This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

An average American has 4 credit cards. With credit cards being an indispensable part of our life, it is of utmost importance to understand how to manage credit and credit cards the right way. By being responsible and aware of the credit card mistakes to avoid, one can ensure a healthy credit score and a good financial life. In this article, we will discuss the 8 common credit card mistakes to avoid for beginners.

Common Credit Card Mistakes To Avoid

Even if you are a seasoned credit card user, make sure you are keeping a tab on all 8 mistakes and are avoiding them consistently.

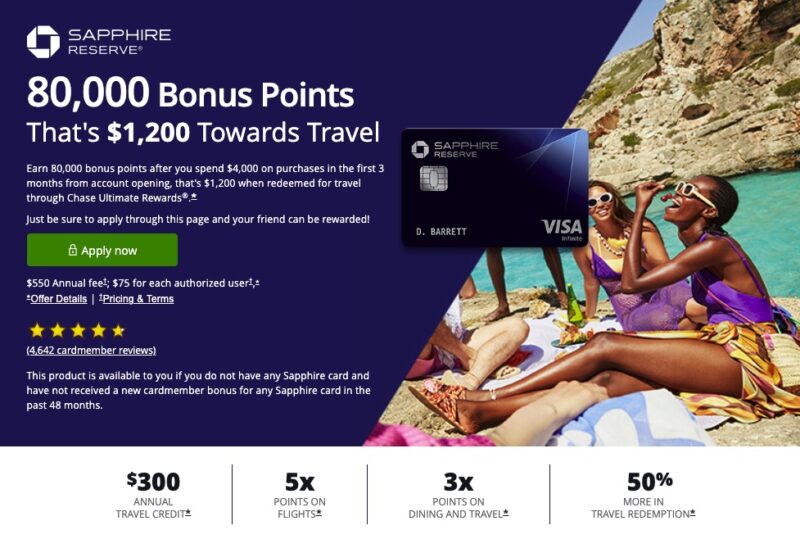

Mistake 1: Paying the Annual Fee for “Prestige” Rather Than Value

Many credit cards come with an annual fee, and typically they bring some value for the user against the annual fee. Every person is unique and has a unique lifestyle, so the value of the credit card will be very different for different people. Let’s say a card has great rewards for air travel – it has tremendous value for people who fly a lot, and not so much value for people who don’t.

So, if you are paying an annual fee for a credit card, make sure you get enough value out of it, rather than just holding it for the ‘prestige’ factor.

Avoid making one of the common credit card mistakes of paying the annual fee on a card you don’t need.

Chase Sapphire Reserve Offer

Mistake 2: Making Unnecessary Purchases to Earn Reward Points

Okay, reward points are great, but do not chase reward points to a point where you start justifying unnecessary purchases “because I earn points on them!”

Even if you get 5% points on every purchase, if you buy a $100 item to get that 5% reward, you are basically overspending $95, unnecessarily!

Avoid making one of the common credit card mistakes of chasing reward points blindly.

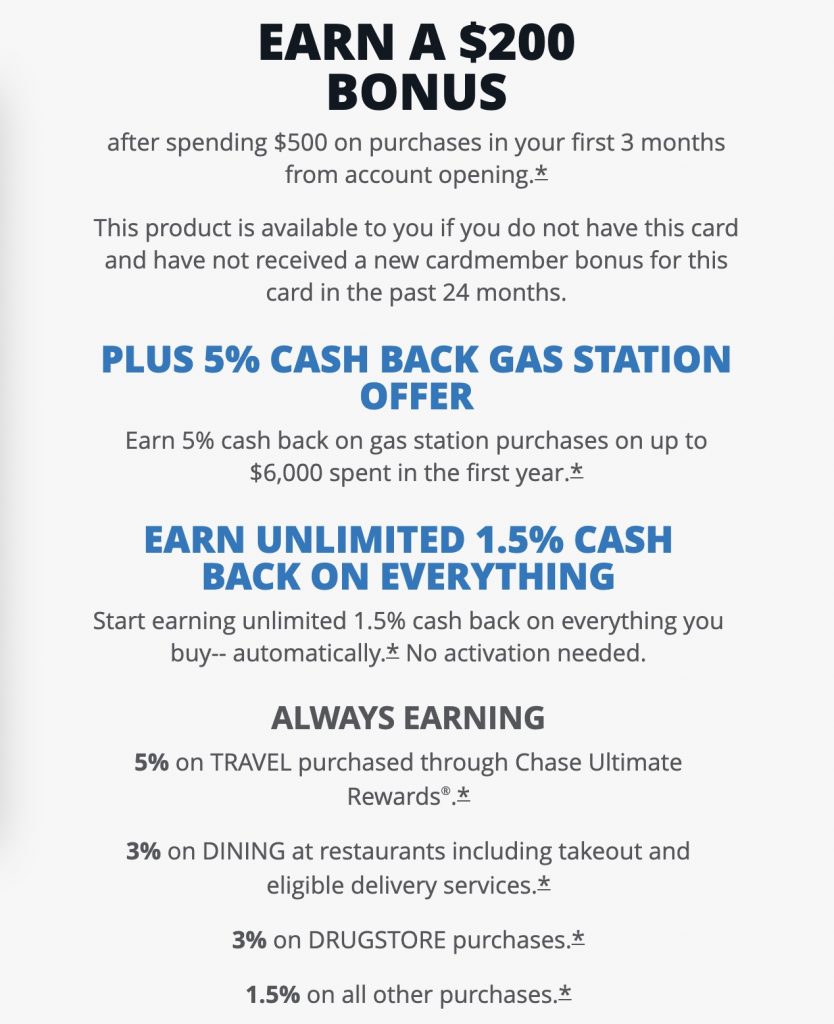

Mistake 3: Paying for Additional Credit Cards With Redundant Benefits

In America, people carry 4 credit cards on average. That’s not necessarily a bad thing if you manage your cards well. One credit card mistake to avoid, however, is to not pay the annual fees on two separate credit cards that offer similar redundant benefits. For example, if you can get lounge access at airports using one card, why pay the annual fee for another card that gives you the same benefit?

Mistake 4: Getting Late on Your Credit Card Statement Balance Payment

There’s no glory in getting late on your credit card payments. The credit card company will slap penalties and interest for sure. They can even increase your interest rate on the credit card in the future because of your ‘bad’ credit behavior.

It can even hurt your credit score, making matters worse on all your other loans and credit cards in the future.

So, avoid making the credit card mistake of being late on credit card payments.

Set up an autopay to make payments before the due date, and also set a reminder to check and make sure the payments are processed successfully.

Mistake 5: Carrying a Balance at High Interest Rates

Credit card interests are notoriously high. 16%, 20%, 25% – it can get crazy very quickly. Do not carry a balance on your credit card if you have to pay such high interest rates. Even stock market returns are not so high. There is practically nothing that can beat a credit card interest rate consistently. So, the best return on your money is to ensure you pay your credit card balance in full, every month, so you never carry a credit card balance.

Avoid making one of the common credit card mistakes of carrying a balance on a high interest credit card (which is – mostly all credit cards).

Bestseller Personal Finance Books

Mistake 6: Overutilizing Your Credit Limit

Another mistake to avoid is having a high credit limit utilization – for example, your credit card has a limit of $1000, and the maximum you want to use of that limit is 30%, i.e. $300 in a month.

$300 out of the $1000 credit limit makes your credit card utilization 30%. And for building a good credit history, you must keep this credit card utilization below 30% at all times.

In fact, you should try and keep it around 10%. By showing good, responsible credit behavior, you can even get a credit limit increase in the future.

Avoid making the common mistake of believing that you can use up to the full credit limit. Well, technically you can, but it is not great for building a good credit history.

Another way of lowering your credit card utilization rate is by adding more credit cards and keeping a very low balance on them. This way the available credit limit increases, hence making the overall credit card utilization rate lower.

CHASE FREEDOM UNLIMITED OFFER

Mistake 7: Taking Cash Advances on Your Credit Card

Many credit cards come with the option of “cash advance” – basically, you can go to an ATM and withdraw cash using your credit card. That is NOT a good idea.

Cash advances have fees (say 5% of the cash withdrawn) and high interest rates (generally more than 20%) because you are technically borrowing cash from the credit card company!

If you really need to borrow cash for a personal reason, a personal loan is a much better option.

Avoid making the mistake of believing that a credit card is the same as a debit card when it comes o withdrawing cash.

Mistake 8: Cycling Credit

This is not talked about often but is a very important mistake to avoid.

Suppose you have a credit card with a limit of $1000, and your credit card statement cycle is from the 1st to the 30th of the month.

On the first day, you buy an iPhone for $1000 using your credit card, the available credit limit becomes $0.

But let’s say after a couple of days, you pay the credit card balance. Now you have the full $1000 credit limit available again.

After a week, you purchase a MacBook Air worth $800, and the available credit limit now becomes $200. You pay off the balance again the next day, and the credit limit becomes $1000 again.

So, you are making a purchase, and paying it off – what can go wrong here?

There is one major problem here: you have used $1800 credit within one statement cycle, while your credit limit is $1000.

When card issuers allowed a certain credit limit on your card, they assumed you would use up to a maximum of that limit in a month. But, by using credit and paying it off multiple times in a month, you are able to artificially raise your credit limit beyond $1000.

That can raise a red flag, and some users have reported that their credit cards got closed because of that!

So, avoid making the credit card mistake of cycling credit!

Conclusion

We hope the list of common credit card mistakes is useful for beginners and advanced users alike. By avoiding these mistakes, you can be sure to progress towards a healthy and secure financial life.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents