This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

CAGR vs IRR – What’s the difference between Compound Annual Growth Rate (CAGR) and Internal Rate of Return (IRR)?

Let’s have a quick overview of CAGR and IRR

In the case of a multiyear investment, it is convenient to break down the return on investment (ROI) in a per-year format for better understanding and easier comparison against other investments. CAGR and IRR are two methods of computing the return on investment in an annualized format.

What is CAGR or Compound Annual Growth Rate?

We have talked about CAGR here on this page.

CAGR or the Compound Annual Growth Rate is the annual rate of return on an investment when the investment returns are reinvested every year.

For example, an investment of $100, growing at 10% per year, will be worth $110 after 1 year.

After 2 years, the same investment will be worth $121 (i.e. a 10% growth on $110)

After 3 years, the same investment will be worth $133.10 (i.e. a 10% growth on $121)

After 4 years, it will be worth $146.41

..and so on.

Visualizing a 10% compounded annual growth is not quite as intuitive (or correct) as $100, $110, $120, $130, and $140…

The 10% annual compounding causes the growth to look like $100 -> $110 -> $121 -> $133.1 -> $146.41

In fact, back-calculating the growth rate can be even more challenging. If the initial amount is $100, and the final amount is $146.41 after 4 years – the CAGR is 10%. This is something not easy to calculate in a quick time.

finlightened.com

CAGR Formula: CAGR = (Final Amount/Initial Amount) ^ (1/Years) – 1

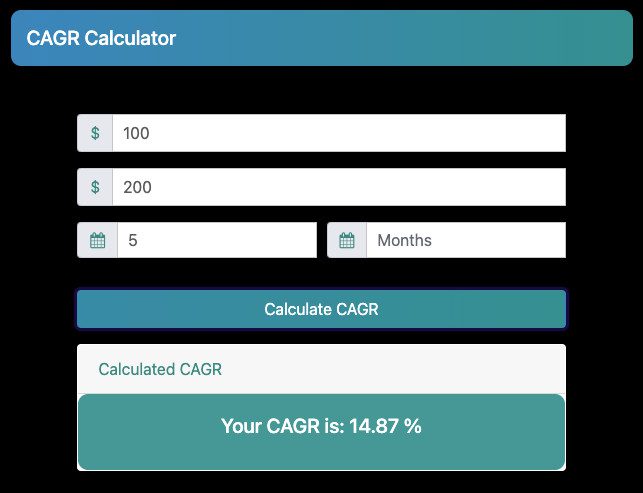

CAGR Example

A simple example of CAGR is the following:

- Initial Investment: $100

- Time Period of Investment: 5 years

- Final Amount: $200

We can use the formula in a calculator, or simply use the online CAGR Calculator. Here we get the CAGR = 14.87% per year.

What is IRR or Internal Rate of Return?

We have discussed what IRR or Internal Rate of Return is here. Let’s understand IRR.

IRR stands for Internal Rate of Return in Finance.

IRR is the return on investment at the project’s breakeven point (i.e., the project is barely justified as valuable).

To understand IRR, you must understand NPV or Net Present Value.

When NPV is positive, the project is expected to be valuable, and the management will give a green light to the project. When NPV is negative, the management will most likely not proceed with the project.

IRR is the rate of return when the NPV of the project is 0 (i.e. when the NPV just breaks even).

What is NPV or Net Present Value?

We have already discussed what NPV or Net Present Value is in Finance here. Let’s understand what NPV is.

finlightened.comNPV stands for Net Present Value in Finance.

Before we understand what NPV is, let’s understand a few basic concepts of finance.

Conceptually, a dollar today (say in 2023) is worth more than a dollar 10 years in the future. Why? Because I can invest this dollar somewhere and in 10 years have much more than a dollar with me. Essentially, there is some ‘time value of money’.

Time Value of Money

The time value of money is a financial concept that refers to the idea that money available today is worth more than the same amount of money in the future. The basic premise is that a dollar received today is worth more than a dollar received in the future because of its potential to earn interest or increase in value over time.

Present Value

Now that we know that a dollar today is worth more than the same dollar 10 years in the future. Directionally we understand that the value of money decreases with the passage of time.

When a business or an investor plans out a business, they also project the cash flows of the business, i.e., how much money they expect to earn in year 1, year 2, year 3, year 4, year 5, etc. However, they have to make an upfront investment today to start the business. Now, we have money in various years – year 0 through year 5. How do we compare them all?

With the knowledge of ‘time value of money’, we can estimate the ‘Present Value’ of money from the future in today’s dollar value.

All future cash flows are adjusted by a factor to estimate their current value or present value. The adjustment factor is called ‘discount rate’.

Discount Rate

A discount rate is not a one-size-fits-all solution. Depending on the context, the discount rate for calculating the present value can vary.

A good way to think about a discount rate is this: “What is the alternative place where I can put this money and what is the return I can expect with a similar amount of risk”

For example, a common investor can use the expected returns of investing in a S&P500 Index ETF. A venture capital fund might have different risk tolerance and their discount rate would be different for their calculation purposes.

The discount rate is used on future cash flows to approximate their value in today’s dollar terms.

NPV

Okay, now we know that there is something called time value of money and discount rate can be used as a tool to determine the time value of money and approximate the future cash flows into Present Value.

So, we make an investment today – we already know the Present Value of that investment.

We use the Discount Rate to calculate the Present Value of all future cash flows.

Now we have all dollar amounts in today’s value. To calculate the Net Present Value, we add all the Present Values (of future cash flows) and subtract the investment made today.

Voila, we have our Net Present Value with us.

finlightened.com

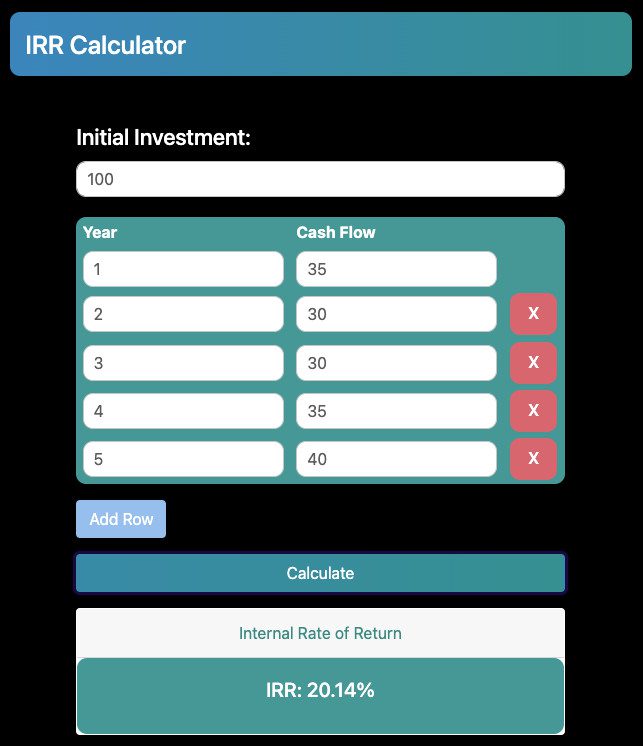

IRR Example

A simple example of IRR is the following:

- Initial Investment in Project: $100

- Cash Flows From Project Year By Year:

- Year 1: $35

- Year 2: $30

- Year 3: $30

- Year 4: $35

- Year 5: $40

We can input these values in a financial calculator, or simply use an online IRR Calculator. Here we get the IRR = 20.14% per year.

CAGR vs IRR: Similarities between CAGR and IRR

Here are some similarities between CAGR and IRR:

- CAGR and IRR both measure return on investment.

- CAGR and IRR are both expressed in percentage, or percentage per year (to be precise).

- CAGR and IRR both take the following common inputs: Initial Investment.

- CAGR and IRR can both be calculated in Excel, Google Sheets, Online on websites, or apps for smartphones.

CAGR vs IRR: Differences Between CAGR and IRR

One Final Value vs Yearly Cash Flows Handled

- CAGR can work with the following inputs: Starting Value, Final Value, and Time Period. Basically, CAGR can only deal with one final value of the investment.

- IRR can work with more cash flows rather than just one final value of the investment (as in the case of CAGR).

One Investment vs Multiple Investments Considered

- CAGR can manage just one starting value or investment

- IRR can manage multi-year cashflows, so it can also handle multi-year investments (you can input an investment as a negative cash flow in any year)

CAGR Calculator Online

You can calculate the Compound Annual Growth Rate online on this site, using this link: CAGR Calculator

Alternatively, you can calculate the Compound Annual Growth Rate online on our partner site, using this link: CAGR Calculator

Bestseller Personal Finance Books

IRR Calculator Online

You can calculate the Internal Rate of Return online on this site, using this link: IRR Calculator

Alternatively, you can calculate the Internal Rate of Return online on our partner site, using this link: IRR Calculator

CAGR Calculator App

You can download our CAGR Calculator app on the Apple App Store for your iOS devices

IRR Calculator App

You can download our IRR Calculator app on the Apple App Store for your iOS devices

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents