This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Simply put, inflation can be defined as the phenomenon that causes your money to lose value over time. Inflation erodes the ‘value’ of your money and diminishes your money’s buying power over time.

What is Inflation and How is Inflation Measured?

Let’s say, five years ago you spent on average $1200 a month on general expenses such as rent, utilities, travel, food, clothing, etc. How much does it cost you to have the same level of lifestyle today? The most likely answer is more than $1200. Why? Generally, the cost of things goes up over time – rent goes up, cost of food goes up, your gym membership goes up, the Netflix subscription goes up, and so on. However, the price of some items and services, mostly related to technology, go down as well. For example, you can get 2-3 times faster internet today for the same price as five years ago. You can get a bigger 4K TV for the same price as you’d have paid 5 years ago. You get the idea.

So with these changes in prices over time, how do we keep track of the overall ‘cost of living’ at a similar standard? There’s no perfect way to measure that. However, we have a few widely accepted ways of measuring this change in ‘cost of living’. One popular method of estimating the cost of living is CPI – the Consumer Price Index.

Consumer Price Index (CPI)

CPI creates a market basket of products and services used by the general population, such as housing, apparel, transportation (cost of public transport, car ownership, airline tickets, etc.), education, communication (telephone, internet, etc.), recreation (movies, gym memberships, etc.), medical care (monthly premium, out of pocket expenses, etc.), food and beverages (grocery, food prices at restaurants, etc.). CPI then applies a weighted average on prices of items in this basket of items to arrive at some sort of a ‘cost of living’ index. There are more than 80,000 individual items that are tracked by the CPI.

See the latest CPI Inflation Data here

Now that we know what CPI is, we can use this calculation for different years to see by much the ‘cost of living’ is going up or down.

CPI example

For simple understanding, let’s say in year 2019 the ‘cost of living’ was $1200 per person. In year 2020, a similar calculation shows the ‘cost of living’ went up to $1230. The year over year inflation is ($1230 – $1200) / ($1200) = $30 / $1200 = 0.025 or 2.5%

In the real world, the Bureau of Labor Statistics in the USA tracks inflation via CPI, which is indexed at a value of 100 for 1984 as the base year.

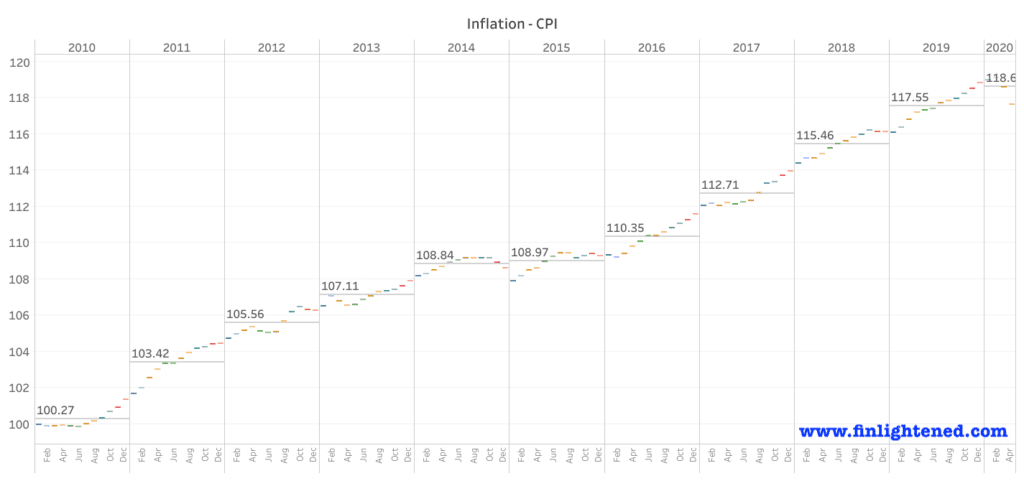

Since inflation is measured relative to a base year, you can pick your own year and compute inflation compared to that year. In the chart below I have based the year 2010 as my base year and defined my inflation index as 100 for January 2010. According to the chart, the average inflation index in 2020 stands at 118.6. So what does that mean? It simply means that the ‘cost of living’ has gone up 18.6% from 2010 to 2020 according to the Consumer Price Index data.

Limitations of CPI as a measure of inflation

Earlier I mentioned that CPI is not a perfect measure of inflation. Why is that so? Without going too much into detail, CPI is not perfect because of a few reasons

- it does NOT account for a representative sample of all products and services produced and consumed.

- Neither does CPI take into account product substitutions, say CPI takes price of oranges into account, and during a season oranges become expensive and consumers switch to eating apple (or another fruit) instead. That substitution is not accounted for in CPI.

- Another limitation is the accounting for new products, say an iPad. People spend money on such items, but CPI includes the products in the market basket much after the product is launched and already consumed by plenty of consumers.

Inflation vs Money

Now that we know inflation eats away the value or buying power of your dollar, what can we do to stay ahead in the game and prevent value erosion? The first step is to understand by how much does inflation erodes the value? We have seen from the chart above that in the last 10 years, inflation has gone up by 18%. The only way we can prevent the loss of value of your money is to make sure that your money grows at least 18% during the same period. So, for buying the ‘basket of goods’ you paid $100 in the year 2010. The same ‘basket of goods’ costs $118 in the year 2020. If your money in the bank also grew at the same rate, we can buy the same basket without any problems. Simple enough?

| Year | Rate 1.5% | Rate 2.0% | Rate 2.5% |

|---|---|---|---|

| 2010 | $100.00 | $100.00 | $100.00 |

| 2011 | $101.50 | $102.00 | $102.50 |

| 2012 | $103.02 | $104.04 | $105.06 |

| 2013 | $104.57 | $106.12 | $107.69 |

| 2014 | $106.14 | $108.24 | $110.38 |

| 2015 | $107.73 | $110.41 | $113.14 |

| 2016 | $109.34 | $112.62 | $115.97 |

| 2017 | $110.98 | $114.87 | $118.87 |

| 2018 | $112.65 | $117.17 | $121.84 |

| 2019 | $114.34 | $119.51 | $124.89 |

| 2020 | $116.05 | $121.90 | $128.01 |

Inflation in the future is difficult to predict, but if we take historical numbers for guidance, we can assume an inflation of 2-3% per year in the USA. Things can change and we can go through high inflation periods, or even deflation periods (opposite of inflation) during the next decade. But, I’m willing to consider 2-3% a safe assumption.

So, the moral of the story is that we must first understand inflation, and then think of ways to protect the purchasing power of our money against inflation.

Investing is considered an excellent hedge against inflation.

To beat the 3% annual depreciation in your money, you practically need to grow my money at a rate greater than 3%. A few ways you can achieve that are as mentioned below:

- invest in the stock market,

- purchase bonds (there are bonds with inflation-adjusted yields),

- put money in a high-yield savings account (VERY difficult to find one with interest rates above 2%),

- buy gold as a hedge against inflation,

- or, invest in real estate.

- bonus: consider investing in bitcoin as many experts claim it to be the ultimate hedge against inflation.

You can pick one or multiple investments, and create your own strategy, depending on your investing style and risk appetite.

Bestseller Personal Finance Books

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps