This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Now that we are in the first week of 2022, let’s review the Stock Performance of some popular groups of stocks for the year 2021. We will take a look at established stocks such as Microsoft, Facebook (Meta), Apple, Amazon, Netflix, Google (Alphabet), Tesla, Shopify, Activision Blizzard, Nvidia, Disney. We track the performance of these 11 stocks in two groups as described below.

- MFAANG – Microsoft, Facebook (Meta), Apple, Amazon, Netflix, Google (Alphabet)

- STAND – Shopify, Tesla, Activision Blizzard, Nvidia, Disney

Stock Performance: MFAANG (Microsoft + FAANG)

The MFAANG consists of the following stocks:

- Microsoft

- Facebook (Meta)

- Apple

- Amazon

- Netflix

- Google (Alphabet)

With the name changes and restructuring from Facebook to Meta, and Google to Alphabet, should we not find a new name for the group? How about keeping NAMAAM as a placeholder, until someone comes up with a better one?

Microsoft (MSFT) Stock Performance

One of the very early technology and software companies, Microsoft has shown promising results in the recent few years. This software giant has exceeded a market capitalization of $2.5 Trillion as of writing this article in the first week of January 2022.

Microsoft reports its earnings numbers in three segments Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. The earnings are well spread across all three segments, making Microsoft a well-balanced company.

The Microsoft Stock grew 54% in the year 2021. The software giant has crushed the market returns in 2021.

Amazon (AMZN) Stock Performance

The e-commerce giant and a leading cloud services provider, Amazon, has experienced exceptional year-over-year growth for the last two decades. As of writing this article, the market capitalization of Amazon stock is about $1.7 Trillion.

Amazon reports its earnings numbers in three segments North America, International, and AWS. The earnings report shows that the most profitable segment for Amazon is clearly the AWS or Amazon Web Services. AWS is a dominant player in the cloud solutions space, even though it keeps getting challenged continuously by other technology companies such as Alphabet (Google Cloud) and Microsoft (Azure).

The Amazon stock grew about 5% in the year 2021. While 5% may seem underwhelming, it is important to that the AMZN stock had returned about 60% in the previous year, 2020.

Apple (AAPL) Stock Performance

The company that revolutionized the mobile phone market with their flagship product – the iPhone, has been a darling of investors big and small for many years now. The legendary investor Warren Buffett believes in the Apple stock so much that his fund Berkshire Hathaway (BRK.A) has more than 40% of its money in the AAPL stock! Apple stock recently crossed $3 Trillion market capitalization mark, the first company in the world to do so.

Apple reports its earnings in the following categories:

- iPhone

- Mac

- iPad

- Wearables, Home and Accessories

- Services

iPhone clearly is the leading source of income for Apple, but ‘Services’ is rising quickly and is the 2nd biggest source of income currently. As of the latest quarterly earnings, net sales through ‘Services’ is already more than that through ‘iPad’ and ‘Mac’ categories, combined.

The Apple stock grew 37% in the year 2021.

Alphabet – Google’s Parent Organization (GOOG) Stock Performance

If you are on the internet, you know Google. If you can’t find some information, you Google it! Google has been a dominant player in the internet search space for almost two decades now. The company reshuffled and restructured and is now a group of companies under the umbrella of the parent organization Alphabet. Google still remains the flagship subsidiary of Alphabet, and the Alphabet stock is still synonymous with the Google stock. The Alphabet stock’s ticker symbol remains GOOG as well.

Alphabet reports earnings in the following segments:

Bestseller Personal Finance Books

- Google Services – includes Google Search, Youtube ads and other Google network revenue.

- Google Cloud

- Other Bets – includes operating segments such as CapitalG, Waymo, X, and more.

Google Services remains the main source of operating income for Alphabet. The ‘Google Cloud’ segment and ‘Other Bets’ were not profitable in the latest quarterly earnings.

The Alphabet (Google) stock grew 68% in the year 2021.

Meta Platforms – Facebook’s and Instagram’s Parent Organization (FB) Stock Performance

The Facebook Company is now restructured and rebranded as Meta, with an aim to bring the immersive ‘metaverse’ experience to more and more people, under a common brand name. Meta owns the popular social media platforms Facebook and Instagram, and also owns the popular Instant Messaging application ‘Whatsapp’. The company is looking to expand further in the world of Virtual Reality and Augmented Reality as it builds its own metaverse ecosystem. The restructure and rebranding aims to reflect that vision. Meta retains its earlier stock ticker symbol FB.

Meta (FB) earnings primarily come from advertisement revenue.

The Meta Stock (FB) grew by 25% in the year 2021.

Netflix (NFLX) Stock Performance

Netflix has been the go-to option for cord-cutters who are switching from traditional cable TV for many years. With high-quality Netflix Original (and Netflix exclusive) shows, Netflix has been able to keep the subscribers engaged and motivated to keep paying for the streaming services. While the company’s dominant position is being challenged by other competitors such as Disney, Netflix still remains a force to reckon with. The current market cap of NFLX stock is about $250 Billion.

Netflix’s (NFLX) earnings primarily come from subscription revenue.

The Netflix Stock (NFLX) grew by 15% in the year 2021. While 15% growth may not seem mind-blowing for a FAANG stock, it is important to note that NFLX stock grew 54% in the previous year, 2020.

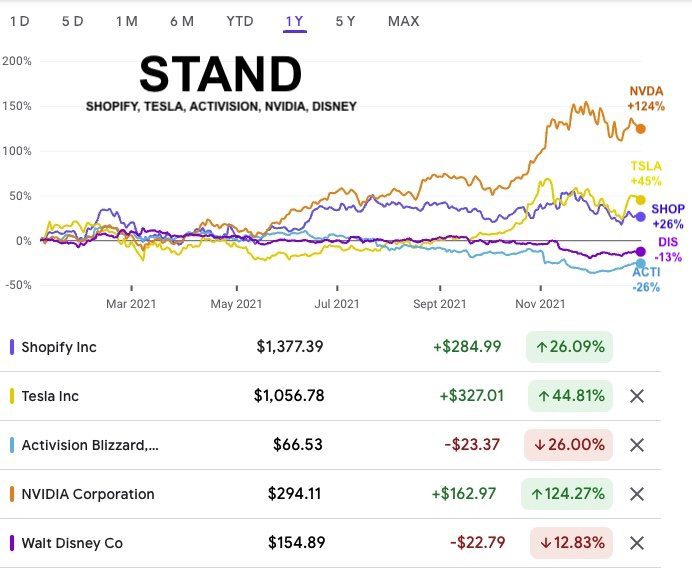

Stock Performance: STAND

STAND is an acronym I use for the group of stocks Shopify, Tesla, Activision Blizzard, Nvidia, and Disney. Let’s see how these stocks performed in the year 2021.

Shopify (SHOP) Stock Performance

Shopify has democratized the e-commerce space. With easy to use interface and reasonable subscription-based pricing (plans starting at $29/month), anyone can open an online store to sell their products and services. Shopify, along with some apps on the Shopify marketplace, takes care of website hosting, product inventory management, marketing, discount coupons, and payment processing integration. All of this simplifies the administrative tasks for new (and even established) business owners. With the surge in online shopping trends, Shopify has seen its position solidify in the market. The current market cap of the SHOP stock is about $170 Billion.

Shopify (SHOP) earnings primarily come from subscription revenue and merchant solutions.

The Shopify Stock (SHOP) grew by 26% in the year 2021. This growth comes in on top of the stellar 136% growth in the previous year, 2020.

Tesla (TSLA) Stock Performance

Tesla is an American company that primarily makes Electric Vehicles, energy storage solutions, and solar panels. It goes beyond just making cars that run on battery power (instead of burning fuel), they have built cars with a certain level of autonomous driving capabilities and aim to achieve widespread availability of ‘Full Self Driving’ capabilities in their cars. Their production models – S, 3, X, Y are available in the market for consumers to buy, while the company plans to launch a ‘CyberTruck’ model in the next few months (expected in 2022 itself) to compete in the pickup & SUV segment as well.

Tesla (TSLA) is a $1.2 Trillion stock, the first and only auto company to achieve this market capitalization.

In a recent press release, Tesla said that a record 936,172 Tesla vehicles were delivered in the year 2021, out of which 308,600 were delivered in Q4 of 2021 (October 1, 2021 – December 31, 2021). Most models delivered were Model 3 and Model Y (Tesla has reported deliveries of model 3 and model Y combined).

The Tesla Stock (TSLA) grew by 45% in the year 2021. This is on top of the explosive 510% growth in the year 2020.

Activision Blizzard (ATVI) Stock Performance

Activision Blizzard creates interactive gaming experiences. They have built games such as Candy Crush™, Call of Duty®, and World of Warcraft® to Overwatch®, Hearthstone®, and Diablo®. If metaverse becomes mainstream, and more and more people enjoy experiences in a virtual world, Activision could leverage the trend and become a strong player in the market.

Activision Blizzard (ATVI) stock has a $52 Billion market capitalization.

The Activision Blizzard Stock (ATVI) fell by 26% in the year 2021. This is a pullback after the 57% growth in the year 2020.

NVIDIA (NVDA) Stock Performance

Nvidia Corporation is a multinational technology company based in Santa Clara, California. It designs graphics processing units (GPUs). The GPUs are widely used in the gaming market, and can also be used in the automotive market. NVIDIA GPUs have also been used to mine bitcoins earlier.

NVIDIA (NVDA) stock has a $750 Billion market capitalization.

The NVIDIA Stock (NVDA) grew by 124% in the year 2021.

Disney (DIS) Stock Performance

The Walt Disney Company, commonly known as ‘Disney’, is a multinational entertainment and media conglomerate headquartered in Burbank, California. The company makes revenue from two segments

- Disney Media and Entertainment Distribution

- Disney Parks, Experiences and Products

While the COVID pandemic has definitely hurt the company’s parks and experiences business, subscriptions such as Disney+, ESPN+, and Hulu could prove to be strong competitors in the media streaming industry, challenging Netflix and other players.

The Walt Disney Company (DIS) stock has a $285 Billion market capitalization.

The Disney Stock (DIS) fell by 13% in the year 2021.

Want to Level Up Your Stock Buying and Selling Experience? Check out my course on SkillShare.

New Users Get 30 Day FREE Access using the referral link

Disclosure: We have investments in all stocks mentioned in the article (i.e. MSFT, FB, AAPL, AMZN, NFLX, GOOG, SHOP, TSLA, ATVI, NVDA, DIS)

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents