the Money Call Option.

For the demo, we are selecting the call option with a Strike Price of $125 (which is less than the current share price of $129.14)

Select an In the Money Call Option. For demo, we are selecting the call option with Strike Price $125 (which is less than the current share price of $129.14)

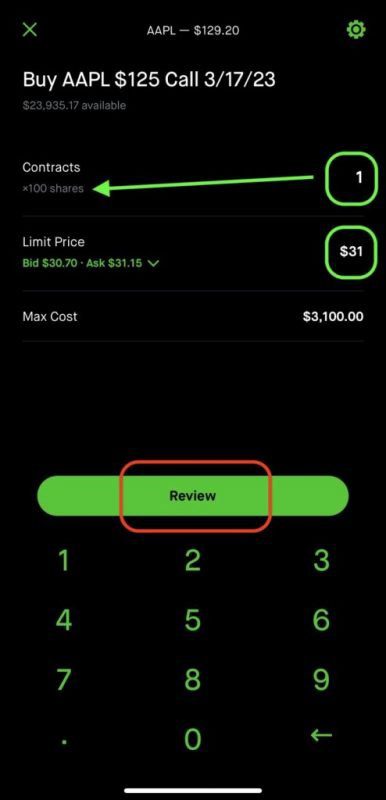

Step 6. Fill in Order Details.

After selecting the call option, on the next screen, fill in the order details such as the number of contracts you want to buy (1 contract is for 100 shares) and the price you want to pay per share. Hit Review when ready.

For the demo, we are buying 1 contract with a limit price of $31 per share. Our total cost of the order would be 1 contract * $31 per share * 100 shares per contract = $3,100.

After selecting the call option, on the next screen, fill in the order details such as the number of contracts you want to buy (1 contract is for 100 shares) and the price you want to pay per share.

Hit Review when ready.

Some Quick Math on the Call Option with Strike Price $125

The breakeven point of this call option contract would be $125 + $31 = $156. If Apple stock rises above the breakeven point, the investor makes profits. Technically with every dollar increase above $156, the investor makes $100 (assuming the investor buys 1 contract of 100 shares). So, simply speaking, if the Apple stock rises to $200 before the expiry date (3/17/2023), the investor can make $200 – $156 = $44 profit per share or $4,400 per contract (i.e. $44 * 100 shares) on an investment of just $3,100.

On the flip side, if the stock price stays at or below the Strike Price ($125), the investor loses all the money, i.e. $3,100 paid to buy the call option contract.

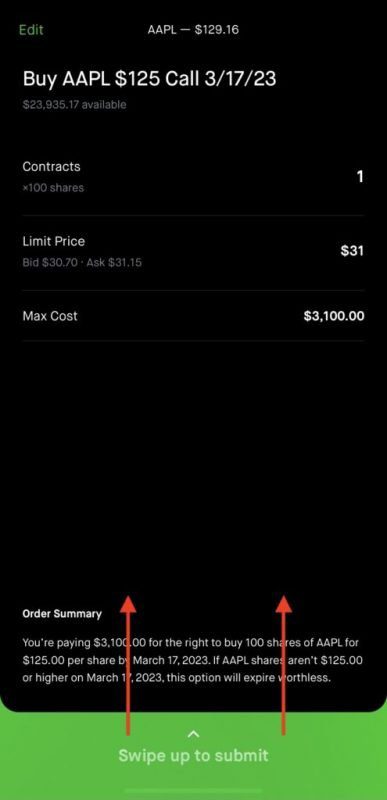

Step 7. Check and Finalize Order.

Check the Order Summary and if everything looks fine, swipe up to submit the order.

Check the Order Summary and if everything looks fine, swipe up to submit the order.

How to Buy an Out of Money Call Option (OTM) on Robinhood

Continuing from steps 1-4 described above.

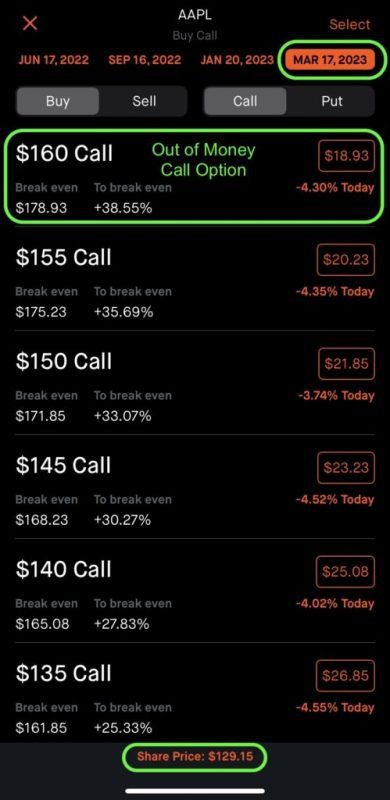

Step 5. Select an Out of Money Call Option.

For the demo, we are selecting the call option with a Strike Price of $160 (which is much more than the current share price of $129.15, as shown on the bottom of the screen)

Select an Out of Money Call Option. For the demo, we are selecting the call option with a Strike Price of $160 (which is much more than the current share price of $129.15, as shown on the bottom of the screen)

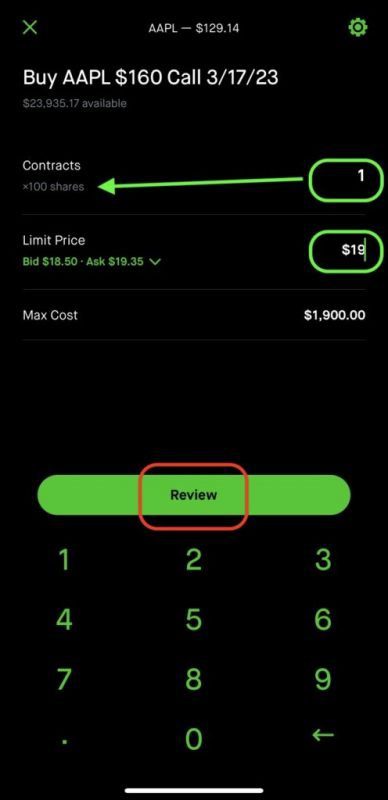

Step 6. Fill in Order Details.

After selecting the call option, on the next screen, fill in the order details such as the number of contracts you want to buy (1 contract is for 100 shares) and the price you want to pay per share. Hit Review when ready.

For the demo, we are buying 1 contract with a limit price of $19 per share. Our total cost of the order would be 1 contract * $19 per share * 100 shares per contract = $1,900.

After selecting the call option, on the next screen, fill in the order details such as the number of contracts you want to buy (1 contract is for 100 shares) and the price you want to pay per share.

Hit Review when ready, double-check order details and swipe up to submit the order.

Some Quick Math on the Call Option with Strike Price $160

The breakeven point of this call option contract would be $160 + $19 = $179. If Apple stock rises above the breakeven point, the investor makes profits. Technically with every dollar increase above $179, the investor makes $100 (assuming the investor buys 1 contract of 100 shares). So, simply speaking, if the Apple stock rises to $200 before the expiry date (3/17/2023), the investor can make $200 – $179 = $21 profit per share or $2,100 per contract (i.e. $21 * 100 shares) on an investment of just $1,900.

On the flip side, if the stock price stays at or below the Strike Price ($160), the investor loses all the money, i.e. $1,900 paid to buy the call option contract.

How to Buy a Long Call Option on WeBull (Step by Step Guide)

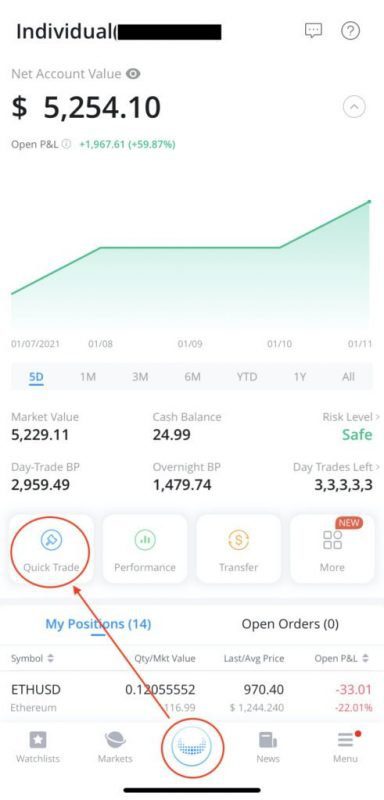

Step 1. Click on ‘Quick Trade’.

Click on the ‘Webull’ button at the bottom of the screen, and then click on the ‘Quick Trade’ button.

Click on the ‘Webull’ button at the bottom of the screen, and then click on the ‘Quick Trade’ button.

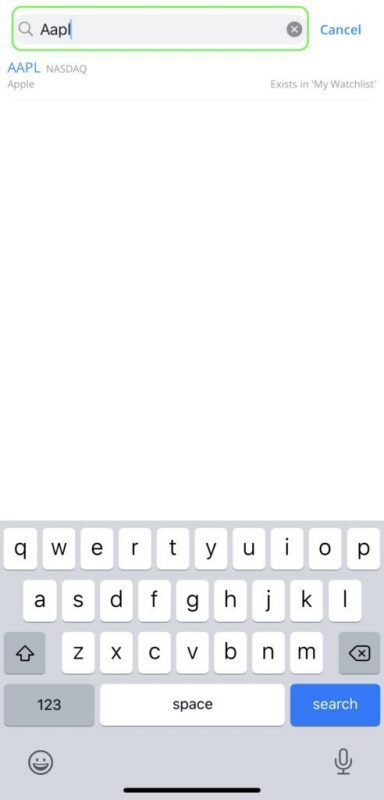

Step 2. Search For The Stock.

A search bar appears at the top of the page. Look for the stock for which you want to buy the option. For the demo, we are searching for Apple (AAPL) stock.

A search bar appears at the top of the page. Look for the stock for which you want to buy the option. For the demo, we are searching for Apple (AAPL) stock.

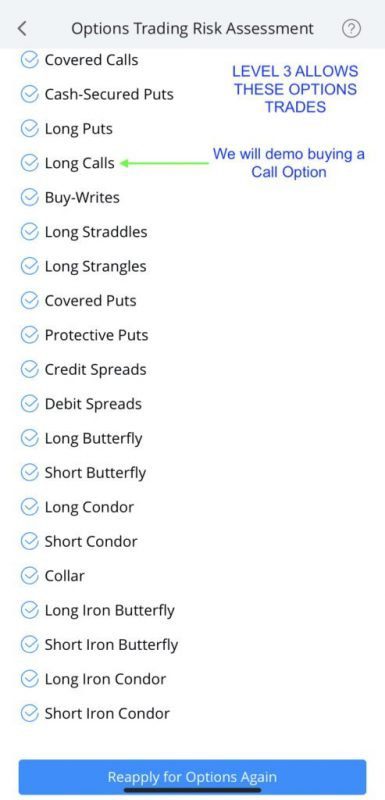

Good to Know: Webull allows investors access to multiple levels of option trading. Here is a screenshot of all options trades available to Level 3 investors. Buying a long call option should be available to even a Level 2 options trader.

Webull allows investors access to multiple levels of option trading. Here is a screenshot of all options trades available to Level 3 investors. Buying a call option should be available to even a Level 2 options trader.

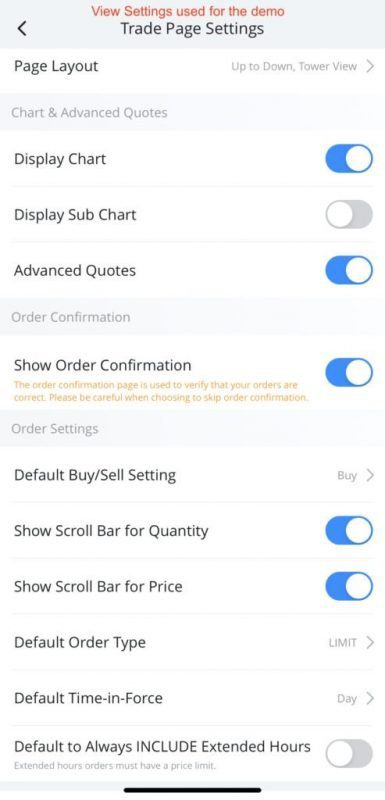

Good to Know: Webull allows users to configure their trade screen. Based on how you have configured it, your screen might look different from the one used in the demo.

Here are the settings used for the demo. You can change your screen settings by clicking the ‘hexagon with a dot’ icon on the top right (see screenshot in next step).

Webull allows users to configure their trade screen. Based on how you have configured it, your screen might look different from the one used in the demo.

Here are the settings used for the demo. You can change your screen settings by clicking the ‘hexagon with a dot’ icon on the top right.

Step 3: On the Create Order screen, look for the ‘Options’ button on the bottom right and click on it.

On the Create Order screen, look for the ‘Options’ button on the bottom right and click on it.

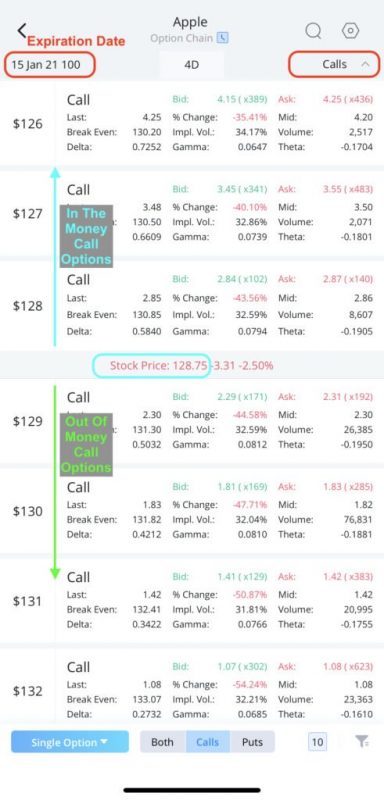

Step 4: The Options Trading screen looks like this. Click on the Expiration Date to open a list of all expiration dates.

- In the top left, there is the expiration date.

- In the top center, there is the number of days between today and the expiration date.

- On the top right, we can see the type of option. We want to make sure it is ‘Calls’ because we are interested in buying a Call Option

- In the center of the screen, there is a horizontal bar with the current stock price. The call options above that bar have strike prices lower than the current stock price, hence are ‘In The Money’ call options. The call options below the horizontal bar have strike prices higher than the current stock price, hence are ‘Out of The Money’ call options.

The Options Trading screen looks like this. Click on the Expiration Date to open a list of all expiration dates.

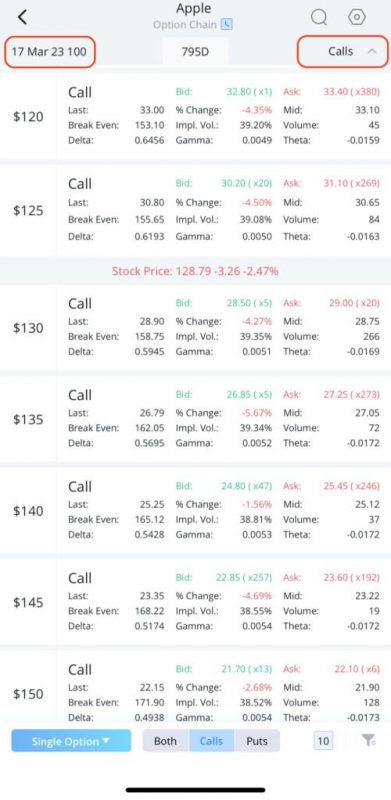

Step 5: Choose the desired expiration date.

For the demo, we are choosing the furthest available date on the list, i.e. 17 March 2023.

Choose the desired expiration date. For the demo, we are choosing the furthest available date on the list, i.e. 17 March 2023 (which is 795 days into the future, as indicated by 795D).

Step 6: The list of all relevant call options with the chosen expiry date will open up.

The list of all relevant call options with the chosen expiry date will open up.

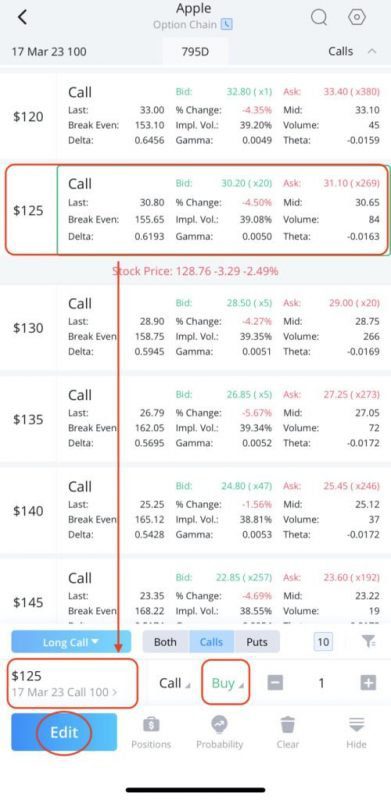

How to Buy In The Money Call Option on Webull

Continuing from Steps 1-6 described above.

Step 7: Choose a call option with a strike price less than the current stock price.

For the demo, we are choosing the $125 Strike Price (which is less than the stock price of $128.76) which is ‘In The Money’.

Confirm the following details at the bottom of the screen

- Call Option – Expiration Date and Strike Price

- The buy button is highlighted

Click on ‘Edit’ to configure the order

Choose a call option with a strike price less than the current stock price. For the demo, we are choosing the $125 Strike Price (which is less than the stock price of $128.76) which is ‘In The Money’.

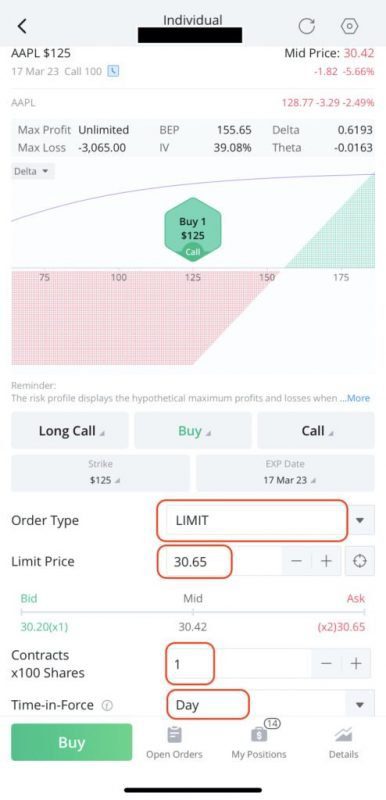

Step 8: Configure the Buy Order on This Screen.

8a. Choose Order Type: We are choosing ‘Limit Order’ and setting a limit price of $30.65

The ‘Bid-Ask’ spread bar can be used to see at what prices people are trying to buy and sell the same call option.

8b. Enter No. of Contracts you want to buy: We are buying 1 contract (of 100 shares)

8c. Select Time in Force: We are choosing ‘Day’ as our order validity.

8d. Hit the ‘Buy’ button

Configure the buy order on this screen.

a. Choose Order Type: We are choosing ‘Limit Order’ and setting a limit price of $30.65

b. Enter No. of Contracts you want to buy: We are buying 1 contract (of 100 shares)

c. Select Time in Force: We are choosing ‘Day’ as our order validity.

d. Hit the ‘Buy’ button

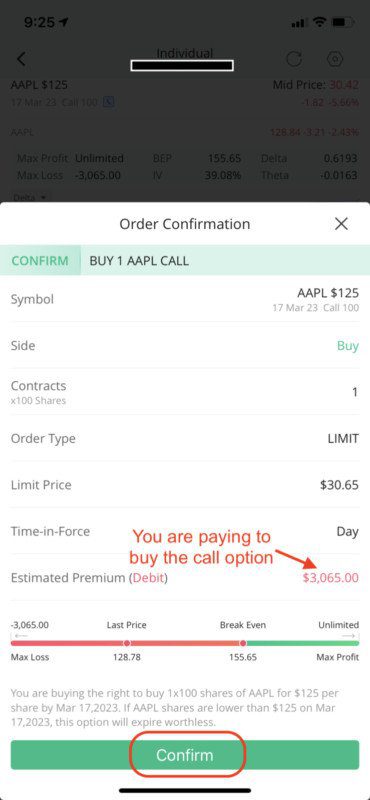

Step 9: Double-check the Details and Hit Confirm to Submit Your Order.

Make sure you are buying the call option for the right stock, for the right expiration date, with the right strike price, by paying the desired premium ($3,065 = $30.65 * 100).

Double-check the details and hit confirm to submit your order.

Make sure you are buying the call option for the right stock, for the right expiration date, with the right strike price, by paying the desired premium ($3,065 = $30.65 * 100).

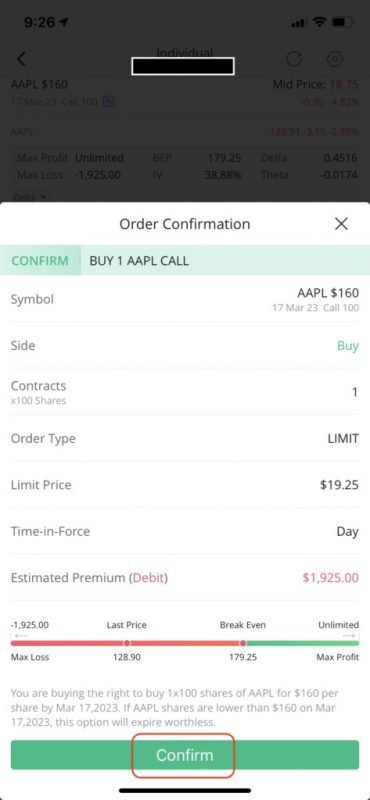

How to Buy Out of The Money Call Option (OTM) on Webull

Continuing from Steps 1-6 described above.

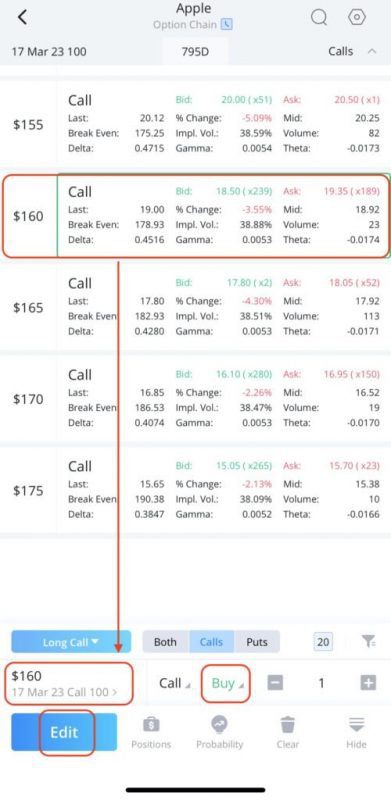

Step 7: Choose a call option with a strike price more than the current stock price.

For the demo, we are choosing the $160 Strike Price (which is more than the stock price of $128.76) which is ‘Out of Money’.

Confirm the following details at the bottom of the screen

- Call Option – Expiration Date and Strike Price

- The Buy button is highlighted

Click on ‘Edit’ to configure the order

Choose a call option with a strike price more than the current stock price. For the demo, we are choosing the $160 Strike Price (which is more than the stock price of $128.76) which is ‘Out of Money’.

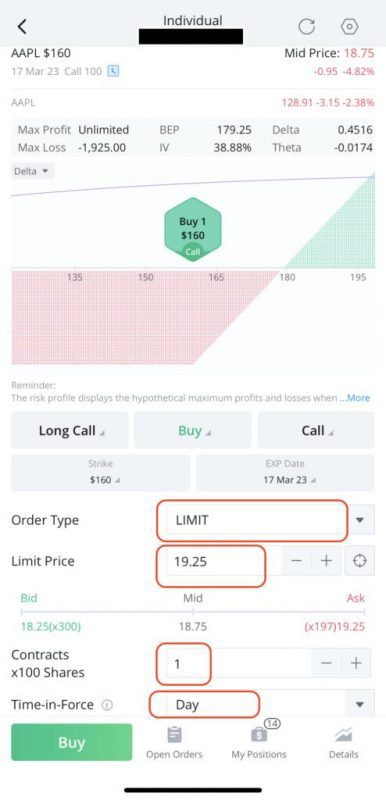

Step 8: Configure the buy order on this screen.

8a. Choose Order Type: We are choosing ‘Limit Order’ and setting a limit price of $19.25

The ‘Bid-Ask’ spread bar can be used to see at what prices people are trying to buy and sell the same call option.

8b. Enter No. of Contracts you want to buy: We are buying 1 contract (of 100 shares)

8c. Select Time in Force: We are choosing ‘Day’ as our order validity.

8d. Hit the ‘Buy’ button

Configure the buy order on this screen.

a. Choose Order Type: We are choosing ‘Limit Order’ and setting a limit price of $19.25

b. Enter No. of Contracts you want to buy: We are buying 1 contract (of 100 shares)

c. Select Time in Force: We are choosing ‘Day’ as our order validity.

d. Hit the ‘Buy’ button

Step 9: Double-check the details and hit confirm to submit your order.

Make sure you are buying the call option for the right stock, for the right expiration date, with the right strike price, by paying the desired premium ($1,925 = $19.25 * 100).

Double-check the details and hit confirm to submit your order.

Make sure you are buying the call option for the right stock, for the right expiration date, with the right strike price, by paying the desired premium ($1,925 = $19.25 * 100).

Is Buying a Call Option Risky?

Yes, Call Options carry asymmetric risk, i.e. on one side, if the stock goes above the breakeven point the upside is unlimited. Every dollar increase in price above the breakeven point theoretically brings $100 in additional profits for the investor. On the flip side, in case the stock price remains below the strike price, the investor loses all the money paid to buy the call option.

Though, it’s worth noting that the investor doesn’t lose any more money even if the stock price crashes to zero. For him or her, the loss is capped at the premium paid for the call option contract. The loss is the same whether the stock stays at the strike price or further crashes down to a lower price.

Conclusion

We Trust The Guide on ‘How to Buy a Long Call Option’ was Helpful.

Investing comes with financial risks. Options are leveraged financial instruments, and the risks (both gains and losses) are accentuated. As always, do your due diligence, understand the risks, and make informed investing decisions.

Happy investing!

For more on Stock Options, check out StartOptions.com

Read also: Straddle vs Strangle Options, Bear Put Spread vs Bull Put Spread, How To Buy A Long Put Option on 100 Shares: Step-by-Step Guide

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents