This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

How to start investing? Where to invest? How much to invest? Here, we will discuss investment ideas for everyone and how to get started. We will also take a look at the difference between investing and trading. Before you start investing, please make sure you have some cash stowed away in an emergency fund to cover an emergency – cars break down and other stuff happens in life, just be financially prepared to tackle it. Also, please be cognizant of the fact that investment involves risk and your portfolio may lose value. Also, check out our Beginner’s Guide To Personal Finance.

- Investing vs Trading

- Where Can You Invest?

- Investing for Retirement

- Investing in Bonds, Stocks and ETFs

- Investing in Real Estate

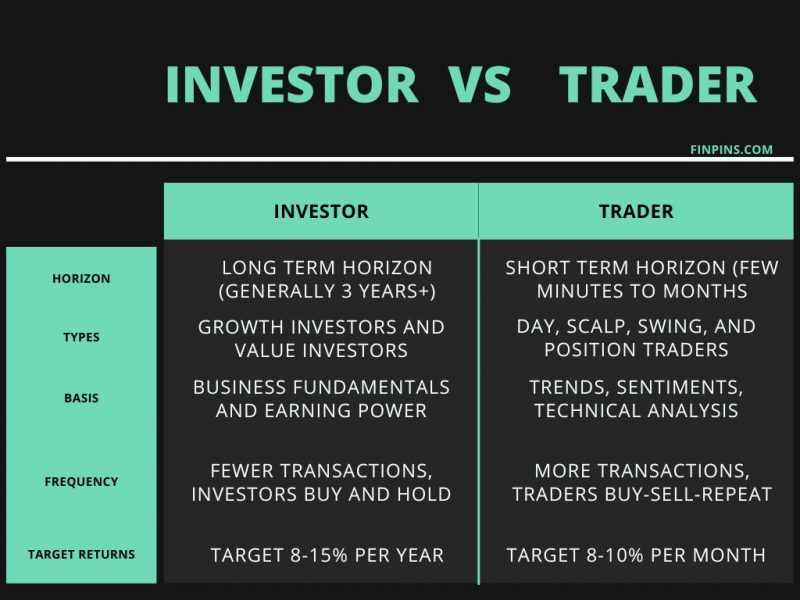

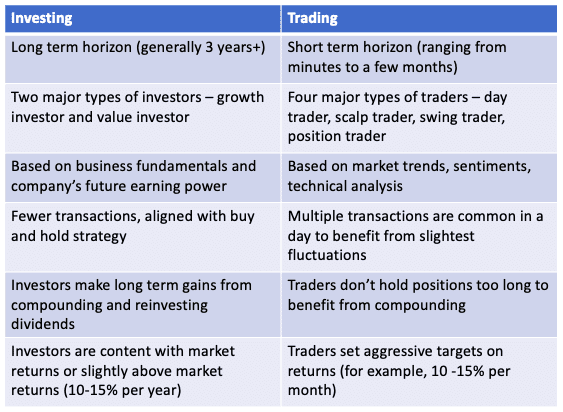

Investing vs Trading

Investing vs Trading: Let’s take a look at the key differences between investing and trading. Generally speaking, investing is rather passive and investors maintain a longer investment horizon than traders who remain much more actively involved with their trades.

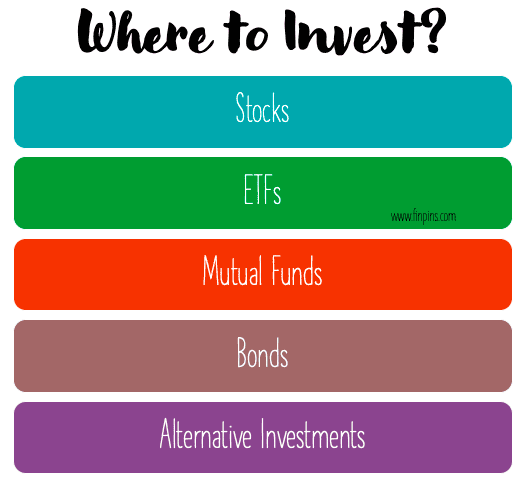

Where Can You Invest?

There are multiple options for investment. Some are passive, and some are active. There are traders leveraging software that time the buy and sell transactions to a fraction of a second to extract value from the volatility of the market. That is active trading and people do that for a living, 8 hours a day, 5 days a week.

Here we will not focus on active trading. Our goal here is to introduce methods of investing to people who are keen on investing with a longer investment horizon while keeping their full-time job.

Investing for Retirement: Where to Invest for Retirement?

How to start investing for retirement? There are multiple options that enable you to plan and invest for retirement. They have tax advantages also. Popular retirement planning options are 401(k), Roth IRA, IRA.

The main advantage of a Roth IRA is that you can lock in a lower tax rate earlier on, and later pay no taxes on the capital gains on your investment.

Read detailed articles on the links below:

Where To Invest For Other Life Goals? Bonds, Stocks, and ETFs

The stock market has minted many millionaires. There are two main ways to invest in the stock market – buying individual stocks (also called equities or shares) and buying ETFs.

ETFs contain shares of more than one company and are more diversified than purchasing a single stock. Since diversification reduces risk, starting off by investing in some ETFs can be the perfect way to test the waters of the stock market in a relatively safe manner.

Stock Picking, or the method of investing in selective stocks, can be risky. Risk is not a bad word here. While there is a risk of losing more money, stock-picking presents the chance to make much higher returns by picking the right stock (or a few stocks).

Buying government-backed bonds is a conservative approach to investment and typically provides lower returns than the stock market. It is ideal for risk-averse investors such as people in retirement or nearing retirement.

Works best on Desktop

Read more about Stocks, ETFs, and Mutual Funds.

Investing in Real Estate

How to start investing in Real Estate?

Bestseller Personal Finance Books

Real Estate has long been considered a safe investment vehicle, and for good reason. Real Estate investment can be very rewarding if done right. Fortunately, that is fairly easier than investing in the stock market via stock picking.

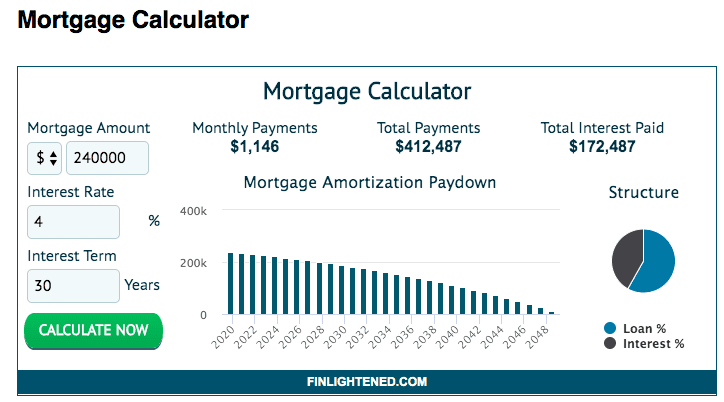

Invest in a House

The mortgage rates are fairly low, under 4% for a 30-year mortgage (as of Oct 2019). By putting just 20% down, you can essentially borrow the remaining 80% at a 4% interest rate.

See today’s mortgage rates below:

| ||||||||||||||||||||||||||||||||||||||||||

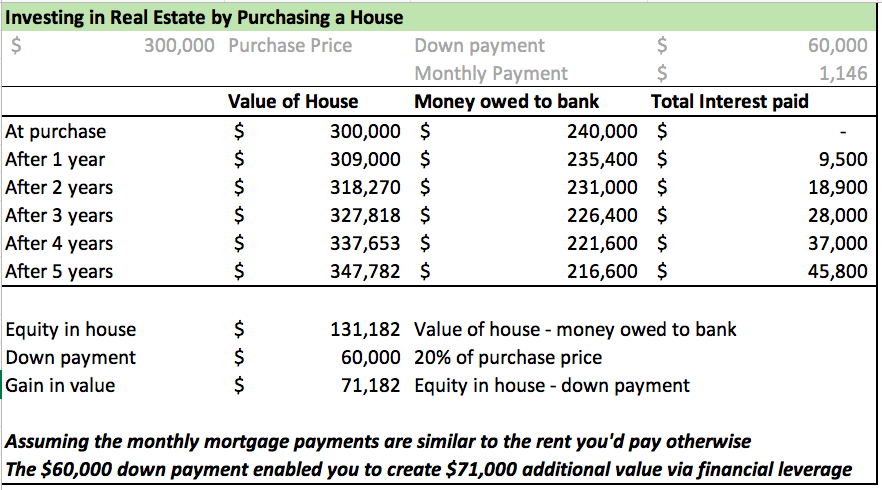

For example, if you purchase a $300,000 house, by putting down $60,000, the returns can be very rewarding five years down the line.

Assumptions:

- Capital Gains: Value of house grows by 3% per year for 5 years

- Rent payment is similar to cost of home ownership, including mortgage payments.

You can try your personalized mortgage payment scenario here.

Invest in a REIT

How to start investing in real estate if you don’t have a huge sum of money to put a down payment on a house? There are multiple REIT (Real Estate Investment Trust) options that give you the option to invest in real estate without the high down payment and without the hassles of homeownership.

DiversyFund is a popular option. The minimum requirement to participate in DiversyFund Growth REIT is as low as $500. By investing in REITs, you can enjoy secure and high returns even with a little investment.

Read Related: DiversyFund vs Fundrise

Check out Alternative Investments

- Invest in REIT

- Invest in GOLD

- Invest in OIL

- Invest in BITCOIN

- Invest in LAND

- Invest in NFTs

- Invest in Basketball Cards

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents