This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Alternative Investing

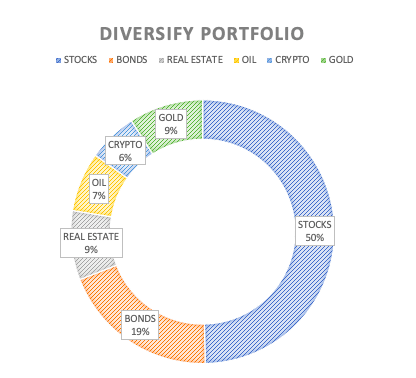

Why diversify portfolio outside of the stock market with alternative investing options? Some investors believe it’s best to invest heavily in stocks, “total market funds”. It works, for the most part, for many investors. But, you should be aware of the various options available to you as an investor. By researching, you might be able to identify other investable options outside of the world of stocks.

With each passing day, the stock market becomes more competitive, and it gets difficult for an average investor to beat the market. Traders time their trades to the tiniest fraction of seconds. A retail investor need not compete with them. It’s better to do some research and consider other options to invest in. Alternative investing diversifies your portfolio beyond stocks, bonds, etc. Most high net-worth individuals (HNI’s) and institutional investors invest in alternative investing options. While the risk and returns can fluctuate there as well, the alternate investing market has less complicated legal structures.

- Alternative Investing

- Invest in REIT

- Invest in GOLD

- Invest in OIL

- Invest in BITCOIN

- Invest in LAND

- Conclusion

- Fresh from the Blog

Why Invest Outside of Stock Market?

As we had heard from many experts that the stock market was very expensive at the end of 2019. Covid-19 sent the market crashing down in mid-March 2020. Some people panic sold stocks. Then, the market rebounded back to previous highs in a matter of weeks. The stock market can be volatile and we have seen it so many times. An alternative investment is a good way of enhancing your portfolio and reducing your exposure to traditional stocks of companies. You can also consider investing in startups or firms that work toward a cause you are passionate about.

Here are some options that we think are best for alternative investing. However, keep in mind these may not show the quickest results as you get in the stock market.

Invest in REIT

What is REIT?

The word REIT stands for REAL ESTATE INVESTMENT TRUST. REITs are such companies that have the ownership of real estate or such companies finance income-producing real estate. The REITs provide the opportunity to own a valuable type of real estate to all types of investors lined up in this field.

REIT stocks

The way that REIT actually works is the same as investing in the industries by purchasing individual company stocks or through a mutual fund. It has also been heard by the experts that there are almost 87 million American citizens who invest in Reits through their 401 investment funds and also through mutual funds.

In the United States of America alone the total REITs of all types own more than 3 trillion U.S dollars in gross assets, which have a stock exchange of 2 trillion U.S dollars which represents over 500,000 properties.

How to invest in REITs?

The REITs contains different type on the basis of the investment that you are looking for such as there is EQUITY REIT in which owns income-producing real estate, mREITs which is based upon mortgages, Public Non-Listed Reits which does not trade on the stock exchange as they are registered on SEC, Private Reits which are also not included in the SEC.

As REIT is a true total return investment, in searching to invest, look for a company that has a good history in it. The liquidity matters the most in REIT because most of the REITs is based upon stock exchange so most of the time you don’t have a long-term investment.

What are REITS ETFs?

The real estate investment interest trusts are exchange-traded funds that are used to invest in the majority of their assets in value companies’ securities. Investing in these types of funds has the advantage that the investor does not have the difficulties himself.

Invest in GOLD

Some of the investors may be uncertain about the dollar-based asset and it may be difficult for them to understand, in such cases gold serves as the best barrier in the alternate investment category. It is one of the eldest and easy ways to invest your cash to bring a good amount of profit. But sometimes the investing may get a negative perception.

How to invest in gold?

While looking for a long-term investment it’s better to invest in gold bars and coins, rather than jewelry, as the gold jewelry set design may get outdated with time. Also, consider buying the gold when the prices dip, or dollar cost average, as gold prices have proven to rise up for decades in a secular trend.

What are Gold futures?

The gold futures can be described as a contract in which the buyer pays initially to take the gold at a specific date by making an agreement to complete the payment. The agreement between the buyer and the seller in which the price, grams, and the delivery time in the future is discussed.

Invest in Gold Stocks

The gold exchange-traded funds are the same as the stocks so investing in the Gold ETF is the same as trading in the stock exchange. These stocks have very low risk as there are many participants in the market. In these types of gold investments, the buyer does have the gold physically.

Bestseller Personal Finance Books

Invest in OIL

The type of oil which is traded commonly is crude oil, which is composed of hydrocarbons and occurs naturally. The crude oil is then refined into more consumer-friendly products. Diesel, petrol (gasoline), jet fuel (aviation turbine fuel) are some common end products. It is a limited resource which means it cannot be recycled once consumed.

How to invest in oil futures?

The supply and demand of crude oil make the prices go up and down. Based on the predictions of production and consumption of oil, you can invest in Oil futures.

How to invest in oil stocks?

The OIL ETF which stands for Oil Exchange Funds is also a method of investing in oil. These are bought and sold in the same manner as the stocks.

Invest in BITCOIN

What is Bitcoin?

Bitcoins do not consist of physical types of coins, these are a digital currency which was formed in January 2009. Bitcoin offers lower transaction fees compared to other online transaction mechanism. Bitcoin enables peer-to-peer transactions worldwide with low processing fees.

What is cryptocurrency?

A blockchain which is a collection of blocks is stored in the bitcoin codes. The cryptocurrency is based upon these blockchains, the word cryptocurrency is actually derived from the techniques which are used to secure a collection of computers interconnected.

How to Invest in Bitcoins?

The most precious type of cryptocurrency still stands bitcoin, although nowadays there are thousands of other cryptocurrencies out there. There are many sites that offer a friendly platform to invest in bitcoins but the first step to this type of investment is to get a bitcoin wallet and then link that wallet to your bank account. Then join a good bitcoin exchange that has a trustworthy reputation & history, and finally place your order. You can also buy Bitcoin on Coinbase, Binance, Moonpay, Robinhood, and a few other apps.

How to invest in cryptocurrency?

The most convenient way to buy cryptocurrency is through cryptocurrency exchanges. The process of investing in cryptocurrency includes buying and placing the currency at a specific place. The cryptocurrency exchanges include Coinbase, GDAx, etc, these allow you to purchase bitcoins no matter how small the investment may be. All the codes regarding your portfolio are stored in your cryptocurrency wallet safely. You can also buy cryptocurrencies on the Robinhood app.

Invest in LAND

Most of the people invest in the land for its limitless need as time passes by. The investor has to keep in mind many points such as the demand, type, etc while investing in land. As land investment is a little time taking process and it is used by the landowners who can use it for recreation and their own use than using it as an investment.

How to invest in land?

The question which arises is that is this type of investment for a small investor?

Land investment has many types which vary according to the location, demand, and place of the land. The residential and commercial land investment has a quick response and a better profit as it is a real estate investment.

How to invest in farmland?

One of the most unique ways to invest in land is through farmland into fields that produce crops that have good demand in the market such as rice, corn, soybean, etc.

Conclusion

As alternative investments are different from stocks and bonds, their addition to your portfolio may lower your overall risk. Every investor has a unique investment style, and mixing the options up may prove rewarding in the long run.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents