This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Money matters can be complicated, but there are some basics that everyone should know. To help you out, we’ve put together a collection of three personal finance flowcharts.

- 1. FinPins Personal Finance Flowchart: Beginner’s Guide to Personal Finance

- 2. Reddit Personal Finance Flowchart: Personal Income Spending Flowchart by u/atlasvoid on r/personalfinance

- 3. Reddit Personal Finance Flowchart: Personal Finance Basics (the Tiered Emergency Fund) by u/BrainSturgeon on r/personalfinance

This simple guide covers the key financial topics that everyone should be familiar with. So take a deep breath and follow the flowcharts – before you know it, you’ll be an expert on all things money!

What is a Personal Finance Flowchart?

Personal finance is the management of money and financial affairs. It includes budgeting, savings, investments, credit cards, mortgages, and insurance. A personal finance flowchart can help you to understand where your money is going and how you can save more money. The flowchart will show you how to organize your money to hit your short-term, mid-term, and long-term financial goals.

3 Hand Picked Personal Finance Flowcharts

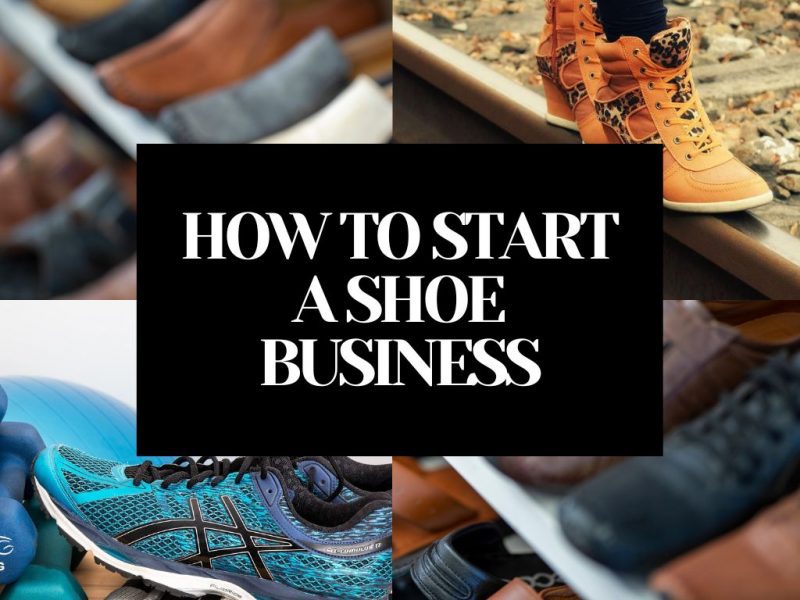

1. FinPins Personal Finance Flowchart: Beginner’s Guide to Personal Finance

2. Reddit Personal Finance Flowchart: Personal Income Spending Flowchart by u/atlasvoid on r/personalfinance

3. Reddit Personal Finance Flowchart: Personal Finance Basics (the Tiered Emergency Fund) by u/BrainSturgeon on r/personalfinance

1. FinPins Personal Finance Flowchart: Beginner’s Guide to Personal Finance

We might be biased, but we strongly believe we have built a comprehensive personal finance flowchart. See details below.

The 10 Steps in the FinPins Personal Finance Flowchart

There are 10 steps in our own personal finance flowchart, beginning right from analyzing the cash flow to building a diversified investment portfolio for long-term financial goals.

- Step 1: Understand Your Cash Flow

- Step 2: Evaluate Your Wealth Builders and Money Guzzlers

- Step 3: Set up a Thunderbolt Fund

- Step 4. Contribute to 401(k) and Get Maximum Employer Match

- Step 5. Build Your Debt Repayment Strategy

- Step 6. Set up ‘Peace of Mind’ Fund: (4-6) months of average monthly expenses

- Step 7. Contribute to Roth IRA

- Step 8. Individual IRA

- Step 9. Set up an Investment Account for ETFs and Stocks

- Step 10. Diversify Outside of The Stock Market

This Detailed FinPins Personal Finance Flowchart Talks About Steps in the Following Order:

Step 1: Understand Your Cash Flow. Analyze your total expenditure and total expenses.

Step 2: Evaluate Your Wealth Builders and Money Guzzlers. Identify which items generate money for you and which take money away from you.

Step 3: Set up a Thunderbolt Fund. Set up a small $500-$1000 fund to handle a sudden emergency.

Step 4. Contribute to 401(k) and Get Maximum Employer Match. Make contributions to get maximum employer match on 401(k)

Step 5. Build Your Debt Repayment Strategy. List all loans in one place, make required payments on ALL. Then, put extra cash into the HIGHEST interest loan to pay it off faster.

Step 6. Set up ‘Peace of Mind’ Fund: (4-6) months of average monthly expenses. Build a fund to cover monthly expenses for 4-6 months.

Step 7. Contribute to Roth IRA. Put post-tax dollars into a ROTH IRA account to let it grow tax-free!

Step 8. Individual IRA. If you benefit from tax deductions, set up an individual IRA account.

Step 9. Set up an Investment Account for ETFs and Stocks. Set up an investment account to buy ETFs, Stocks, and Bonds. Don’t get into ‘Stock Options‘ too early.

Bestseller Personal Finance Books

Step 10. Diversify Outside of The Stock Market. Diversify away from the stock market, and start investing in alternative assets to reduce dependencies on the stock market.

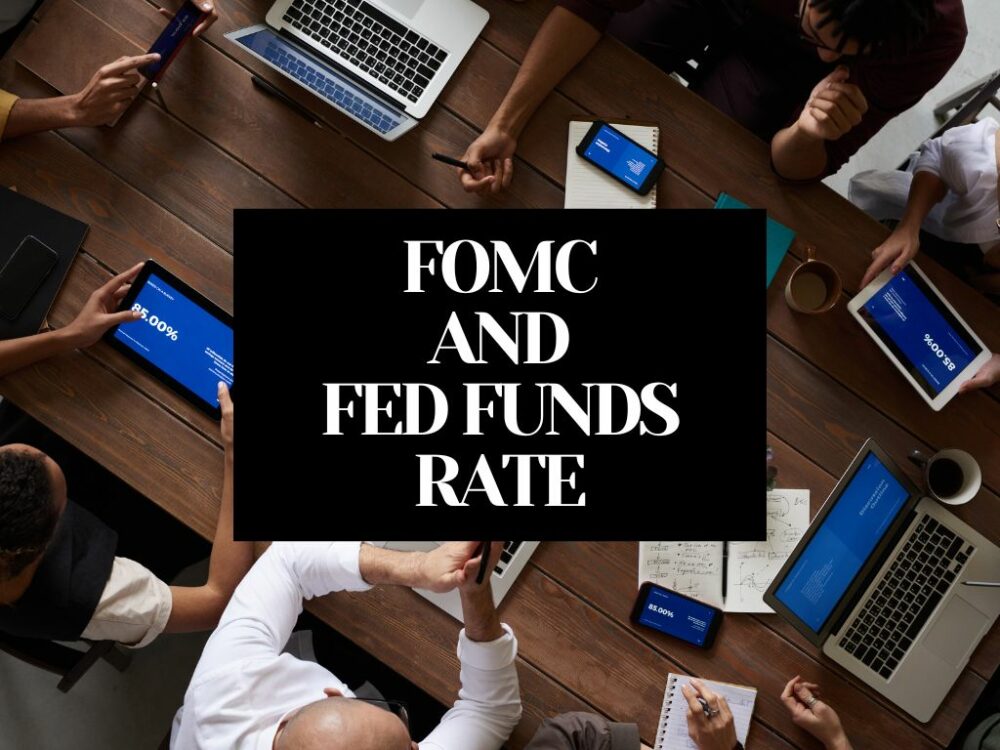

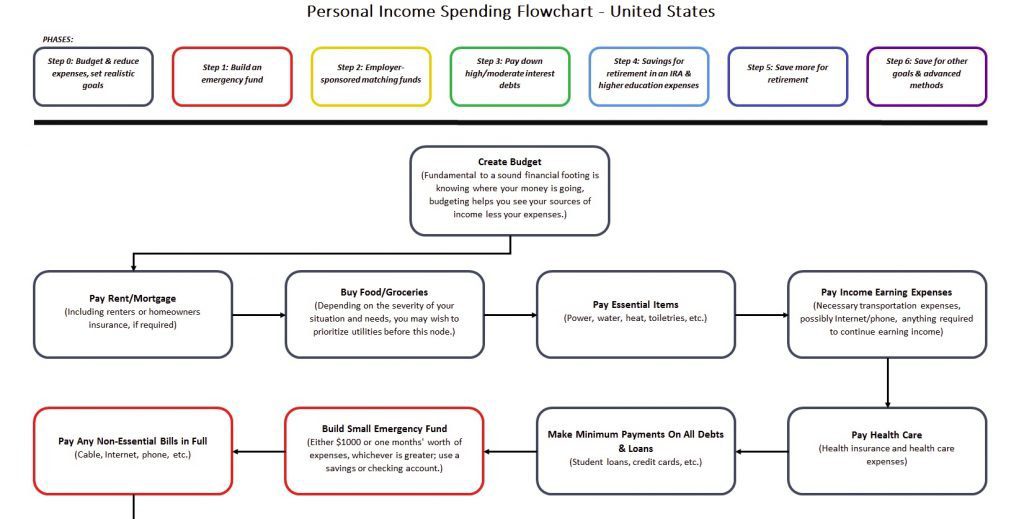

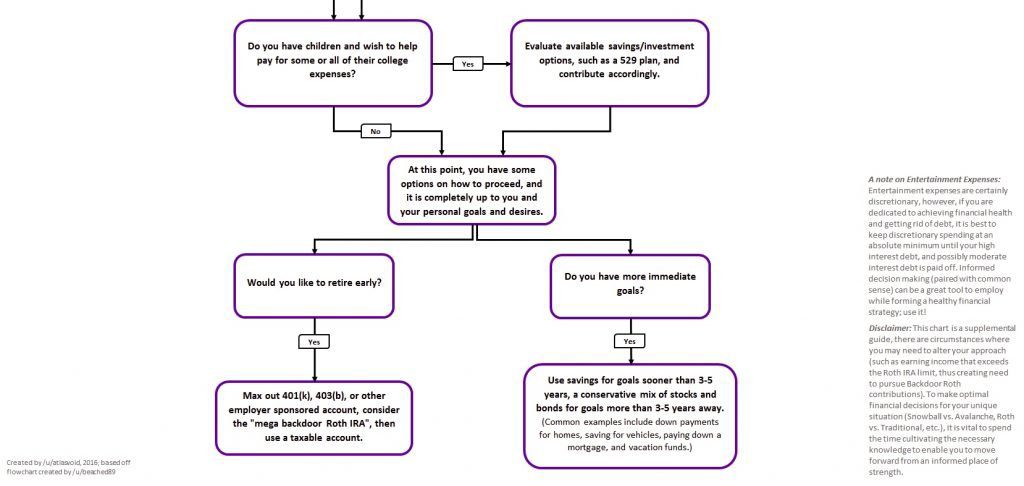

2. Reddit Personal Finance Flowchart: Personal Income Spending Flowchart by u/atlasvoid on r/personalfinance

The Reddit user u/atlasvoid has posted his version of a very detailed personal finance flowchart. See the explanation of all the steps, decision-making process, and details below.

The 7 Phases in the Reddit Personal Finance Flowchart

- Step 0: Budget and Reduce Expenses. Set Realistic Goals

- Step 1: Build an Emergency Fund

- Step 2: Employer-sponsored Matching Funds

- Step 3: Pay Down High and Moderate Interest Debts

- Step 4: Savings for Retirement in an IRA & Higher Education Expenses

- Step 5: Save More for Retirement

- Step 6: Save for Other Goals and Advanced Methods

This Detailed Reddit Personal Finance Flowchart Talks About Steps in the Following Order:

- Create Budget (Fundamental to a sound financial footing is knowing where your money is going, budgeting helps you see your sources Of income less your expenses.)

- Pay Rent/Mortgage (Including renters or homeowners insurance, if required)

- Buy Food/Groceries (Depending on the severity Of your situation and needs, you may wish to prioritize utilities before this node.)

- Pay Essential Items (Power, water, heat, toiletries, etc.)

- Pay Income Earning Expenses (Necessary transportation expenses, possibly Internet/phone, anything required to continue earning income)

- Pay Health Care (Health insurance and health care expenses)

- Make Minimum Payments On All Debts & Loans (Student loans, credit cards, etc.)

- Build Small Emergency Fund (Either $1000 or one months’ worth of expenses, whichever is greater; use a savings or checking account.)

- Pay Any Non-Essential Bills in Full (Cable, Internet, phone, etc.)

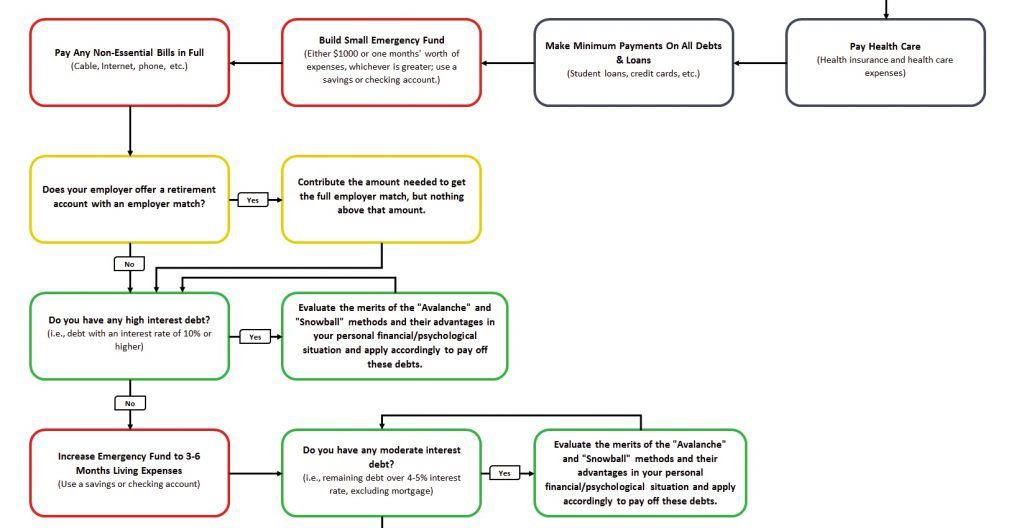

- Does your employer offer a retirement account with an employer match? if YES, Contribute the amount needed to get the full employer match, but nothing above that amount. If NO, Go to Step 11.

- Do you have any high-interest debt? (i.e., debt with an interest rate of 10% or higher) if YES, Evaluate the merits of the “Avalanche” and “Snowball” methods and their advantages in your personal financial/psychological situation and apply accordingly to pay off these debts. If NO, go to Step 12.

- Increase Emergency Fund to 3-6 Months Living Expenses (Use a savings or checking account)

- Do you have any moderate interest debt? (i.e., remaining debt over 4-5% interest rate, excluding mortgage) If YES, Evaluate the merits of the “Avalanche” and “Snowball” methods and their advantages in your personal financial/psychological situation and apply accordingly to pay off these debts. If NO, go to step 14.

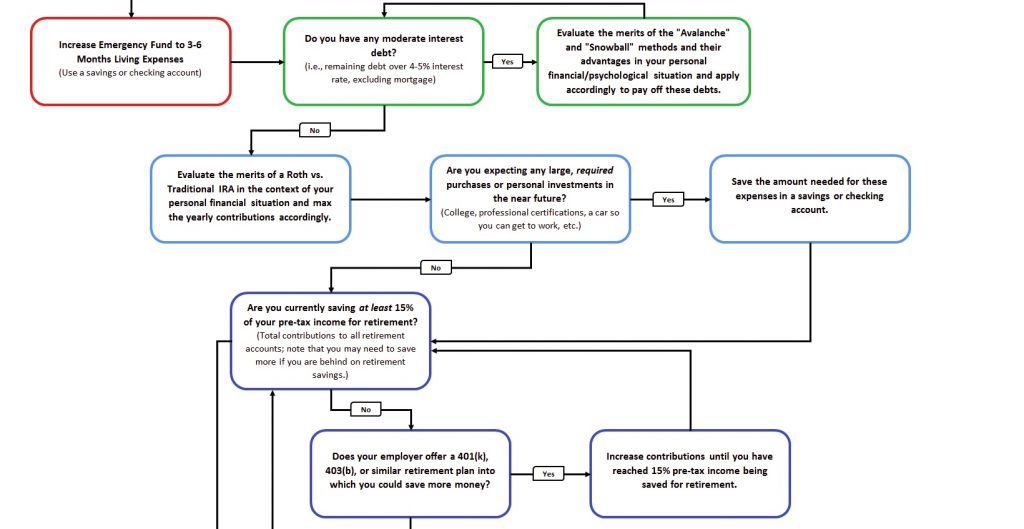

- Evaluate the merits of a Roth vs. Traditional IRA in the context of your personal financial situation and max the yearly contributions accordingly.

- Are you expecting any large, required purchases or personal investments in the near future? (College, professional certifications, a car so you can get to work, etc.) If YES, Save the amount needed for these expenses in a savings or checking account. If NO, go to step 16.

- Are you currently saving at least 15% of your pre-tax income for retirement? (Total contributions to all retirement accounts; note that you may need to save more if you are behind on retirement savings.) If YES, go to Step 19. If NO, go to Step 17.

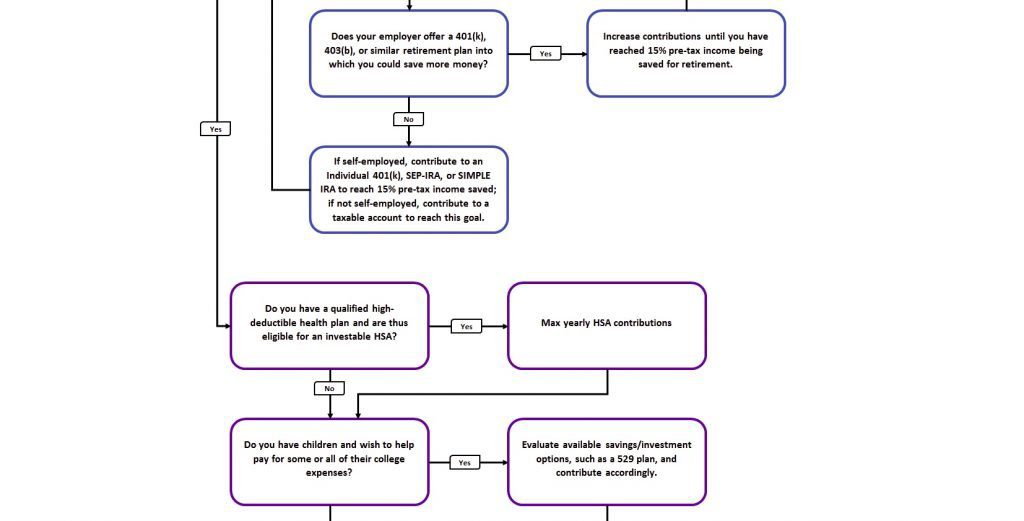

- Does your employer offer a 401(k), 403(b), or similar retirement plan into which you could save more money? If YES, Increase contributions until you have reached 15% pre-tax income being saved for retirement. If NO, go to step 18.

- If self-employed, contribute to an Individual 401(k), SEP-IRA, SIMPLE IRA to reach 15% pre-tax income saved; if not self-employed, contribute to a taxable account to reach this goal. Recheck your status on Step 16.

- Do you have a qualified high-deductible health plan and are thus eligible for an investable HSA? If YES, Max out your yearly HSA contributions. If NO, go to Step 20.

- Do you have children and wish to help pay for some or all of their college expenses? If YES, Evaluate available savings/investment options, such as a 529 plan, and contribute accordingly. If NO, go to Step 21.

- At this point, you have some options on how to proceed, and it is completely up to you and your personal goals and desires.

- Would you like to retire early? If YES, Max out 401(k), 403(b), employer sponsored account, consider the “mega backdoor Roth IRA”, then a taxable account.

- Do you have more immediate goals? If YES, Use savings for goals sooner than 3-5 years, a conservative mix of stocks and bonds for goals more than 3-5 years away. (Common examples include down payments for homes, saving for vehicles, paying down a mortgage, and vacation funds.)

See high-resolution pic on Imgur

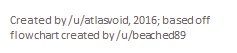

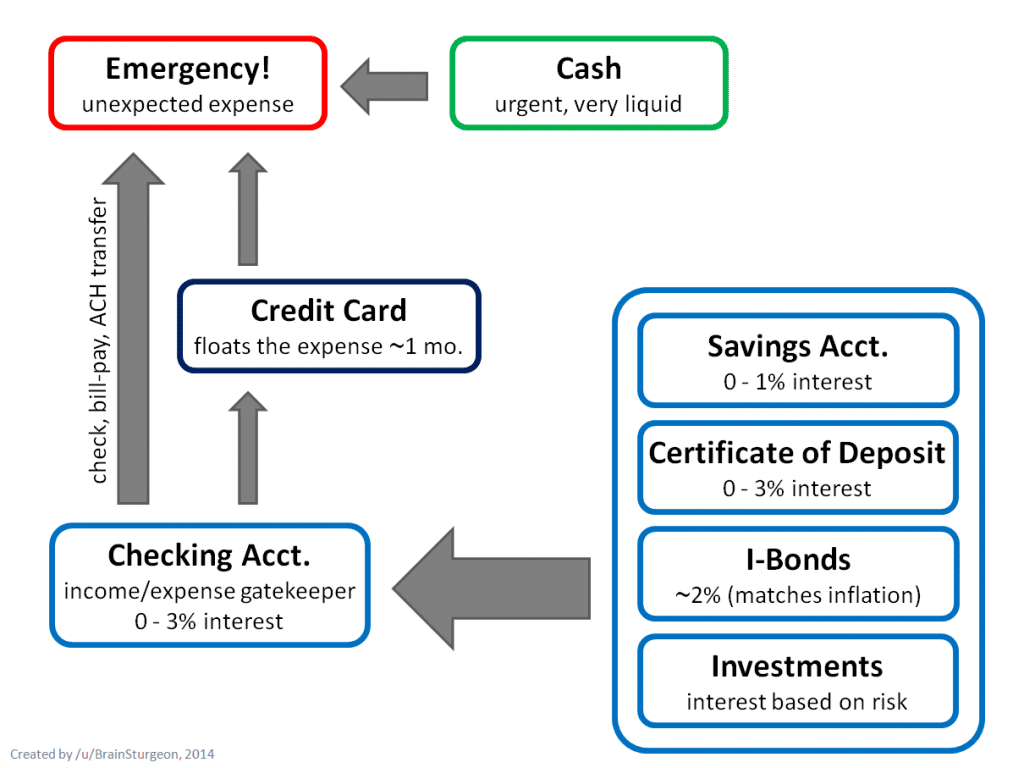

3. Reddit Personal Finance Flowchart: Personal Finance Basics (the Tiered Emergency Fund) by u/BrainSturgeon on r/personalfinance

We also looked at the personal finance flowchart created by u/BrainSturgeon. It is a simplified flowchart, broken down into 6 easy steps.

- This personal finance flowchart suggests starting with an Emergency Fund (i.e. money that is ‘liquid’ or easily accessible to cover 3-6 months’ worth of expenses).

- The second step is to contribute to a Company 401k account to get the employer contribution match.

- The third step is to take care of the debt, by paying off the highest interest loans first (NOTE: This is our preferred method of paying off debt as well – pay off the highest interest debt first!)

- The next step is to make contributions to IRA accounts. See what combination works best for you between Roth IRA and Traditional IRA, and contribute maximum possible annually, as allowed by IRA

- The fifth step is to add more money to your 401k account, up to the annual maximum allowed by IRS.

- The final step is to start saving and investing in assets such as bonds and index funds.

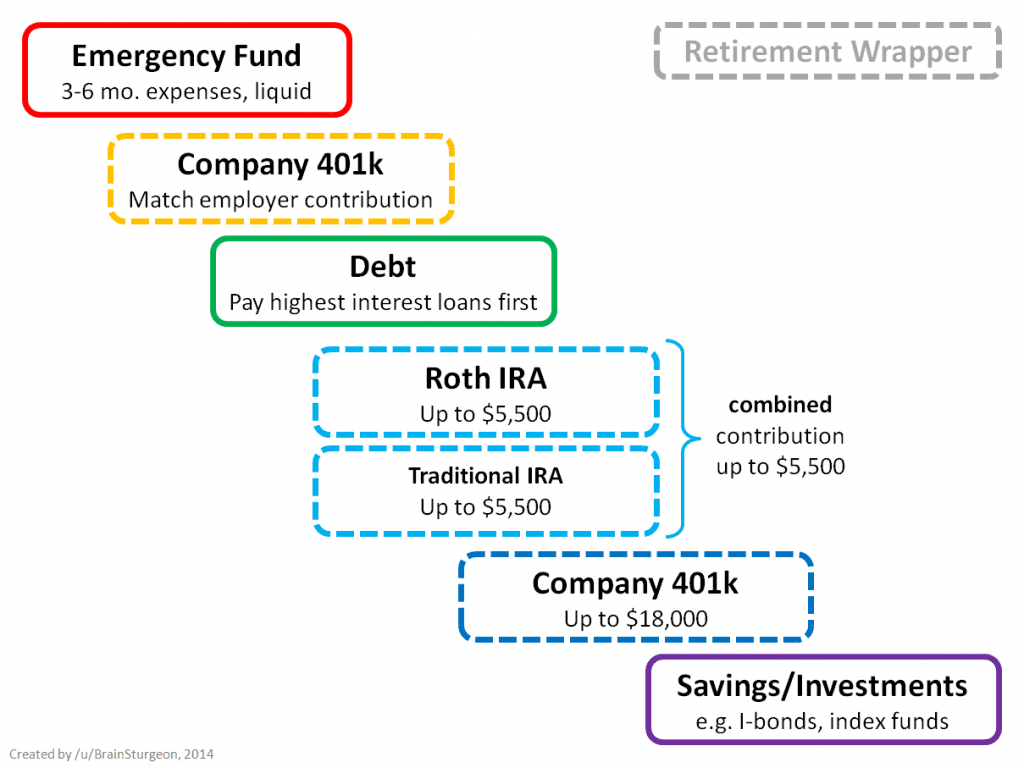

The Reddit user u/BrainSturgeon also has an interesting take on creating a Tiered Emergency Fund. See the details below. You can employ this strategy based on your risk tolerance.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents