This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Best New Year Resolutions for Investors in 2021

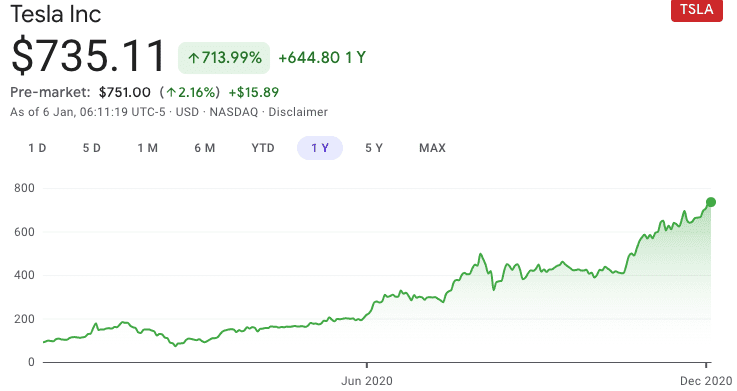

2020 was an ‘interesting’ year. The world got struck by a pandemic, bustling cities were quietened by lockdowns, masks become a new fashion accessory, sanitizers became commonplace – it’s all been so surreal. While for those who had a 2020 resolution to travel the world, plans might not have materialized well, the work from home culture did kindle the ‘hobby’ of investing among many first-time investors. Thanks to the easy-to-use investment apps such as Robinhood, Webull, and M1, some first-timers made a killing by buying into Tesla (TSLA) and NIO stocks (among others) earlier in 2020. The key, of course, is to focus on the long term and increase the odds of financial success in the long run as well. So, here we present a list of best new year resolutions an investor should consider for 2021.

Google finance screenshots [6 Jan 2021]: 1-year growth in TSLA stock 714% | 1-year growth in NIO stock 1,346%

Best New Year Resolutions for 2021

Resolution 1. Check Pulse on Emergency Fund

Take a look at how much you are spending every month and how much do you have saved in your emergency fund. A stash of easily accessible (if need be) funds to cover 4-6 months of your household expenses should be good. Don’t have an emergency fund yet? 2021 might be the perfect year to start building it.

Resolution 2. Eliminate Credit Card Debt

Credit card interest rates are high, ranging anywhere between 18% and 30%. If you’re carrying a credit card balance and paying high interest on it, consider paying all of it off before you put any money into new investments. The stock market ‘may’ provide annual returns of 8-12% over the next five years. The credit card company will definitely charge you high interest rates.

Resolution 3. Buy (more) Stocks and ETFs to Build Your Portfolio

Aim for a good investment portfolio that will make your money grow. Money kept in bank accounts essentially loses value due to inflation. Investing in stocks and ETFs can help you build wealth for your future. The good news is that you can get started with very little money and build a portfolio over time.

Related articles:

Resolution 4. Keep Cash as Part of Your Portfolio

Okay, not to confuse with the cash for an emergency fund, you should consider keeping some cash that is uninvested. Why? So that you can buy into the market when it dips. However, be careful to evaluate before buying falling stocks – have the company’s earnings outlook changed, or is it just panic selling that is driving the price down? If you still believe in the stock (or ETF), you can buy them at a discount! Even a 8-10% cash component in the portfolio is good enough to pounce on such opportunities.

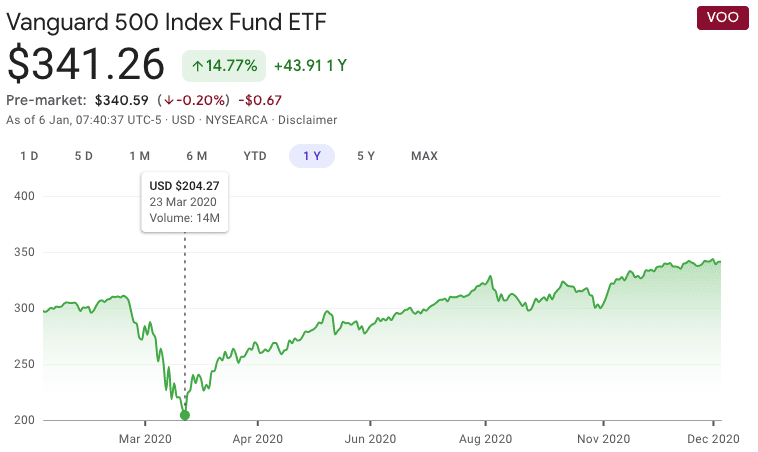

See the 67% returns on VOO (Vanguard’s S&P 500 Tracking Fund) for investors who could put extra cash in March 2020.

Google Finance Screenshot [Jan 6, 2021]: From a low of $204 in March 2020 to $341 in Jan 2021, VOO has risen 67% so far.

Resolution 5. Diversify Your Investment Portfolio And Automate Your Investments

Stocks, ETFs, Bonds, Cash – all are good. But have you thought about buying assets outside the stock and bond market? You can consider investing in real estate or commodities or even cryptocurrencies. All assets have risks and returns associated with them, but diversifying outside of the stock market could help diversify the risks. For example, when the stock market crashes, your investments in real estate could still be doing well. Cryptocurrencies are very volatile (hence risky) but they have rewarded investors in 2020 with great returns. Consider adding multiple assets to your portfolio based on your risk appetite and automate the investments into those assets.

Related articles:

- Diversify Portfolio with Alternative Investing

- Should I Invest in Bitcoin?

- Invest in Real Estate: DiversyFund vs Fundrise.

Resolution 6. Don’t Ignore Retirement Accounts

Are you getting the maximum employer match on your 401(k)? If no, it might be time to adjust your contributions to get the maximum employer match. Also if you are in lower tax brackets now, consider stashing some money into a ROTH IRA account, after you’ve contributed enough in 401(k) to get the full employer match.

Related Articles:

Resolution 7. Evaluate Performance of Your Mutual Funds

Check whether the Mutual Funds are worth the fees you are paying. Are your mutual funds beating their benchmark funds? Are they beating the market or can they do so over the next 3, 5, or 10 years? If yes, stick with them! If no, consider switching to a different fund or an ETF that can give similar returns for a lower fee.

Bestseller Personal Finance Books

Related Articles:

Resolution 8. Plan your Taxes

Profits from investments can be exhilarating. However, if you realize any of the capital gains or receive dividends from your investments, set some money aside for paying the taxes that might be due on them. Proper planning of taxes can enable you to enjoy your profits worry-free and keep stress at bay while filing taxes.

Related Article: Dividends

Resolution 9. Learn about Stock Options

If you have never traded options, it is fine. Honestly, options can be intimidating for new investors. However, we encourage you to learn about them. It could help you up your investing game and prove to be the best new year resolution EVER! Options provide great leverage and risk mitigation features and can also be part of your overall portfolio. Options have higher volatility than stocks, so we strongly recommend you understand the risks before putting actual dollars into stock options.

Easy to understand resources on Stock Options:

Resolution 10. Help out your Friends and Family With Investing (Best New Year Resolution)

Now that you have embarked on the financial success journey, consider helping out friends and family by guiding them to the right resources. We believe our website is a great one, so we’ll be thrilled if you subscribe to our newsletters and also recommend us to them!

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents