This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Why Does Personal Finance Matter?

Simply put, developing a better understanding of money management, debt, investment, and cash flow is essential. The world requires monetary transactions for almost everything – food, shelter, clothing, healthcare, entertainment, and traveling.

No matter what your goals are, chances are there is some monetary element attached to them. We believe a strong grasp of personal finance concepts can empower people to manage money better and make informed financial decisions. Hence, we created this beginner’s guide to personal finance.

If you master the concepts and implement them well, this guide can be the difference between a stressful and relaxed life.

Feel like taking a short evaluation of where you stand? Take this short, 7-question, Financial Literacy Quiz! It will take less than 5 minutes of your time.

How Can I Manage Money Better?

Simply follow along with our Step by Step Guide to Personal Finance! It’s easy to understand and set up a solid strategy. You can implement it step by step over time to achieve your financial goals. Trust us, it will be totally worth it!

- Beginner’s Guide to Personal Finance: 10 Steps to Manage Money Better

- Step 1: Understand Your Cash Flow

- Step 2: Evaluate Your Wealth Builders and Money Guzzlers

- Step 3: Set up a Thunderbolt Fund

- Step 4. Contribute to 401(k) and Get Maximum Employer Match

- Step 5. Build Your Debt Repayment Strategy

- Step 6. Set up ‘Peace of Mind’ Fund: (4-6) months of average monthly expenses

Beginner’s Guide to Personal Finance: 10 Steps to Manage Money Better

Step 1: Understand Your Cash Flow

Make a budget to keep track of how much comes into your bank account, and how much money goes out of your bank account every month, quarter, and year.

For example, if every month you make (after taxes) $4,000 from your main job , $300 from a side-hustle and $200 from an online teaching course, your Money In = $4,000 + $300 + $200 = $4,500

If you spend $1,500 on rent, $500 on groceries, $300 on car, $200 on other items, your Money Out is $2,500. For simplification I had written money going out of ‘bank account’, but essentially any money you spend in cash, through bank transfer or credit cards, all amounts must be added up to get a realistic picture of your spending.

Pro Tip: Take a step further and analyze whether you are spending money on the right things or not. A good framework I follow to analyze whether I am spending money wisely or not is the MoSCoW tool.

Your potential savings (PS) = Money In (MI) – Money Out (MO)

If your potential savings is negative

Is it temporary and do you have a path to positive PS already planned? Great! If you don’t see the path to positive PS, it’s time to roll up your sleeves and get some work done on increasing income and reducing spending.

If your potential savings is positive

When you are spending less than you are earning, directionally, you’re doing good. But, How positive (how much $$$) is your PS? Are you happy with it? If yes, that’s amazing.

If not, then let’s think of ways you can increase it in the future.

Step 2: Evaluate Your Wealth Builders and Money Guzzlers

After understanding the cash flow and potential savings, it is also important to understand the monetary behavior of everything around you.

The things you own can be classified into two broad categories – those that will generate money for you (Wealth Builders) and those that will take money away from you (Money Guzzlers).

Money Guzzler Example

Let’s say you bought a brand-new car for $35,000 today. In the next 12 months, you will pay about $150*12 = $1800 in insurance on it, and if you want to sell it back, maybe you will get $25,000 for it. So, in a year the car guzzled $10,000 (in lost market value i.e. depreciation) + $1,800 in insurance expenses. You have to decide whether the comfort of owning that car is worth $11,800 in that year or not. I’m not saying you should not have a good car, but just that you must be aware of the associated expenses.

Bestseller Personal Finance Books

Wealth Builder Example

Let’s say you invested $35,000 in a real estate investment fund that gives 5% dividends every year. In addition to the dividend, the fund grows (expected) at 3% per year. This real estate fund will give you $1750 cash in the next 12 months (which you can choose to reinvest) and will grow in value to $36,050. That’s a gain of $1,750 + ($36,050 – $35,000) = $2,800

I understand – we cannot always have everything in and around us that is wealth builder, we need cars to move around after all! But, analyzing everything through the lens will help make better decisions in life. Maybe we can shift our priorities a bit and take out a couple of dollars from a money guzzler and put that into a wealth builder if possible. Some rebalancing might help immensely in the long run.

Step 3: Set up a Thunderbolt Fund

We have done the analysis, let’s get hands-on with money management. First things first – Build a small ‘thunderbolt fund’ to cover small emergencies. A $500 – $1000 fund is enough to cover a car breakdown or an unexpected bill from the doctor’s office.

A thunderbolt fund will help protect you if and when lightning strikes, hence it makes it to the top 3 action items on our essential guide to personal finance.

It is alarming that 44% of Americans don’t have a cash reserve to cover an immediate $400 cost.

Let’s change that, shall we?

Accumulate and put that money in an easy-to-access account such as a money market account or a high-yield savings account that allows instant withdrawals.

Beginner’s Guide to Personal Finance Pro Tip: To Manage Money Better, Set SMART Goals and Work Backwards

Set up realistic goals for your wealth creation and retirement, and work backward.

SMART Goals are Specific, Measurable, Attainable, Relevant, Time-bound

Taxes and eligibility for various tax accounts change from time to time. It will also be different based on your filing status (single, married filing jointly, married filing separately, etc.). However, having a good idea of how much money you want to have at retirement enables you to take the necessary actions today.

If you are reading from outside of the USA, a lot of this might not make sense to you – 401(k), Roth – what in the world are they? Don’t worry, you can skip those parts (Step 4, Step 7, and Step 8)

Step 4. Contribute to 401(k) and Get Maximum Employer Match

If you work for a company or organization that offers retirement benefits (most large and medium-sized companies do, in case of questions, check with your human resources department), learn more about the 401(k) match policy.

If the employer matches your contribution up to a certain amount, make sure to set your contributions such that you get the maximum employer match. Most companies have easy-to-understand matching policies, such as 100% match up to 6% of your annual salary. So, if you make $100,000 and you contribute $6,000 to 401(k), your employer puts another $6,000 in your 401(k) account.

Some employers might have complicated matching structures, such as 100% match up to 3% of annual salary, then 50% up to 6% of annual salary. So, in this case, if your salary is $100,000 and you contribute $6,000 to 401(k), the employer will match 100% of the first $3,000, and then for the next $3,000 they would match only 50%. That brings us to $3,000 + $1,500 = $4,500 match contribution from the employer.

No matter what the 401(k) policy is, it helps to understand how much you need to contribute to get the maximum ‘free money’ from your employer.

Since 401(k) is a tax-advantaged account, the contributions you make to it are not taxed. The money grows in your account tax-free as well. However, the withdrawals may be subject to taxes, depending on your income situation at that point in time.

Read Related: 401(k) Mistakes to Avoid

Step 5. Build Your Debt Repayment Strategy

After taking the free money on the table, it’s time to think about debt repayment. The ONLY sensible way to pay off debt is by making required payments on all loans and using any spare money available to attack the highest interest rate loan first.

If you have credit card debt at an 18% interest rate, no matter the amount, any extra dollar you have with you should go toward repayment of that, instead of a 5% loan because the loan amount is smaller.

I have seen justifications for paying small debts first and then later using those dollars to make payments on bigger loans. It’s mathematically not efficient and you would end up paying more in interest rates.

Think of it this way – you have a spare cookie with you. Two cookie monsters – one big and one small – visit you every month. If you don’t give the cookie to them, one cookie monster bites you with a strength of 20 cmf (cookie-monster-force), the other one bites you with 10 cmf. Who would you give the cookie to? The one with the higher cmf, right? The same is the case with loans, the interests ‘bite’ you every month. Feed the spare ‘cookie’ to the higher interest ‘monster’.

Please note, here we are talking about prioritizing the spare dollar, after making required payments on all loans. If the required payments are not made on a loan, it can trigger a penalty and cause more harm instead.

Beginner’s Guide To Personal Finance

Step 1 – 5 to Manage Money Better

Step 6. Set up ‘Peace of Mind’ Fund: (4-6) months of average monthly expenses

Call it an emergency fund or ‘peace of mind fund’ or whatever you like. Having a stash of cash for a rainy day is a good idea. I call it the ‘peace of mind’ fund because it feels right – it actually provides peace to me to know if something untoward happens, I will not be financially stressed for the next few weeks or months.

We are humans, we take the shock, absorb it, recover, and then come out stronger. This fund, while it cannot prevent mishaps such as a job loss, will buy you enough time to recover and fight back as soon as you can.

4-6 months’ worth of expenses is a generic guideline. Everyone reacts differently to different events. You can name your own amount that provides you peace of mind.

Step 7. Contribute to Roth IRA

Roth IRA is also a retirement investment account. Roth IRA is different from 401(k) and traditional IRA in the way the account is taxed. If you are eligible for Roth IRA, you can contribute post-tax dollars to it. The money then grows tax-free and withdrawals are tax-free as well.

If you believe you are paying lower taxes now than you’d pay at your retirement age, then it’s worth considering putting your post-tax dollars into a ROTH IRA account and letting it grow tax-free. When you withdraw at the right time, you won’t be liable for taxes on it!

Roth IRA has eligibility requirements and an annual cap on how much you can contribute to it. The current cap for the tax year 2021 is the following: $6,000 ($7,000 if you’re age 50 or older). It’s best to stay updated with any changes by following the information on the IRS website.

Read related: Roth IRA vs 401(k)

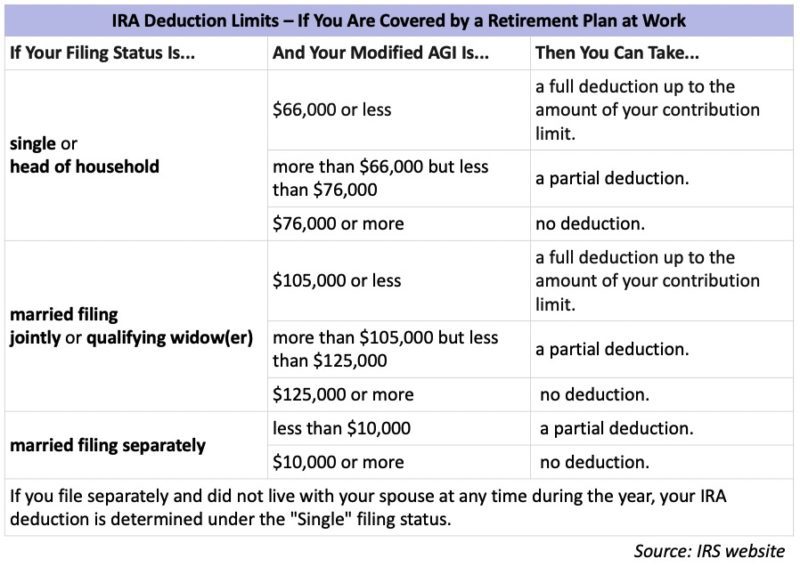

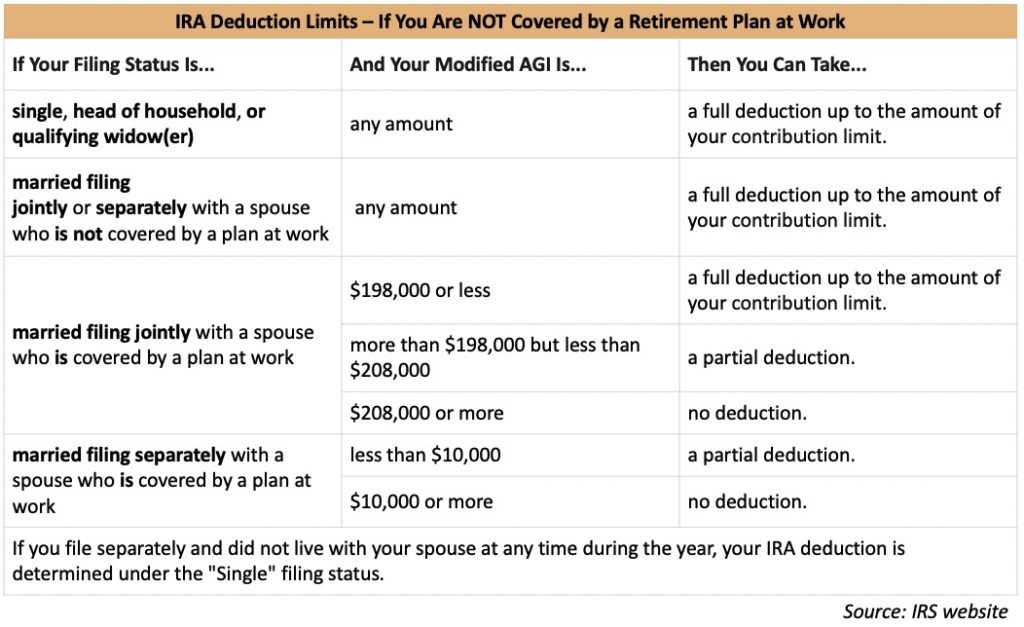

Step 8. Individual IRA

The next step, after considering investing in 401(k) and Roth IRA is to decide whether to have an IRA account or not. The annual contribution limit to IRA is similar to ROTH IRA i.e. $6,000 ($7,000 if you’re age 50 or older) for 2021.

Whether or not you are covered by a retirement plan at work can determine your eligibility for a deduction on your IRA contributions.

How To Determine If You are Covered by Retirement Plan at Work?

Based on whether you are or aren’t covered by a retirement plan at work, check out the eligibility for tax deductions on your IRA contributions below.

Covered by Retirement Plan at Work

Not Covered by Retirement Plan at Work

If you do not qualify for tax deductions on your contributions to your IRA, you might be better off skipping IRA and setting up a normal investment account at this stage.

Step 9. Set up an Investment Account for ETFs and Stocks

Choose a broker you like that provides access to trading stocks and ETFs. If you are considering using an investment app, check out our comparison of the best investment apps with zero-commission trades. Trading commissions can eat up your profits. For example, if you buy a $100 share, and pay a commission of $8 just to execute the trade, you are already falling behind on your returns (you are at -8% already). If your order sizes are large, say $10,000+ per trade, then the $8 commission tends to fade away as a smaller percentage.

The brokerages that charge commissions on trades may offer a broader range of features, so if you care about some extra features and anticipate large-sized orders, you can choose to go for them as well!

Build a Solid Investment Foundation

Step 9a: Buy Quality ETFs

- Broad market Index Funds – S&P 500 tracker, World Index tracker

- Thematic ETFs from trusted fund managers – Artificial Intelligence, Clean Energy, Genomics

Step 9b: Buy 12-15 stocks you love (large-cap and mid-cap)

- Buy 8-10 large-cap stocks

- Buy 4-5 mid-cap stocks, or add another 4-5 large-cap stocks.

Step 9c. Other Stock Picking (optional)

- Companies you believe will do well but you don’t own yet.

- Don’t chase ‘hot tips’ from social media.

- Avoid penny stocks (stocks priced at $1 per share or less). With more and more brokerages offering fractional shares, the price per share of the stock is IRRELEVANT now. You can invest as little as $1 in Apple stock which is priced at over $100 per share today.

If you are new to trading stocks and are interested in trading options, we recommend you learn about stock options well. Spend 6-12 months learning and paper trading (i.e. not putting any actual money) stock options. Once you get a better grasp, you can jump into the world of stock options as well.

Read related: How to Buy Your First Stock

Step 10. Diversify Outside of The Stock Market

Alternative Investments can help you create a well-balanced diversified portfolio. Consider some of the following assets to ensure your entire portfolio doesn’t crash when the stock market nosedives.

- Real Estate or Real Estate Investment Trust Funds

- You can buy physical real estate and benefit from the price appreciation and rental income

- If you have smaller amounts to invest, you can still invest in real estate with as little as $500 with Fundrise, DiversyFund, and other REITs.

- Read related: Fundrise vs DiversyFund

- Commodities (Oil, Gas, Gold, Silver, etc.)

- Cryptocurrency (Bitcoin, Ethereum, Litecoin, etc.)

- Some more institutional investors have shown their faith in Bitcoin in recent months.

- With more and more acceptance of cryptocurrency as a method of payment by the financial world (PayPal, MasterCard) and companies such as Tesla (potentially), cryptocurrencies may become mainstream in a few years.

- Despite the rise in prices of Bitcoin and Ethereum in 2021, cryptocurrencies as an asset class still remain volatile. Volatility = risk.

- Read related: Should I Invest in Bitcoin?

- Startups

- More than 90% of startups fail, but the ones that succeed can bring serious returns for investors.

- If you wish to invest in startups, there are some platforms such as WeFunder that you can use.

- If you have an idea for a startup, you can consider raising funds on WeFunder too.

Beginner’s Guide To Personal Finance

Steps 6 -10 To Manage Money Better

Do Health Checks and Evaluate Progress Periodically

All the steps mentioned above will help you create a solid strategy for building wealth over time. We recommend doing regular health check-ups on your strategy and tracking progress against your financial goals.

We hope the beginner’s essential guide to personal finance will help you make decisions and manage money better for a financially secure future.

FAQ on Beginner’s Guide to Personal Finance

Should I invest in 401(k) before paying off debt?

Yes, because the return on 401(k) is very high.

Let us explain. Suppose your company gives a 100% match up to 6% of your salary.

You make $80,000/ year, you contribute $4,800, your employer contributes another $4,800, your total investment = $9,600. This fund also grows at a rate depending of which investment you choose.

On the other hand, if you are using the $4,800 to pay off the debt on a loan that charges you 8% per year interest, you save a maximum of $384. That’s it!

$4800 + market growth > $384 saved

Plain and simple.

Should I Fully Complete One Step Before Moving To The Next Step?

Well, not necessarily 100% complete before moving on to the next step. But, the items listed are in order of priority. You may choose to split your resources between multiple items, and allocate a major share to a higher priority item and smaller shares to lower priority items until the higher priority goal is 100% achieved.

For example, if you have a goal of saving $5000 in your peace of mind fund, and you have $1000 to spare each month, you can do the following.

- contribute 100%, i.e. $1000 per month for 5 months to complete that goal in 5 months.

- or, you can do $800 per month for 6 months + $200 in the 7th month to achieve that goal, while partially completing other goals during these 7 months.

The key here is to understand the priorities and allocate your dollars strategically.

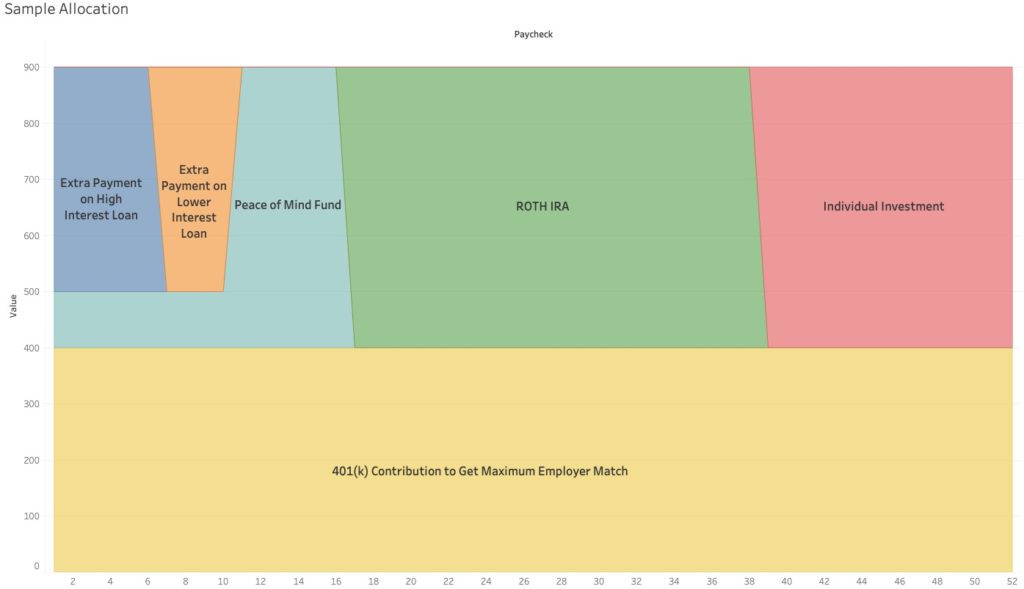

Sample Allocation Strategy

In Sample Allocation below, the horizontal axis represents the paycheck number a person who just started a full-time job expects to receive for the next 2 years (26 paychecks/year * 2 years = 52 paychecks).

From each paycheck, she/he is able to keep $900 after paying for rent (or mortgage payments), car, required loan payments, and other expenses.

- In the first few weeks (starting from the left-hand side), she/he focuses on making extra payments on the high-interest loans, while simultaneously building the ‘peace of mind’ fund.

- Then she/he transitions to paying off the lower interest loans faster with the help of extra payments, while still building the ‘peace of mind’ fund.

- After paying off the loans (mortgage excluded – mortgage interest rates are generally very low to make sense paying them off earlier), she/he shifts attention to completing the target of the ‘peace of mind’ fund.

- Then, maximum annual contributions to Roth IRA (for year 1 and year 2)

- And finally shifts to putting money in individual investment accounts.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents