This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

What is Cash Flow?

One of the most important ways to take control of your finance is to make a budget and manage the cash flows.

A business sells services and products and aims to create a profit by creating value for the end consumer. Consumer pays money for the value created. In order to produce the goods and services, the business also incurs some costs – such as labor, equipment, raw materials, etc.

The money flows into the business in form of customers paying for the product and services. Money flows out of business when the business pays for labor, equipment, and raw materials.

Since money flows in (when a customer buys a product or service, the business earns the money) and out (when a business pays for materials, labor, rent, etc), it is imperative to keep track of how much money is moving in which direction.

Cash Flow is simply the direction in which the money flows. Money coming into a business is considered positive flow, and money going out of business is considered negative cash flow.

Similarly, people should also keep a cash flow tracking mechanism for their earnings and expenses. As long as the cash flows are positive regularly, month after month, you are doing a great job.

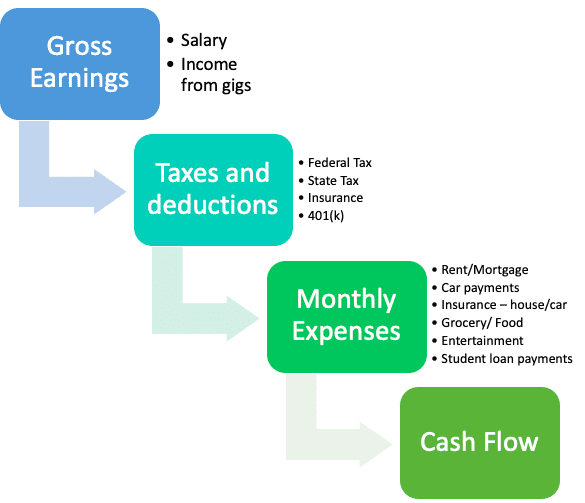

For personal finance management, a simple equation can help you:

Net Cash Flow = Sum (gross incomes) – sum (taxes & deductions) – sum (monthly expenses)

There it is, sweet and simple

Personal Cash Flow Statement

In the world of personal finance, cash flow allows you to decide how much money you have available in hand at the end of the month, after paying off taxes and all monthly expenses. With the money remaining, you can decide whether to invest it or save up for a vacation or make extra payments to pay off your mortgage earlier.

Creating a Personal Cash Flow Statement

Whether or not you own a business, keeping track of money and cash flow is always a great idea! So, how can we use the same concepts to track cash flows in our life?

For making a personal cash flow statement, you should do the following

- record all income and sources of income

- note the taxes payable and other deductions

- jot down all the expenses that occur in a month

Let’s leverage the broader concept of cash flow – it has 2 categories – money in and money out.

Money In

If you’re a salaried person, your main sources that contribute to your Money IN is your salary. Let’s say you make $5,000 a month, on a gross basis.

Money Out

In the money-out category, there would be

- federal and state taxes

- insurance premiums (medical, dental, vision, life)

- 401k contributions

- any other deduction

Let’s say the money that gets deposited to your bank is $3,500 after all deductions

There are more items that will be categorized as money out:

- Rent/Mortgage

- Utilities

- Student loan payments

- Car payments

- Car insurance

- Phone and internet

- Subscription services – Netflix, Amazon Prime, etc.

- Membership fees – Gym, Mensa, any other organization fees

- Grocery expenses

- Restaurants, Movies, entertainment costs.

Net Cash Flow

Let’s say after covering all the items above, you’re left with $500 a month. This $500 is your net cash flow for the month. You should typically aim to do two things with your cash flow – 1. increase the cash flow itself (by increasing money in and decreasing money out), and 2. invest the cash flow in a way that it grows on its own over time.

Bestseller Personal Finance Books

Cash Flow Analysis

For better personal finance management, individuals should also factor in investment and expense decisions while evaluating the impact on all future cash flows. For example, if you want to take up an expensive course at a reputed university, will it improve your future cash flows? By how much?

I did such an analysis when I decide to take up a huge loan for my MBA.

You can read about it here: Is MBA Worth It?

What is Cash Flow Positive?

If you manage your personal finances well for a month, and your earnings are more than expenses, you are cash flow positive. It is great, but in the long term, you need to make this habit repeatable. That will set you up for long-term success.

What is Cash Flow Negative?

If in a month, your expenses are more than your income, you are cash-flow negative for that month.

In your personal life, if you’re cash-flow negative, try and understand the reason behind it. What are you spending the money on – if it is spent on a course in Artificial Intelligence or Data Science, maybe it will significantly increase your earnings in the future.

If it is because you dined out too many times at fancy restaurants, that is not healthy for your finances!

Budgeting: How to Make a Budget And Manage Cash Flow Better?

Below are 6 easy to follow steps to budget well and manage cash flow.

1. Add up All Your Income

You might be generating income from one or multiple sources. List them all and put the monthly numbers next to them.

- Income from salary

- Income from side hustles or a business

- Rental Income

- Dividends that you receive as cash (and do not reinvest)

Some income streams might have variable earnings (for example in commissions-based jobs), a good method would be to take the average of the last 6-12 months.

2. Compute Taxes and Deductions

Estimate all the taxes and deductions from your gross earnings. List the mall and add them up.

- Federal and State Taxes

- 401(k) and IRA contributions

- Social Security (FICA) deductions

- Health Insurance Premiums (Medical, Dental, Vision, Life & Disability)

There are many free online tools that will give an approximate figure for taxes and deductions. These tools are a good guideline, however, they are accurate to the dollar and cent. Err on the side of caution and keep a little buffer and assume you’d be paying slightly more in taxes and deductions.

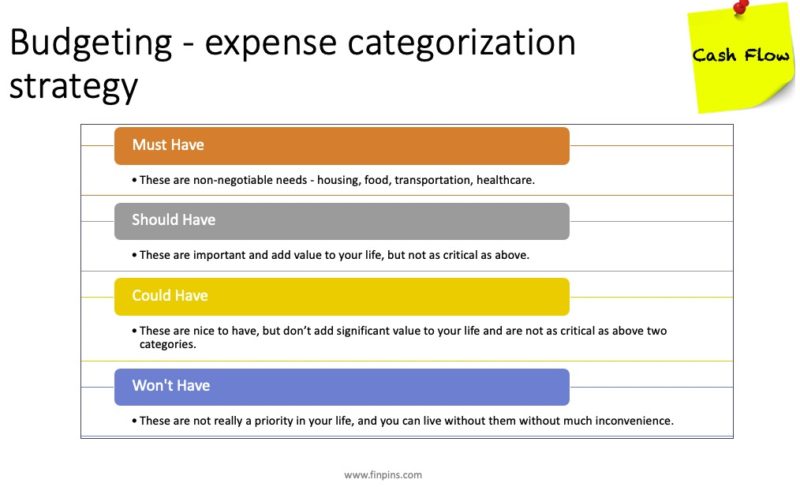

3. Track All Expenses and Categorize Them (using MoSCoW)

Create broad categories or as detailed as you want them to be. Categorize all these expenses, per your judgment, into expenses that are ‘must have’, ‘should have’, ‘could have’, and ‘won’t have’. See details of MoSCoW in the section below.

- Create Broad categories such as housing, grocery, restaurants, cars, etc.

- Convert annual expenses into monthly numbers.

- Categorize using the MoSCoW method.

- Evaluate how much you are spending on ‘could have’ and ‘won’t have’ categories. Reduce those expenses or eliminate them if possible.

4. Autopilot Necessary Expenses

There are some expenses that we have to bear no matter what, such as food, rent, clothing etc. These expenses can be put on autopilot by creating scheduled payments from your bank account.

- Identify the non-negotiable expenses and put them on autopilot.

- If possible, create a separate account to handle all the autopilot expenses.

5. Autopilot Savings and Investments

We believe everyone should have a rough idea of how much they want to save every paycheck or every month. Set those goals and automate them using scheduled payments (same as for necessary expenses) to your investment account. It would help even more if these amounts are sent to investment accounts even before you get the chance of spending a dollar on anything else. Remember this is payment from ‘current’ you to ‘future’ you. Pay yourself first!

- Have a target amount to save every month.

- Between retirement accounts, personal investing accounts, and savings accounts make sure you are hitting your targets consistently.

- Autopilot monthly contributions to your savings and investment account.

6. Redirect Leftovers to Savings and Investments

If at the end of the month, doing all the steps above, you still have some money left in your bank account. Congratulations, you have been amazing! You can reward yourself with a small treat or a little indulgence.

Keeping your eye on the long term game, don’t get too carried away in indulgence. Redirect the leftovers to your investment account.

What is MoSCoW Budgeting Tool?

MoSCoW is an effective tool for the categorization and prioritization of items. It is an acronym for four categories

- Must-Have

- Should Have

- Could Have

- Won’t Have

The four categories help us identify items on a spectrum of most important to least important, in the M-S-C-W sequence. It can be powerful to categorize your expenses using the MoSCoW tool.

Must-Have

You can place your non-negotiable needs such as food, housing, transportation, healthcare, etc. in the Must Have expense category

Should Have

You can put the other very important items on which you spend money. These are not really ‘essential’, but they add significant value to your life.

Could Have

You can put the ‘nice to have’ items on this list. They add good value to your life, but not enough to be called critical and not enough to be categorized in the above two categories.

Won’t Have

Sometimes we all spend on things we don’t really need or want. You know which ones apply to you. Identify them and place them under the ‘Won’t have’ category.

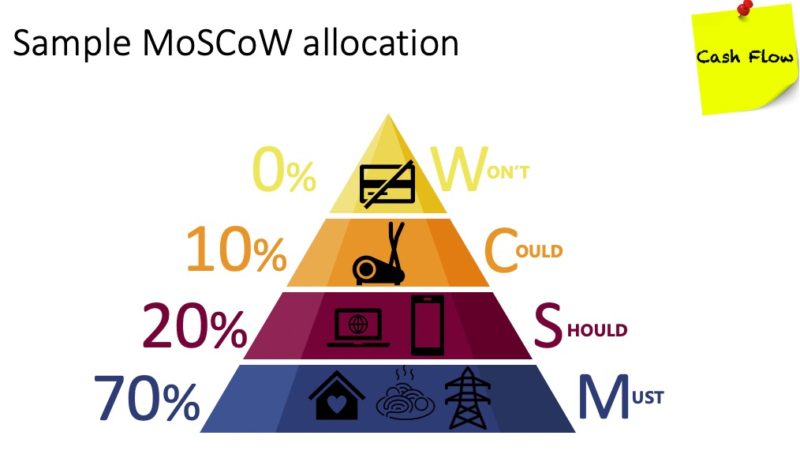

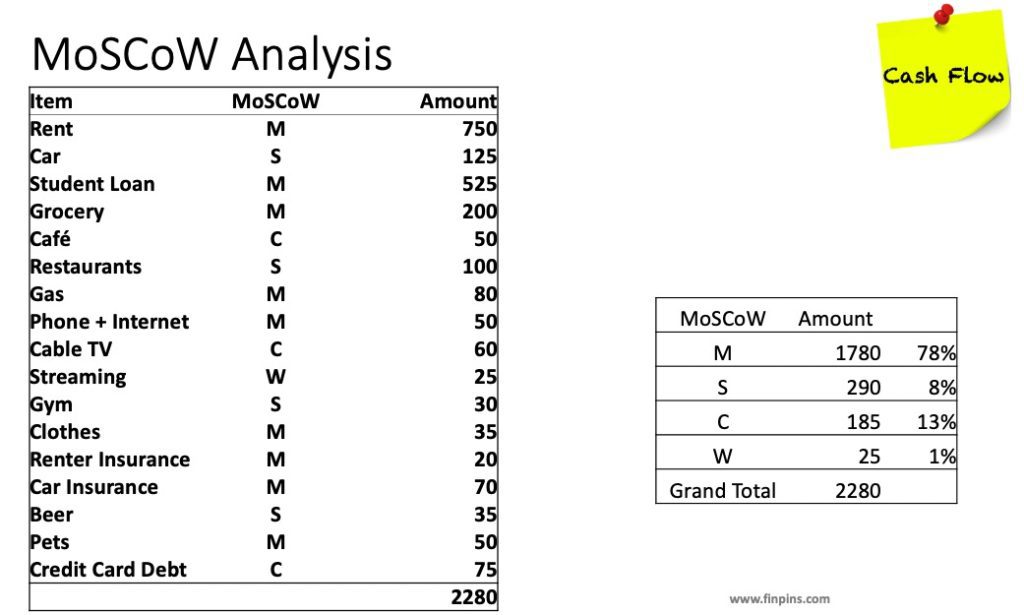

What does the MoSCoW Categorization look like?

We like to visualize MoSCoW allocation in the form of a pyramid. Ideally, the most important items, i.e. in the Must-Have category, should form the base of the pyramid. The other three categories should stack up in the order of importance as shown below.

How Can I Create My Own MoSCoW?

You can easily create a spreadsheet as shown below and compute the percentages of M, S, C, W. Or else, you can simply download it from here for free. If you have difficulty downloading, shoot an email to contact@finlightened.com and I will send it to you via email.

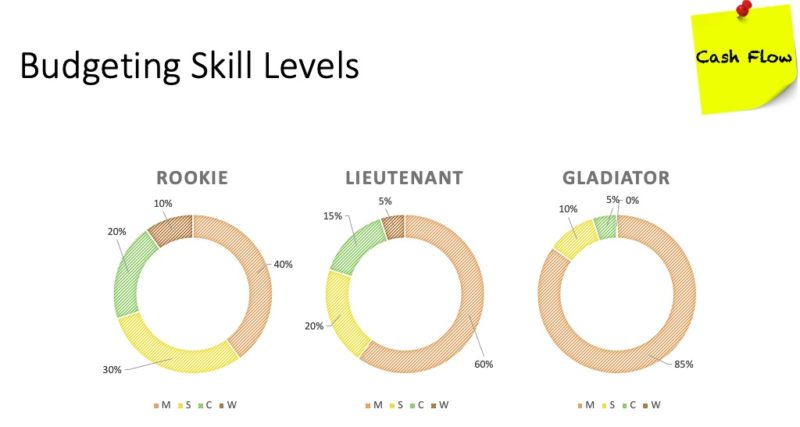

How Do I Know I am Doing Good?

That’s a great question! Everyone is comfortable with their own levels of spending and investing. We have a guideline for expense management as shown below.

We use 3 personas to identify the budgeting skills of an individual.

Rookie

A Rookie is someone who doesn’t actively try to manage expenses, they have a high percentage of expenses allocated to S, C, W categories. For example, in the diagram shown, the allocation to M is just 40%, whereas the allocation to C and W combined is 30%.

Lieutenant

A Lieutenant is someone who is aware of budgeting and takes measures to control his or her expenses actively. They have room for improvement, but they are taking steps in the right direction. For example, in the diagram shown, the lieutenant has 60% of his expenses allocated to M, and just 20% combined to C and W categories.

Gladiator

The super earnest, the best of the best, the gladiator ensures he or she has no more than 0% expense allocation to W. A gladiator comes down hard on the C and W categories and keeps them under 10% of their total expenses.

Download FREE MoSCoW Tool for Budgeting

Our valuable subscribers have access to downloading the MoSCoW tool for FREE.

You will get an email with a link to download the MoSCoW Tool instantly. Don’t forget to check your spam.

Add contact@finlightened.com to your contact WHITELIST to prevent misdirecting emails to spam.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents