What is SIP Calculator?

To understand SIP Calculator, let’s first understand what SIP is.

What is SIP?

SIP stands for Systematic Investment Plan. It is a method of investing in mutual funds, and is a popular choice among mutual fund investors in many countries such as India.

Conceptually, it is similar to dollar cost averaging where an investor invests a fixed amount every month or every week. SIP offers the same functionality in an automated manner for investing in mutual funds.

What Does The SIP Calculator Do?

The SIP Calculator takes the inputs from the user – monthly investment amount, length of investment, and the expected annual returns (%) on investment, and then computes the future value of the SIP investments at the end of the investment period.

How To Use SIP Calculator?

Using the SIP Calculator to calculate the total future value of SIP investments is very easy. Simply follow the steps below:

Step 1

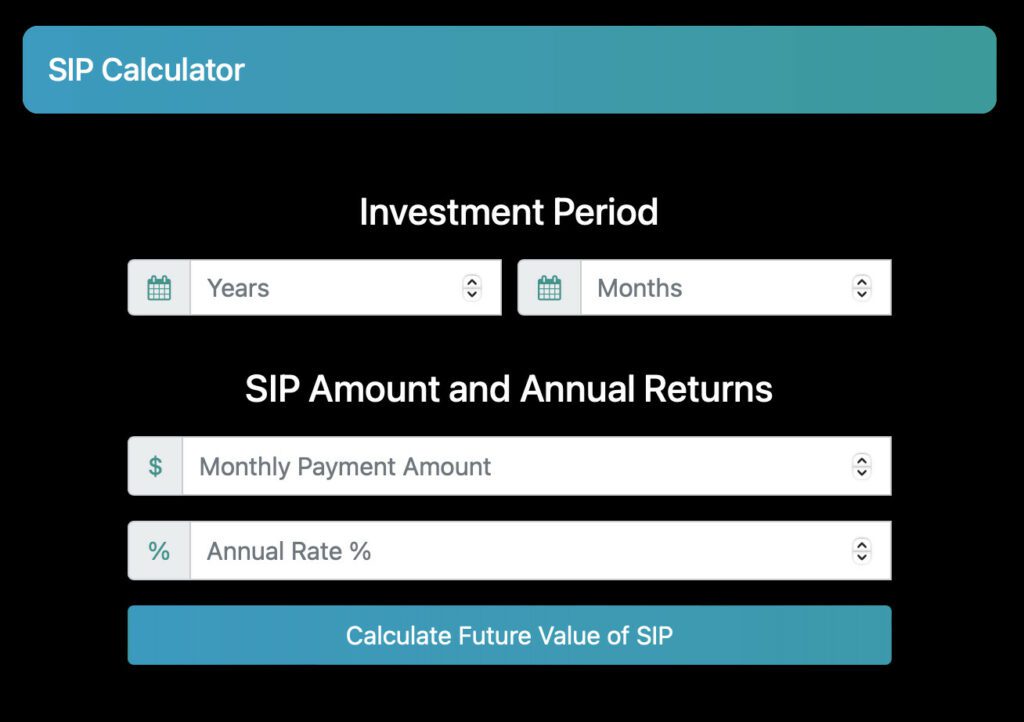

Open the SIP Calculator online. You should see a calculator with some input fields such as the years and months of the investment period, the monthly investment amount in the SIP, and the expected annual returns on investment.

Step 2

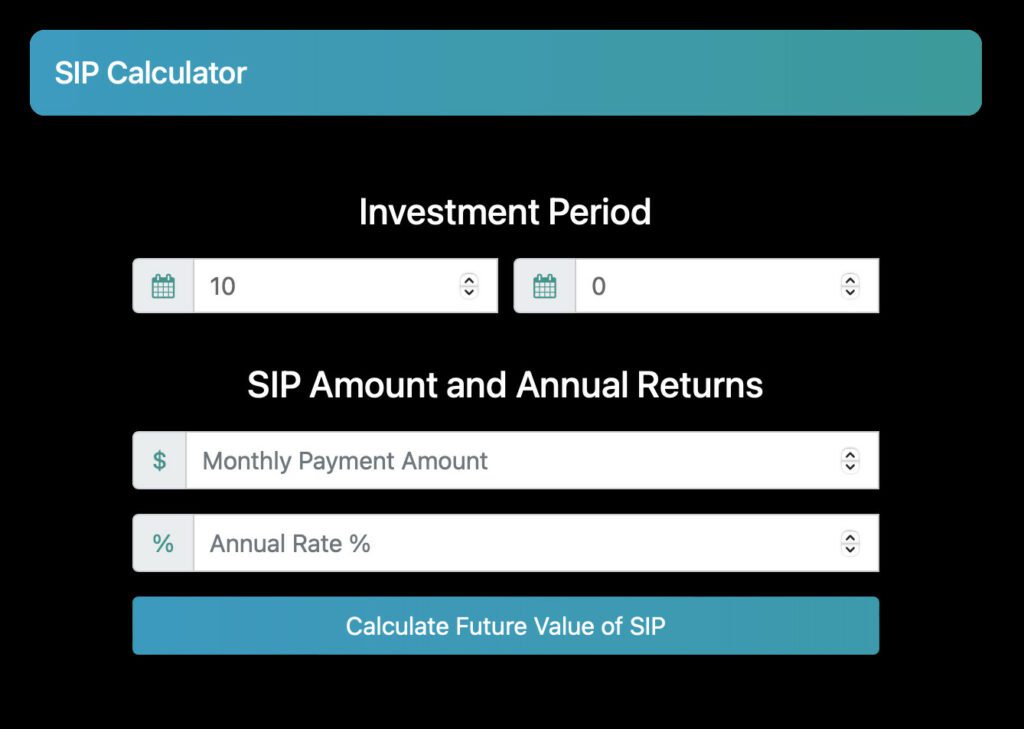

Input the duration of investment in years and months.

Let’s say the investment period is 10 years and 0 months.

Step 3

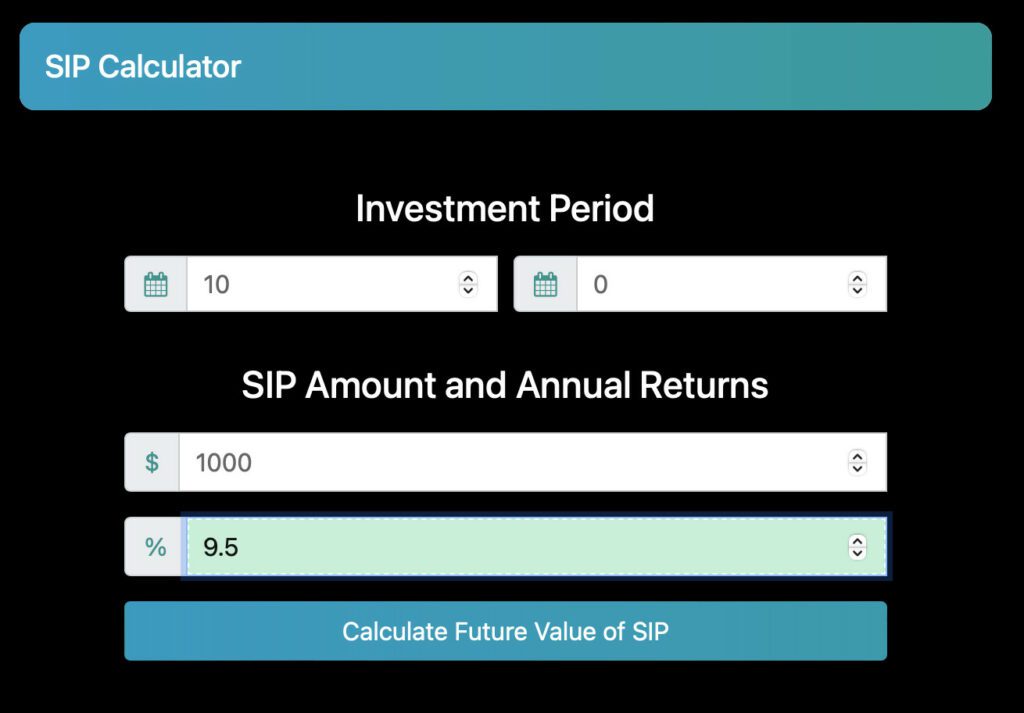

Input the monthly investment amount and the expected annual rate of return on investment. Please note that the SIP Calculator is asking for the investment amount per month, but the expected return on investment is per year.

Let’s say the monthly investment amount is $1000 and the expected return on investment is 9.5% per year.

Step 4

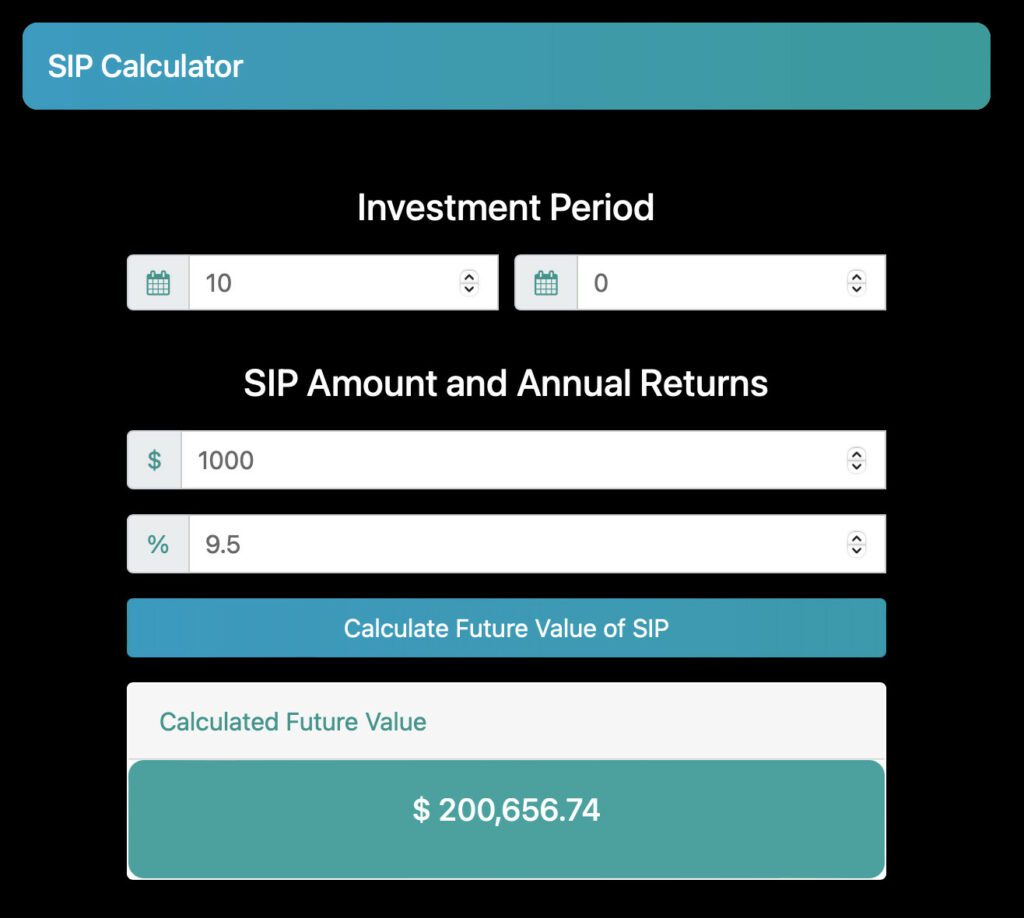

Once all the fields are complete, click on the “Calculate Future Value of SIP” button to view results.

Here, in our example, we get the future value of SIP as $200,657.

So, essentially, if we invest $1000 a month at 9.5% annual returns for 10 years, we will accumulate a total of $200,657 by the end of the 10-year period.

Frequently Asked Questions on SIP and SIP Calculator

What is SIP Future Value Calculator?

SIP Future Value Calculator is the same as the SIP Calculator.

What is the full form of SIP?

The full form of SIP is Sytematic Investment Plan.

Is SIP a type of investment asset class?

No, SIP is not an investment asset class. Instead, it is a method of investing periodically (monthly, quarterly, annually etc.) in mutual funds. It is similar to the concept of dollar cost averaging.

How to calculate Future Value of a lumpsum investment?

In order to calculate the Future Value of a lumpsum investment, you can use the

Reverse CAGR Calculator [this site]

or

Reverse CAGR Calculator [partner site]

Page Contents