This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

We are in the final stretch of 2021. With just a few more days to go before we step into the year 2022, it’s a good time to get our new year resolutions in place. 2021 was a painful year for millions of people around the world. Our hearts go out to all those who were pained and impacted negatively by the pandemic.

Our world got struck by 2nd, 3rd, 4th waves of the pandemic, lockdowns became a common theme in some parts of the world, masks are now a very popular fashion accessory, sanitizers are now pretty much a standard practice everywhere. After the 2020 travel bans, in 2021 we did see some windows and bubbles opening up some traveling again. In bits and pieces, 2021 was both better and worse than 2020.

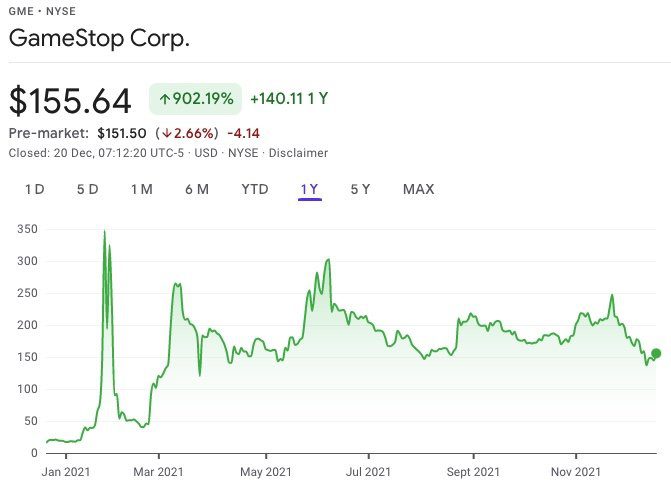

In the investing world, some interesting events took place, notably the GameStop showdown between hedge funds and Reddit. See my detailed coverage on that here.

Short Story on GameStop

TLDR: Thanks to the easy to use investment apps such as Robinhood, Webull, and M1, some first timers made a killing by buying into GameStop (GME) stocks and stock options. Millennials YOLO’d their savings into the speculative bets, and some made 100x on their investment in a matter of days.

Google finance [20 Dec 2021]: 1 year growth in GME stock from $19 to $350 before returning to $155.

While speculations are fun, I believe the key is to focus on the long term and act accordingly. So, here I present a list of best new year resolutions an investor should consider for 2022.

Best New Year Resolutions for 2022

Resolution 1. Check Pulse on Emergency Fund

This remains the number 1 resolution anyone needs to make. Especially, in a frothy stock market and a volatile economy, with new variants potentially shutting down parts of the economy again.

Take a look at how much you have saved in your emergency fund. A stash of easily accessible (if need be) fund to cover 4-6 months of your household expenses should be good. Don’t have an emergency fund yet? Today might be the perfect time to start building it.

Read also: 10 Great Financial Decisions You Can Make

Resolution 2. Eliminate Credit Card Debt

Credit card interest rates are insanely high, ranging anywhere between 18% and 30%. If you’re carrying a credit card balance and paying high interest on it, prioritize to pay all of it off as soon as you can. With the Fed increasing the interest rates 3 times next year, you credit card interest rates will also go further up. Pay your debt off as soon as you can to avoid paying even higher interests.

Read also: How To Use Credit Card Responsibly

Resolution 3. Build Your Portfolio Through Regular Investing and Dollar Cost Averaging

Aim for a good investment portfolio that will make your money grow. Money kept in bank accounts essentially lose value due to inflation. High inflation may or may not be ‘transitory’ as explained by many other experts. Investing in stocks and ETFs can help you beat inflation and also build wealth for your future. You don’t need huge amounts of money to build a portfolio. You can get started with very little money and over time build a huge portfolio by investing regularly and dollar cost averaging.

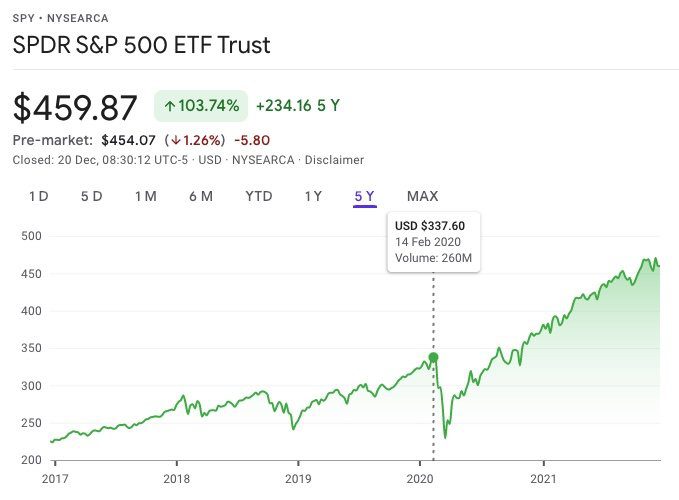

Do not try to time the market, many people sold their stocks after Covid-related crash in 2020, and never bought back in, because they anticipated the stocks would further crash (‘I will buy later when it further dips’ they thought). They missed out on the spectacular recovery and the upside that came with it.

Sure, the stock market may crash again, but it might go up another 40% before crashing by 50%. It is almost impossible to time the market successfully twice – once while exiting, and once while re-entering. Keep it simple, just invest regularly.

Related articles:

Resolution 4. Keep Some Spare Cash For Investing If a Crash Happens

In resolution 3, we talked about not timing the market. However, that doesn’t mean you can’t take advantage of market crashes. You can consider keeping 10-12% of your portfolio in cash to pounce on such investing opportunities. A crash will happen sooner or later – maybe in 3 months, or 3 years or 10 years. We cannot predict exactly when, but we can be prepared to take advantage of it with some cash on hand.

However, be careful to evaluate before buying falling stocks – have the company’s earnings outlook changed, or is it just panic selling that is driving the price down? If you still believe in the stock (or ETF), you can buy them at a discount! Buying the dips on broad market ETFs might be a safer bet, in general.

Bestseller Personal Finance Books

Resolution 5. Diversify Your Investment Portfolio And Automate Your Investments

Stocks, ETFs, Bonds, Cash – all are good. But have you thought about buying assets outside the stock and bond market? You can consider investing in real estate or commodities or even cryptocurrencies. All assets have risks and returns associated with them, but diversifying outside of the stock market could help diversify the risks. For example, when the stock market crashes, your investments in real estate could still be doing well. Cryptocurrencies are very volatile (hence risky) but they have rewarded investors in 2021 with great returns. Consider adding multiple assets to your portfolio based on your risk appetite and automate the investments into those assets.

Related articles:

- Diversify Portfolio with Alternative Investing

- Should I Invest in Bitcoin?

- Invest in Real Estate: DiversyFund vs Fundrise.

Resolution 6. Evaluate Your Retirement Accounts

Are you getting the maximum employer match on your 401(k)? If not, it might be time to adjust your contributions to get the maximum employer match. Also if you are in lower tax brackets now, consider stashing some money into a ROTH IRA account, after you’ve contributed enough in 401(k) to get the full employer match.

Related Articles:

Resolution 7. Evaluate Performance of Your Mutual Funds

Check whether the Mutual Funds are worth the fees you are paying. Are your mutual funds beating their benchmark funds? Are they beating the market or can they do so over the next 3, 5, or 10 years? If yes, stick with them! If not, consider switching to a different fund or an ETF that can give similar returns for a lower fee.

Switching to a lower fee ETF that gives similar returns can save you a huge chunk of your portfolio bleeding out as fees. A simple 2% fee on a mutual fund can eat away more than half of your portfolio over 40 years. Let that sink in. Do not neglect fees!

Related Articles:

Resolution 8. Plan your Taxes in Advance

Profits from investments can be exhilarating. However, if you realize any of the capital gains or receive dividends from your investments, set some money aside for paying the taxes due. Proper planning of taxes can enable you to enjoy your profits worry-free and keep stress at bay while filing taxes. Plenty of investors err on the side of caution and keep half of all their realized profits aside for paying their taxes. At the end of the year, if they owe less in taxes, they have some spare cash to enjoy! It’s better that way than having to worry about arranging cash for paying taxes last moment.

Related Articles

Resolution 9. Learn about Stock Options

If you have never traded options, it is fine. Honestly, options can be intimidating for new investors. However, we encourage you to learn about them. It could help you up to your investing game and prove to be the best new year resolution EVER!

Options provide great leverage and risk mitigation features and can also be part of your overall portfolio. Options have higher volatility than stocks, so we strongly recommend you understand the risks before putting actual dollars into stock options.

Guess what, I have a 2-hour course that will make you learn about options in the easiest way possible. New SkillShare users get 30-day free access to SkillShare, so they can check my courses out as well as thousands of other courses.

Easy to understand resources on Stock Options:

Resolution 10. Help out your Friends and Family With Finance and Investing (Best New Year Resolution for 2022)

Now that you have embarked on the financial success journey, consider helping out friends and family by guiding them to the right resources. We believe our website is a great one, so we’ll be thrilled if you subscribe to our newsletters and also recommend us to them!

You can also access these video courses on SkillShare to get started with taking control of your finance. Even better, even these courses can be accessed for FREE if you use my referral link and sign up as a new user on SkillShare.

Click here for previous year’s resolutions

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents