This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Getting just another credit card is not sufficient, instead, you need to look for the best one for you that suits your needs. In this article, you will get a comprehensive guide about all the details of the best credit cards for teachers. Let’s get started.

Best Credit Cards For Teachers (Jump To Section)

Being a teacher is one of the noblest jobs because only teachers can make a good future for the new generation by providing them with proper education. Teachers are given a lot of respect for their noble work. Sometimes it happens that they are underpaid. We can’t help you with the payment part but we can certainly help you to save more and spend in a way that gives you more benefits that result in more savings. So, you can make use of a credit card which can certainly provide you with some extra benefits.

CHASE FREEDOM UNLIMITED OFFER

If you are a teacher, you are going to find this article quite helpful because you will learn a lot about the best credit cards for teachers in 2022. As an educator or teacher, you may have to spend a lot on various classroom items, lunch breaks, etc. You can put some of these expenses on your credit card. Slowly you will be used to this credit card and you will understand that the best credit cards will provide you with lots of perks and benefits.

You can lower your out-of-pocket education costs by taking advantage of credit card benefits. Also, when you will make use of these kinds of credit cards, you will get lots of rewards to spend on school programs, parties, and other expenses. Apart from all of these, you will also learn a few factors that should be kept in mind while looking for the best credit card.

What Can Be The Best Credit Cards For Teachers?

Surely, you can not get a one-size-fits-all credit card to cover all kinds of expenses. You may face a lot of challenges as well as confusion while choosing the best credit card for yourself. Well, you can take the help of our well-researched guide which will make this decision a little easy. Here is a list of things you should keep in mind while trying to choose a credit card for yourself.

- You have to find out your credit score.

- Make sure you are picking the best one that is suitable for your needs.

- Do not hesitate to ask questions when you are in doubt.

Let’s talk about these in detail.

You have to find out your credit score

When you are going to make use of your credit card, you need to use it responsibly. Do not forget that credit cards are a very important financial tool, especially if you are going to use them for a long-time. You need to know that applying for a credit card often creates a record on your credit report. Also, do not apply for lots of those tricky yet beneficial cards that offer unusually good deals.

Also, when you are applying for a credit card, do not forget to review all information carefully. If you have a higher score on your credit report, you will be able to get more benefits on the credit card. Any negative remark on the credit report can lead to a bad credit score.

Make sure you are picking the best one that is suitable for your needs

When you are going to get a credit card, you need to know why you need a credit card for yourself. There can be a lot of reasons for getting a credit card.

If you make use of credit card debt consolidation, you may consolidate all of your bills from the smaller cards onto a single card with lower interest rates and annual fees.

To get shopping vouchers, you may choose credit cards with higher rewards and incentives. You can also choose a cashback credit card for your school shopping. When you will choose a cashback credit card, you will get cashback every single time you make a purchase. Apart from this, you should take into account that low-rate cards can be less of a nuisance than switching cards every time the 0% promotional period expires.

Do not hesitate to ask questions when you are in doubt

It is pretty obvious to know the details of a credit card before you sign up for the credit card. Also, you need to make a comparison between a few credit cards from which you are going to choose for yourself. You can also take some advice from a financial advisor. In that case, you need to tell them about your financial situation, including your income and how you intend to use your new card. You may ask a few questions like for which purchases your card is going to pay you rewards, what if your card application is declined, what to do when you find the right card, etc.

So, now that you are all set with the details of how to choose the best credit card for yourself, here are our top recommendations for you.

Best Credit Cards For Teachers

Here listed below are some of the best credit cards for teachers.

Bestseller Personal Finance Books

- Citi Double Cash Card

- Chase Freedom Unlimited

- Capital One Venture Rewards Credit Card

- The Platinum Card from American Express

- Chase Slate Edge Credit Card

- Capital One Quicksilver Cash Rewards Credit Card

- Discover It Cashback Credit Card

- Blue Cash Preferred Card from American Express

Let’s take a look at them in brief.

1. Citi Double Cash Card

If you are searching for a great card for all average spenders, you may go for the Citi Double Cash Card. This credit card can earn Citi ThankYou Points. This point means as a cardholder of the Citi Double Cash card, you will now get 2% on every purchase with unlimited 1% cash back when you make a purchase. Along with that, an additional 1% will be added too as you pay for those purchases. You will also get 2X points- 1x when you purchase and 1x when you pay off your bill.

You can make use of these points in the Citi travel portal. Apart from this, the earned points on the card can be used for cash back redemption offers, etc. You will also get access through Citi’s transfer program. This indicates you can earn 2x transferable points on all purchases with absolutely no caps. Isn’t it surprising?

This card is considered one of the best credit cards for teachers because you can transfer points to airline miles. The most interesting part is there is no annual fee for this credit card for teachers. There is an intro balance transfer fee of 3% of each transfer (a minimum of $5) completed within the duration of the first 4 months of account opening. After that, your fee will be 5% of each transfer (a minimum of $5).

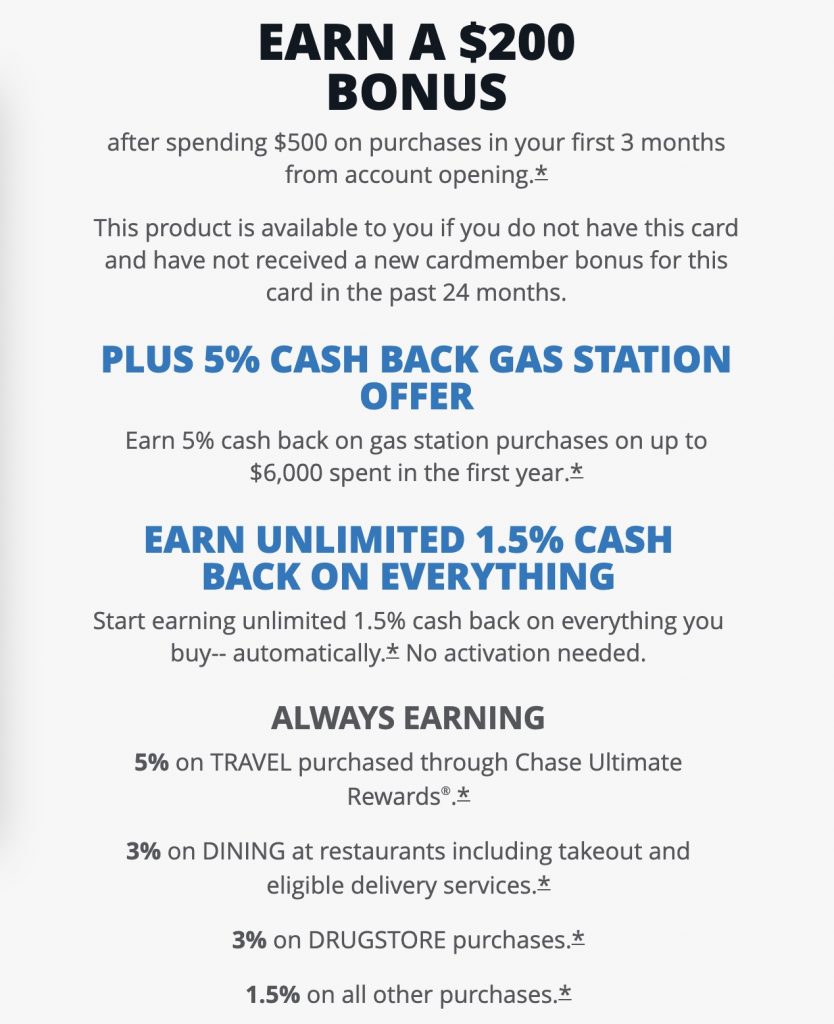

2. Chase Freedom Unlimited

Another all-purpose credit card for teachers is the Chase Freedom Unlimited. As a welcome offer, you will get 1.5% cash back on everything you buy (on up to $20,000 spent in the first year). You will gonna also be able to get 6.5% cash back on travel purchased through Chase Ultimate Rewards®. An additional 4.5% cash back on drugstore purchases and dining at restaurants, which include takeout; eligible delivery service is available too on this card. On up to $20,000 spent in the first year, these many cashback offers are available for you.

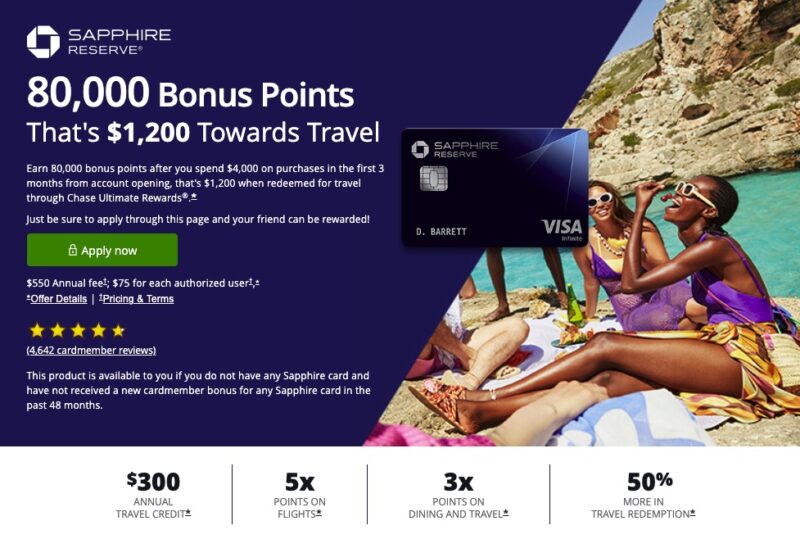

When you are done with the first year of the credit account opening, these cashback offers are going to be 5% on Chase travel purchased through Ultimate Rewards®, 3% on drugstore purchases and dining at restaurants, and 1.5% cash back on all other purchases. If you can pair up the Freedom Unlimited Card with some ultimate rewards credit cards like Sapphire preferred card or Sapphire reserve, your 1.5% cash-back will be converted to 1.5x Ultimate Rewards points.

CHASE FREEDOM UNLIMITED OFFER

Also, there will be no such minimum amount for redeeming the cashback offers. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. You should also know that the cashback rewards will not expire at all as long as your credit card account is open. All of these benefits on your Freedom Unlimited® card come with no such annual fee. With this Chase Unlimited credit card, you can track your credit score. You can also get real-time alerts on everything on this best credit card for teachers.

3. Capital One Venture Rewards Credit Card

If you are a teacher as well as a frequent traveler, this capital One Venture Rewards Credit Card is going to be the most interesting one for you. This card boasts transferable rewards. As a welcome bonus, you will get 75,000 miles once you spend $4,000 on purchases within 3 months from account opening. Miles will not expire for the life of the account and there’s no limit to how many you can earn. You can make use of your miles to get reimbursed for any travel purchase.

This card gives you the ability to earn 2x Capital One miles on all purchases with no caps. Apart from this, you can get Global Entry or TSA PreCheck for an application fee of $100. This will cover secondary car rental insurance, lost luggage coverage, roadside dispatch, etc. There will be no foreign transaction fees. Another few facilities are security, zero fraud liability, and extended warranty coverage.

On this card, you will receive 5x miles per $1 on hotels and rental cars booked through Capital One Travel. You can get 2x miles per $1 on all other purchases. Apart from these, you are going to enjoy 2 complimentary visits to a Capital One Lounge or Plaza Premium Lounges each year. Though this card charges a $95 annual fee, the perks and benefits are something quite lucrative.

4. The Platinum Card from American Express

This Platinum Card from American Express is undoubtedly the top 1 card for luxury travel benefits. No doubt, this is one of the most popular credit cards for teachers because the benefits are countless on this card. You will get 100,000 Membership Rewards® points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership. You will also get 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel.

Also, you are eligible to get up to $20 back each month on eligible purchases made with your Platinum Card® on Audible, Disney+, The Disney Bundle, ESPN+, Hulu, Peacock, etc. You will also get covered up to $200 in statement credits per calendar year in baggage fees and more at one select qualifying airline.

Apart from these, you will also receive $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings, which require a minimum two-night stay, through American Express Travel. This credit card also covers purchase protection, extended warranty, zero liability fraud protection, and no foreign transaction fees. This Platinum Card from American Express demands an annual fee of $695.

5. Chase Slate Edge Credit Card

Another beneficial and lucrative credit card for teachers is the Chase Slate Edge Credit Card. You can start this credit card with 0% Intro APR for 18 months from account opening on purchases and balance transfers. All the benefits on this credit card come with no annual fee. You can reduce the interest rate by 2% by paying the bills on time. You also need to spend $1000 on your card by your next account anniversary to enjoy this benefit.

While using this card, you will get a one-time review for a higher credit limit when you make payments on time, and spend $500 in your first six months. This credit card is quite good for tracking your credit with free access to your latest score, real-time alerts, and more.

6. Capital One Quicksilver Cash Rewards Credit Card

The Capital One Quicksilver Cash Rewards Credit Card comes with no annual fee to enjoy all benefits on the card. As a welcome bonus, you will get a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening. Every single day, you can earn unlimited 1.5% cash back on every purchase. This card does not demand any foreign transaction fee too. You will earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel.

On Capital One Travel, you are going to find a lot of trip options that come with the best price ever. If you are signed up once for the credit card, cash back won’t expire for the life of the account and there’s no limit to how much you can earn from this credit card for teachers.

7. Discover It Cashback Credit Card

Another interesting credit card for teachers is the Discover It Cashback Credit Card where you are going to match all the cash back you’ve earned at the end of your first year. Also, there is no such minimum spending or maximum reward option. On this credit card, you can earn 5% cash back on purchases from different places. It may include Amazon.com, grocery stores, restaurants, gas stations, etc. Also, you are eligible to get unlimited 1% cash back on all other purchases automatically.

On this credit card, you can remove your personal data from select people-search websites. You have the option to make use of the mobile app for this credit card. You can redeem your cash back in any amount, any time. All of your rewards will not expire ever. You can get a 0% intro APR on purchases for the first 15 months from the account opening. Then the rate will change from 13.49% to 24.49% Standard Variable Purchase APR.

8. Blue Cash Preferred Card from American Express

This special Blue Cash Preferred Card from American Express comes with the highest grocery store category bonus on the market. This card offers you a huge 6% cash back on the first $6,000 in grocery store purchases each year. Though this credit card comes with an annual fee of $95, you have the opportunity to get this back by getting the rewards from only $31 in groceries each week. You will also be eligible for 3% cash back on U.S. gas station and transit purchases.

Chase Sapphire Reserve Offer

Some Final Thoughts

We hope, through this informative article, you got to learn all about the best credit cards for teachers in the current year. Just keep in mind that choosing a credit card wisely can make you earn more rewards along with various perks and benefits. Also, you need to take care of your credit score which is gonna make your availability of the next credit card easy. Stay tuned to us for more informative articles.

Read also:

- 4 Best Credit Cards For Nannies

- 9 Best Credit Cards for Wedding Expenses

- 10 Best Credit Cards For Consultants

- 8 Best Credit Cards For Golf Lovers

- 6 Best Credit Cards for Traveling Consultants

- How to Use Credit Card Responsibly: 7 Must-Have Credit Habits

- Plastic Money – 3 Huge Payment Networks – Visa, Mastercard, and American Express

- Apple Pay and Google Pay – Which Is Better Among Top 2 Services?

- 8 Cool Benefits of Obtaining A Personal Loan – When to Consider It?

- How Do Business Credit Cards Work? 5 Reasons You Should Get One

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents