This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

How to create your portfolio: Create new M1 Pies on M1 Finance (Step-by-Step Guide)

M1 Finance is a very handy app. It provides investors a great way to invest in multiple stocks by creating customized ‘pies’ and buying partial shares. I love the concept of creating pies, but it can be challenging to navigate the entire process of creating and adding the pie to your M1 portfolio. So, I created a guide for you. Learn how to create your portfolio today.

Perks of Opening an M1 Finance Account

Let’s discuss some of the perks M1 Finance offers to its customers and investors that enable long-term stability and efficiency in the trading market. First of all, it allows you to build your own portfolio or invest in premade portfolios with stocks and ETFs. However, you can also choose an online bank account and even a loan service at a low-interest rate.

With M1 Finance the investor has low expense ratios and low account minimums while facing dynamic rebalancing. Also, there are no commissions and no account management fees, which means you can easily set up an account and enjoy all of the M1 Finance promotions, advantages, perks, and benefits.

You get to choose exactly how much control you want over your investments and you can enjoy your investing and trading experience.

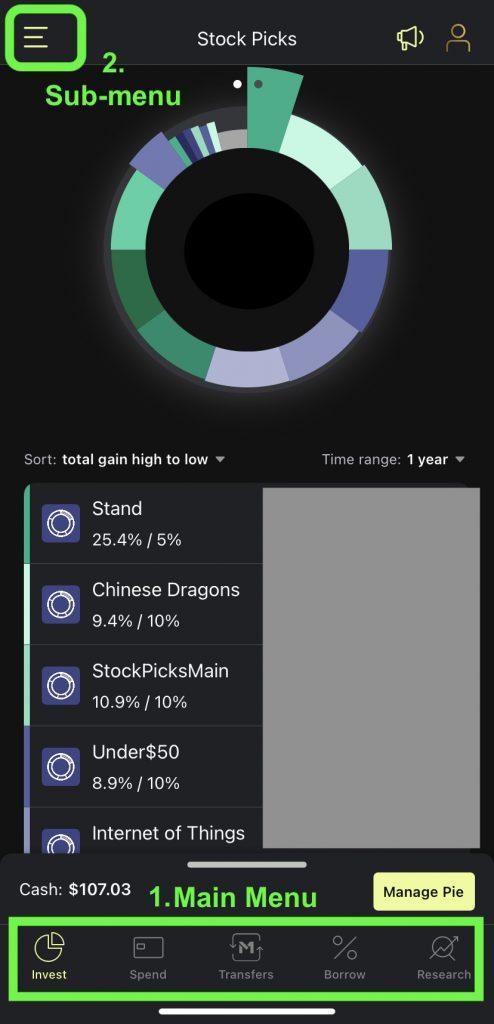

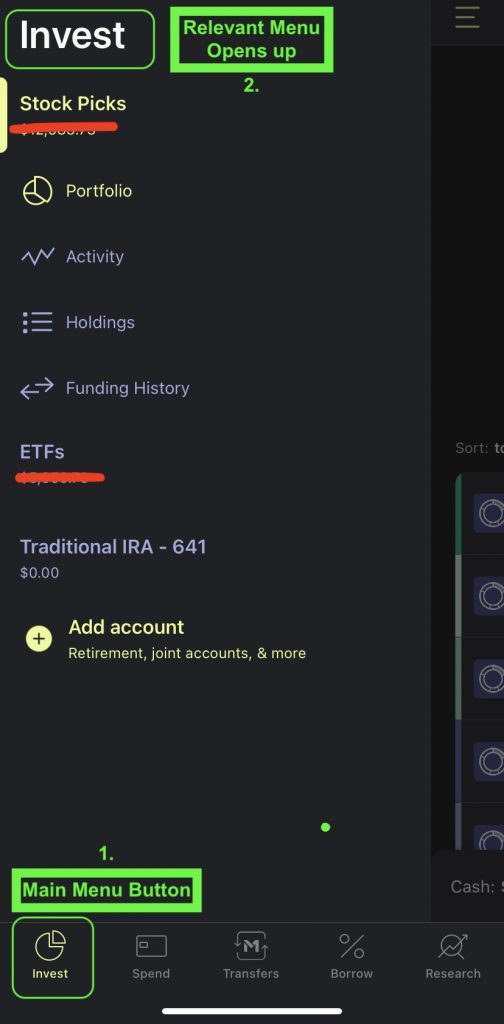

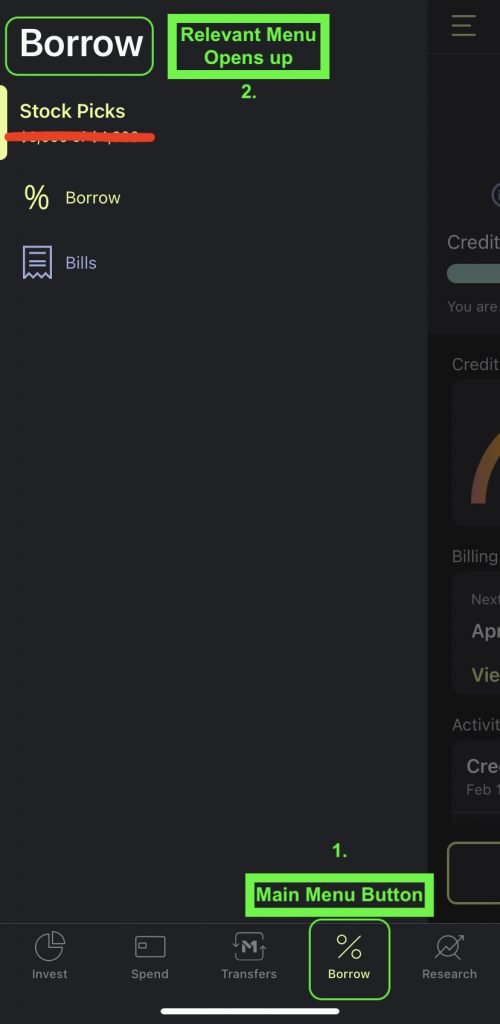

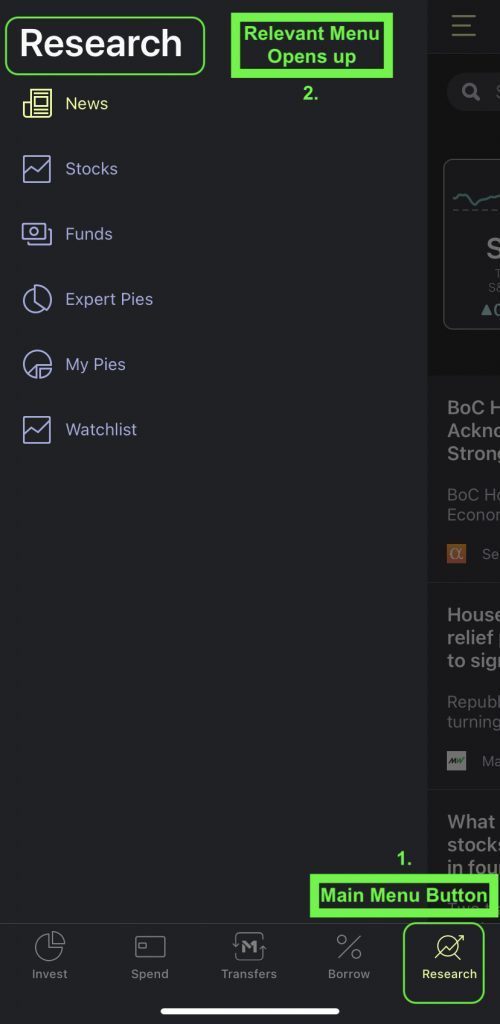

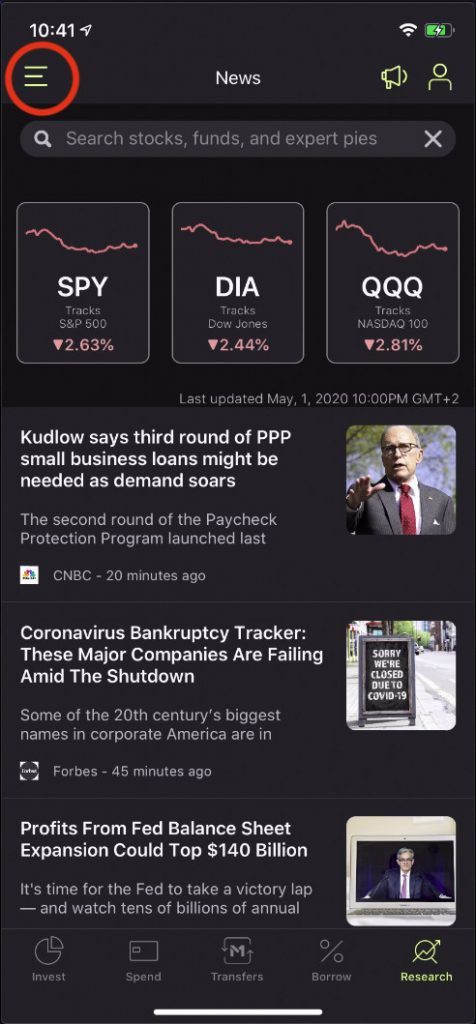

Pro Tip: The Main Menu Buttons are at the Bottom. The top left button (three bars) is for sub-menu.

The Three Bar Button on Top Left opens up the Sub-Menu, depending on which Button at the Bottom is Active.

How to use M1 Finance to create your portfolio using M1 Pies.

This is a step by step tutorial to create M1 pies on the M1 finance app. There are four main parts to it:

- PART ONE: Creating the Pie: How to Create a New Pie on M1 Finance

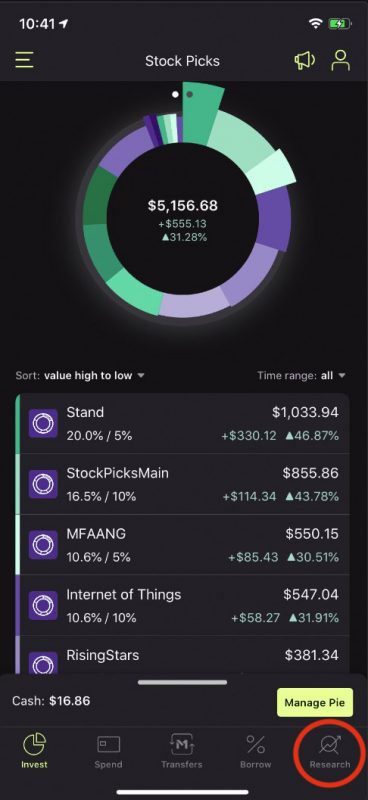

- Step 2. After the basic setup, from the bottom menu bar, click on ‘Research’ button.

- Step 3. The research button should open up a page. Click on the 3 horizontal bar button on top left for all menu options (specific to research).

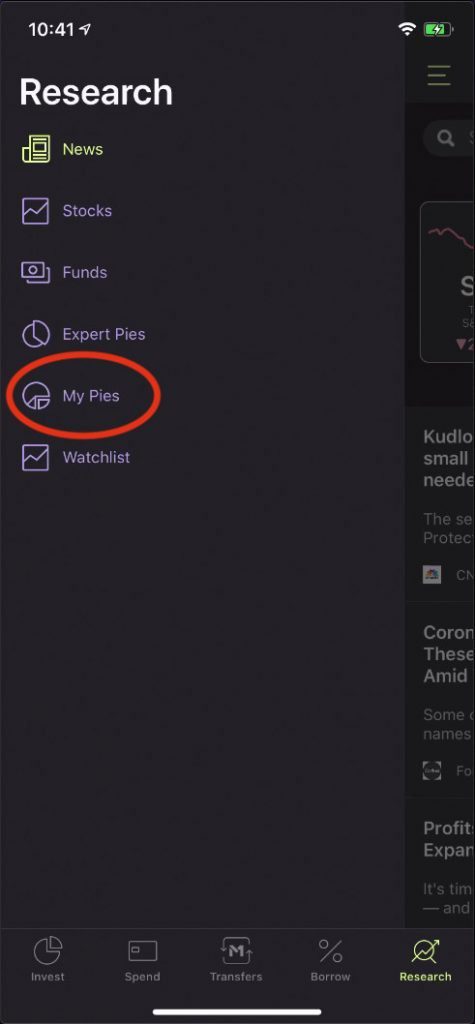

- Step 4. Select ‘My Pies’ from the menu bar on the left.

- Step 5. ‘My Pies’ would open up the page showing all your M1 pies (it would be empty if this is your first pie). Click on the ‘+’ sign on top right to see the add options.

- Step 6. The new page titled ‘Create New Pie’ should open up. Click on the big ‘+’ button in the center of the screen.

- PART TWO: Add Slices and Create M1 Pies

- PART THREE: Assign Weights to M1 Pie Slices

- PART FOUR: Add the M1 Pie to an investment portfolio

- Step 12. You pie now has a name and is ready to use. To use the pie in your portfolio, click the ‘Invest’ button in the menu at the bottom.

- Step 13. Click on the ‘Manage Pie’ button on the bottom right. A small menu should pop up, click on ‘Edit Pie’ button.

- Step 14. Now the details of the portfolio should show. To add the new pie, use the ‘+’ button toward the center-right of the screen.

- Step 15. On the top menu, select ‘My Pies’.

- Step 16. Locate your pie you just created, and click the ‘+’ button on the right hand side of the Pie name.

- Step 17. Adjust the weights if you have multiple pies. Hit ‘Save’ on top right to finalize the addition of the pie to your M1 portfolio.

- Congratulations, you just created and added a customized pie to your portfolio.

This is a step by step tutorial to create M1 pies on the M1 finance app. There are four main parts to it:

- Create new pie on M1 Finance

- Add Slices to M1 Pie

- Assign Weights to M1 Pie Slices

- Add the M1 pie to an investment portfolio

PART ONE: Creating the Pie – How to Create a New Pie on M1 Finance

Step 1. Download and install the M1 app. Go through the basic setup as described below.

Download and install the M1 Finance app. Go through the basic setup as described below.

Basic Setup: After installing the M1 Finance app, please do the following:

- Create an investment account

- Connect your bank account

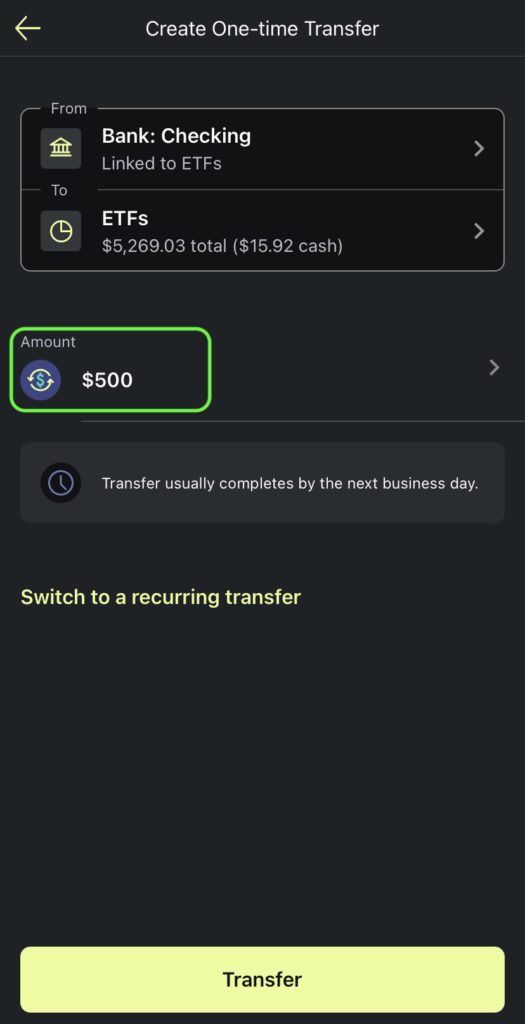

- Transfer money to get started. You can choose one-time transfer or set up a recurring transfer option.

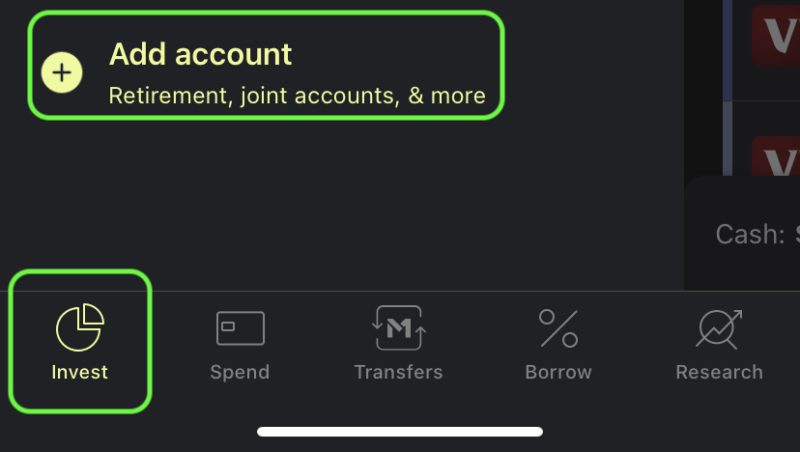

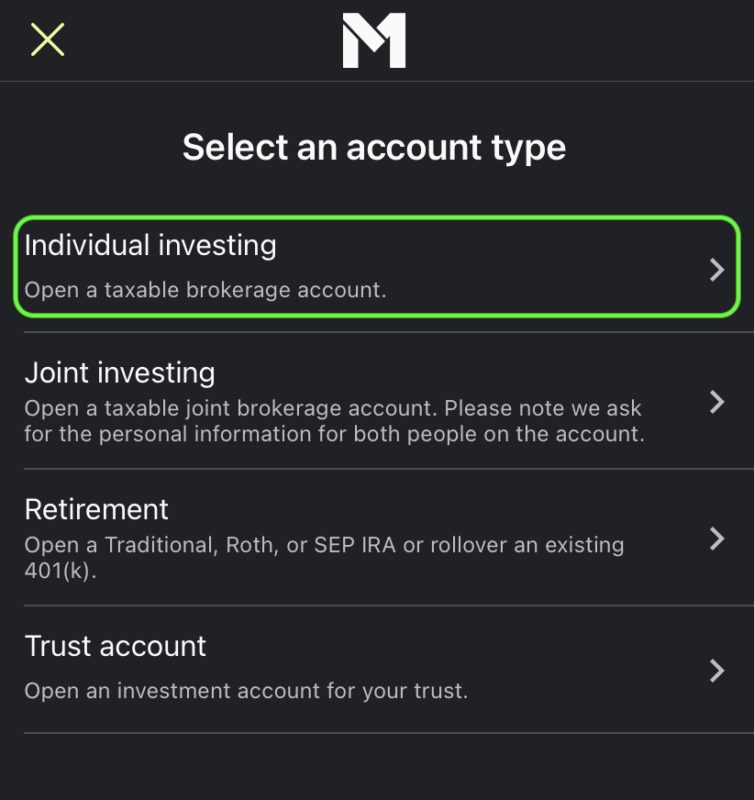

Step 1a. Create an Investment Account on M1 Finance

Create an investment account on M1: 1. Select ‘Invest’ at the bottom of the app, then select ‘Add account’ 2. When the selection screen appears, select ‘Individual Investing’ and create an account and name it.

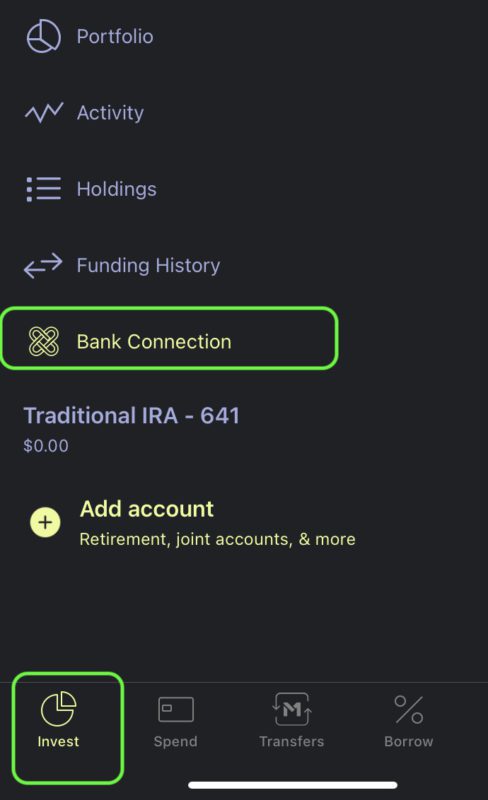

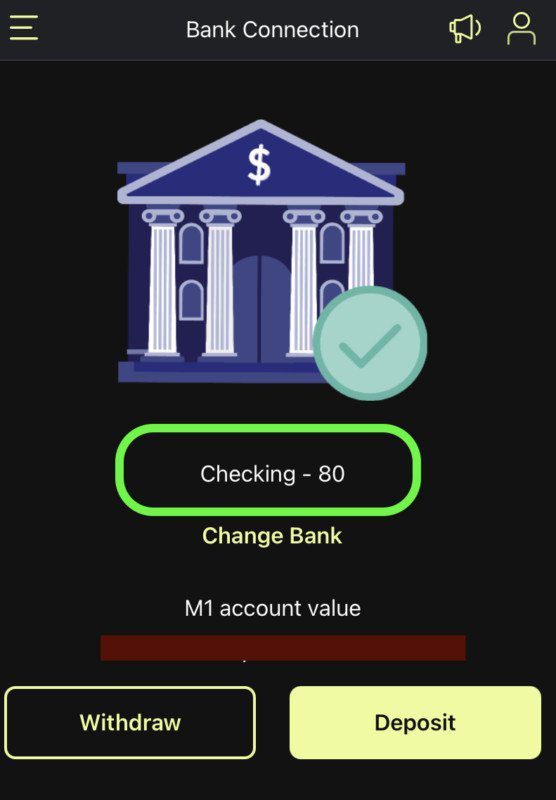

Step 1b. Connect Your Bank Account to M1 Finance

To connect a bank account, 1. go to the ‘Invest’ button at the bottom, make sure the right investment account is selected (the one you just created), and then select ‘Bank Connection’. It should be easy to connect the bank account from there. 2. After connecting the bank account you should now see the bank details on the screen (last two digits of account)

Step 1c. Transfer Money to M1 Finance

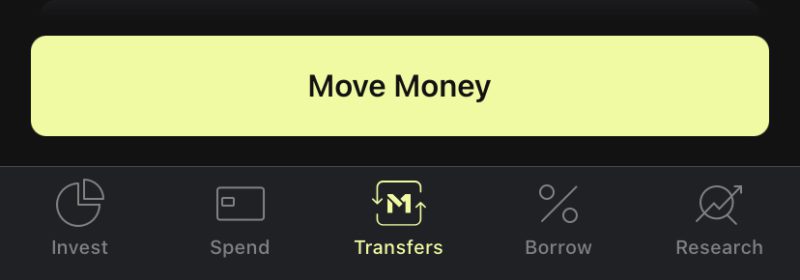

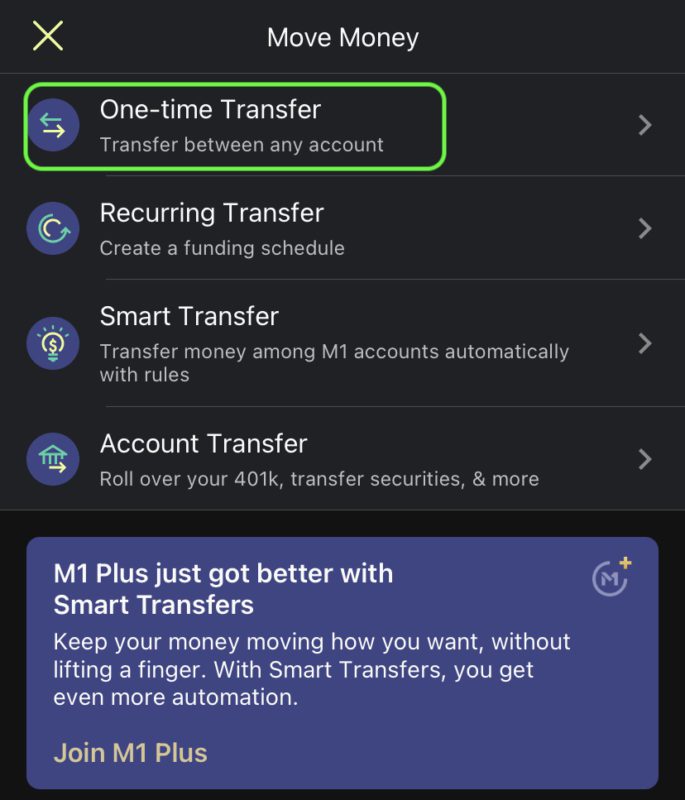

Transfer Money to M1: 1. Click on the ‘Transfers’ button at the bottom of the app, then choose ‘Move Money’ 2. Click on ‘One-time transfer’ 3. Select linked bank account, M1 investment account, and amount. Hit Transfer. It usually takes one business day for the transfer to complete.

Step 2. After the basic setup, this is what the app menu would look like. From the bottom menu bar, click on ‘Research’ button.

After the basic setup, this is what the app menu would look like. From the bottom menu bar, click on the ‘Research’ button.

Step 3. The research button should open up a page like this. click on the 3 horizontal bar button on top left for all menu options (specific to research).

The research button should open up a page like this. click on the 3 horizontal bar button on top left for all menu options (specific to research).

Step 4. Select ‘My Pies’ from the menu bar on the left.

Select ‘My Pies’ from the menu bar on the left.

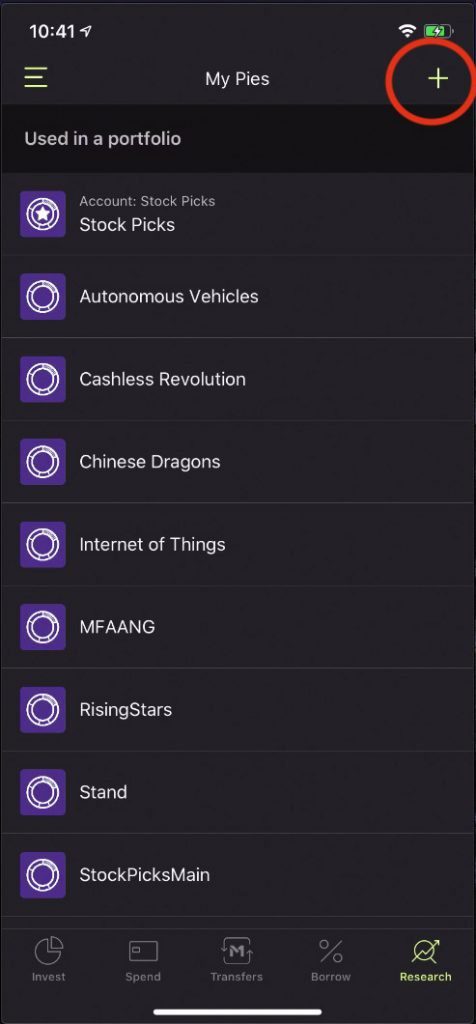

Step 5. ‘My Pies’ would open up the page showing all your M1 pies (it would be empty if this is your first pie). Click on the ‘+’ sign on top right to see the add options.

‘My pies’ would open up the page showing all your M1 pies (it would be empty if this is your first pie). Click on the ‘+’ sign on top right to see the add options.

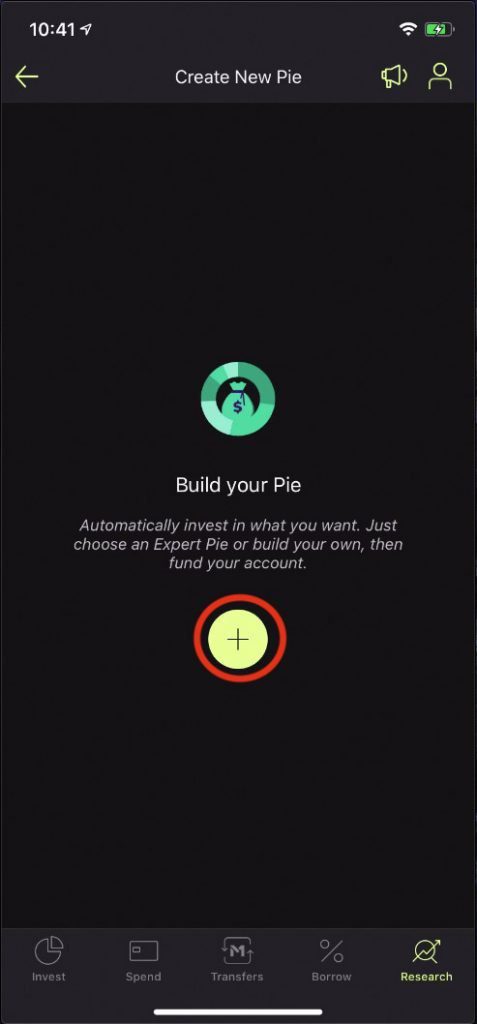

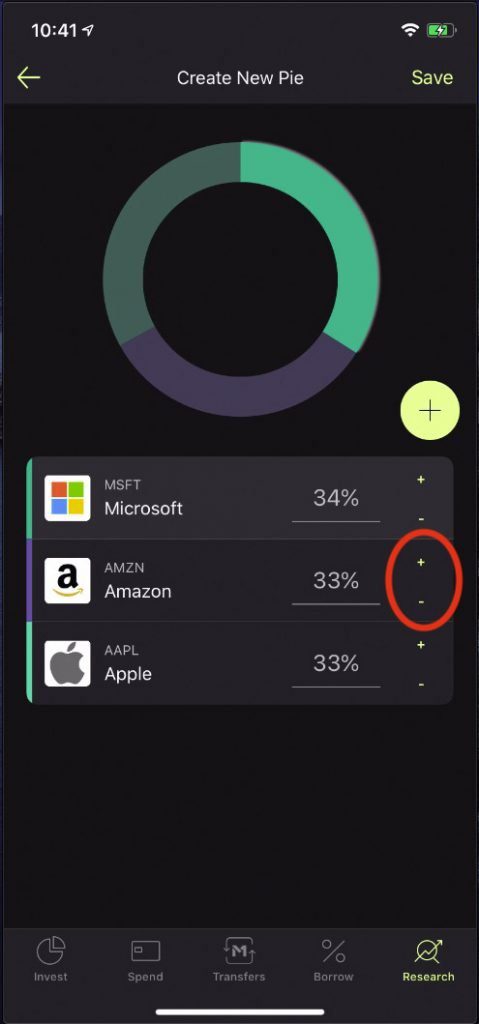

Step 6. The new page titled ‘Create New Pie’ should open up. Click on the big ‘+’ button in the center of the screen.

The new page titled ‘Create New Pie’ should open up. Click on the big ‘+’ button in the center of the screen.

PART TWO: Add Slices To M1 Pies

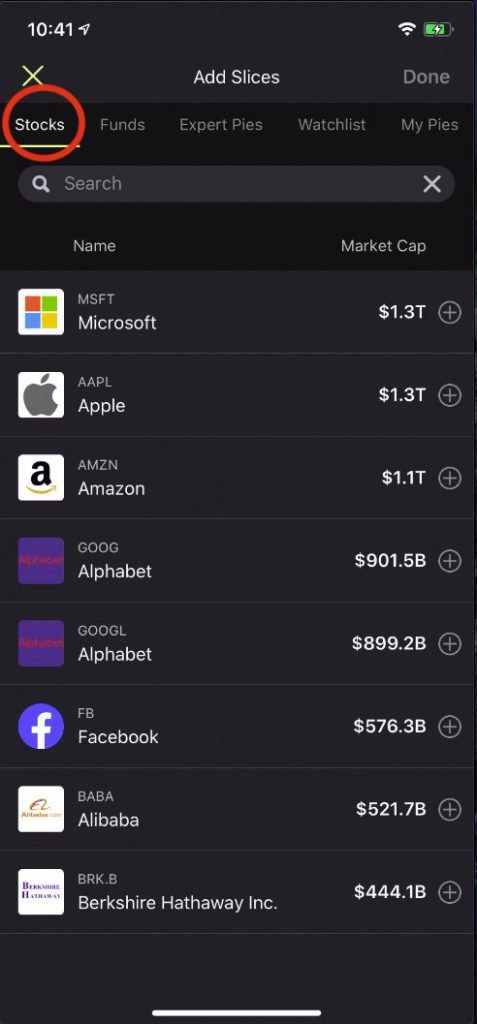

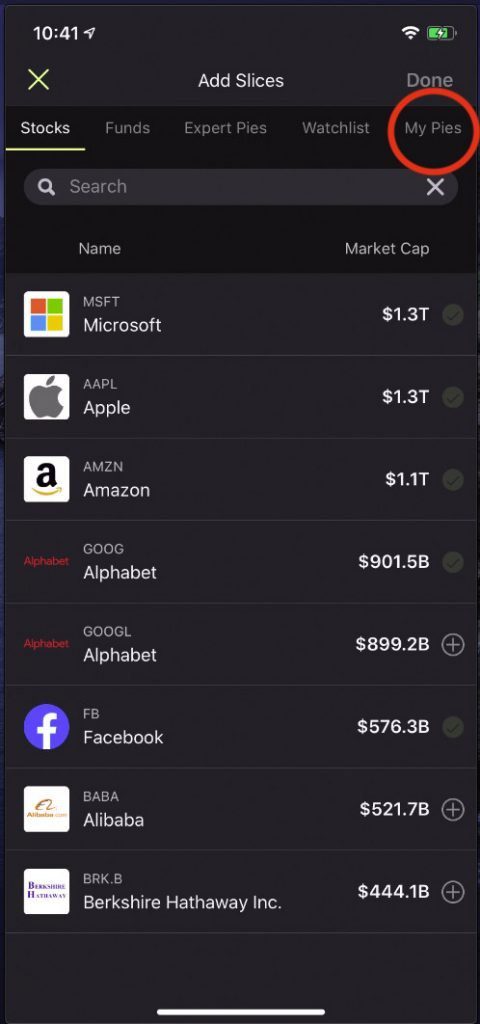

Step 7. Now you should be able to see all the ‘Add Slices’ options. On the top menu, you can choose Stocks, Funds, Expert Pies, My Pies etc. (Yes you can add a pie as a slice to another pie too.)

Now you should be able to see all the ‘Add Slices’ options. On the top menu, you can choose Stocks, Funds, Expert Pies, My Pies etc. (Yes you can add a pie as a slice to another pie too.)

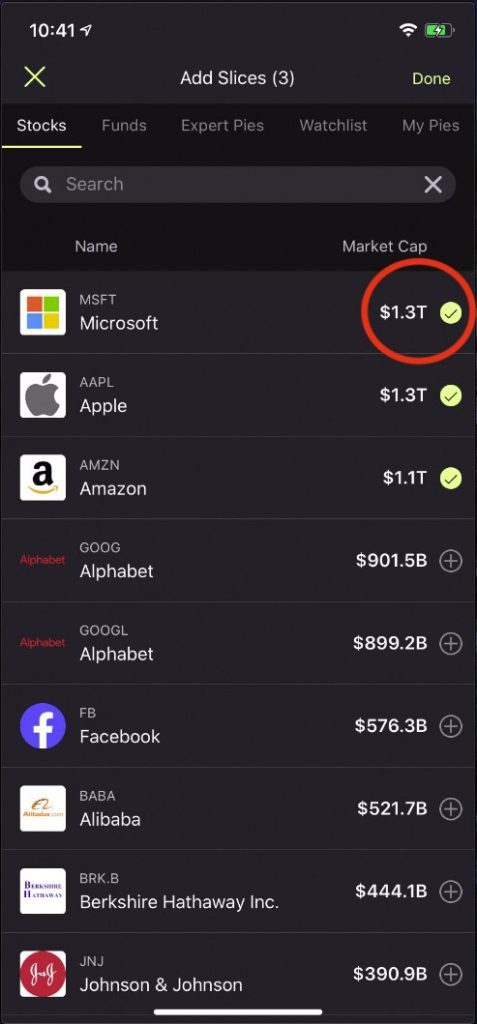

Step 8. Let’s select some stocks for the M1 pie.

Simply search for the stocks you want and add them using the small ‘+’ buttons on the right side of the stock details. You can add multiple stocks, as shown in the screenshot – MSFT, AAPL, AMZN. After selecting the stocks, click on the ‘Done’ button on the top right.

Let’s select some stocks for the M1 pie.

Simply search for the stocks you want and add them using the small ‘+’ buttons on the right side of the stock details.

After selecting the stocks, click on the ‘Done’ button on the top right.

PART THREE: Assign Weights to M1 Pie Slices

Step 9. You should now get the option to assign weights to your stocks in the M1 pie.

This is your chance to set weights according to your desire. If you want to invest more in a particular stock, assign a bigger weight to it. Needless to say, the sum of all weights should total to 100.

You should now get the option to assign weights to your stocks in the M1 pie.

This is your chance to set weights according to your desire. If you want to invest more in a particular stock, assign a bigger weight to it.

Needless to say, the sum of all weights should total to 100.

Step 10. After adjusting the final weights, save your M1 pie.

After adjusting the final weights, save your M1 pie.

Step 11. Now it’s time to give your pie a name and a description. Hit save button when done.

Now it’s time to give your pie a name and a description. Hit save button when done.

PART FOUR: Add the M1 Pie to an Investment Portfolio

Step 12. You pie now has a name and is ready to use. To use the pie in your portfolio, click the ‘Invest’ button in the menu at the bottom.

You pie now has a name and is ready to use. To use the pie in your portfolio, click the ‘Invest’ button in the menu at the bottom.

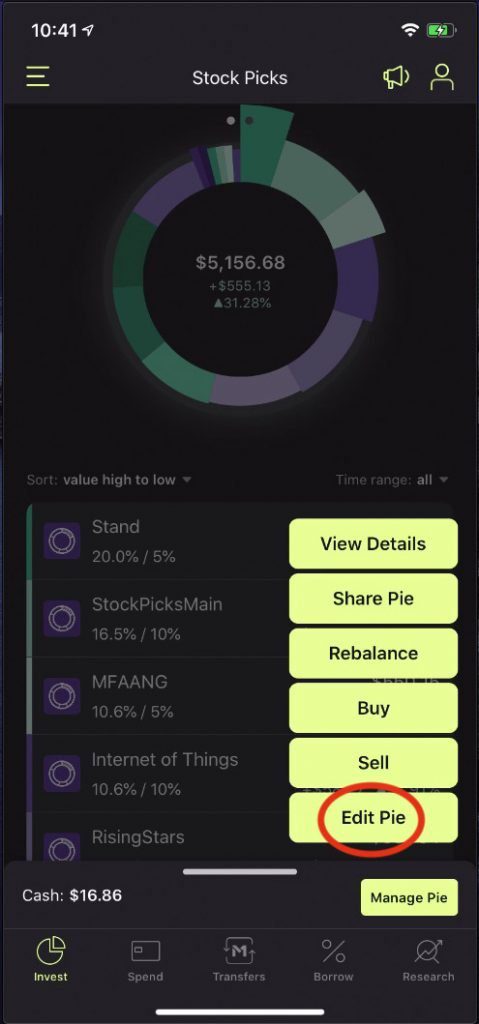

Step 13. Click on the ‘Manage Pie’ button on the bottom right. A small menu should pop up, click on ‘Edit Pie’ button.

Click on the ‘Manage Pie’ button on the bottom right. A small menu should pop up, click on ‘Edit Pie’ button.

Step 14. Now the details of the portfolio should show. To add the new pie, use the ‘+’ button toward the center-right of the screen.

Now the details of the portfolio should show. To add the new pie, use the ‘+’ button toward the center-right of the screen.

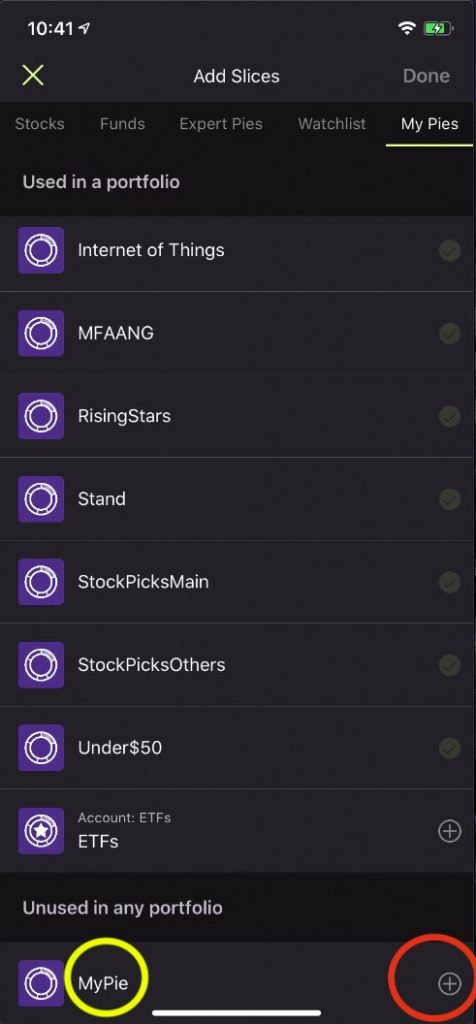

Step 15. On the top menu, select ‘My Pies’.

On the top menu, select ‘My Pies’.

Step 16. Locate your pie you just created, and click the ‘+’ button on the right hand side of the Pie name.

Locate your pie you just created, and click the ‘+’ button on the right hand side of the Pie name.

Step 17. Adjust the weights if you have multiple pies. Hit ‘Save’ on top right to finalize the addition of the pie to your M1 portfolio.

Adjust the weights if you have multiple pies. Hit ‘Save’ on top right to finalize the addition of the pie to your M1 portfolio.

Congratulations, you just created and added a customized pie to your portfolio.

FAQ on M1 Finance

How to create another pie or multiple pies on M1 finance?

The process of creating a new pie remains the same. You can create as many pies as you want following steps 2 through 11. You can then add the new pies (or choose not to) to your portfolio by following steps 12 through 17.

How many pies can you create on M1?

I have created over a dozen customized pies and I believe I can keep creating more and more till at least 100.

Can I buy fractional shares on M1?

Yes, when you create a pie and invest an amount, say $100, in the MFAANG pie, you are effectively buying fractional shares of all stocks in the pie.

Now you know how to create your M1 portfolio and start investing.

Did you like the ‘How to create your portfolio’ guide? Let us know your thoughts!

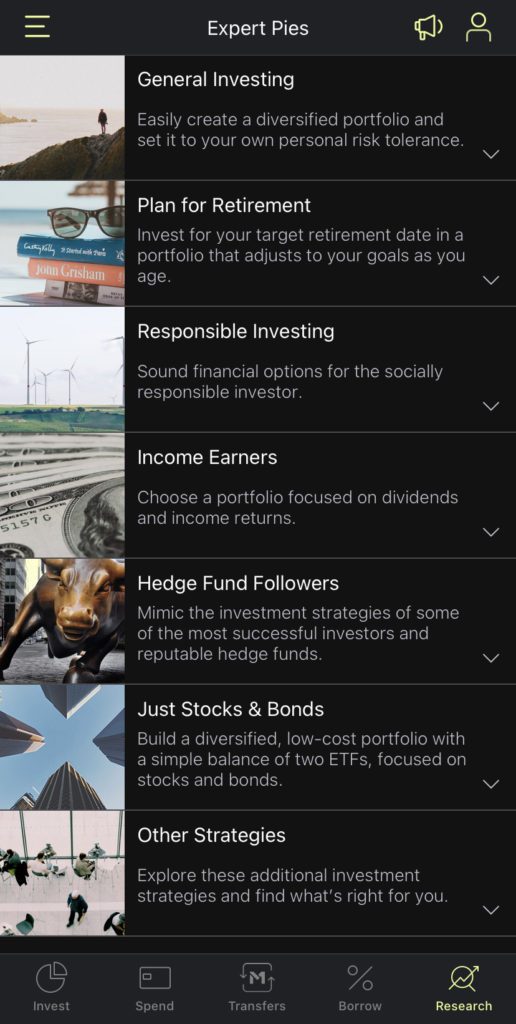

Expert Pies on M1

There are many ready-to-use expert pies available on M1 for investors. Here’s a list below:

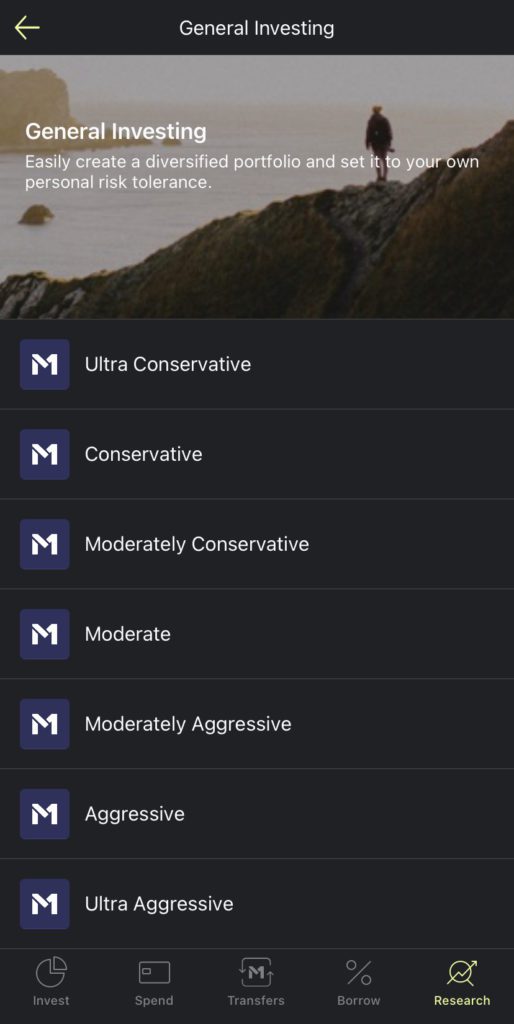

- General Investing (based on style of investing – from ultra conservative to ultra aggressive)

- Plan for Retirement (investments according to target retirement dates)

- Responsible Investing (invest with a social cause)

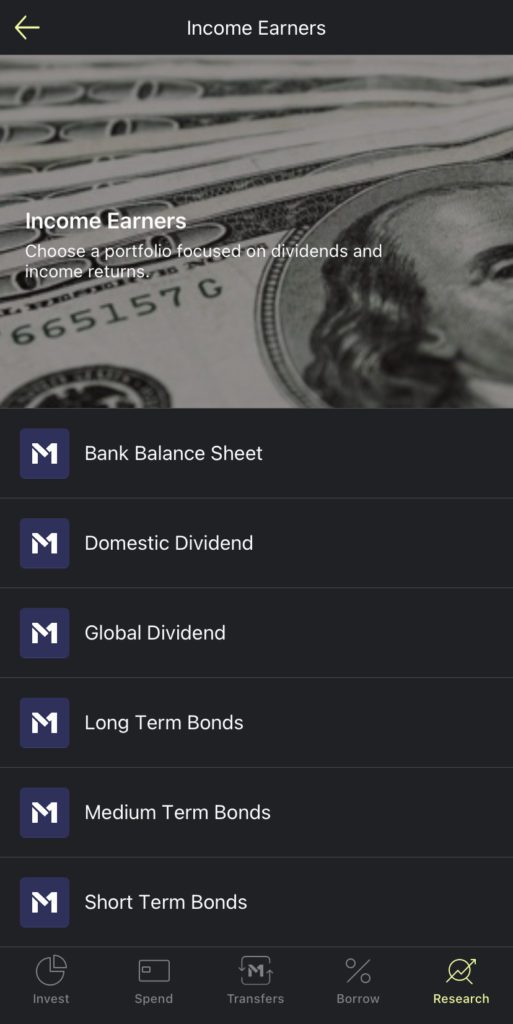

- Income Earners (invest for regular income)

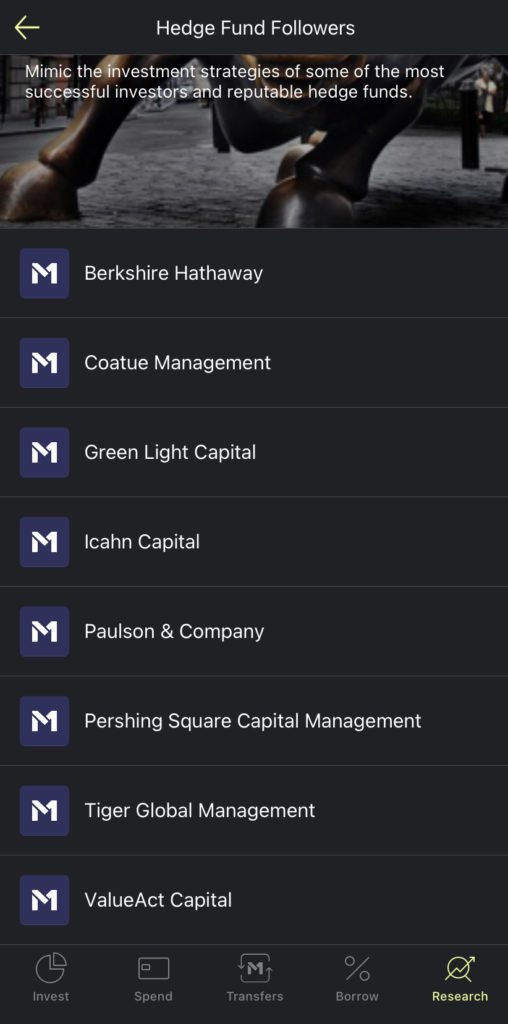

- Hedge Fund Followers (copy the investing style of hedge funds such as Tiger Global and Pershing Square)

Expert Pies on M1

Bestseller Personal Finance Books

Best M1 Pies for Beginners

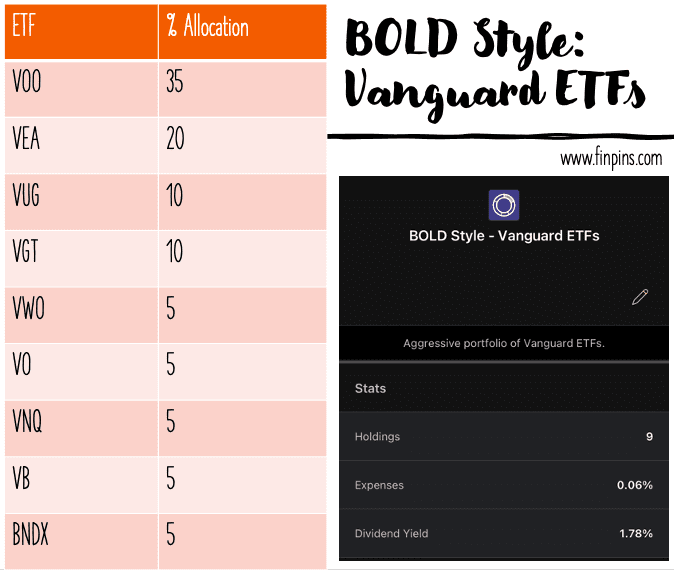

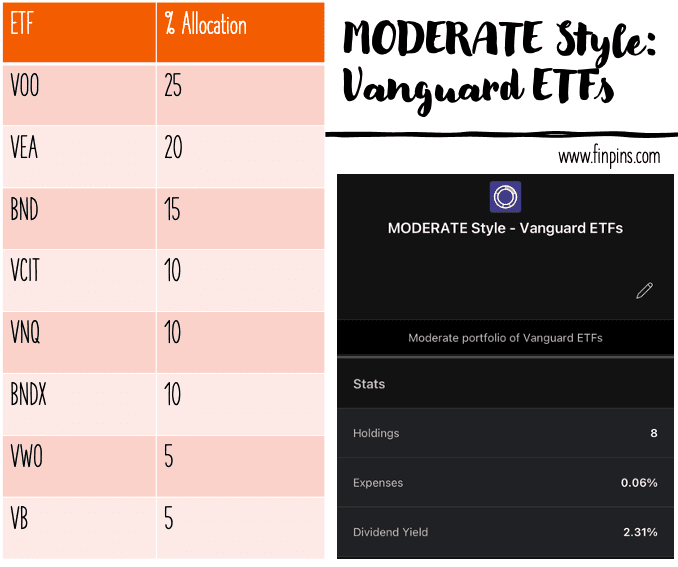

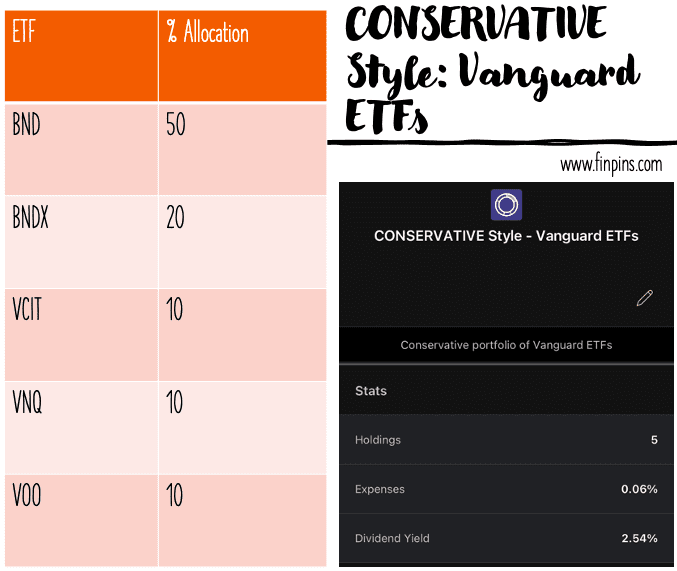

We have created three M1 pies consisting of Vanguard ETFs, based on the three basic styles of investing.

- Bold – aggressive style of investing

- Moderate – moderate style of investing

- Conservative – conservative style of investing

Vanguard ETFs used in the BOLD, MODERATE, and CONSERVATIVE Pies

- VOO Vanguard 500 Index Fund ETF

- VEA Vanguard Developed Markets Index Fund ETF

- VUG Vanguard Growth Index Fund ETF

- VGT Vanguard Information Technology Index Fund ETF

- VWO Vanguard FTSE Emerging Markets ETF

- VO Vanguard Mid-Cap ETF

- VNQ Vanguard Real Estate ETF

- VB Vanguard Small-Cap ETF

- BNDX Vanguard Total International Bond ETF

- BND Vanguard Total Bond Market ETF

- VCIT Vanguard Intermediate-Term Corporate Bond ETF

BOLD Style – Aggressive M1 Portfolio (Pie) with Vanguard ETFs

| ETF | % Allocation |

| VOO | 35 |

| VEA | 20 |

| VUG | 10 |

| VGT | 10 |

| VWO | 5 |

| VO | 5 |

| VNQ | 5 |

| VB | 5 |

| BNDX | 5 |

MODERATE Style – Moderate M1 Portfolio (Pie) with Vanguard ETFs

| ETF | % Allocation |

| VOO | 25 |

| VEA | 20 |

| BND | 15 |

| VCIT | 10 |

| VNQ | 10 |

| BNDX | 10 |

| VWO | 5 |

| VB | 5 |

CONSERVATIVE Style – Conservative M1 Portfolio (Pie) with Vanguard ETFs

| ETF | % Allocation |

| BND | 50 |

| BNDX | 20 |

| VCIT | 10 |

| VNQ | 10 |

| VOO | 10 |

OTHER M1 FINANCE FEATURES

M1 Borrow: Borrow Money at Super Low Interest Rates

A clear winner feature of M1 finance is the M1 Borrow feature.

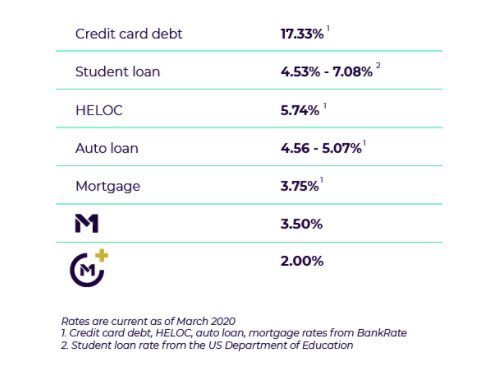

Through M1 Borrow, investors can borrow up to 35% of their investment account’s value (IRA accounts excluded) at a low-interest rate of 3.50% per year. The deal gets even sweeter for M1 Plus members who can borrow at a further reduced interest rate of 2% per year.

The screenshot from the M1 website does a quick comparison of the borrowing rates and shows how good M1 Borrow is. Even at 3.5%, the interest rates are incredibly cheap, but if you want lower rates, consider upgrading to M1 Plus status which can cost $125 per year. M1 also sends out targeted promotions and you might end up saving on the $125 annual fee as well!

Things to Remember about M1 Borrow

- Understandably, the interest rates on M1 Borrow get influenced by the Federal Funds Rate (yes, the one you keep hearing about in the news) and can change if the Fed Funds Rate changes.

- As the borrowing limit is up to 35% of the investment account value, change in value of the account may cause a change in borrowing limit. For example, if your investment account’s value is $15,000 you are eligible to borrow 35% of $15,000 = $5,250. If, next month the value of your investment account grows to $20,000, your borrowing limit will change to 35% of $20,000 = $7,000.

- You only pay interest on what you actually borrow, NOT on your borrowing limit. So if you borrow only $1000 out of your borrowing limit of $5,250 you will be charged interest on just the $1,000 borrowed.

- The investment account needs to be worth $10,000 or more to qualify for M1 Borrow program. [update: threshold lowered to just $5,000 in May 2021]

- You can withdraw the borrowed amount and use it for personal usage or keep it in M1 to invest it.

- If you decide to borrow the money and invest it back in the stock market, you should be aware of the investment risks such as losing capital (+ borrowed capital in this case).

Overall, I believe M1 Borrow is a great feature that allows easy access to money at low interest rates WITHOUT a credit check and extensive approval process.

Is There a Promotion on M1 Finance? e.g. Free Stock or Free Cash?

Yes, M1 is currently running a promotion where new users can get up to free $30 in their M1 account for signing up and funding the account. Use the link below to get the offer. Happy Investing!

M1 is also running a targeted promotion that offers up to 100% off (yes 100% off) on a year on M1 plus membership.

For IRA transfers to M1, you can earn a bonus up to $3,500.

M1 Finance is a great solution for investors who want to build investment portfolio. Check out the Best Investment App comparison table to see how M1 compares against other investment apps.

Best Investment App Comparison

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents