This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

How to Buy Your First Stock

You are ready to start investing and want to take the first step by buying your first stock. Unsure how to get it done? We got you covered! Before we get into the step-by-step guide on buying your first stock at Robinhood and Webull, we will take a look at a few important things to consider about the stock and the brokerage (be it an app or web-based platform) through which you can buy the stock.

Page Contents

- How to Buy Your First Stock

- What to Check Before Buying Your First Stock?

- How to Choose a Stock Investing App to Buy Your First Stock?

- How to Buy Your First Stock on Robinhood (step by step guide)

- Robinhood Market Buy: How to Place Market Buy Order (Buy in Dollars) on Robinhood

- Robinhood Market Buy: How to Place Market Buy Order (Buy in Shares) on Robinhood

- Robinhood Limit Buy: How to Place Limit Buy Order on Robinhood

- How to Buy Your First Stock on WeBull (step by step guide)

- Webull Limit Buy Order: How to Place Limit Buy Order on WeBull

- Other Considerations for Beginner Investors

What to Check Before Buying Your First Stock?

A few important things to check in stock before buying its shares are the following:

Future Earning Power

This is a fundamental quality of a stock. If the company has good or great earnings prospects in the future, the stock will likely do well. Avoid stocks of companies whose future looks bleak. This is a basic rule to follow to avoid falling for a ‘cheap stock’ based on some other metrics.

Trading Volume

Trading volume gives us the idea of the liquidity of the stock i.e. how many times a stock is sold and bought per day on average. The higher the trading volume, the better are your chances of selling the stock if need be.

Market Cap

The market value of the company, the higher the market cap, the more valuable the company is in the eyes of the stock market. For reference, Apple, Amazon, Microsoft – all have market caps in excess of TRILLION dollars. It’s a good practice for beginners to stick to the established (and high market cap, i.e. > $10 Billion for example) stocks.

Stock Price

Stocks trading at a price less than $1 per share are considered ‘penny stocks’. They tend to be riskier than stable stocks and would not be a good place to start investing.

For more information on basic stock metrics, please refer to this article: Stock Basics: Getting Started With Stocks

How to Choose a Stock Investing App to Buy Your First Stock?

A few things to check in a stock investing app are the following:

Security and Insurance

Make sure to check the app has inbuilt security features to protect your investment and your account. In case the brokerage goes broke, how is your investment protected? Look for security and insurance information for the brokerages. Sample statements from the platforms Robinhood, WeBull, eToro, and M1 Finance on insurance and security offered to their customers.

Member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash).

– Robinhood

Webull Financial is a member of SIPC, which protects securities customers of its members up to $500,000 ($250,000 of cash). Our clearing firm, Apex Clearing, has purchased an additional insurance policy. The coverage limits provide protection for securities and cash up to an aggregate of $150 million, subject to maximum limits of $37.5 million for any one customer’s securities and $900,000 for any one customer’s cash. Similar to SIPC protection, this additional insurance does not protect against a loss in the market value of securities.

– WeBull

Securities Investor Protection Corporation (SIPC) protects against the loss of cash and securities held by a customer. SIPC protection is up to $500,000 which includes a $250,000 limit for cash. SIPC does not protect you for any decline in the value of your securities. Our clearing firm has also purchased supplemental insurance in the event that SIPC limits are exhausted.

M1 Spend and M1 Plus accounts are FDIC insured up to $250,000 and further insured through Lincoln Savings Bank.

– M1 Finance

If you are a US resident, your cash holdings are FDIC insured for up to $250,000.

Your USD funds are held in an FDIC-insured custodial account. Even if eToro were to fail, your money would be protected and returnable to you (up to $250k).

– eToro

Commission and Fees

Commissions and fees for executing buy and sell orders can add up very quickly. Especially for beginner investors who don’t place large order sizes, commissions can eat significantly into profits. For example, some brokers charge up to $8 per order. An investor who has $500 to invest, buys a stock for $400 and then sells it a month later for $450 ends up paying the commission of $8 for buying + $8 for selling. Even though he theoretically made $50 ($450 – $400) on the trade, he has to pay $16 in commissions, i.e. 32% of his profits are eaten away in commissions.

Look for brokerages that offer low or zero-commission trades. Some of these brokerages have good enough features to execute trades for beginner and intermediate-level investors.

Ease of Use

An easy-to-understand and use interface is very important for beginner investors. A cluttered screen with difficult language doesn’t help new investors and scares them away from investing, or worse, causes them to place an unintentional trade. Start with easy-to-understand apps.

Types of Investments Available

There are multiple assets and derivatives you can invest in. For beginners, the most important would be the availability of stocks and ETFs. But it’s good to know if the brokerage other types of investments such as stock options (for future investments).

For our detailed comparison of three popular apps- Robinhood, M1 Finance, and WeBull, see here: Best Investment App Comparison

How to Buy Your First Stock on Robinhood (step by step guide)

The first four steps in this guide are common, no matter which stock order type you want to place for buying shares. Then, depending on whether you want to place a market buy or limit buy order, the steps are different from step 5 onward.

For more information on other stock order types, please visit: Stock Order Types

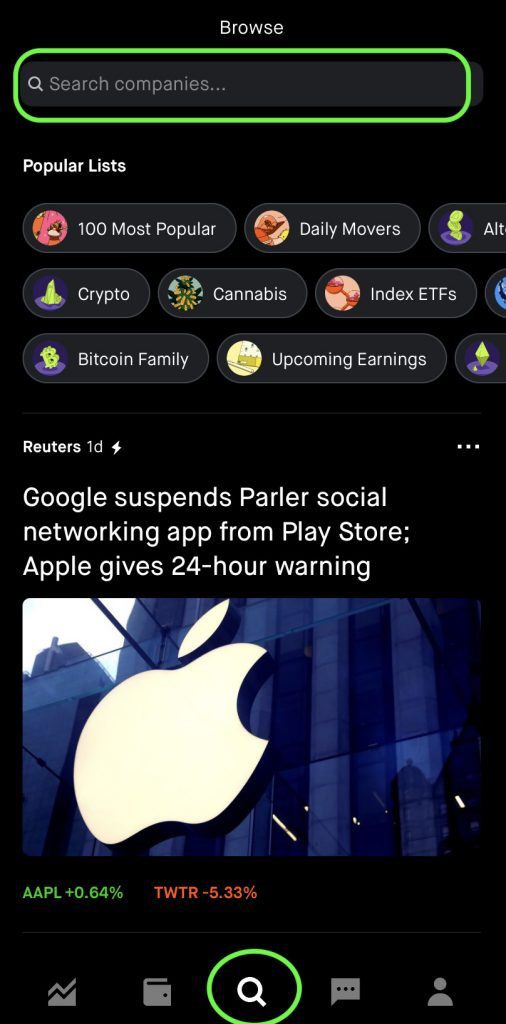

Common Step 1. Click the search button at the bottom , a search bar appears at the top of the screen.

Click the search button at the bottom , a search bar appears at the top of the screen.

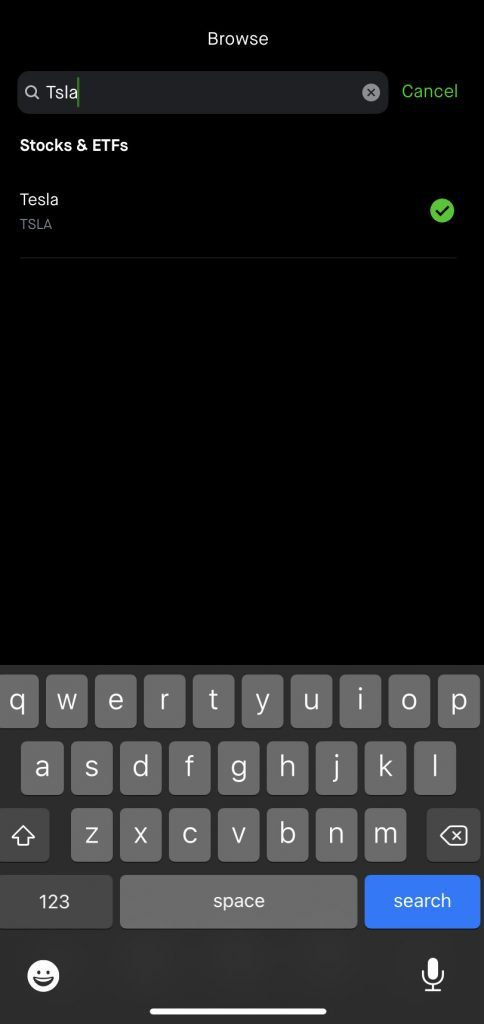

Common Step 2. In the search bar, type the name of the stock or ETF you are interested in.

For demo purposes, we are looking at Tesla (TSLA). You can either search for the company by its name or by its ticker symbol. Robinhood sometimes gives smart suggestions as well. For example, if you type in ‘electric vehicles’, it will suggest you a list of stocks related to electric vehicles.

Bestseller Personal Finance Books

Click on the stock name ‘Tesla’ to see the details.

Click the search button at the bottom , a search bar appears at the top of the screen.

Then, click on the stock name to see the details.

Common Step 3. When the stock details page opens up, go to the bottom of screen and hit the ‘trade’ button.

When the stock details page opens up, go to the bottom of screen and hit the ‘trade’ button.

Step 4. Clicking on the the trade button will open up a mini menu (buy, sell, trade options). Click ‘Buy’ button.

Clicking on the the trade button will open up a mini menu (buy, sell, trade options). Click ‘Buy’ button

As mentioned earlier, the first four steps for placing all stock order types are common. However, the next steps are a little different depending on whether you want to place a market buy or limit buy order. Let’s take a look at a few cases and the steps for them.

Robinhood Market Buy: How to Place Market Buy Order (Buy in Dollars) on Robinhood

Continuing from the Common Steps 1-4 described above.

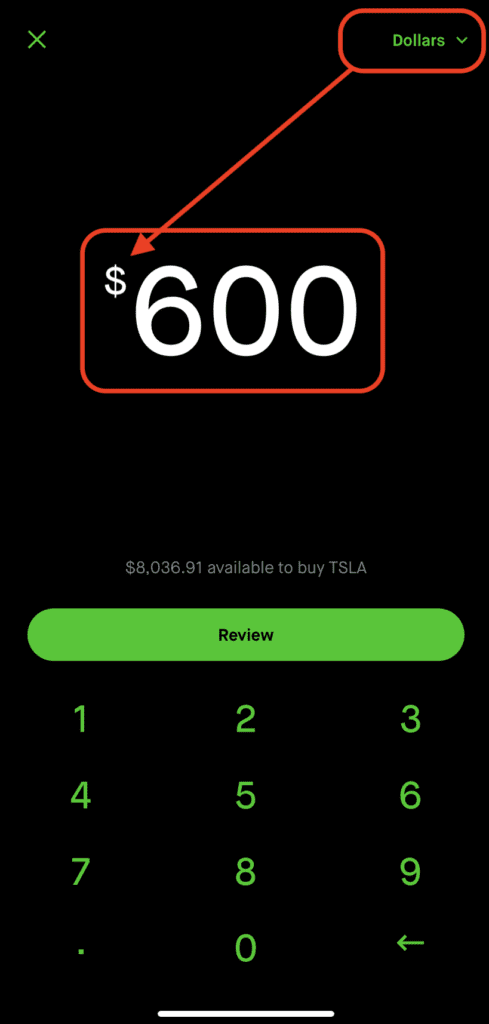

Step 5. On the order screen, click on the top right text and choose ‘Dollars’. Enter a dollar amount you want to invest, for example, $600 (from the stimulus check?) and hit ‘Review’.

A way to double check is to look for the dollar sign in the center of the screen when you enter the amount you want to invest.

On the order screen, click on the top right text and choose ‘Dollars’. Enter a dollar amount you want to invest, for example, $600 and hit ‘Review’.

Step 6. Read the order summary, $600 to buy 0.691634 shares of Tesla stock, and if you’re ready, swipe up to submit the buy order.

Read the order summary and swipe up to submit the buy order.

Robinhood Market Buy: How to Place Market Buy Order (Buy in Shares) on Robinhood

Continuing from the Common Steps 1-4 described above.

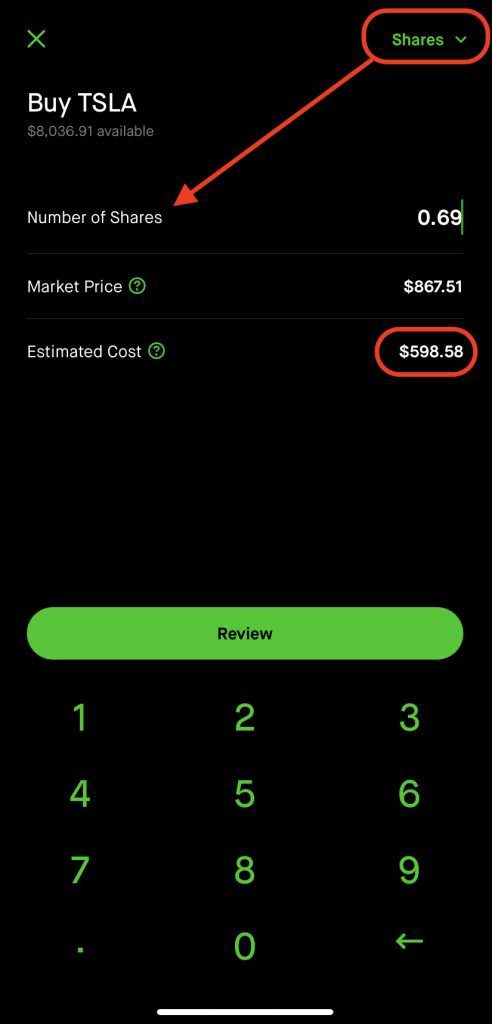

Step 5. On the order screen, click on the top right text and choose ‘Shares’. Enter a number, for example 0.69, and Robinhood calculates for you how much the order would cost in dollars.

See the ‘Estimated Cost’ value is dynamically calculated as $598.58 at the latest ‘market price’ of $867.51.

A way to double-check is to look for the data field that reads ‘Number of Shares’ in the center of the screen. On Robinhood, you can purchase fractional shares as well.

Hit ‘Review’ when ready.

On the order screen, click on the top right text and choose ‘Shares’. Enter a number, for example 0.69, and Robinhood calculates for you how much the order would cost in dollars.

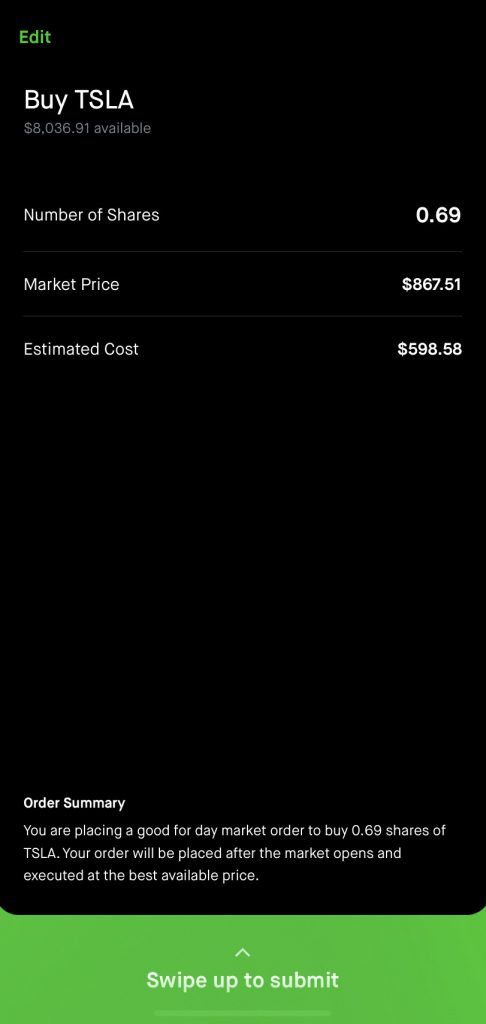

Step 6. Double check the order details, and swipe up to submit the order.

Double check the order details, and swipe up to submit the order.

Robinhood Limit Buy: How to Place Limit Buy Order on Robinhood

Continuing from the Common Steps 1-4 described above.

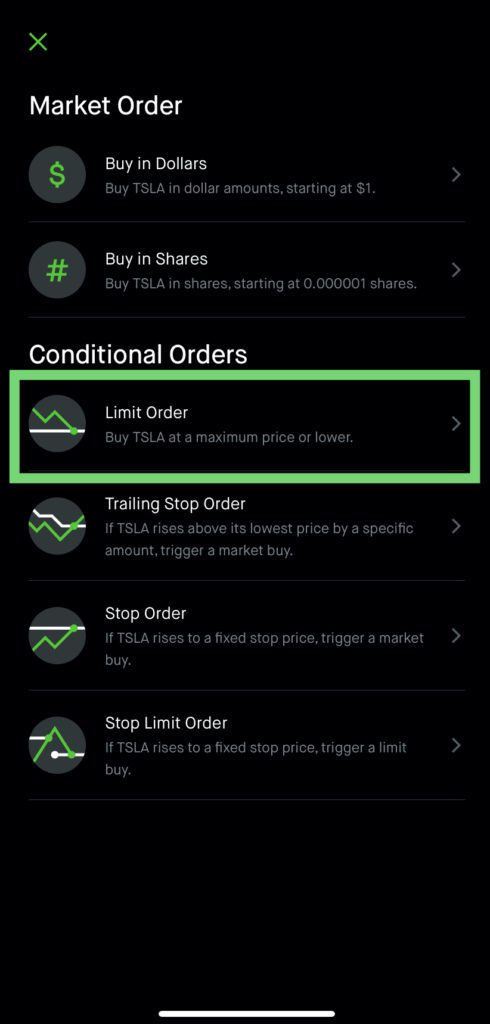

Step 5. On the order screen, click on the top right text and choose ‘Limit Order’.

On the order screen, click on the top right text and choose ‘Limit Order’.

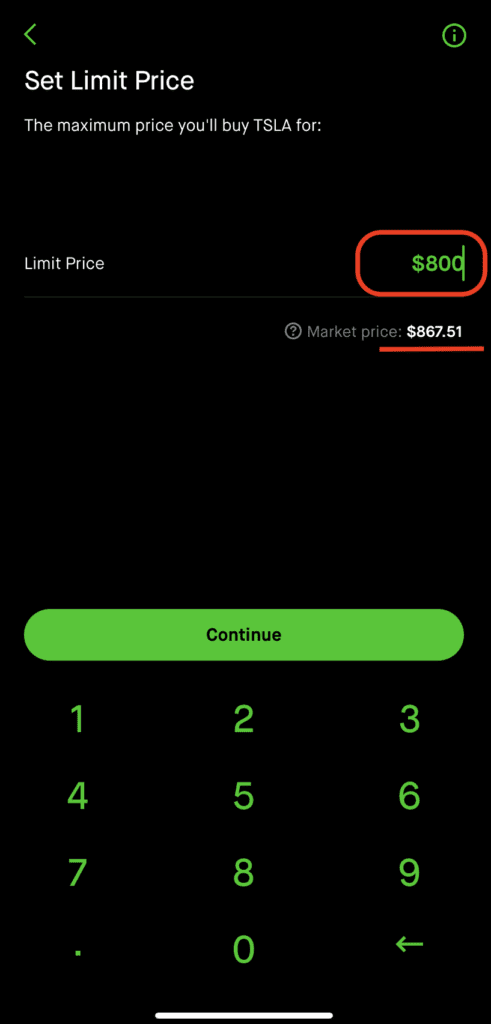

Step 6. On the ‘Set Limit Price’ screen, enter the maximum price you’re willing to pay to buy a share of Tesla.

Setting a Limit Price doesn’t guarantee your buy order will get executed. That’s because for you to buy, someone needs to be willing to sell the share at your limit price as well. For our demo, let’s set a limit price of $800 per share (note the last market price here is $867.51 per share)

On the ‘Set Limit Price’ screen, enter the maximum price you’re willing to pay to buy a share of Tesla.

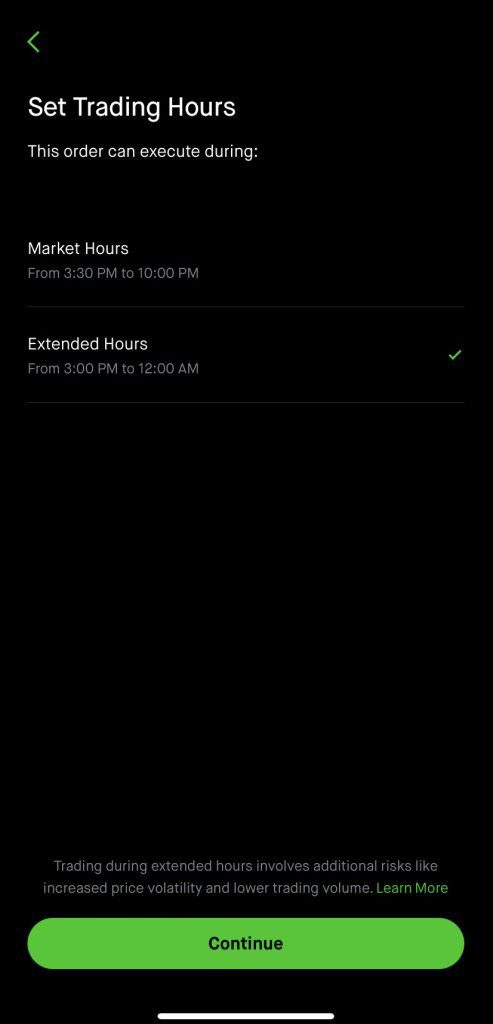

Step 7. On the ‘Set Trading Hours’ screen, pick whether you want your order to be executed during market hours only or also during the extended hours.

Please note that during the extended hours, the trade volume is usually much lower i.e. fewer people buy and sell stocks during the extended hours.

[Also note, the market hours in the US are from 9:30 am to 4:00 pm Eastern Time (New York Time). At the time of taking screenshots, the device is configured for Central Europe Time hence the 6 hour gap.]

On the ‘Set Trading Hours’ screen, pick whether you want your order to be executed during market hours only or also during the extended hours.

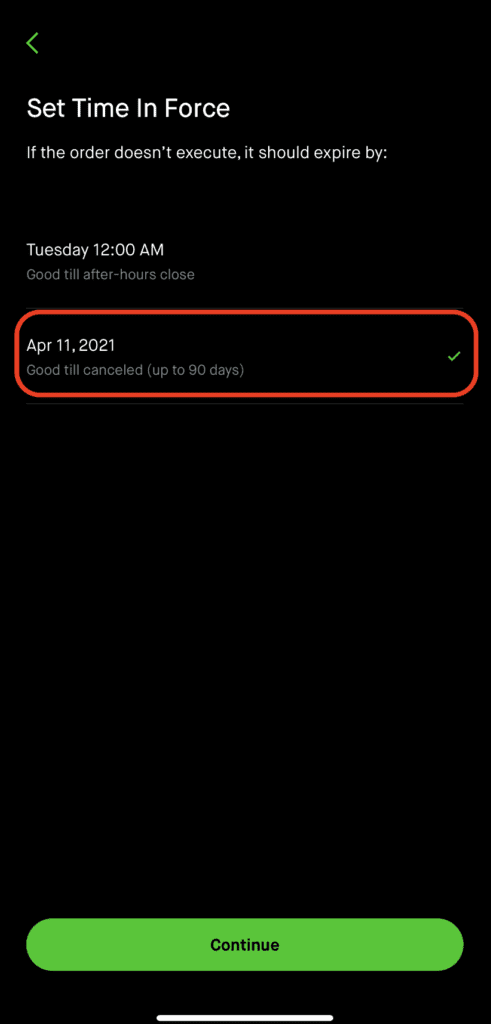

Step 8. On the ‘Set Time in Force’ screen, pick whether you want your order to be in force for just the current/next trading day or you want to have it in force for the next 90 days.

This is important because if you place a limit order at a price much below the current market price (as we did in step 6 by setting the limit price $67 below the market price of $867) the stock price might not come down to $800 in a day or two.

Setting a longer time frame gives us a better chance of catching the stock at a lower price. So, here for our demo, we select the longer timeframe or the ‘good till cancelled’ option which keeps are order in force for 90 days.

Hit ‘Continue’ when ready.

On the ‘Set Time in Force’ screen, pick whether you want your order to be in force for just the current/next trading day or you want to have it in force for the next 90 days.

Step 9. On the next screen, enter the number of shares you want to buy.

Robinhood does not allow buying fractional shares when using the ‘limit order’. You’d notice there is no decimal point at the bottom left of the screen.

Hit Review and then swipe up to submit your ‘limit buy order’.

On the next screen, enter the number of shares you want to buy.

There you go! You now know how to buy your first stock on Robinhood!

How to Buy Your First Stock on WeBull (step by step guide)

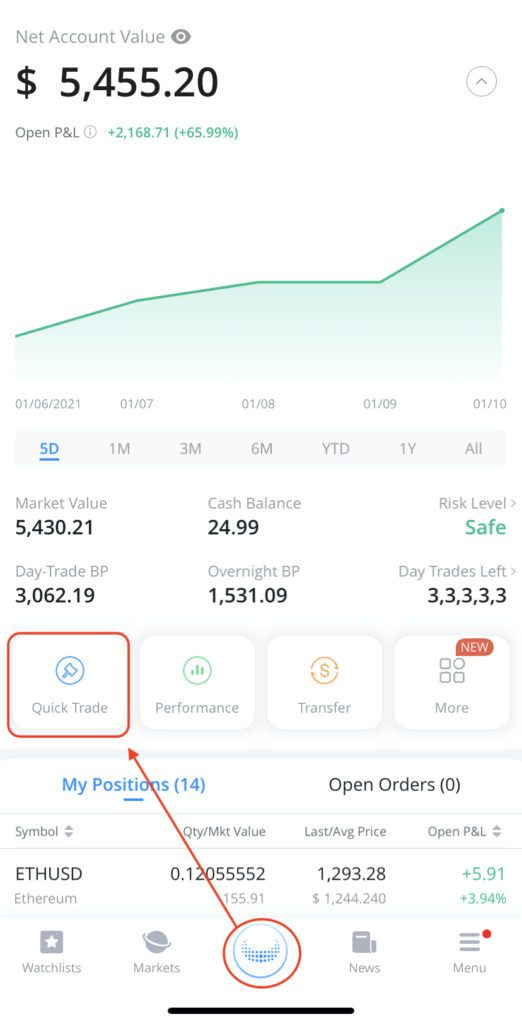

Step 1. Click on the center button with the Webull logo on it, and then click on ‘Quick Trade’ button.

Click on the center button with the Webull logo on it, and then click on quick trade button.

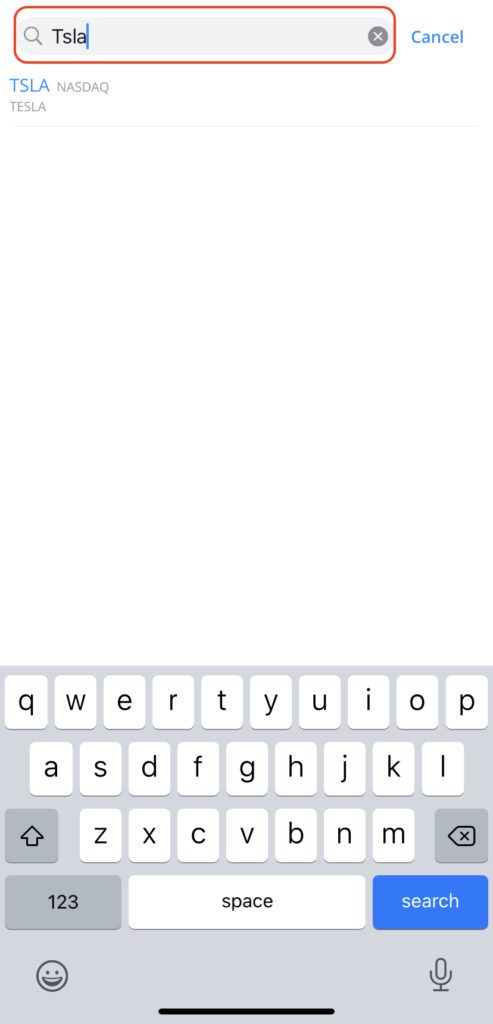

Step 2. After clicking quick trade, a search bar should appear at the top of the next screen. Type in the name of the stock you want to buy. For demo, we are typing in TSLA (for Tesla stock).

Unlike Robinhood, which gives smart stock suggestions even if you type something like ‘electric vehicles’, Webull does not have that feature yet. So, you’d have to either find the stock by company name or by its ticker symbol.

After clicking quick trade, a search bar should appear at the top of the next screen. Type in the name of the stock you want to buy. For demo, we are typing in TSLA (for Tesla stock).

Webull Limit Buy Order: How to Place Limit Buy Order on WeBull

Continuing from steps 1-2 described above.

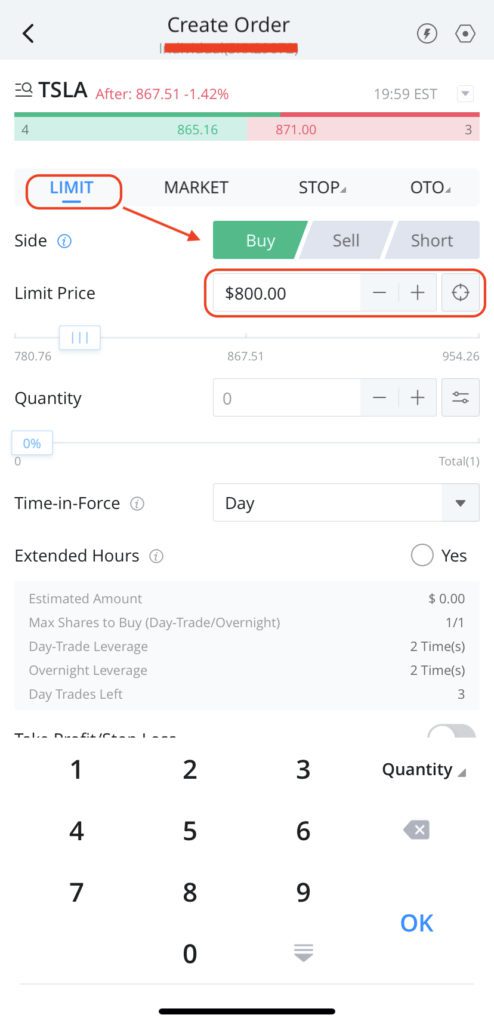

Step 3. Select the ‘Limit’ button on the top bar, and ‘Buy’ button on the ‘Side’ menu. Enter the limit buy price in the field below. Let’s say we want to place a limit buy order at $800 per share.

Select the ‘Limit’ button on the top bar, and ‘Buy’ button on the ‘Side’ menu. Enter the limit buy price in the field below. Let’s say we want to place a limit buy order at $800 per share.

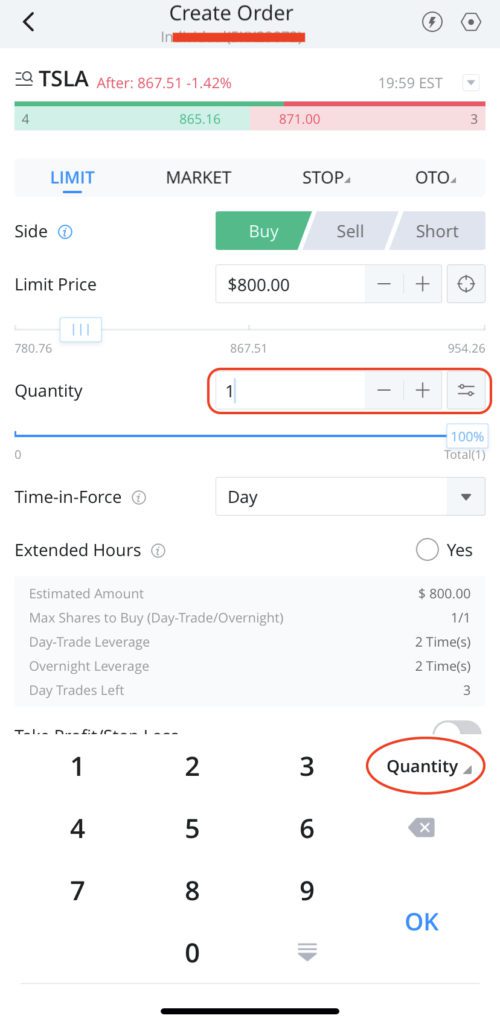

Step 4. Enter number of shares you want to buy in the ‘Quantity’ field.

If you have an investment amount (in dollars) on your mind, you can use the helpful ‘Quantity/Amount’ toggle button on the app’s pop-up keyboard. While as of writing this article, Webull does not have the partial share buying feature, the ‘Quantity/Amount’ toggle button helps you get an estimate of how many full (integer) shares you can buy with the amount you want to invest.

Enter number of shares you want to buy in the ‘Quantity’ field.

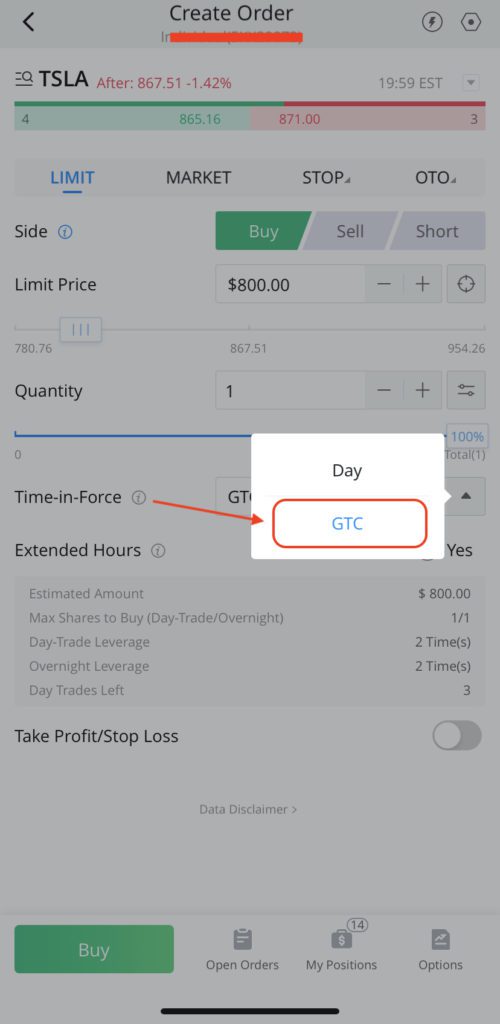

Step 5. Pick a ‘Time in Force’ for your order. For demo, let’s pick GTC (Good Till Cancelled), which is valid for 90 days.

This enables me to purchase the Tesla stock for $800 if the stock price falls at or below $800 any time within the next 90 days.

Pick a ‘Time in Force’ for your order. For demo, let’s pick GTC (Good Till Cancelled), which is valid for 90 days.

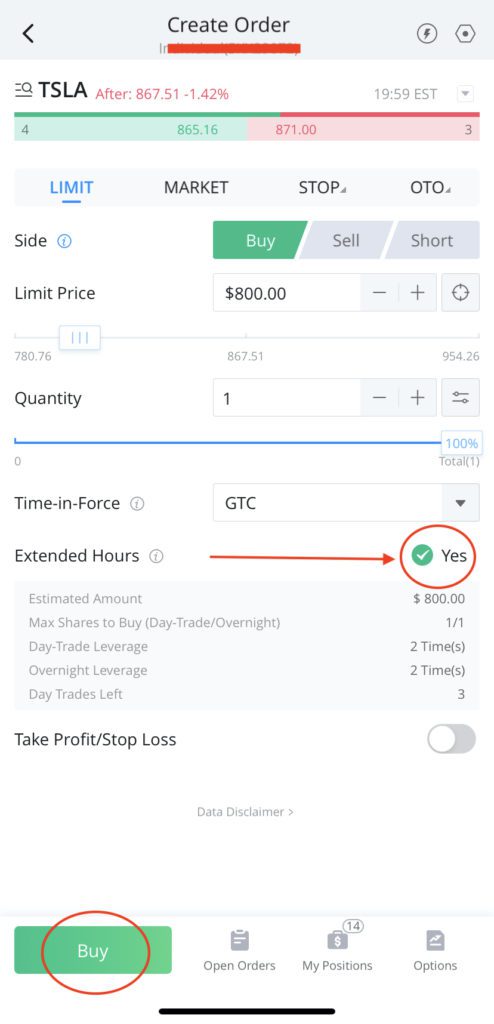

Step 6. Choose whether you want to have the order executed during extended hours or not. Then hit ‘Buy’ button at the bottom left.

For a buy-and-hold investor, executing the limit order should be fine even during extended hours. Please bear in mind that the trading volume is lower during the extended hours, so price can fluctuate greatly (hence may not be a great choice for someone looking to buy and sell the stock within a few minutes)

Choose whether you want to have the order executed during extended hours or not. Then hit buy button at the bottom left.

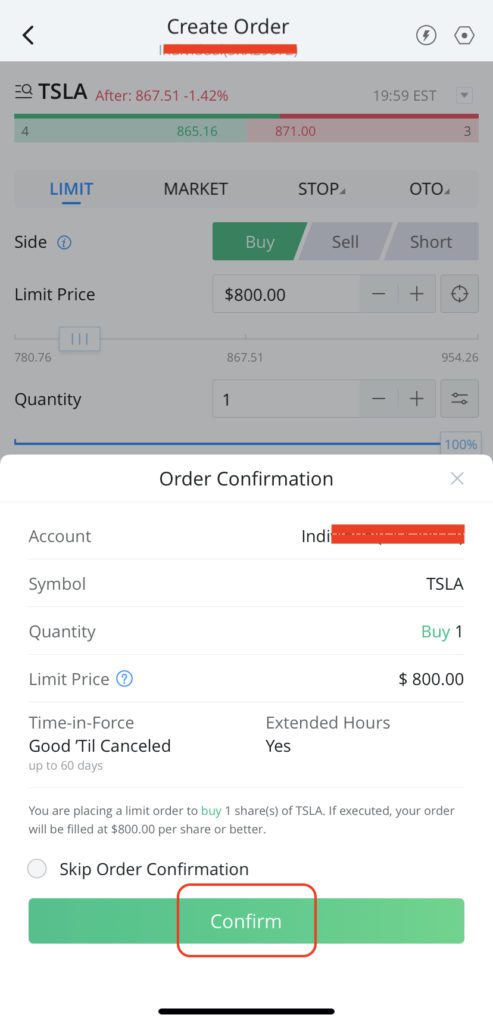

Step 7. An ‘Order Confirmation’ menu should appear at the bottom of the screen. Make sure the details are okay, and once ready, click the ‘Confirm’ button.

You can switch off the ‘Order Confirmation’ feature by checking the ‘Skip Order Confirmation’ radio button, but it’s a good practice of double check the orders to avoid placing unwanted orders erroneously.

An ‘Order Confirmation’ menu should appear at the bottom of the screen. Make sure the details are okay, and once ready, click the ‘Confirm’ button.

There you go! You now know how to buy your first stock on Webull!

For a complete list of stock order types such as stop buy, trailing stop orders etc. available on Robinhood and WeBull, please refer to the article Stock Order Types.

Other Considerations for Beginner Investors

As My First Investment, Should I buy a stock or an ETF?

ETFs are beginner-friendly assets. They are easy to trade and carry some diversification in themselves. If you plan to buy and hold investments for a long period, consider starting off with an ETF.

For more information on what ETFs are which are some of the popular ETFs to consider, please check these articles:

As I Continue Investing, Why Should I Buy Shares of More Than One Stock?

Creating a portfolio is important as it diversifies risk. Don’t put all eggs in one basket. Diversification is recommended not just within the stock market, but also outside the stock market with alternative investments. Having a well-balanced portfolio should be the target of all investors.

Read about Alternative Investing

I Got a ‘Hot Tip’ on as Stock From a Friend. Should I Invest All My Money in it?

Chasing ‘hot tips’ rarely works out well, unless it is from a seasoned investor or someone well versed with the stock market. While investing money, it is always advisable to keep the impulses in check and do your own due diligence before buying or selling any stocks.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents