This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

What is Boat Insurance?

Boatowners love their prized possession and want to protect their boats against any kind of damage. While the best-case scenario is that the boat never gets a single scratch on it, the risk of damage always lingers around.

The good news is there are plenty of options to insure the boat, to cover the damages caused to your boat, depending on the type of coverage needed and the budget for the boat insurance, you most certainly will find a suitable plan available online.

Read also:

What are the types of coverage available in boat insurance?

There are multiple components of boat insurance, such as liability, property coverage, uninsured boater coverage, medical payments coverage, and other add-ons. Let’s take a look at all of them.

1. Boat Insurance Liability Coverage

Suppose you are out in the waters enjoying your boat ride. Unfortunately, you get involved in an incident with your boat hitting another boat or someone else’s property. Not only can it ruin your day, but it can also bring along a financial burden to pay for repairs for the damage caused by the incident.

At the very minimum, if you’re liable for the damage, you must pay for the damages caused by you to the other person’s property. If someone needs medical attention because of an injury, you must cover their medical bills as well, and also “loss of income” if the person misses out on work due to the injury. All of this can add up very quickly.

To avoid taking such a financial hit, you can get sufficient liability coverage.

But remember, the liability will pay out for damages caused to the OTHER party, NOT you or your boat. For insuring your own boat, take a look at Boat Insurance Property Coverage.

2. Boat Insurance Property Coverage

In case of any damage or theft of your property, property coverage on your boat can help pay for the damage.

So, in the previous example, if your boat gets involved in an accident then the liability coverage will pay for the damages caused to the other party, and the property coverage will pay for the damages caused to your boat.

3. Uninsured Boater Coverage

Let’s say you are being a responsible boat owner, you have purchased the right liability coverage to pay for any potential damage covered to others and others’ properties. What if someone causes an accident and causes injury to your and your boat passengers?

Their liability insurance should pay for the medical expenses, right? Yes, if they have taken out enough liability coverage! Wait! what? Yes, as shocking as it may sound, you might encounter other boaters that do not have sufficient liability (or no liability coverage at all!).

To protect yourself in such incidences, you can opt for uninsured boater coverage that will pay for your and your passengers’ medical expenses.

4. Medical Payments Coverage

If you get involved in an accident and need medical insurance, the medical payment coverage will take care of the medical expenses.

Bestseller Personal Finance Books

Even if you do not get involved in an accident, and get some sort of injury while operating on your boat, the medical payments coverage will help cover the medical bills.

You already might have medical insurance (through an employer or other means), but the medical payments coverage on your boat insurance can prove to be a cheaper option (especially if you have a high deductible medical plan).

5. Add-ons For Boat Insurance – Trailer, Accessories, Special Equipment, etc.

In addition to the four main components of boat insurance, you can also get some add-ons to cover things such as the damage to the boat trailer (used to carry the boat), special equipment installed on the boat, and other boat-related accessories.

Depending on the add-ons, the premium of the insurance will increase.

Where To Buy Boat Insurance?

Below we have listed some of the top 12 boat insurance companies in the USA. It is always a great idea to get multiple quotes (at least 3) from different insurance companies and then make a final decision.

1. Progressive Boat Insurance | $100 per year onwards

Progressive is a leading provider of boat insurance, offering coverage options for a variety of watercraft including fishing boats, sailboats, personal watercraft, and more. Their boat insurance policies are designed to provide financial protection against loss or damage to your boat, as well as liability coverage in the event of an accident involving your boat that causes injury or property damage to others.

One of the key benefits of Progressive boat insurance is the flexibility it offers. Policyholders can choose from a variety of coverage options, including total loss replacement, which provides a new boat if your existing one is damaged beyond repair, as well as coverage for accessories and equipment.

In addition, Progressive offers a range of discounts to help make boat insurance more affordable, including discounts for multiple boats, safety courses, and bundling with other insurance products.

Progressive also offers convenient online tools, such as their boat insurance quote generator, which provides you with an instant quote based on your boat’s make and model, as well as your specific coverage needs. This can help you get a better understanding of the cost of boat insurance and how it fits into your overall budget.

The types of insurance offered by Progressive include insurance for Bass and fishing boats, pontoon boats, powerboats, personal watercraft (such as jet skis and wave runners), and sailboats.

2. Geico Boat Insurance

Geico is one of the most popular online insurance companies in the United States.

Geico offers boat insurance that can cover the following: physical damage to the boat, replacing a severely damaged boat for a new one, covering charges for a fuel spill cleanup, liability, medical payments, etc.

The types of boats that can be insured via Geico are pontoon boats, personal watercraft, fishing & bass boats, power boats, and sailboats. Geico may also provide insurance if your boat doesn’t fit the above criteria if you contact them with more details.

3. Allstate Boat Insurance | $25 per month onwards

Allstate Insurance offers a variety of plans to suit your requirements. You can choose the type and extent of insurance coverage, pick a deductible you’re comfortable with, and you’re done!

Allstate offers property coverage, watercraft liability coverage, uninsured watercraft coverage, and medical payments coverage.

You can get boat insurance from Allstate for your pontoon boats, personal watercraft, powerboats, fishing boats, and sailboats.

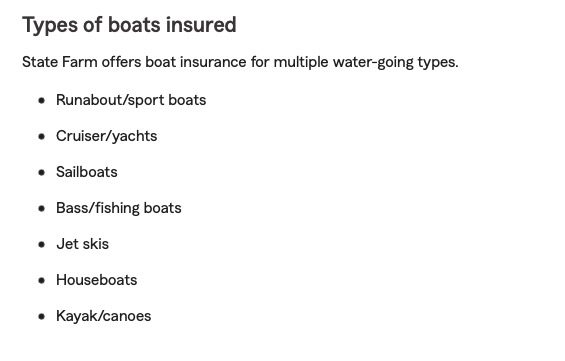

4. State Farm Boat Insurance

Statefarm can provide coverage for sinking, fire, collision, theft, and even storms. Make sure you choose all types of protection you need while deciding on your insurance.

To get a quote from State Farm, you can either call them, get a callback from a Statefarm agent, or get an online quote from the website itself.

Statefarm provides boat insurance for sailboats, jet skis, houseboats, kayaks, fishing boats, yachts, and sports boats.

5. Liberty Mutual Boat Insurance

Liberty Mutual can protect you against unexpected events such as damage to your boat or someone else’s property (in case you are held liable for the damage), emergency towing etc.

With Liberty Mutual, you can get a customized quote on your insurance policy based on what types of coverage you want.

While we couldn’t find an online quote tool on their website, you can call their phone number 1-800-295-2568 or look for an agent in your neighborhood.

Liberty Mutual can provide insurance coverage for yachts, jet skis, powerboats, sailboats, fishing boats, pontoon boats, personal watercraft, and more (just ask them!).

6. Nationwide Boat Insurance

You can simply call the number 1-866-603-9273 or look for an agent in your neighborhood for buying insurance from Nationwide.

With plenty of flexibility and discounts available (such as multi-boat, multi-policy, or paid-in-full discounts), you could get great coverage at an affordable price.

Nationwide also provides coverage on personal watercraft.

7. National Boat Owners Association Insurance

The National Boat Owners Association has been operating as a boat insurance company for more than 30 years. NBOA Insurance claims to be the best and most cost-effective in the market today.

You can start the insurance quote process online on their website.

NBOA can provide insurance coverage for all kinds of boats such as fishing boats, sailboats, cabin cruisers, power boats, and yachts.

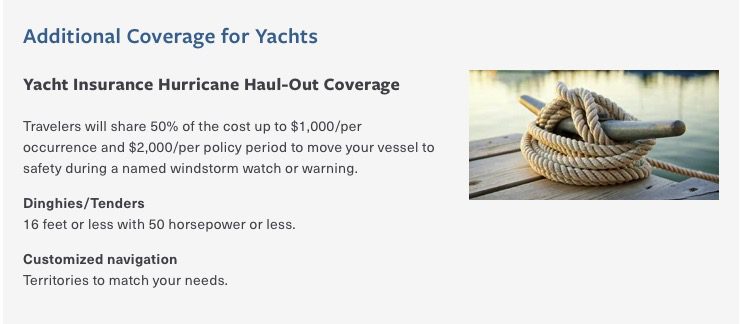

8. Travelers Boat and Yacht Insurance

Travelers Insurance offers multiple coverages for your boat. To get the insurance quote process started, you can visit their website, call on their number 1-888-314-6571, or find a local agent in your neighborhood.

Through Travelers Insurance, you can get additional coverage for your yachts such as Hurrican Haul-Out coverage to take your yacht to a safe place in case of an expected hurricane or storm.

9. AARP (Hartford) Boat Insurance

Simply call the number +1-800-555-2510 to get your insurance questions answered and receive an insurance quote. Based on your coverage requirements and discounts that you may be eligible for, you can zero in on the perfect insurance plan for you.

Hartford takes pride in simplifying insurance for customers and explaining insurance terms in ‘plain English.

The AARP (Hartford) Insurance provides coverage for powerboats, pontoon boats, personal watercraft, fishing boats, and sailboats.

10. SkiSafe Boat Insurance

SkiSafe takes pride in providing insurance coverage to more than half a million boats. They have been around for more than 40 years in business, and are known for great customer service.

With great coverage options and discounts available (such as discounts for winter layup, boating safety course, and clean driving record), you can create a personalized insurance plan, and save some money as well.

You can start the insurance quote process online on their website.

SkiSafe provides insurance coverage for fishing boats, yachts, pontoons, jet skis, and sailboats. In case of questions, just ask if they can provide coverage for your boat type and boat accessories.

11. Markel Boat Insurance | $100 per year onwards

Markel insurance has been providing coverage for more than 45 years. You can get customized insurance coverage through them making sure you and your boat are sufficiently protected.

To get the insurance quote process started, you can visit their website, make a call on 1-800-236-2453, or find a local agent in your neighborhood.

Markel Insurance also provides coverage for personal watercrafts and yachts.

12. United Marine Boat Insurance

United Marine Boat Insurance has been in business for more than 30 years.

To get a customized quote on your insurance, you can call their number 1-800-477-7140 or get an online quote in less than 90 seconds on their website!

United Marine Underwriters also provide coverage for fishing boats, yachts, houseboats, charter boats, personal watercraft, and performance boats.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents