This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Game of Loans: are all kinds of debt bad?

The game of loans is very interesting. There are two main strategies to win at the game of loans – secure loans at lower interest rates and make extra payments on any high interest loan.

- Game of Loans: are all kinds of debt bad?

- Game of Loans Strategy 1: Extra Payments

- The Impact of Extra Payments on Loan Interest

- Case 1: You make no extra payments, you pay more than $38,000 in interest

- Case 2: Lump sum payment of $1,000 upfront saves you $860 in interest

- Case 3: Extra payment of $100 per month saves you $16,000 in interest

- Case 4: Extra payment of $25 every month saves you $6,000 in interest

- Game of Loans Strategy 2: Lower Interest Rates

Before we dive into the strategies, let’s investigate whether all debt is bad, and see how debt can be used for financial leverage.

Not all debt is bad. What makes a debt bad is the obscenely high interest rate. What’s an obscenely high interest rate? It depends. If you are able to borrow money at a low interest rate and make a wise investment into something that gives you better returns, the debt in that case is a way to grow your business or portfolio via financial leverage.

For example, John borrows $10,000 from his Credit Union for a period of 12 months at an interest rate of 3.5% and puts that money to buy inventory for his convenience store. If John makes a 10% mark up on the extra inventory, he makes 10% * $10,000 = $1,000

At the end of the year, John has $11,000 with him. John then pays back to his credit union the $10,000 and 3.5% of $10,000 as interest payment = $10,350

John pockets $650 using the money he never owned, by borrowing money from the credit union. This is an example of financial leverage.

The problem with debt starts when the interest rate goes up. Interest rates on credit cards are more than 16%. It is practically impossible for the majority of the population to invest somewhere to get returns higher than that on a sustainable and predictable basis.

Accumulating high interest credit card debt is not advisable. Sometimes the credit cards have great offers such as 0% APR for 12, 15, or even 18 months. You can use them smartly as long as you’re confident you’ll pay off all balance in time before the crazy high interest rates kick in.

Game of Loans Strategy 1: Extra Payments

The Impact of Extra Payments on Loan Interest

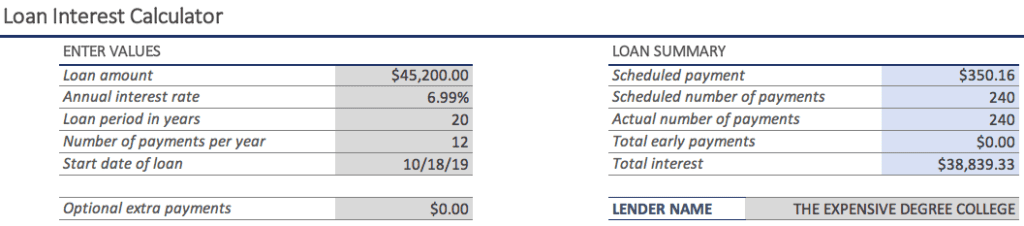

Jane graduated with a degree from a university with a student loan debt of $45,200. Her student loan interest is 6.99% for the next 20 years. According to her amortization schedule, Jane will have to pay $350.16 per month for the next 20 years to pay the loan off.

A student loan of $45,200 at a 6.99% Interest rate has a monthly payment of $350. The total interest paid over the tenure of the loan is $38,839.

Let’s look at the numbers above

Loan amount = Amount or Principal that Jane owes i.e. $45,200

Annual interest rate = This is the cost of borrowing the money from the bank/credit union/loan program i.e. 6.99% per year

Loan Period in years = Total term of the loan i.e. 20 years

The number of payments per year = Frequency of payments, for monthly payments, the frequency is 12 payments per year.

Start Date of Loan = Date of writing this blog, this is not very relevant for now.

Optional Extra payment = Any amount that Jane wants to pay on top her scheduled monthly payments. We will see how making extra payments can help Jane in the long run.

Bestseller Personal Finance Books

Scheduled payment = Monthly payment Jane has to make i.e. $350.16 per month

Scheduled number of payments = 20 years * 12 payments/year = 240 total payments according to the loan amortization schedule

The actual number of payments = This can vary according to the payment strategy Jane adopts. She can reduce this by making extra payments every month.

Total early payments = Sum of all extra monthly payments Jane makes

Total interest = The total extra money the loan provider gets, apart from the principal. It’s fairly simple to understand that Jane will have to return the $45,200 that she borrowed, and on top of that she will have to pay the interest charges over the period of the loan, $38,839.33 in this case.

Case 1: You make no extra payments, you pay more than $38,000 in interest

Jane now has a job and she looks at her student loan amortization schedule. She treats the $350.16 monthly payment for the student loan as an ordinary expense, such as rent, and doesn’t give any extra thought to it. This way she will pay off the loan in 20 years, making regular payments.

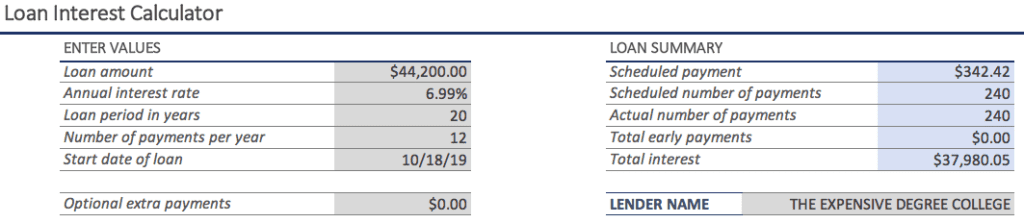

Case 2: Lump sum payment of $1,000 upfront saves you $860 in interest

On the first day at the job, Jane received a sign-on bonus of $1,000 cash for joining her new job. Jane thinks about using the $1,000 to pay some principal off the loan straightaway. Here’s how the $1,000 payment would impact her loan.

The principal will go down to $44,200, and the monthly payment will drop to $342.42, saving her an additional $860 in interest payment over the term of the loan.

When $1,000 is paid toward the student loan account, the principal reduces to $44,200 and the interest paid over the tenure of the loan goes down by $860.

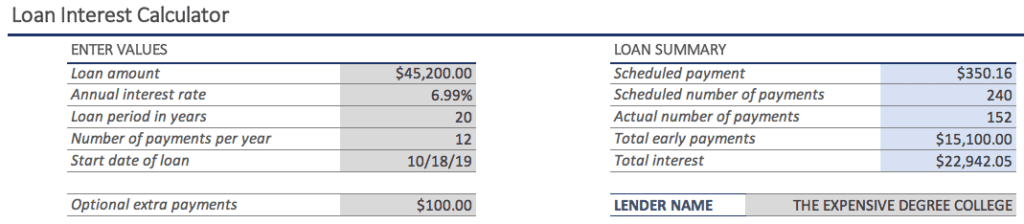

Case 3: Extra payment of $100 per month saves you $16,000 in interest

Jane decided to use the money to buy a couch for her new apartment, but she promised herself to make extra payments every month to make and to maintain healthy financial habits on an ongoing basis.

Initially, Jane calculated she’d make $100 extra payments every month. If she does that, here’s how the scenario changes.

Jane would pay $350.16 + $100 = $450.16 every month. Jane’s total number of payments go down to 152, enabling her to pay off her loan 7 years and 4 months earlier, and Jane would save a whopping $16,000 on the total interest payments.

An extra payment of $100 every month can make a huge difference. Notice how the actual number of payments has reduced by 88 months, with a whopping saving of almost $16,000 in interest payments.

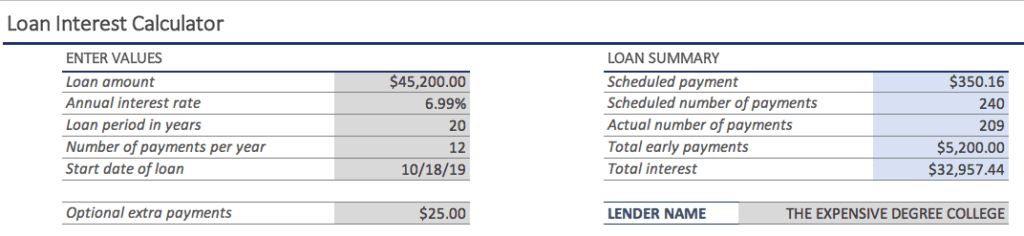

Case 4: Extra payment of $25 every month saves you $6,000 in interest

Even though making $100 has tremendous benefits, Jane wants to take small steps and decided to make $25 extra payments every month. She is convinced she will skip a few cups of coffee at fancy cafes and save an extra $25 monthly.

Let’s see how this small step can help Jane financially.

Jane’s new monthly payment will be $350.16 + $25 = $375.16. The number of payments reduces by 31 months, enabling Jane to pay off her loan 2 years and 7 months earlier.

Jane is saving about $6,000 in interest payments overall.

An extra payment of $25 every month can also make a noticeable impact on the interest payment, reducing it by almost $6,000 over the entire term of the loan.

Game of Loans Strategy 2: Lower Interest Rates

How much can a lower interest rate help your finances?

Securing a loan at a lower interest rate can make a world of difference to your overall financial health. Lower interest rate loans can translate to lower monthly payments and lower total interest paid.

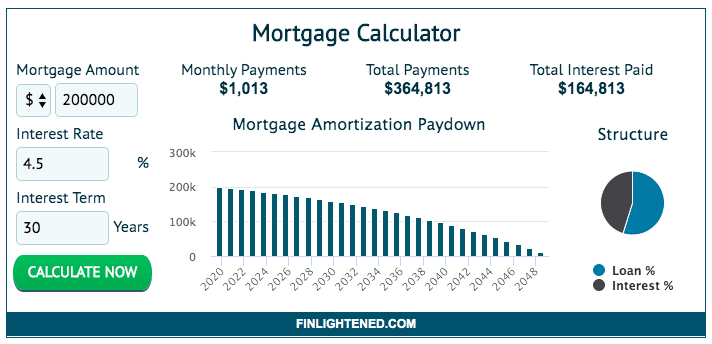

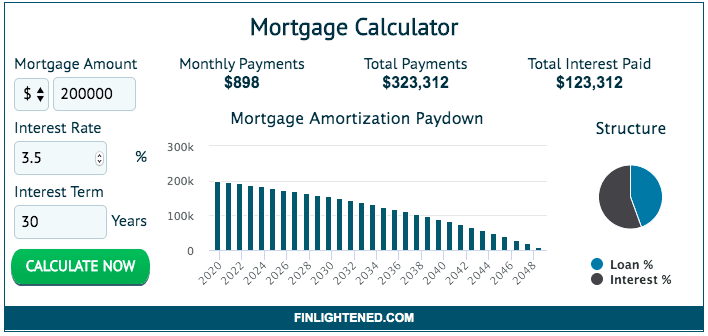

Here’s a quick comparison for a $200,000 30-year mortgage. You can try your own scenarios here.

How can 1% lower interest impact your financial health?

It can save you more than $40,000 in interest.

At 4.5% interest rate on mortgage (for 30 years) the monthly payment is $1,013 and the total interest paid over the term of the loan is $164,813

If the interest rate is 1 percentage point (100 basis points) lower, at 3.5% mortgage rate, the monthly payment is $115 lower ($1,013 – $898 = $115) than the previous case. This in turn also saves on interest payment by more than $40,000 ($164,813 – $123,312 = $41,501) over the term of the loan.

As you can see, a modest 1% lower interest rate can save you a huge amount. $41,501 in this case over the entire period of the loan.

You should always seek opportunities to find lower interest rates on all your loans. Do interest rate shopping at various providers and find the lowest rate you can get. A little bit of extra effort can translate into savings of tens of thousands of dollars in the long run.

Pro Tip: Always seek refinancing opportunities if your credit score goes up or the interest rates go down. See how much you can save on interest using the student loan payoff calculator.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents