This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Stock, Shares, Equity – what do these words mean? The person on the tv news keeps screaming that the market rose yesterday, the market fell today – how to make sense of all of that? If you’ve ever wondered about the questions above, we got you covered. Let’s begin with the basic definition of stock.

Understanding the Basics of Stock

A stock (also known as equity) is a security that represents the ownership of a fraction of a corporation. This entitles the owner of the stock to a proportion of the corporation’s assets and profits equal to how much stock they own. Units of stock are called “shares.”

Investopedia

In simple terms, stocks (or equities) are a type of ownership of a company. A share is a tradable portion of the stock, usually an integer, such as 1,2, and 3, etc. In general conversations, people use the words stock, share, equity interchangeably.

- Stock – Understanding the Basics

- Market Capitalization

- Ticker Symbol or a Stock Symbol

- Stocks: what are some popular numbers to watch out for?

- What is Stock Market Volatility?

- What is ‘Market’?

Market Capitalization

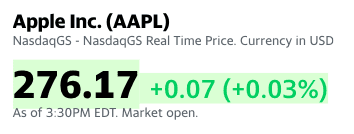

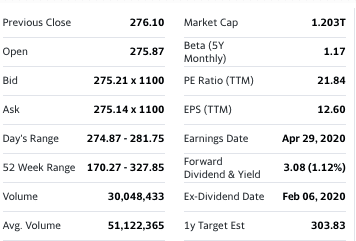

(Image: Yahoo Finance)

In order to buy a piece of the company, you can buy a share of the company’s stock. Let’s see how Apple is a Trillion dollar company ($2T company, now in August 2020).

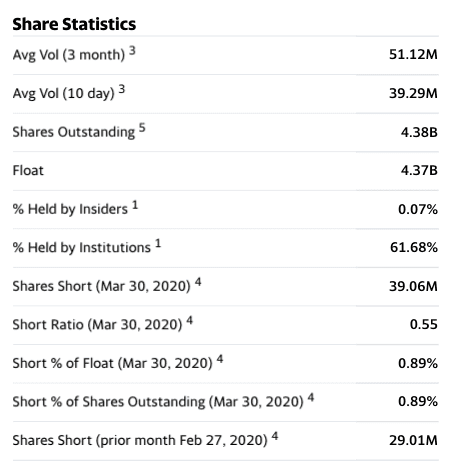

(Image: Yahoo Finance)

Apple has 4.38 Billion shares outstanding. At the market price of $276 per share, 4.38 Billion shares outstanding gives Apple a market capitalization (market cap) value of $1.2 Trillion. So, effectively, when you buy 1 share of Apple for $276, you own 1 / 4.38 billionth of the company!

Small, Mid, and Large Cap Stocks

I always wondered what is the line that divides stocks into three categories. After researching I discovered that there is no hard line that separates the small, mid, and large stocks from each other. Generally, a stock with a market cap of less than $2 Billion is considered a small-cap. We consider a stock with a $2B – $10B market cap mid-cap, and any stock over a $10B market cap is considered large-cap.

- Small Cap Stock: Market cap < $2 Billion

- Mid Cap Stock: Market cap between $2 Billion and $10 Billion

- Large Cap Stock: Market cap > $10 Billion

As of writing this post, there are over 1500 large cap stocks tradable on the New York Stock Exchange. Some popular ones are Apple, Amazon, Microsoft, Google (Alphabet), Alibaba, Facebook, etc.

Ticker Symbol or a Stock Symbol

What do symbols such as AAPL, AMZN, MSFT, TSLA, FB mean?

A stock symbol is an abbreviated form of the stock name. You might have seen the scrolling ribbon at the bottom of a news channel indicating stock prices. The stock price reports generally use stock ticker symbols to identify the stock. Some companies can have very similar names, and a novice investor can end up inadvertently investing in the ‘wrong’ stock.

It may sound silly, but it is worth the while to double-check the stock ticker symbol before investing. Thousands of investors bought shares of the ‘other’ Zoom stock by mistake. Read the story here.

Some popular stocks and their ticker symbols:

Apple is AAPL

Amazon is AMZN

Microsoft is MSFT

Facebook is FB

Stocks: what are some popular numbers to watch out for?

P/E ratio

P/E ratio, probably the most famous number out there, is the price to earnings ratio. Mathematically, it is the share price divided by the earnings per share. Or, put another way, the P/E ratio is the market cap divided by the total earnings of the company.

Taking our example of Apple (AAPL), if the market cap is $1.2T, annual net income is $55.25B, the Price-to-earning ratio is 1200 / 55.25 = 21.7 approximately.

The P/E ratio can be calculated on the basis of trailing 12-month earnings or the estimated future 12-month earnings. Accordingly, it is called Trailing P/E or Forward P/E ratio.

Other numbers

(source: Yahoo Finance)

- Previous Close: Share price at the end of the previous trading day.

- Open: Share price at the beginning of the current trading day.

- Bid: This is a buy order placed, 1100 shares at a price of $275.11 each.

- Ask: This is a sell order placed, 1100 shares at a price of $275.14 each.

- Day’s range: The variation in the share price during the current trading day.

- 52 week range: The variation in the share price during the previous 52 weeks.

- Volume: The number of shares traded during the current trading day

- Avg. Volume: The number of shares traded daily on average over the past three months.

- Market cap: No. of shares outstanding * Market Price of 1 share.

- Beta: This measures the volatility (see at bottom of the page) of the stock against the broad market.

- PE ratio: (Price per share) / (Earnings per share) OR (Market cap) / (Total Income)

- EPS: Earnings per share = (Total Income) / (No. of shares outstanding)

- Dividend and Yield: The cash payout the company gives to each shareholder, usually every quarter.

- Ex-dividend date: It’s like a cut-off date that qualifies or disqualifies an investor from receiving the next dividend payment. If an investor owned the stock before the ex-dividend date, he or she will receive the next dividend, according to number of shares owned.

- 1y target estimate: This is a price estimate based on one or many analysts’ prediction. Since it is a prediction, use it as a reference cautiously as it can be way off!

Read: How to Buy Your First Stock

What is Stock Market Volatility?

Volatility is a measure of risk or uncertainty in the market price of a share – it is measured as the dispersion from the mean. If the market price fluctuates/swings more, it has higher volatility.

What is ‘Market’?

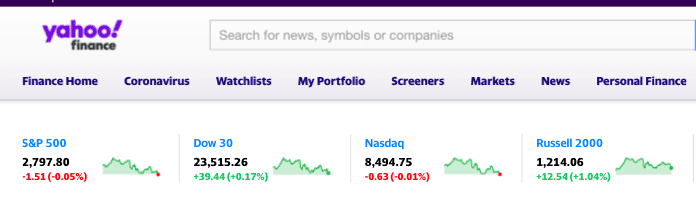

So, coming back to the question we asked at the very beginning of this post – what is ‘market’? The market is a big basket (or index) of stocks that represent a portion of the stocks traded. The most common ‘basket’ of stocks referred to as ‘market’ are S&P500, Dow 30, Nasdaq, and Russell 2000.

Bestseller Personal Finance Books

S&P 500

The Standard and Poor 500 (S&P 500) index contains 500 of the largest tradable companies in the United States. As an index, it contains 505 stock symbols (because some companies have two share classes – e.g. Alphabet has GOOG and GOOGL), all weighted proportionately to the market cap. So, a stock with a $1T market cap will carry twice the weight in the index as a stock with a $500B market cap.

The major components that form the S&P500 index are Microsoft, Apple, Amazon, Alphabet, Facebook, etc.

You can invest in the S&P500 through the following ETFs:

- Vanguard S&P 500 | VOO (expense ratio: 0.03%)

- iShares Core S&P 500 | IVV (expense ratio: 0.03%)

- SPDR Portfolio S&P 500 | SPLG (expense ratio: 0.03%)

- SPDR S&P 500 | SPY (expense ratio: 0.09%)

Expense ratio is the cost associated with the operations and fund management of ETFs and Mutual Funds – usually a percentage of your investment in the ETF or Mutual fund

Dow 30

The Dow Jones Industrial Average contains 30 companies. Unlike S&P 500 which uses market cap for weighting, Dow uses the share price for weighting the stocks in the index. So, a stock with a $500 market price will be given twice the weight of a stock with a $250 market price, regardless of the market cap.

The major components that form the Dow 30 index are 3M, UnitedHealthcare, Apple, Boeing, Microsoft, etc.

You can invest in Dow 30 Index through the SPDR Dow Jones Industrial Average ETF | DIA (expense ratio 0.16%)

Nasdaq Composite Index

The NASDAQ Composite Index is a stock market index that represents the performance of a broad range of stocks listed on the NASDAQ stock exchange. It includes stocks from various sectors such as technology, telecommunications, biotechnology, and financial companies.

The Nasdaq Composite Index is often used as a barometer for the performance of the technology and growth sectors of the stock market.

The NASDAQ Composite Index was introduced in 1971 and is one of the most widely followed stock market indices in the world. It is a market capitalization-weighted index, which means that the companies with the largest market values have a greater impact on the index’s performance.

Nasdaq 100

Nasdaq contains 100 companies in the index, with a strong focus on technology. It actually contains 103 stock symbols (because some companies have two share classes – e.g. Alphabet has GOOG and GOOGL). The Nasdaq stocks are weighted in the index according to their market cap.

The major components that form the Nasdaq 100 index are Microsoft, Apple, Amazon, Facebook, Netflix etc.

You can invest in the Nasdaq Index through the Invesco QQQ Trust ETF | QQQ (expense ratio: 0.20%)

TIP: Do not confuse between the Nasdaq index with the Nasdaq stock (NDAQ)

Russell 2000

Russell 2000 is an index made of 2000 small-cap companies in the United States. It represents the small-cap market. It’s contrary to the S&P 500 which represents the large-cap market. However, stocks in Russell 2000 index are also weighted according to their market cap.

You can invest in the Russell 2000 Index through the Vanguard Russell 2000 ETF | VTWO (expense ratio: 0.10%)

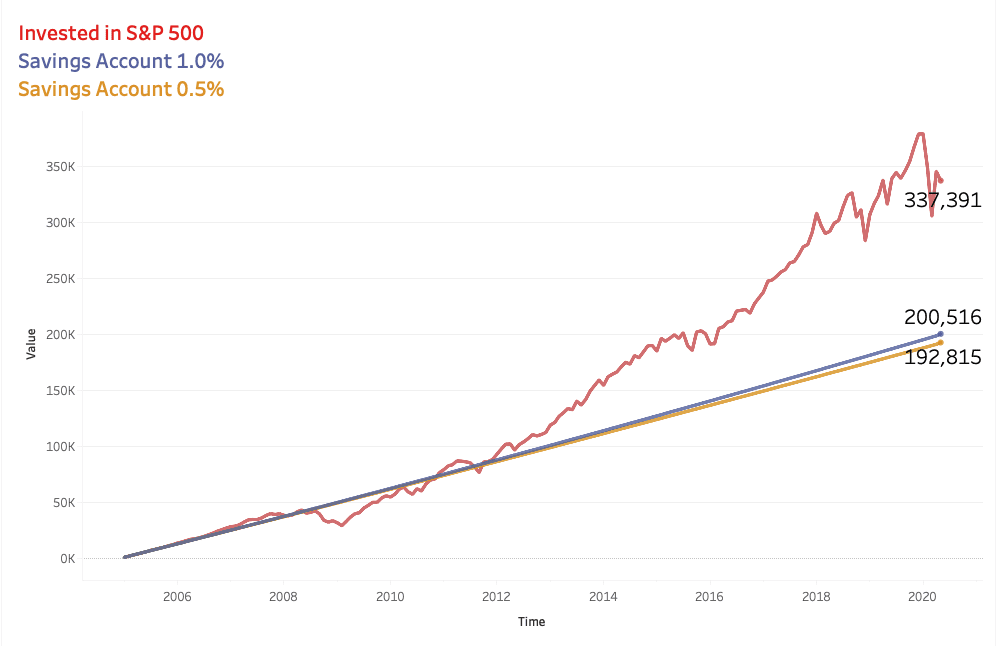

Investing in S&P500 vs Savings Account, $1000 per month from January 2005 till April 2020

You can get a guaranteed return through savings accounts, but the price for the guarantee is reflected in the lower interest rate. When you invest in the market, you take the risk (of losing your capital) but are also rewarded for taking the risk. The choice every investor has is to trade the risk for return. There is no right answer here, but investing, despite short-term volatility, tends to bring better returns over the long term.

Read: How to Buy Your First Stock

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents