This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

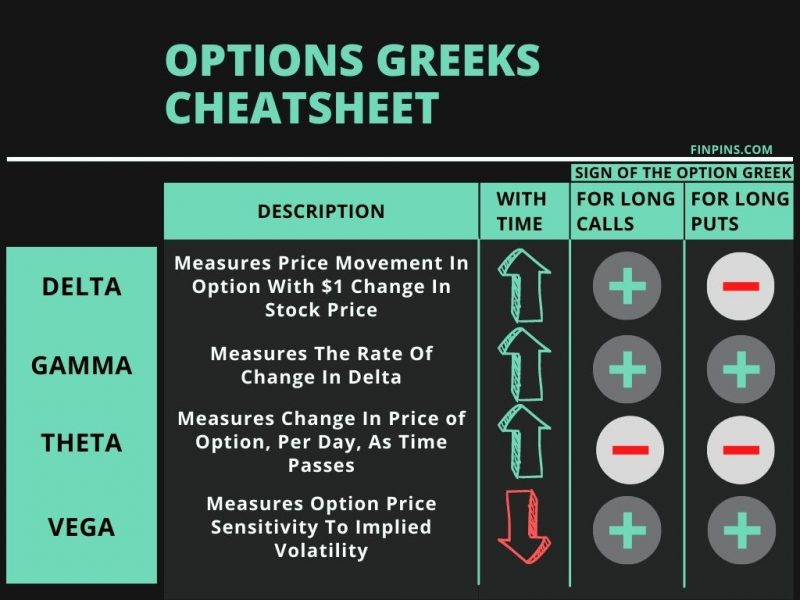

In this article on Options Greeks Cheat Sheet, we will go over the 4 major Stock Options Greeks used by options traders – Delta, Gamma, Theta, and Vega. We will go over them in detail and how the values of these stock options greeks change with respect to the strike price of the options contract, price of the underlying stock itself, time remaining until contract expiration, implied volatility, etc.

We have also prepared an Options Greeks Cheat Sheet for a quick reference for you to sum everything up. To jump to a particular section, please use the ‘Page Contents’ menu below.

- Options Greeks: Delta and Gamma

- What is Delta of a Stock Option?

- What is Gamma of a Stock Option?

- Options Greeks: Theta and Vega

- What is Theta of a Stock Option?

- What is Vega of a Stock Option?

- Options Greeks Cheat Sheet

Options Greeks: Delta and Gamma

The greeks, such as Delta and Gamma, of stock options help us explain the price of the stock option contract. These are theoretical concepts, which are directionally correct, but the option price changes are not guaranteed to follow any exact ‘formula’. In this section, we will explore the delta of a stock option and also understand what gamma is.

What is Delta of a Stock Option?

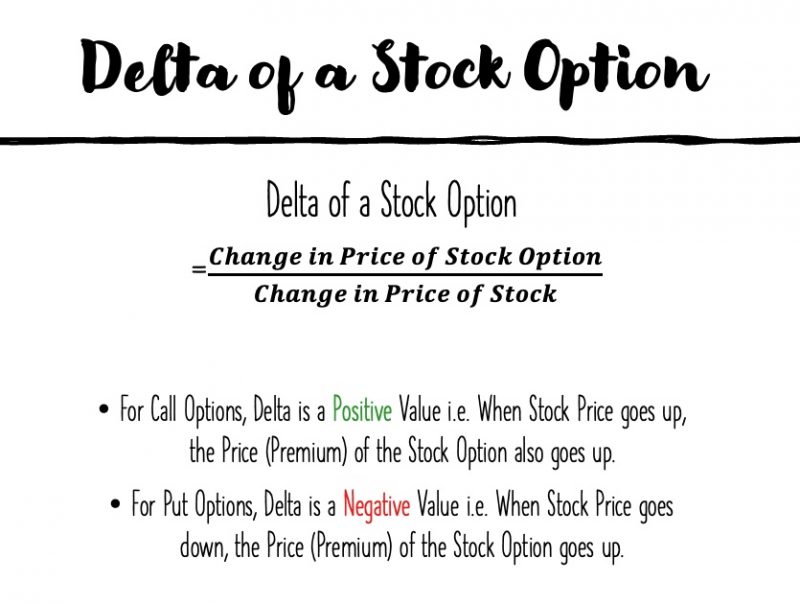

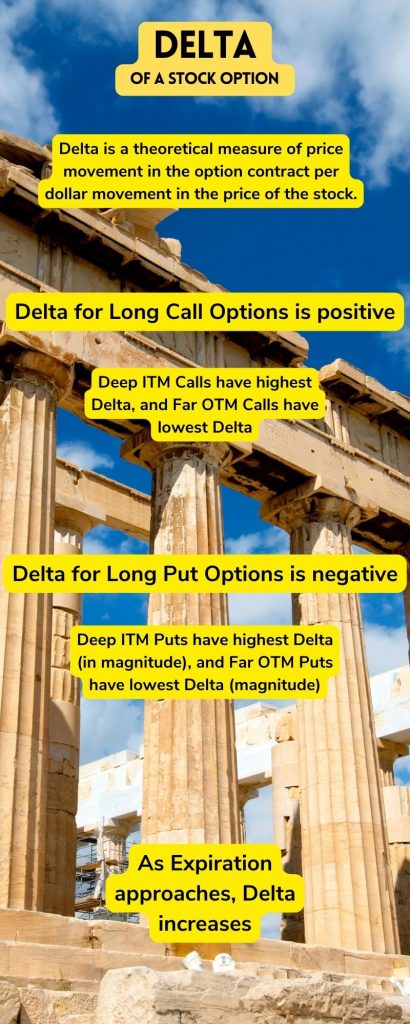

Delta is a theoretical measure of price movement in the option contract per dollar price movement in the price of the underlying asset (let’s assume the underlying asset is a stock).

Option Price Calculation based on Delta: What Happens to Option Price when the Stock Price Changes?

Price Change of Call Option

Investors buy a call option when they want to benefit from an increase in the stock price. When the stock price goes up, the call option price also goes up. Hence, Delta of a Call Option is Positive. Delta helps us calculate what the theoretical change in the call option price would be based on price movement in the stock.

Let’s consider the following scenario:

- Current Stock Price = $100

- Call Option Premium (Current Value) = $15

- Delta of the Call Option = 0.25 or 25%

Case 1: Stock Price rises to $101

The Call Option premium rises by 0.25 * ($101 – $100) = $0.25, to reach $15.25

Case 2: Stock Price rises to $105

The Call Option premium rises by 0.25 * ($105 – $100) = $1.25, to reach $16.25

Case 3: Stock Price falls to $99

The Call Option premium falls by 0.25 * ($100 – $99) = $0.25, to reach $14.75

Case 4: Stock Price falls to $95

The Call Option premium falls by 0.25 * ($100 – $95) = $1.25, to reach $13.75

Price Change of Put Option

Investors buy a put option when they want to benefit from a decrease in the stock price. When the stock price goes down, the put option price goes up. Hence, Delta of a Put Option is Negative. Delta helps us calculate what the theoretical change in the put option price would be based on price movement in the stock.

Let’s consider the following scenario:

- Current Stock Price = $100

- Put Option Premium (Current Value) = $5

- Delta of the Put Option = -0.10 or -10%

Case 1: Stock Price falls to $99

The Put Option premium rises by 0.10 * ($100 – $99) = $0.10, to reach $5.10

Case 2: Stock Price falls to $95

The Put Option premium rises by 0.10 * ($100 – $95) = $0.50, to reach $5.50

Bestseller Personal Finance Books

Case 3: Stock Price rises to $101

The Put Option premium falls by 0.10 * ($101 – $100) = $0.10, to reach $4.90

Case 4: Stock Price rises to $105

The Put Option premium falls by 0.10 * ($105 – $100) = $0.50, to reach $4.50

How does Strike Price Impact the Delta of a Stock Option?

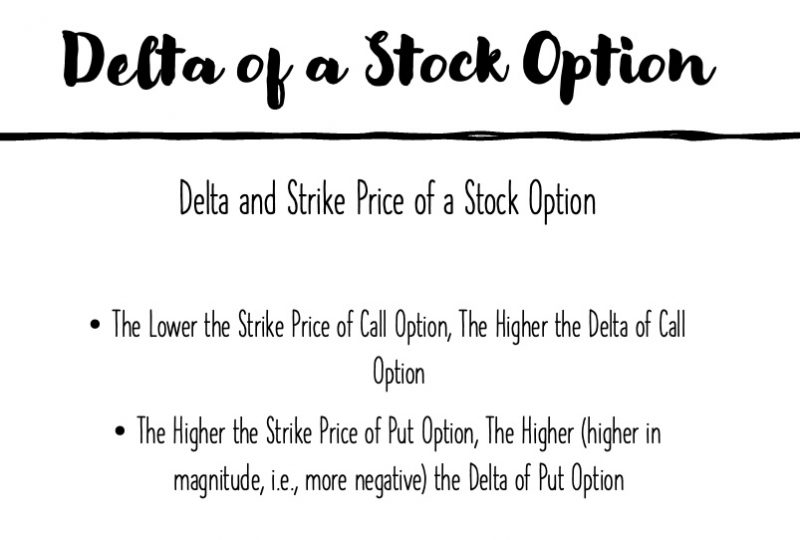

Out of Money Call Options with strike price far from the stock’s current price have a low delta – a dollar change in stock price will move the call option price by a lower dollar amount.

Out of Money Call Options with strike price closer to the stock’s current price have a higher delta.

In the Money Call Options have a higher delta than Out of Money Call Options.

Deep In the Money Call Options have a higher delta than ITM Call Options with strike prices closer to the stock’s current price.

Generally, the lower the strike price of the Call Option, the higher the Delta.

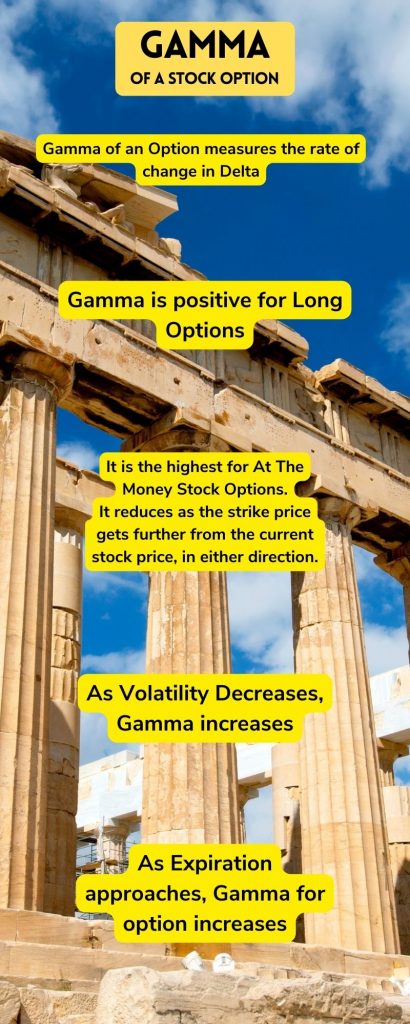

What is Gamma of a Stock Option?

So, now that we understand what Delta is, let’s see how Gamma relates to Delta of a Stock Option. You might have wondered whether Delta itself changes based on some other factors. In fact, delta changes!

Gamma of a Stock Option actually measures the rate of change in delta. Gamma is always positive and is the highest for At The Money Stock Options (i.e. for options with the strike price closest to the stock’s current price). It reduces as the strike price gets further from the current stock price, in either direction.

For an analogy, if delta is the speed of a car, gamma is the rate of change in speed or acceleration of the car.

Options Greeks: Theta and Vega

The greeks, such as Theta and Vega, of stock options help us explain the price of the stock option contract. These are theoretical concepts, which are directionally correct, but the option price changes are not guaranteed to follow any exact ‘formula’. In this section, we will explore the concept of theta of a stock option and also understand what Vega is.

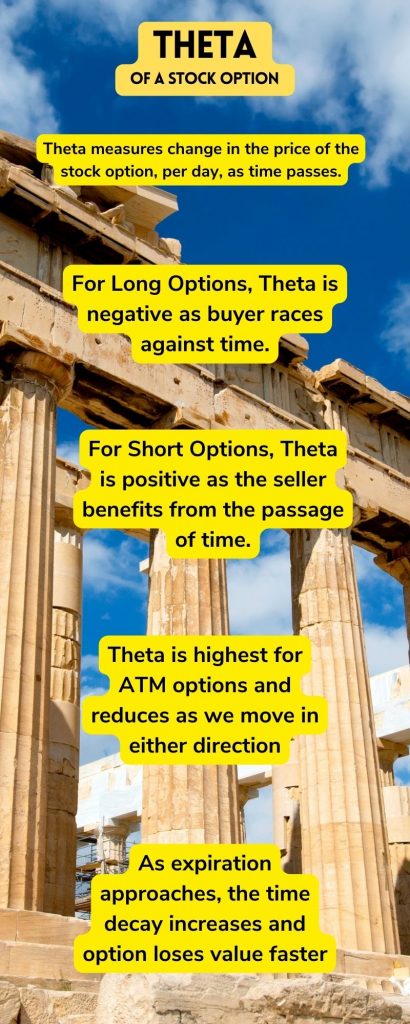

What is Theta of a Stock Option?

Suppose, you hold a call option with a strike price of $125 on a stock. The current price of the stock is $110. Theoretically, there is a better chance of the stock going above $125 in the next 2 years as compared to the next 2 weeks. If we compare 2 different call option contracts, for the same strike price of $125, but different expiration dates – one-two weeks from now, and another 2 years from now. The contract that has 2 more years before expiration is more valuable because it has time on its side!

Extrinsic Value and Time Decay of a Stock Option

The value-added due to ‘time’ is called the Extrinsic Value of the Stock Option contract. Understandably, as time passes, the value of the call option erodes. This erosion of value is called ‘time decay’.

Theta is a theoretical measure of price movement in the option contract based on the time remaining until the contract’s expiration date. Theta measures change in the price of the stock option contract, per day, as time passes.

For call and put option BUYERS, theta is a negative number. Because, as time passes, the value of the option contract decreases because of time decay. Since the buyers hold the contract they are ‘hurt’ by the time decay. The call and put option SELLERS, on the other hand, benefit from the time decay.

Option Price Calculation based on Theta

Risk-averse investors buy stock options with a longer period of time remaining until expiration.

Let’s consider the following scenario.

- Current Stock Price = $100

- Strike Price of Call Option = $125

- Call Option Premium (Current Value) = $15

- Time until Expiration Date = 2 weeks

- Theta of the Call Option = -$1.50

What Happens to Stock Option Price as Time Passes?

As time passes, the call option continues to experience time decay and its extrinsic value erodes. If the stock price doesn’t rise and reaches $125 (the strike price) before the expiration date, the call option becomes worthless.

- After 1 day, the stock price remains unchanged, the option contract loses $1.50 value, to reach $13.50

- After second day, the stock price remains unchanged, the option contract loses another $1.50 value, to reach $12

- and so on.

Does Theta Remain Constant Over Time?

Another way to ask the question is – Is the time decay linear, i.e. -$1.50 per day, every day?

Not necessarily!

The closer the expiration date approaches, the theta tends to become bigger (higher in magnitude, hence more negative).

Just imagine hoping for the stock price to jump from $100 to $125 on the last day. The probability of that happening is lower, hence decay is larger closer to the expiration date.

There are a lot of moving pieces here, and the example above assumes that the stock price is relatively stable around $100, to focus solely on the impact of time.

How Does Strike Price Affect Theta of a Stock Option?

The Stock Options that are ‘At the Money’ i.e. with Strike Price closest to the current price of the stock experience the highest impact of time decay. Hence, the Theta of At-The-Money Stock Options is the highest (in magnitude).

The Theta decreases in magnitude for stock options as strike prices move further away from the current price of the stock, in either direction. In other words, In-The-Money and Out-of-Money Stock options are less impacted by Theta compared to At-The-Money Stock Options.

What is Vega of a Stock Option?

Vega measures the expected change in the price of stock option per percentage point change in Implied Volatility. We know, Vega is a little more complicated to understand as compared to Delta, Gamma, and Theta. So, let’s make it as simple as we can, starting with understanding Implied Volatility first.

What is Implied Volatility?

Let’s break down Implied Volatility in simpler words.

Volatility, as you might know already, is the standard deviation of the stock price, i.e. how much the stock price sways away from average. Now, we can take a look at historical data for a stock and easily compute the standard deviation of the stock prices on a daily basis. That is how we can get historical volatility. Implied Volatility is a ‘guess’ or ‘prediction’ of the volatility in the stock price in the future, i.e. will the stock price grow in a straight line, or will the price chart look shaky (deviating from the average) in the future.

Implied Volatility is expressed as an annualized percentage number.

What is Vega?

Vega measures the change in value (premium) of the stock option contract per percentage point change in Implied Volatility.

Note that Implied Volatility is somewhat based on a ‘prediction’ of options traders in the market, and is controlled by buying and selling pressure on the stock option. It can change even without any change in the underlying stock’s price.

To Wrap up Vega and Implied Volatility

So, effectively, the buying and selling pressure in the options trading market determines the Implied Volatility. The change in Implied Volatility impacts the Vega. Vega, in turn theoretically impacts the price of the stock options contract.

Options Greeks Cheat Sheet

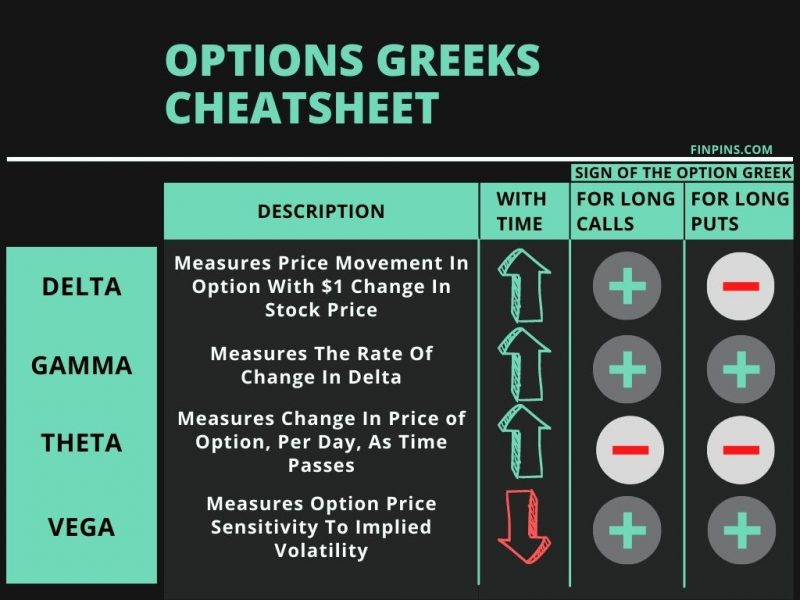

Refer to the “Options Greeks Cheat Sheet” infographic for a quick summary of the 4 Stock Options Greeks – Delta, Gamma, Theta, and Vega.

For more on Stock Options, check out StartOptions.com

Read also: Call vs Put Options

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents