This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

What are FAZER Stocks?

If you are actively involved in the stock market and seek opportunities to find the next big winner in the market, you might have heard the term FAZER. FAZER is a word coined by a popular stock advisory service. It’s an acronym for 5 stocks that can potentially be the next FAANG in terms of potential returns for investors. We will take a look at what are these FAZER stocks, and how they have performed in the year 2021.

According to the teaser for FAZER stocks, here’s what we know about the five FAZER stocks:

F — the just-$2B market cap edge computing pioneer that enables internet data to travel between different countries — and even continents — at warp speed.

A — at only $4B in market cap, their revolutionary software platform is singlehandedly replacing the concept of the in-house “tech team.”

Z — the radical video technology company changing the way society will communicate in the future.

E — the “next Google” that’s redefining the concept of search functionality as we know it, but at 175 times smaller than the current size of Google.

R — the silent king of streaming media that has set itself up perfectly to dominate tomorrow’s entertainment industry.

The 5 FAZER Stocks

Based on the clues dropped, here’s my guess at the names of the 5 FAZER stocks:

- F – Fastly (FSLY)

- A – Appian (APPN)

- Z – Zoom (ZM)

- E – Elastic NV (ESTC)

- R – Roku (ROKU)

Please note that these are my best guesses, and even though I am highly convinced that Fastly, Appian, Zoom, Elastic NV, and Roku are the five FAZER stocks, I am not subscribed to the service so I cannot confirm it.

Fazer Stocks Snapshot

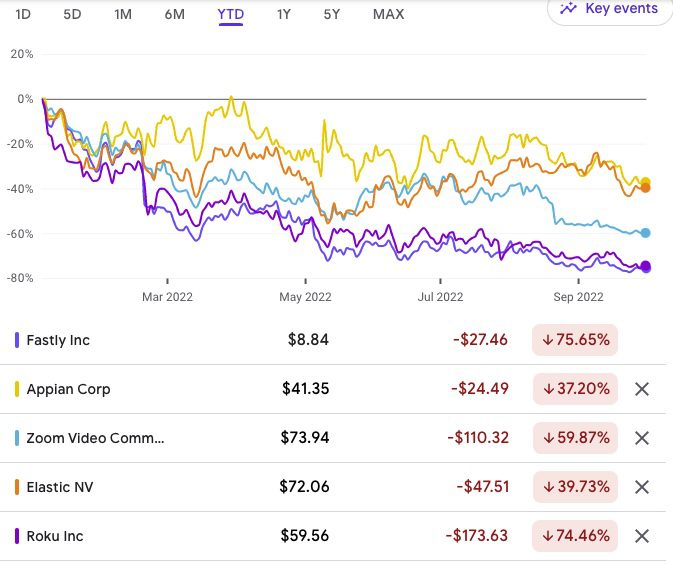

FAZER Stocks Performance

FAZER STOCKS had a difficult time in the stock market in the year 2021.

FAZER STOCKS are having a tough time in the stock market in 2022 as well.

Fastly (FSLY) Stock Performance

Fastly is a technology company that provides Content Delivery Network (or CDN) and Edge Computing services. Effectively, a CDN helps reduce the latency (i.e. response time) when a user interacts with a website or application. In a globalized world, a CDN is very important to ensure the customers across the globe get good user experience, and CDN helps achieve that goal.

Imagine you have a website that is hosted on one single server in the United States. The website visitors in the US will get a fast loading time and your website opens in less than 1 second. But, what if a visitor visits your website from Japan? Will he or she get the same loading time of less than 1 second? Probably a lot longer than 1 second! CDN helps solve the problem by making the data available in multiple locations (access points or ‘edges’) so that the user gets to access the website from a location nearest to them, reducing latency and enhancing the user experience. Having near-zero latency is even more important when it comes to streaming live sports or running a betting website.

Fastly (FSLY) stock has a market capitalization of $4 Billion.

The Fastly Stock fell 59% in the year 2021. This is a pullback after the explosive 386% growth in the previous year, 2020.

Appian Corporation (APPN) Stock Performance

Appian provides a low-code solution for businesses and it allows users to create custom apps that can be deployed on any device. It also offers low-code / no-code app integration options.

Appian (APPN) stock has a market capitalization of about $5 Billion.

The Appian Stock fell 55% in the year 2021. This is a pullback after the explosive 325% growth in the previous year, 2020.

ZOOM Video Communications (ZM) Stock Performance

If you’ve attended a virtual meeting during the pandemic, most likely you have heard of Zoom. Zoom’s software for virtual meetings has had enormous adoption during the COVID-19 pandemic, thanks to its ease of use, and ability to handle large groups of participants seamlessly. At one point, the term ‘Zoom call’ became synonymous with ‘video call’. This speaks volumes about the success of the company’s brand itself.

Zoom (ZM) stock has a market capitalization of $54 Billion.

Bestseller Personal Finance Books

The Zoom Stock fell 49% in the year 2021. This is a pullback after the explosive 385% growth in the previous year, 2020.

Elastic N.V. (ESTC) Stock Performance

Elastic N.V. is a technology company headquartered in California. The company provides solutions for real-time search through structured and unstructured data, along with analytics capability, for consumers and enterprises alike.

Elastic (ESTC) stock has a market capitalization of $11 Billion.

The Elastic Stock fell 13% in the year 2021. This is a pullback after the 130% growth in the previous year, 2020.

Roku, Inc. (ROKU) Stock Performance

A small device that can attach to any TV with an HDMI port and effectively make it a smart TV – sounds like a great idea, right? Roku provides this exact solution. Roku devices enable the download and installation of multiple apps such as Youtube, Amazon Prime Video, Netflix, and many others on their small hardware devices. Then you connect the device to your TV and enjoy the features of smart TV for a fraction of the cost. Apart from the popular Roku streaming devices, the company also offers other products such as Roku TV, soundbar, etc.

Roku (ROKU) stock has a market capitalization of $30 Billion.

The Roku Stock fell 28% in the year 2021. This is a pullback after the 220% growth in the previous year, 2020.

FAZER Stocks Performance: Since IPO

All five FAZER stocks started trading on the stock market within the last 5 five years, Appian (APPN) being the earliest and Fastly (FSLY) being the latest to be listed on the stock exchange.

- Fastly (FSLY) started trading in May 2019

- Appian (APPN) started trading in May 2017

- Zoom (ZM) started trading in April 2019

- Elastic N.V. (ESTC) started trading in October 2018

- Roku (ROKU) started trading in September 2017

Let’s take a look at the performance of FAZER stocks since they started trading.

Among the FAZER stocks, Roku has brought in the best returns (740%) since IPO. Appian has brought in the second-best returns at 285%, despite the strong pullback experienced in the year 2021. Zoom has grown 190% since its IPO. Elastic stock has risen by 66% since it got listed on the stock exchange. Fastly has grown by 44% since it started trading on the stock market.

Conclusion

It helps to see the complete picture and not base your investment decisions depending on returns in a short fixed period of time. It is even more important to analyze whether or not the stocks are likely to outperform in the future. If, through your analysis, you believe these stocks are going to outperform the overall market (S&P 500), these recent pullbacks might be a great buying opportunity for you.

Want to Level Up Your Stock Buying and Selling Experience? Check out my course on SkillShare.

New Users Get 30 Day FREE Access using the referral link

Disclosure: We have investments in all stocks mentioned in the article (i.e. FSLY, APPN, ZM, ESTC, ROKU)

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents