This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Stock Order Types

As investors, we must know about various tools available to us for controlling the buying and selling price of a stock. Unfortunately, many investors just use the plain ‘buy/sell’ options, not fully utilizing the array of stock order types provided by the investing platform or app. In this post, we will go through some great ways to place orders for buying and selling stocks while maintaining better control of the price we pay or fetch for the stock. We’ll focus on market buy, market sell, limit buy, limit sell, stop loss, buy stop, buy stop limit, sell stop limit, trailing stop loss, and trailing stop limit order types. We will also review how to place the different types of stock orders step by step on Robinhood and Webull – two popular 0% commission stock trading apps.

Let’s take control of your stock orders.

Jump to Section:

Popular Stock Order Types

Here are the popular stock order types available on trading platforms, including Robinhood and Webull.

- Market Buy Order

- Market Sell Order

- Limit Buy Order

- Limit Sell Order

- Stop Buy Order

- Stop Loss (Sell) Order

- Stop Limit Buy Order

- Stop Limit Sell Order

- Trailing Stop Buy Order

- Trailing Stop Loss (Sell) Order

- Trailing Stop Limit Buy Order

- Trailing Stop Limit Sell Order

Let’s dive deep into each one of them below.

Stock Order Types: Market Buy and Market Sell

Market Buy

This is like going to the market and paying whatever the current price (spot price) of the item is. In the market, there are multiple buyers and multiple sellers, by placing a market buy order you agree to pay the price that a seller is currently asking for. If a stock is trading at $49, you’ll end up paying close to that amount for buying a share of the stock. This is the simplest and most common form of buying transaction. Unfortunately, most investors are aware of ONLY this type of buy orders. Keep reading below to see other stock order types.

Market Sell

Like the market buy orders, market sell orders are also like going to the market and selling your stock at the current price (spot price). If a current buyer is willing to pay $49 for the share, you’ll just sell it to them on the spot for $49. This is the simplest and most common form of selling transaction.

Conditional Stock Order Types: Limit Buy and Limit Sell

Limit Buy

Limit buy gives you more control on your purchase price. Let’s say a stock is trading at a current market price of $49. However, you want to pay a maximum of $46 per share of the stock. You can use the ‘limit buy’ feature and set a limit order with a purchase price of $46. When the order gets queued at the exchange, it carries the message that your maximum willingness to pay for the share is $46. Your order will not get executed until the stock drops to $46 or below.

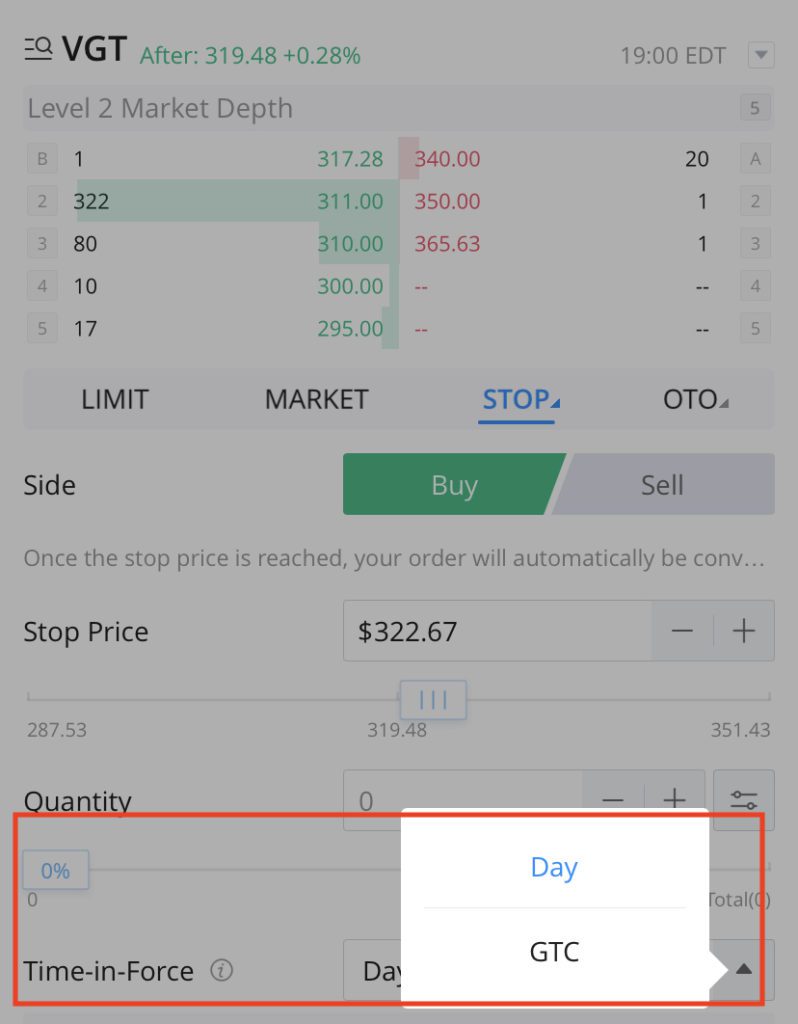

You can control the validity of your limit order as well. If you want to keep this order valid for only one day (i.e. willing to buy the stock for $46 only for the day), you can choose to make the order valid for the day only. However, if you are fine to wait out a few days in anticipation of the stock price to fall to $46 over the next few days, you can choose the validity as Good Till Cancelled (GTC) and keep your order valid for 90 days (or until you cancel before 90 days).

WeBull Time in Force Order Validity – Day or GTC (Good Till Cancelled)

Limit Sell

Limit sell gives you more control on your selling price. Let’s say a stock is trading at a current market price of $49. However, you want to sell the stock for a minimum of $55 per share. You can use the ‘limit sell’ feature and set a limit order with a selling price of $55. When the order gets queued at the exchange, it carries the message that you are willing to sell the stock at a minimum price of $55. Your order will not get executed until the stock rises to $55 or above.

You can control the validity of your limit sell order as well. If you want to keep this order valid for only one day (i.e. willing to sell the stock for $55 only for the day), you can choose to make the order valid for the day only. However, if you are fine to wait out a few days in anticipation of the stock price to rise to $55 over the next few days, you can choose the validity as Good Till Cancelled (GTC) and keep your order valid for 90 days (or until you cancel before 90 days).

Stock Order Types: ‘Stop Orders’

Stop Loss

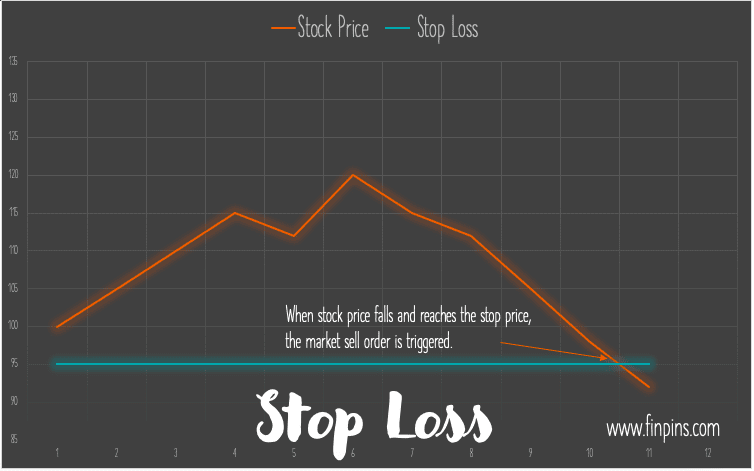

What’s worse than losing money? Probably nothing. Many investors follow the mantra of limiting their loss. While traders may see this as absolutely essential, many long term investors also see value in placing stop loss orders. This way they can mitigate the risk of losing more money than they can afford to lose.

So how can a stop loss order help? Let’s say a stock is trading at a current market price of $125. You own the stock and want to see it grow. However, you believe that if the stock falls below $115, it might go into free fall and not rise back to an acceptable price point within a reasonable timeframe (say 6 months). In this case you can place a stop loss order at $115. If the share price falls to $115, your order gets executed as a market sell order (this means that you may also fetch lower than $115 for the stock, depending on availability and willingness of buyers on the exchange). If the share price doesn’t fall to $115 your sell order does not get executed.

It’s a good risk mitigation strategy as it protects your downside.

Buy Stop

When you want to invest in a stock if it gains upward momentum, you can use the buy stop order to set a stop price (say $130) above the current market price (say $120). When the stock rises and hits the $130 mark, your order gets placed as a market buy order.

Bestseller Personal Finance Books

Stop Limit

Sell Stop Limit

A stop limit sell order is very much like the stop loss order, with the key difference being that once your stop order price is reached, $115 from the example above, your order gets queued as a limit sell order instead of a market sell order. Understandably, for stop limit sell orders, you need to provide a limit sell price as well (Some brokers set a condition that the limit sell price should be greater than or equal to the stop price). Let’s say you’re willing to accept a minimum of $116 for the stock. When the stock price reaches $115, a limit sell order is triggered for a price of $116 per share.

The risk with sell stop limit order is that maybe the stock price goes in free-fall and keeps going down, because of the limit sell price of $116, you might not be able to sell your shares at all!

Buy Stop Limit

A stop limit buy order gives you control over the buying price of shares. For a buy stop limit order for a stock trading at $120, you need to provide a stop price, say $128, and a limit buy price (Some brokers set a condition that the limit buy price should be at or below the stop price), say $125. When the stock price rises and hits the stop price ($128), a limit buy order (for $125) is triggered.

If you anticipate a stock price to rise based on some news, earnings etc, but you only want to buy the stock if there is an initial uptick in the stock price (hence not you’re not buying it straightaway now), you can create a buy stop limit order.

The risk here is that if the stock price skyrockets after the news, and never comes down to $125, you might not be able to buy the stock since you’re setting a limit buy price ($125)’

Stop Loss Vs Stop Limit Orders

TIP: Think of stop price as a trigger point.

In case of stop loss orders, the stop price triggers a market sell order.

For buy stop orders, the stop price triggers a market buy order.

In case of stop limit sell orders, the stop price triggers a limit sell order.

For stop limit buy orders, the stop price triggers a limit buy order.

finpins.com

Advanced Stock Order Types

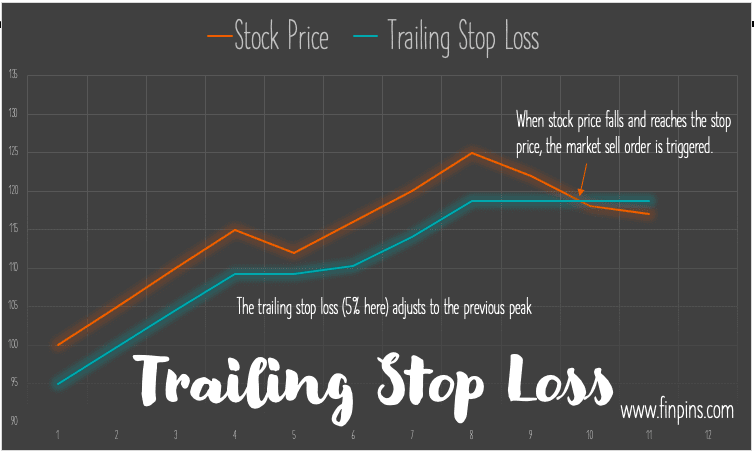

Trailing Stop Loss

Suppose a stock you own is trading at a current market price of $100. To protect your downside, you can place a stop loss or a stop limit order to sell the stock at $95 if the stock price falls. But, what if the stock goes up to $110 and you want to re-adjust your stop loss price to $105? You can keep monitoring the stock price and cancelling and placing new stop loss orders based on the price movement.

Luckily there’s a better way of doing it – by using trailing stop loss orders. Trailing stop loss orders can be configured in two ways

- you can either set a trail percentage amount for the price fall from the peak price, for example 5%

- or, you can set a trail dollar amount for the price fall from the peak price, for example $5

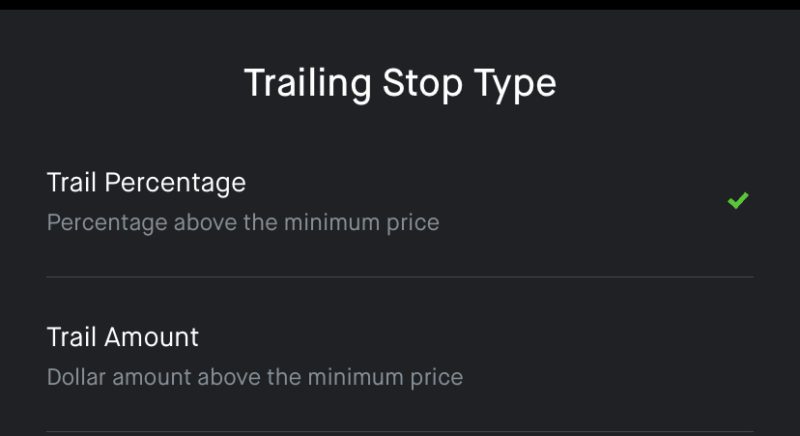

Robinhood – choose trail dollar or trail percentage

Robinhood – Set trail percentage

Suppose you set a 5% trail percentage, the stock price rises from $100 to $110 the next day, the stop loss automatically adjusts from $95 (5% less than $100) to $104.5 (5% less than $110). If the stock goes further up to $130, the stop loss adjusts to $123.50 (5% less than $130).

Suppose you set a $5 trail dollar, the stock price rises from $100 to $110 the next day, the stop loss automatically adjusts from $95 ($5 less than $100) to $105 ($5 less than $110). If the stock goes up further to $130, the stop loss adjusts to $125 ($5 less than $130).

In the stock price falls and reaches the stop price (calculated either via percentage trail or dollar trail), a market sell order is triggered.

Trailing Stop Limit

Trailing stop limit is pretty much the same as Trailing stop loss, with the added option of setting a limit sell price. So, in case the stock price falls and reaches the stop price, a limit sell order is triggered.

Robinhood Stock Order Types

Stock Order Types on Robinhood

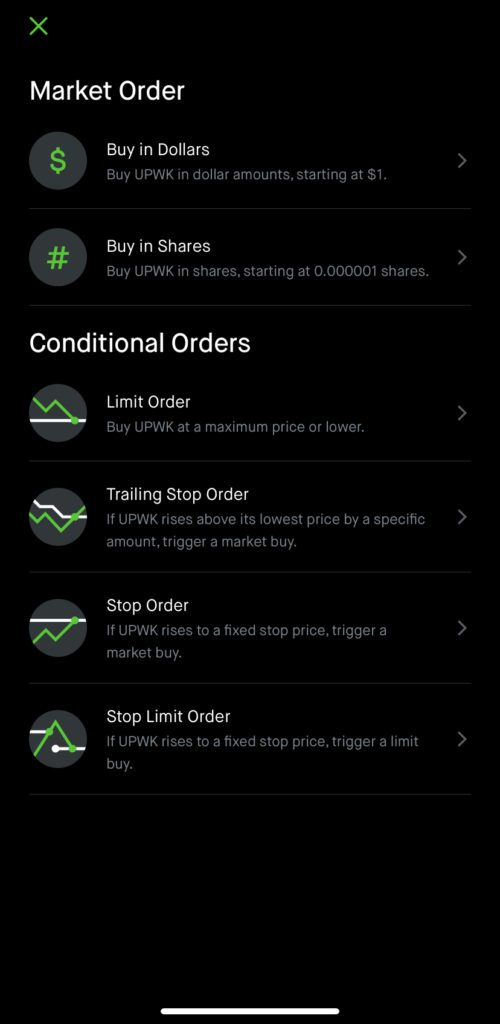

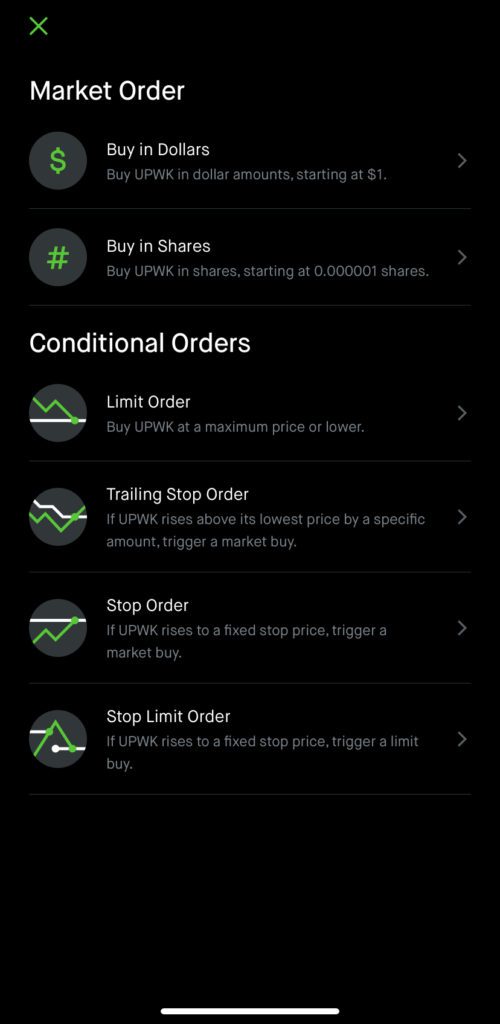

Robinhood Stock Order Types for Buying

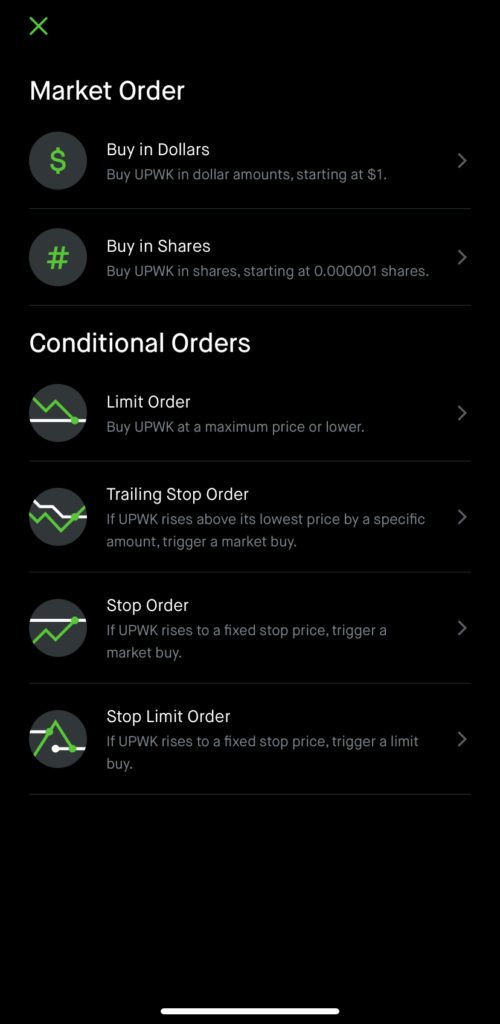

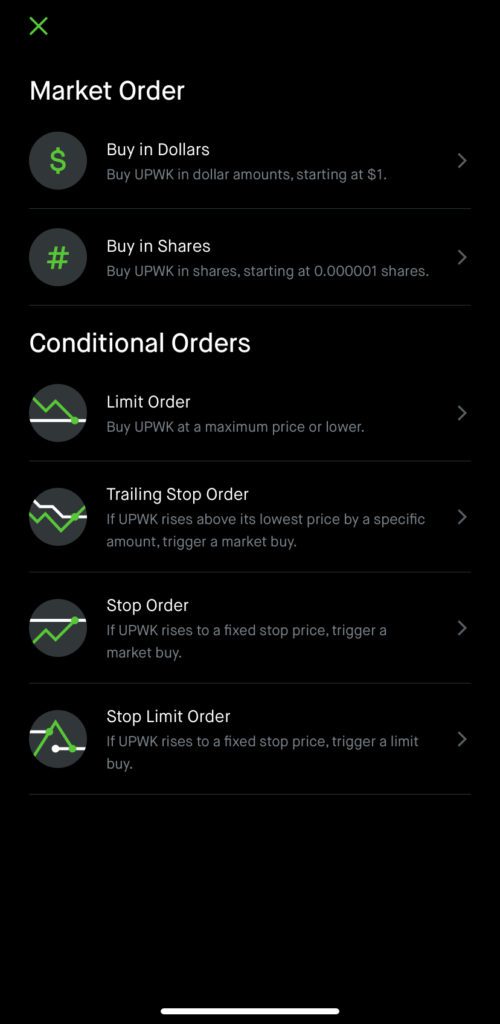

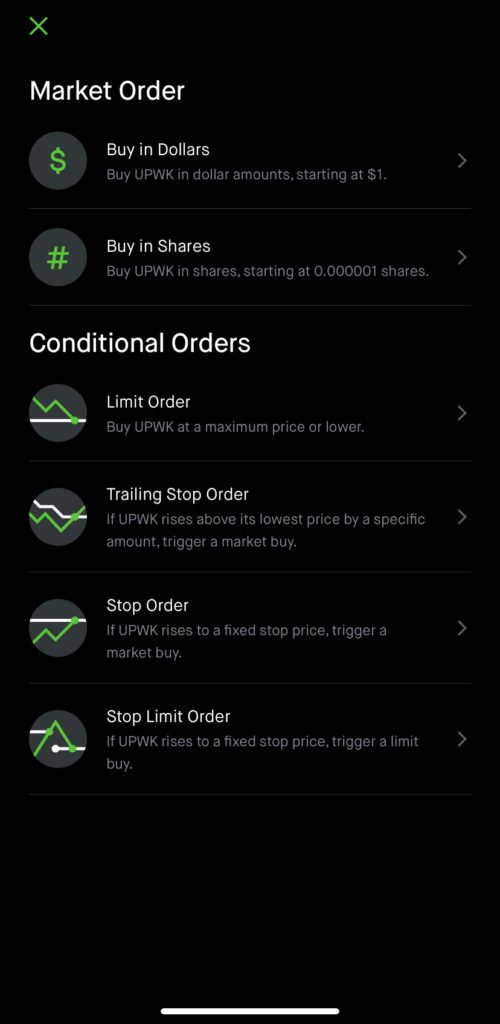

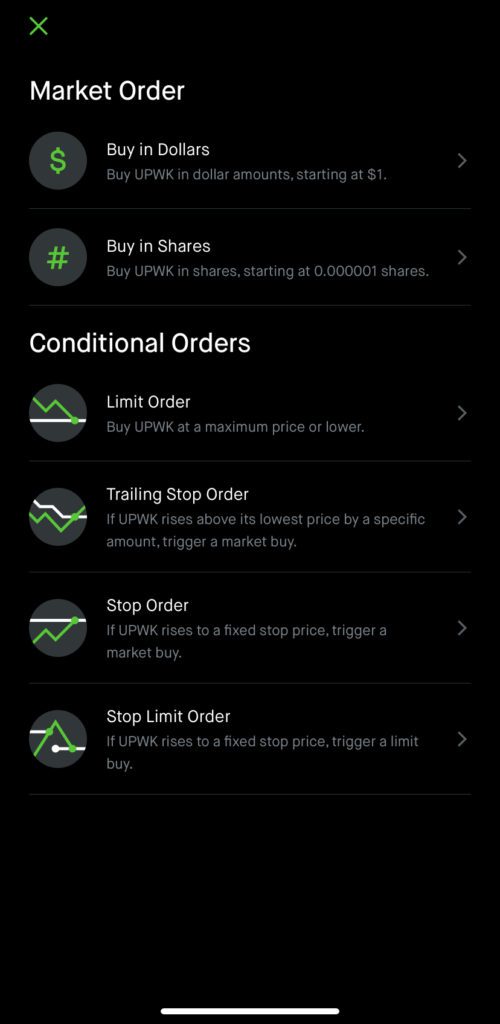

There are six main types of orders available on Robinhood, as seen on the screenshot here.

- Market Orders

- Buy in Dollars

- Buy in Shares

- Conditional Orders

- Limit Order

- Trailing Stop Order

- Stop Order

- Stop Limit Order

Robinhood Stock Order Types for Buying

Let’s dive into each stock order type one by one.

Robinhood Market Order – Buy in Dollars (step-by-step)

Step 1: Pick option 1 ‘Buy in Dollars’. You can also buy partial shares on Robinhood

Pick option 1 ‘Buy in Dollars’. You can also buy partial shares on Robinhood

Step 2: Enter Dollar figure you want to invest in the stock (at current market prices) and submit your order

Enter Dollar figure you want to invest in the stock (at current market prices) and submit your order

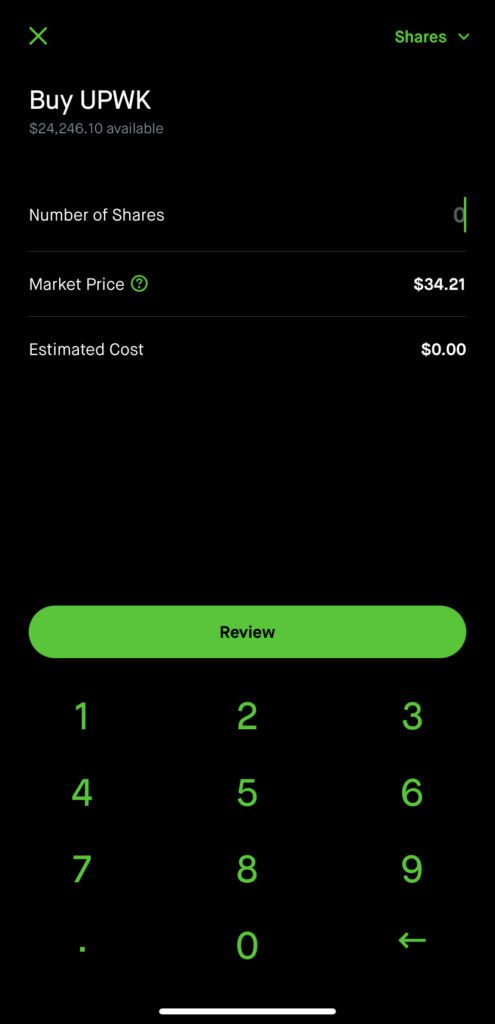

Robinhood Market Order – Buy in Shares (step-by-step)

Step 1. Pick option 2 ‘Buy in Shares’. You can also buy partial shares on Robinhood

Pick option 2 ‘Buy in Shares’. You can also buy partial shares on Robinhood

Step 2. Enter number of shares you want to purchase (at current market prices) and submit your order

Enter number of shares you want to purchase (at current market prices) and submit your order. You can also use decimals here if you want, for example, you can buy 2.5 shares.

How to access Stop Loss, Stop Limit, Trailing Stop Loss and other advanced stock order types in Robinhood.

The first four steps are common to access the ‘Conditional Orders’ Screen. In Step 2 you can choose either ‘Buy’ or ‘Sell’ depending on what you want to do.

Step 1. Choose a stock, and click on the trade button on the bottom right.

Choose a stock, and click on the ‘Trade’ button on the bottom right.

Step 2. Choose ‘Buy’ or ‘Sell’ based on what you intend to do.

Choose ‘Buy’ or ‘Sell’ based on what you’re planning to do.

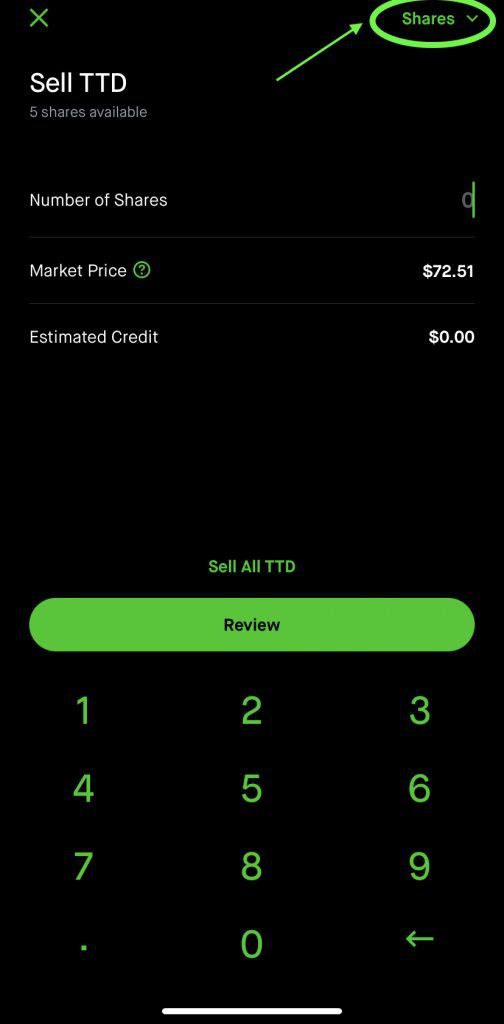

Step 3. On top right, click on the ‘shares’ or ‘dollars’ button to open up the menu for advanced orders.

On top right, click on the ‘shares’ or ‘dollars’ button to open up the menu for advanced orders.

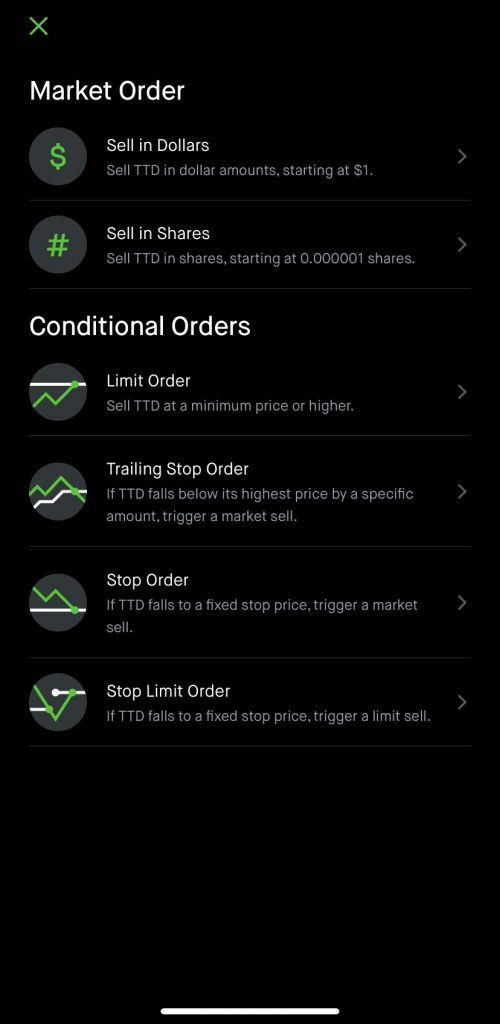

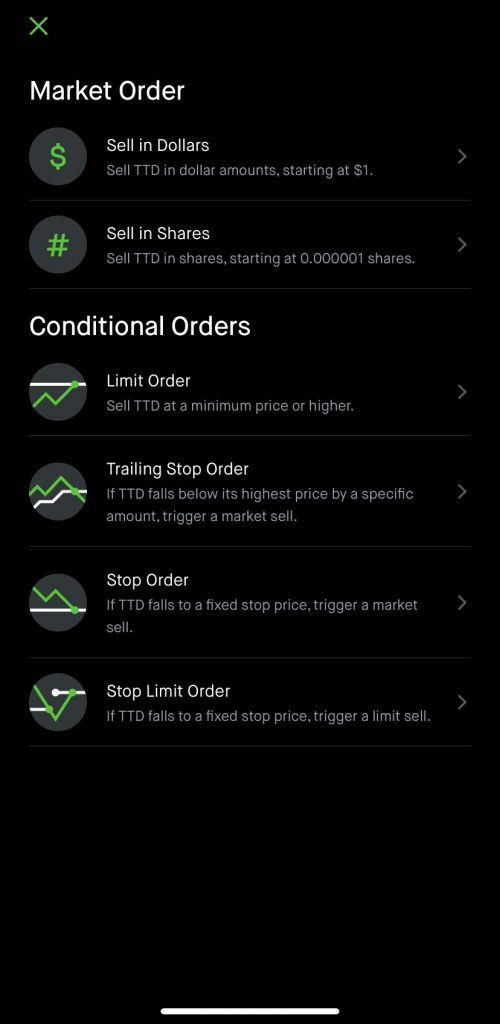

Step 4. The Stock Order Types Screen Open Up.

The stock order types screen opens up. Here you can access the order types – Limit Buy Order, Limit Sell Order, Trailing Stop Buy, Trailing Stop Loss (Sell), Stop Buy, Stop Loss (Sell), Stop Limit Buy, and Stop Limit Sell orders.

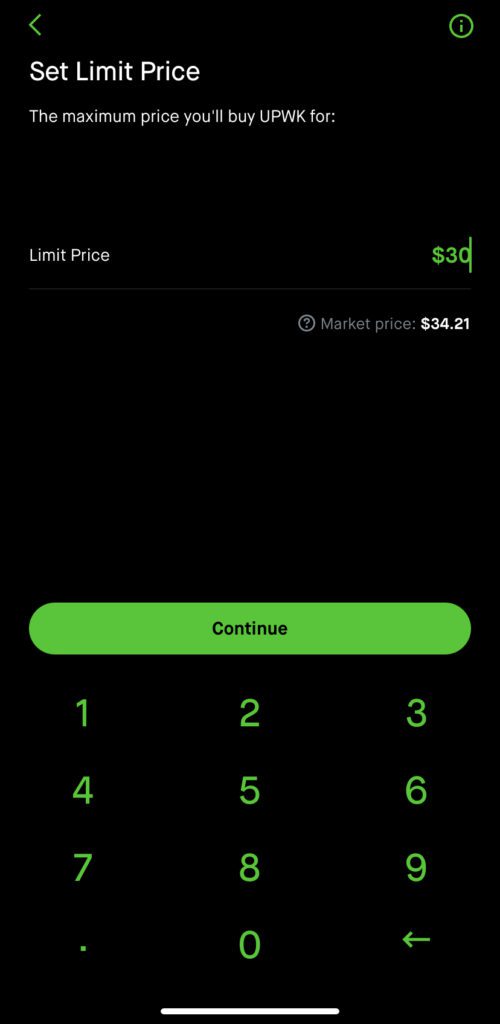

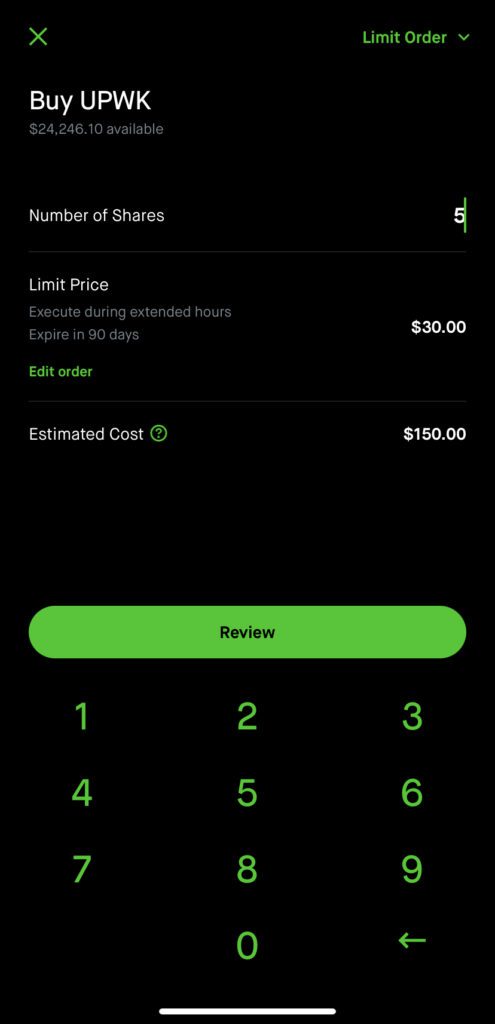

Robinhood Conditional Order – Limit Buy Order on Robinhood (step-by-step)

Use steps 1-4 from the section above.

Step 5. After Choosing ‘Buy’ initially in Step 2, Pick option 3 ‘Limit Order’ in the Conditional Orders section.

Pick option 3 ‘Limit Order’ in the Conditional Orders section.

Step 6. Enter the limit price of the maximum price you are willing to pay per share. For example, $30.

Enter the limit price of the maximum price you are willing to pay per share. For example, $30.

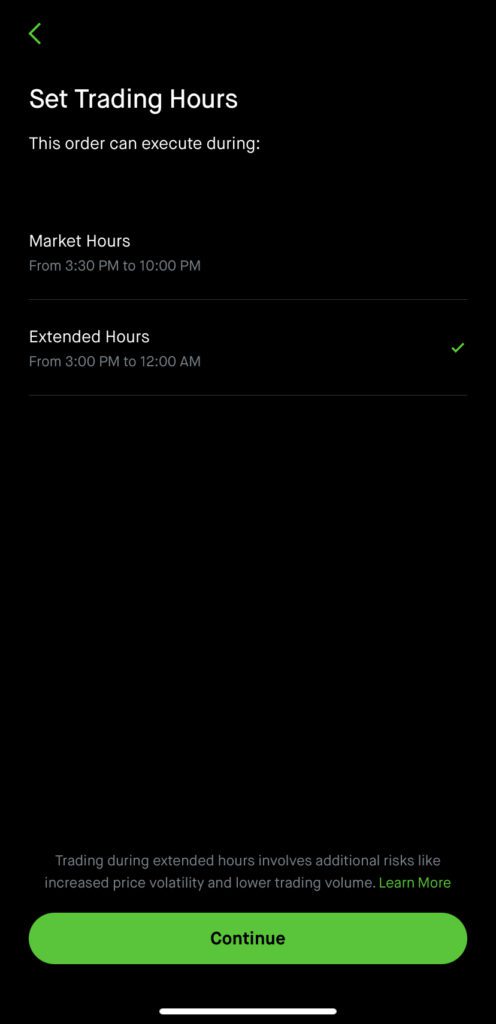

Step 7. Select whether you are okay executing the order during market hours or also during the extended hours i.e. pre-market and after-market included.

[the general market hours in the US is 9:30 am – 4pm Eastern Time. At the time of taking these screenshots, the phone was in European Time Zone, hence the 6 hour difference (3:30pm to 10:00pm)].

Select whether you are okay executing the order during market hours or also during the extended hours i.e. pre-market and after-market included.

[the general market hours in the US is 9:30 am – 4pm Eastern Time. At the time of taking these screenshots, the phone was in European Time Zone, hence the 6 hour difference (3:30pm to 10:00pm)].

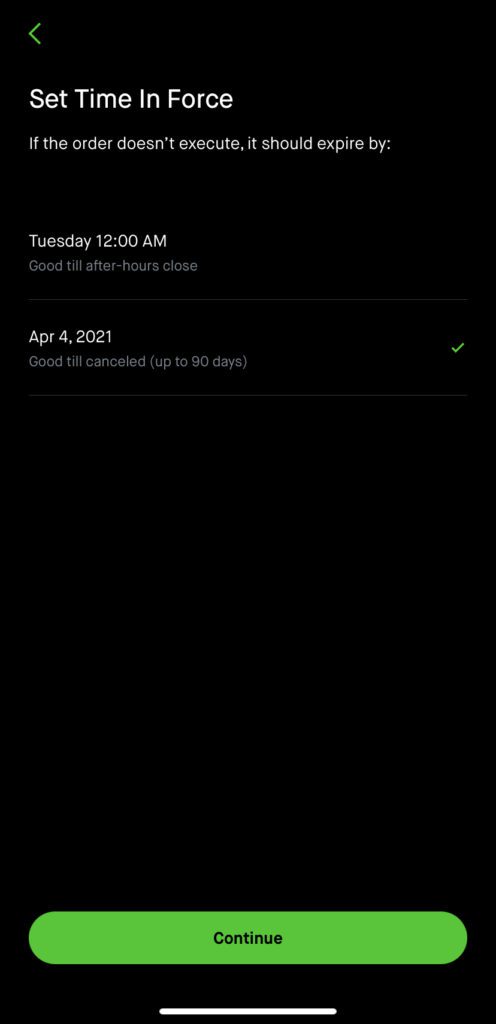

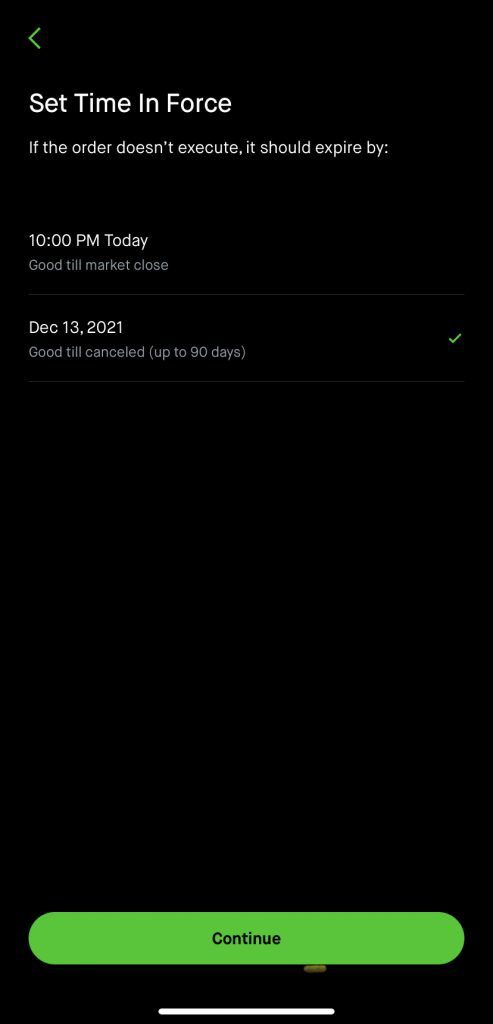

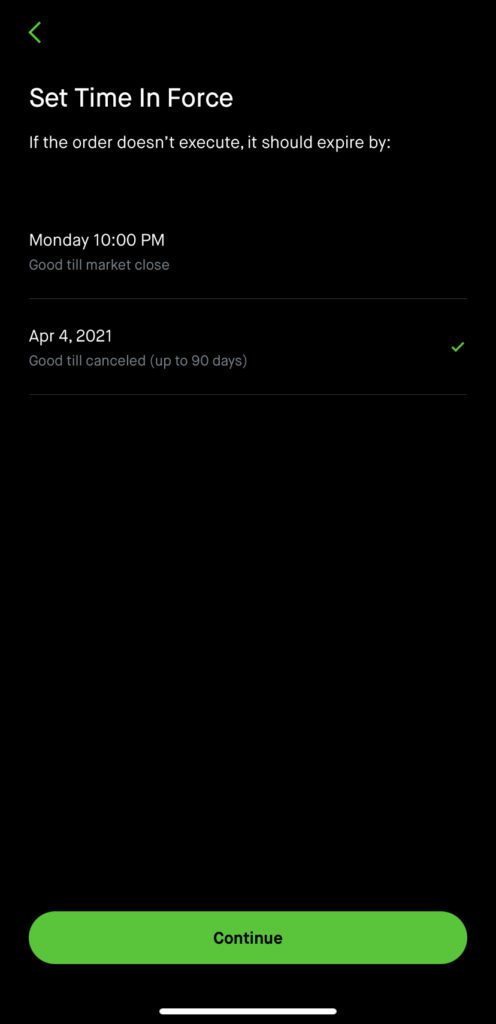

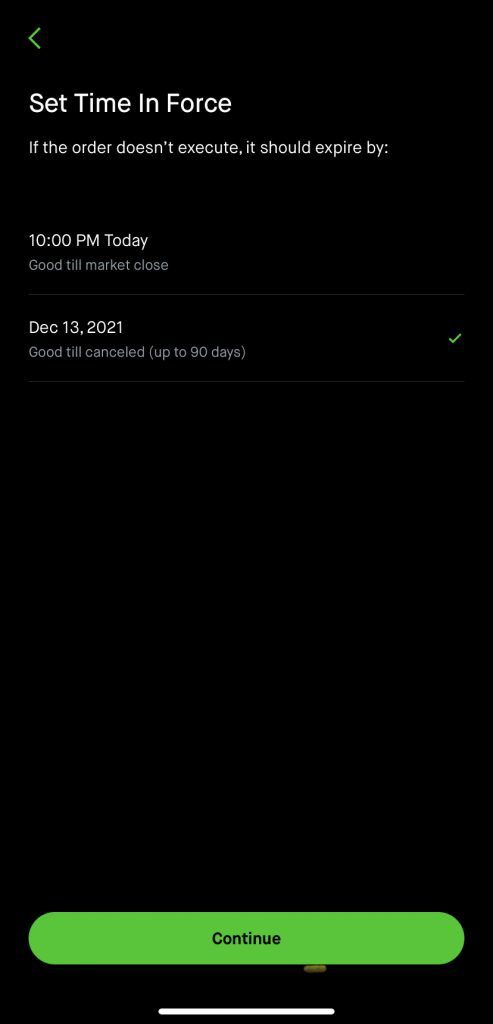

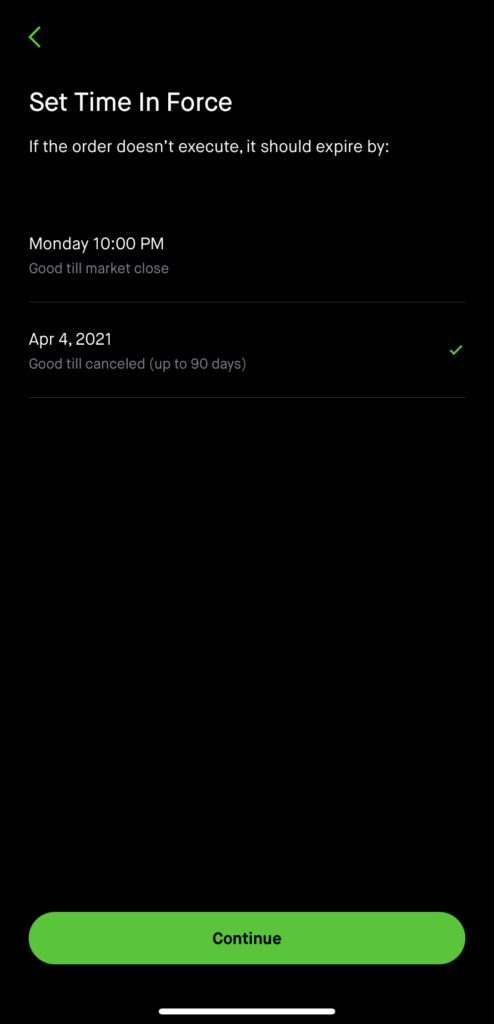

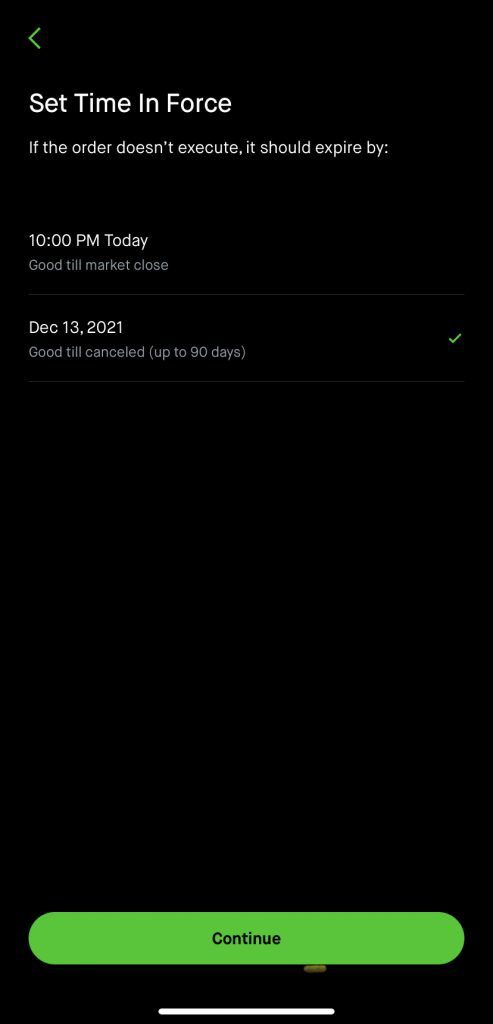

Step 8. Select the validity of the order i.e. for how long should the order be in force.

Let’s say you are okay with the order getting executed anytime within the next 90 days, so you can pick the relevant option.

Select the validity of the order i.e. for how long should the order be in force.

Let’s say you are okay with the order getting executed anytime within the next 90 days, so you can pick the relevant option.

Step 9. Enter number of shares you want to purchase.

Enter number of shares you want to purchase.

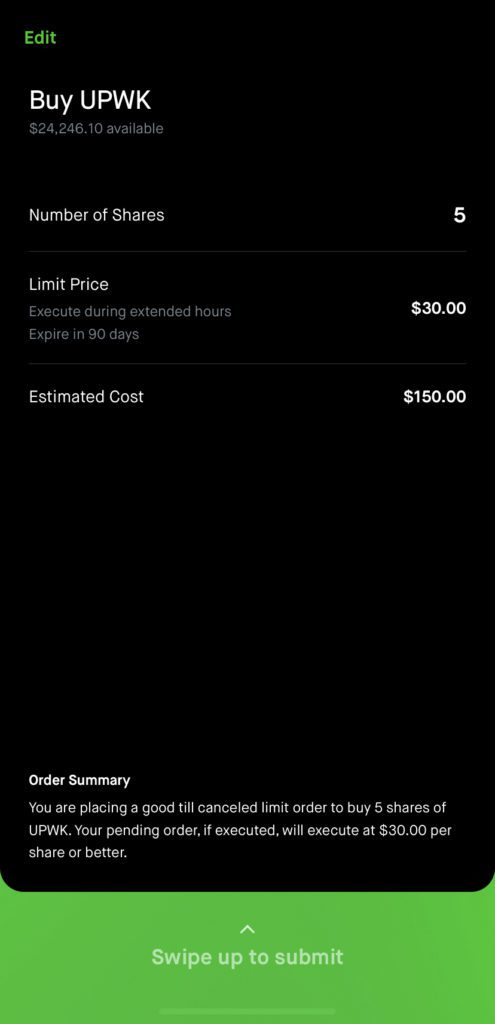

Step 10. Hit review and swipe up to submit your order.

Hit review and swipe up to submit your order.

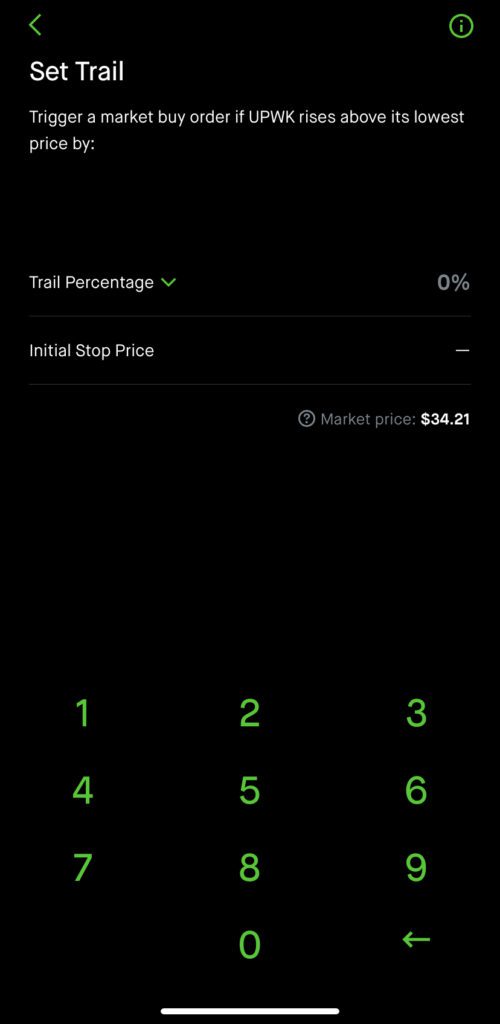

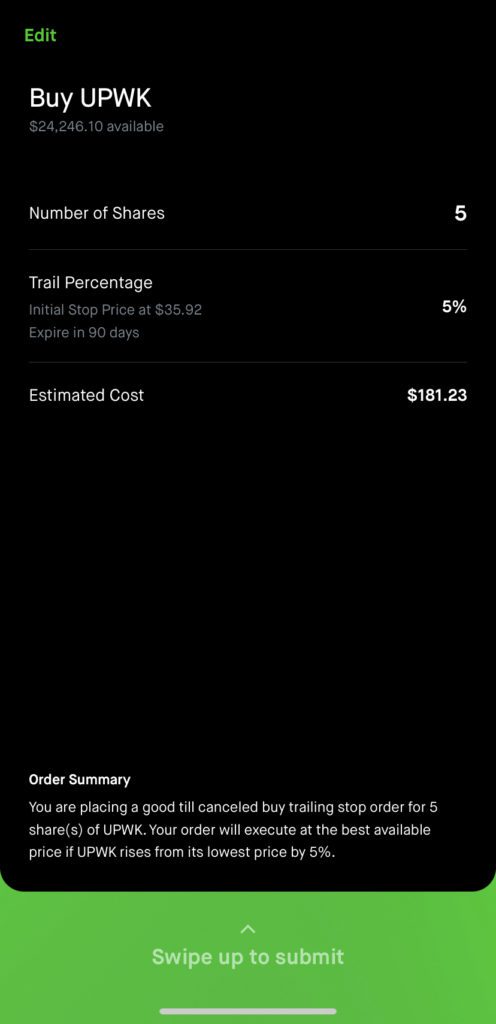

Robinhood Conditional Order – Trailing Stop Buy Order on Robinhood (step-by-step)

Use steps 1-4 from the section above.

Step 5. After Choosing ‘Buy’ initially in Step 2,, Pick option 4 ‘Trailing Stop Order’ in the Conditional Orders section.

Pick option 4 ‘Trailing Stop Order’ in the Conditional Orders section.

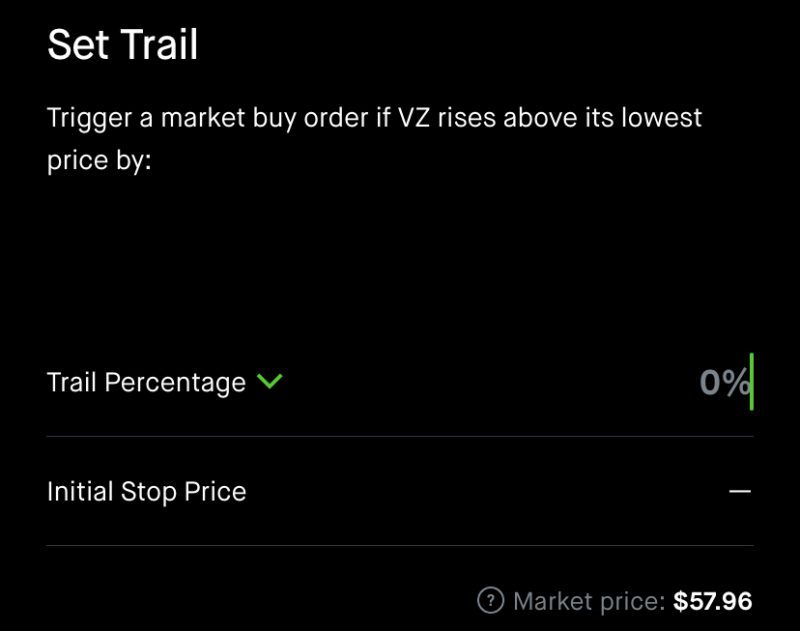

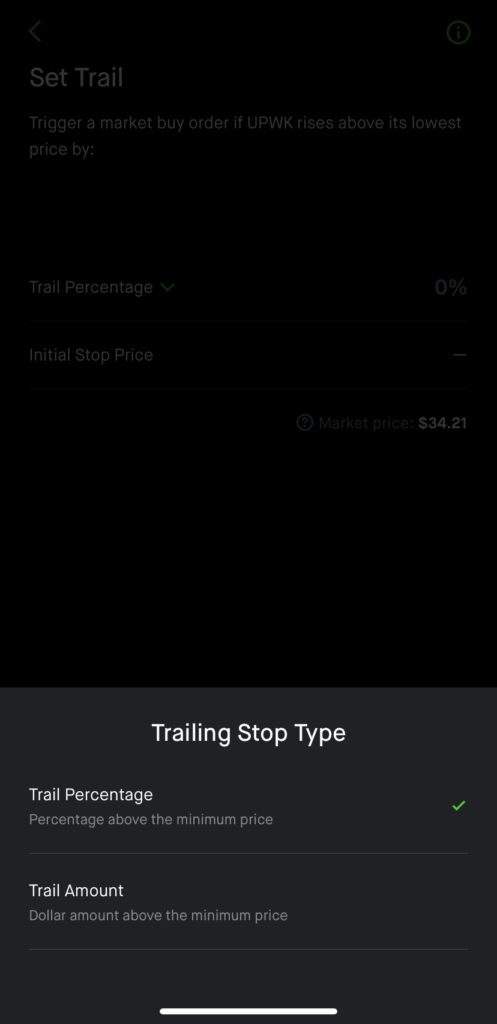

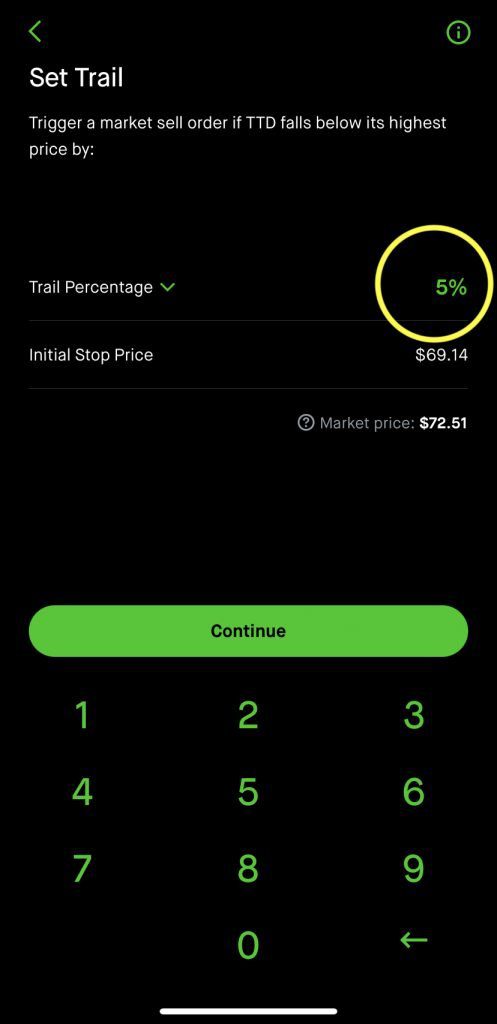

Step 6. On the ‘Set Trail’ screen you will see two fields. The first field is ‘Trail Percentage’ and the second field is initial stop price.

On the ‘Set Trail’ screen you will see two fields. The first field is ‘Trail Percentage’ and the second field is initial stop price.

Step 7. If you wish to set a dollar trail instead of a percentage trail, click on the green down arrow and at the bottom of the screen there would a pop-up with two options – ‘Trail Amount’ and ‘Trail Percentage’. Select ‘Trail Amount’ if you wish so.

If you wish to set a dollar trail instead of a percentage trail, click on the green down arrow and at the bottom of the screen there would a pop-up with two options – ‘Trail Amount’ and ‘Trail Percentage’. Select ‘Trail Amount’ if you wish so.

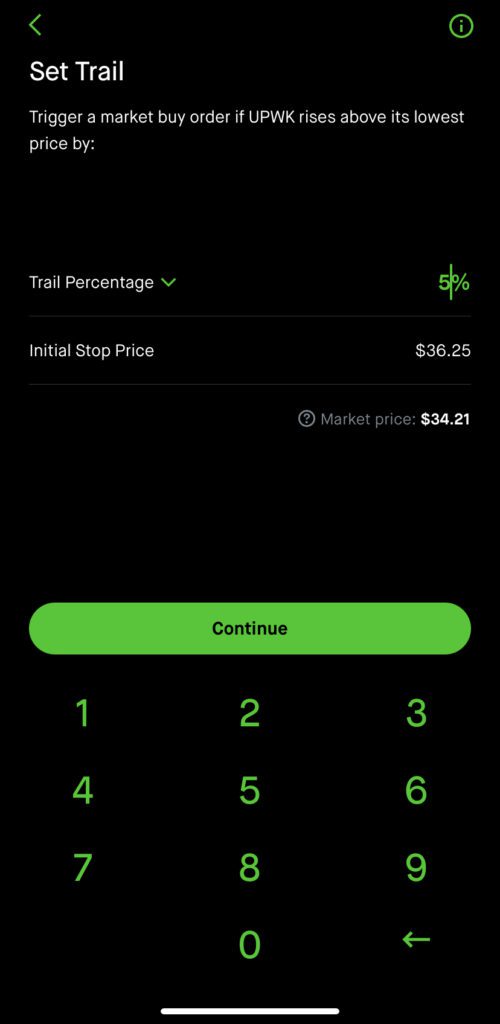

Step 8. For the demo, let’s go with ‘Trail Percentage’ option and set the percentage to 5%.

What is essentially means is that the buy order will only get triggered when the stock price rises by 5% from the current levels i.e. 5% above $34.21 = $36.25.

For the demo, let’s go with ‘Trail Percentage’ option and set the percentage to 5%.

What is essentially means is that the buy order will only get triggered when the stock price rises by 5% from the current levels i.e. 5% above $34.21 = $36.25.

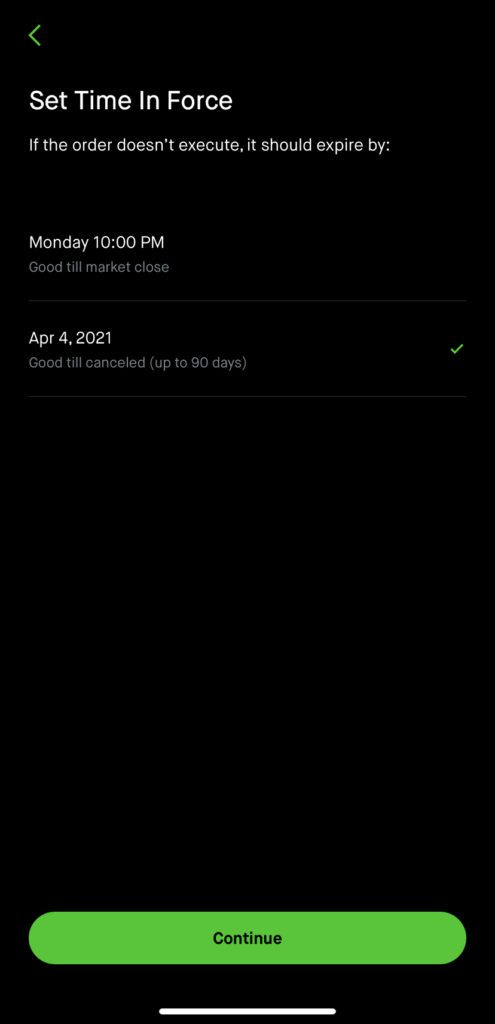

Step 9. Set a validity period for the order to remain in force.

Set a validity period for the order to remain in force.

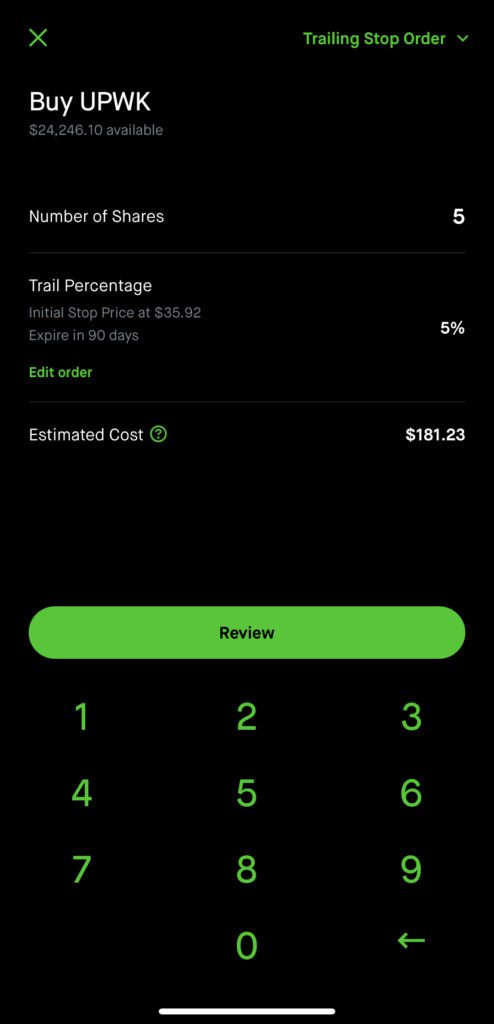

Step 10. Enter number of shares you want to purchase.

Enter number of shares you want to purchase.

Step 11. Hit review and swipe up to submit your order.

Hit review and swipe up to submit your order.

Robinhood Conditional Order – Trailing Stop Loss (Sell) Order on Robinhood (step-by-step)

Use Steps 1-4 from the section above.

Step 5. After Choosing ‘Sell’ initially in Step 2,, Pick option 4 ‘Trailing Stop Order’ in the Conditional Orders section.

Pick option 4 ‘Trailing Stop Order’ in the Conditional Orders section.

Step 6. On the ‘Set Trail’ screen you will see two fields. The first field is ‘Trail Percentage’ and the second field is initial stop price.

On the ‘Set Trail’ screen you will see two fields. The first field is ‘Trail Percentage’ and the second field is initial stop price. You can toggle it by simply clicking on the text and choosing the desired option.

For this demo, let’s use a trailing percentage of 5%.

Step 7. Set a validity period for the order to remain in force. Review Order Details and Swipe up to Submit the Order.

Set a validity period for the order to remain in force.

Robinhood Conditional Order – Stop Buy Order on Robinhood (step-by-step)

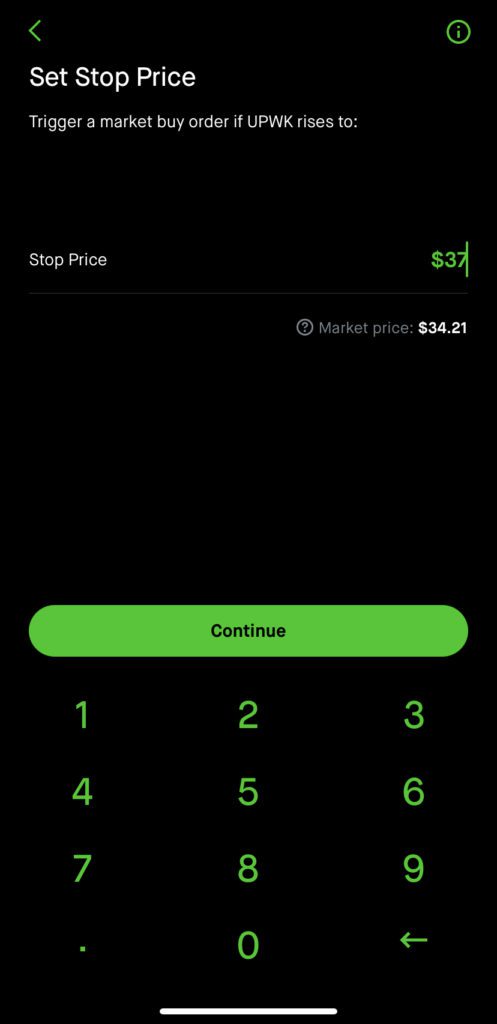

Step 5. After Choosing ‘Buy’ initially in Step 2, Pick option 5 ‘Stop Order’ in the Conditional Orders section.

Pick option 5 ‘Stop Order’ in the Conditional Orders section.

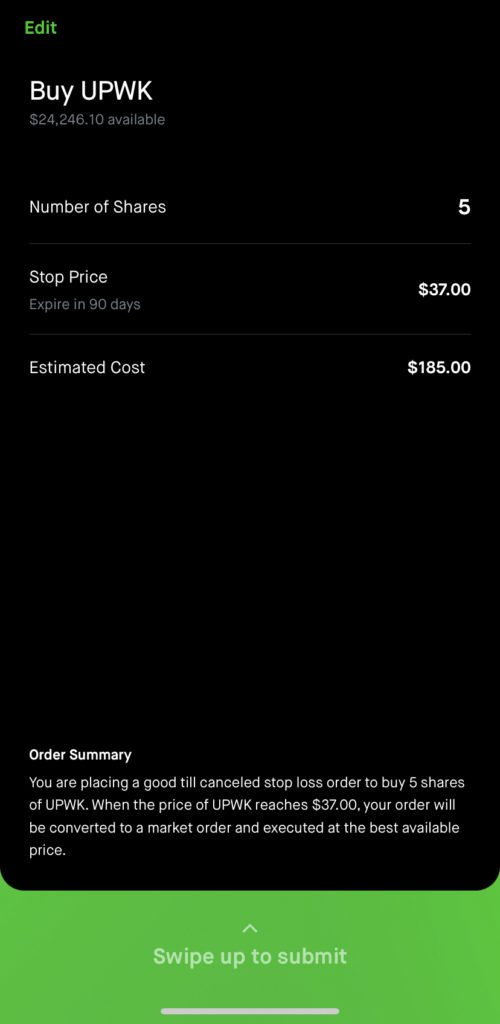

Step 6. On the ‘Set Stop Price’ screen, enter a price (higher than current market price) at which you want the buy order to be triggered, for example $37.

On the ‘Set Stop Price’ screen, enter a price (higher than current market price) at which you want the buy order to be triggered, for example $37.

Step 7. Set a validity period for the order to remain in force.

Set a validity period for the order to remain in force.

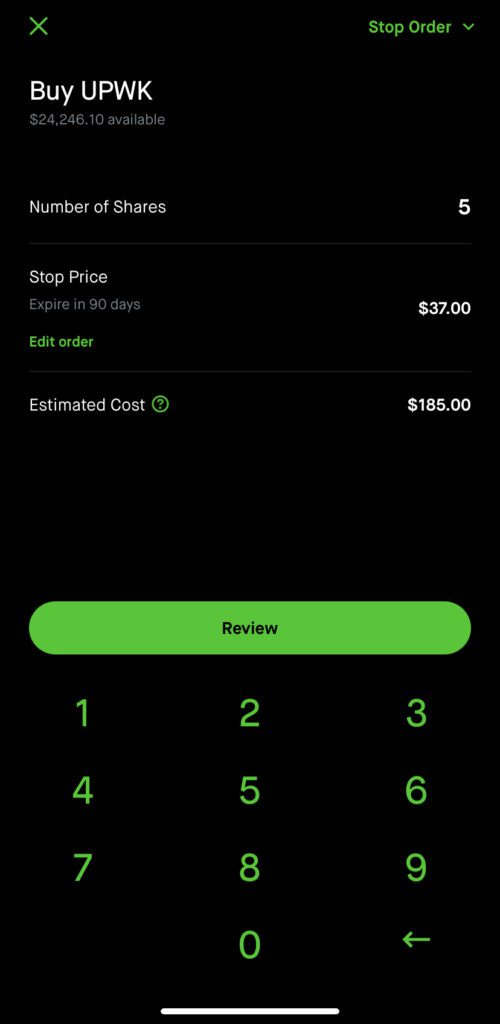

Step 8. Enter number of shares you want to purchase.

Enter number of shares you want to purchase.

Step 9. Hit review and swipe up to submit your order.

Hit review and swipe up to submit your order.

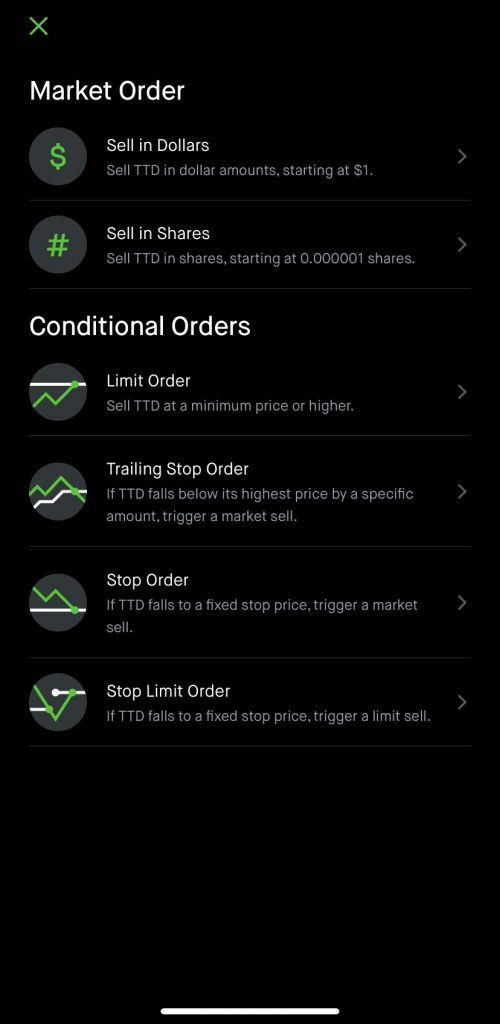

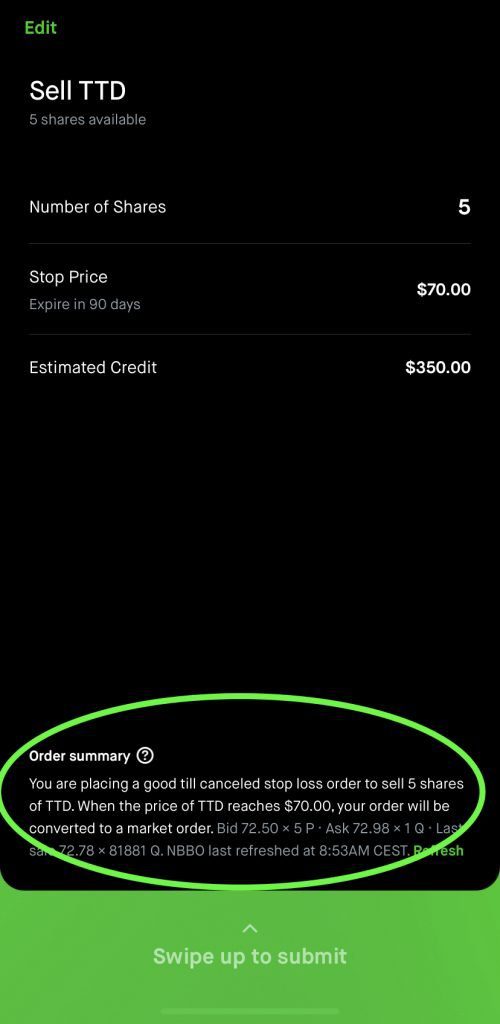

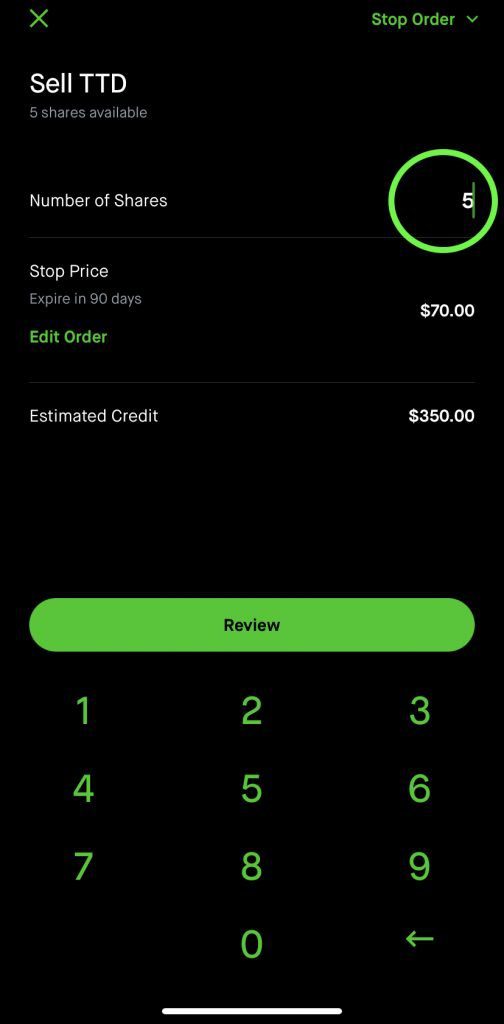

Robinhood Conditional Order – Stop Loss (Sell) Order on Robinhood (step-by-step)

Use steps 1-4 from section above.

Step 5. After Choosing ‘Sell’ initially in Step 2, Pick option 5 ‘Stop Order’ in the Conditional Orders section.

Pick option 5 ‘Stop Order’ in the Conditional Orders section.

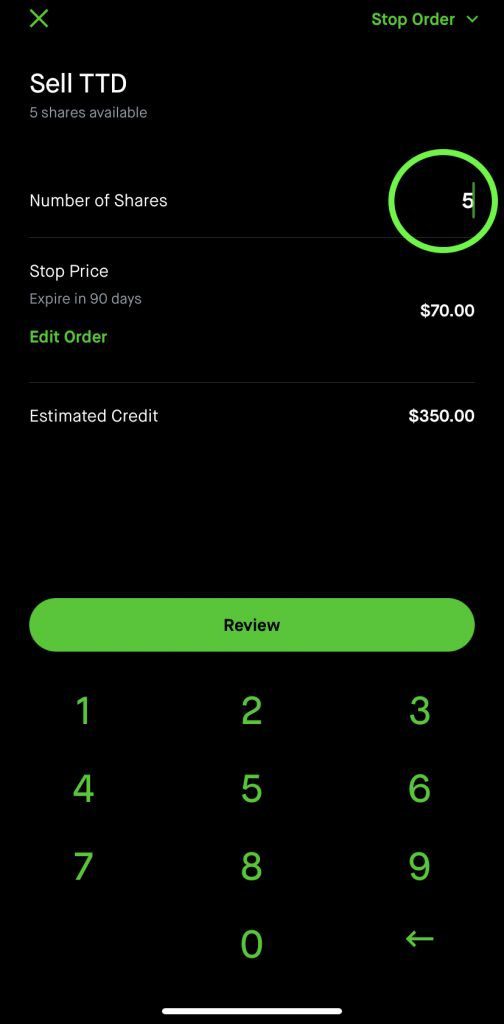

Step 6. On the ‘Set Stop Price’ screen, enter a price (lower than current market price) at which you want the sell order to be triggered, for example $70.

On the ‘Set Stop Price’ screen, enter a price (lower than current market price) at which you want the sell order to be triggered, for example $70.

Step 7. Set a validity period for the order to remain in force.

Set a validity period for the order to remain in force.

Step 8. Enter number of shares you want to sell.

Enter number of shares you want to sell, for e.g.,5 shares.

Step 9. Hit review and swipe up to submit your order.

Hit review and swipe up to submit your order.

Read order summary to make sure it makes sense to you. Here it reads “when the price of TTD reaches $70.00, your order will be converted to a market order”. This makes sense because we want the stop loss (sell) order to be triggered if the stock price falls to $70.

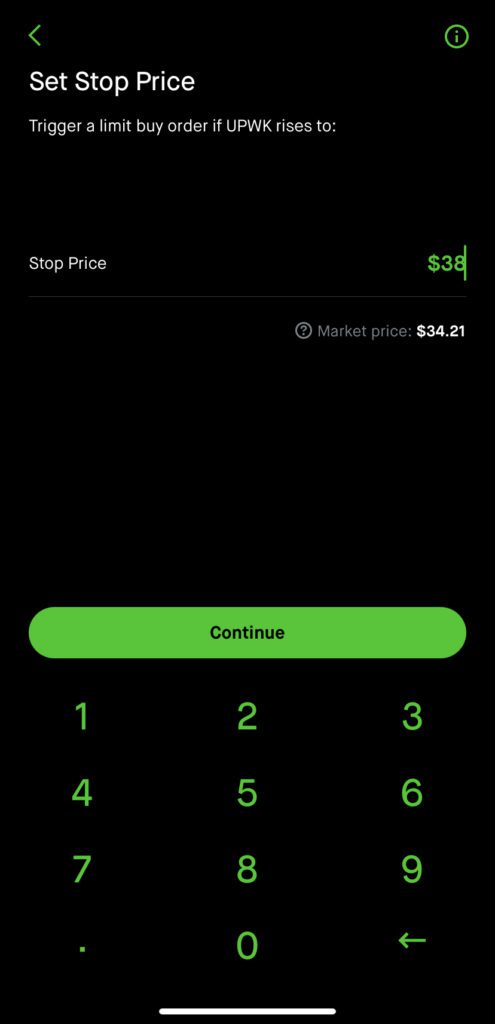

Robinhood Conditional Order – Stop Limit Buy Order on Robinhood (step-by-step)

Step 5. After Choosing ‘Buy’ initially in Step 2, Pick Option 6 ‘Stop Limit Order’ in the Conditional Orders section.

Pick option 6 ‘Stop Limit Order’ in the Conditional Orders section.

Step 6. Robinhood shows visualization to help understand how stop limit order works.

Robinhood shows visualization to help understand how stop limit order works.

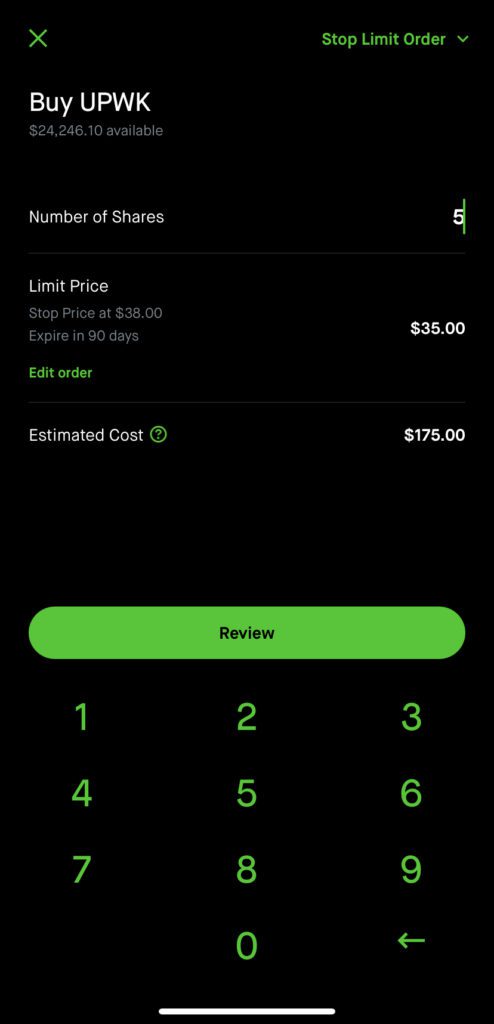

Step 7. On the ‘Set Stop Price’ screen, enter a price (higher than current market price) at which you want the buy order to be triggered, for example $38.

On the ‘Set Stop Price’ screen, enter a price (higher than current market price) at which you want the buy order to be triggered, for example $38.

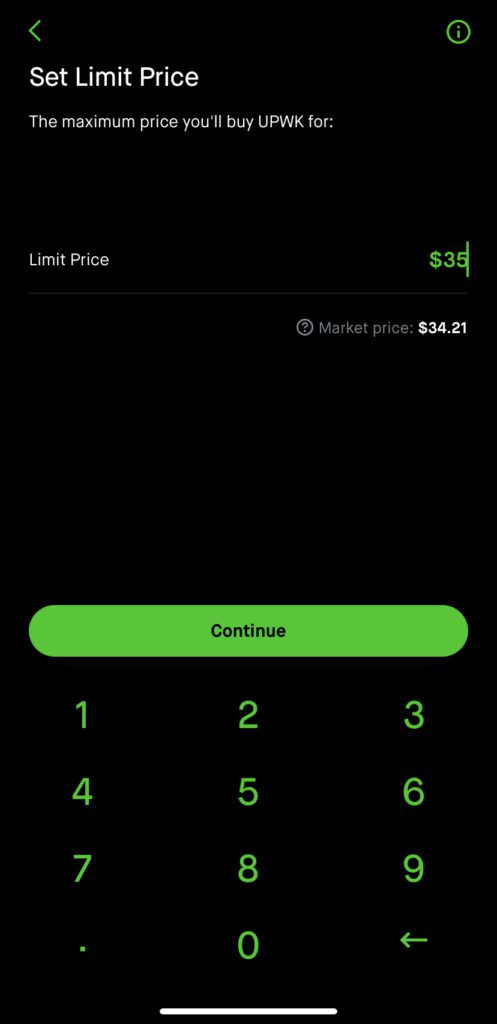

Step 8. After setting the stop price, you would be prompted to set a limit price as well i.e. the maximum you are willing to pay per share.

In theory, when the stock price will hit the ‘stop price’ or the trigger point at $38, your limit order of buying the stock at $35 will become active.

After setting the stop price, you would be prompted to set a limit price as well i.e. the maximum you are willing to pay per share.

In theory, when the stock price will hit the ‘stop price’ or the trigger point at $38, your limit order of buying the stock at $35 will become active.

Step 9. Set a validity period for the order to remain in force.

Set a validity period for the order to remain in force.

Step 10. Enter number of shares you want to purchase. Hit review and swipe up to submit your order.

Enter the number of shares you want to purchase. Hit review and swipe up to submit your order.

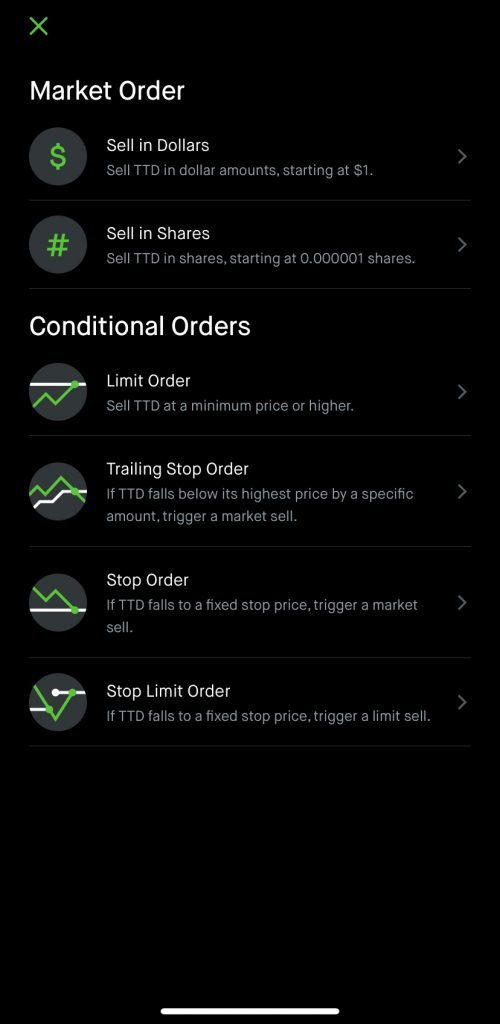

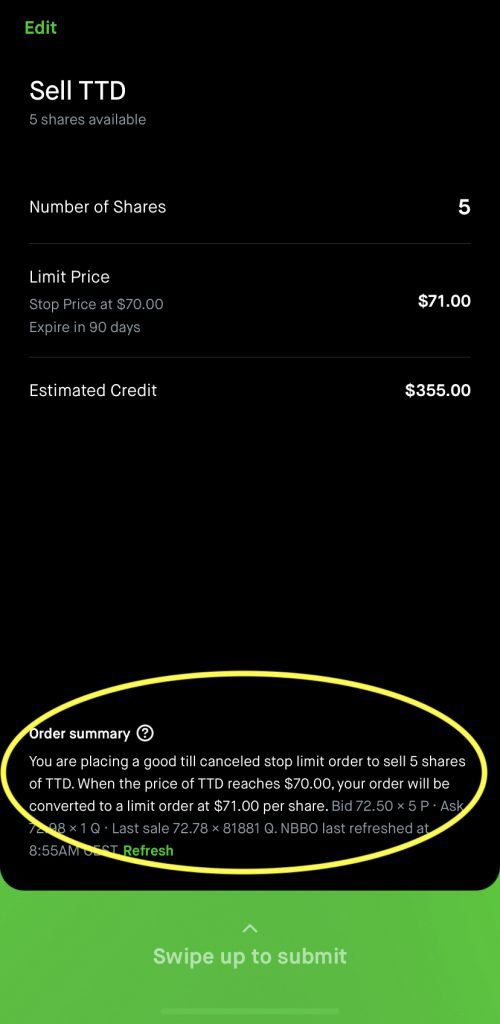

Robinhood Conditional Order – Stop Limit Sell Order on Robinhood (step-by-step)

Step 5. After Choosing ‘Sell’ initially in Step 2, Pick Option 6 ‘Stop Limit Order’ in the Conditional Orders section.

Pick option 6 ‘Stop Limit Order’ in the Conditional Orders section.

Step 6. On the ‘Set Stop Price’ screen, enter a price (lower than current market price) at which you want the sell order to be triggered, for example $70.

On the ‘Set Stop Price’ screen, enter a price (lower than the current market price) at which you want the sell order to be triggered, for example, $70.

Step 8. After setting the stop price, you would be prompted to set a limit price as well i.e. the minimum you are willing to sell the shares for.

In theory, when the stock price will hit the ‘stop price’ or the trigger point at $70, your limit order of selling the stock at $71 will become active.

After setting the stop price, you would be prompted to set a limit price as well i.e. the minimum you are willing to sell the shares for.

In theory, when the stock price will hit the ‘stop price’ or the trigger point at $70, your limit order of selling the stock at $71 will become active.

Step 9. Set a validity period for the order to remain in force.

Set a validity period for the order to remain in force.

Step 10. Enter number of shares you want to sell. Hit review.

Enter the number of shares you want to sell. Hit review.

Step 11. Review the Order and Swipe Up to Place the Order.

Review the Order and Swipe Up to Place the Order.

Here the Order Summary says “When the price of TTD reaches $70, your order will be converted to a limit order at $71 per share”. This is what we wanted to do, trigger a limit sale order when the stock price falls to $70, but the minimum we are willing to sell the shares for is $71/share. So, in case the stock falls to $70 and recovers a bit back up to $71, the limit sell order will sell our shares for $71 each.

So, now we have covered how to place all the six different stock order types on Robinhood.

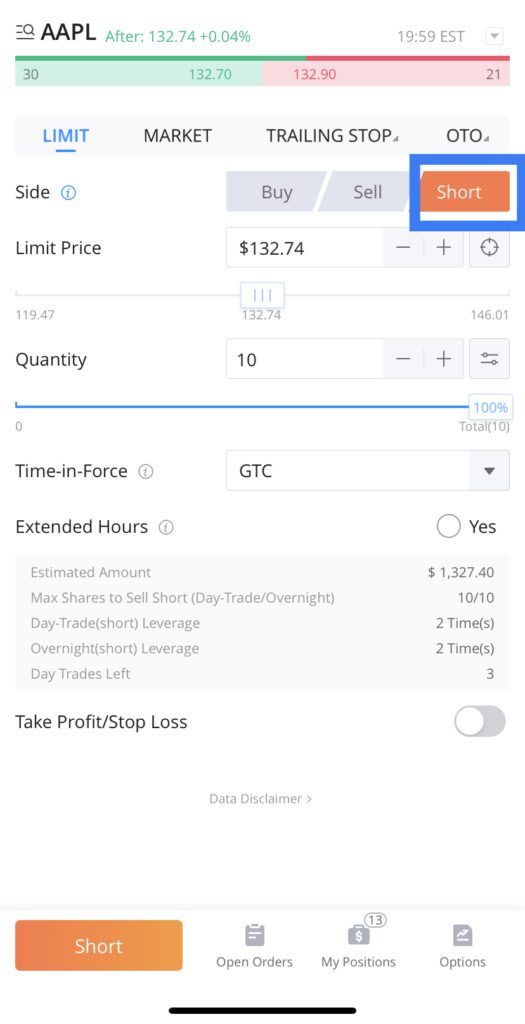

WeBull Stock Order Types

Stock Order Types on WeBull

Webull offers investors a single-screen interface to choose a buy or sell order, choose the type of order (limit, market, stop, trailing stop, stop limit, etc.). Webull even offers the ‘short’ selling feature wherein an investor can sell a stock without owning it (i.e. borrow from a broker and sell it) and buy at a later point when the price falls. Since ‘shorting’ or ‘short selling’ is riskier, we recommend beginners and intermediates to stay away from the ‘short’ selling order type (unless they fully understand the risks).

WeBull Order Types Available to Investors

- Market Order (Buy, Sell, Short)

- Limit Order (Buy, Sell, Short)

- Stop Order (Buy, Sell, Short)

- Stop Limit Order (Buy, Sell, Short)

- Trailing Stop (Buy, Sell, Short)

- OTO – One Triggers the Others (not covered in this article)

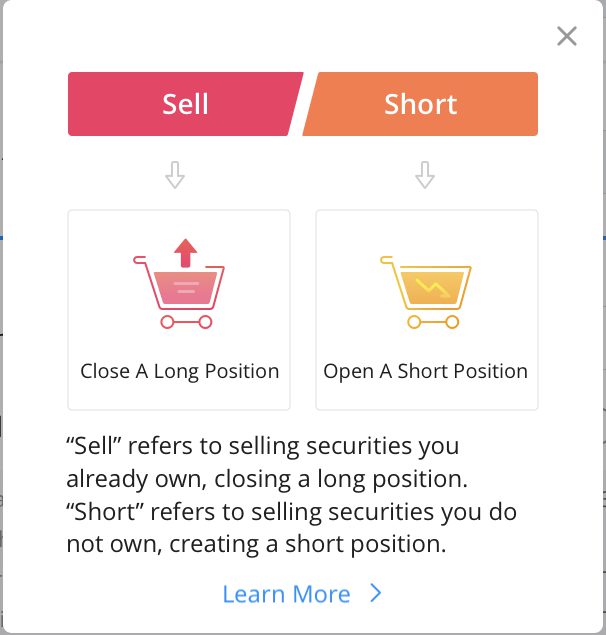

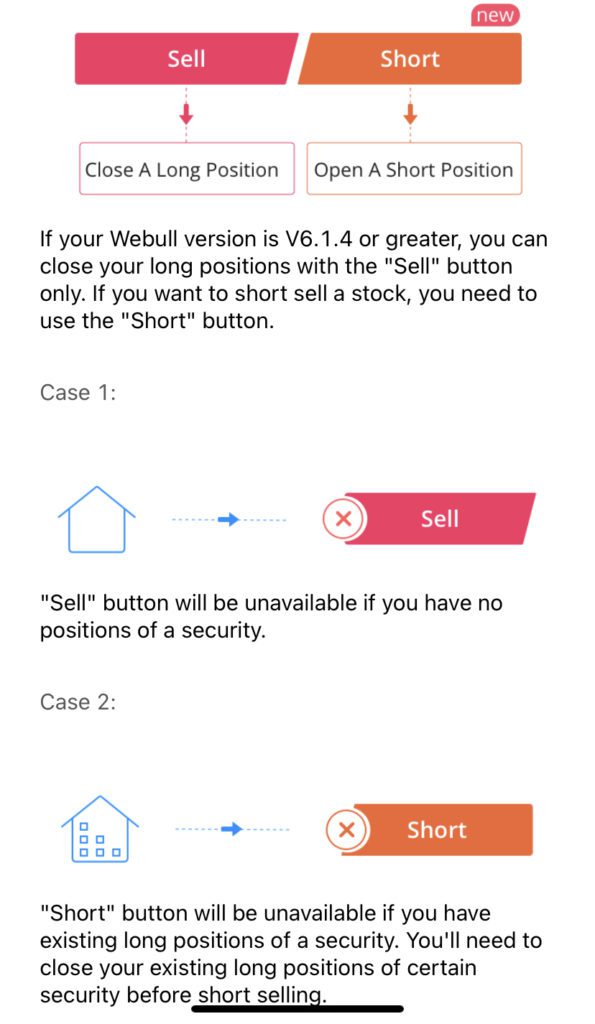

WeBull Conditional Order: Short Selling on Webull

We recommend beginners to stay away from shorting stocks until they grasp the concept and understand the risks fully. However, let’s quickly understand how shorting works on WeBull.

We recommend beginners to stay away from shorting stocks until they grasp the concept and understand the risks fully.

Let’s take a look at Short Selling or Shorting stocks. The main difference between regular selling and ‘short selling’ is the following:

- Sell: You sell stocks you own i.e. you close a long position.

- Short: You don’t own the stock. You borrow the stocks from the broker and sell it in order to buy it at a later time at a lower price (i.e. you’re betting the price will go down so your trade becomes profitable)

Read also: Short Story on GameStop

Difference between the ‘Sell’ and ‘Short’ orders

- Sell: You sell stocks you own i.e. you close a long position.

- Short: You don’t own the stock. You borrow the stocks from the broker and sell it in order to buy it at a later time at a lower price (i.e. you’re betting the price will go down so your trade becomes profitable)

Webull has introduced a new button ‘Short’ to distinguish it from the ‘Sell’ button. Earlier the ‘Sell’ button was used for shorting the stocks as well.

This is a good design change to make users aware whether they are selling stocks they own or accidentally shorting the stocks (i.e. borrowing from broker and selling it).

If you are bearish on a stock, an alternative to short-selling, also my preferred method, is buying a put option.

Read more about put options here.

Further reading: Straddle vs Strangle Options, Bear Put vs Bull Put Spread, Bear Call vs Bull Call Spread, Options Trading Levels, Stock Options Strategies, Options Greeks Cheat Sheet

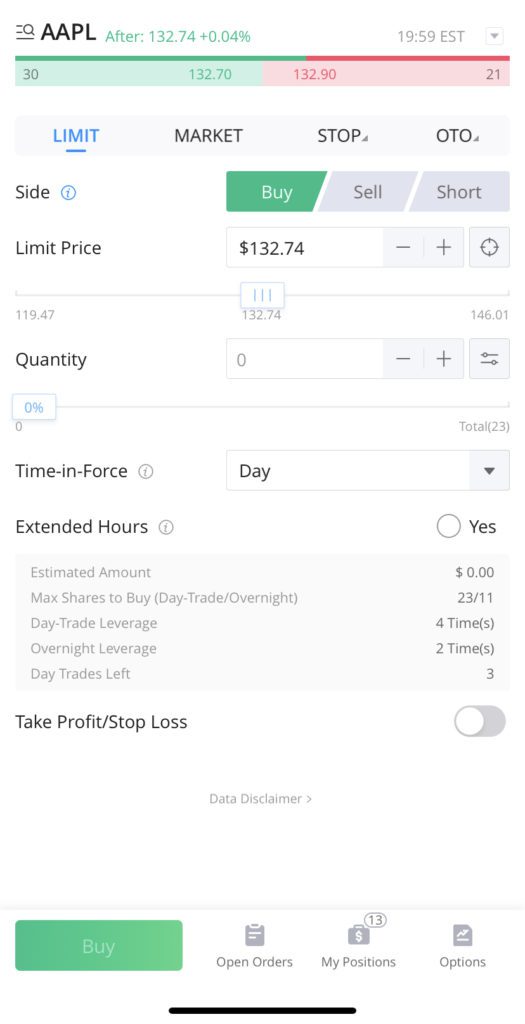

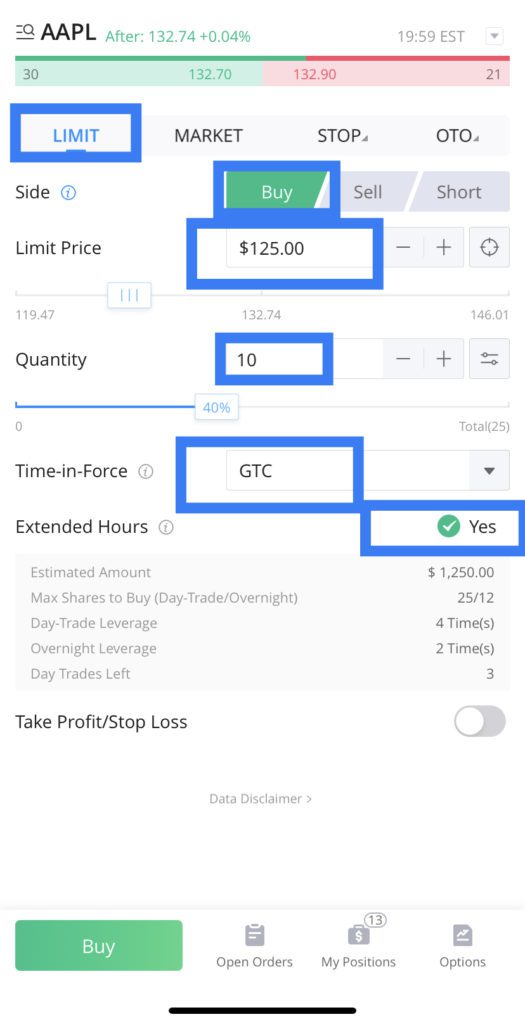

WeBull Conditional Order: Limit Buy Order on Webull

Placing a Limit Buy order on Webull is fairly simple.

- Select ‘Limit’ from the top bar

- Select ‘Buy’ as the ‘Side’

- Set a limit price you are willing to pay for the stock

- Enter quantity i.e. no of shares (Webull does not allow buying partial shares yet, however, Robinhood allows partial shares.)

- Select the order’s time in force

- Pick whether you want order to be executed during extended hours as well

Webull’s single screen order placement may seem overcrowded at first, but once you understand the fields, it is very convenient to place orders on Webull.

How to Place a Limit Buy Order on WeBull

- Select ‘Limit’ from the top bar

- Select ‘Buy’ as the ‘Side’

- Set a limit price you are willing to pay for the stock

- Enter quantity i.e. no of shares (Webull does not allow buying partial shares yet, however Robinhood allows partial shares.)

- Select the order’s time in force

- Pick whether you want order to be executed during extended hours as well

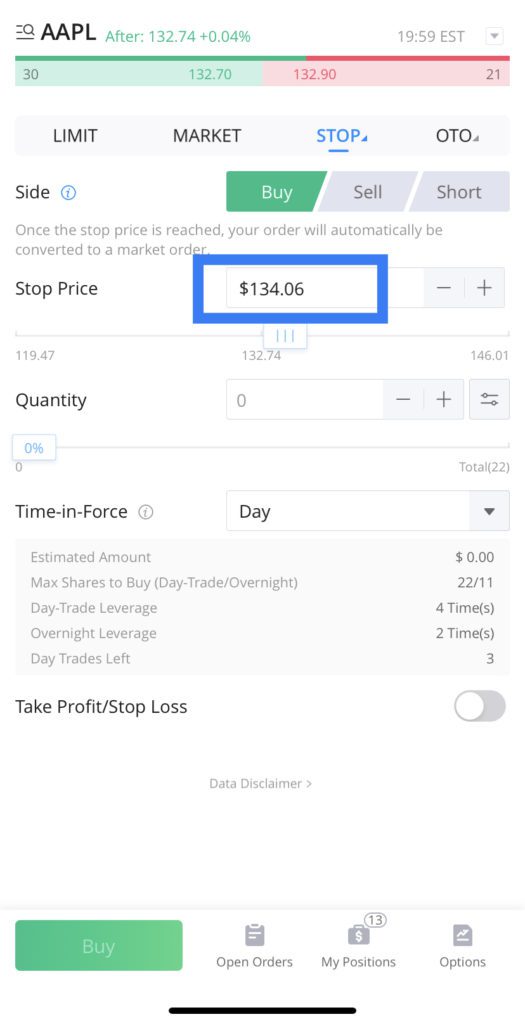

WeBull Conditional Order: Stop Buy Order on WeBull

- Select ‘Stop’ on the top bar

- Choose the side as ‘Buy’

- Set a ‘Stop Price’

- Enter quantity

- Select Time in Force

How to Place Stop Buy Order on WeBull

- Select ‘Stop’ on the top bar

- Choose the side as ‘Buy’

- Set a ‘Stop Price’

- Enter quantity

- Select Time in Force

WeBull Order Types: Accessing ‘Stop Limit’ and ‘Trailing Stop’ Orders on WeBull

In addition to the ‘Stop’ order, you can access the Stop Limit and Trailing Stop order types by clicking on the small blue arrow next to ‘Stop’ on the top bar.

In addition to the ‘Stop’ order, you can access the Stop Limit and Trailing Stop order types by clicking on the small blue arrow next to ‘Stop’ on the top bar.

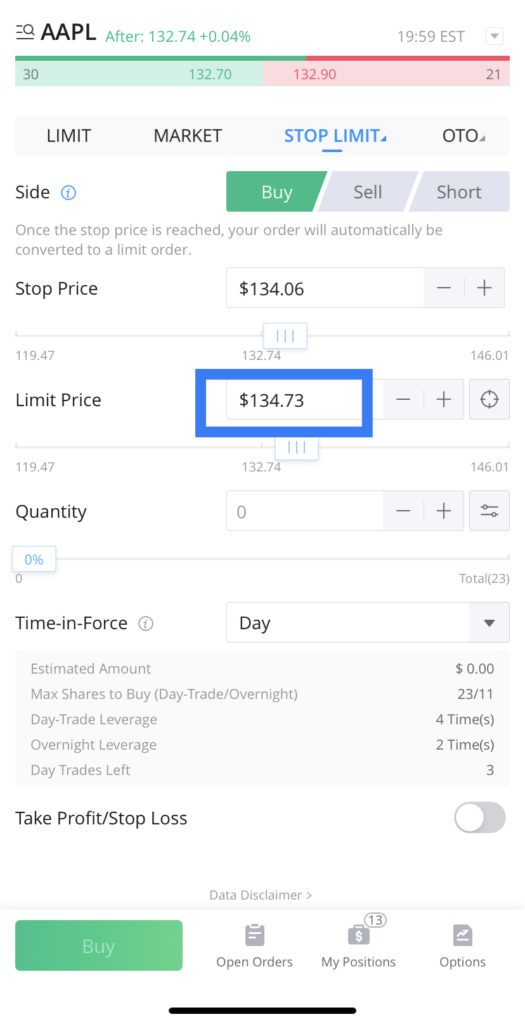

Webull Conditional Order: Stop Limit Order on WeBull

How to place a Stop Limit Order on WeBull

- Click on blue arrow next to ‘Stop’ on the top bar and choose ‘Stop Limit’ from the drop-down menu.

- Choose the side as ‘Buy’

- Set a ‘Stop Price’

- Set a ‘Limit Price’

- Enter quantity

- Select Time in Force

How to place a Stop Limit Order on WeBull

- Click on blue arrow next to ‘Stop’ on the top bar and choose ‘Stop Limit’ from the drop-down menu.

- Choose the side as ‘Buy’

- Set a ‘Stop Price’

- Set a ‘Limit Price’

- Enter quantity

- Select Time in Force

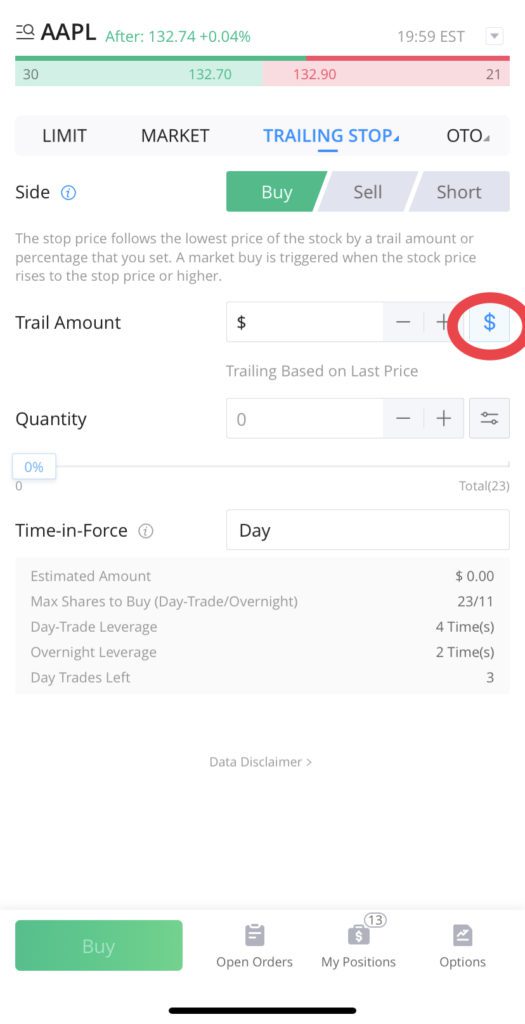

WeBull Conditional Order: Trailing Stop Order on WeBull

- Click on blue arrow next to ‘Stop’ on the top bar and choose ‘Trailing Stop’ from the drop-down menu.

- Choose the side as ‘Buy’

- Set a ‘Trail Amount’ or ‘Trail Percentage’

You can toggle the options between ‘Trail Amount’ and Trail Percentage’ by clicking on the icon on the right side of the data input field.

- Enter quantity

- Select Time in Force

How to place a Trailing Stop Order on WeBull

- Click on blue arrow next to ‘Stop’ on the top bar and choose ‘Trailing Stop’ from the drop-down menu.

- Choose the side as ‘Buy’

- Set a ‘Trail Amount’ or ‘Trail Percentage’

You can toggle the trailing options between ‘Trail Amount’ and Trail Percentage’ by clicking on the icon on the right side of the data input field.

- Enter quantity

- Select Time in Force

WeBull Trailing Stop Loss Order

Similar to placing the trailing stop BUY order explained above, you can place a trailing stop loss order on Webull as well.

- Click on blue arrow next to ‘Stop’ on the top bar and choose ‘Trailing Stop’ from the drop-down menu.

- Choose the side as ‘SELL’

- Set a ‘Trail Amount’ or ‘Trail Percentage’

You can toggle the options between ‘Trail Amount’ and Trail Percentage’ by clicking on the icon on the right side of the data input field.

- Enter quantity

- Select Time in Force

We have covered multiple stock order types available on WeBull and hope that you would strategically use them to your advantage while investing.

Most of these order types are available on popular trading apps Robinhood and WeBull.

Also, read our feature by feature analysis of the

Best Investment Apps.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents