This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

ETF vs Mutual Fund

ETF vs Mutual Fund – what should I invest in? the question looms in the mind of every investor. Here we will cover the key similarities and differences between ETFs and Mutual Funds so that you can decide what works better for you.

You can also choose to have a hybrid strategy and allocate some portion of your portfolio to mutual funds, and some to ETFs. We will also go through the list of the top 25 mutual funds (with inception dates before the year 2000) and their average annualized returns since inception.

Similarities in ETFs and Mutual Funds

There are two main similarities between ETFs and Mutual Funds

- Both ETFs and Mutual Funds are a basket of assets and due to this they have some inherent diversification and are relatively less risky than investing in individual stocks.

- Both ETFs and Mutual Funds offer a wide variety of investment options in a particular sector (e.g. technology, pharmaceuticals), geography (e.g. emerging markets), asset type (e.g. stocks or bonds) etc.

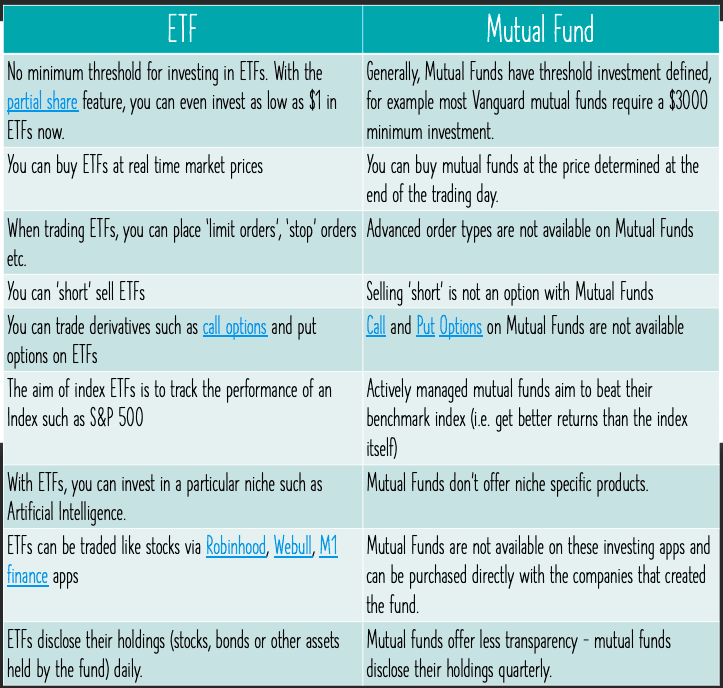

ETF vs Mutual Fund: Key Differences

The key differences between ETFs and Mutual Funds are listed below.

[tables best viewed in landscape mode if on a mobile device]

| ETFs | Mutual Funds |

| No minimum threshold for investing in ETFs. With the partial share feature, you can even invest as low as $1 in ETFs now. | Generally, Mutual Funds have a threshold investment defined, for example, most Vanguard mutual funds require a $3000 minimum investment. |

| You can buy ETFs at real-time market prices | You can buy mutual funds at the price determined at the end of the trading day. |

| When trading ETFs, you can place ‘limit orders’, ‘stop’ orders, etc. | Advanced order types are not available on Mutual Funds |

| You can ‘short’ sell ETFs | Selling ‘short’ is not an option with Mutual Funds |

| You can trade derivatives such as call options and put options on ETFs | Call and Put Options on Mutual Funds are not available |

| The aim of index ETFs is to track the performance of an index such as the S&P 500 | Actively managed mutual funds aim to beat their benchmark index (i.e. get better returns than the index itself) |

| With ETFs, you can invest in a particular niche such as Artificial Intelligence. | Mutual Funds don’t offer niche-specific products. |

| ETFs can be traded like stocks via Robinhood, Webull, M1 finance apps | Mutual Funds are not available on these investing apps and can be purchased directly from the companies that created the fund. |

| ETFs disclose their holdings (stocks, bonds, or other assets held by the fund) daily. | Mutual funds offer less transparency – mutual funds disclose their holdings quarterly. |

ETF vs Mutual Fund: Other Differences

- Most ETFs are passively managed, although some actively managed ETFs also exist.

- Mutual Funds are mostly actively managed by the fund managers, although some index mutual funds are also available.

- ETFs tend to have lower fees, as low as 0.0% in some cases. (However, it is possible that the fees can increase in the future).

- Actively managed mutual funds tend to have higher fees. Even if in short term the fund manager beats the index, it is uncommon to see mutual funds beating the index, taking the higher fees into account, in the long term.

- ETFs are more tax-efficient. The investor is only responsible for capital gains tax when he or she sells the ETF for a profit.

- Mutual Funds (unless held in a tax-advantaged account such as 401(k) ) may pass on the capital gains taxes to the fund investors even if the investor never sold units (shares) of the mutual fund.

ETF vs Mutual Fund Comparison: S&P 500 Index

Vanguard Products: VFIAX vs VOO

Index Fund: Vanguard 500 Index Fund Admiral Shares (VFIAX)

This was the industry’s first index fund for individual investors. The fund is well-diversified and has exposure to multiple industries and represents about 75% of the U.S. stock market. If your 401(k) plan offers this fund, a 0.04% expense ratio might be one of the lowest in the market.

- Expense Ratio: 0.04%

- Minimum initial investment: $3000

(Check out other options too – Fidelity FXAIX @ 0.015% and Schwab SWPPX @ 0.02% have low fees as well)

ETF: Vanguard S&P 500 ETF (VOO)

The VOO ETF comes in slightly cheaper at a 0.03% expense ratio, and with easy tradability via a broker and a lower threshold for investment VOO might be a better option for starter investors.

- Expense Ratio: 0.03%

- Minimum Initial Investment: $303 (price of one share, as of Nov 2, 2020)

Pro Tip: You can invest as little as $1 by buying fractional shares on Robinhood and other apps that support partial share transactions.

Best Mutual Funds 2020 – Long Term Performance

Here’s a list of the top 25 Mutual Funds, with inception dates before the year 2000, ranked according to their annualized return since inception. (updated Dec 2020).

[tables best viewed in landscape mode if on a mobile device]

| Fund | Ann. Return | Inception |

| Wasatch Micro Cap (WMICX) | 17.73% | 1995 |

| Fidelity Select Software & IT Services (FSCSX) | 16.87% | 1985 |

| AllianzGI Technology Institutional (DRGTX) | 16.21% | 1995 |

| Vanguard Health Care Investor (VGHCX) | 16.09% | 1984 |

| Fidelity Select Health Care (FSPHX) | 16.06% | 1981 |

| Fidelity Magellan (FMAGX) | 15.99% | 1963 |

| T. Rowe Price Communications & Technology Investor (PRMTX) | 15.99% | 1993 |

| PGIM Jennison Health Sciences Z (PHSZX) | 15.82% | 1999 |

| Fidelity Select Medical Technology and Devices (FSMEX) | 15.48% | 1998 |

| BlackRock Health Sciences Opportunities Investor A (SHSAX) | 15.36% | 1999 |

| Delaware Smid Cap Growth A (DFCIX) | 15.20% | 1986 |

| T. Rowe Price Health Sciences Investor’s (PRHSX) | 15.13% | 1995 |

| Nuveen Small Cap Growth Opportunities I (FIMPX) | 14.85% | 1995 |

| Fidelity Growth Company (FDGRX) | 14.78% | 1983 |

| Columbia Seligman Communications & Information A (SLMCX) | 14.72% | 1983 |

| Fidelity OTC (FOCPX) | 14.67% | 1984 |

| Fidelity Select Retailing’s (FSRPX) | 14.64% | 1985 |

| Columbia Acorn Institutional (ACRNX) | 14.46% | 1997 |

| Kinetics Internet No Load (WWWFX) | 14.44% | 1996 |

| Fidelity Select IT Services (FBSOX) | 14.20% | 1998 |

| T. Rowe Price Mid-Cap Growth Investor (RPMGX) | 14.08% | 1992 |

| American Funds The Growth Fund of America A (AGTHX) | 14.01% | 1973 |

| Fidelity Select Leisure’s (FDLSX) | 13.90% | 1984 |

| Vanguard PRIMECAP Investor (VPMCX) | 13.80% | 1984 |

| Sequoia (SEQUX) | 13.75% | 1970 |

| Fund | Ann. Return | Symbol | Inception |

|---|---|---|---|

| Wasatch Micro Cap (WMICX) | 17.73% | WMICX | 1995 |

| Fidelity Select Software & IT Services (FSCSX) | 16.87% | FSCSX | 1985 |

| AllianzGI Technology Institutional (DRGTX) | 16.21% | DRGTX | 1995 |

| Vanguard Health Care Investor (VGHCX) | 16.09% | VGHCX | 1984 |

| Fidelity Select Health Care (FSPHX) | 16.06% | FSPHX | 1981 |

| Fidelity Magellan (FMAGX) | 15.99% | FMAGX | 1963 |

| T. Rowe Price Communications & Technology Investor (PRMTX) | 15.99% | PRMTX | 1993 |

| PGIM Jennison Health Sciences Z (PHSZX) | 15.82% | PHSZX | 1999 |

| Fidelity Select Medical Technology and Devices (FSMEX) | 15.48% | FSMEX | 1998 |

| BlackRock Health Sciences Opportunities Investor A (SHSAX) | 15.36% | SHSAX | 1999 |

| Delaware S mid Cap Growth A (DFCIX) | 15.20% | DFCIX | 1986 |

| T. Rowe Price Health Sciences Investor's (PRHSX) | 15.13% | PRHSX | 1995 |

| Nuveen Small Cap Growth Opportunities I (FIMPX) | 14.85% | FIMPX | 1995 |

| Fidelity Growth Company (FDGRX) | 14.78% | FDGRX | 1983 |

| Columbia Seligman Communications & Information A (SLMCX) | 14.72% | SLMCX | 1983 |

| Fidelity OTC (FOCPX) | 14.67% | FOCPX | 1984 |

| Fidelity Select Retailing's (FSRPX) | 14.64% | FSRPX | 1985 |

| Columbia Acorn Institutional (ACRNX) | 14.46% | ACRNX | 1997 |

| Kinetics Internet No Load (WWWFX) | 14.44% | WWWFX | 1996 |

| Fidelity Select IT Services (FBSOX) | 14.20% | FBSOX | 1998 |

| T. Rowe Price Mid-Cap Growth Investor (RPMGX) | 14.08% | RPMGX | 1992 |

| American Funds The Growth Fund of America A (AGTHX) | 14.01% | AGTHX | 1973 |

| Fidelity Select Leisure's (FDLSX) | 13.90% | FDLSX | 1984 |

| Vanguard PRIMECAP Investor (VPMCX) | 13.80% | VPMCX | 1984 |

| Sequoia (SEQUX) | 13.75% | SEQUX | 1970 |

Popular Mutual Funds for Investing in Large Cap, Small Cap, Technology, and Real Estate funds.

Here is a list of some popular mutual funds, their investment style, and expense ratios.

| Mutual Fund | Fund Type | Expense Ratio |

|---|---|---|

| DRIPX | MP 63 Fund | Large Cap | Value | 0.69% |

| ACLLX | American Century NT Large Co Value Fund | Large Cap | Value | 0.01% |

| FTRNX | Fidelity Trend Fund | Large Cap | Growth | 0.64% |

| TRBCX | T Rowe Price Blue Chip Growth Fund | Large Cap | Growth | 0.69% |

| PGTAX | Putnam Global Tech Fund | Technology | 1.16% |

| FSPTX | Fidelity Select Technology Portfolio | Technology | 0.71% |

| BREIX | Baron Real Estate Fund | Real Estate | 1.08% |

| TIREX | TIAA CREF Real Estate Securities Fund | Real Estate | 0.50% |

| OPOCX | Invesco Discovery Fund | Small Cap | Growth | 1.08% |

| QUASX | AB Small Cap Growth Portfolio | Small Cap | Growth | 1.17% |

| LPRAX | Blackrock Lifepath Dynamic Retirement Fund | Target Retirement Date | 0.90% |

ETF vs Mutual Fund – Is There an Easy Choice?

ETF: For the average investor, the advantage of tax efficiency, more investment options, lower threshold, ease of trading on investment apps, etc. put ETF a favorite option.

Mutual Fund: Other investors who trust the fund managers to beat the market and are willing to pay a higher fund management fee to find mutual funds as a great investment option. As seen in the list of top 25 mutual funds, investors have bagged great returns on mutual funds as well.

Availability may limit the choices: In many retirement accounts (employers’ 401(k) plans), ETFs may not be available and mutual funds might be the only option available for employees to invest in. However, ETFs can be purchased on investing apps such as Robinhood, M1, and Webull.

Bestseller Personal Finance Books

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents