This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Over the past ten years, advertising has changed majorly. It is now the profit-generating platform to advertise your business. Any small business’s costs rise as a result of spending money on advertising. You might miss out on thousands of points, cashback, or other incentives if you choose the wrong credit card.

Best Credit Cards for Ad Spending (Jump To Section)

If you own a small business, you will invest money in advertising your business through online platforms instead of doing it in traditional media. You can spend money on websites like Google, Facebook, Amazon, and Twitter due to the rise of online search engines, social media, and CPC advertising.

In today’s marketplace, breaking down the target audience for online advertising has become the preferred approach for expanding businesses. If your business expenditure is high in spending for ads, then you should make sure you’re getting the best rewards possible.

You can earn significant rewards that convert into rewards or gets discount for travel or cash back by choosing which credit cards to use for your Google Ads spending. Fortunately, for small business owners, there are credit cards that provide extra points for spending money on advertising. Companies should not miss any opportunity to obtain points from advertising expenditures.

Best Credit Cards for Ad Spending

Let’s take a look at some of the best credit cards available for spending on digital advertisement platforms.

- Best Credit Cards for Ad Spending

- 1. American Express Business Gold Card | $295 Annual Fee

- 2. Chase Ink Business Preferred Card | Annual fee: $95

- 3. American Express Platinum Card | Annual fee: $695

- 4. American Express Blue Business Plus Credit Card | $0 Annual Fee

- 5. Chase Ink Business Unlimited Credit Card | $0 Annual Fee

- 6. Southwest Rapid Rewards Performance Business Credit Card | $199 Annual Fee

- 7. Citi Double Cash Card | $0 Annual Fee

- 8. Capital One Spark Cash Plus | $150 Annual Fee

- 9. Capital One Spark Miles for Business | 0$ Intro Annual Fee

- 10. Capital One Spark Cash Select For Business | $0 Annual Fee

1. American Express Business Gold Card | $295 Annual Fee

The Amex card is the go-to card for small business owners who wish to profit from ads. It is the best option if your company regularly spends money on Google or Facebook ads. You will always obtain 4x earnings on your purchases if advertising is your main expenditure.

This AMEX gold credit card offers 4x bonus earnings. Although you can choose which categories you want to get the bonus in each statement period, it truly depends on your expenditure in those two categories. The 4x bonus is up to the first $150,000 in annual purchases. After then, each dollar spent on items results in an additional point. The idea behind this card is to act as a one-stop shop where you can swipe it for everything, giving you more mental space to concentrate on your company.

For example, with the Amex Business Gold, you can choose U.S. advertising for certain media like online, TV, and radio as one of your categories and use this card to pay for your Google Ads expenses to earn extra benefits. Your 70,000 Membership Rewards points will be awarded after making $10,000 in total transactions. You can use your bonus points to book a flight with American Express Travel, who will also give you back 25% of your points.

Key Features:

- Making a $10,000 transaction during the first three months will earn you 70,000 extra points.

- Choose the categories where you spend the money every month to earn four times as many Membership Rewards points.

- Earn 1x points on all other purchases.

- There are no foreign transaction fees.

- The annual cost is $295.

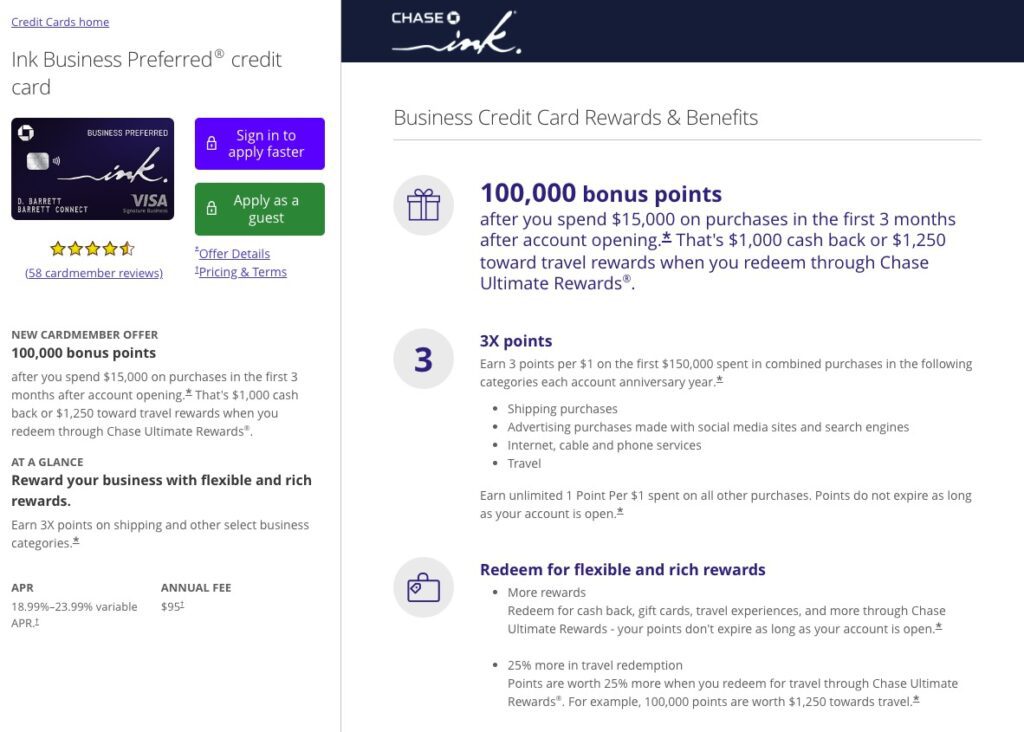

2. Chase Ink Business Preferred Card | Annual fee: $95

For anyone who spends money on online advertising to promote their business, the Chase Ink Business Preferred card is undoubtedly the best credit card. If you take advantage of the $100,000 credit card sign-up bonus, you should spend $15,000 in three months. This credit card might be out of your price range based on the size of your company, but it will be available to others.

Many small business owners should be provided for categories such as social and google search advertising along with shipping, phone, and travel. Additionally, if you maximize the bonus categories, you might earn nearly 500,000 Ultimate Rewards points.

The Chase Ink Business Preferred Card features excellent business benefits for a low annual fee of 95 dollars. You can exchange your Chase points for Star Alliance flights and Hyatt accommodations in addition to earning 3x points on purchases related to digital advertising.

Key Features:

- You will gain 100,000 more points if you spend $15,000 on purchases in the first three months.

- Transportation, broadband, phone, and also expenditures for social media and search engine marketing are all eligible for 3x points when it comes to advertising-related costs.

- Your smartphone is protected (up to $1,000 if stolen or damaged).

- Missed connections, missing or delayed luggage, and trip cancellations are all covered by travel insurance.

- It has insurance for both purchases and automobile rentals.

- For each dollar spent up to the first $150,000, 3.5 points are awarded.

- Every dollar spent on all other purchases adds one point.

- There are no foreign transaction fees.

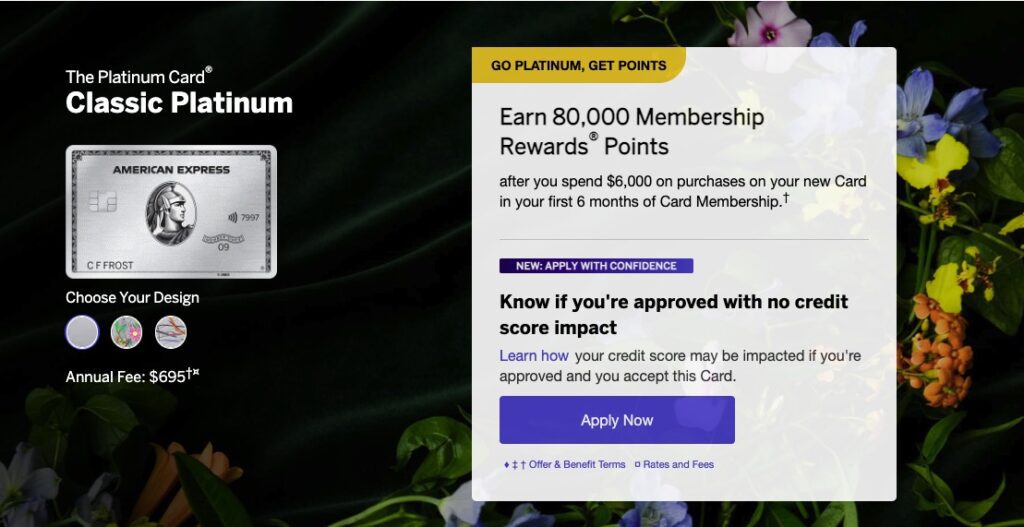

3. American Express Platinum Card | Annual fee: $695

If your company spends a lot of money on advertising each month, you’ll want to ensure that each dollar is profitable. Additionally, you’ll want a card that offers a variety of additional advantages that you can use.

You need an American Express Platinum card to maximize your spending. More than $1,400 in annual bill credits are by the Amex Platinum card. In addition to any available credit card lounge privileges. Earn 80,000 Enrollment Rewards Points after making $6,000 purchases during the first six months of card membership. Based on the most recent valuations, TPG estimates $1,600.

Prepaid hotel reservations made through American Express Travel earn 1 point for every $1 spent. While flight reservations made directly with airlines or through American Express Travel (up to $500,000 per calendar year, then 1 point per $1) earn 5 points for every $1 spent.

Bestseller Personal Finance Books

Additionally, this card entitles you to enter Centurion Lounges when traveling abroad and Delta Lounges when flying Delta. This credit card is for you if you travel more frequently. If you make good use of the features and benefit from everything this credit card offers, it will be worth more than the annual fee. Please be aware that some advantages require registration.

Key Features:

- Members of Equinox can receive up to $300 in annual statement credits.

- Uber Cash up to $200 annually.

- Credits on annual Clear membership statement of up to $189.

- Credits from Saks Fifth Avenue are worth up to $100 each year.

- There are no foreign transaction fees.

- Application cost credits are offered once every four years for TSA Pre-Check or once every 4.5 years for Global Entry.

- Travel insurance that covers trip cancellation and delay are examples of travel protection.

- Prepaid hotel bills and airline fee statement credits are eligible for an annual of $200.

- Digital entertainment statement credits worth up to $240 per year.

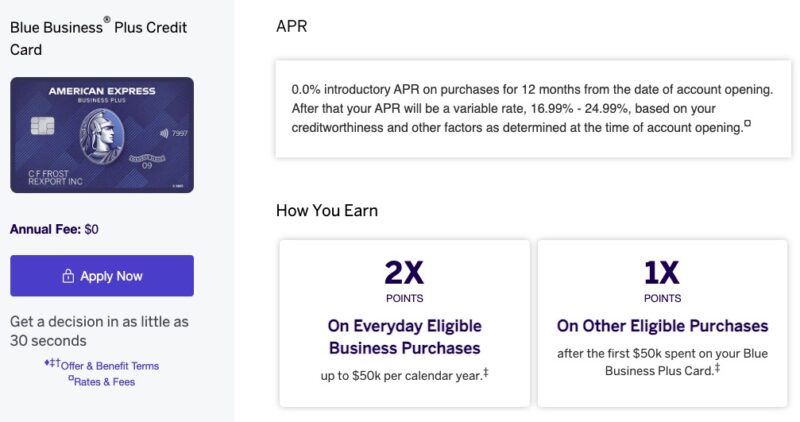

4. American Express Blue Business Plus Credit Card | $0 Annual Fee

If you can maximize how to use your membership reward points, you do not require to track your spending in every category. This credit card has a $150 with 15,000 Membership Reward Points as a sign-up incentive, which is still an initial offer for a credit card without an annual charge.

In addition, credit cards provide simple rewards. You can earn twice as many Membership Rewards points on daily business expenses up to $50,000 per year. After this point limit, every dollar spent results in a 1X point increase.

While there are various ways to spend your points, getting the most value out of them by transferring them to airline and hotel partners is recommended.

Key Features:

- There is no yearly cost.

- You may go over the allotted spending limit with Expanded Buying Power.

- For international transactions, there is a 2.7% charge.

- By making $3,000 in eligible purchases throughout the first three months, you can earn 15,000 Membership Loyalty points.

- Up to $50,000 in annual purchases, you can earn 2X Membership Rewards points, and after that, just 1X points.

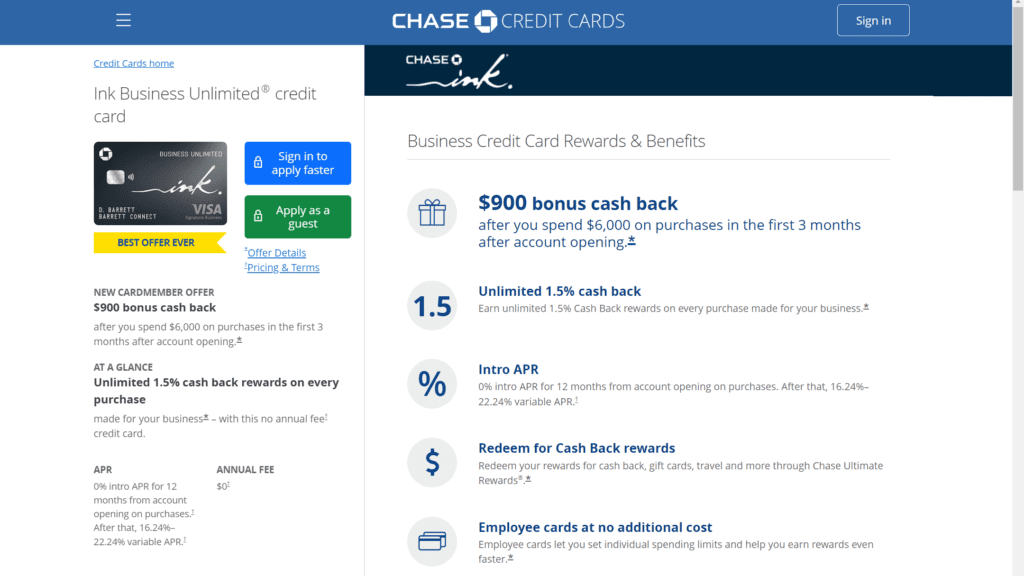

5. Chase Ink Business Unlimited Credit Card | $0 Annual Fee

Earning cashback incentives comes in the form of Ultimate Rewards points, which are redeemable for cash back at a rate of one single cent per point.

To get 25% to 50% more value when using the points for travel, you can transfer the Ultimate Rewards points to high-end Chase credit cards like the Ink Business Preferred Card or Chase Sapphire Reserve Card.

The Chase Ink Business Unlimited Credit Card offers an unlimited 1.5% back on all purchases. If you use this credit card within the first three months of account setup, you might receive a $900 bonus cash back after making only $6,000 in payments. Small business owners who seek more control over their use of credit cards for advertising expenses can set specific spending limits.

Rewards points can use to purchase items such as cash back, gift cards, and vacations. The cashback will be deposited to your bank account or delivered as a statement credit.

Key Features:

- A cashback of 1.5% is limitless.

- Upon completing qualified transactions totaling $6,000 in the first three months, you get a sign-up bonus of $900.

- The initial 12 months have an APR of 0%.

- There is no yearly fee.

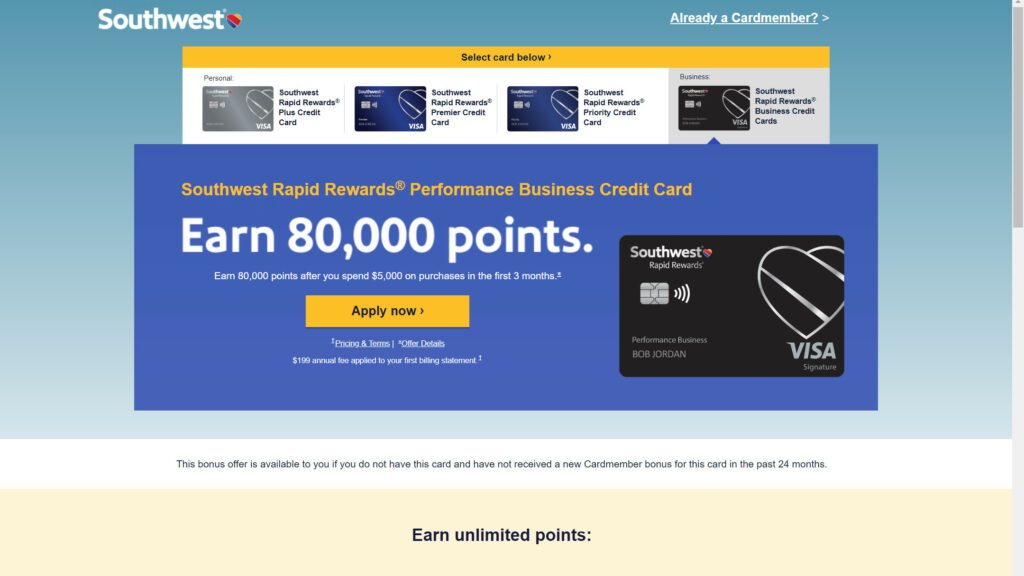

6. Southwest Rapid Rewards Performance Business Credit Card | $199 Annual Fee

The Rapid Rewards Performance Business Credit Card from Southwest offers 4 points for every dollar spent on purchases made with Southwest Airlines, 3 points for every dollar spent with Rapid Rewards hotels and partners for car rentals, and 2 points for every dollar spent on other common business categories. The annual cost is fair for a premium credit card, and Southwest travelers will receive a lot of incentives.

The Southwest Performance Business Credit Card is appealing, even though premium airline cards (especially business) can struggle to compete with personal travel credit cards due to high annual fees and limited features. Business owners can earn bonus points on regular expenses with the card’s wide range of bonus-earning areas.

Additionally, new cards can already earn enough points through cautious spending and the card’s initial incentive to become eligible for the coveted Southwest Companion Pass in a matter of months.

Remember to apply for the card. You must be a small business owner. Although you don’t need a physical office building or thousands of people for your business to be successful, you can run a profitable startup or a growing side hustle. Chase is normally more demanding when confirming that applicants are legitimate small business owners.

Key Features:

- Upon spending $5,000 in purchases within the first three months, you will receive 80,000 points.

- Your initial billing statement includes a $199 yearly charge.

- On the anniversary of your Cardmembership, you earn 9,000 points annually.

- Spend $1 on Southwest Airlines® purchases, and you’ll receive 4 points.

- When you book a hotel or rental vehicle with Rapid Rewards, you’ll receive three points for every dollar you spend.

- For every $1 you spend on internet, cable, phone, social media, and search engine marketing, you’ll earn two points.

- Spending on local transportation, including ridesharing, earns you two points for every dollar.

- For every $1 spent on other purchases, you will receive 1 point

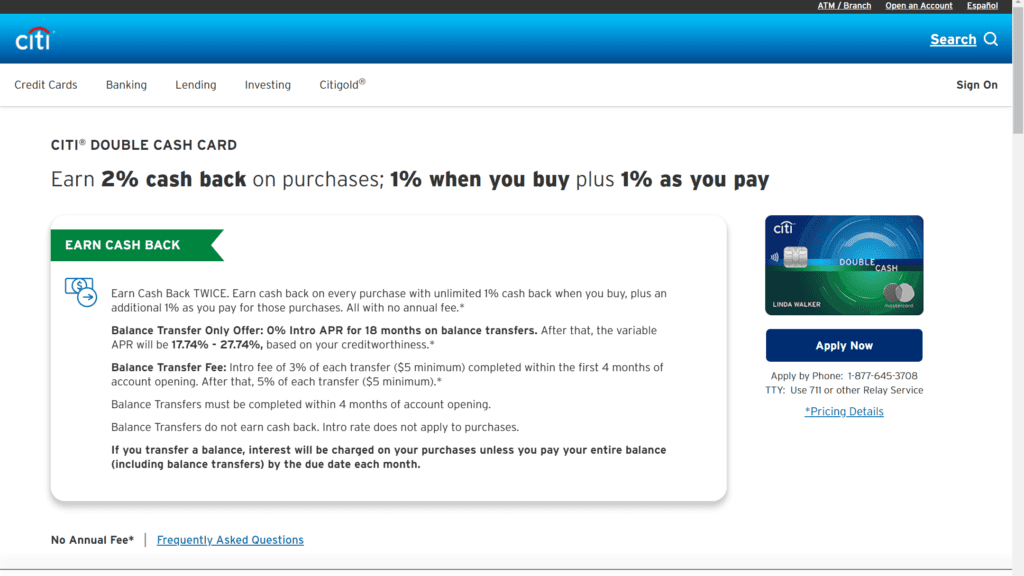

7. Citi Double Cash Card | $0 Annual Fee

The Double Cash Card has simple earning schemes that are easy to track even though it is not a credit card designed specifically for businesses. When you spend $1 on something, you’ll receive one extra point & when you give it back, you’ll receive one point.

The Citi Double Cash card makes earning easy because it offers 2x points on all purchases, even those made for advertising as Google, Amazon, and Facebook ads. You can earn as many points as you want with no upper limit.

Key Features:

- Utilize the Citi® Double Cash Card to earn cashback benefits on each transaction.

- You can use your credit card to make purchases, it will always receive 1% cash back.

- Plus, an additional 1% as you use the card to make your payments, whether you pay for your purchases in full or over time.

- ThankYou® Points are redeemed for cash back.

- This credit card means that each billing cycle, you will receive 1 ThankYou® point for every $1 spent on purchases and an extra ThankYou® point for every additional $1 spent on your buy balance, provided that there is a similar amount in your Purchase Monitor.

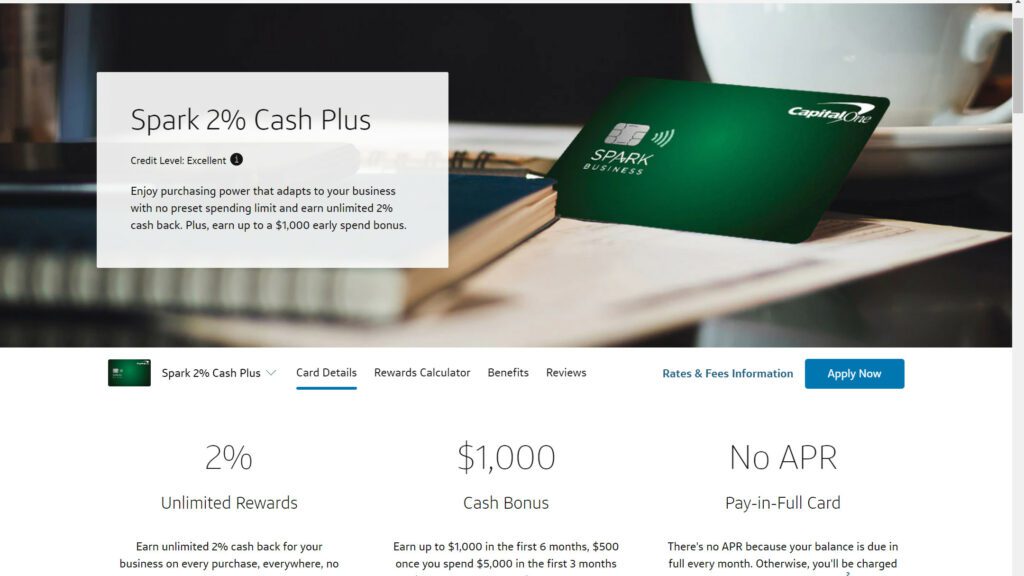

8. Capital One Spark Cash Plus | $150 Annual Fee

Earn 2% cash back for your company on all purchases without limits or category limitations. In addition, hotels and rental vehicles booked through Capital One Travel are eligible for unlimited 5% cash back.

Earn a maximum of $1,000 in the first six months, $500 after a $5,000 spending cap in the first three months, and $500 after a $50,000 spending cap in the first six months. You must pay the debt in full each month. Thus, there is no APR. You will assess a 2.99% monthly late fee if not paid.

Take advantage of flexible purchasing power with no predetermined spending cap and unlimited 2% cash back. Earn a bonus for spending money early of up to $1,000.

Key Features:

- Based on your purchasing habits, payment history, and credit profile, Spark 2% Cash Plus adjusts to your needs.

- Earn a $200 cash incentive annually for every $200,000 or more you spend; this will more than pay your annual charge.

- For a one-time fee of $150, receive limitless rewards, cash bonuses, and business-level benefits.

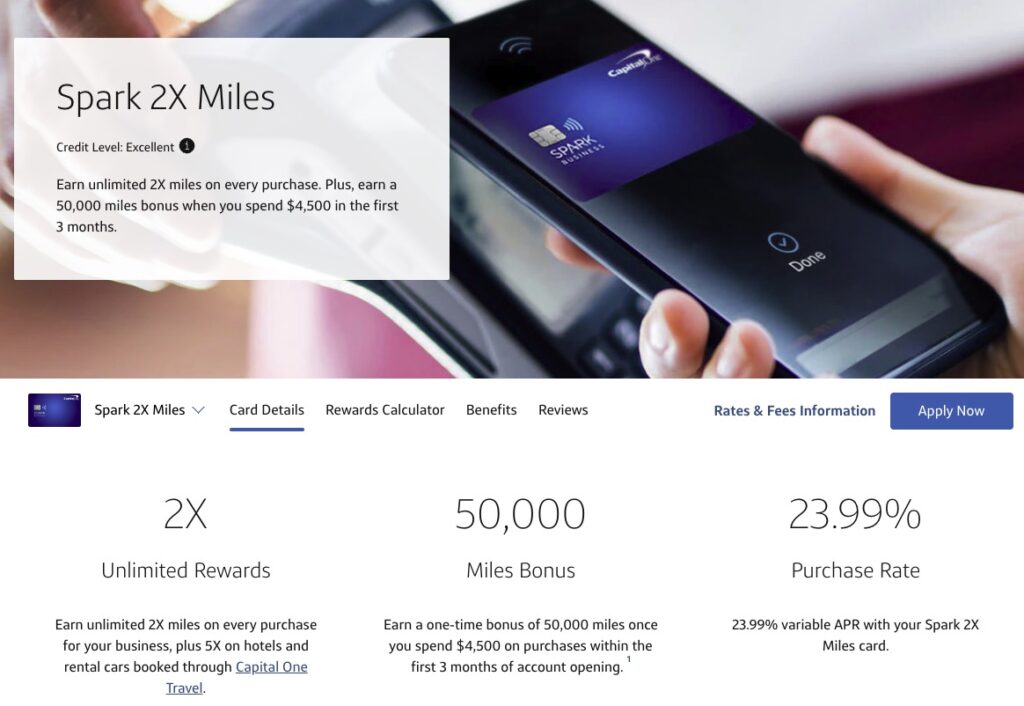

9. Capital One Spark Miles for Business | 0$ Intro Annual Fee

Even though this card doesn’t offer specific advertising incentives, it’s still a fantastic first set of business cards. There is a nine-month 0% intro APR term that uses as an advertisement loan with no interest. Additionally, this card offers 2x miles for every dollar spent, making it a fantastic option for companies looking to convert their advertising expenditures into miles for travel.

The Capital One Spark Miles for Business credit card is an excellent business credit card with even greater travel advantages. The first year is free; however, each additional year is $95.00.

Key Features:

- It has nine months with a 0% introductory APR rate.

- After spending $4,500 in the first three months, you’ll receive 50,000 bonus miles.

- This card has unlimited 2x miles for every $1 spent.

- Redeeming miles will cost you one penny each or 2% cash back (You can also redeem your miles for credit statements or gift cards, but that will usually equal to fewer than 1 cent).

- Employee ID cards are unrestricted and free.

- Whenever you want, use any airline.

- There are no seat limitations or blackout dates.

- The first year’s yearly cost is free; after that, it is $95.

- No cost for balance transfers.

- There is no international transaction fee.

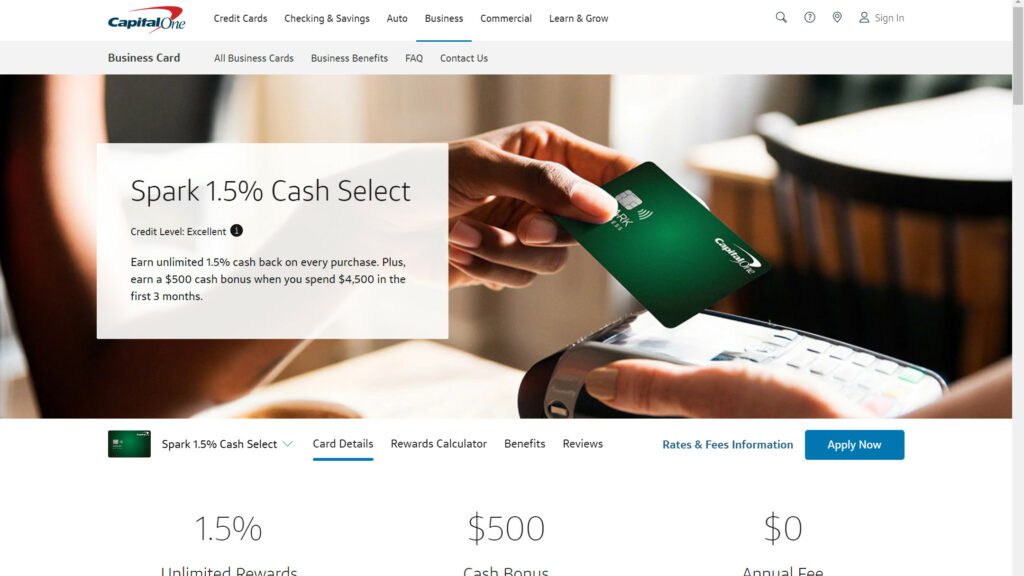

10. Capital One Spark Cash Select For Business | $0 Annual Fee

You can always receive 1.5% cash back for your company on all of your purchases, without any restrictions on where you can use it or what you can buy. In addition, hotels and rental vehicles booked through Capital One Travel are eligible for unlimited 5% cash back.

Spend $4,500 on purchases during the first three months after account opening to receive a one-time $500 cash bonus. Utilize the huge incentives and a cash bonus on top of a $0 annual fee. For the duration of the account, get cash-back incentives for any amount, at any time. The variable APR ranges from 16.24% to 22.24% depending on your creditworthiness.

Key Features:

- To avoid having to log into your account each month, set up an AutoPay account.

- You can obtain a cash advance in addition to an emergency replacement if your card is lost or stolen.

- To make planning and tax time easier, get a detailed summary of your spending.

- Give an account manager the responsibility for making purchases and paying bills, checking the books, and fixing any issues.

- Download your purchase history in several formats, including Quicken, QuickBooks, and Excel, quickly and securely.

- Without giving out your actual card number to retailers, make safer online purchases.

Summary:

If your small business invests a lot of money in online advertising, you should receive some rewards for the spend, besides gaining new clients through your Google and Facebook ads. As you promote your company, these credit cards might help you earn cash back, points, or miles.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents