This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Americans lead the world in many fields, but are Americans good at personal finance? Why is there so much credit card debt? Let’s take a look at some facts and numbers related to the state of personal finance in the United States.

Before we get into the numbers, let us also keep a very important thing in perspective. We are not judging anyone for not being ‘smart’ with money. There are hundreds of millions of people in the world, and everyone has a unique story – the house they grew up in, the values they were raised with, the financial situation they have been during their early years in life – all that goes into defining their risk tolerance and behavior with money. Our goal is to understand how we can get better at personal finance, in the best way we can.

Facts on Personal Finance in the United States of America

Did you know these five facts?

- 44% Americans don’t have cash reserve to cover an immediate $400 cost

- 43% Student Loan borrowers in America do not make regular monthly payments toward their loan

- 38% American households have average credit card debt of $16,000 at a high interest rate of 16% or more.

- 56% American adults have less than $10,000 saved for retirement

- According to economists, the Social Security Trust Fund might go bankrupt before year 2035.

According to Fortune, two-thirds of Americans cannot pass a basic financial literacy quiz. Can you? Show your prowess in finance education by scoring 5/5.

Read This: Beginner’s Guide To Personal Finance

Saving vs Investing: Which is Better?

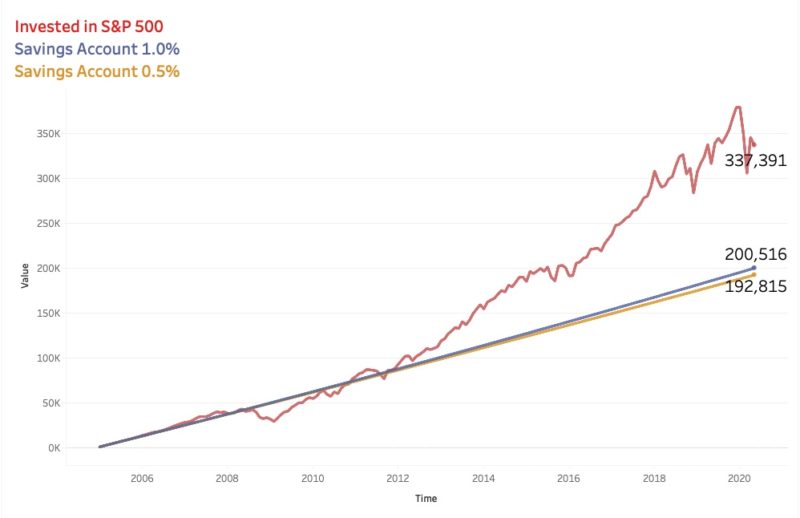

Investing involves risk, but over the long term, investors have seen better returns if they have been disciplined with regular investments in the market and maintaining a longer-term outlook. See below the scenario that compares a regular monthly investment of $1,000 in S&P 500 vs. the same investment in a savings account that offers 0.5% and 1% annual return.

Despite temporary setbacks for market investors from time to time during the 15 year period, they gained much more by sticking to their investing approach.

An investor who invested $1,000 per month in the S&P 500 from Jan 2005 to May 2020 would have about $337,000 in his investment account (considering he or she did not re-invest the dividends). A person saving $1,000 per month for the same period would have just about $200,500 in a 1% per year savings account.

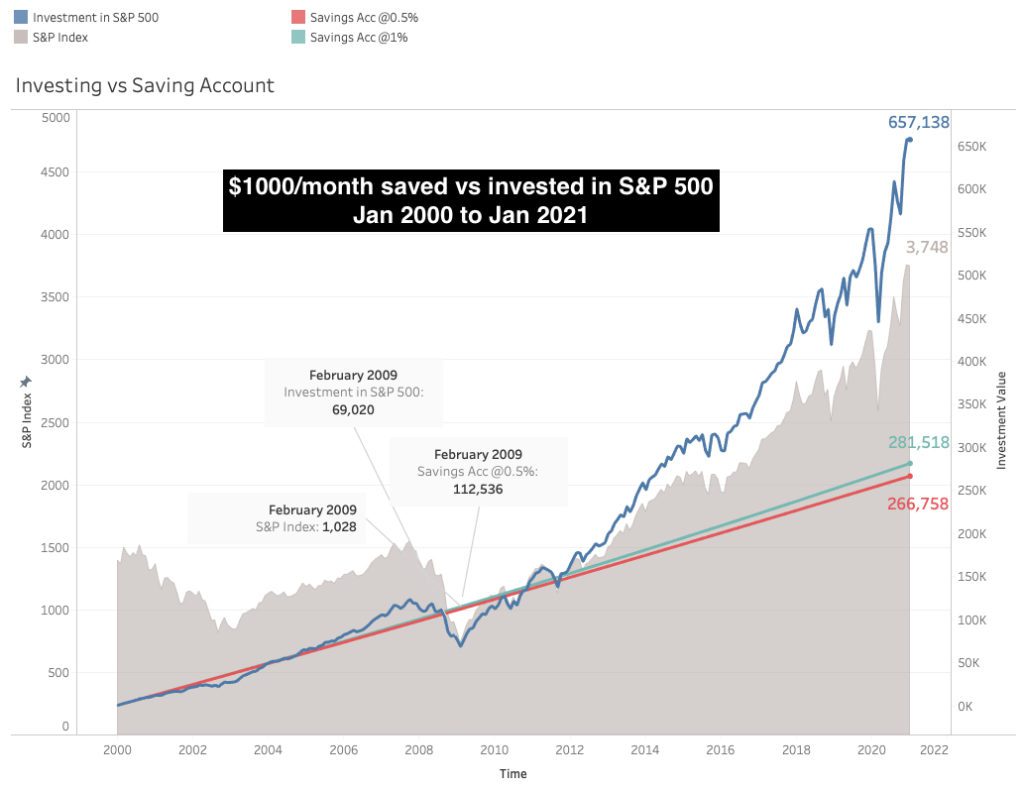

Updated Chart: Saving vs Investing $1000 per month from Jan 2000 to Jan 2021

Despite market setbacks and periods of flat markets, the disciplined investor in S&P 500 came out ahead by sticking to the strategy of regular investing during Jan 2000 to Jan 2021. As observed, there were periods when the market investor fell behind, as denoted in the chart in February 2009, but staying invested enabled the investor to take advantage of the bull run that followed and beat the savings accounts by a huge margin.

An investor who invested $1,000 per month in the S&P 500 from Jan 2000 to Jan 2021 would have about $657,000 in his investment account (considering he or she did not re-invest the dividends). A person saving $1,000 per month for the same period would have just about $281,500 in a 1% per year savings account.

Investing vs Debt Repayment: Still Paying off Student Loans?

Read my story here: How I paid off $100K student loan in 26 months

Slay the Student Loan Debt Dragon, but first…

Adopt a balanced approach to plan for short, mid, and long-term financial security. Killing off the debt is important, but it is more important to win the long-term game.

Short term

Put cash away for surviving 3-6 months. You can use this cash and time to figure something out. An emergency fund will buy you time and you can maintain your sanity while you try to recover from a crisis.

Mid term

There’s a difference between trading and investing. For mid-term security, investing in broad market index funds is a great option. If you have an investment horizon of 3+ years, ETFs are a good place to start.

Long term

Okay, so this is the long-term game we need to win. Start with getting the maximum employer match on retirement accounts. Never leave free money on the table. Retirement date target funds are a good option, or if you have a little more risk appetite, and retirement is further away, investing in a broad market index fund is a good option too.

Interested in Getting Started With Investing but Unsure Where to Start?

We have some easy to understand resources for you.

Bestseller Personal Finance Books

- Getting Started With Stocks

- How to Start Investing With $20

- What are ETFs?

- Alternative Investments

- Best Investment App: Feature by Feature Comparison

Recommended Books on Amazon

We believe these books on finance are great resources for developing a better understanding of money management and personal finance.

The Intelligent Investor – Benjamin Graham

The Psychology of Money – Morgan Housel

The Millionaire Next Door – Thomas J Stanley, William D Danko

The links above are affiliate links. We may earn a small commission if you use them to make a purchase.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents