This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Party rental insurance is a kind of insurance policy that covers damages, injuries, and accidents that may occur during a rental-equipment event. Event hosts or party rental businesses typically buy this type of insurance to protect themselves against possible liabilities that may arise during an event.

Weddings, birthday parties, business events, and other social gatherings can all be covered by party rental insurance. Rental tools such as tents, tables, chairs, audiovisual equipment, and other celebration supplies may be covered.

Party rental insurance coverage varies based on the policy and the insurance provider.

However, the policy typically includes liability coverage for the event host or rental business, as well as coverage for property damage, bodily injury, and other potential liabilities.

Let us have a look at 9 top party rental insurance providers in the USA.

Best Party Rental Insurance Companies

Here’s a list of the best party rental insurance providers you can consider for insuring your events.

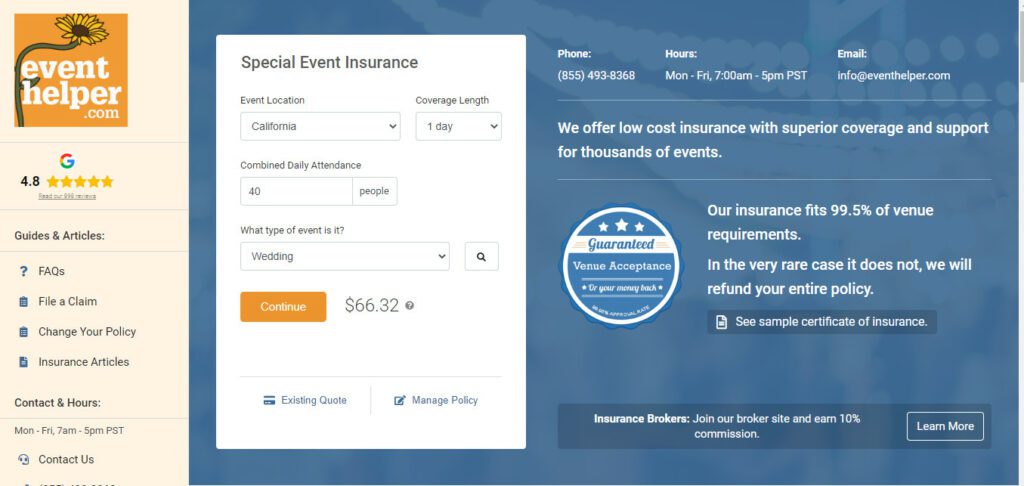

1. The Event Helper

The Event Helper is an insurance provider for event coordinators, including party rental insurance. Party rental insurance is intended to protect businesses that hire out equipment and services for events such as parties, weddings, and corporate functions.

The Event Helper provides liability insurance, which can cover property damage or injury caused by rented tools as well as property damage or injury caused by the event itself.

The policy also covers rented or leased equipment, as well as any materials, supplies, or other products that the rental business uses or sells.

Tents, tables, chairs, linens, dance floors, lighting, sound equipment, and catering equipment are examples of renting equipment that can be covered by The Event Helper’s party rental insurance.

Furthermore, The Event Helper’s party rental insurance policy can be tailored to the rental company’s particular requirements. Adding additional insureds, increasing coverage limits, or adding endorsements to cover specific kinds of equipment or services are all examples of this.

2. K&K Insurance Group

K&K Insurance Group is a well-known insurance provider for a number of industries, including party and event rental companies. They provide a specialized insurance policy known as “Party Rental Insurance,” which is intended to cover various risks that may emerge during an event or party rental.

K&K’s Party Rental Insurance insurance may include the following coverage options:

General Liability Insurance: This coverage shields the party rental business from bodily injury or property damage claims caused by their equipment or operations.

Property insurance safeguards the party rental company’s equipment and property from harm or loss caused by fire, theft, or other covered perils.

Bestseller Personal Finance Books

Commercial Auto Insurance: If the party rental company employs vehicles to transport their equipment to events, they may require commercial auto insurance to defend themselves from accidents or other incidents on the road.

Workers’ Compensation Insurance: This coverage is intended to compensate workers who are injured or become ill while working for the party rental business.

Liquor Liability Insurance: If the party rental business provides alcohol at events, they may require liquor liability insurance to defend themselves from claims of bodily harm or property damage caused by those who consume alcohol at the event.

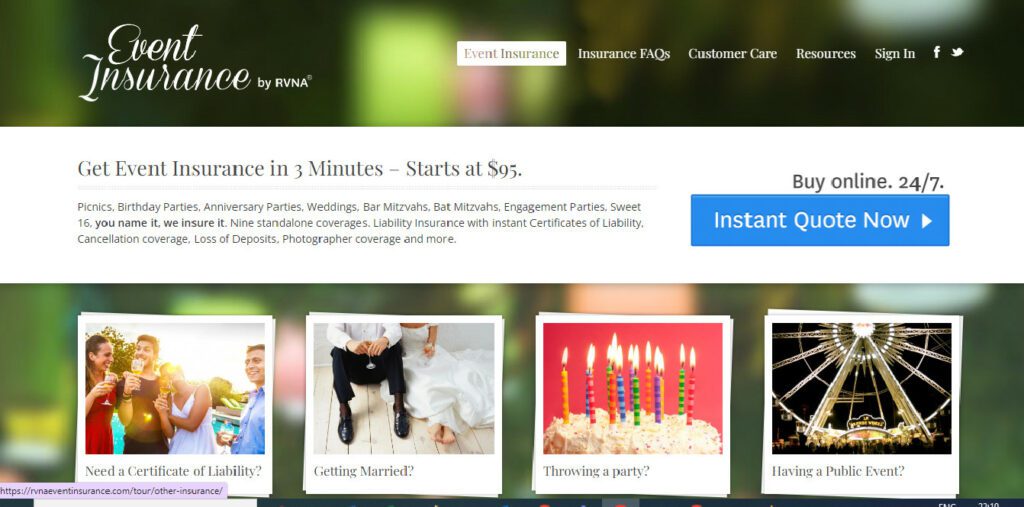

3. RVNA Event Insurance

RVNA Event Insurance provides party rental insurance to safeguard event hosts and party rental businesses from potential liability during an event.

This form of insurance is intended to cover the costs of damages, injuries, and accidents that may occur during an event, such as slips and falls, property damage, and other unforeseeable circumstances.

RVNA Event Insurance offers party rental insurance for a variety of events, including weddings, business events, festivals, and private parties.

Protection for rented equipment, such as tents, tables, chairs, and audiovisual equipment, as well as liability coverage for the event host or rental company, can be included.

When buying RVNA Event Insurance’s party rental insurance, it is critical to carefully review the policy to ensure that it covers all of the event’s requirements. To ensure that the coverage is sufficient for the specific event, it is also critical to grasp the policy limits, deductibles, and exclusions.

4. Cossio Insurance Agency

Cossio Insurance Agency is an insurance company that specializes in insuring party rental companies. They provide a wide range of insurance policies, including party rental insurance, which is intended to protect party rental companies from a variety of risks and liabilities.

Cossio Insurance Agency’s party rental insurance usually includes general liability coverage, which protects against third-party claims of bodily injury, property damage, or personal injury that occur on the premises of the party rental business or as a result of its operations.

Accidents or injuries caused by renting equipment, such as bounce houses, slides, and other party rental items, may also be covered.

Cossio Insurance Agency’s party rental insurance policies may include product liability coverage, which protects against claims resulting from injuries or damages caused by defective or malfunctioning rental equipment, in addition to general liability coverage.

Commercial property coverage, which protects the physical assets of the party rental business, such as buildings, equipment, and inventory, and business interruption coverage, which compensates for lost income and other expenses if the business is forced to close temporarily due to a covered loss, are two other coverage options that may be included in party rental insurance policies from Cossio Insurance Agency.

5. Aon Affinity

Aon Affinity is an insurance company that provides a variety of insurance products, including party hire insurance.

Party rental insurance is intended to protect party rental businesses and their customers from liability in the event of an accident, property damage, or other types of losses during a party or event.

Party rental insurance from Aon Affinity usually includes coverage for the rental company’s equipment, such as tables, chairs, and tents, as well as liability coverage for accidents or injuries that may occur during the rental period.

Additional options, such as liquor liability insurance, may be included in the coverage, providing coverage for any accidents or injuries that may occur as a result of alcohol consumption at the gathering.

6. Markel Specialty Insurance

Markel Specialty Insurance provides party rental insurance to safeguard party rental companies and their clients from financial losses caused by accidents or damage during events.

Weddings, corporate events, graduations, and other private parties are all covered by the insurance coverage. Liability protection is typically included, which covers bodily harm and property damage claims resulting from accidents or negligence involving rental tools.

Markel Specialty Insurance provides party rental insurance to safeguard party rental companies and their clients from financial losses caused by accidents or damage during events.

Weddings, corporate events, graduations, and other private parties are all covered by the insurance coverage. Liability protection is typically included, which covers bodily harm and property damage claims resulting from accidents or negligence involving rental tools.

Protection for leased equipment, such as tents, chairs, tables, and decorations, may also be a possibility. Markel Specialty Insurance also provides additional coverage options, such as liquor liability insurance, which can protect the party rental business and its clients from alcohol-related accidents and incidents.

Party rental companies must typically provide information about their business operations and the events for which they will provide services in order to receive party rental insurance from Markel Specialty Insurance.

The cost of the insurance policy will rely on the coverage options chosen as well as the size and scope of the events covered.

7. InsureMyEquipment.com

InsureMyEquipment.com provides party rental insurance for individuals and companies in the event of damage or a mishap during the rental period. This type of insurance can protect both the renter and the rental business from financial loss caused by damages or injuries sustained during the rental period.

Party rental insurance usually covers bodily injury and property damage liability, as well as legal expenses that may emerge from a lawsuit. This insurance can also cover damage to leased equipment such as tents, tables, chairs, and other rental items.

InsureMyEquipment.com provides a variety of party rental insurance choices to meet a variety of needs and budgets. They also offer online quotes and applications, allowing customers to receive coverage swiftly.

8. Event Insurance Now

Event Insurance Now provides party rental insurance for a variety of events, including weddings, birthdays, business events, and more. Their party rental insurance plans can help protect both renters and rental businesses from financial loss caused by accidents or damage during the rental period.

Insurance for Special Events Party rental insurance plans now typically include liability, property damage, and equipment damage coverage. If someone is hurt or their property is damaged as a result of the leased equipment or activities at the event, liability coverage can help pay for legal fees and medical expenses.

Property damage coverage can help pay for damage to leased equipment as well as any other property that may be damaged during the rental period.

Furthermore, Event Insurance Now provides customizable insurance choices to meet a variety of needs and budgets. Customers can tailor their coverage limits, deductibles, and other policy features to suit their specific needs.

One of the advantages of using Event Insurance Now is the quick and simple online application procedure. Customers can get an estimate and buy insurance online in just a few minutes, without the need for extensive paperwork or phone calls.

10. Hill & Usher

Hill & Usher is a company that provides insurance for companies that hire out equipment for events such as weddings, parties, and other special occasions.

Hill & Usher insurance can help protect rental companies from financial losses caused by property damage, accidents, or other incidents that may occur during an event.

Hill & Usher provides a variety of insurance coverage, including general liability insurance, which can cover third-party physical injury or property damage claims, and product liability insurance, which can cover any damages or injuries caused by a rented product.

Hill & Usher may also provide coverage for rented equipment such as tables, chairs, and other things.

Conclusion

Party rental insurance can offer crucial protection for your event or party, but not all policies are made equal, so it’s important to take measures before buying.

Renting party supplies like tents, chairs, and tables is a major financial commitment. Without insurance, you might be responsible for expensive device damage.

You can make sure that you are sufficiently protected in the event of mishaps, damage, or injuries by taking precautions before purchasing party rental insurance. It is crucial to thoroughly read the terms and conditions of the policy and select the appropriate level of coverage for your particular event.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents