This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

As a digital nomad, expenses such as foreign transaction fees, airplane baggage fees, and other charges may cut into the profits. By keeping fixed costs to a minimum, digital nomads can save financially, move more freely than most individuals could ever think, and learn a new skill every day.

Best Credit Cards For Digital Nomads (Jump To Section)

Building a strong financial foundation and using credit cards responsibly are essential for the future success of digital nomads. Using credit cards that offer rewards, privileges, and sign-up benefits is an effective method to cut costs.

You’re undoubtedly losing money if you don’t use at minimum one travel credit card. Digital nomads may and should concentrate on establishing credit even if they have no urgent plans to move permanently or return to the United States because having no credit can be just as bad as having any negative credit.

Digital nomads may still not desire to lead a nomadic life permanently. Digital nomads may also run into problems when they decide to settle down, and not be able to buy a car or a house if they’ve not yet established credit while traveling.

To make your ongoing travels and trip purchases relatively easy, quite affordable, and a little more luxurious, we have put together a list of a few best credit cards for digital nomads.

Best Credit Cards For Digital Nomads

Let’s take a look at some of the best credit cards for digital nomads available in the market today.

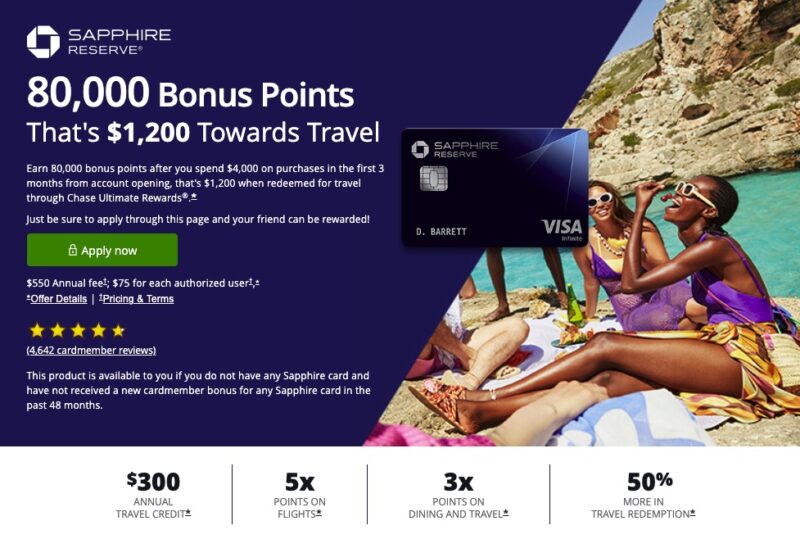

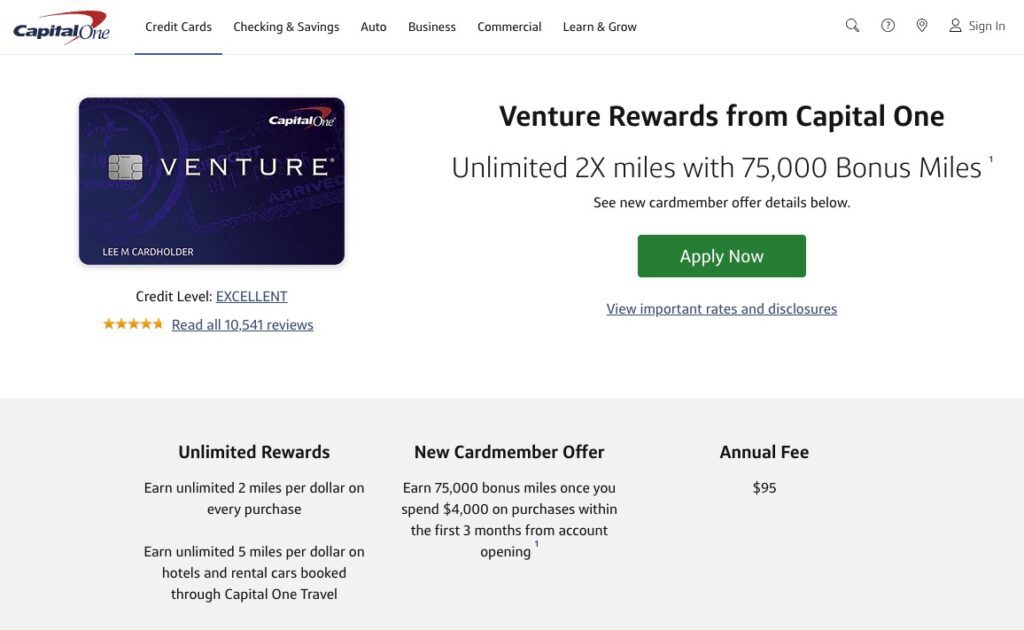

1. Capital One Venture Card | Annual fee: $95

Flat-rate, hassle-free perks are a big appeal for the Capital One Venture card. It has many advantages for regular travelers or digital nomads, such as the ability to transfer points to airline and hotel accommodations partners.

With this travel credit card, you can earn 75,000 bonus miles once you spend $4,000 during the first three months of account setup. The incentive is worth $750 if you redeem points for travel at a certain rate. There are no yearly fees when you apply for the Capital One Venture card. Benefits are just accessible to Visa Signature card-eligible accounts. Rules apply.

By making a trip reservation via Capital One Travel, you can redeem your miles to get reimbursed for any travel expenses. With 15+ travel loyalty program relationships, you can transfer your points to airline or accommodation partners.

Additionally, every purchase you make will result in a limitless 2X mile earning. The miles have no time limit and are valid for the duration of your account. If you want to avoid having to think about which card to use when making a purchase. In addition, Capital One Travel, where you can get the lowest rates on thousands of travel alternatives, offers 5X miles on hotel and rental car reservations.

Key Features:

- If you spend over $4,000 in the first 90 days, you’ll receive 75,000 bonus miles.

- 10000 Anniversary Miles ($100 in Travel Credits).

- 5x miles on accommodations, rental vehicles, and flights purchased through Capital One Travel.

- 2x miles on all additional purchases.

- $95 annual fee.

- Every four years, $100 in application credits for TSA Pre-Check and Global Entry.

- Free Priority Pass membership with unlimited visits allows access to airport lounges.

- No additional charges for approved users.

- No foreign transaction fees.

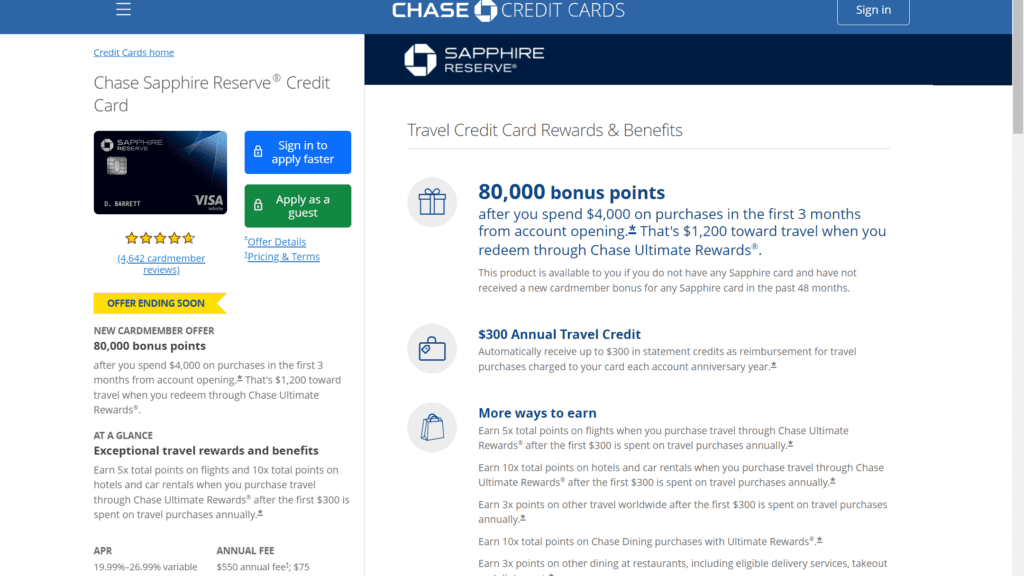

2. Chase Sapphire Reserve Credit Card | Annual fee: $550

Due to its 3x income on all other travel (other than expenditures made with the $300 travel credit) and eating purchases as well as its traveling protections, the Chase Sapphire Reserve is a great card for travelers and digital nomads.

It also has travel insurance that covers a wide range of services, from emergency medical and dental coverage to refunds for costs associated with baggage delays and flight delays.

Chase Sapphire Reserve Offer

Despite the $550 annual charge, the up to $300 annual travel credit, the large earning potential on eating and travel expenses, and the travel safeguards can all add up to a lot of value if you travel frequently.

Additionally, owners of the Chase Sapphire Reserve credit card can use the Chase travel website to redeem their points for 1.5 cents each or transfer them to hotel and airline partners.

Bestseller Personal Finance Books

After you spend $4,000 during the first three months of creating your account, you’ll receive 60,000 extra points. This bonus has a $1,200 value according to the most recent TPG estimations. With this card, there is a variety of methods to earn rewards (also known as Ultimate Rewards points) and use them to pay for travel.

1 dollar spent at restaurants equals 3 points (including eligible delivery services and takeout).

Key Features:

- $550 Annual Fee.

- $300 in annual travel credits.

- Points transfer to 11 airline and three hotel partners or straight redemption of points for 1.5 cents each through the Ultimate Rewards travel portal.

- TSA/Global Entry every four years, PreCheck application fees are credited.

- Special benefits from National Car Rental for car rentals.

- Access to The Luxury Hotel & Resort Collection

- Complimentary 12-month Lyft Pink membership.

- No foreign transaction fees.

- 10 points are awarded for every $1 spent on hotels and car rentals with Chase Travel.

- 10 points for every $1 spent on Chase Meals through Ultimate Rewards upon made in-advance restaurant reservations. Flights purchased through Chase Travel earn 5 points for every $1 spent. All other purchases earn 1 point for every $1 spent.

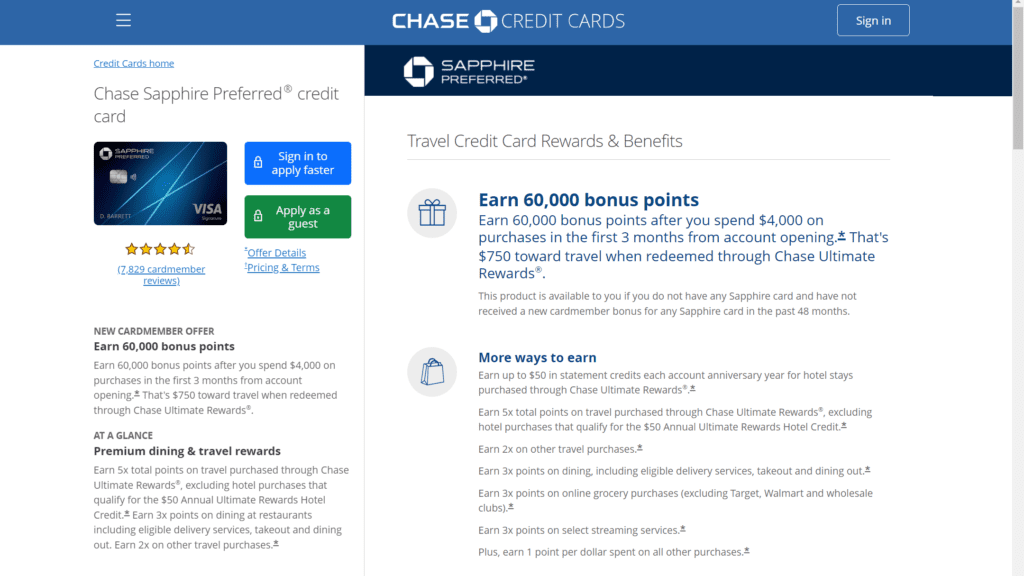

3. Chase Sapphire Preferred Credit Card | Annual fee: $95

One of the most widely used travel rewards credit cards is the Chase Sapphire Preferred card, which is a good choice for digital nomads and casual travelers alike who want to get the most out of their credit cards. The Chase Sapphire Preferred is often described as the introduction card into the world of points, miles, incentives, and perks by experts in travel hacking.

It is in many aspects because it is affordable and offers you so much more than a typical cash-back card. But regardless of how long you’ve been using your credit card or if you’re just getting started, it’s a good strategy. The first year of use on the Chase Sapphire Preferred Credit Card is free. The next year, the annual charge is $95.

Key Features:

- Earnings are 2x points for eating at restaurants, traveling, and dining in.

- Sign-up Bonus: 60,000 bonus points after spending $4,000 within the first three months, more bonus points for shopping at the grocery store.

- $95 Annual Fees.

- No foreign transaction costs.

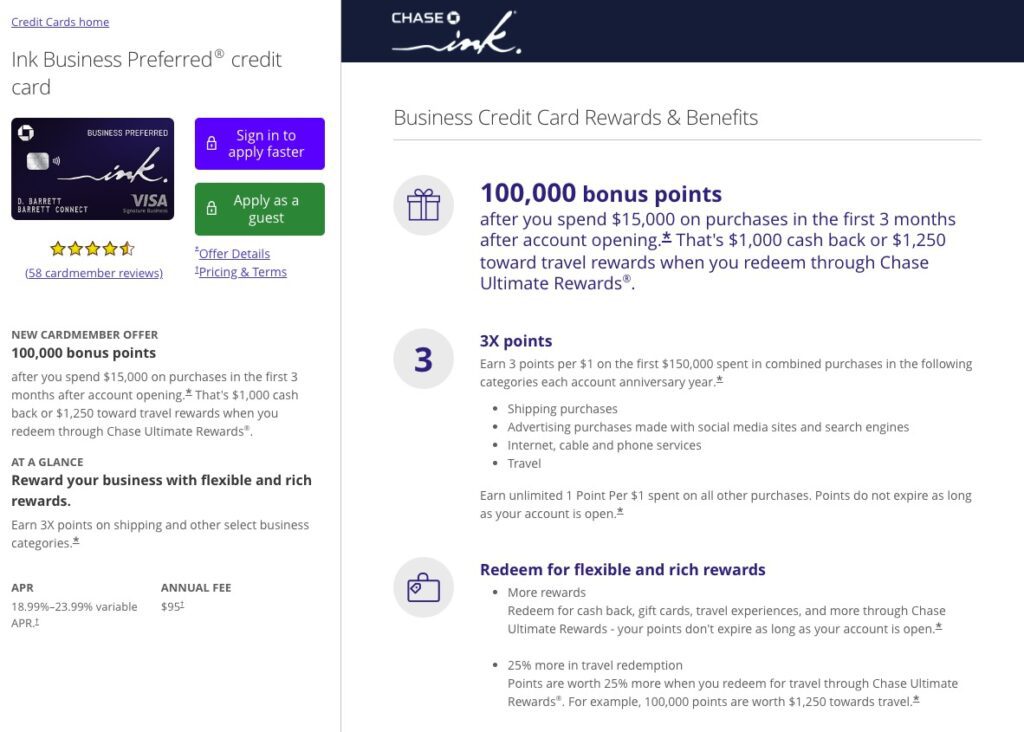

4. Chase Ink Business Preferred Card | Annual fee: $95

The Chase Ink Business Preferred card is certainly the perfect credit card for digital nomads who manage their businesses while they are on the road. You may have the best of the two with this Credit card due to the innovative combination of travel rewards and business benefits that are designed for companies that may operate remotely.

Make sure that you’ll be able to meet the required spending requirement of $15,000 in three months if you’re following the huge 100,000 credit card sign-up reward. Depending on the size of your business, this might be beyond your reach, but it will be accessible to others.

The Chase Ink Business Preferred Card only costs $95 a year while having good business perks. In addition to receiving 3x points on digital advertising expenditures, you may convert your Chase points for Star Alliance flights and Hyatt hotels. Adding 3x points for every dollar spent on travel seals the deal.

Every business owner’s wallet should contain this card. It is highly recommended, in my opinion. Some of the top benefits you can get with this card for your company are listed below:

Key Features:

- 3x points on relevant expenses for digital nomads including transportation, broadband, phone, and spending for social media and search engine marketing.

- Protection for your smartphone (up to $1,000 in case it’s stolen or destroyed).

- Travel insurance covers lost or delayed luggage, missed connections, and trip cancellations.

- It has car rental insurance & purchase insurance.

- 3.5 points for every dollar spent during the first $150,000.

- If you spend $15,000 within the first three months on purchasing, you’ll receive 100,000 extra points.

- All other purchases earn one point for every dollar spent.

- No foreign transaction costs

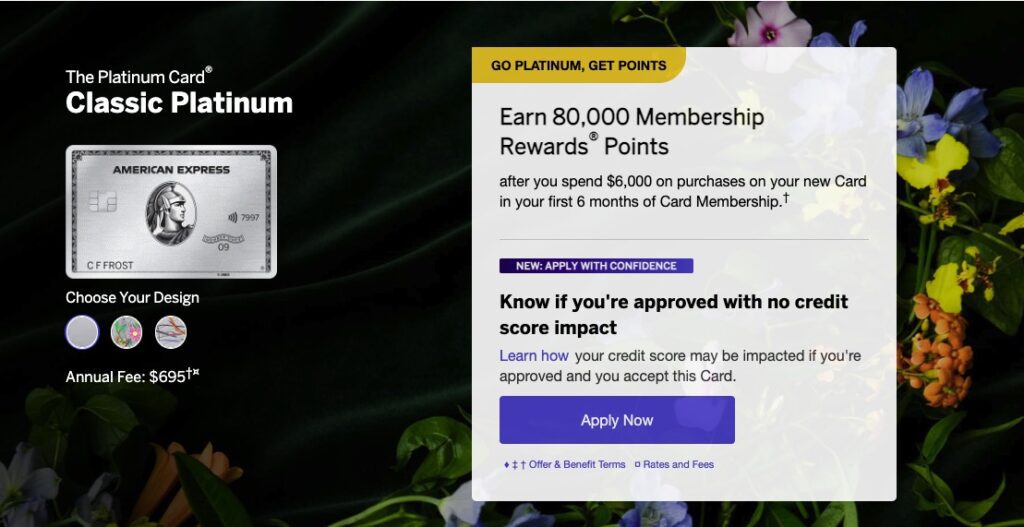

5. American Express Platinum Card | Annual fee: $695

The American Express Platinum card is essential if you want to maximize your travel as a digital nomad. The Amex Platinum offers the most extensive lounge perks of any credit card on the market, plus more than $1,400 in yearly statement credits. After making $6,000 in purchases within the first six months of card membership, earn 80,000 Membership Rewards Points. (valued at $1,600 according to the most recent TPG estimations).

Flights booked directly with airlines or through American Express Travel (up to $500,000 per calendar year, then 1 point per $1 beyond) earn 5 points for every $1 spent, while prepaid hotel reservations made through American Express Travel earn 1 point for every $1 spent.

For long-term travelers and digital nomads, the Platinum Card from American Express is a good investment because of the urgent care evacuation benefit that is offered only for having the account as long as you make a return (even for a short time) to your main residence every 90 days. This credit card will be more valuable to you than the annual fee if you use the benefits properly and take benefit of all that it has to offer. Please take note that some benefits require enrollment.

Key Features:

- Up to $300 per year in statement credits for Equinox membership.

- $200 annual credit for prepaid hotel statements and airline fee statement credits.

- Up to $240 in annual digital entertainment statement credits.

- Up to $200 in Uber Cash every year.

- Up to $189 in annual Clear membership statement credits.

- Up to $100 in annual Saks Fifth Avenue credits.

- Every four years for Global Entry or every 4.5 years for TSA Pre Check, application cost credits are given.

- Protections for traveling, such as trip interruption and trip delay insurance.

- Benefit for emergency medical evacuation, whether or not the travel was paid for with the card.

- No Foreign transaction fees.

6. American Express Business Gold Card | $295 Annual Fee

For those who use Amex Travel frequently, American Express Business Gold offers rewards of up to 4x points on flight bookings. The two categories where your business spends the most money are eligible for 4x rewards with this credit card. The 4x, however, is restricted to the initial $150,000 in annual total purchases. For each dollar spent on items after that, an additional point is awarded.

When arranging prize travel with Amex Travel, for example, each point is worth one penny. In addition, you receive back 25% of your points, up to 25,000 points annually. Finally, you can transfer points to a partner airline’s frequent flyer program 1:1.

Key Features:

- Spend $10,000 within the first three months and receive 70,000 bonus points.

- Select categories where you spend the most money each month and earn 4x Membership Rewards points.

- 1x points for all other purchases.

- No foreign transaction costs.

- $295 Annual Fee.

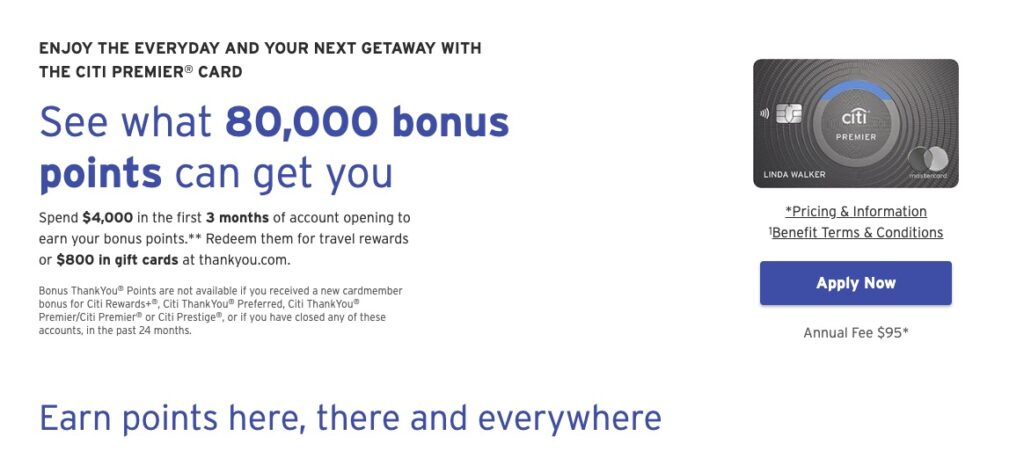

7. Citi Premier Credit Card | $95 Annual fee

Given how demanding a nomadic lifestyle can be on equipment, the Citi Premier offers a 24-month extended warranty benefit that can be very useful when traveling. It also has a terrific earning rate for a balanced combination of everyday expenses and travel-related costs.

Earn 80,000 Citi Premier points after making $4,000 in purchases over the first three months. TPG’s calculations place the value of that bonus at $1,440. You will receive three points for every $1 spent at gas stations, diners, lodging establishments, airports, and supermarkets and one point for every additional dollar.

Key Features:

- Purchase insurance against theft and damage, as well as an extended warranty.

- Use the Citi ThankYou travel center to immediately redeem points for tickets at a rate of 1.25 cents each, or transfer points to more than 15 airline partners.

- Annual $100 statement credit each calendar year for a single hotel booking made through thankyou.com for $500 or more (excluding taxes and fees).

- Free of charge, you can add an authorized user to your account.

- No charges for international transactions.

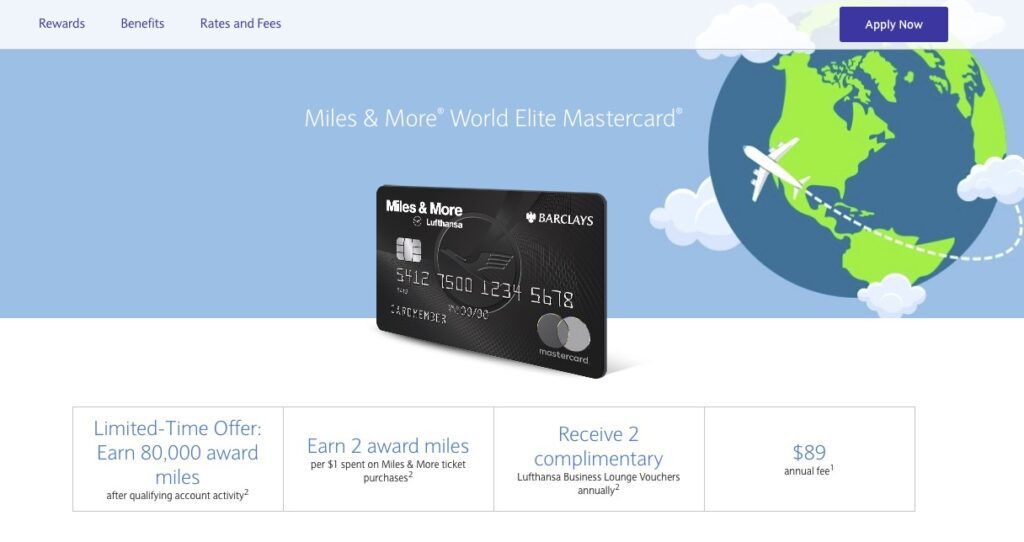

8. Barclays Miles & More World Elite Card | 89$ Annual Fee

A MasterCard specifically created for people who travel is the Barclays Miles & More World Elite Card.

Key Features:

- The Barclays Miles & More World Elite Card has an $89 yearly charge.

- No foreign transaction fees.

- Signup Bonus: When you spend more than $3,000 in the first three months, you’ll get 80,000 bonus miles.

- Tickets purchased from Miles & More airline partners earn 2x miles for every $1 spent.

- For all other purchases, one mile is worth one dollar.

- Save up to 15% on lodging and car rentals.

- 2 annual coupons for the Lufthansa Business Lounge.

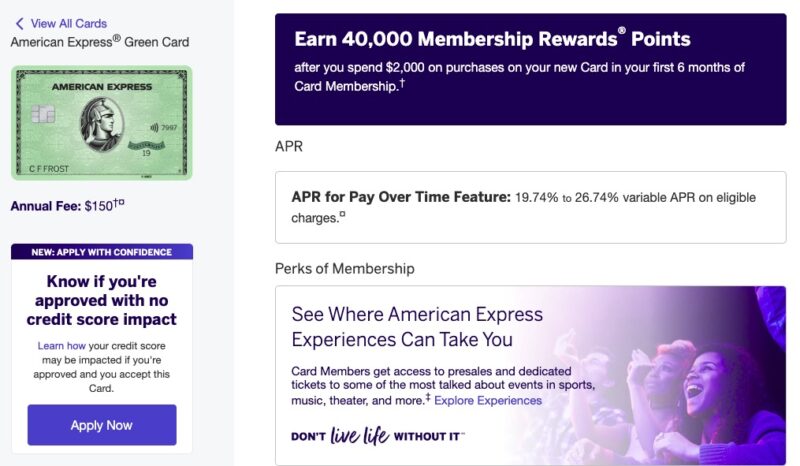

9. American Express Green Card | 150$ Annual Fee

If you travel regularly and reserve hotels and rental cars, the American Express Green Card is a wonderful travel credit card. After spending $2,000 in the first six months with your new card, earn 45,000 Membership Rewards points.

Spending money at restaurants situated all around the world and on travel, including public transportation, earns you three points.

Key Features:

- Signup Bonus: 40,000 points following a $2,000 purchase within the first six months

- 3x points for every dollar spent on dining out including takeout & delivery

- 3x points for each dollar spent on transportation taxis, buses, trains, tolls, etc.

- All other purchases earn one point for every dollar spent.

- No charges for international transactions.

- $150 Annual Fee.

- You can transfer points to partners at airlines and hotels.

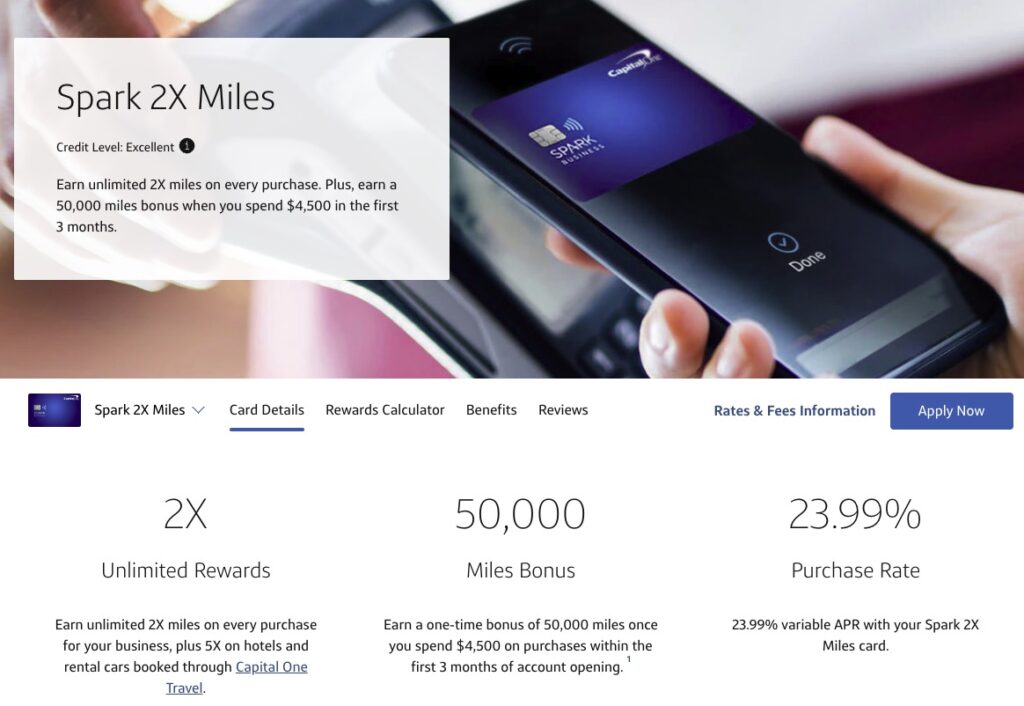

10. Capital One Spark Miles for Business | 0$ Intro Annual Fee

A fantastic business credit card with even better benefits for travel is Capital One Spark Miles for Business. The first year is free, while the following years cost $95.00.

Key Features:

- 5x miles for lodging and vehicle rentals.

- 2x miles for every other dollar spent.

- Signup Bonus: 50,000 miles if you make a purchase of $4,500 in the first three months.

- Points can be transferred to more than 12 travel partners.

- TSA pre-check or Global Entry $100 credit (once every 4 years).

- No foreign transaction costs.

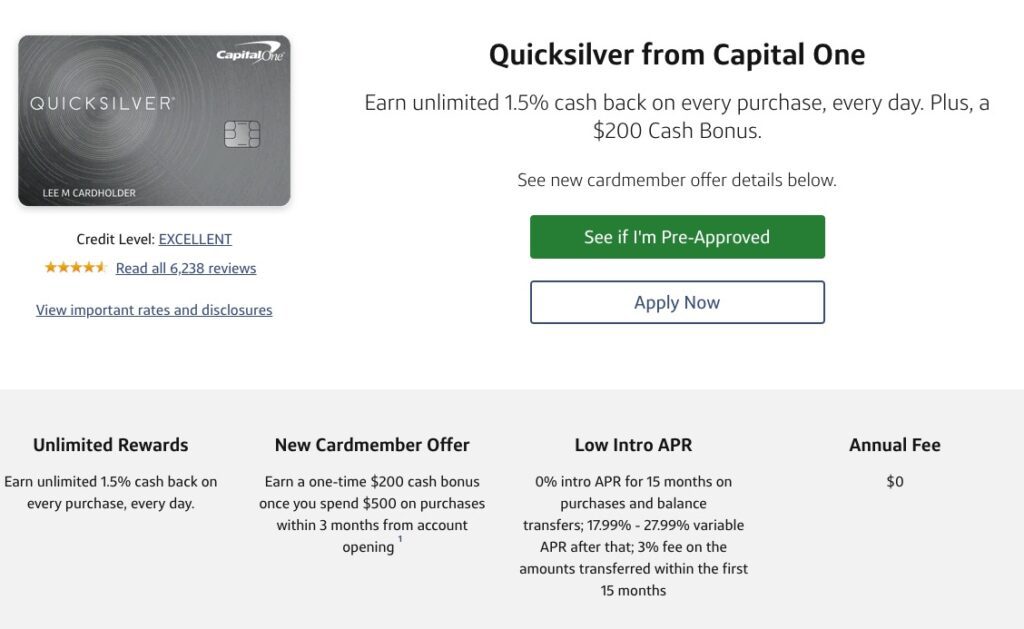

11. Capital One Quicksilver Credit Card | 0$ Annual Fee

Although the Capital Quicksilver Credit Card doesn’t offer a lot of travel-related benefits, it is still a fantastic choice for any traveler.

Key Features:

- No international transaction fee.

- $0 Annual Fee.

- 1.5% cashback.

- If you spend $500 in the first three months, you’ll get a $200 cash incentive.

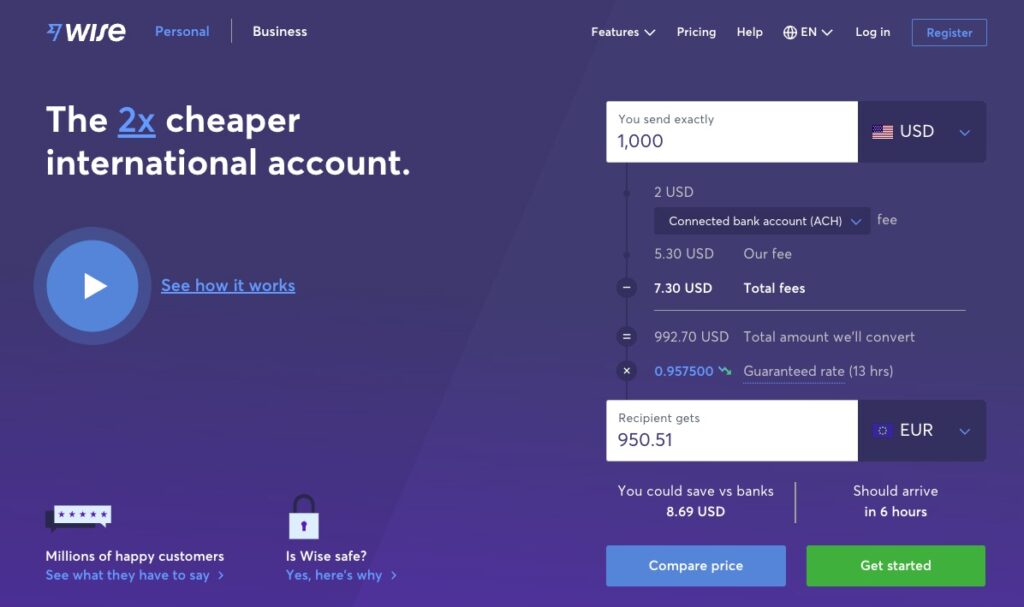

Bonus: Wise, formerly TransferWise

While not really a credit card, another outstanding option for digital nomads is Wise, formerly known as TransferWise. Wise began as a money transfer service that makes it possible to send money across currencies at the true exchange rate and with minimal fees.

More features have been introduced to their services over time. A multi-currency account, for example, allows you to send, receive, and spend money in a variety of currencies without having to pay high transaction fees. These account details may be in USD, EUR, GBP, AUD, or other currencies.

You can receive a physical debit card that you may use anywhere in the world.

- Best Credit Cards For Digital Nomads

- 1. Capital One Venture Card | Annual fee: $95

- 2. Chase Sapphire Reserve Credit Card | Annual fee: $550

- 3. Chase Sapphire Preferred Credit Card | Annual fee: $95

- 4. Chase Ink Business Preferred Card | Annual fee: $95

- 5. American Express Platinum Card | Annual fee: $695

- 6. American Express Business Gold Card | $295 Annual Fee

- 7. Citi Premier Credit Card | $95 Annual fee

- 8. Barclays Miles & More World Elite Card | 89$ Annual Fee

- 9. American Express Green Card | 150$ Annual Fee

- 10. Capital One Spark Miles for Business | 0$ Intro Annual Fee

- 11. Capital One Quicksilver Credit Card | 0$ Annual Fee

- Bonus: Wise, formerly TransferWise

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents