This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

What Does Living Paycheck to Paycheck Mean?

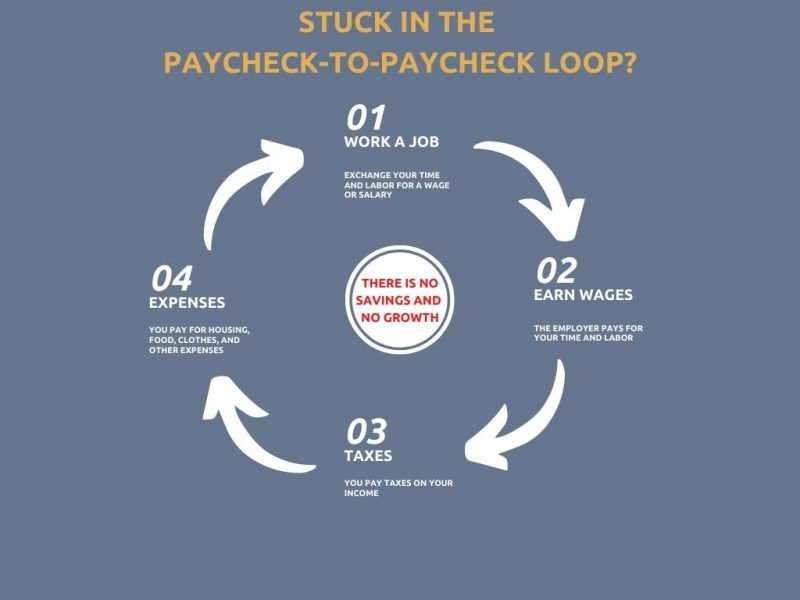

Why do we need the financial freedom flywheel? Here’s why – the general paycheck to paycheck lifestyle looks something like this –

- you work a job, i.e. contribute your time and labor,

- you earn salary/wages every 2 weeks (or every month, depending on your employer’s pay cycle) ,

- the government takes their cut on your salary for supporting the social security, medicaid, and other initiatives & infrastructure in the country,

- then, with what is left, you make payments for your debt, rent/mortgage, car, gas, household expenses etc.

The Endless Loop of Paycheck to Paycheck Lifestyle

Believe it or not, irrespective of the salary/wages, a LOT of people end up with practically nothing by the end of this loop. And it repeats again and again, for a long long time.

This is the endless loop of a paycheck-to-paycheck lifestyle. Have you or a close one been experiencing this? Let’s see how to break out of this.

The Financial Growth Flywheel | Financial Freedom Flywheel

How can you quit living a paycheck to paycheck life?

The answer is to develop a growth mindset and build a financial freedom flywheel.

The financial freedom flywheel (inspired from other examples, including one created by Jeff Bezos at Amazon) looks like this – you start by making some minor adjustments – revaluate your expenses (even look at optimizing taxes), save up a little money, even if it is a token amount.

Start putting away that tiny amount toward an investment – be it in the stock market or somewhere else. It need not be a huge amount, forming a habit is the key element here.

Start with the next paycheck you receive!

If you need help in understanding investment options, check these out

The investment can be in the stock market, a side business, a blog – basically anything that decouples (partially or fully) your time and labor from the cash flow it can generate. For example, once you buy an AAPL stock, the dividends* come in irrespective of how much time and labor you put in or not in observing the stock. In this case, your investment is fully decoupled from your labor. You may consider creating a video course or even starting a blog and writing articles – it requires more effort than buying the AAPL stock, but once the content is out there, and it starts getting eyeballs, it can bring in a subscription and ad revenue without much maintenance in the future. So, here, the investment is partially decoupled.

The cash flow from the investment, however little, will add to your earnings. Once this flywheel is set in motion, the small amounts will start snowballing and your net worth will grow over time.

*It doesn’t even have to be earned in the form of dividends, even if it is an investment in a growth stock or ETF that doesn’t pay out dividends but rather increases in market value, your net worth is still growing over time.

Bestseller Personal Finance Books

Financial Freedom Flywheel is NOT a Get Rich Quick Scheme

It takes time to develop a habit of investing and creating a financial freedom flywheel like this, and once it is in motion you’ll start seeing your net worth grow. At one point, it will almost become addictive and you’d do whatever it takes to keep the flywheel in motion.

A word of caution – please do not fall for any ‘get rich quick schemes’ while pursuing higher net worth. If it sounds too good to be true, it most likely isn’t true.

The higher returns on any investment or business are almost always accompanied by higher risk. For example, if while investing in the stock market, you want accelerated returns on your investment, you can consider trading stock options. However, I strongly recommend you fully understand the risks and how to mitigate those risks before you buy or sell any stock options in pursuit of higher returns.

How Does Magic of Compounding Work?

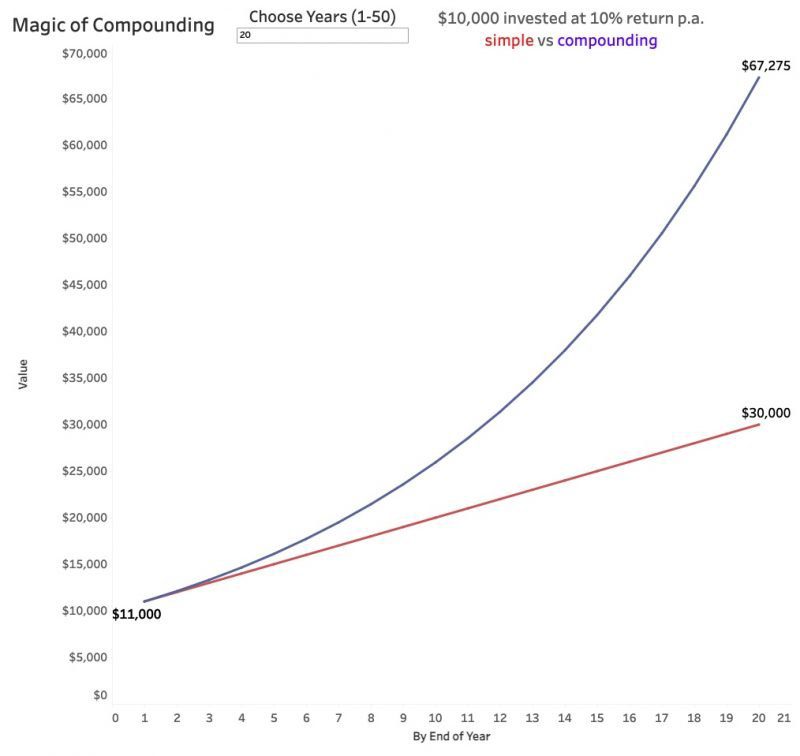

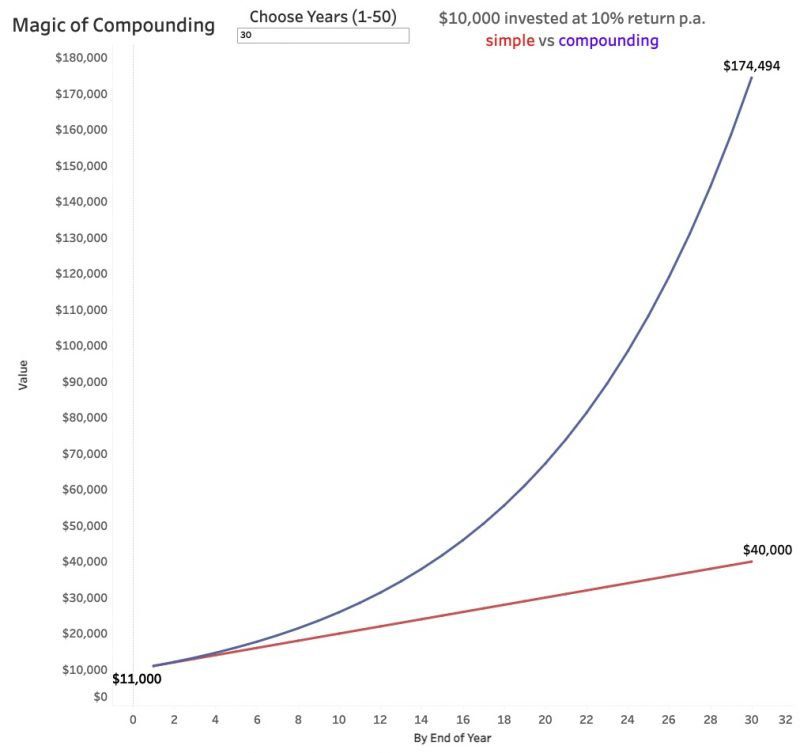

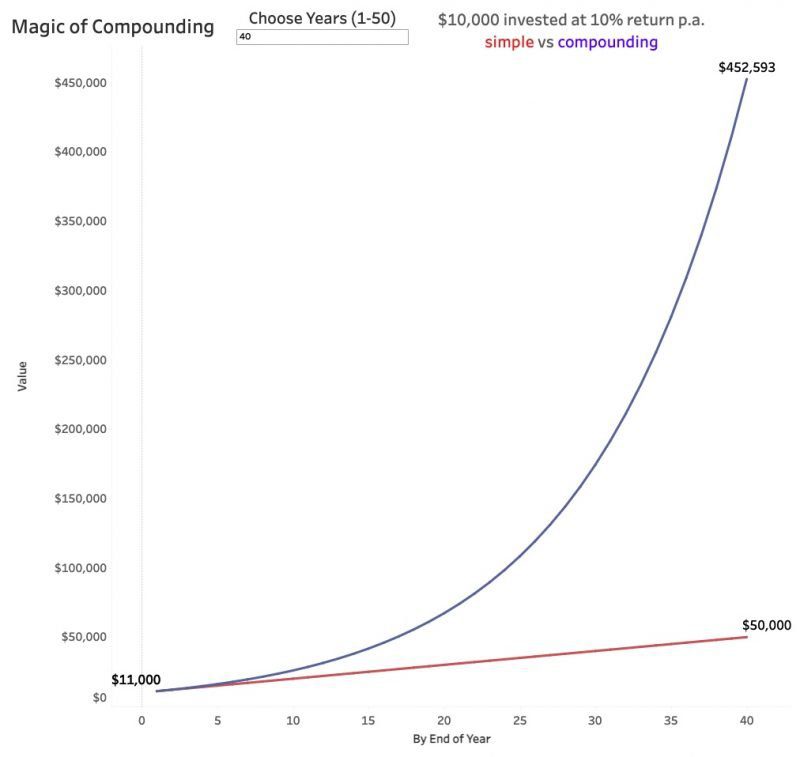

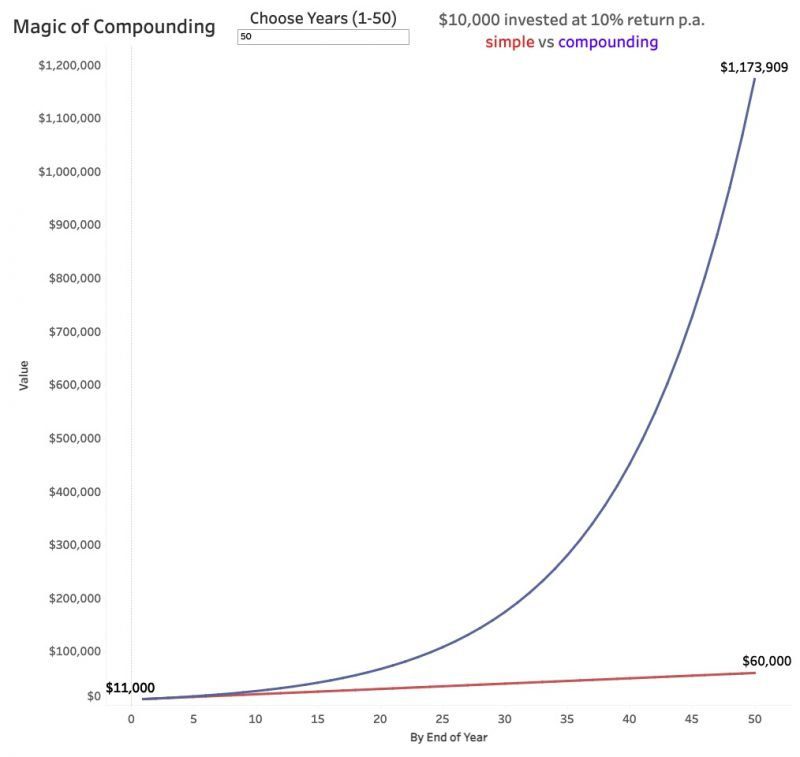

The magic of compounding works slowly by reinvesting the income from time to time. Suppose there’s an investment that returns 10% per year, and you start with $10,000. At the end of the first year, you’d earn $1,000 in income (e.g. interest or dividends). You can choose to keep that $1,000 away or reinvest it in the same investment plan. If you choose to reinvest the $1,000 you just earned, it will stay invested for one year alongside the $10,000 you initially invested. In total, at the end of year 2, you’d earn an income of 10% * $11,000 = $1,100.

This may seem like a small difference – i.e. just an increase of $100 for a full year. However, let’s see how this process works over long periods of time.

To illustrate the difference, let’s assume there are two teenagers A and B with $10,000 cash they earned by doing some gigs. They both put their money in an investment plan that pays 10% per year to them. A chooses to collect and keep away the income generated (i.e. $1,000) in a savings account that practically gives 0 return. B chooses to reinvest all income in the same investment plan.

Keep in mind that neither of them is making any additional contributions, apart from the $10,000 invested initially.

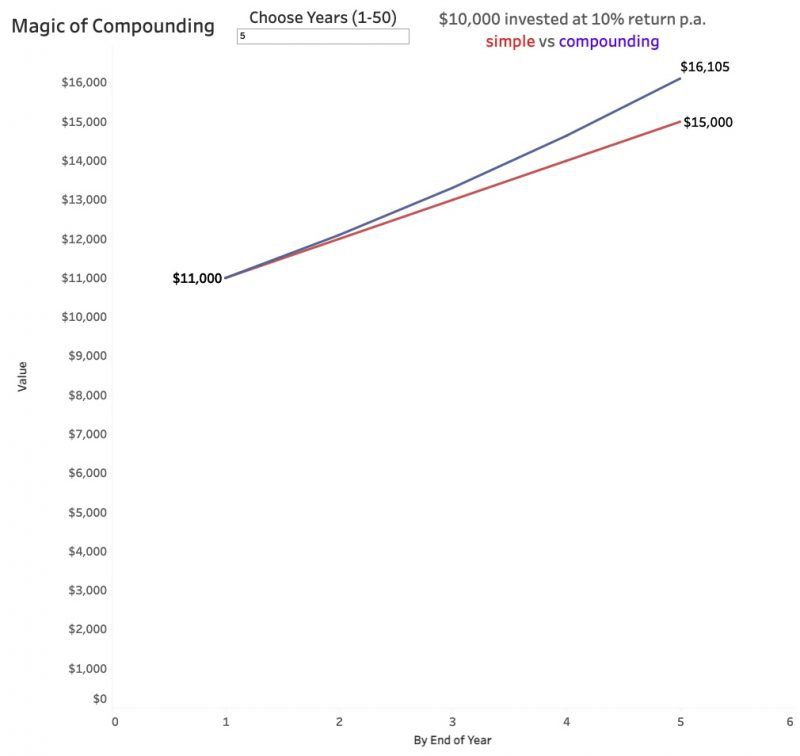

5 years

At the end of year 1, both A and B have $11,000. But, by end of 5 years, B has a total of $16,105 while A has $15,000 (i.e. his initial $10,000 and $1,000 * 5 years).

B has $1,105 more than A after 5 years.

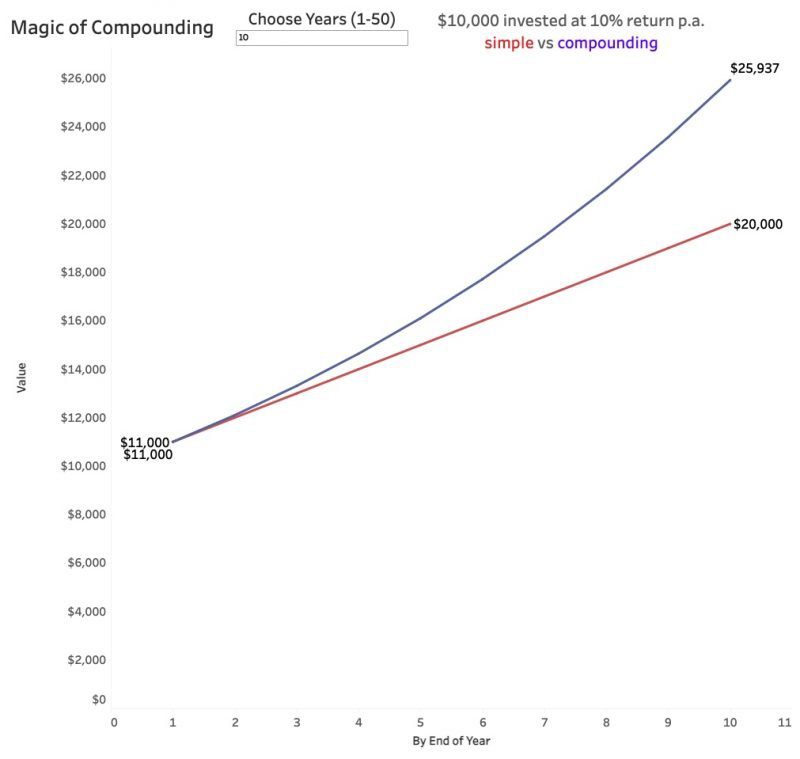

10 years

B has $5,937 more than A after 10 years.

20 years

B has $37,275 more than A after 20 years.

30 years

B has $134,494 more than A after 30 years.

40 years

B has $402,593 more than A after 40 years.

50 years

B has $1,113,909 more than A after 50 years.

At this stage, A sits on $60,000 while B has $1.17M with him, just by sticking to his plan of reinvesting all income he got into the same plan. A’s growth was linear, while B’s growth was exponential. This is the magic of compounding.

To Summarize

The flywheel can come in handy for anyone and everyone, irrespective of their wages or salary.

- To get started, squeeze out a tiny amount by optimizing your taxes and expenses

- Every drop counts, do not underestimate the power of a tiny contribution every month

- Focus on developing a habit of saving and investing rather than the amount

- Once the flywheel starts spinning, it gets easier (even addictive) to keep it spinning

- Your net worth will grow over time and through the magic of compounding.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents