This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

In this article, I will show you how to read a credit card statement. So let’s take a look at what an actual credit card statement looks like.

How To Read A Credit Card Statement

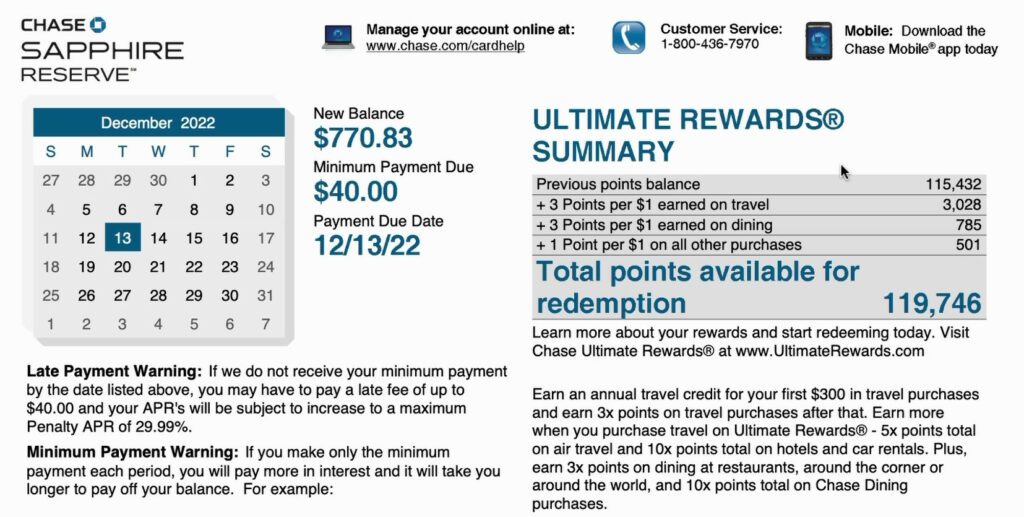

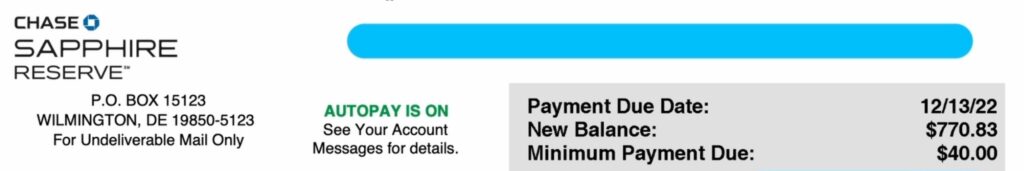

This is a credit card statement from Chase for the Chase Sapphire Reserve card and here on the top left, we see a calendar. It has highlighted the date 13 December here because that is the payment due date.

The payment due date is 12/13 which is December 13, 2022.

This is the latest by which I can make my payment and how much I have to pay is written here in the form of a balance. The balance I have is $770.83. And the minimum payment due is $40.

I will tell you what is the difference between the balance and the minimum payment due, in a bit.

My recommendation to everyone is to always pay off the balance. That is the smart way of using a credit card i.e., you make purchases in a month and you pay off the entire balance by the payment due date.

That is how you should ideally use a credit card.

For some reason, if you’re not able to make that payment at least pay the minimum payment due.

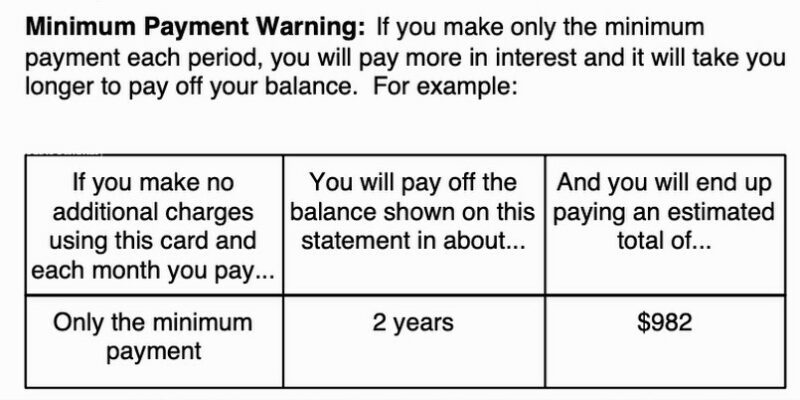

Chase is doing a good job by telling the user here in the form of the minimum payment warning that if you make only the minimum payment each period you will pay more in interest and it will take you longer to pay off your balance.

And then they have given an example that if you make no additional charges using the card and you pay only the minimum payment which is $40, in this case, it will take you two years to pay off the balance of $770.

Now here you have to understand that if you’re just making the minimum payment, you are paying interest on any balance that is unpaid. So, if you’re paying $40 this month you still have $730.83 remaining on which you will have to pay high interest. And in total, you will end up paying $982 instead of paying $770.

So, you’re paying $210 extra in the form of interest.

Avoid 1 Expensive Mistake and always pay off this entire balance in full by the payment due date.

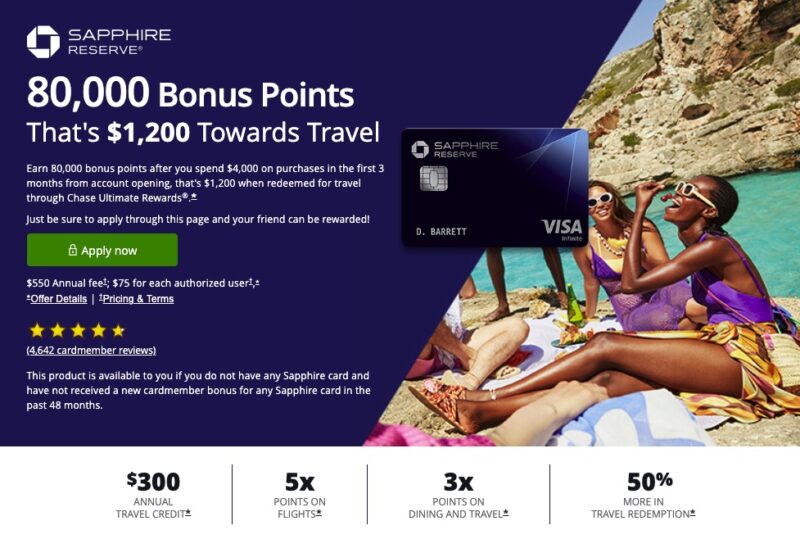

Chase Sapphire Reserve Offer

Account Summary Section

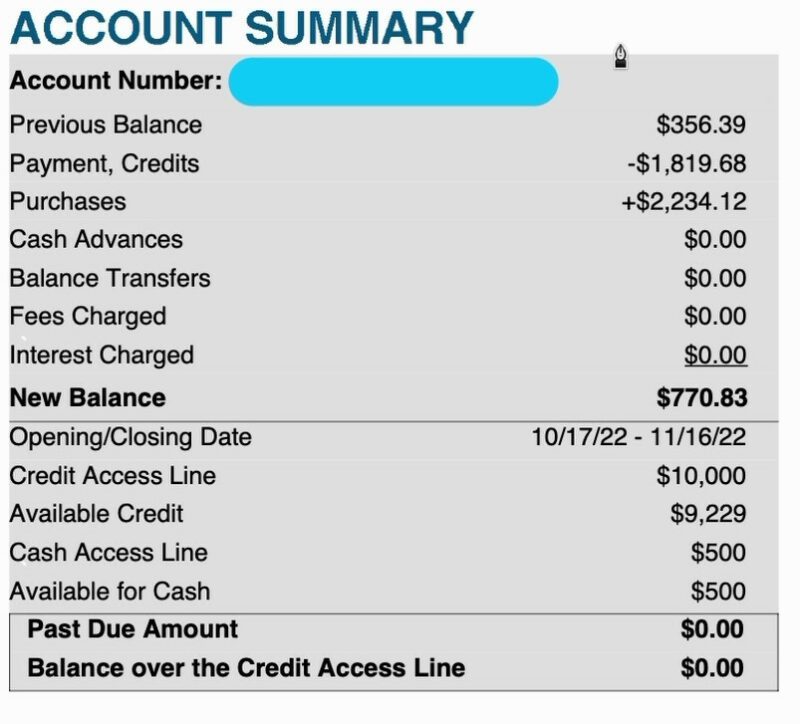

Now let’s scroll down a little and here you would see some more information in the account summary. It will tell what is the previous balance.

And this balance is not the balance that I’m carrying from the previous statement. It is just the balance at the starting point of the statement date. So, the statement date has an opening date of 10/17 i.e., October 17 and it has a closing date of 11.16 which is November 16.

So on this date, 10/17 I had $356 which was not paid. But, the due date for this payment was later than 10/17 and I paid off the entire balance before the due date.

Within the period 10/17 to 11/16, I made a total payment of $1,819 and I made total purchases worth $2,234. If you do all the math now I have $770.83 which is my new balance for this credit card statement.

You would see there are some more line items here such as cash advances (which I never recommend) and balance transfers. I would avoid balance transfers because my recommendation is never to have a credit card balance in the first place.

If you don’t have cash advances you don’t carry a balance, then your fees and interest by default would be zero.

Bestseller Personal Finance Books

Available Credit Card Limit

As you can see, this credit card has a limit of $10,000. I have used $770.83 at this point so I have available $9,229. That is pretty basic math. You just take out the $771 from $10,000 and you are left with available credit of $9,229.

You will see the past due amount is zero because I paid off my previous month’s balance in full.

Account Messages

Next, let’s see, take a look at some messages.

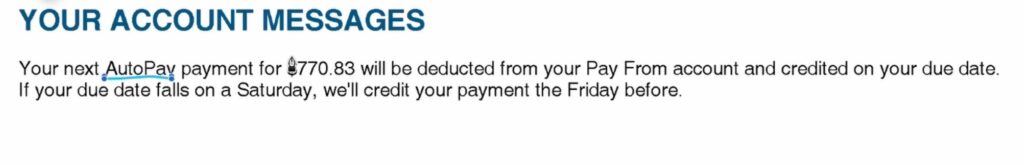

So here it tells me that I have an AutoPay set up. I recommend everyone to set up an AutoPay.

My auto pay is set up to pay off the entire credit card statement balance in full and it will be deducted from my checking account on the due date.

There is a good system in place that if the due date falls on a Saturday Chase will credit the payment on the Friday before. So this AutoPay system is avoiding late payments. They will be proactive and make that payment on a Friday instead of delaying it and paying it on Monday (in that case I might be liable for late payment). So this is good practice here.

If we keep scrolling down here, they have highlighted (again) that my autopay is on – which is good.

And again tells me my payment due date is 12/13, my new balance is $770.83 and the minimum payment due is $40.

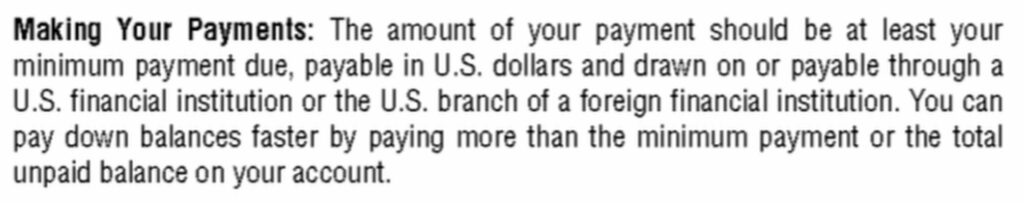

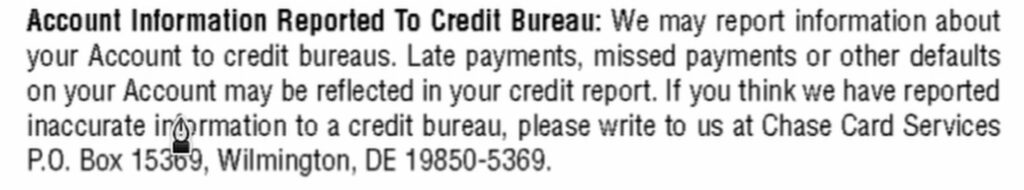

If I further scroll down it will tell me more information. Here it tells me that the amount of payment should be at least your minimum payment due. So, the minimum payment due is the bare minimum need to do but always try and pay your entire balance.

It further says that late payments missed payments or other defaults on your account may be reflected in your credit report.

That is why it is very important to make sure you’re making your payments on time because a late payment or a missed payment can have a negative remark on your credit report. It can damage your credit score and then make things worse financially for you.

Account Activity: Transactions By Date

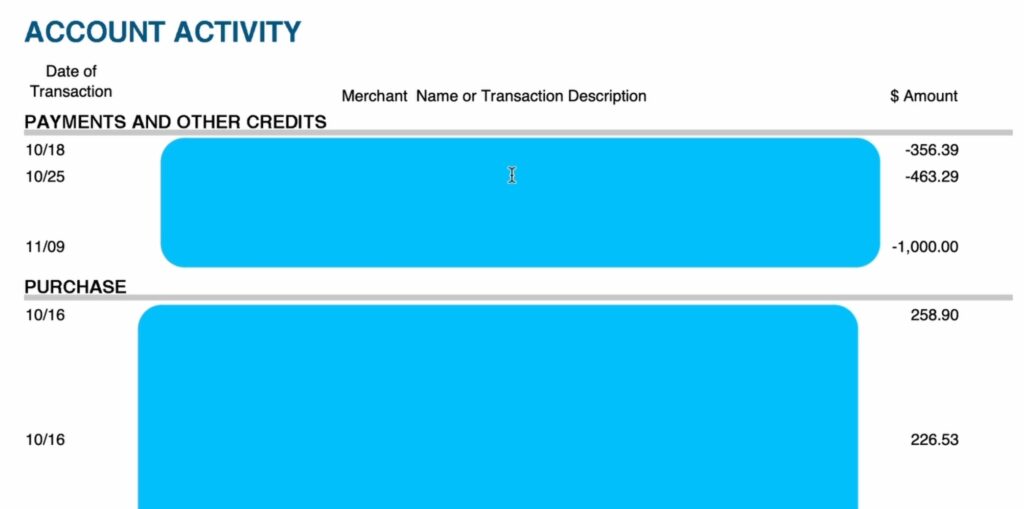

So let’s go down further and here you will see the details of all the transactions that happened on your credit card account.

On top, I have the payments and other credits mentioned. So, if I made a payment toward my credit card it will all be summarized here. A negative sign here indicates that I made a payment to the credit card from my checking account. As you can see, there are three payments that I made.

Below that, we have the section on Purchase. If I use my credit card to make a purchase, all of these get listed by date here. I have hidden the details but you can see the date and amount. If there is a positive amount on the credit card statement, it means that you made a purchase, i.e., the amount was charged to the credit card.

The negative amounts on a credit card statement mean that the payment was made to the credit card account from a checking account.

You can take a look at all of these transactions line by line and in case you find something that you don’t really recognize, or you think there has been a fraudulent charge on your credit card, you can contact the customer support line. They take these things very seriously they will help you out in the best way possible.

Interest Charges

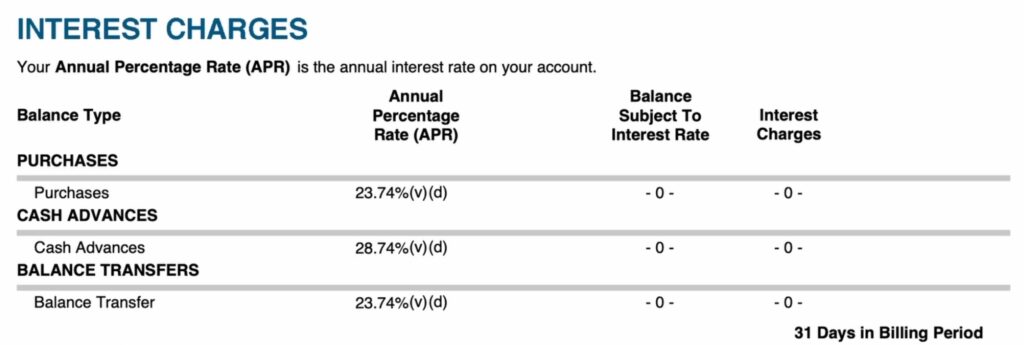

Okay so we continue down below and here is something that I want you to understand here.

It explains to me the interest charges. The annual percentage rate (APR) is the annual interest rate on your account. Using this credit card if I’m making a purchase and if I do not pay the credit card balance in full by the due date, I will pay 23.74% interest. 23.74% is a very high interest rate.

If I take a cash advance, i.e., if I use my credit card at an ATM to withdraw cash, the interest that I will be charged is higher. It is 28.74%. So, trust me, and avoid taking cash advances on your credit card.

If you’re doing a balance transfer, i.e., if you have a balance on your credit card and you’re moving it to this card – you would be charged 23.74% per year on that outstanding amount.

So these are the key elements you would find on the credit card statement

I want to show you one more thing.

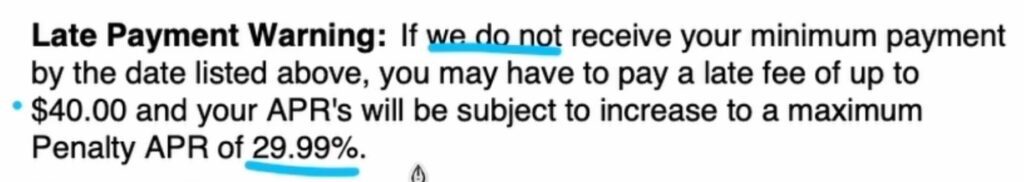

If I go to the first page here, it says in the late payment warning that if Chase does not receive the minimum payment by the date listed above which is the due date here, you may have to pay a late fee of up to $40.

So this $40 is a fee that you have to pay on top of the interest that you will be charged. Further, your APR will be subject to an increase to a maximum penalty APR of 29.99%.

Let’s go to this reverse CAGR calculator and I will show you how crazy 29.99% is which is essentially 30%.

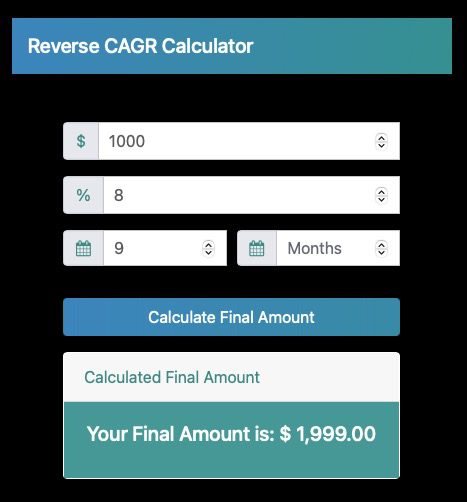

So if I’m putting money in a stock market let’s say $1,000 and I expect the stock market to return me 8% on average every year, and I keep the money in the stock market for 9 years. I hit “calculate” and see that my money almost doubles in 9 years at 8% annual growth in the stock market.

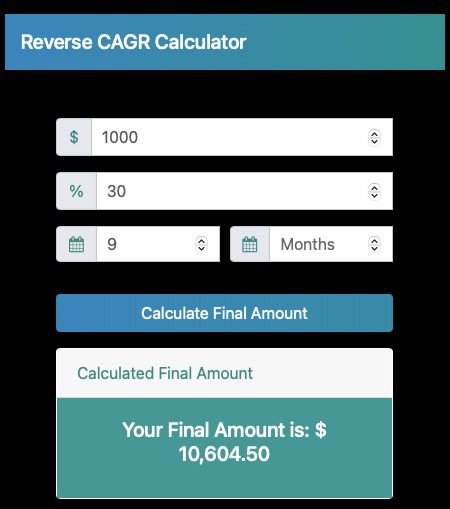

However, if anyone can make 30% a year I will show you what difference it makes in nine years.

So let’s change this interest rate to 30% per year.

Any guesses on how much this amount would be at 30% annual growth? Maybe twice maybe three times?

Let’s check it out.

So if I hit calculate, the answer is 10,604!

So basically if you are able to get 30% per year on any investment, in nine years your money grows 10.5 fold, that is a 950% return in nine years.

This is insane.

That is why I always tell my friends to never ever carry a balance on credit cards because of these crazy high interest rates.

While your $1000 will become $2,000 in the stock market in nine years, at 30% it will become $10,604.

It is very important to understand compound interest. Those who don’t understand compound interest, find themselves in a tough spot financially.

Okay, so that is how you read your credit card statement.

Chase Ultimate Rewards

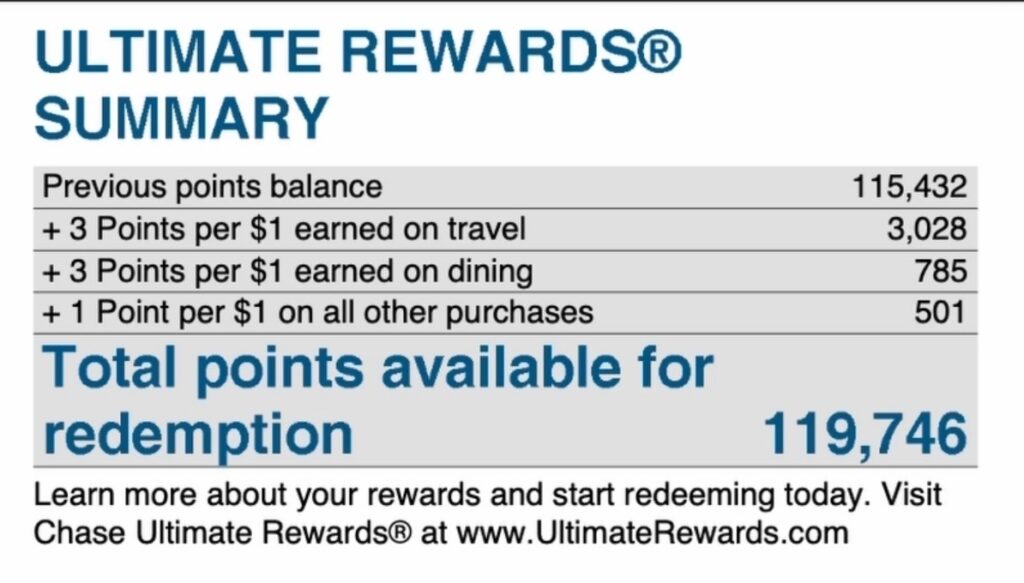

Another quick thing I wanted to show you here is the Ultimate Rewards Summary.

Some of the credit cards such as the Chase Sapphire Reserve give you access to the Chase Ultimate Rewards program. Basically, you can earn reward points on your purchases.

If you’re traveling a lot, like I tend to do, then you get three points per dollar spent on travel. I would have traveled anyway so why not get points against the travel?

And then these points can be either used as cash back or they can be transferred to airline partners or hotel partners and you can use the airline miles to book flight tickets for yourself.

That is a separate topic, but, since it showed up in this credit card statement, I wanted to tell you about that as well.

Credit Card Statement Dates And Timeline Simplified

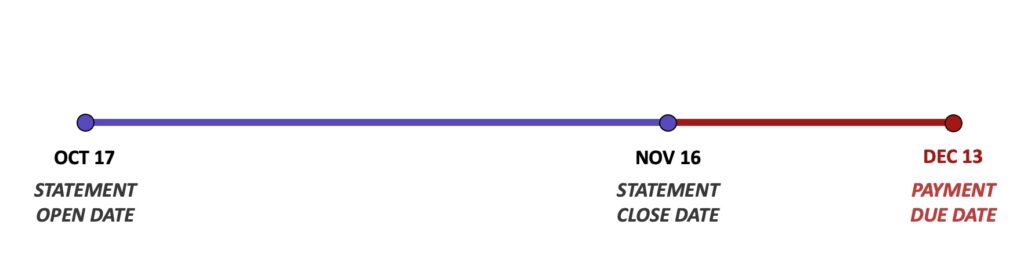

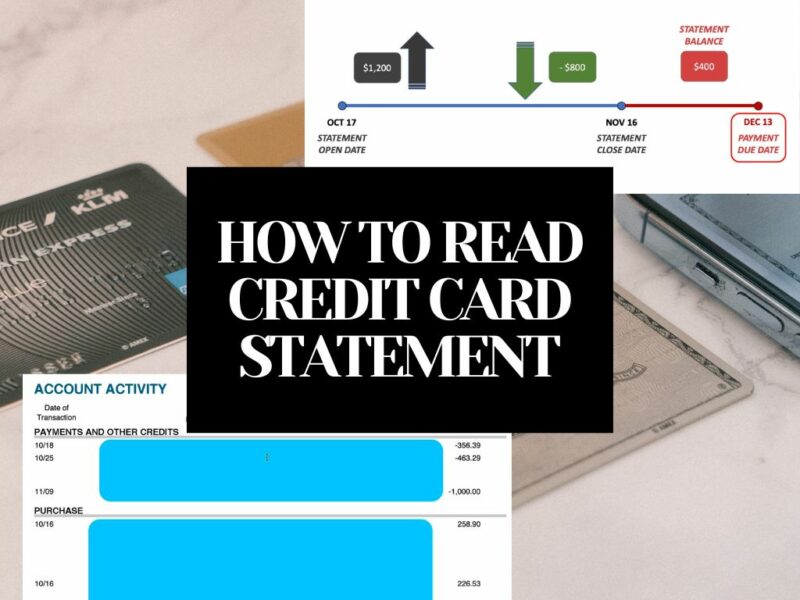

Okay, so let’s take a simplified view of how this credit card statement thing works. Let’s say there is a credit card statement that has an open date or a start date of October 17 and a statement close date of November 16.

Generally, the statement of a credit card is based on a monthly basis – so, 30 days on average.

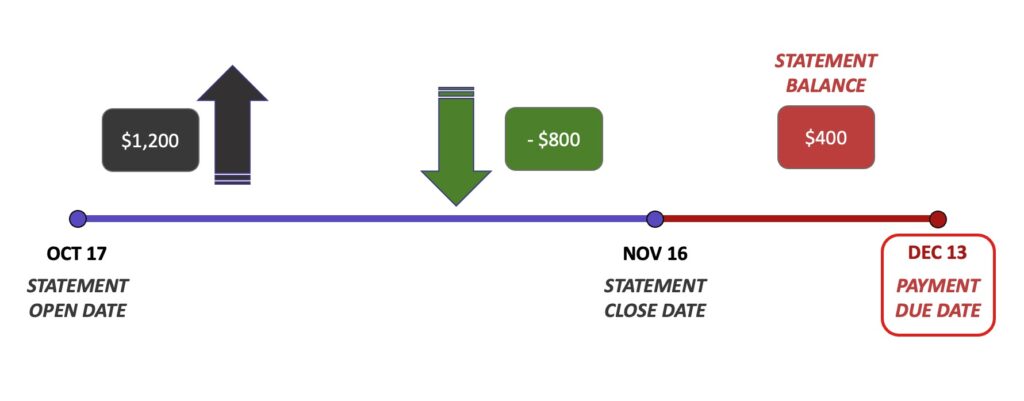

Let’s say during this statement period that is between the open date and the statement close date I make some transactions and those transactions equal $1,200. So that is the money that I’m spending on the credit card.

And let’s say from time to time I’m making some payments on my credit card as well. That is I’m moving money from my checking account to the credit card account. Let’s say by the end of this statement period I am making an $800 payment to the credit card account. So when this statement closes on November 16 I have a statement balance of $400 ($1200 – $800 = $400).

I don’t really have to pay the statement balance on November 16th which is the statement close date, I have to pay it by the payment due date which is December 13th.

Generally, there is a gap of at least two weeks between the statement close date and the payment due date.

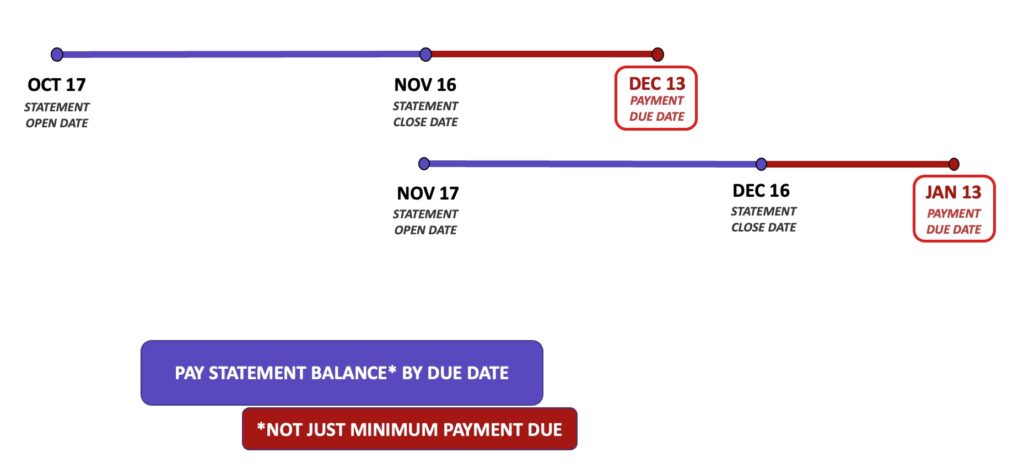

Things might get a little confusing when we are talking about continuous statements coming in every month. So, let’s say there is a statement for this period of October 17th to November 16th with a due date of December 13th. However, since I have the credit card active and open, I will have another statement period starting from November 17th and it will go through December 16th and then it will have its own due date on January 13th.

So, it can be confusing for some people. But, to keep things simple, just focus on the current statement, i.e., tackle one statement at a time and focus on paying the statement balance by the due date.

Make sure you’re not just paying the minimum payment due but you are paying the FULL statement balance by the due date.

I hope this simplifies reading a credit card statement a little better.

Conclusion

I hope this article was helpful and you will read your credit card statements and pay your balances in full every month.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents