This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

How to start investing as a college student in stocks? With as little as $20 per week? Is it even possible?

Taking the first step to invest in the stock market can seem daunting. You want to invest in Amazon but the stock trades at $3300. You want to buy a Google stock but are intimidated by the $2500 market price. What can you do if you just have a spare $20 or $100 and want to get involved now? The good news is that you can invest in these great companies’ stocks with even a little money now using the fractional share or partial share feature. Fractional share feature is available on Robinhood as well as M1 Finance platforms.

You can invest little amounts, say $20, every week and use the dollar cost average (see the section below) method to mitigate the short-term volatility. Here, in this article, we will demo investing $20 in M1 finance to buy partial shares.

- How to Start Investing As A College Student in Amazon or Apple?

- Start Investing in Custom Pie on M1 Finance: MFAANG

- Start Investing in Custom Pie on M1 Finance: Cashless Revolution

- Other options to Start Investing With $20

- When to Buy a Stock?

- What is Dollar Cost Average?

Read also: How to buy a fractional share on Robinhood

How to Start Investing As A College Student in Amazon or Apple?

We love M1 finance for multiple reasons. Here are three mentioned below:

M1 Feature 1: Ability to Create Multiple Customized Pies on M1

M1 Finance has the ability to create customized investment pies, such as one pie for FAANG stocks only. You can choose the weights of each stock according to your wish. If you believe more in Netflix than Amazon, you can give it a higher weight so your money gets invested accordingly.

Read: How to Create Pie and Portfolio on M1 Finance

M1 Feature 2: Ability to Mimic an ETF on M1 Finance

Do you really like an ETF but don’t want to pay the ETF fees? Just create your own pie and put the stocks and desired weights held by the ETF! There is also an option to rebalance your pie in case you desire that.

M1 Feature 3: Ability to Buy Fractional Shares on M1 Finance

There are so many amazing stocks out there and you want to invest in ten of them this month. Let’s say you want to buy FAANG stocks. If you buy 1 stock each of Facebook, Apple, Amazon, Netflix, and Google, it will cost you well over $5000 [prices as of March 11, 2022].

Sometimes companies do stock splits to increase the number of available shares and reduce the price of stock per share proportionately. For example, Amazon has announced a stock split in the near future.

But what to do if you just have $100 to invest this month? With M1 finance you can buy partial shares. For example,

- Create a FAANG pie, with stock weights of your choice. Let’s assume 20% each for simplicity.

- Invest $100 in the FAANG pie you created.

- Effectively you’re investing $20 each in Facebook, Apple, Amazon, Netflix, and Google stocks.

Start Investing in Custom Pie on M1 Finance: MFAANG

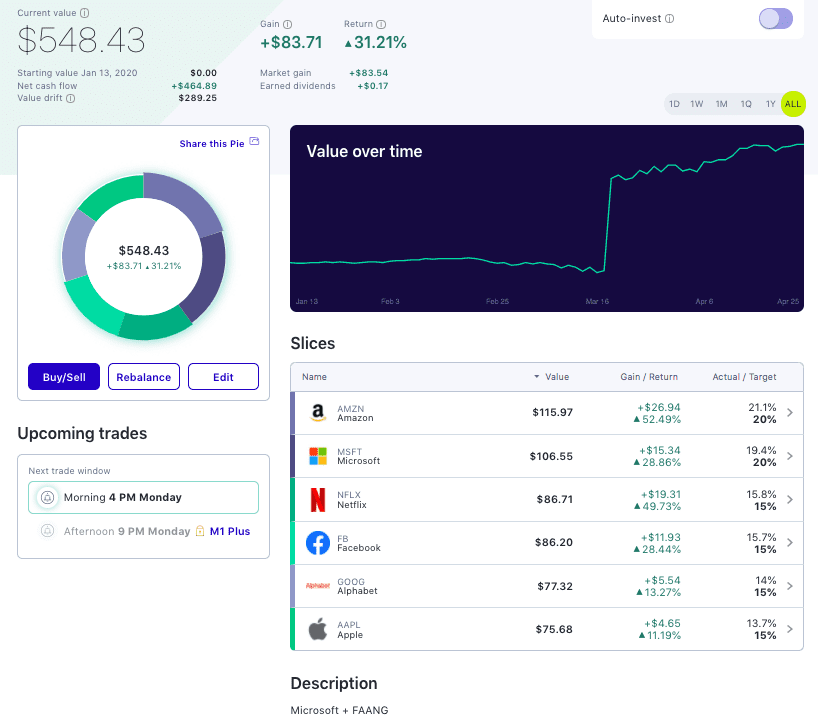

In this M1 MFAANG pie, I have added the 6 stocks – Microsoft (20%), Facebook (15%), Apple (15%), Amazon(20%), Netflix (15%), and Google <Alphabet> (15%).

As the stock prices fluctuate, the assigned percentages change. As you can see in the picture, Amazon has grown to 21.1% of the pie because the AMZN stock price climbed at a faster rate. There is a rebalance feature in M1, but bear in mind, rebalancing too often might trigger multiple buys and sell transactions, and result in fees.

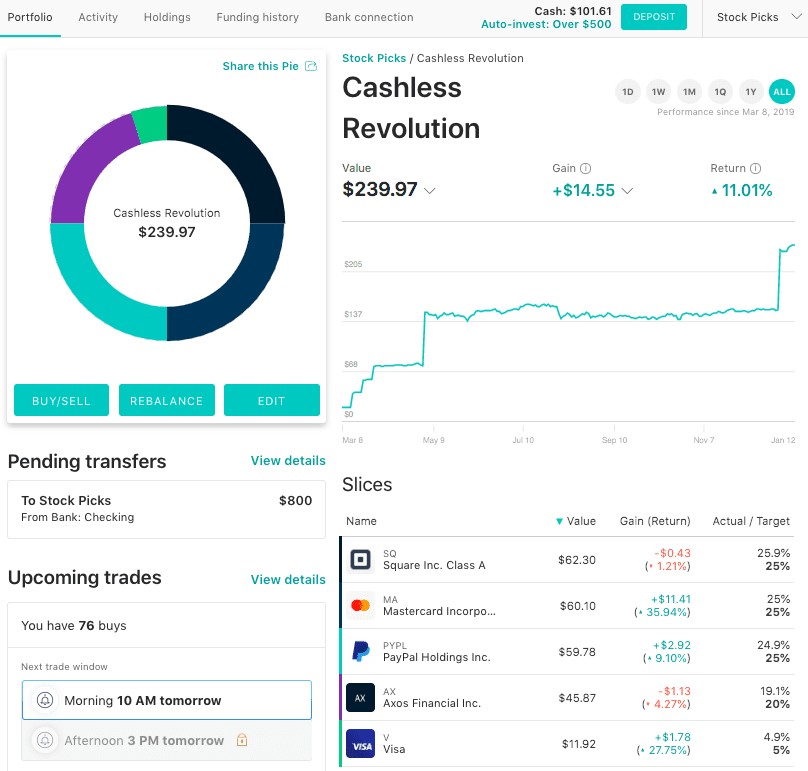

Start Investing in Custom Pie on M1 Finance: Cashless Revolution

Open FREE account with M1 Finance here and get up to FREE $20* to start investing.

*Please read offer details on the M1 finance site for more information on the promotion terms and validity.

Bestseller Personal Finance Books

Other options to Start Investing With $20

Robinhood recently introduced the feature that allows you to buy partial shares. If you’ve got a favorite stock or just want to invest in ETFs without creating customized pies, you can read how to buy fractional shares on Robinhood here.

Apart from Robinhood, Stash and Acorns are the other two apps where you can invest in small amounts.

When to Buy a Stock?

Investors with a longer time horizon (that’s my preferred style of investing) should aim to buy stocks regularly, once a week, once a month, or any frequency that suits them. Regardless of the short-term volatility, average investors gain in the longer term from disciplined periodic investing. It is very difficult for an average investor to speculate and time the market to buy low and sell high in short periods of time.

Another benefit of buying stocks regularly is the ‘dollar cost average’.

What is Dollar Cost Average?

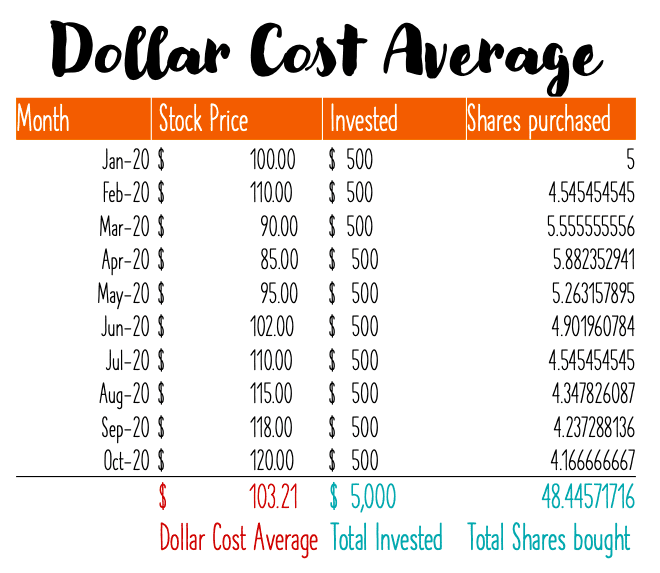

Suppose a stock has a market price of $100 in January 2020, $110 in February, $90 in March, $85 in April, $95 in May, $102 in June, $110 in July, $115 in August, $118 in September, and $120 in October. A disciplined investor who allocates and invests a fixed amount every month in the stock, using the partial stock feature, here is how his or her transaction history would look like.

Total money invested over 10 months: $5000, total shares purchased: 48.45, the average price paid per share: $103.21. This is how dollar cost averaging works. Dollar Cost Average method enables the investor to take advantage of the market volatility by buying more when the price is low and less when the price is high.

| Month | Stock Price | Invested | Shares purchased |

| Jan-20 | $ 100.00 | $ 500 | 5 |

| Feb-20 | $ 110.00 | $ 500 | 4.54 |

| Mar-20 | $ 90.00 | $ 500 | 5.55 |

| Apr-20 | $ 85.00 | $ 500 | 5.88 |

| May-20 | $ 95.00 | $ 500 | 5.26 |

| Jun-20 | $ 102.00 | $ 500 | 4.90 |

| Jul-20 | $ 110.00 | $ 500 | 4.54 |

| Aug-20 | $ 115.00 | $ 500 | 4.34 |

| Sep-20 | $ 118.00 | $ 500 | 4.23 |

| Oct-20 | $ 120.00 | $ 500 | 4.16 |

| $ 103.21 | $ 5,000 | 48.44 | |

| Dollar Cost Average | Total Invested | Total Shares bought |

| Month | Stock Price | Invested | Shares bought |

|---|---|---|---|

| 20-Jan | $100.00 | $500 | 5.000 |

| 20-Feb | $110.00 | $500 | 4.545 |

| 20-Mar | $90.00 | $500 | 5.556 |

| 20-Apr | $85.00 | $500 | 5.882 |

| 20-May | $95.00 | $500 | 5.263 |

| 20-Jun | $102.00 | $500 | 4.902 |

| 20-Jul | $110.00 | $500 | 4.545 |

| 20-Aug | $115.00 | $500 | 4.348 |

| 20-Sep | $118.00 | $500 | 4.237 |

| 20-Oct | $120.00 | $500 | 4.167 |

| $104.50 | $5,000 | 48.446 | |

| Dollar Cost Average | Total Invested | Total Shares bought |

Happy investing!

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents